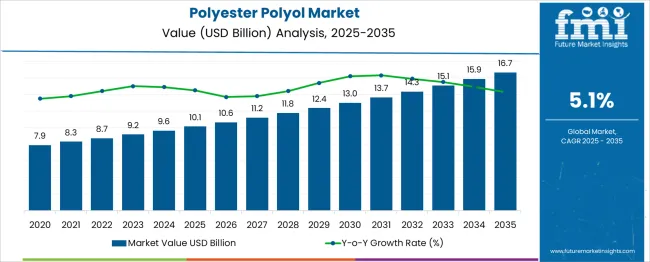

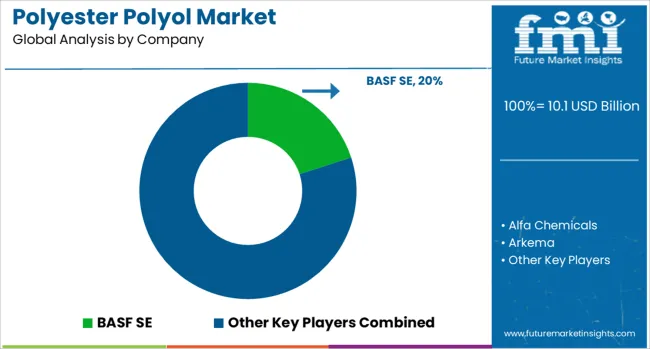

The global polyester polyol market is likely to reach from USD 10.1 billion in 2025 to approximately USD 16.6 billion by 2035, recording an absolute increase of USD 6.5 billion over the forecast period. This translates into a total growth of 64.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035. The market size is expected to grow by nearly 1.6X during the same period, supported by increasing demand from diverse end-use industries, growing focus on green materials, and expanding applications in specialty chemicals and advanced materials manufacturing.

Between 2025 and 2030, the polyester polyol market is projected to expand from USD 10.1 billion to USD 12.9 billion, resulting in a value increase of USD 2.8 billion, which represents 43.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising industrial production, increasing adoption of polyurethane systems in construction and automotive sectors, and growing demand for flexible and rigid foam applications. Chemical manufacturers are expanding their polyester polyol production capacities to meet the growing demand from various end-use industries seeking high-performance polymer solutions.

| Metric | Value |

| Estimated Value in (2025E) | USD 10.1 billion |

| Forecast Value in (2035F) | USD 16.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

From 2030 to 2035, the market is forecast to grow from USD 12.9 billion to USD 16.6 billion, adding another USD 3.7 billion, which constitutes 56.9% of the ten-year expansion. This period is expected to be characterized by technological advancements in bio-based polyester polyol production, implementation of circular economy principles in polymer manufacturing, and development of high-performance specialty grades for emerging applications. The growing focus on green chemistry and regulatory push for environmentally friendly materials will drive innovation in polyester polyol formulations with improved performance characteristics and reduced environmental impact.

Between 2020 and 2025, the polyester polyol market experienced steady expansion, driven by recovery in industrial activities post-pandemic and increasing demand from construction and automotive sectors. The market developed as manufacturers recognized the versatility and performance advantages of polyester polyols in various polyurethane applications. Industry consolidation and strategic partnerships began emphasizing the importance of integrated supply chains and technical support services for maintaining competitive advantage in the global polyester polyol market.

Market expansion is being supported by the increasing demand for polyurethane systems across diverse applications including flexible foam, rigid foam, coatings, adhesives, sealants, and elastomers. Modern industries are increasingly focused on materials that offer superior performance characteristics such as durability, chemical resistance, and mechanical properties. Polyester polyols' ability to impart specific properties to polyurethane systems, including enhanced hydrolytic stability, superior mechanical strength, and excellent adhesion characteristics, makes them preferred intermediates in high-performance polymer applications.

The growing focus on green materials and bio-based chemicals is driving innovation in polyester polyol production from renewable feedstocks such as vegetable oils, recycled PET, and bio-succinic acid. Industrial preference for customizable polymer solutions that can be tailored to specific application requirements is creating opportunities for specialty polyester polyol grades. The rising demand from emerging economies for construction materials, automotive components, and consumer goods is also contributing to increased polyester polyol consumption across different industrial sectors and geographical regions.

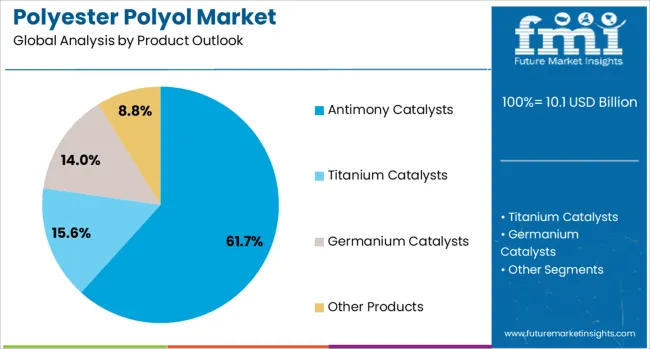

The market is segmented by product, source, application, and region. By product, the market is divided into antimony catalysts, titanium catalysts, germanium catalysts, and other products. Based on source, the market is categorized into petroleum-based and bio-based polyester polyols. In terms of application, the market is segmented into food, pharmaceuticals, electronics, consumer goods, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The antimony catalysts segment is projected to account for 61.7% of the polyester polyol market in 2025, reaffirming its position as the industry's dominant catalyst system. Manufacturers increasingly rely on antimony-based catalysts for their proven efficiency in polyesterification reactions, cost-effectiveness, and well-established processing parameters. These catalysts offer optimal balance between reaction rate and product quality, enabling consistent production of polyester polyols with desired molecular weight distributions and functionality.

This product category forms the backbone of conventional polyester polyol production, as it represents the most commercially viable and technically mature catalyst technology. Industry expertise and decades of operational experience continue to strengthen confidence in antimony catalyst systems. With established supply chains and processing infrastructure optimized for antimony catalysts, their widespread adoption ensures stable production economics. The segment's broad applicability across different polyester polyol grades ensures sustained dominance, making it the central enabler of global polyester polyol manufacturing capacity.

Petroleum-based polyester polyols are projected to represent 85.7% of market demand in 2025, underscoring their role as the industry's primary feedstock platform. Manufacturers gravitate toward petroleum-derived raw materials for their consistent quality, reliable supply chains, and cost-competitive pricing structures. These conventional polyester polyols offer proven performance characteristics, extensive application knowledge, and established customer specifications across diverse end-use industries.

The segment is supported by mature petrochemical infrastructure, integrated production facilities, and economies of scale that ensure competitive manufacturing costs. Additionally, petroleum-based polyester polyols benefit from decades of formulation expertise, comprehensive technical data, and validated processing parameters that minimize adoption risks for downstream users. As industries prioritize supply security and consistent product quality, petroleum-based polyester polyols will continue to dominate market demand, maintaining their foundational role in the global polyurethane value chain.

The food application segment is forecasted to contribute 61.4% of the polyester polyol market in 2025, reflecting its critical role in food packaging, processing equipment, and storage solutions. Industries are increasingly adopting polyester polyol-based polyurethane systems for their excellent barrier properties, chemical resistance, and compliance with food contact regulations. This aligns with growing demand for advanced packaging materials that extend shelf life, maintain product quality, and ensure food safety throughout the supply chain.

The segment benefits from stringent regulatory frameworks that mandate use of approved materials in food contact applications, creating barriers to entry and ensuring stable demand for qualified polyester polyol grades. Premium pricing for food-grade materials and growing focous on green packaging solutions provide additional growth opportunities. With heightened focus on food safety, waste reduction, and packaging innovation, food applications serve as a strategic growth driver, making them a critical segment for polyester polyol manufacturers targeting high-value markets.

The polyester polyol market is advancing steadily due to increasing demand from polyurethane industries and growing applications in specialty chemicals. The market faces challenges including raw material price volatility, environmental regulations on catalyst systems, and competition from alternative polyol technologies. Innovation in bio-based production routes and green manufacturing practices continue to influence product development and market expansion strategies.

The growing adoption of bio-based feedstocks is enabling manufacturers to develop green polyester polyol products with reduced environmental footprint. Green chemistry initiatives promote use of renewable raw materials, enzymatic catalysis, and solvent-free processes that minimize environmental impact. Circular economy principles are driving development of polyester polyols from recycled materials, particularly post-consumer PET waste, creating value from waste streams while reducing dependence on virgin petrochemical feedstocks.

Modern polyester polyol manufacturers are incorporating advanced process control systems, real-time monitoring, and predictive analytics to optimize production efficiency and product quality. Digital technologies enable precise control of reaction parameters, molecular weight distribution, and functionality, ensuring consistent product characteristics. Industry 4.0 concepts also facilitate supply chain integration, customer collaboration, and rapid product customization to meet specific application requirements and market demands.

| Country | CAGR (2025-2035) |

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

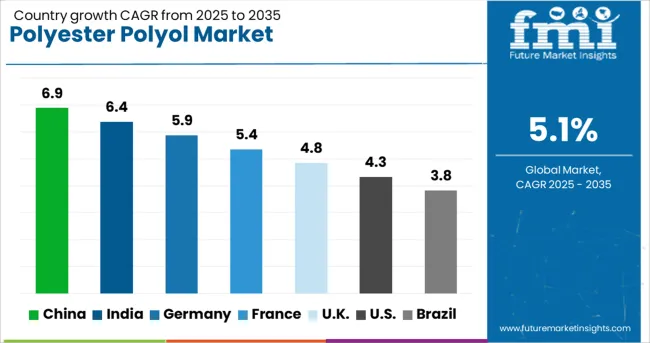

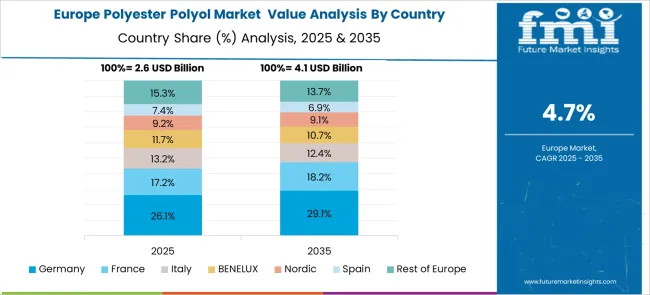

The polyester polyol market is experiencing steady growth globally, with China leading at a 6.9% CAGR through 2035, driven by massive industrial production capacity, expanding manufacturing sectors, and growing domestic demand for polyurethane products. India follows at 6.4%, supported by rapid industrialization, infrastructure development, and increasing consumption of consumer goods. Germany shows solid growth at 5.9%, emphasizing technical innovation and high-performance applications. France records 5.4%, focusing on green chemistry and specialty grades. The UK demonstrates 4.8% growth, prioritizing value-added applications and technical specialties. The USA shows 4.3% growth with focus on advanced materials and industrial applications.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from polyester polyol in China is projected to exhibit strong growth with a CAGR of 6.9% through 2035, driven by massive industrial capacity expansion and growing demand from construction, automotive, and consumer goods sectors. The country's position as the world's largest polyurethane market and manufacturing hub creates significant demand for polyester polyol intermediates. Major domestic and international chemical companies are establishing integrated production facilities to serve the expanding Chinese market and export requirements.

Revenue from polyester polyol in India is expanding at a CAGR of 6.4%, supported by rapid industrialization, growing construction activities, and increasing demand for consumer durables. The country's expanding middle class and urbanization trends are driving consumption of polyurethane-based products in furniture, automotive, and construction applications. Chemical manufacturers are establishing production capacities to serve growing domestic demand and leverage India's competitive manufacturing advantages.

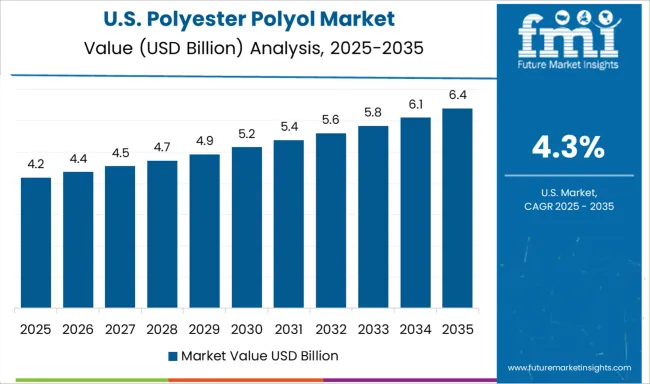

Demand for polyester polyol in the USA is projected to grow at a CAGR of 4.3%, supported by focus on high-performance materials, specialty applications, and green chemistry solutions. American manufacturers are focused on developing innovative polyester polyol grades for advanced applications in aerospace, medical devices, and specialty coatings. The market is characterized by technical sophistication, customer collaboration, and value-added product development.

Revenue from polyester polyol in Germany is projected to grow at a CAGR of 5.9% through 2035, driven by the country's strong chemical industry base, technical expertise, and focus on high-performance applications. German manufacturers consistently deliver innovative polyester polyol solutions for demanding applications in automotive, construction, and industrial sectors requiring superior quality and reliability.

Revenue from polyester polyol in the UK is projected to grow at a CAGR of 4.8% through 2035, supported by focus on specialty chemicals, technical applications, and value-added products. British manufacturers prioritize innovation, quality, and customer service, positioning themselves in high-margin market segments requiring specialized polyester polyol grades.

Revenue from polyester polyol in France is projected to grow at a CAGR of 5.4% through 2035, supported by the country's focus on green chemistry, circular economy principles, and innovative material solutions. French manufacturers prioritize environmental responsibility, developing bio-based and recycled polyester polyol products that meet stringent eco-friendly criteria.

Revenue from polyester polyol in Brazil is projected to grow at a CAGR of 3.8% through 2035, supported by the country's diversified industrial base, growing construction sector, and expanding automotive production. Brazilian manufacturers benefit from access to petrochemical feedstocks, established polyurethane industry, and growing regional market opportunities.

The polyester polyol market is characterized by competition among global chemical companies, regional manufacturers, and specialty producers. Companies are investing in production capacity expansion, technology licensing, backward integration, and customer technical services to deliver reliable, cost-effective, and innovative polyester polyol solutions. Product quality, technical support, and supply chain reliability are central to strengthening customer relationships and market position.

BASF SE, Germany-based, leads the market with 20.0% global value share, offering comprehensive polyester polyol portfolio with focus on innovation and eco-friendly. The company leverages its integrated production network, technical expertise, and global presence to serve diverse customer requirements across multiple industries. Alfa Chemicals provides specialized polyester polyol grades for technical applications with focus on quality consistency and customer service. Arkema, France, delivers innovative solutions combining performance and eco-friendly for demanding applications.

Arpadis focuses on custom polyester polyol formulations and technical collaboration with customers developing specialized polyurethane systems. DIC CORPORATION, Japan, provides high-quality polyester polyols leveraging its expertise in specialty chemicals and polymer technology. Dow, USA, offers a broad portfolio of polyester polyols with a focus on innovation and application development. Evonik Industries AG, Germany, specializes in high-performance grades for advanced applications. Huntsman Corporation provides integrated polyurethane solutions including diverse polyester polyol offerings for global markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 10.1 Billion |

| Product | Antimony Catalysts, Titanium Catalysts, Germanium Catalysts, Other Products |

| Source | Petroleum-based, Bio-based |

| Application | Food, Pharmaceuticals, Electronics, Consumer Goods, Other Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF SE, Arkema, DIC Corporation, Dow, Evonik Industries AG, Huntsman Corporation, Oleon NV, PCC SE, Stepan Company, TER HELL & Co GmbH |

| Additional Attributes | Production capacity analysis by region, raw material price trends, regulatory landscape for catalyst systems, eco-friendly initiatives in polyester polyol production, technical specifications by application, supply chain dynamics, end-use industry growth patterns |

Product:

Source:

Application:

Region:

The global polyester polyol market is estimated to be valued at USD 10.1 billion in 2025.

The market size for the polyester polyol market is projected to reach USD 16.7 billion by 2035.

The polyester polyol market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in polyester polyol market are antimony catalysts, titanium catalysts, germanium catalysts and other products.

In terms of source outlook , petroleum-based segment to command 85.7% share in the polyester polyol market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA