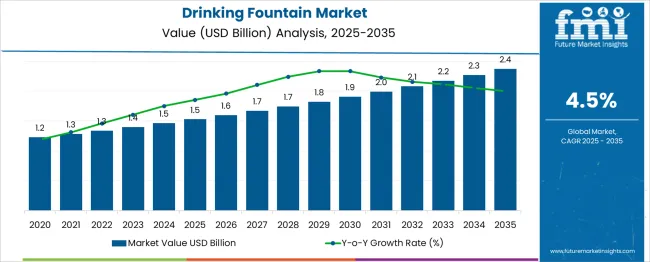

The Drinking Fountain Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Between 2025 and 2030, the market is expected to increase from USD 1.5 billion to USD 1.9 billion, reflecting steady expansion driven by urban infrastructure upgrades and demand for public hydration solutions. Year-on-year analysis shows gradual growth, reaching USD 1.6 billion in 2026 and USD 1.7 billion in 2027, supported by installations in schools, commercial complexes, and recreational facilities to promote accessible drinking water options.

By 2028, the market is forecasted to maintain its upward trajectory, reaching USD 1.7 billion, followed by USD 1.8 billion in 2029 and USD 1.9 billion by 2030. Growth is anticipated to be reinforced by increasing adoption of touchless and sensor-operated fountains that enhance hygiene standards in public spaces. Manufacturers are expected to focus on integrating filtration technology and energy-efficient cooling systems to cater to health-conscious consumers and sustainability-focused buyers. These dynamics position drinking fountains as an essential component of modern hydration infrastructure, driving opportunities for innovation and product differentiation in the coming decade.

| Metric | Value |

|---|---|

| Drinking Fountain Market Estimated Value in (2025 E) | USD 1.5 billion |

| Drinking Fountain Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The drinking fountain market holds a focused share across several water dispensing and facility infrastructure sectors. In the water dispensing and hydration solutions market, its share is approximately 12–14%, as bottled water dispensers and smart hydration systems account for larger portions. Within the commercial kitchen and foodservice equipment market, it contributes about 3–4%, since this category includes a wide range of appliances such as ovens, refrigeration, and beverage machines.

In the public infrastructure and facility equipment market, the share is around 5–6%, as drinking fountains are essential for parks, schools, airports, and stadiums. For the residential and commercial plumbing fixtures market, it accounts for nearly 4–5%, competing with sinks, faucets, and other fixtures. In the smart water management and filtration systems market, its share is smaller at about 2–3%, given the dominance of advanced IoT-enabled water systems. Growth in this segment is driven by increasing focus on public health, sustainability, and accessibility to clean drinking water in urban spaces and commercial facilities. Innovations such as sensor-activated, touchless fountains and integrated filtration systems are boosting adoption. With rising regulatory emphasis on hygiene and environmental sustainability, the drinking fountain market is expected to strengthen its position across these parent markets in the coming years.

Growth is being reinforced by increasing investments in public amenities, educational institutions, healthcare facilities, and commercial complexes where drinking fountains are seen as essential fixtures. The market is benefiting from rising demand for sustainable water dispensing solutions, particularly those that reduce plastic waste and promote eco-friendly alternatives.

Technological innovations in touchless systems and filtration capabilities are also supporting product adoption, especially in urban and indoor settings. As urban populations grow and more emphasis is placed on health and hygiene in shared spaces, demand for modern and hygienic hydration solutions continues to rise.

Moreover, regulatory standards focused on sanitation and accessibility have compelled public and private sectors to upgrade older units or install new systems. The market outlook remains optimistic as functionality, design adaptability, and health consciousness shape future developments across key verticals..

The drinking fountain market is segmented by type, material, installation, price range, end users, distribution channel, and geographic regions. The drinking fountain market is divided into Wall-mounted fountains, Tabletop fountains, Free-standing fountains, and Others. In terms of material, the drinking fountain market is classified into Stainless steel, Plastic, Concrete, and Others (fiberglass, bamboo, ceramic, etc.). Based on the installation of the drinking fountain, the market is segmented into Indoor and Outdoor. The price range of the drinking fountain market is segmented into Medium, Low, and High. The end users of the drinking fountain market are segmented into Commercial, Residential, and Industrial. The distribution channel of the drinking fountain market is segmented into Indirect sales and Direct sales. Regionally, the drinking fountain industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

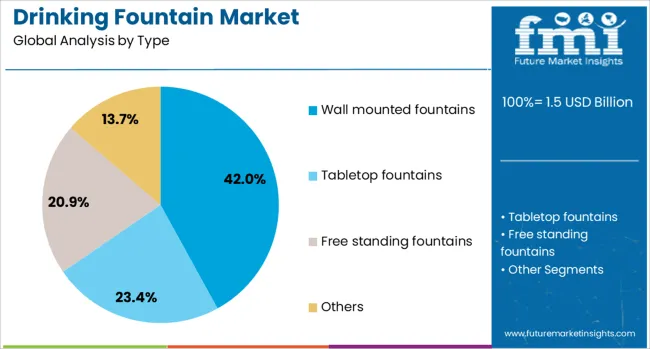

The wall-mounted segment is projected to account for 42% of the Drinking Fountain market revenue share in 2025, establishing it as the leading type. Growth in this segment has been attributed to the compact design and space-saving installation of wall-mounted units, which make them highly suitable for high-traffic environments such as schools, airports, hospitals, and commercial buildings. Their elevated positioning allows easy integration into existing wall infrastructure, thereby reducing floor obstruction and improving access.

The increased preference for wall mounted units has also been influenced by modern aesthetic designs and compatibility with touchless and sensor-based features that support enhanced hygiene. Facility managers have favored these models due to their durability, ease of maintenance, and compliance with accessibility standards.

Additionally, their ability to be paired with bottle filling stations has aligned them with sustainability goals, promoting a reduction in single-use plastic consumption. As modernization and retrofitting projects expand across sectors, wall mounted units are expected to retain their leadership position within the market..

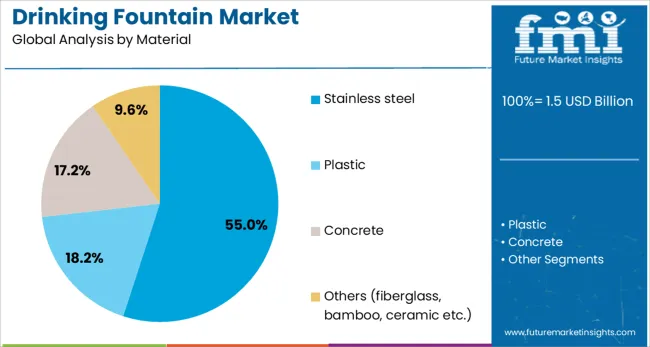

The stainless steel segment is expected to hold a dominant 55% share of the Drinking Fountain market revenue in 2025. This material has been widely adopted due to its exceptional durability, corrosion resistance, and ease of cleaning, which make it particularly suitable for high-use and public installations. The hygienic properties of stainless steel have made it the preferred material in environments where sanitation is critical, including healthcare facilities, food service areas, and educational institutions.

Its ability to withstand varying water conditions and resistance to vandalism have further enhanced its utility in both indoor and outdoor installations. Manufacturers have increasingly focused on stainless steel for premium product lines, integrating it with advanced filtration, UV sanitation, and sensor-based technologies.

Its compatibility with modern design aesthetics has also supported wider adoption across architecturally sensitive projects. As demand rises for low-maintenance and long-lasting fixtures that meet stringent health and safety standards, stainless steel continues to lead material preferences in the global market..

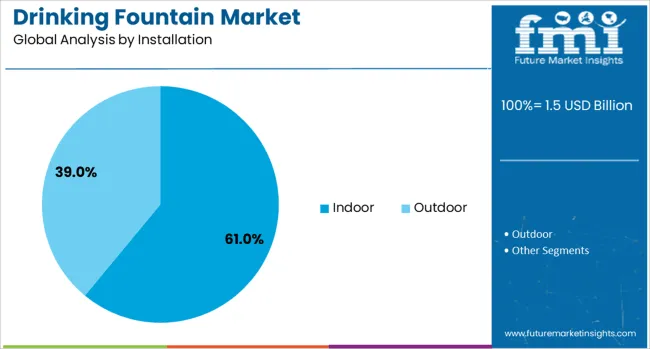

The indoor segment is projected to represent 61% of the Drinking Fountain market revenue share in 2025, making it the most prominent installation setting. This segment’s growth has been driven by increasing deployments in educational institutions, healthcare facilities, transit stations, and corporate environments where controlled indoor settings support consistent operation and hygiene. The preference for indoor installations has been supported by facility managers’ need for secure, clean, and temperature-stable environments that ensure reliable usage.

Indoor fountains are often paired with advanced purification systems and touchless features, aligning with post-pandemic health protocols. Additionally, the ability to monitor and maintain units more efficiently indoors has contributed to their rising adoption.

High footfall areas such as shopping malls, schools, and office buildings have increasingly incorporated indoor drinking fountains into their infrastructure to promote hydration and reduce dependence on bottled water. As the shift toward wellness-focused indoor environments continues, the demand for indoor installations is expected to dominate the landscape of the Drinking Fountain market..

The drinking fountain market is witnessing expansion driven by demand in commercial spaces, educational institutions, and public infrastructure projects. Growth has been supported by facility upgrades in transportation hubs and sports complexes. Opportunities lie in touchless hydration systems and retrofitting initiatives across developed markets. Key trends include integration of filtration units and bottle-filling stations for convenience and hygiene. However, challenges such as high installation costs, plumbing retrofitting complexities, and regional water quality variations are restricting penetration in some areas. Overall, the market outlook reflects sustained demand with innovation shaping future adoption.

The primary growth driver for the drinking fountain market has been increased adoption across public and commercial spaces undergoing modernization. In 2024 and 2025, new installations were observed in airports, schools, and sports arenas as part of infrastructure upgrade programs. Touch-free and chilled water units were favored in high-traffic locations to enhance user experience. Integration of advanced filters to improve water quality became a standard in municipal projects. This momentum suggests that public-sector investments and corporate facility revamps will continue to elevate market demand in the short to medium term.

Significant opportunities are visible in the development of touchless drinking fountains and retrofitting programs in older buildings. In 2025, demand increased for hands-free units in healthcare facilities and corporate offices to meet safety-focused expectations. Retrofitting older fountains with advanced filters and energy-efficient chillers offered growth potential for aftermarket service providers. Compact designs for indoor spaces and outdoor ruggedized models also gained attention in hospitality and tourism facilities. These factors underline the importance of customization and adaptability for vendors seeking to capture untapped market segments globally.

Emerging trends in the drinking fountain market include the addition of multi-stage filtration systems and integrated bottle-filling stations. In 2024, educational institutions and corporate campuses increasingly installed combination units to meet user preference for quick hydration solutions. Smart monitoring features tracking usage and filter life became popular in large office spaces. Portable hydration stations for outdoor events were introduced to cater to temporary setups. These developments highlight an ongoing transition toward value-added features that combine convenience, quality, and operational efficiency, shaping the future direction of drinking fountain design and manufacturing.

Restraints in the drinking fountain market stem from significant installation expenses and recurring maintenance requirements. In 2024 and 2025, smaller businesses and cost-sensitive public entities delayed replacement projects due to plumbing retrofitting costs and ongoing service charges. In regions with inconsistent water quality, filter replacement frequency increased, adding to operational burdens. Limited availability of skilled service technicians further slowed adoption in rural installations. These challenges indicate the necessity for cost-effective product lines and simplified maintenance solutions to drive wider adoption across diverse geographies and facility types.

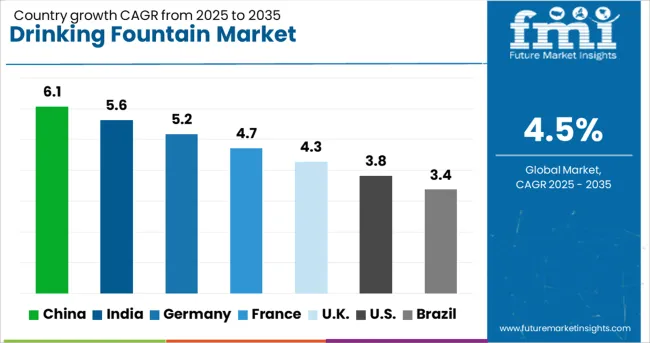

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

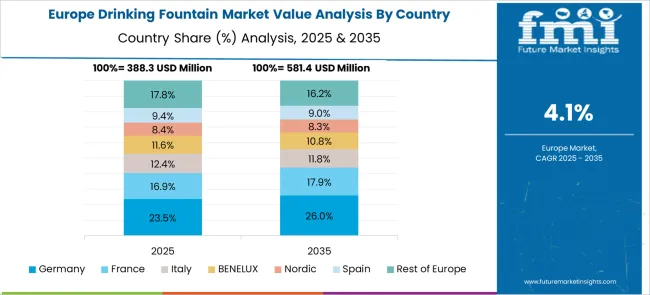

The global drinking fountain market is projected to grow at a 4.5% CAGR during 2025–2035. China leads at 6.1% CAGR, driven by rapid installation in educational campuses, public spaces, and transportation hubs. India follows at 5.6%, supported by government initiatives to promote clean drinking water accessibility and urban infrastructure expansion. Germany posts 5.2% CAGR, with demand focused on sustainable hydration solutions and smart fountains integrated with IoT monitoring. The UK records 4.3% CAGR, while the United States grows at 3.8%, reflecting steady replacement demand and rising consumer preference for touchless and filtered units. Asia-Pacific dominates with aggressive public health initiatives and infrastructure modernization, whereas developed markets emphasize premium, energy-efficient, and smart-enabled fountain systems.

China leads global demand for drinking fountains, expected to grow at 6.1% CAGR through 2035. Growth is fueled by government-led initiatives for public water accessibility in schools, parks, airports, and metro stations. Increasing urbanization and smart city projects further accelerate installations of advanced, filtered drinking fountains with real-time monitoring features. Domestic manufacturers dominate mass deployment with cost-efficient designs, while international brands introduce premium touchless models with integrated UV purification. E-commerce channels enhance consumer access to high-end fountains for commercial and office use.

The market in India is projected to grow at 5.6% CAGR, driven by government campaigns such as Jal Jeevan Mission and Swachh Bharat promoting safe drinking water availability. Increasing adoption in schools, public transport hubs, and office complexes boosts demand for hygienic and affordable solutions. Manufacturers are innovating with foot-operated and touch-free fountains to meet health-conscious consumer preferences. The hospitality and healthcare sectors also drive demand for stainless steel, energy-efficient fountains integrated with water filtration systems. Digital payment-enabled fountains are emerging in premium public spaces.

Germany is forecasted to grow at 5.2% CAGR, supported by rising adoption of sustainable hydration solutions and compliance with EU water quality regulations. Demand for contactless and filtered drinking fountains increases in corporate offices, airports, and schools. Integration of IoT-based monitoring systems for water quality and usage analytics is gaining traction in smart building projects. Manufacturers prioritize eco-friendly designs featuring low energy consumption and recyclable materials. Public spaces, sports arenas, and transit facilities remain key application areas for high-performance fountains.

The United Kingdom market is expected to expand at 4.3% CAGR, driven by government initiatives to reduce plastic waste and promote refill stations in public spaces. Increased installation in parks, transportation hubs, and educational institutions aligns with sustainability goals. Premium demand comes from contactless and filtered units integrated with water purification technologies. Manufacturers also focus on retrofitting existing public water points with modern features like UV sterilization. The hospitality sector adopts designer fountains with built-in temperature control for premium beverage dispensing.

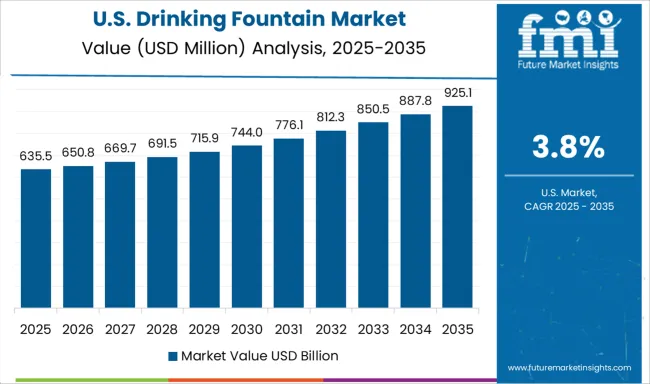

The United States market is projected to grow at 3.8% CAGR, reflecting maturity but rising adoption of touchless and smart-enabled drinking fountains in public spaces, offices, and schools. Upgrades in airports and transport hubs create opportunities for advanced units equipped with filtration, bottle-filling features, and IoT monitoring. Increasing health and hygiene awareness post-pandemic accelerates demand for antimicrobial surfaces and UV purification in fountain systems. Manufacturers emphasize compliance with ADA standards and energy-efficient certifications to align with federal building codes.

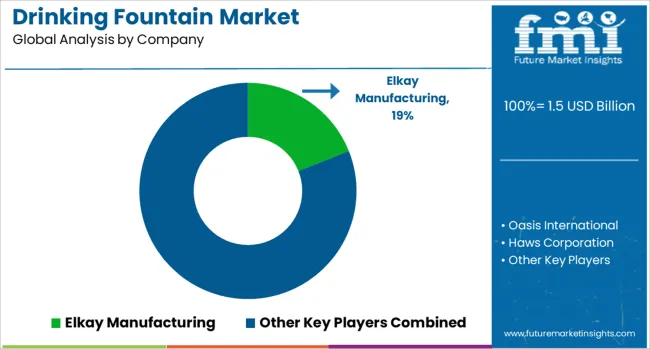

The drinking fountain market is moderately consolidated, with Elkay Manufacturing recognized as a leading player due to its wide range of hydration solutions, including touchless and bottle-filling stations. The company focuses on innovation, durability, and compliance with water safety standards, making it a preferred choice in schools, offices, and public infrastructure projects. Key players include Oasis International, Haws Corporation, Acorn Engineering, Cosmetal, Maestro, and Moerdijk.

These companies offer drinking fountains in various configurations, including wall-mounted, freestanding, refrigerated, and filtered units, addressing diverse applications in commercial, institutional, and public spaces. Their products emphasize hygienic features, easy maintenance, and ADA-compliant designs to enhance accessibility. Market growth is driven by rising demand for clean drinking water in urban environments, increased focus on public health, and growing adoption of sustainable alternatives to single-use plastic bottles.

Leading manufacturers are investing in touchless dispensing technologies, advanced water filtration systems, and IoT-enabled monitoring for maintenance efficiency. Emerging trends include energy-efficient refrigeration units, antimicrobial surface coatings, and smart hydration stations with real-time usage tracking. North America and Europe dominate the market due to stringent water quality regulations and infrastructure modernization, while Asia-Pacific shows strong growth driven by urban development and public health initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | Wall mounted fountains, Tabletop fountains, Free standing fountains, and Others |

| Material | Stainless steel, Plastic, Concrete, and Others (fiberglass, bamboo, ceramic etc.) |

| Installation | Indoor and Outdoor |

| Price Range | Medium, Low, and High |

| End Users | Commercial, Residential, and Industrial |

| Distribution Channel | Indirect sales and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Elkay Manufacturing, Oasis International, Haws Corporation, Acorn Engineering, Cosmetal, Maestro, and Moerdijk |

| Additional Attributes | Dollar sales by product type (wall-mounted, freestanding, recessed) and material (stainless steel, plastic, concrete, ceramic) for applications spanning educational, commercial, residential, and public spaces. North America leads with ~35–38% share, Asia-Pacific grows fastest at ~6–6.2% CAGR. Buyers prioritize touch-free, filtered, antimicrobial units. Innovations include IoT monitoring, UV sanitization, and integrated bottle-fill stations. |

The global drinking fountain market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the drinking fountain market is projected to reach USD 2.4 billion by 2035.

The drinking fountain market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in drinking fountain market are wall mounted fountains, tabletop fountains, free standing fountains and others.

In terms of material, stainless steel segment to command 55.0% share in the drinking fountain market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexible Plastic Drinking Pouch Market

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Fountain Dispenser Equipment Industry Analysis in North America Growth, Trends and Forecast from 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA