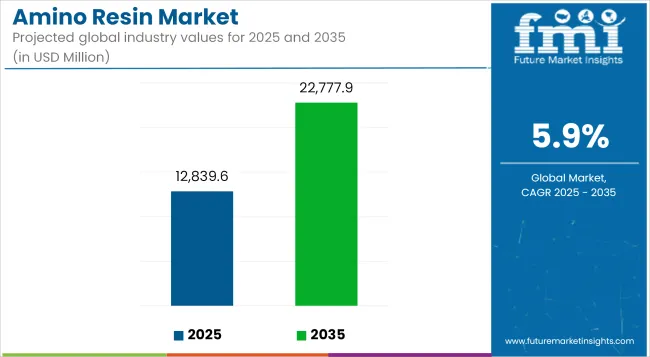

The global amino resin market is projected to grow from USD 12,839.6 million in 2025 to USD 22,777.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.9%. Demand growth is being driven by the increasing use of high-performance thermosetting polymers in applications such as wood adhesives, laminates, automotive components, construction materials, and industrial coatings.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 12,839.6 Million |

| Projected Market Size in 2035 | USD 22,777.9 Million |

| CAGR (2025 to 2035) | 5.9% |

Amino resins such as urea-formaldehyde, melamine-formaldehyde, and melamine-urea-formaldehyde continue to be adopted due to their favorable cost-to-performance ratio, strong adhesive properties, and resistance to moisture and heat. Their utilization has remained widespread in engineered wood products, including medium-density fiberboard (MDF), particleboards, plywood, and decorative laminates. These materials play a significant role in global furniture manufacturing, modular construction, and interior architecture systems.

Formaldehyde emission control is shaping the landscape of product development. Regulatory initiatives such as the USA Environmental Protection Agency’s TSCA Title VI and the European Union’s E1 and E0 formaldehyde limits are prompting a shift toward low-emission formulations.

As a result, producers are investing in modified amino resins with improved environmental profiles and reduced volatile organic compound (VOC) content. Formaldehyde scavengers, alternative crosslinking agents, and hybrid polymer systems are being developed to ensure regulatory compliance without compromising performance.

Bio-based amino resins are also being evaluated for commercial use. Derived from renewable feedstocks such as lignin, soy protein, and glyoxal, these alternatives are under active investigation in markets with heightened focus on carbon footprint reduction and sustainable procurement. R&D efforts are directed toward matching the mechanical strength and curing behavior of conventional resins while meeting life cycle assessment (LCA) criteria.

In the construction industry, the growing use of pre-fabricated elements and surface coating applications has underscored the importance of amino resins in decorative surfaces, laminates, and insulation panels. Automotive applications are expanding in areas such as underbody coatings and interior trim adhesives, where dimensional stability and heat resistance are required.

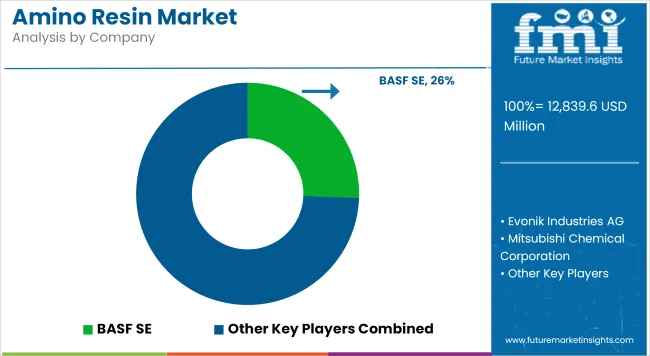

The Asia-Pacific region remains the dominant production and consumption hub, driven by growth in residential construction and increasing exports of engineered wood furniture. Industry players are expected to increase capital allocation toward process optimization and product diversification to address evolving environmental and performance expectations across end-use sectors.

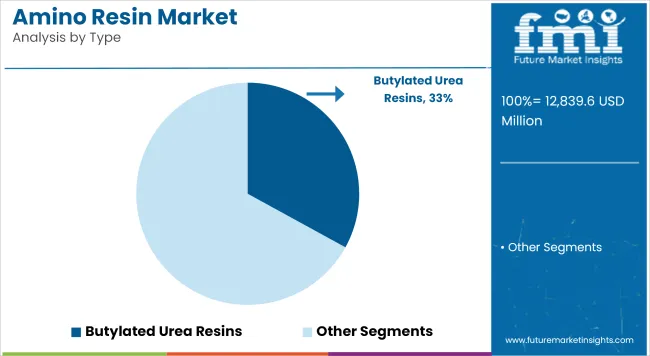

The butylated urea resins segment is projected to account for approximately 33% of the global amino resin market share in 2025 and is expected to grow at a CAGR of 5.7% through 2035. These resins are widely used as adhesives in the manufacture of particle boards, MDF, and plywood, particularly in interior-grade applications.

They offer good hardness, water resistance, and curing speed, making them suitable for large-scale production of wood composites. Demand is supported by continued growth in the construction and furniture sectors across Asia-Pacific and Latin America, where cost-sensitive manufacturing environments favor these urea-based solutions.

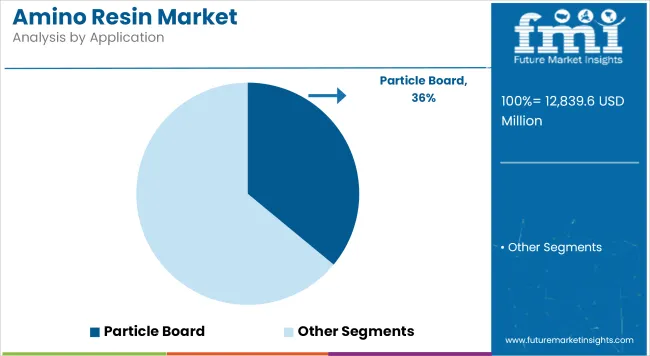

The particle board segment is estimated to hold approximately 36% of the global amino resin market share in 2025 and is projected to grow at a CAGR of 6.1% through 2035. Amino resins act as binding agents in the production of particle boards, enhancing mechanical strength, moisture resistance, and dimensional stability.

These engineered wood panels are commonly used in cabinetry, shelving, and low-load structural applications. With the expansion of affordable housing and modular furniture manufacturing, particularly in India, Southeast Asia, and Eastern Europe, the demand for resin-bonded particle boards continues to rise. The adoption of low-emission resin technologies is also growing, aligning with formaldehyde regulation and sustainability goals.

Environmental regulations and formaldehyde content limits hinder growth.

Amino resins are classified as probable carcinogens, and global regulations are tightening in an effort to control formaldehyde emissions. The use of resin in indoor construction, furniture, and consumer products is impacted by this. Manufacturers are also grappling with increasing raw material prices, volatile petrochemical availability and demand to achieve new environmental certifications without sacrificing performance.

Green resins, engineered wood growth, and construction trends offer strong upside.

Considerable opportunities exist in the production of low-emission and formaldehyde-free variants of amino resins, especially melamine-rich resins intended for glazing and exterior-grade applications. The increasing use of prefabricated construction, DIY furniture, and modular interiors leads to an augmented market demand for resin-laminated boards. Emerging future growth vectors in this sector include bio-based feedstocks, advanced curing technologies and heat-resistant coatings.

Demand in Construction, Automotive & Wood Panel Applications Drives Steady Growth of the USA Amino Resin Market. The Growing production of residential housing and furniture is increasing demand for amino resins in particleboard and MDF manufacturing. The push of regulations on formaldehyde emissions is driving innovation in low-emission urea-formaldehyde and melamine-formaldehyde resins.

Manufacturers are turning to continuous processing technologies to enhance resin quality and energy efficiency. Key players are focusing on R&D of water-based, bio-derived amino resin solutions to cater to the sustainability objectives and green building certifications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

The demand for high-performance laminates, adhesives, coatings, and other materials has increased in the region, thereby strengthening the market in this area. Melamine-based resins are used in kitchen surfaces, flooring, and automotive interiors. The emphasis on environmentally aware resins has ignited spending on formaldehyde-reduced types.

Local manufacturers have already been tweaking their product lines to comply with REACH and/or low-VOC standards. The infrastructure redevelopment projects, renovation of heritage buildings and new wood-based composite panels also support the growth. Hybrid amino resins with enhanced thermal stability are also being utilized by universities and materials labs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Growth of engineered wood products and surface coatings from the European countries is fuelling the stability demand for amino resins, due to the construction code in EU for sustainable construction materials. Furniture, cabinetry and industrial coatings cause Germany, Italy and Poland to dominate resin consumption.

The EU’s focus on circular economy principles is driving the uptake of recyclable and low-emission resin systems. Companies are adopting MUF and phenol-modified amino resins to improve durability and moisture resistance. Biobased feedstock, though, is supported by government R&D programs, and resin recyclability is emerging as a purchasing factor for manufacturers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.9% |

The amino resin market in Japan is driven by its precision-centric manufacturing industrial sector, where applications are predominantly in electronic components, automotive trim, and formaldehyde-free adhesives. Melamine Resins: The high-performance variety is popular in circuit boards and specialized coatings. The demand for advanced molding compounds used in the production of durable plastic components is increasing.

Quality control, product consistency and lower emissions, which also comply with national air quality regulations, are prioritized by domestic manufacturers. Japanese research institutions are also developing amino resins with flame-retardant properties for niche electronics and antimicrobial applications in healthcare.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea's amino resin market is likely to be aided by growing construction activity, export-led furniture production and automotive interior application. As the country invests in high-gloss laminates and durable coatings, demand for melamine resins is growing. Use of low-formaldehyde urea resins is encouraged and facilitated by eco-labeling and certification of sustainable products.

Membership Advertisement: Leading chemical companies are enhancing production automation to ensure uniform resin batches and efficient curing. As a result, startups and academic institutions are experimenting with hybrid amino resin systems with nano-additives for high-temperature and chemical-resistant applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

The amino resin market is evolving as companies introduce formaldehyde-free solutions to meet growing demands for sustainability. Recent product introductions feature low-emission amino resins designed for use in furniture, construction, and interior design, providing adhesives that lower formaldehyde emissions while maintaining performance. New multifunctional additives are also being introduced, focusing on enhancing durability, appearance, and crosslinking properties in coatings, adhesives, and textiles.

The overall market size for the amino resin market was USD 12,839.6 Million in 2025.

The amino resin market is expected to reach USD 22,777.9 Million in 2035.

The demand for amino resins is rising due to their widespread use in wood adhesives, coatings, and laminates, particularly in construction and furniture manufacturing. Increasing production of particle boards and rising adoption of butylated melamine resins for improved durability and water resistance are further fueling market growth.

The top 5 countries driving the development of the amino resin market are China, the USA, Germany, India, and Japan.

Butylated melamine resins and particle board applications are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Premixes Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

Acetaminophen API Market Report – Demand, Trends & Industry Forecast 2025–2035

Acetaminophen Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Acetaminophen-Opioid Combination Market Analysis – Size, Share & Forecast 2024-2034

Food Amino Acids Market Size, Growth, and Forecast for 2025 to 2035

Feed Amino Acids Market Analysis by Product, Application, and Region through 2035

Chiral Amino Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Serine Amino Acid Market - Size, Share, and Forecast Outlook 2025 to 2035

Liquid Amino Ingredients Market Analysis by Source,Type and Application Through 2035

Alanine Aminotransferase Reagent Market

(S)-(+)-2-Amino-1-Propanol Market Size and Share Forecast Outlook 2025 to 2035

Fermented Amino Acid Complex Market Size and Share Forecast Outlook 2025 to 2035

Specialty Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Branched Chain Amino Acids Market Size and Share Forecast Outlook 2025 to 2035

Theophylline And Aminophylline Market Size and Share Forecast Outlook 2025 to 2035

Resin Capsule Market Forecast and Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA