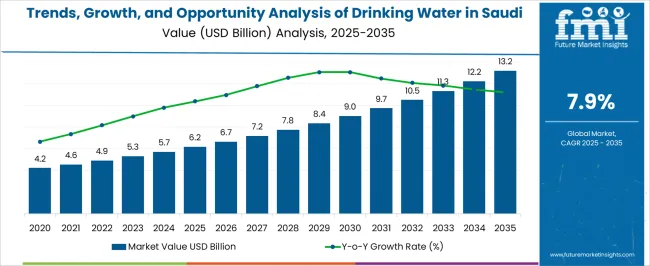

The Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The Drinking Water market in Saudi Arabia is experiencing significant growth, driven by rising demand for safe, reliable, and convenient water sources amid increasing urbanization, population growth, and arid climatic conditions. Awareness regarding health and hygiene, coupled with government initiatives to improve water quality standards and infrastructure, is further propelling market expansion. Functional drinking water is increasingly being preferred due to added minerals and vitamins that support wellness, while surface water treatment and desalination initiatives are enhancing supply consistency.

The market is also shaped by the growing adoption of bottled water for residential, commercial, and institutional use, with a focus on sustainability and eco-friendly packaging. Investment in advanced water treatment technologies and distribution networks is improving accessibility and quality assurance, further supporting demand.

Consumer preference is increasingly shifting toward products that provide both hydration and health benefits As awareness regarding waterborne diseases and quality standards rises, the Drinking Water market in Saudi Arabia is expected to continue expanding, offering opportunities for innovation in product types, packaging, and resource management.

| Metric | Value |

|---|---|

| Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Estimated Value in (2025 E) | USD 6.2 billion |

| Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

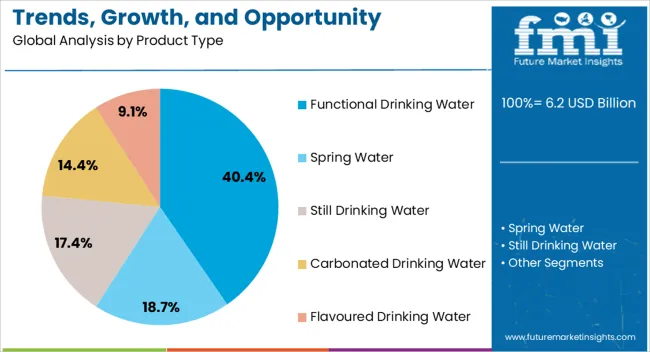

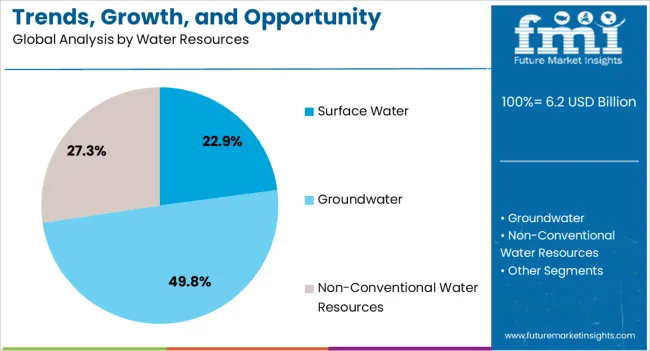

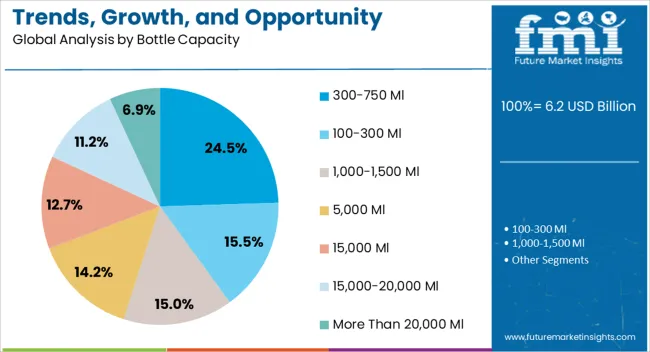

The market is segmented by Product Type, Water Resources, Bottle Capacity, End User, Packaging Type, and Sales Channel and region. By Product Type, the market is divided into Functional Drinking Water, Spring Water, Still Drinking Water, Carbonated Drinking Water, and Flavoured Drinking Water. In terms of Water Resources, the market is classified into Surface Water, Groundwater, and Non-Conventional Water Resources. Based on Bottle Capacity, the market is segmented into 300-750 Ml, 100-300 Ml, 1,000-1,500 Ml, 5,000 Ml, 15,000 Ml, 15,000-20,000 Ml, and More Than 20,000 Ml. By End User, the market is divided into Commercial and Residential. By Packaging Type, the market is segmented into PET Bottle, Glass Bottle, Stand-Up Pouches, and Retort Pouches. By Sales Channel, the market is segmented into Indirect, Departmental Store, and Direct. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The functional drinking water product type is projected to hold 40.4% of the market revenue in 2025, establishing it as the leading category. Growth is being driven by increasing consumer preference for water products that provide additional health benefits, including enhanced minerals, electrolytes, and vitamins. This segment supports hydration while promoting wellness, which is particularly appealing in a region with high temperatures and lifestyle-related health concerns.

Retailers and distributors are actively promoting functional drinking water through targeted marketing, enhancing visibility and adoption. The product type also benefits from innovations in formulation, packaging, and convenience-oriented designs that encourage repeat purchase and brand loyalty.

Government regulations ensuring safety, quality, and labeling transparency have strengthened consumer confidence in functional water offerings As demand for health-oriented beverages grows, functional drinking water is expected to maintain its leading position in the Saudi Arabian market, supported by continuous product innovation, marketing initiatives, and the growing preference for convenient, ready-to-drink solutions that align with wellness trends.

The surface water resource segment is anticipated to account for 22.9% of the market revenue in 2025, making it the leading source category. Its growth is being driven by the need for sustainable water extraction and treatment solutions to address increasing demand across urban and rural areas. Advanced treatment technologies, including filtration, purification, and disinfection processes, ensure safety and compliance with regulatory standards.

Surface water sources provide a reliable and cost-effective supply for bottling and functional water production, supporting the overall market expansion. Initiatives to monitor water quality, combined with investment in storage and distribution infrastructure, further enhance the segment’s adoption.

Consumers and institutions increasingly prefer water sourced from treated surface water due to its consistency, safety, and traceability As Saudi Arabia continues to prioritize sustainable water management and develop infrastructure to ensure a stable supply, surface water is expected to remain a critical resource segment, supporting the growth of functional and packaged drinking water across the country.

The 300-750 Ml bottle capacity segment is projected to hold 24.5% of the market revenue in 2025, establishing it as the leading packaging category. Its prominence is driven by convenience, portability, and suitability for both individual and household consumption. This size range is preferred for on-the-go hydration, office, and fitness usage, making it highly versatile across consumer segments.

The segment also supports branding, promotional campaigns, and premium positioning due to customizable labeling and packaging options. Retailers and distributors benefit from the ease of storage, display, and logistics, enhancing overall market penetration.

Growing consumer awareness regarding hygiene, quality assurance, and safe drinking practices further reinforces the preference for this bottle size As lifestyle trends continue to emphasize convenience and mobility, the 300-750 Ml bottle capacity segment is expected to maintain its leadership, supported by ongoing innovation in packaging materials, sustainability initiatives, and the increasing availability of functional water options in this range.

| Leading Product Type | Functional Water |

|---|---|

| Value Share (2025) | 40.4% |

Functional drinking water’s segment share is expanding to reach 40.4% by 2025 end. The segment’s growth is driven by rising concerns over obesity in the country. Bottled water companies are thus intently producing functional water, including zero-calorie herbal water infused with herbal extracts.

Many manufacturers are also releasing all kinds of fruits, mineral flavors, and herbs to elevate water’s taste and offer added health benefits. Running fitness and health trends are also creating significant demand for functional water.

| Leading Sales Channel | Indirect Sales |

|---|---|

| Value Share (2025) | 70.1% |

Indirect sales continue to produce substantial earnings for key vendors. The segment is predicted to hold a monopoly over the industry with a massive 70.10% in 2025. Growing sales of bottled potable water from hypermarkets/ supermarkets, online retailers, convenience stores, and departmental stores are increasing this segment’s size.

Propagation of online channels via the company’s website and eCommerce platform rapidly increasing the sales of potable water. Additionally, online channels are highly preferred by bulk purchasers due to easier and faster delivery.

One of the motives of the National Water Strategy in the country includes high-quality and cost-effective water and wastewater services. Another strategic objective is to mobilize water sector competitiveness, localization of capabilities, private sector participation, and innovation.

In the competitive drinking water industry of Saudi Arabia, opportunities exist for water treatment and sewage water plants, contractors for water and wastewater systems, and consultants. Manufacturers of tanks, pipelines, flowmeters, smart meters, pumps, and other industry equipment are also expected to benefit from ambitious national water goals.

The United States exporters are further predicted to find business prospects in this remunerative industry. Although they do not need to appoint any local Saudi distributor or agent to do business with Saudi companies, it is highly suggested that they partner with a local firm to monitor business opportunities, identify contract opportunities and public sector sales, and maneuver standard testing and import regulations.

Players operating in the solar power sector are anticipated to profit from the improving uptake of solar generation, as the country aims to increase its renewable energy usage. Moreover, opportunities abound for water monitoring and efficiency solutions like helium gas, audio devices, and radar beams to surveil leaks in the networks.

Numerous key players who are contributing to the kingdom’s water goals are projected to have a far-reaching impact on Saudi Arabia’s drinking water industry, extending beyond the forecast period.

Going Down the Chain of Events Shaping the Drinking Water Industry in Saudi Arabia

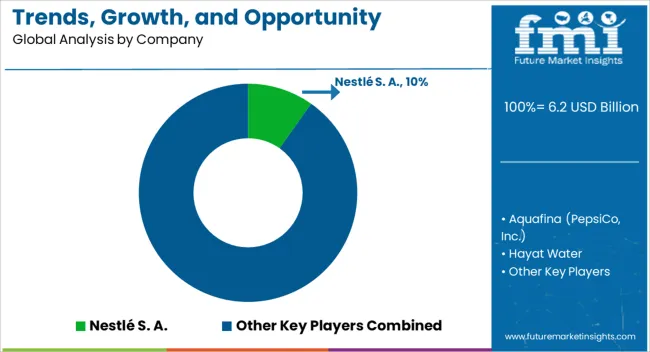

The global trends, growth, and opportunity analysis of drinking water in saudi arabia is estimated to be valued at USD 6.2 billion in 2025.

The market size for the trends, growth, and opportunity analysis of drinking water in saudi arabia is projected to reach USD 13.2 billion by 2035.

The trends, growth, and opportunity analysis of drinking water in saudi arabia is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of drinking water in saudi arabia are functional drinking water, spring water, still drinking water, carbonated drinking water and flavoured drinking water.

In terms of water resources, surface water segment to command 22.9% share in the trends, growth, and opportunity analysis of drinking water in saudi arabia in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Size and Share Forecast Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Tourism in Burma Market Forecast and Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Market Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

Outbound Tourism in GCC Countries - Trends, Growth, and Opportunity Analysis (2024 to 2034)

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Europe Connected Car Market Growth - Trends & Forecast through 2034

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA