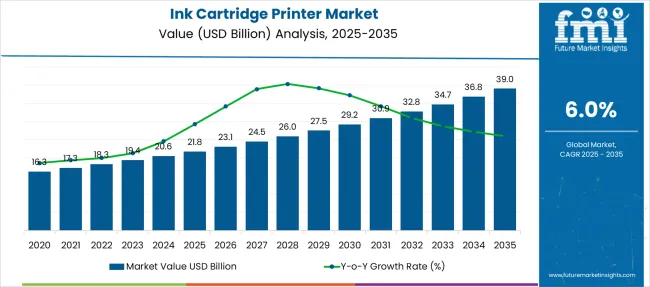

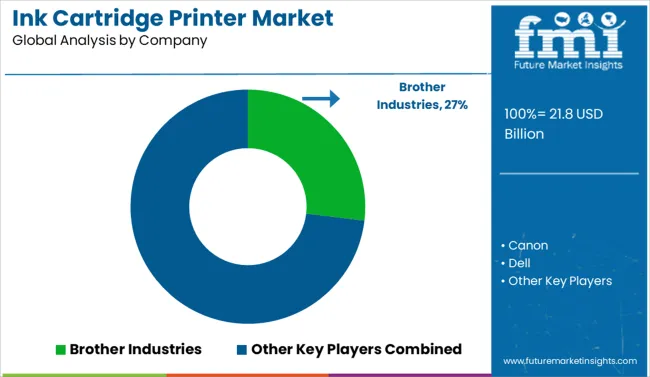

The Ink Cartridge Printer Market is estimated to be valued at USD 21.8 billion in 2025 and is projected to reach USD 39.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Ink Cartridge Printer Market Estimated Value in (2025 E) | USD 21.8 billion |

| Ink Cartridge Printer Market Forecast Value in (2035 F) | USD 39.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The ink cartridge printer market is witnessing steady expansion as businesses and consumers increasingly demand high quality, cost effective, and versatile printing solutions. The shift toward digital transformation across offices and institutions has fueled consistent demand for reliable printing infrastructure.

Advancements in ink formulation, precision nozzles, and compatibility with various substrates have improved the efficiency and output quality of ink cartridge printers. Sustainability concerns are also influencing product design, with manufacturers investing in recyclable cartridges and refillable systems.

Additionally, the proliferation of e commerce platforms has enabled direct access to a wider range of cartridge products and printer models. The market outlook remains positive as commercial and educational sectors continue to prioritize dependable and scalable printing solutions, especially in regions where digital and physical documentation coexist as essential operational requirements.

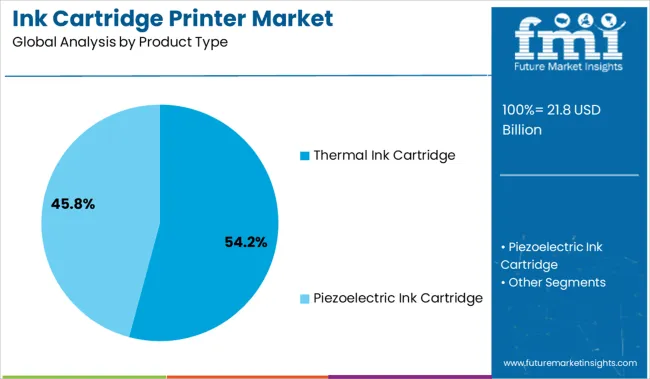

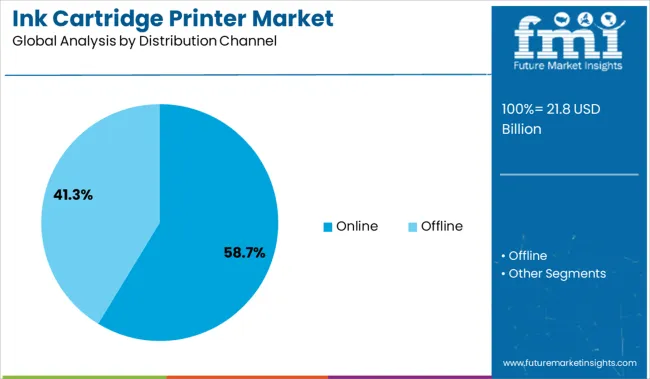

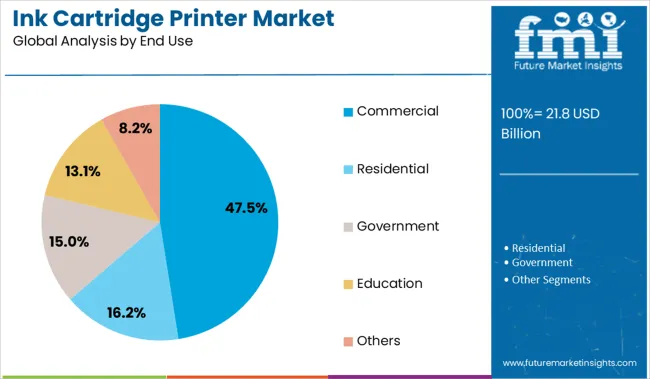

The ink cartridge printer market is segmented by product type, distribution channel, and end use and geographic regions. The ink cartridge printer market is divided by product type into Thermal Ink cartridges and Piezoelectric Ink cartridges. In terms of distribution channels, the ink cartridge printer market is classified into Online and Offline. Based on end use, the ink cartridge printer market is segmented into Commercial, Residential, Government, Education, and Others. Regionally, the ink cartridge printer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thermal ink cartridge segment is expected to account for 54.20 percent of total market revenue by 2025 within the product type category, making it the dominant segment. This leadership is driven by the widespread adoption of thermal inkjet technology for its precise droplet control, fast drying output, and compatibility with high speed printing applications.

The simplicity of its design enables lower manufacturing costs and easier maintenance, which appeals to both enterprise and individual users. Moreover, its suitability for printing on a variety of surfaces including paper, plastic, and coated materials supports diverse end use cases across sectors.

These benefits have positioned thermal ink cartridges as the preferred choice for users seeking cost efficiency, consistent performance, and adaptability in daily printing tasks.

The online distribution channel is projected to contribute 58.70 percent of total market revenue by 2025, securing its position as the leading distribution mode. This growth is fueled by consumer preference for convenience, wider product selection, and competitive pricing available through digital platforms.

E commerce expansion has enabled manufacturers and third party sellers to reach end users directly, streamlining the supply chain and enhancing customer experience. Furthermore, the ability to compare specifications, read reviews, and access subscription based cartridge replacement services has strengthened buyer confidence.

Online platforms also support targeted promotions and real time inventory management, making them highly efficient for both sales and after sales engagement. These combined factors have reinforced the online channel’s dominance in the ink cartridge printer market.

The commercial segment is expected to account for 47.50 percent of total market revenue by 2025 under the end use category, making it the largest application area. This is driven by sustained printing needs across industries such as retail, education, logistics, and finance where physical documentation and labeling remain operationally critical.

Businesses continue to invest in durable and scalable printer systems that support large volume output with minimal downtime. Thermal ink cartridges are particularly favored in commercial environments for producing high resolution barcodes, receipts, and forms.

Additionally, the need for brand consistency in printed materials and secure document printing has supported the continued use of ink cartridge printers in office settings. As digital and physical workflows converge, the commercial segment remains a stronghold for consistent and high frequency printing requirements.

Demand for ink cartridge printers is rising in SOHO and remote work setups, while sales of refillable and high-yield cartridges are expanding due to cost-saving requirements. OEMs are leveraging subscription models and chip-enabled cartridges to defend margins and secure recurring revenue.

Demand for ink cartridge printers surged 19% in 2025 as remote work setups stabilized across North America, Europe, and Asia. Refillable tank systems outpaced single-use cartridges, particularly in India and Southeast Asia, where refill models gained a 28% market share. SOHO buyers prioritized printers with smart refill indicators and spill-proof nozzles, pushing average unit prices up by 14%. Online channels saw a 31% spike in bulk ink bottle subscriptions, as consumers opted for lower cost-per-page. Brands that bundled duplex printing and wireless connectivity in entry-tier models observed repeat purchase rates 17% higher, emphasizing the link between functional flexibility and brand loyalty in residential segments.

Sales of OEM ink cartridges shifted from single transactions to recurring models, growing 23% through direct-to-consumer subscriptions in 2025. Printer manufacturers deployed cartridge recognition chips to block third-party refills, reclaiming 12% of lost aftermarket share. USA enterprise buyers subscribed to managed print services with pre-scheduled cartridge delivery, reducing procurement time by 41%. In Japan and Germany, educational institutions opted for automated reordering linked to printer usage analytics, increasing cartridge consumption predictability. Vendors offering climate-responsible return programs for empty cartridges reported 21% higher renewal rates, as sustainability-incentivized users engaged more consistently with official supply channels.

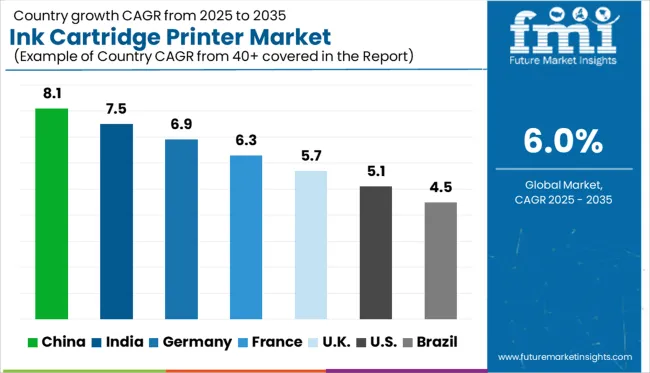

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global ink cartridge printer market is expected to grow at a CAGR of 6.0% between 2025 and 2035. At the forefront, China (BRICS) leads with a CAGR of 8.1%, surpassing the global average by 2.1 percentage points, supported by booming office automation, increased home printing demand, and domestic manufacturing scale. India (BRICS) follows with 7.5% (+1.5 pp), driven by digital literacy expansion, SME growth, and government e-governance initiatives. Among OECD nations, Germany records 6.9% (+0.9 pp), reflecting sustained demand from educational and professional sectors, along with eco-friendly ink innovations. The UK sees moderate growth at 5.7% (–0.3 pp), while the United States trails at 5.1% (–0.9 pp), where market maturity and cloud-based alternatives are slowing ink-based printer adoption. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to grow at a CAGR of 8.1% from 2025 to 2035, underpinned by expanding SME printing needs, government digitization efforts, and rising consumer spending on home office equipment. From 2020 to 2024, adoption was driven mainly by educational institutions and government departments. Over the next decade, retail and logistics industries are expected to boost demand for fast, low-cost printing.

India is anticipated to register a CAGR of 7.5% during the 2025-2035 period, led by rapid expansion in the education sector and increased digital literacy in Tier 2 and Tier 3 towns. From 2020–2024, consumer preference leaned toward low-cost, single-function models. Looking ahead, multifunction printers with Wi-Fi and mobile integration will see stronger traction.

Germany is projected to expand at a CAGR of 6.9% between 2025 and 2035, driven by the steady evolution of office printing needs and small business digitization. Between 2020 and 2024, the market witnessed moderate activity, with a focus on sustainable and energy-efficient printing solutions. Future growth will favor ink-efficient and eco-label certified products.

The UK is expected to witness a CAGR of 5.7% through 2035, supported by hybrid work trends and demand for home office printing setups. In the 2020–2024 period, purchases were largely driven by government contracts and educational usage. Going forward, cloud-connected models and cartridge recycling programs will define growth trajectories.

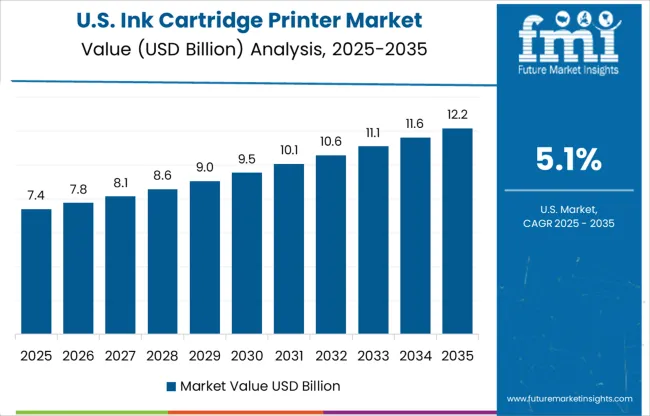

The USA market is set to expand at a CAGR of 5.1% between 2025 and 2035, driven by demand from small businesses, schools, and healthcare offices. From 2020 to 2024, ink cartridge printer sales were impacted by office closures and remote work patterns. As hybrid work stabilizes, printer fleets are being reconfigured for decentralized usage.

Demand for ink cartridge printers remains resilient in 2025, fueled by hybrid office setups and ongoing SOHO (Small Office/Home Office) trends. Brother Industries leads with a significant market share, maintaining dominance through cost-efficient ink systems and global retail reach. HP and Canon remain key players, innovating in refillable cartridges and smart connectivity. Epson and Lexmark focus on eco-tank and high-volume printing solutions, capturing demand from educational institutions. Fuji Xerox and Ricoh are enhancing wireless and cloud-based printer deployments across APAC. Sales of ink cartridge printers are also being influenced by subscription-based ink delivery models, with Dell and Samsung offering bundled service packages. Panasonic, Toshiba, and OKI continue to serve niche industrial and government sectors with durable and compact inkjet units.

In March 2025, HP Inc. unveiled the HP Color LaserJet Enterprise 8000 Series, the first printers featuring quantum-resistant firmware at its Amplify Conference. These models integrate ASIC-based security to defend against future quantum threats, reflecting HP’s advancement in secure print hardware.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.8 Billion |

| Product Type | Thermal Ink Cartridge and Piezoelectric Ink Cartridge |

| Distribution Channel | Online and Offline |

| End Use | Commercial, Residential, Government, Education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Brother Industries, Canon, Dell, Fuji Xerox Co., HP Development Company, Konica Minolta Inc, Kyocera Corporation, Lexmark International, OKI Electric Industry, Panasonic Corporation, Ricoh, Samsung, Seiko Ipson Corporation, Toshiba Corporation, and Xerox Corporation |

| Additional Attributes | Dollar sales by cartridge technology and end‑user segment, demand dynamics across OEM, compatible, and remanufactured channels, regional trends in APAC versus Americas and EMEA, innovation in smart and refillable cartridges, environmental impact of plastic waste and recycling, and emerging subscription‑based service models. |

The global ink cartridge printer market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the ink cartridge printer market is projected to reach USD 39.0 billion by 2035.

The ink cartridge printer market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in ink cartridge printer market are thermal ink cartridge and piezoelectric ink cartridge.

In terms of distribution channel, online segment to command 58.7% share in the ink cartridge printer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ink Abrasion Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Key Players & Market Share in the Inkjet Printers Industry

Ink Tank Printer Market

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Trinket Box Market Size and Share Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA