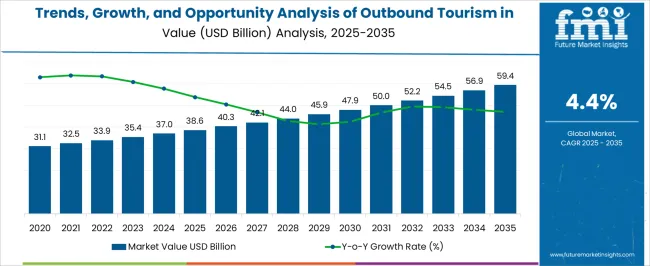

The Trends, Growth, and Opportunity Analysis of Outbound Tourism in France is estimated to be valued at USD 38.6 billion in 2025 and is projected to reach USD 59.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The outbound tourism market in France is experiencing sustained growth, driven by rising disposable incomes, increasing international connectivity, and evolving consumer preferences for experiential travel. Tourists are increasingly seeking diverse destinations, personalized experiences, and convenience in travel planning. The market is supported by advancements in digital platforms, including online booking, travel management apps, and AI-powered recommendation systems that enhance trip customization and efficiency.

Growing awareness of cultural, leisure, and adventure tourism opportunities abroad is contributing to increased demand. Government initiatives to promote tourism, along with expanding air travel networks and competitive pricing strategies, are further enabling outbound travel. Demographic factors, such as a rising proportion of working professionals and young adults, are influencing the selection of international destinations.

As travelers increasingly prioritize safety, flexibility, and cost-effective options, the outbound tourism sector is positioned for long-term expansion Investments in sustainable tourism practices and experiential travel services are expected to create additional opportunities and reinforce market growth in the coming decade.

| Metric | Value |

|---|---|

| Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Estimated Value in (2025 E) | USD 38.6 billion |

| Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast Value in (2035 F) | USD 59.4 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

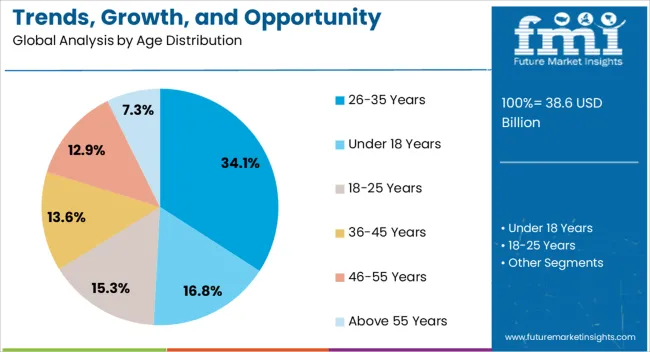

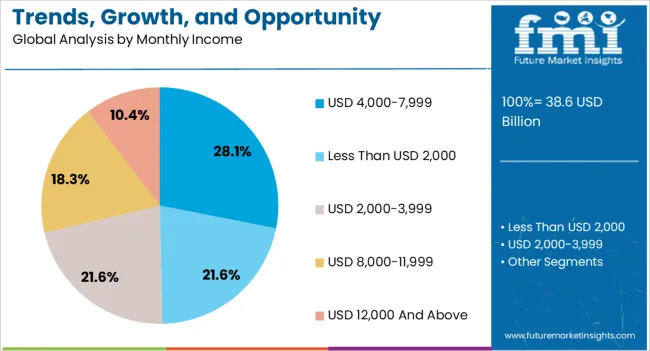

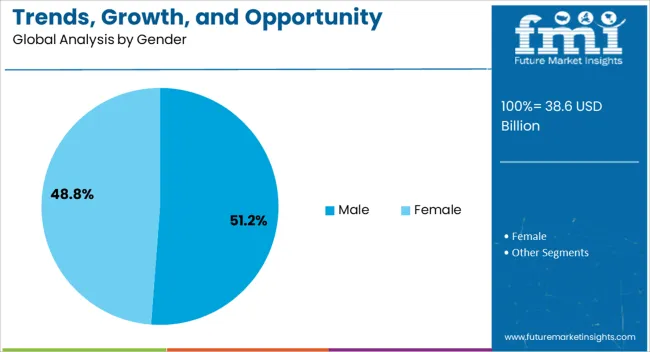

The market is segmented by Age Distribution, Monthly Income, Gender, Purpose, Mode Of Transportation, Travel Frequency, and Peak Season and region. By Age Distribution, the market is divided into 26-35 Years, Under 18 Years, 18-25 Years, 36-45 Years, 46-55 Years, and Above 55 Years. In terms of Monthly Income, the market is classified into USD 4,000-7,999, Less Than USD 2,000, USD 2,000-3,999, USD 8,000-11,999, and USD 12,000 And Above. Based on Gender, the market is segmented into Male and Female. By Purpose, the market is divided into Vacations, Visiting Family And Friends, Business Trips, Study, and Others. By Mode Of Transportation, the market is segmented into Air, Rail, Sea, and Road. By Travel Frequency, the market is segmented into Several Times Each Year, Once Each Year, Once For Each 2-3 Years, and Others. By Peak Season, the market is segmented into April To June, October To December, July To September, and January To March. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 26-35 years age group is projected to hold 34.1% of the outbound tourism market revenue in France in 2025, establishing it as the leading age segment. This growth is driven by the high mobility, disposable income, and willingness to spend on international experiences within this demographic. Individuals in this age range are more likely to seek adventure, cultural exploration, and social experiences, leading to increased travel frequency.

The use of online travel platforms, social media influence, and peer recommendations further encourages outbound travel. Professional exposure, flexible work arrangements, and digital nomad trends are increasing travel propensity among this age group.

As expectations for personalized itineraries and seamless travel experiences rise, the 26-35 years segment continues to shape travel patterns, travel expenditure, and demand for innovative tourism services The ability of the industry to cater to their preferences, including multi-destination trips and experiential tourism, reinforces its leadership in the market.

The USD 4,000-7,999 monthly income bracket is anticipated to account for 28.1% of outbound tourism revenue in France in 2025, making it the leading income segment. Growth is being driven by the disposable income available for discretionary spending on international travel and leisure experiences. Individuals in this income range have sufficient financial capacity to explore premium travel options, multi-destination itineraries, and curated experiences abroad.

The ability to afford flexible travel schedules and value-added services such as guided tours and cultural activities enhances travel adoption. Increased accessibility to digital booking platforms, dynamic pricing, and loyalty programs further stimulates travel decisions.

As consumers continue to seek unique, memorable, and personalized experiences, the USD 4,000-7,999 income segment plays a critical role in driving market growth The combination of financial capacity, travel awareness, and lifestyle aspirations ensures its continued dominance in shaping outbound tourism trends.

The male segment is projected to hold 51.2% of outbound tourism revenue in France in 2025, positioning it as the leading gender category. Growth is supported by increased participation in business, adventure, and leisure travel, along with higher engagement in experiential tourism activities. Men in this segment are more likely to invest in multi-destination trips, international sports events, and cultural explorations, contributing to higher travel expenditure.

The adoption of digital travel planning tools, social media influence, and peer networks facilitates informed decision-making and enhances travel experiences. Rising professional mobility and exposure to global markets have increased the propensity of male travelers to explore international destinations.

As demand for personalized, convenient, and immersive travel experiences continues to grow, the male segment remains a primary driver of outbound tourism revenue The continued expansion of airline networks, flexible travel options, and digital engagement further reinforces the leadership of this segment in the market.

Technology development has completely changed the outbound tourism sector by simplifying the process for tourists to plan trips, reserve lodging and flights, and obtain information while overseas. Social networking sites, internet travel companies, and mobile apps have all contributed to market trends of outbound tourism in France.

The availability and cost of modes of transportation like trains, airplanes, and rental cars influences the outbound tourism sector. New flight routes and high-speed rail networks, among other improvements to the transportation infrastructure, enable access to new locations and increase travel convenience.

France's economic stability and success significantly prompt the growth of the outbound tourist demand. Factors such as disposable income levels, employment rates, and GDP growth influence people's ability and willingness to travel overseas.

In 2020, the France industry recorded an outbound tourism demand of USD 38.6 million. Sales of outbound tourism in France reached USD 35.3 million in 2025, expanding at a 4.0% CAGR from 2020 to 2025.

From 2020 to 2025, the French tourism industry expanded, spurred by expanding disposable income, improved air connectivity, and growing interest in foreign travel experiences. In 2025, France consolidated its spot as one of the world's leading outbound tourism sectors, with almost 50 million outbound visits and €60 billion in overseas expenditures.

| Attributes | Details |

|---|---|

| France’s Outbound Tourism Industry Revenue (2020) | USD 38.6 million |

| Historical Industry Valuation (2025) | USD 35.3 million |

| HCAGR (2020 to 2025) | 4.0% |

Forecasts indicate that outbound tourism demand continues its upward trend through 2025 and 2035, but at a slightly slower rate. The industry environment is likely to be determined by elements such as changing consumer choices, concerns about sustainability, and technological developments in travel services.

Outbound tourism providers serving the French sector ought to concentrate on individualized experiences, sustainable practices, and digital innovation to take advantage of the increasing demand and maintain their competitiveness in the dynamic market.

Rapid technological improvements threaten established outbound tourism vendors by disrupting traditional tourism business models and distribution channels, as evidenced by the emergence of virtual reality experiences, sharing economy platforms, and online travel agencies.

The accessibility and convenience of travel to some areas inside France is constrained by inadequate or obsolete transportation infrastructure, including roads, trains, and airports, which harm outward tourism.

For French citizens, traveling abroad has many obstacles, including strict visa requirements, complicated travel documentation needs, and shifting immigration laws in target nations.

A thorough segmentation analysis of outbound tourism in France is included in this section. The producers of outbound tourism are closely monitoring market trends and the expanding demand in the April to June segment. Similarly, the 26-35 years segment outshines the age group segment.

| Leading Peak Season Segment | April to June |

|---|---|

| Market Share (2025) | 38% |

With perfect weather and longer daylight hours, April to June attracts more people to discover outbound destinations. A greater number of tourists arrive at outbound destinations during this period because many popular tourist attractions and events are set to occur during this season.

April to June are ideal choices for tourists on a tight budget because they are less expensive and have fewer crowds than the busiest summer months. Families have plenty of outbound tourism opportunities to take international vacations during school vacations and long weekends from April to June.

| Leading Age Distribution Segment | 26-35 years |

|---|---|

| Market Share (2025) | 34.1% |

Higher outbound tourism sales are frequently the result of the 26-35 age group's greater discretionary money and freedom to travel. The 26-35 age group of young professionals is full with travel and adventure seekers who want to make lasting memories.

The 26-35 age group has a strong desire to travel, which increases outbound tourism due to social media's significant influence. Based on trends, the 26-35 age group is more likely to value travel as a means of self-discovery and personal development, which strengthens sales in the outbound tourism sector.

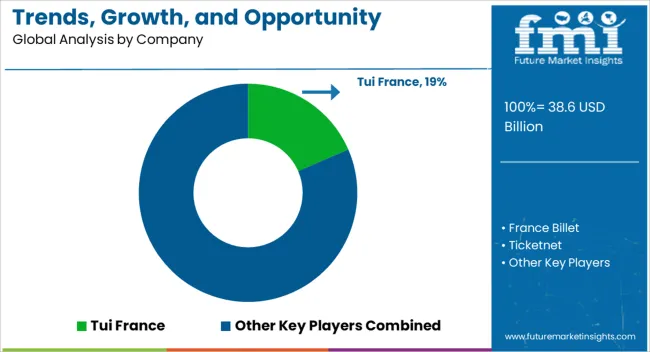

Within the highly competitive sector in France, several prominent outbound tourism providers compete for customer attention and market share. Major outbound tourism vendors operate in different outbound tourism segments to offer tourists a variety of experiences.

Tui France distinguishes itself by offering travel packages that cover various interests and price points and by having a vast network. Specializing in ticketing services, France Billet and Ticketnet enable easy reservations for events and attractions. With a variety of choices ranging from resorts to vacation rentals, Odalys Evasion specializes in vacation lodging.

Global Business Travel France offers specialized solutions for conferences and business travel, catering to business travelers. Travel Lab SAS strongly emphasizes immersive travel, creating one-of-a-kind itineraries and experiences for discriminating tourists.

Fram is recognized for its guided tours and holiday packages, which it offers to leisure tourists looking for hassle-free getaways. Travelers travel with peace of mind owing to Pv-Cp Distribution's offerings of travel insurance and associated services. Holidays Heliades caters to tourists with discriminating tastes and specializes in luxurious vacation experiences and exotic locations.

Leading outbound tourism providers strive in a changing market, always coming up with new ideas to satisfy changing customer needs. By emphasizing client happiness and providing exceptional service, they add to the dynamic environment of France's outbound tourist sector.

Noteworthy Advancements Observed in Outbound Tourism in France

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 38.6 billion |

| Projected Valuation (2035) | USD 59.4 billion |

| Anticipated CAGR (2025 to 2035) | 4.4% |

| Historical Analysis of Outbound Tourism in France | 2020 to 2025 |

| Demand Forecast for Outbound Tourism in France | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Key Companies Profiled | Tui France; France Billet; Ticketnet; Odalys Evasion; Global Business Travel France; Travel Lab SAS; Oui.sncf SAS; Fram; Pv-Cp Distribution; Vacances Heliades; Other (on request) |

The global trends, growth, and opportunity analysis of outbound tourism in france is estimated to be valued at USD 38.6 billion in 2025.

The market size for the trends, growth, and opportunity analysis of outbound tourism in france is projected to reach USD 59.4 billion by 2035.

The trends, growth, and opportunity analysis of outbound tourism in france is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of outbound tourism in france are 26-35 years, under 18 years, 18-25 years, 36-45 years, 46-55 years and above 55 years.

In terms of monthly income, usd 4,000-7,999 segment to command 28.1% share in the trends, growth, and opportunity analysis of outbound tourism in france in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Europe Connected Car Market Growth - Trends & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Tourism in Burma Market Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Market Forecast and Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

Outbound Tourism in GCC Countries - Trends, Growth, and Opportunity Analysis (2024 to 2034)

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA