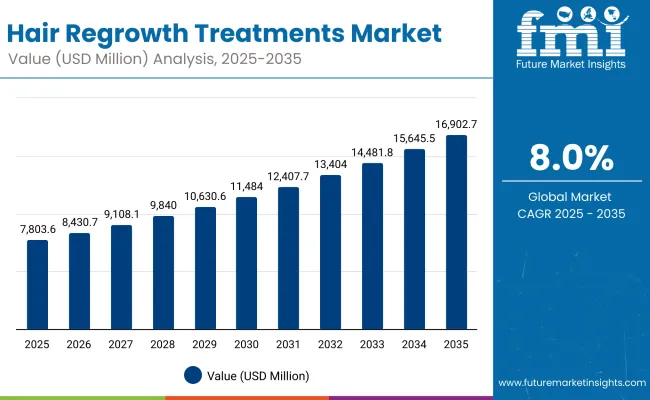

The Global Hair Regrowth Treatments Market is expected to record a valuation of USD 7,803.6 million in 2025 and USD 16,902.7 million in 2035, with an increase of USD 9,099.1 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.0% and more than a 2X increase in market size.

Global Hair Regrowth Treatments Market Key Takeaways

| Metric | Value |

|---|---|

| Global Hair Regrowth Treatments Market Estimated Value (2025E) | USD 7,803.6 million |

| Global Hair Regrowth Treatments Market Forecast Value (2035F) | USD 16,902.7 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 7,803.6 million to USD 11,484.9 million, adding USD 3,681.3 million, which accounts for around 40% of the total decade growth.

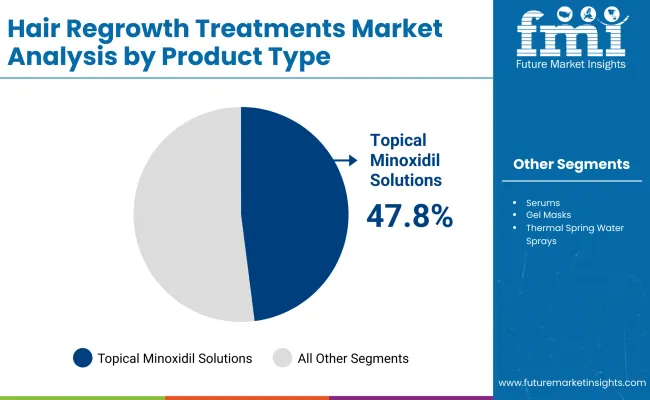

This phase records steady adoption in over-the-counter topical solutions, dermatology-prescribed regimens, and dietary hair supplements, driven by the rising prevalence of male pattern baldness and women experiencing age-related or hormonal hair thinning. Topical minoxidil formulations dominate this period as they cater to over 47% of the global demand, being the most clinically recognized and widely available solution.

The second half from 2030 to 2035 contributes USD 5,417.8 million, equal to nearly 60% of total growth, as the market jumps from USD 11,484.9 million to USD 16,902.7 million. This acceleration is powered by widespread deployment of laser therapy devices, digital platforms offering personalized regrowth plans, and integration of natural/herbal oils within mainstream treatments.

E-commerce and direct-to-consumer brands capture a larger share by the end of the decade, with digital-first companies like Hims, Keeps, and Nutrafol leveraging online subscription models. Clinical services and dermatology clinics also scale up significantly, particularly in Asia, where medical tourism and affordable procedures drive market adoption. Innovation in oral nutraceuticals, AI-based diagnostics for scalp health, and hormone-specific regimens further expand recurring revenue opportunities.

From 2020 to 2024, the Global Hair Regrowth Treatments Market grew from USD 6,520 million to USD 7,450 million, driven by rising consumer preference for over-the-counter topical treatments and supplements. During this period, the competitive landscape was dominated by established minoxidil brands such as Rogaine and Kirkland Signature, which together controlled nearly 15% of revenue.

Competitive differentiation relied on proven efficacy, clinical trust, and broad retail availability. Herbal oils and natural products gained momentum in Asia and Latin America, but adoption was slower in the West, where clinically backed minoxidil solutions remained the first line of choice. Subscription-based telehealth companies like Hims and Keeps emerged, but their share was still under 5% of the global market by 2024.

Demand for hair regrowth treatments will expand to USD 7,803.6 million in 2025, and the revenue mix will begin to shift as oral supplements and devices grow faster than traditional topical formulas. By mid-decade, players like Nutrafol and Viviscal are pushing category expansion into nutraceuticals, while DS Laboratories and Shapiro MD are integrating AI-driven scalp diagnostics with tailored regimens.

Traditional leaders face rising competition from new digital-first players offering bundled care plans, subscription refills, and direct dermatologist access. Emerging entrants specializing in hormone-based customization, natural formulations, and AR/VR-based scalp imaging tools are gaining share. The competitive advantage is moving away from single-product solutions to integrated care ecosystems, subscription-driven customer retention, and digital distribution strength.

Advances in clinically tested formulations and digital distribution have expanded the accessibility of hair regrowth solutions worldwide. Topical minoxidil remains the most trusted treatment due to decades of proven results, but oral supplements and nutraceuticals are gaining attention among younger consumers looking for preventive care.

The popularity of personalized regimens tailored by age, gender, and hormonal profile has significantly increased, enabling consumers to treat scalp hair loss, beard thinning, and even eyebrow/eyelash concerns with targeted solutions.

The expansion of dermatology clinics and telemedicine-based consultations has fueled market growth, particularly in Asia-Pacific, where medical tourism and lower treatment costs encourage early adoption. E-commerce penetration has accelerated sales, offering global access to both established brands like Rogaine and Nutrafol as well as smaller natural/herbal entrants.

Segment growth is expected to be led by topical minoxidil solutions in 2025, but oral nutraceuticals and laser therapy devices are projected to show faster growth in the second half of the decade. The shift reflects growing consumer demand for both convenience and holistic, multi-modal hair regrowth solutions.

The market is segmented by product type, application area, user group, channel, and region. Product type includes topical minoxidil solutions, oral supplements, laser therapy devices, and natural/herbal oils, which represent the core solutions driving adoption. Application area classification covers scalp hair loss, eyebrow/eyelash thinning, and beard enhancement, catering to both cosmetic and medical requirements.

Based on user group, the market is segmented into men, women, post-partum mothers, and age-related hair loss patients, reflecting the diverse demand base across life stages and conditions. In terms of channel, categories encompass pharmacies & drugstores, e-commerce, dermatology clinics, and supermarkets, highlighting the balance between traditional retail and emerging digital platforms.

Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, where adoption patterns differ based on cultural acceptance, healthcare infrastructure, and consumer affordability.

| Product Type | Value Share % 2025 |

|---|---|

| Topical minoxidil solutions | 47.8% |

| Others | 52.2% |

The topical minoxidil solutions segment is projected to contribute 47.8% of the Global Hair Regrowth Treatments Market revenue in 2025, maintaining its lead as the dominant product type. This strong position is driven by decades of clinical validation, FDA and EMA approvals, and consumer trust in minoxidil as the most reliable first-line treatment for androgenetic alopecia. Topical solutions are widely distributed through pharmacies, e-commerce, and dermatology clinics, ensuring strong penetration across both developed and emerging markets.

Growth within this segment is further fueled by innovations in formulations, such as foam-based solutions, low-irritant versions, and gender-specific concentrations that enhance usability and reduce side effects. Subscription-based direct-to-consumer brands are also expanding minoxidil accessibility with auto-refill plans and bundled dermatologist consultations, reinforcing minoxidil’s status as a staple treatment. While competition from oral supplements and devices is increasing, topical minoxidil is expected to retain its position as the backbone of the market due to affordability, proven efficacy, and accessibility.

| Application Area | Value Share % 2025 |

|---|---|

| Scalp hair loss | 72.1% |

| Others | 27.9% |

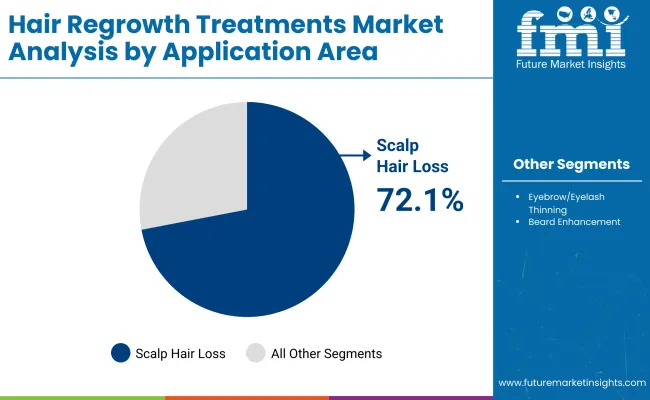

The scalp hair loss segment is forecasted to hold 72.1% of the market share in 2025, led by its central role in addressing male and female pattern baldness the most prevalent form of hair loss globally. Treatments in this category range from topical minoxidil to oral nutraceuticals and laser therapy devices, all of which are designed to restore or slow down hair thinning on the scalp. The high share reflects both medical necessity and the strong cultural and psychological emphasis on scalp hair as a marker of youth and vitality.

The segment’s dominance is reinforced by its suitability across diverse age groups, from young adults experiencing early-onset alopecia to older patients with progressive thinning. Dermatology clinics are increasingly incorporating advanced regrowth therapies such as platelet-rich plasma (PRP) and laser caps alongside topical treatments, widening the treatment mix available for scalp hair restoration. With technological advancements and growing consumer willingness to invest in long-term scalp care, this segment is expected to continue leading demand in the Global Hair Regrowth Treatments Market.

| User Group | Value Share % 2025 |

|---|---|

| Men | 63.4% |

| Others | 36.6% |

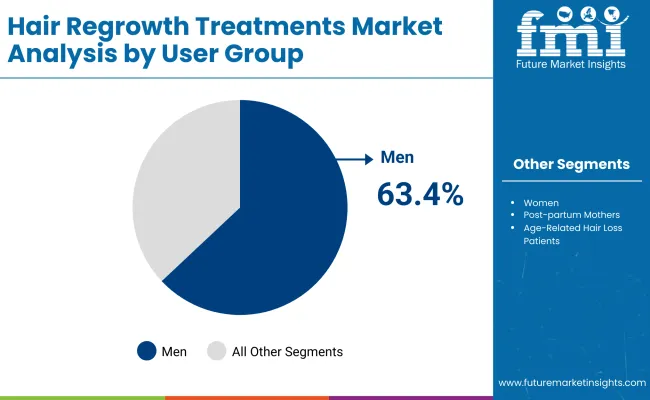

The men’s segment is projected to account for 63.4% of the Global Hair Regrowth Treatments Market revenue in 2025, establishing it as the leading user group. Male pattern baldness affects a significant proportion of the global male population, with prevalence increasing sharply after the age of 30. The availability of well-recognized treatments such as minoxidil and finasteride-based regimens has further reinforced men’s adoption levels, with subscription services and telehealth platforms making access more convenient than ever.

The segment’s dominance is strengthened by lifestyle and cultural trends that emphasize appearance and grooming, especially in regions such as North America, Europe, and East Asia. Online awareness campaigns and influencer-driven marketing have also helped normalize male hair regrowth treatments, reducing stigma around seeking medical or cosmetic intervention.

While the women’s and post-partum mothers’ categories are expected to show strong growth over the next decade, men will continue to drive the largest share of demand, supported by early diagnosis, high treatment persistence, and a wide range of both prescription and over-the-counter solutions.

Rising Acceptance of Preventive and Multi-Modal Hair Regrowth Solutions

One of the strongest growth drivers for the Global Hair Regrowth Treatments Market is the shift from reactive to preventive approaches to hair loss management. Historically, treatments such as topical minoxidil were adopted once visible baldness had occurred. Now, consumers in their early 20s and 30s especially men at risk of androgenetic alopecia and women with hormonal hair loss are turning to oral supplements, nutraceuticals, and scalp care products as preventive solutions.

Brands like Nutrafol and Viviscal are capitalizing on this trend by marketing hair wellness as part of overall health. This preventive orientation significantly expands the customer base beyond patients with advanced hair thinning, creating a recurring revenue opportunity.

Coupled with rising awareness driven by social media influencers, this driver pushes growth across both developed markets like the USA and rapidly expanding economies like India and China, where younger demographics are highly engaged in beauty and grooming.

Expansion of Digital Platforms and Subscription-Based Telehealth Models

Another major driver is the rapid adoption of digital-first distribution and subscription-based treatment services. Platforms such as Hims and Keeps have disrupted traditional pharmacy distribution by offering complete online ecosystems diagnosis through teleconsultation, treatment prescriptions, auto-refill minoxidil, finasteride, or supplement packs, and long-term tracking.

This model has been particularly successful in the USA and is expanding globally into Europe and Asia. Consumers value the privacy, convenience, and affordability of such services, especially for a condition often associated with stigma.

The recurring subscription structure creates predictable revenue streams for companies while reducing consumer dropout rates, which historically has been a challenge in the hair regrowth space. This shift toward digital ecosystems is a powerful driver sustaining long-term growth.

Limited Treatment Efficacy and High Dropout Rates

Despite the growth, the Global Hair Regrowth Treatments Market faces a restraint in terms of product efficacy and consumer adherence. Topical minoxidil, while clinically proven, does not work for all patients and requires consistent application over months to maintain visible results. Similarly, oral supplements often face skepticism as outcomes vary across individuals depending on genetics, nutrition, and hormonal profiles.

These limitations lead to high dropout rates, especially within the first 6-12 months of use. In markets like the USA and Europe, where consumers are highly aware and demanding of results, this factor creates churn and reduces long-term market penetration. New entrants with natural or herbal oils also struggle to provide robust clinical validation, limiting adoption beyond niche consumer bases.

Regulatory Barriers and Side-Effect Concerns

Regulatory frameworks in different regions present another restraint. In the USA and Europe, topical minoxidil is FDA- and EMA-approved, but other products like finasteride are prescription-only, creating barriers to easy access. In addition, oral supplements and herbal oils fall into gray regulatory zones, often marketed as nutraceuticals without strict efficacy claims, leading to trust issues.

Side effects such as scalp irritation from minoxidil, hormonal effects from finasteride, or allergic reactions to herbal blends further restrict adoption. In Asia-Pacific and the Middle East, regulatory approval processes for new ingredients or devices can be lengthy, delaying market entry and regional expansion. These challenges slow down product innovation and consumer confidence, acting as a cap on growth potential.

Integration of AI and Digital Diagnostics in Personalized Hair Regrowth Plans

A key trend shaping the market is the use of AI-driven diagnostic tools and digital imaging platforms for scalp analysis. Emerging brands and dermatology clinics are adopting mobile apps, AR scalp imaging, and AI algorithms that assess follicle density, scalp health, and potential hair thinning trajectories.

Based on these diagnostics, companies can recommend personalized regimens combining topical minoxidil, oral supplements, and lifestyle changes to maximize efficacy. This trend is especially strong in China, Japan, and India, where tech-savvy consumers and large smartphone penetration rates enable rapid adoption. By enhancing personalization, AI tools improve consumer trust, reduce dropout rates, and differentiate premium brands in a crowded marketplace.

Rising Popularity of Natural and Herbal Oils as Complementary Treatments

Another important trend is the growing role of natural and herbal oils in consumer regimens. While not always clinically comparable to minoxidil, these products such as rosemary oil, castor oil, and ayurvedic blends are increasingly popular due to their “clean-label,” chemical-free appeal. In markets such as India, Southeast Asia, and Latin America, herbal oils have strong cultural acceptance and are used alongside topical or oral treatments as supportive care.

Global brands are recognizing this trend, with some integrating natural oils into product portfolios to cater to consumers who seek holistic, low-risk alternatives. This trend also aligns with the broader global movement toward plant-based wellness and is likely to grow in parallel with mainstream clinical treatments, carving out a complementary rather than competitive role in the market.

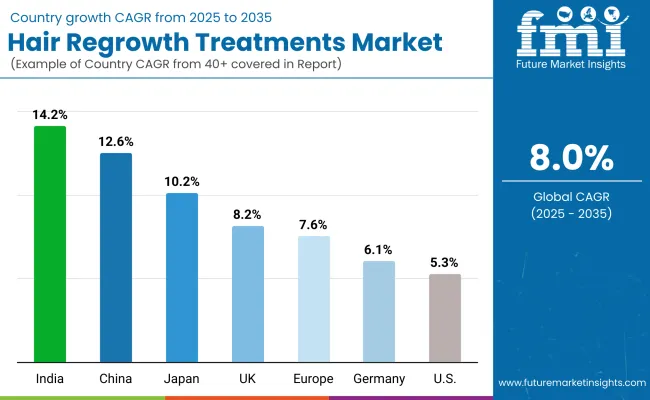

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.6% |

| USA | 5.3% |

| India | 14.2% |

| UK | 8.2% |

| Germany | 6.1% |

| Japan | 10.2% |

| Europe | 7.6% |

The country-wise outlook of the Global Hair Regrowth Treatments Market highlights strong growth momentum in Asia, with India (14.2% CAGR) and China (12.6% CAGR) emerging as the fastest-expanding markets between 2025 and 2035. In India, rising disposable incomes, greater acceptance of nutraceuticals, and the deep cultural roots of herbal oils are driving rapid expansion.

Younger consumers are proactively adopting preventive treatments, while urban populations are increasingly turning to e-commerce platforms for minoxidil and supplement purchases. China, on the other hand, is benefitting from strong demand for premium dermatology services, rising adoption of AI-based scalp diagnostics, and growing consumer openness to laser therapy devices. Both markets are expected to outpace global averages due to their large populations, younger demographics, and a fast-growing awareness of cosmetic wellness.

In contrast, developed markets like the USA (5.3% CAGR), Germany (6.1% CAGR), and the UK (8.2% CAGR) reflect slower but steady growth as penetration levels are already high and competition is mature. The USA remains the largest single-country market, supported by subscription-based telehealth services such as Hims and Keeps, but growth is capped by high dropout rates and regulatory restrictions on certain oral treatments.

European markets, including the UK and Germany, are witnessing moderate expansion, supported by dermatology clinics and clean-label natural alternatives, though stricter regulatory frameworks slow the adoption of newer products.

Japan (10.2% CAGR) is a standout among developed nations, benefitting from high consumer spending on grooming, advanced clinic-based therapies, and widespread acceptance of technology-driven solutions such as laser caps. Overall, the regional picture shows Asia-Pacific driving global growth, while the USA and Europe maintain market maturity with gradual, innovation-driven gains.

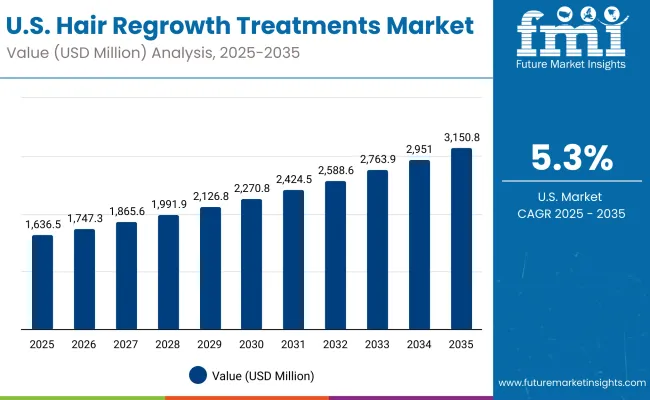

| Year | USA Hair Regrowth Treatments Market (USD Million) |

|---|---|

| 2025 | 1636.53 |

| 2026 | 1747.33 |

| 2027 | 1865.63 |

| 2028 | 1991.94 |

| 2029 | 2126.80 |

| 2030 | 2270.80 |

| 2031 | 2424.54 |

| 2032 | 2588.69 |

| 2033 | 2763.95 |

| 2034 | 2951.08 |

| 2035 | 3150.88 |

The Global Hair Regrowth Treatments Market in the United States is projected to grow at a CAGR of 5.3%, driven by the expansion of subscription-based telehealth platforms and sustained consumer reliance on topical minoxidil solutions. The USA market is highly competitive, with Rogaine, Hims, and Keeps leading in both retail and digital channels.

While minoxidil remains the backbone of treatment, oral nutraceuticals like Nutrafol and Viviscal are gaining strong traction among women and aging populations. Dermatology clinics are also expanding advanced regrowth services such as PRP (platelet-rich plasma) therapy and laser-based devices. However, dropout rates due to inconsistent results remain a challenge, prompting companies to bundle multiple modalities and offer long-term subscription care.

The Global Hair Regrowth Treatments Market in the United Kingdom is expected to grow at a CAGR of 8.2%, supported by a blend of traditional pharmacy-based distribution and rising e-commerce penetration. Increasing social acceptance of cosmetic interventions, particularly among younger men and post-partum mothers, is fueling market demand.

The UK also shows strong interest in clean-label, natural, and herbal oils marketed as scalp nourishment products, often purchased online. Premium dermatology clinics in London and Manchester are offering integrated treatments, combining minoxidil, microneedling, and low-level laser therapy to appeal to consumers seeking faster results. Regulatory oversight, while strict, has improved consumer trust in clinically backed regimens, positioning the UK as one of Europe’s innovation-driven markets.

India is witnessing rapid growth in the Global Hair Regrowth Treatments Market, which is forecast to expand at a CAGR of 14.2% through 2035. This strong momentum is underpinned by high consumer acceptance of herbal oils and ayurvedic formulations, alongside the rising availability of minoxidil solutions at pharmacies and online platforms.

Tier-2 and Tier-3 cities are becoming important growth centers due to cost reductions and increased awareness of preventive hair care. Younger demographics, especially men in urban areas, are early adopters of oral supplements and nutraceuticals.

Dermatology clinics are also recording strong uptake for affordable PRP and microneedling therapies, often marketed as cosmetic procedures. The combination of cultural familiarity with hair oils and modern clinical treatments creates a unique hybrid growth pathway in India.

The Global Hair Regrowth Treatments Market in China is expected to grow at a CAGR of 12.6%, the second-highest among leading economies. Demand is driven by rapid adoption of advanced dermatology services, AI-powered scalp diagnostic tools, and smart laser therapy devices. Chinese consumers are highly receptive to premium, tech-enabled solutions that combine convenience with perceived efficacy.

Municipal healthcare programs and wellness platforms are also promoting preventive treatments among younger consumers, creating a broad demand base. Domestic brands are competing aggressively with global leaders by offering affordable minoxidil solutions and herbal alternatives tailored to local preferences.

With strong e-commerce penetration, live-streaming sales, and growing awareness around cosmetic wellness, China is positioned to become one of the most dynamic markets in the global landscape.

| Country | 2025 Share (%) |

|---|---|

| USA | 21.0% |

| China | 10.7% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.3% |

| India | 4.4% |

| Europe | 19.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.6% |

| Japan | 7.5% |

| Germany | 12.0% |

| UK | 6.5% |

| India | 5.3% |

| Europe | 18.1% |

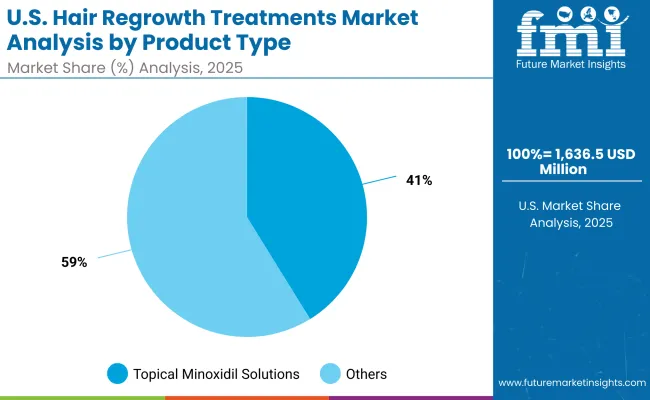

| USA By Product Type | Value Share % 2025 |

|---|---|

| Topical minoxidil solutions | 41.2% |

| Others | 58.8% |

The Global Hair Regrowth Treatments Market in the United States is valued at USD 1,636.53 million in 2025. Topical minoxidil contributes 41.2%, while other categories including supplements, laser devices, and herbal oils collectively account for 58.8%, which shows a clear transition toward diversified, multi-modal regrowth solutions.

This shift reflects the limitations of relying on minoxidil alone and the rising consumer demand for complementary or alternative treatments. Supplements like Nutrafol and Viviscal are strongly positioned, especially among women and aging consumers, while laser therapy devices are being promoted as convenient home-use solutions with non-invasive appeal.

The expansion of subscription-based telehealth platforms such as Hims and Keeps is a major catalyst, as they bundle minoxidil with finasteride, supplements, and dermatologist access, thereby creating integrated treatment pathways. The increasing popularity of preventive care, particularly among younger men in their 20s and 30s, is driving consistent year-on-year adoption.

Dermatology clinics are also strengthening demand by combining minoxidil with advanced procedures like PRP (platelet-rich plasma) injections and microneedling, appealing to consumers who seek faster and more visible results. As consumer awareness matures, the USA market is expected to maintain steady growth by aligning product innovation with convenience, personalization, and clinical credibility.

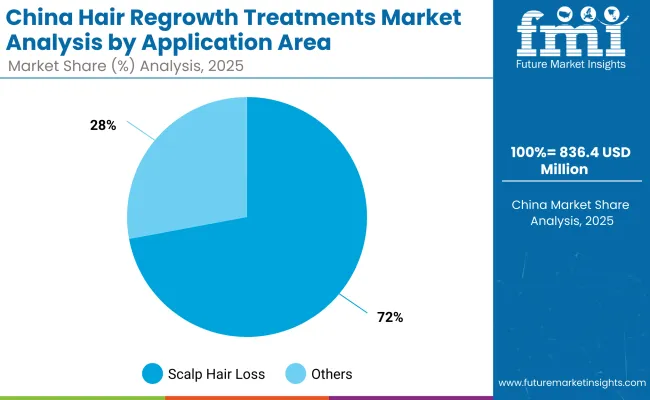

| China By Application Area | Value Share % 2025 |

|---|---|

| Scalp hair loss | 72.1% |

| Others | 27.9% |

The Global Hair Regrowth Treatments Market in China is valued at USD 836.45 million in 2025, with scalp hair loss treatments leading at 72.1%, followed by other cosmetic segments like eyebrow/eyelash regrowth and beard enhancement at 27.9%.

The dominance of scalp treatments is a direct reflection of consumer priorities in managing androgenetic alopecia, which affects both men and women in urban centers. China’s consumer base is increasingly favoring high-tech regimens, such as AI-powered scalp diagnostic tools and laser caps, which allow personalization and convenience at home. These solutions are often integrated with minoxidil or natural oils, creating a hybrid treatment model that blends tradition with modern science.

The strong role of e-commerce platforms like Tmall and JD.com in distributing hair regrowth products further accelerates adoption, aided by live-streaming sales channels that educate consumers about efficacy and routines.

Domestic companies are competing aggressively with international brands by offering cost-effective minoxidil formulations and herbal blends tailored to local preferences, while premium clinics in tier-1 cities are pushing procedures like PRP therapy and microneedling. As China deepens its investment in wellness and aesthetic healthcare, it is expected to outpace most developed markets and solidify its role as a global growth hub.

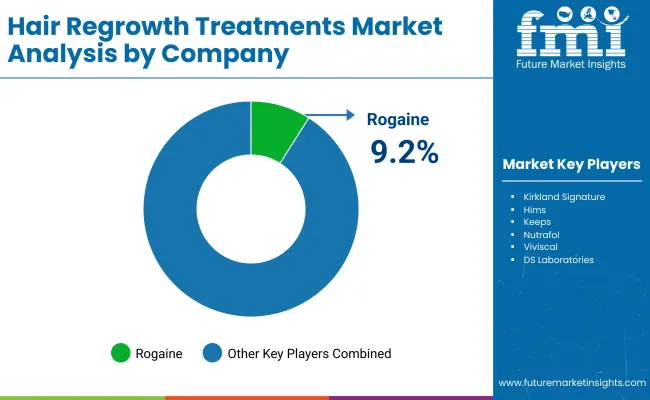

| Company | Global Value Share 2025 |

|---|---|

| Rogaine | 9.2% |

| Others | 90.8% |

The Global Hair Regrowth Treatments Market is moderately fragmented, with a mix of long-established pharmaceutical leaders, direct-to-consumer subscription brands, and natural/nutraceutical-focused players. Global leaders like Rogaine (J&J) dominate the topical minoxidil category, leveraging decades of clinical credibility and wide-scale distribution across pharmacies and e-commerce channels.

Their dominance is particularly strong in the USA and Europe, where minoxidil is considered the gold standard treatment. However, their market share is under pressure from emerging players diversifying the regrowth category.

Direct-to-consumer brands such as Hims, Keeps, and Shapiro MD are rapidly expanding by offering bundled regimens that include minoxidil, finasteride, oral supplements, and dermatologist support. Their model emphasizes convenience, privacy, and subscription-based retention, appealing strongly to younger men. Nutraceutical players like Nutrafol and Viviscal are capturing women’s and older consumers’ attention by positioning regrowth as part of holistic wellness, supported by influencer campaigns and clinical backing.

Meanwhile, niche-focused providers like DS Laboratories and Lipogaine differentiate through advanced formulations, herbal blends, and device integration. Competitive differentiation is shifting from single-product solutions toward integrated ecosystems combining topical, oral, device-based, and digital services into personalized packages.

The balance of power in this market is moving away from legacy minoxidil brands alone, toward companies capable of delivering convenience, personalization, and recurring revenue models through e-commerce and clinic partnerships.

Key Developments in Global Hair Regrowth Treatments Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Topical minoxidil solutions, Oral supplements, Laser therapy devices, Natural/herbal oils |

| Application Area | Scalp hair loss, Eyebrow/eyelash thinning, Beard enhancement |

| User Group | Men, Women, Post-partum mothers, Age-related hair loss patients |

| Channel | Pharmacies & drugstores, E-commerce, Dermatology clinics, Supermarkets |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rogaine, Kirkland Signature, Hims , Keeps, Nutrafol , Viviscal , DS Laboratories, Lipogaine , Regaine (J&J), Shapiro MD |

| Additional Attributes | Dollar sales by product type and application area, adoption trends in telehealth and subscription-based models, rising demand for topical minoxidil and oral nutraceuticals, segment-specific growth in men and post-partum women, revenue share by e-commerce and dermatology clinics, integration of AI-based scalp diagnostics and laser therapy devices, regional trends shaped by cultural acceptance and affordability, and innovation in natural/herbal formulations alongside clinically validated treatments. |

The Global Hair Regrowth Treatments Market is estimated to be valued at USD 7,803.6 million in 2025.

The market size for the Global Hair Regrowth Treatments Market is projected to reach USD 16,902.7 million by 2035.

The Global Hair Regrowth Treatments Market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in the Global Hair Regrowth Treatments Market are topical minoxidil solutions, oral supplements, laser therapy devices, and natural/herbal oils.

In terms of application area, the scalp hair loss segment is projected to command 72.1% share in the Global Hair Regrowth Treatments Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Hair Brush Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA