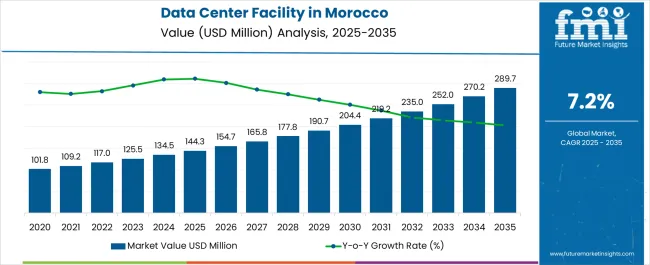

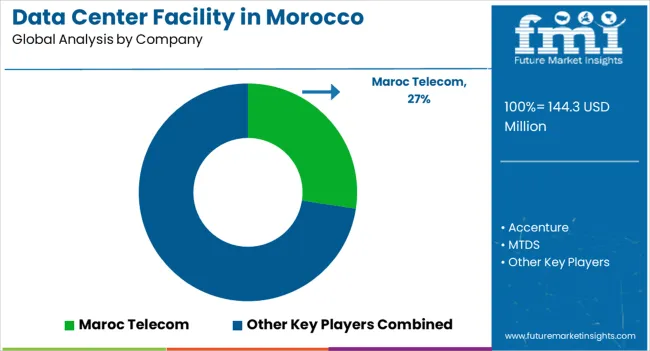

The Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco is estimated to be valued at USD 144.3 million in 2025 and is projected to reach USD 289.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Estimated Value in (2025 E) | USD 144.3 million |

| Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Forecast Value in (2035 F) | USD 289.7 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The data center facility market in Morocco is experiencing substantial growth. Expansion is being driven by increasing digitalization, rising cloud adoption, and growing demand for enterprise IT infrastructure.

Current market dynamics reflect robust investment in modern hardware, scaling of enterprise operations, and implementation of advanced data management systems, while regulatory frameworks and government initiatives supporting ICT infrastructure are enhancing market confidence. Future outlook indicates accelerated deployment of high-performance data centers, adoption of energy-efficient solutions, and integration of advanced security and monitoring technologies.

Growth rationale is supported by increasing enterprise reliance on reliable and scalable IT infrastructure, expansion of cloud services, and the strategic importance of Morocco as a regional hub for digital services Continuous investment in hardware modernization, network optimization, and power efficiency is expected to drive sustainable market expansion, improve operational performance, and strengthen competitive positioning over the forecast period.

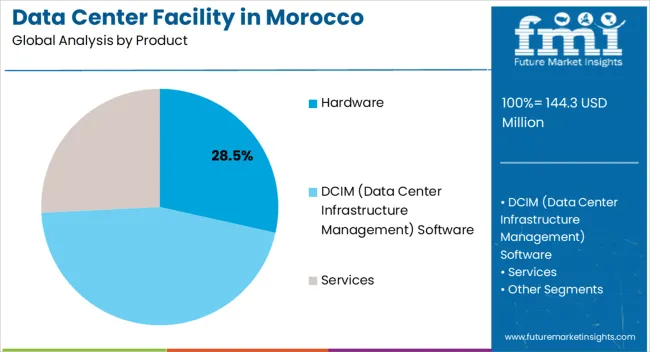

The hardware segment, holding 28.5% of the product category, has maintained a leading position due to its critical role in supporting high-performance computing and storage requirements. Demand has been reinforced by continuous upgrades and replacement cycles, ensuring data centers operate efficiently with minimal downtime.

Adoption has been supported by the increasing reliance on server, storage, and networking equipment to support enterprise operations and cloud infrastructure. Supply chain optimization, technological innovation in hardware components, and adherence to energy efficiency standards have enhanced market acceptance.

The segment’s growth is further reinforced by strategic procurement and integration practices, ensuring reliable infrastructure deployment and contributing significantly to overall market share.

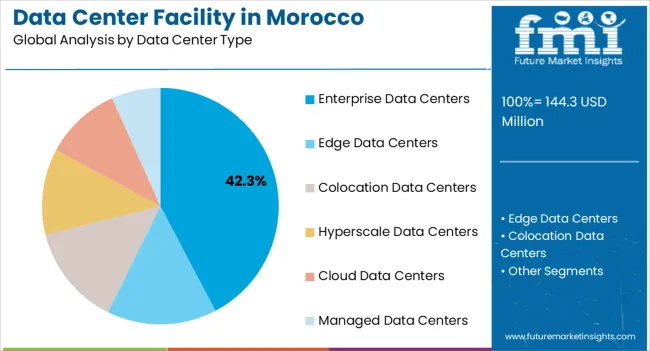

The enterprise data centers segment, representing 42.3% of the data center type category, has been leading due to the increasing requirement for dedicated and secure IT environments for corporate operations. Adoption has been driven by businesses seeking enhanced control, scalability, and compliance with data governance standards.

Operational reliability, enhanced data management capabilities, and capacity for high workloads have reinforced preference for enterprise setups. Expansion in sectors such as finance, telecommunications, and e-commerce has contributed to sustained demand.

Technological upgrades, integration of virtualization, and modular design approaches have further supported growth Enterprise data centers continue to capture market share by aligning with corporate digital transformation strategies and infrastructure modernization plans.

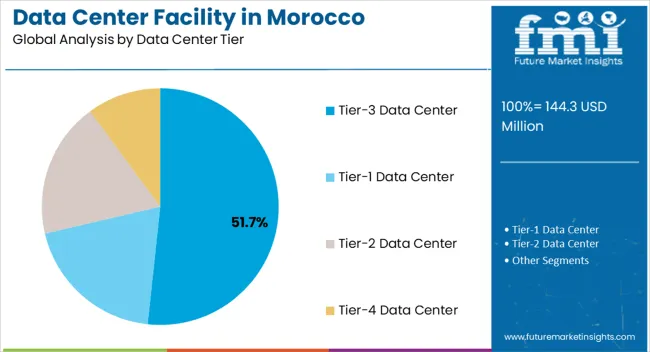

The Tier-3 data center segment, holding 51.7% of the data center tier category, has emerged as the leading tier due to its balance of high availability, redundancy, and operational efficiency. Adoption has been reinforced by enterprise demand for minimal downtime and compliance with international reliability standards.

The segment benefits from advanced power and cooling systems, robust network architecture, and disaster recovery capabilities. Market acceptance is supported by the ability to accommodate critical workloads and mission-critical applications with guaranteed service levels.

Investment in Tier-3 facilities, combined with technological enhancements and proactive maintenance practices, is expected to sustain its leading position and drive continued market growth across Morocco’s evolving data center landscape.

From 2020 to 2025, the data center facility experienced a CAGR of 5.9%, reaching a size of USD 144.3 million in 2025. The data center facility space is expected to rise at a CAGR of 7.6% from 2025 to 2035. The ecosystem is expected to reach USD 259.9 million during the forecast period.

| Historical Value (2025) | USD 117.5 million |

|---|---|

| Historical CAGR (2020 to 2025) | 5.9% |

Morocco is a country that is located in the North Africa region. The location of Morocco makes it an ideal geographic location for edge centers. The Moroccan government has shown interest in promoting the digital economy and ICT sector. Incentives and favorable policies can attract investment in edge data center infrastructure, encouraging the growth of this sector.

Morocco invested in submarine and terrestrial fiber-optic cables, providing robust international connectivity. This infrastructure facilitates data exchange and transit, making it easier for edge data centers to connect to global networks and content providers.

With the escalating demand for low-latency applications, edge data centers are gaining traction in Morocco. Businesses are looking to deploy IT resources closer to end-users, IoT devices, and emerging technologies, necessitating strategic investments in edge data centers.

The facilities enable faster data processing, real-time analytics, and improved user experiences for latency-sensitive applications such as online gaming, video streaming, and smart city services. Data center providers are expanding their footprint to accommodate the localization needs of enterprises seeking to leverage the advantages of edge computing.

| Attributes | Key Factors |

|---|---|

| Latest Trends |

|

| Growth Hindrances |

|

| Upcoming Opportunities |

|

The table below shows the CAGRs of the top 5 countries for the review period 2025 to 2035. Morocco is expected to remain dominant by exhibiting a CAGR of 7.6% to exceed a valuation of USD 289.7 million by 2035.

| Projected Size (2035) | USD 289.7 million |

|---|---|

| Value-based CAGR (2025 to 2035) | 7.6% |

The data center facility space is estimated to grow at a CAGR of 7.6% over the forecast period. Companies and investors focus on increasing their investments in Morocco for the data center facility. These investments focus on developing and commissioning new data centers and improving the country's digital infrastructure assets and products.

Various plans involving the interconnection of cloud and carrier-neutral data centers in Morocco are underway to drive the development of the data center facility in Morocco. Data centers want to balance operational productivity and ecological sustainability, considering more excellent climate conditions.

| Category | Forecast CAGR (2025 to 2035) |

|---|---|

| Hardware (Product) | 6.7% |

| Cloud Data Center (Data Center Type) | 10.0% |

| Carriers and telcos (End-use Industry) | 6.8% |

| Tier-3 Data Center (Data Center Tier) | 8.9% |

Hardware components include servers, storage devices, networking equipment, power, and cooling systems. These components form the backbone of any data center, providing the necessary computing and storage capabilities and the infrastructure for data processing and distribution.

Data centers come in various sizes, from small-scale facilities to large hyperscale data centers. Regardless of size, all data centers require hardware components to function.

More extensive data centers, especially those serving cloud service providers and enterprises, rely heavily on a vast array of servers and storage systems, driving up the demand for hardware. The hardware segment was estimated to have held the dominant share of 60.2% in 2025, valued at USD 70.74 million.

Enterprises are moving their IT infrastructure, applications, and data to the cloud, driving the demand for cloud data centers. The ongoing digital transformation that is occurring across industries drives the need for IT infrastructure that is scalable. This further acts as a driver for the cloud data centers.

Cloud data centers offer on-demand scalability and elasticity, allowing businesses to quickly and cost-effectively expand their computing resources to meet changing workloads. This flexibility is desirable to companies with fluctuating computational needs. These factors will enable the cloud data centers segment to grow at a CAGR of 10.0% over the forecast period.

Carriers and telcos already possess extensive network infrastructure, including fiber-optic cables, data transmission capabilities, and a network of data centers. This infrastructure forms a solid foundation for expanding into the data center facility.

Connectivity is a critical factor for data centers. Carrier and telco-owned data centers often have direct access to a wide range of network providers and internet exchanges, which is primarily driving their preference among users. This access ensures high-speed connectivity for customers and businesses collaborating equipment in these facilities.

Carrier data centers are typically designed with built-in redundancy fails to ensure uninterrupted service. They have multiple network paths, power sources, and cooling systems, making them attractive to businesses with strict uptime requirements. This allowed the carriers/telcos to have held the dominant share of 31.2% in 2025.

Tier 3 data centers are designed to provide high reliability and uptime. Businesses increasingly depend on uninterrupted access to their data and applications, making the reliability of Tier-3 facilities a compelling factor for GrowthGrowth.

Many Tier-3 data centers are built with scalability in mind. They allow businesses to start with a smaller footprint and expand their infrastructure as their needs grow. This scalability accommodates the evolving requirements of companies over time. These factors allow the tier-3 data centers to grow at a CAGR of 8.9% over the forecast period.

Key players focus on improving the customer experience during payments for their data center facility solutions. They are also considering the different needs and requirements of the end-users and developing solutions that are tailor-made as per their needs.

Key Strategies Adopted by the Players

Product Innovation:

Companies in the data center facility focus on product innovation, introducing new features, functionalities, and integrations to address security challenges. They develop intuitive interfaces, pre-built security modules, and machine learning capabilities. They invest in research and development to stay ahead of emerging technologies.

Strategic Partnerships and Collaborations:

Data center facility companies are forming strategic partnerships with technology vendors, cybersecurity firms, and industry leaders to expand their customer base, integrate platforms, and expand reach. These partnerships ensure industry compliance and trust, fostering innovation and growth.

Expansion into Emerging Regions:

Data center facility companies have adopted strategies to expand into emerging regions. They focus on developing localized solutions, establishing strategic partnerships, investing in research, and focusing on customer education and training. They also offer competitive pricing models and flexible payment options to attract and retain customers.

Mergers and Acquisitions:

Companies in the data center facility are implementing mergers and acquisitions to expand their offerings and acquire new technologies, intellectual property, and customer bases. This technique improves cloud cost management capabilities, stimulates innovation, produces economies of scale, and strengthens their presence.

Key Developments:

The global trends, growth, and opportunity analysis of data center facility in Morocco is estimated to be valued at USD 144.3 million in 2025.

The market size for the trends, growth, and opportunity analysis of data center facility in Morocco is projected to reach USD 289.7 million by 2035.

The trends, growth, and opportunity analysis of data center facility in Morocco is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of data center facility in Morocco are hardware, _power systems, _cooling system, _data center racks, _others (electrical systems, general building infra, other hardware), dcim (data center infrastructure management) software, services, _consulting, planning, and design services, _security & disaster recovery services, _data center mitigation services, _integration & deployment services, _modernization and optimization services and _support services.

In terms of data center type, enterprise data centers segment to command 42.3% share in the trends, growth, and opportunity analysis of data center facility in Morocco in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Saudi Arabia Drinking Water Market Insights – Trends & Forecast 2024-2034

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Italy Culinary Tourism Market Insights – Growth & Forecast 2024-2034

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Thailand Sustainable Tourism Market Trends – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Burma Tourism Market Analysis – Trends & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Europe Rail Tourism Market Growth – Forecast 2024-2034

South Africa Sports Tourism Market Growth – Trends & Forecast through 2034

GCC Shisha Tobacco Market Report – Growth & Trends 2024-2034

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

France Outbound Tourism Market Insights – Growth & Forecast 2024-2034

China Outbound Tourism Market Insights – Growth & Forecast 2024-2034

Outbound Tourism in GCC Countries - Trends, Growth, and Opportunity Analysis (2024 to 2034)

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Europe Connected Car Market Growth - Trends & Forecast through 2034

Thailand Medical Tourism Market Growth – Trends & Forecast 2024-2034

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA