The resin capsule market is witnessing consistent growth, primarily driven by the increasing use of fast-curing anchoring systems in mining, tunneling, and construction industries. Resin capsules offer superior load-bearing capacity, chemical resistance, and installation efficiency, making them a preferred choice for structural reinforcement applications.

The current market dynamics reflect rising safety standards, the adoption of automation in underground operations, and the need for reliable bonding solutions in challenging environments. Product innovation focused on improving curing speed and shelf stability is further enhancing market performance.

As infrastructure development and mining activities expand globally, demand for resin capsules is expected to grow steadily. The integration of sustainable materials and advanced catalyst systems is anticipated to improve performance while aligning with environmental regulations.

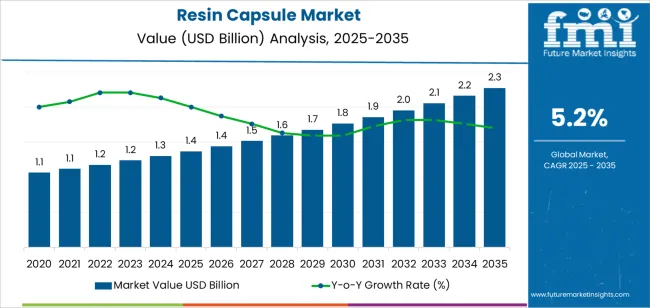

| Metric | Value |

|---|---|

| Resin Capsule Market Estimated Value in (2025 E) | USD 1.4 billion |

| Resin Capsule Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

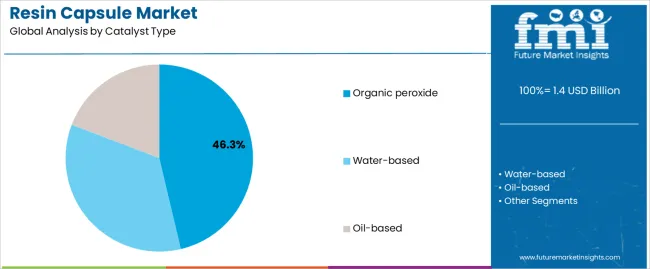

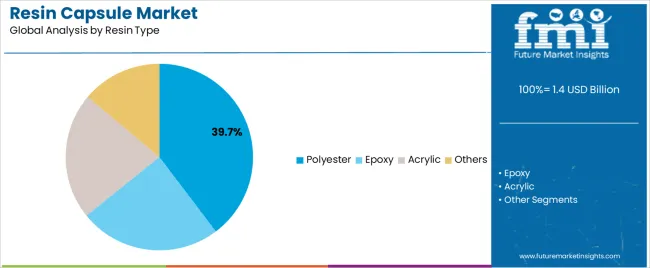

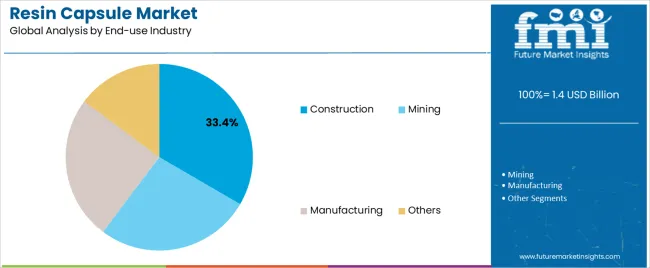

The market is segmented by Catalyst Type, Resin Type, and End-use Industry and region. By Catalyst Type, the market is divided into Organic peroxide, Water-based, and Oil-based. In terms of Resin Type, the market is classified into Polyester, Epoxy, Acrylic, and Others. Based on End-use Industry, the market is segmented into Construction, Mining, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic peroxide segment leads the catalyst type category with approximately 46.3% share, owing to its strong catalytic efficiency and compatibility with a wide range of resin systems. Its ability to initiate rapid polymerization under varying temperature conditions enhances productivity in time-sensitive applications.

The segment’s dominance is reinforced by consistent performance, predictable curing behavior, and adaptability across both polyester and epoxy resin formulations. Organic peroxides are favored in underground anchoring and bolting applications where quick setting and high bonding strength are critical.

With continued infrastructure expansion and stringent safety compliance in mining and tunneling operations, this segment is expected to maintain its leading position.

The polyester segment dominates the resin type category, accounting for approximately 39.7% share in the resin capsule market. Its popularity stems from cost-effectiveness, rapid curing characteristics, and strong adhesion properties suitable for both temporary and permanent anchoring.

Polyester resins are preferred due to their high reactivity, chemical resistance, and long-term durability under varying environmental conditions. The segment benefits from extensive industrial utilization in construction and civil engineering projects, where reliability and efficiency are prioritized.

Continuous formulation advancements have improved thermal and mechanical stability, further extending the segment’s lifecycle performance. With growing demand for versatile anchoring materials, polyester resin capsules are expected to sustain their market leadership.

The construction segment accounts for approximately 33.4% share of the end-use industry category, reflecting its status as the largest consumer of resin capsules. Increasing demand for structural reinforcement, concrete anchoring, and rebar fixing in large-scale infrastructure projects has driven adoption.

Resin capsules offer fast installation and high load-bearing capability, reducing labor time and improving overall site efficiency. Their use in bridges, tunnels, and building foundations has become standard practice due to consistent performance and compliance with safety regulations.

The segment also benefits from rising investment in urban development and public infrastructure globally. As governments emphasize sustainable and durable construction practices, the construction segment is expected to retain its dominant market position.

The scope for global resin capsule market insights expanded at a 7.2% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 5.2% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 7.2% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.2% |

Between 2020 and 2025, the global market experienced significant growth, with a CAGR of 7.2%. This growth was attributed to increasing infrastructure projects worldwide, particularly in the construction, mining, and tunneling sectors.

From 2025 to 2035, the market is projected to grow slightly slower, with a CAGR of 5.2%. Despite this deceleration, the market is expected to continue expanding due to infrastructure developments and the demand for reliable anchoring and reinforcement solutions.

Factors influencing this growth include technological advancements, environmental regulations, and the emergence of new applications for resin capsules.

| Attributes | Details |

|---|---|

| Restraints |

|

The table highlights the CAGRs across five crucial countries, the United States, Japan, China, the United Kingdom, and South Korea. Japan emerges as a vibrant market poised for remarkable growth, projected to achieve a 6.5% CAGR by 2035.

Renowned for its commitment to innovation, Japan is a pivotal player across diverse industries, boasting a flourishing economic landscape characterized by ongoing advancement.

The substantial CAGR highlights a proactive stance in embracing and propelling advancements within the market, cementing its role as a significant contributor to the global industry. This underscores the dedication to sustainable practices, positioning it as a noteworthy force driving positive developments within the resin capsule sector on a global scale.

| Countries | CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.3% |

| Japan | 6.5% |

| China | 6.1% |

| The United Kingdom | 5.7% |

| South Korea | 6.3% |

Resin capsules are extensively used in the United States due to the vast construction industry, which demands reliable anchoring and reinforcement solutions for infrastructure projects such as bridges, highways, and buildings.

The mining sector in the United States relies on resin capsules for securing bolts and anchors in underground operations, further driving market demand.

The dedication to innovation and technological advancement fuels a robust market for resin capsules in Japan. With a strong focus on infrastructure development and earthquake-resistant construction, resin capsules are vital in securing structures and ensuring their stability in seismic-prone regions.

The thriving mining industry also contributes to the significant usage of resin capsules in underground operations.

The market in China experiences high demand due to the rapid urbanization and extensive construction activities. Resin capsules are widely used in the construction sector to anchor and reinforce structures, including high-rise buildings, bridges, and tunnels.

The flourishing mining industry relies on resin capsules for rock reinforcement and ground support in underground mines.

In the United Kingdom, resin capsules are predominantly used in construction and infrastructure. Focusing on sustainable development and infrastructure modernization projects, resin capsules ensure the structural integrity and safety of buildings, bridges, and tunnels.

The mining industry in the United Kingdom utilizes resin capsules for ground stabilization and reinforcement in underground operations.

The market benefits from the thriving construction industry and focuses on infrastructure development. Resin capsules are extensively used in South Korea for securing anchors and bolts in construction projects and for rock reinforcement and ground support in mining operations.

Investing in advanced technology and innovation further drives the adoption of resin capsules in various applications.

The table below overviews the resin capsule landscape based on catalyst type and resin type. Organic peroxide is projected to lead the catalyst type market at a 5.1% CAGR by 2035, while polyester in the resin type category is likely to expand at a CAGR of 5% by 2035.

Organic peroxides serve as catalysts in various chemical processes, driving demand from industries such as polymer manufacturing, plastics, and rubber. The versatility of polyester drives demand for polyester resins, positioning them as the leading category in the resin type market.

| Category | CAGRs from 2025 to 2035 |

|---|---|

| Organic Peroxide | 5.1% |

| Polyester | 5% |

Organic peroxide emerges as the frontrunner in the catalyst type segment, expected to achieve a solid 5.1% CAGR by 2035. This projection reflects the increasing demand for organic peroxides as catalysts in various industrial processes, particularly in polymer manufacturing, plastics, and rubber industries.

Organic peroxides are crucial in initiating and accelerating chemical reactions, making them indispensable components in producing resin capsules and other related products.

Polyester resin stands out in the resin type category, poised to expand at a CAGR of 5% by 2035. The versatility and wide-ranging applications across the automotive, construction, and electronics industries contribute to its steady growth trajectory.

With attributes like high strength, durability, and corrosion resistance, polyester resin finds extensive use in manufacturing fiberglass, coatings, laminates, and, notably, resin capsules. This sustained demand for polyester resin underscores its significance in shaping the market landscape over the forecast period.

The competitive landscape is characterized by intense rivalry among key players striving to gain a significant market share. Companies engage in strategies such as product innovation, strategic partnerships, mergers, and acquisitions to strengthen their foothold in the market.

Manufacturers focus on expanding their geographical presence to tap into emerging markets with increasing infrastructure development activities. Moreover, competitive pricing strategies and quality assurance measures are crucial in differentiating products and attracting customers.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.4 billion |

| Projected Market Valuation in 2035 | USD 2.3 billion |

| CAGR Share from 2025 to 2035 | 5.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | By Catalyst Type, By Resin Type, By End-use Industry, By Region |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

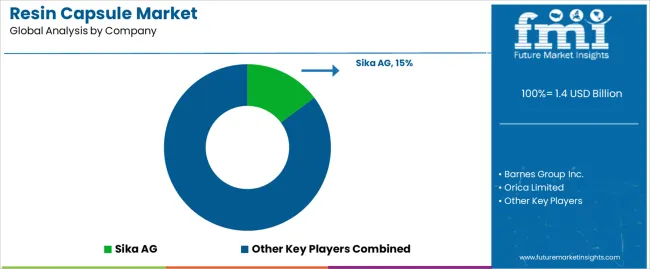

| Key Companies Profiled | Sika AG; Barnes Group Inc.; Orica Limited; DYWIDAG-Systems International; Bohle AG; Rawlplug; Sormat OY; Arkema SA; Fischer Holding GmbH & CO.; Hexion Inc.; Koelner Rawlplug IP |

The global resin capsule market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the resin capsule market is projected to reach USD 2.3 billion by 2035.

The resin capsule market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in resin capsule market are organic peroxide, water-based and oil-based.

In terms of resin type, polyester segment to command 39.7% share in the resin capsule market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resin Silencer Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Market Share Breakdown of Capsule Filling Machine Manufacturers

Capsule Coffee Machines Market

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wine Capsule Market Insights – Trends & Forecast 2024-2034

Agar Resin Market

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Furan Resin Market Size and Share Forecast Outlook 2025 to 2035

Empty Capsule Market Report - Growth, Demand & Forecast 2025 to 2035

Amino Resin Market Growth - Trends & Forecast 2025 to 2035

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Cobalt Resinate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA