The saturated polyester resin market is growing steadily, supported by its increasing adoption across industrial coatings, packaging, and construction applications. Demand is primarily driven by the resin’s superior flexibility, chemical resistance, and weatherability, which enhance product performance and surface durability.

Current market dynamics reflect strong growth in powder and coil coatings, propelled by environmental regulations favoring low-VOC and solvent-free formulations. The market is further supported by infrastructure development and expanding automotive production, both of which rely heavily on durable coating materials.

Technological advancements in resin modification have improved thermal stability and mechanical strength, widening applicability across industrial and consumer goods sectors. Looking ahead, sustainable manufacturing practices and bio-based resin development are expected to strengthen market competitiveness and ensure long-term growth prospects in diversified end-use industries..

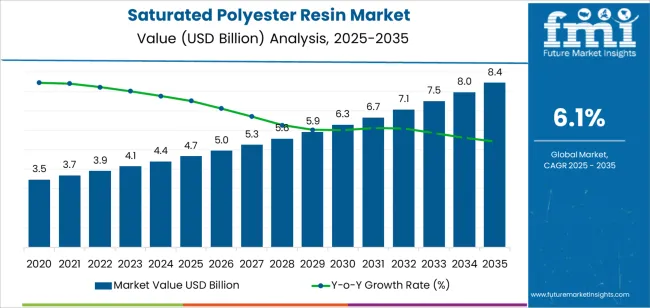

| Metric | Value |

|---|---|

| Saturated Polyester Resin Market Estimated Value in (2025 E) | USD 4.7 billion |

| Saturated Polyester Resin Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

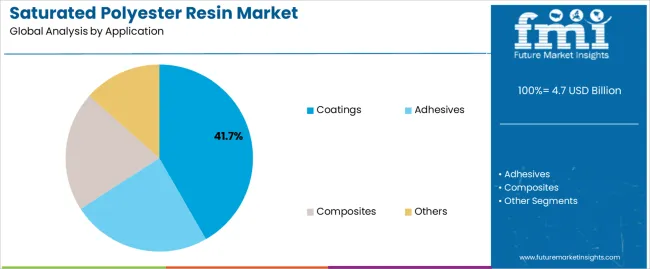

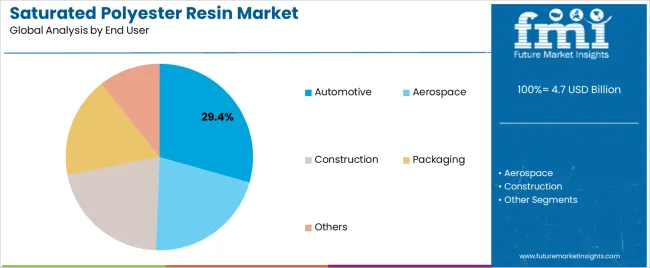

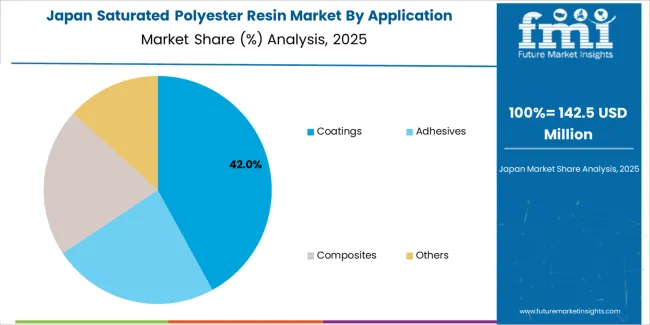

The market is segmented by Application and End User and region. By Application, the market is divided into Coatings, Adhesives, Composites, and Others. In terms of End User, the market is classified into Automotive, Aerospace, Construction, Packaging, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coatings segment dominates the application category with approximately 41.7% share, driven by its essential role in providing protective and decorative finishes across multiple industries. The superior adhesion, chemical resistance, and UV stability of saturated polyester resins make them ideal for architectural, industrial, and automotive coatings.

The segment’s expansion is reinforced by rising demand for powder coatings, which offer environmental benefits and improved process efficiency. Growing construction activity and industrial maintenance needs have further boosted consumption.

Manufacturers are focusing on advanced formulations with enhanced curing performance and improved gloss retention to meet high-quality standards. With increased preference for sustainable and durable coating systems, the coatings segment is expected to maintain its leadership throughout the forecast period..

The automotive segment leads the end-user category, accounting for approximately 29.4% of the market. Growth in this segment is fueled by the need for durable coatings and composite materials that enhance vehicle longevity and appearance.

Saturated polyester resins are used in automotive coatings, interior components, and structural composites, offering superior resistance to abrasion and corrosion. The expansion of electric and lightweight vehicles has increased the use of resin-based materials due to their weight reduction benefits.

Additionally, stringent environmental and performance standards are encouraging the adoption of high-performance resins that improve energy efficiency and recyclability. With global automotive production rebounding and continuous innovation in material engineering, the automotive segment is anticipated to sustain a dominant share over the coming years..

The saturated polyester resin market generated an estimated revenue of USD 3.5 billion in 2020. Over the span of four years, the market grew at a pace of 9.00% CAGR and added revenue of USD 4.7 billion in 2025. Several reasons can be attributed to this growth:

The market is anticipated to surpass a valuation of USD 8.4 billion by 2035, with a growth rate of 6.10% CAGR. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

Depending on the applications, the saturated polyester resin market is bifurcated into coatings, adhesives, and composites. The coatings segment is anticipated to develop at a moderate CAGR of 6.00% through 2035.

| Attributes | Details |

|---|---|

| Applications | Coatings |

| Forecasted CAGR (2025 to 2035) | 6.00% |

The saturated polyester resin market is categorized by end-users into automotive, aerospace, construction, and packaging. The automotive segment dominates the market and is anticipated to develop at a modest CAGR of 5.70% through 2035.

| Attributes | Details |

|---|---|

| End-user | Automotive |

| Forecasted CAGR (2025 to 2035) | 5.70% |

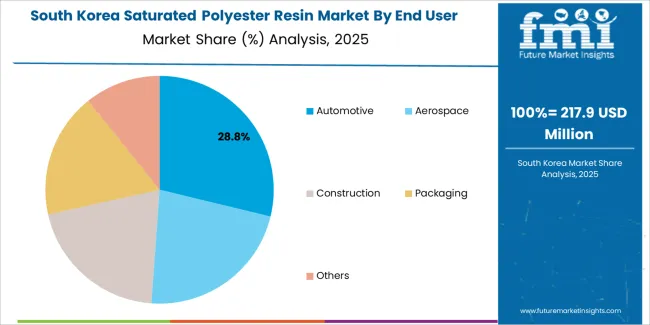

The section provides an analysis of the saturated polyester resin market by country, including Japan, China, the United States, South Korea, and the United Kingdom. The table presents the CAGR for each country, indicating the expected market growth in each respective country through 2035.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| Japan | 7.40% |

| United Kingdom | 7.20% |

| South Korea | 6.90% |

| China | 6.80% |

| United States | 6.20% |

South Korea is one of the leading countries in this market. The South Korea saturated polyester resin market is anticipated to maintain its position by progressing at an annual growth rate of 6.90% until 2035.

The United Kingdom also holds a strong position in the saturated polyester resin industry. The United Kingdom saturated polyester resin market is anticipated to maintain its dominance by progressing at an annual growth rate of 7.20% until 2035.

China, too, dominates the saturated polyester resin industry in the international marketplace after the United States. The Chinese saturated polyester resin market is anticipated to exhibit an annual growth rate of 6.80% until 2035.

The United States tops the chart when it comes to dominating the saturated polyester resin market, which is anticipated to register a CAGR of 6.20% through 2035.

Japan, too, is one of the leading countries in the saturated polyester resin industry. Over the next ten years, the Japanese demand for saturated polyester resins is projected to rise at a 7.40% CAGR.

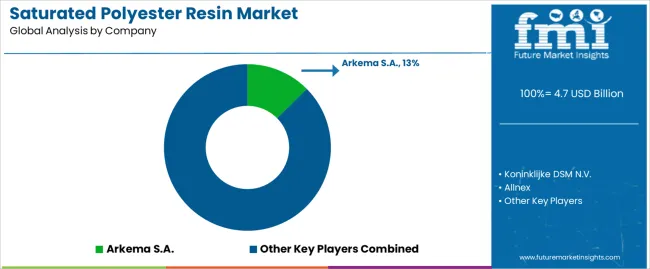

The global market for saturated polyester resins is very competitive and includes many players catering to both international and domestic consumers, such as Koninklijke DSM N.V., Allnex, Arkema S.A., Hitachi Chemical Co. Ltd., and Stepan Company.

These companies generally serve automotive, aerospace, and manufacturing sectors where polyester resins are used to provide protective coatings, adhesives, and composite materials. Key market players are also heavily investing to make their offerings less harmful to the environment, lightweight, and affordable to expand their consumer base.

Recent Developments

The global saturated polyester resin market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the saturated polyester resin market is projected to reach USD 8.4 billion by 2035.

The saturated polyester resin market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in saturated polyester resin market are coatings, adhesives, composites and others.

In terms of end user, automotive segment to command 29.4% share in the saturated polyester resin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Saturated Kraft Paper Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Polyester Polyol Market Size and Share Forecast Outlook 2025 to 2035

Polyester Hot Melt Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyester Straps Market Size and Share Forecast Outlook 2025 to 2035

Polyester Fiber Market Size and Share Forecast Outlook 2025 to 2035

Polyester Labels Market – Growth & Demand 2025 to 2035

Industry Share Analysis for Polyester Straps Companies

Polyester Resin Dispersion Market Analysis & Forecast by Viscosity Type, Process, End-Use Industry and Region through 2025 to 2035

Spun Polyester Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Metallised Polyester Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

High-Strength Polyester Thread Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Resin Capsule Market Forecast and Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA