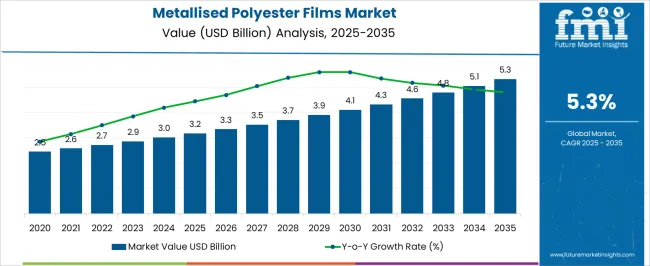

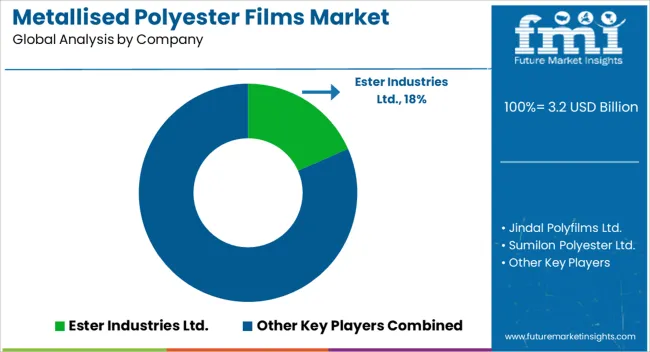

The Metallised Polyester Films Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Metallised Polyester Films Market Estimated Value in (2025 E) | USD 3.2 billion |

| Metallised Polyester Films Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The metallised polyester films market is witnessing robust growth, driven by the growing preference for advanced flexible packaging solutions that offer superior barrier properties, extended shelf life, and visual appeal. These films are increasingly being adopted as a sustainable and cost-effective alternative to aluminum foil due to their recyclability, light weight, and compatibility with high-speed printing and lamination processes.

The surge in global food consumption, expansion of organized retail, and evolving consumer demand for ready-to-eat and packaged goods are key factors propelling the usage of metallised polyester films. In parallel, the rise of e-commerce and the need for protective secondary packaging have further supported market penetration.

Technological advancements in vacuum metallising, coupled with enhanced tensile strength and optical density of polyester substrates, have allowed manufacturers to cater to high-performance packaging requirements Additionally, ongoing innovations in nanocoating and sustainability-driven manufacturing practices are expected to reinforce the market’s long-term prospects across developed and emerging economies.

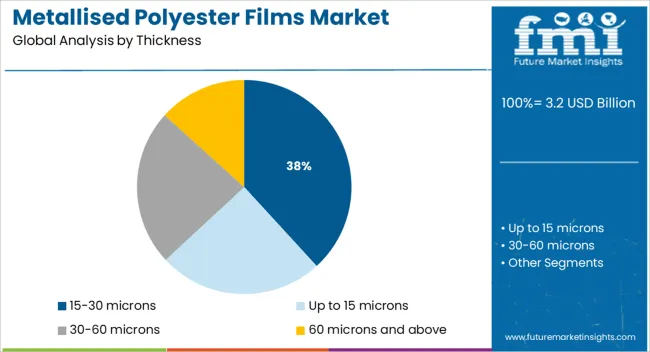

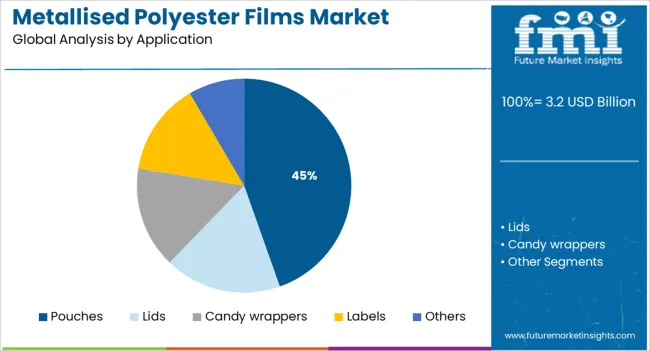

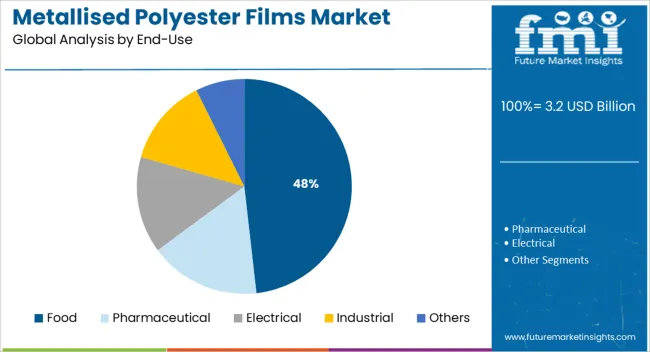

The market is segmented by Thickness, Application, and End-Use and region. By Thickness, the market is divided into 15-30 microns, Up to 15 microns, 30-60 microns, and 60 microns and above. In terms of Application, the market is classified into Pouches, Lids, Candy wrappers, Labels, and Others. Based on End-Use, the market is segmented into Food, Pharmaceutical, Electrical, Industrial, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 15 to 30 microns segment is anticipated to account for 38.2% of the total revenue share in the metallised polyester films market in 2025, reflecting its strong acceptance across high-volume packaging applications. The segment’s leading position is being supported by its optimal balance between mechanical strength, flexibility, and cost efficiency, making it suitable for a wide range of industrial and commercial uses.

Films within this thickness range have been preferred for their compatibility with automated packaging lines, enhanced barrier performance, and resistance to moisture and oxygen. Their versatility in laminates and adaptability to various printing techniques have strengthened their position in multilayer pouch structures and wrappers.

Additionally, this thickness range provides a favorable combination of lightweight properties and material efficiency, reducing overall packaging costs for manufacturers while maintaining product protection The high adoption rate across fast-moving consumer goods has reinforced demand for this segment, especially in food, confectionery, and personal care packaging applications.

The pouches segment is projected to hold 44.6% of the total revenue share in the metallised polyester films market by 2025, making it the leading application area. This growth has been driven by the increasing shift towards single-serve, resealable, and lightweight packaging formats that cater to urban consumption habits and mobile lifestyles.

Metallised polyester films used in pouches offer excellent barrier properties against moisture, gases, and UV light, thereby preserving product freshness and extending shelf life. Their ability to be sealed, printed, and shaped into various forms has allowed packaging manufacturers to meet the branding and logistical needs of both consumer and industrial goods.

Pouches made with metallised films are also widely used in snack foods, beverages, frozen products, and health supplements due to their tamper-resistant and puncture-proof features The growing demand for attractive shelf-ready packaging and reduced material waste has further enhanced the preference for metallised film-based pouches across the food and non-food sectors.

The food segment is forecast to account for 48.2% of the metallised polyester films market revenue in 2025, solidifying its position as the dominant end-use industry. The high share of this segment is attributed to the critical role metallised films play in preserving food quality, aroma, and texture throughout the supply chain. Rising consumer expectations for hygienic, long-lasting, and visually appealing packaging have increased the reliance on metallised polyester films by food processors and packaging converters.

These films provide excellent oxygen and moisture barriers, making them suitable for packaging snacks, dairy, confectionery, dry goods, and instant foods. The need for extended shelf life and reduced food waste in both developed and emerging economies has accelerated the adoption of high-barrier packaging formats.

Moreover, their compatibility with form-fill-seal technologies and fast-moving production lines has made them indispensable in modern food packaging operations As clean-label and on-the-go food trends continue to rise, metallised polyester films are expected to remain central to next-generation food packaging innovations.

The global market for metallised polyester films caters to packaging application in market segments such as food, pharmaceuticals, consumer electronics etc. Metallised polyester films is a special grade of plastic film with coating of aluminum material.

Metallised polyester films have superior gloss when metallised on optically clear base film. Metallised polyester films are one side coated layer whereas other side is either plain or corona treated.

Metallised polyester films are in high demand in pharmaceutical and food & beverages sector due to cost effective packaging solution offered by metallised polyester films. However the wide known application also includes wrapping films, labeling films, peelable and non-peelable lidding films, etc. The global market for metallised polyester films is expected to show impressive CAGR during the forecast period 2020-2025.

Shift in global packaging market from flexible packaging formats to flexible packaging formats is further expected to boost the global demand for metallised polyester films. In general, the use of metallised polyester films to achieve barrier properties needed for product shelf-life has been increasing over the years.

Metallised polyester films offer sleek metallic appearance of a polyester film at reduced weight and cost. Metallised polyester films are used for their high tensile strength, transparency, reflectivity, gas and odor barrier properties and electrical insulation. Manufacturers supply metallised polyester films as per thickness and width specifications required by end customers.

Metallised polyester films are applied to aluminum and offer a tough and resilient surface capable of performing many post forming operations. Metallised polyester films are available in large variety of finishes including silver, gold, pewter, and copper. Metallised film are abrasion and corrosion resistant.

Metallised polyester films are free of hexavalent chrome, heavy metals, and substances of very high concern. Metallised polyester film is the finest solution when it comes to high gas barrier levels, aroma and flavor preservation.

Metallised polyester films manufacturer offers a variety of adhesion promoting polyester films along with combination of plasma gases to get excellent metal adhesion and general gas barrier as well as a significant improvement of the water vapor barrier.

Metallised polyester films market is growing in areas of patterned metallising, clear oxide coating, high performance coating, product security and brand authentication. However aluminium is not an acceptable image in some regions such as Germany etc.

There is high opportunity of metallised polyester films in labeling with development of new glue applied film bases, and in sustainable films such as PLA (polylactic acid) etc. On February 2020, Cosmo Films launched the highly effective high barrier metallised BOPP film particularly for packed food.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Some of the players operating in the global metallised polyester films market include Ester Industries Ltd., Jindal Polyfilms Ltd., Sumilon Polyester Ltd., SRF Limited, Polyplex, Cosmo Films Ltd., Polinas Corporate, Uflex Ltd., Toray Plastics (America) Inc., and Impak Films USA LLC.

The global metallised polyester films market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the metallised polyester films market is projected to reach USD 5.3 billion by 2035.

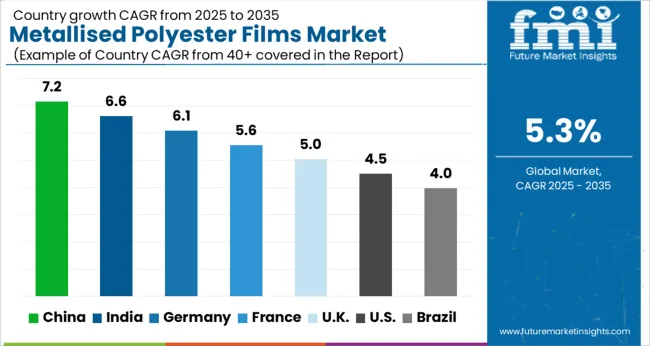

The metallised polyester films market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in metallised polyester films market are 15-30 microns, up to 15 microns, 30-60 microns and 60 microns and above.

In terms of application, pouches segment to command 44.6% share in the metallised polyester films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyester Shrink Film Market Size and Share Forecast Outlook 2025 to 2035

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Embossed Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Saturated Polyester Resin Market Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA