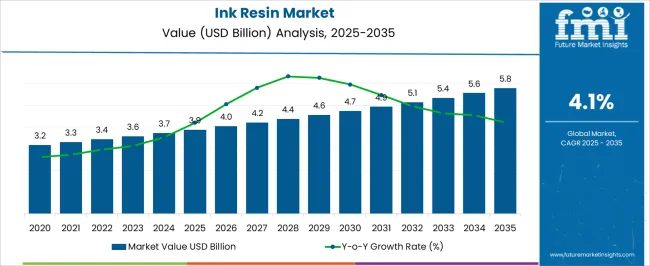

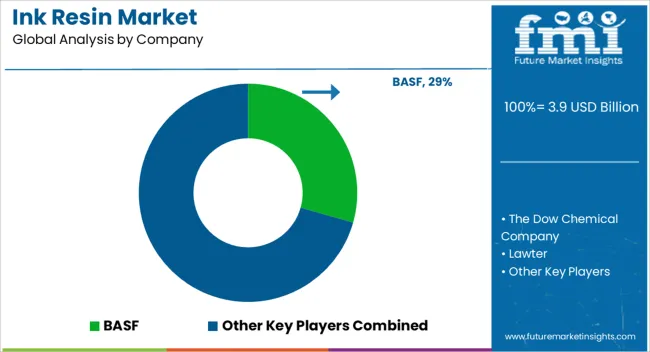

The Ink Resin Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. Regulations pertaining to volatile organic compounds, heavy metals, and environmental compliance directly impact raw material selection, formulation processes, and production techniques within the market. Manufacturers are required to adhere to stringent standards, particularly in regions with robust chemical safety laws, which can increase compliance costs and limit the use of certain resin types, thereby affecting the overall cost structure and market expansion.

The regulatory pressures are expected to drive innovation toward eco-friendly and low-emission ink resins, promoting the adoption of bio-based or waterborne alternatives. This transition may initially slow market growth due to higher production costs and certification requirements, but it simultaneously opens opportunities for companies that can successfully develop compliant, high-performance products. Regulatory harmonization across key regions can further influence cross-border trade, pricing strategies, and competitive positioning. The market’s growth trajectory is closely tied to regulatory evolution, with compliance acting both as a constraint and a driver for technological advancement. Companies that proactively align product development with evolving standards are likely to capture greater market share, while those unable to adapt may face operational limitations, illustrating a clear linkage between regulatory dynamics and sustainable growth in the Ink Resin market.

| Metric | Value |

|---|---|

| Ink Resin Market Estimated Value in (2025 E) | USD 3.9 billion |

| Ink Resin Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The ink resin market is witnessing sustained expansion due to the increasing demand for high performance printing inks in packaging, publication, and commercial printing applications. Growing emphasis on print quality, adhesion properties, and environmental compliance is encouraging manufacturers to develop resins that enhance pigment dispersion and surface finish.

The shift toward sustainable and bio based inks is also reshaping formulation strategies, particularly within food grade and low VOC segments. Technological advancements in resin modification have improved compatibility with various ink technologies, including UV curable, water based, and oil based systems.

As the packaging industry continues to expand globally, driven by e commerce and fast moving consumer goods, the market for ink resins remains on a steady growth trajectory. Regulatory frameworks encouraging the reduction of solvent based emissions and improvement in print safety are also supporting market evolution.

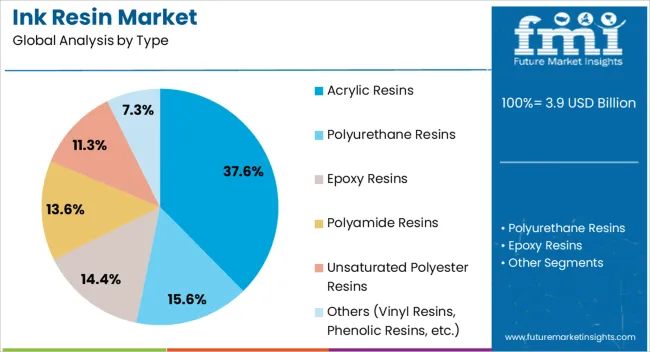

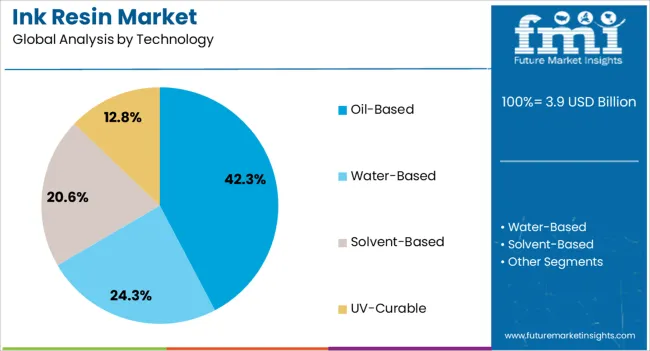

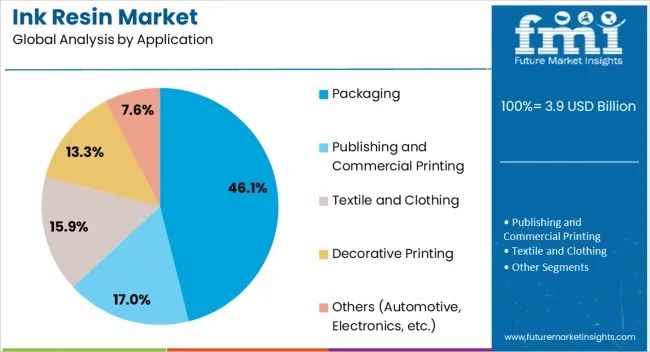

The ink resin market is segmented by type, technology, application, printing process, and geographic regions. By type, the ink resin market is divided into Acrylic Resins, Polyurethane Resins, Epoxy Resins, Polyamide Resins, Unsaturated Polyester Resins, and Others (Vinyl Resins, Phenolic Resins, etc.). In terms of technology, the ink resin market is classified into Oil-Based, Water-Based, Solvent-Based, and UV-Curable. Based on application, the ink resin market is segmented into Packaging, Publishing and Commercial Printing, Textile and Clothing, Decorative Printing, and Others (Automotive, Electronics, etc.). By printing process, the ink resin market is segmented into Lithographic, Flexographic, Gravure, Letterpress, and Other. Regionally, the ink resin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic resins segment is expected to hold 37.60% of total market revenue by 2025 under the type category, making it the leading formulation. This leadership is driven by the excellent weather resistance, fast drying capabilities, and superior color retention that acrylic resins offer in diverse printing environments.

Their adaptability to both water-based and solvent-based ink systems makes them suitable across a broad range of substrates, including plastic, paper, and foil. In addition to performance benefits, acrylic resins provide stability and adhesion, which are essential in high-speed printing operations.

These qualities have reinforced their demand in flexible packaging and label printing, where consistent quality and durability are critical. With ongoing developments in low VOC and hybrid acrylic systems, the segment continues to expand its footprint in global ink applications.

The oil-based technology segment is projected to capture 42.30% of total revenue within the technology category by 2025, positioning it as the dominant segment. This preference stems from the strong penetration of oil-based systems in traditional printing formats such as offset printing, where ink flow and image sharpness are critical.

Oil-based inks provide excellent rub resistance, gloss, and long-term print quality, particularly on coated and uncoated paper surfaces. Their compatibility with large volume production environments and reduced drying time requirements in certain substrates has further supported their use.

Despite the rise of alternative technologies, oil based systems remain integral in commercial and publication printing, maintaining their relevance through continuous improvements in formulation and sustainability.

The packaging application segment is forecasted to account for 46.10% of the total ink resin market by 2025, establishing it as the leading application area. This growth is attributed to the global surge in flexible and rigid packaging demand across food, beverage, pharmaceutical, and personal care sectors.

Packaging applications require inks with high adhesion, resistance to moisture and abrasion, and vibrant color quality, all of which are supported by advanced ink resin formulations. The trend toward customized and digitally printed packaging has also boosted the need for resins that perform consistently across a range of printing technologies.

Furthermore, regulatory standards around packaging safety and recyclability are encouraging the development of resins that align with food contact compliance and sustainable print practices. These drivers collectively position packaging as the primary growth engine for the ink resin market.

The market has been expanding due to increasing demand in printing, packaging, and specialty coating applications. Ink resins have been valued for their ability to enhance adhesion, durability, gloss, and print quality across various substrates. Growth has been driven by rising consumption in flexible packaging, commercial printing, and industrial coatings. Technological innovations in resin formulations, including UV-curable, water-based, and bio-based resins, have strengthened performance characteristics. Market expansion has also been supported by evolving consumer preferences for high-quality, sustainable, and versatile printing solutions across multiple industries globally.

The market has been significantly influenced by growth in commercial printing, packaging, and labeling applications. Ink resins have been used extensively in flexographic, gravure, offset, and digital printing processes to improve adhesion, color intensity, and gloss. The food and beverage, pharmaceutical, and personal care sectors have increasingly relied on high-performance ink formulations to ensure brand visibility, product safety, and shelf appeal. Additionally, flexible packaging, cartons, and labels have required specialized resins that provide resistance to heat, moisture, and mechanical abrasion. As demand for visually appealing and durable printed materials has increased, ink resin adoption has been reinforced across industrial and commercial sectors, ensuring consistent market expansion.

Technological advancements in resin chemistry have strengthened the ink resin market by improving performance, environmental compliance, and application versatility. UV-curable and LED-curable resins have been developed to reduce energy consumption, increase production speed, and minimize VOC emissions. Water-based and bio-based resin systems have addressed environmental concerns while maintaining adhesion and gloss properties comparable to solvent-based alternatives. Specialized resin blends have been optimized for digital printing, flexible packaging, and metal decorating applications. The modifications in polymer chain structure and molecular weight distribution have enhanced mechanical properties, durability, and color retention. These innovations have encouraged manufacturers to expand product portfolios and offer tailored solutions for specific printing and industrial applications.

The market has been shaped by regulatory frameworks and sustainability initiatives targeting VOC emissions, hazardous chemicals, and environmental impact. Restrictions on solvent-based resins in Europe, North America, and Asia-Pacific have encouraged adoption of water-based, bio-based, and UV-curable alternatives. Eco-label certifications and green printing practices have further promoted sustainable resin solutions. Manufacturers have been incentivized to innovate in low-emission, biodegradable, and recyclable resins to meet compliance and consumer expectations. These regulations and trends have created opportunities for eco-friendly product differentiation while ensuring performance standards in packaging, industrial coatings, and printing applications, positioning the ink resin market for long-term sustainable growth.

Despite steady growth, the market has faced challenges related to raw material volatility, cost pressures, and formulation complexity. Fluctuating prices of petrochemical derivatives, acrylics, and polymer precursors have affected production costs. Compatibility with different inks, pigments, and printing substrates has required careful formulation development. Maintaining performance while meeting environmental regulations has necessitated continuous R&D investments. Competitive pressures from alternative resin suppliers and generic products have influenced pricing strategies. Manufacturers have responded by optimizing production processes, improving supply chain efficiency, and developing multi-functional resin systems. These measures have helped sustain product quality, maintain market competitiveness, and meet the evolving needs of printing, packaging, and industrial end users.

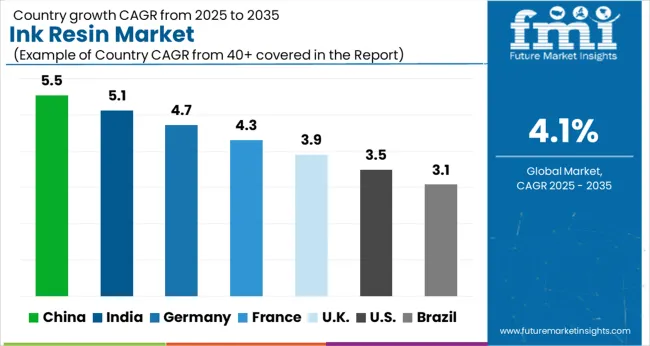

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The market is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by increasing demand for printing inks, packaging applications, and advancements in resin formulations. China leads with a 5.5% CAGR, propelled by large-scale manufacturing and adoption in industrial printing. India follows at 5.1%, supported by growing packaging industries and ink production capacity. Germany, at 4.7%, benefits from high-quality printing technology and strong industrial demand. The UK, growing at 3.9%, focuses on specialty inks and innovative resin applications, while the USA, at 3.5%, sees steady demand from commercial printing and packaging sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.5%, driven by increasing demand for printing inks in packaging, commercial printing, and specialty applications. Manufacturers are investing in high-performance resins that enhance print quality, durability, and environmental compliance. The market is also supported by rising e-commerce packaging needs and advancements in ink formulations compatible with digital printing technologies. Strategic collaborations with chemical suppliers are improving product portfolios and production efficiency. Continuous innovation in resin chemistry and adaptation to regulatory standards are further accelerating market adoption.

India is expected to expand at a CAGR of 5.1%, fueled by growing packaging industry demand and commercial print sector expansion. Companies are focusing on producing eco-friendly resins and adapting formulations for flexible and digital printing applications. Investment in R&D for improved adhesion, color consistency, and drying properties is enhancing market competitiveness. Rising demand from food and beverage packaging, labels, and decorative printing is supporting growth.

Germany is forecasted to grow at a CAGR of 4.7%, supported by stringent regulatory requirements for safe and sustainable printing inks. Manufacturers emphasize high-quality resins with low VOC content and compatibility with digital and industrial printing. Collaborations with global chemical technology providers are driving advanced resin formulations. Adoption is also accelerated by rising industrial packaging needs and specialized printing applications in automotive, electronics, and consumer goods sectors.

The United Kingdom is projected to grow at a CAGR of 3.9%, influenced by demand for high-quality packaging and printing inks across various sectors. Companies are investing in resins that offer improved adhesion, color stability, and reduced environmental impact. Growth is further supported by the expansion of flexible and digital printing applications in labels, decorative, and commercial printing. Strategic partnerships and innovations in resin chemistry are strengthening market presence.

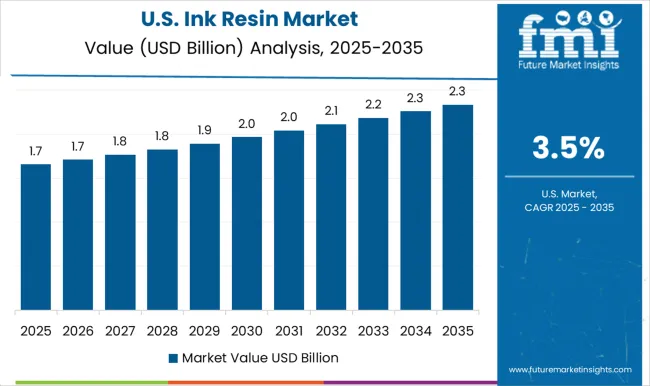

The United States is forecasted to grow at a CAGR of 3.5%, driven by demand from packaging, commercial printing, and specialty ink applications. Market players focus on eco-friendly, high-quality resin solutions that enhance print durability, color consistency, and drying speed. Integration with digital and industrial printing technologies is expanding adoption. Investments in advanced resin chemistry, safety compliance, and collaborative R&D initiatives are supporting competitive advantage.

The market is experiencing steady growth driven by the demand for high-performance printing solutions across packaging, commercial printing, and specialty applications. Leading providers such as BASF, The Dow Chemical Company, and Evonik Industries dominate the market by offering a wide range of resin technologies, including acrylics, polyurethanes, and epoxy-based formulations. These companies focus on developing resins that improve adhesion, durability, and color vibrancy while maintaining compatibility with various ink systems.

Allnex, Kraton Corporation, and Flint Group contribute significantly with innovative solutions for UV-curable, solvent-based, and waterborne inks, addressing environmental concerns and regulatory compliance. Lawter, Cymk Inks, and Arakawa Chemical Industries specialize in specialty resins tailored for packaging and industrial applications, enhancing print quality and functional performance. DIC Corporation, Nissin Chemical Industry, and Indulor emphasize product consistency, reliability, and global distribution networks to support large-scale printing operations.

The market is influenced by trends such as sustainability, the shift toward eco-friendly ink formulations, and the integration of digital printing technologies. Continuous investment in research and development allows these providers to enhance product performance, meet evolving customer requirements, and maintain competitiveness in a dynamic market environment. These leading companies collectively drive innovation, sustainability, and quality in the ink resin sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Type | Acrylic Resins, Polyurethane Resins, Epoxy Resins, Polyamide Resins, Unsaturated Polyester Resins, and Others (Vinyl Resins, Phenolic Resins, etc.) |

| Technology | Oil-Based, Water-Based, Solvent-Based, and UV-Curable |

| Application | Packaging, Publishing and Commercial Printing, Textile and Clothing, Decorative Printing, and Others (Automotive, Electronics, etc.) |

| Printing Process | Lithographic, Flexographic, Gravure, Letterpress, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, The Dow Chemical Company, Lawter, Cymk Inks, Arakawa Chemical Industries, Evonik Industries, Kraton Corporation, Allnex, Flint Group, DIC Corporation, Nissin Chemical Industry Co., Ltd., and Indulor |

| Additional Attributes | Dollar sales by resin type and application, demand dynamics across printing, packaging, and coatings sectors, regional trends in industrial and commercial usage, innovation in durability, adhesion, and eco-friendly formulations, environmental impact of production and disposal, and emerging use cases in sustainable and high-performance printing solutions. |

The global ink resin market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the ink resin market is projected to reach USD 5.8 billion by 2035.

The ink resin market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in ink resin market are acrylic resins, polyurethane resins, epoxy resins, polyamide resins, unsaturated polyester resins and others (vinyl resins, phenolic resins, etc.).

In terms of technology, oil-based segment to command 42.3% share in the ink resin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Resin Silencer Market Size and Share Forecast Outlook 2025 to 2035

Resin Capsule Market Forecast and Outlook 2025 to 2035

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Ink Abrasion Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Resin Pigments Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Ink Tank Printer Market

Linkage Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA