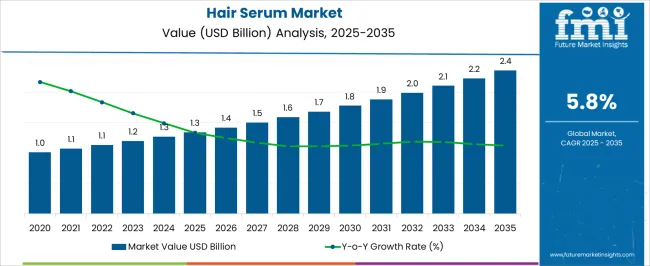

The hair serum market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The trajectory highlights steady growth as consumer preference for premium personal care products and advanced hair treatment solutions continues to rise globally. From 2020–2024, the market progresses from USD 1.0 billion to USD 1.2 billion, marking the early adoption stage, with demand driven by heightened awareness of scalp health, frizz control, and styling needs. Annual gains such as USD 1.1 billion in 2021 and 2022, followed by USD 1.2 billion in 2023 and 2024, demonstrate consistent uptake, supported by growing availability of serums with multifunctional benefits like UV protection, hydration, and anti-hair fall properties. Between 2025–2030, the market advances from USD 1.3 billion to USD 1.8 billion, contributing nearly 45% of the overall projected expansion.

This stage reflects rising penetration in emerging economies, where urban consumers increasingly adopt salon-inspired haircare regimens, alongside innovations in lightweight, non-greasy formulations. By 2031–2035, the market expands further from USD 1.9 billion to USD 2.4 billion, accounting for about 40% of the total growth. This period reflects mainstream acceptance of serums with botanical extracts, silicones alternatives, and personalized haircare solutions. The hair serum market shows a clear upward trajectory through 2035, underpinned by lifestyle changes, innovation in product offerings, and widening consumer reach across both developed and emerging regions.

| Metric | Value |

|---|---|

| Hair Serum Market Estimated Value in (2025 E) | USD 1.3 billion |

| Hair Serum Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The hair serum market accounts for a notable position within the global hair care industry, contributing approximately 12–14% of the overall hair styling and treatment segment, where shampoos, conditioners, and hair oils dominate larger volumes. Within the broader personal care and beauty products sector, hair serums account for around 8–9%, driven by rising consumer focus on hair nourishment, frizz control, and styling convenience. In premium and professional salon products, their share is estimated at 15–16%, supported by frequent salon use and high-end formulations enriched with vitamins, proteins, and natural extracts. Within the e-commerce and online retail hair care category, hair serums represent nearly 10–11%, reflecting growing adoption among digital shoppers seeking personalized hair care solutions.

In men’s grooming and styling segments, the share is relatively modest at 5–6%, as styling gels and pomades maintain larger consumption. Growth is being shaped by increasing awareness of hair damage prevention, rising preference for multifunctional products, and expansion of influencer-led marketing campaigns. Manufacturers are focusing on improving product formulations, incorporating lightweight, non-greasy textures, and targeting diverse hair types. Although smaller than traditional shampoos or conditioners, the hair serum market is consolidating its importance as an essential, value-added product in daily hair care routines, salon offerings, and online retail platforms.

The hair serum market is expanding steadily, driven by increasing consumer awareness around targeted hair care and the adoption of specialized products for diverse hair textures and concerns. Rising disposable incomes, urban lifestyles, and the influence of beauty influencers are encouraging product experimentation across genders and age groups.

Manufacturers are investing in lightweight, multifunctional serums enriched with botanical ingredients, appealing to health-conscious and environmentally aware consumers. E-commerce platforms and salon partnerships are also streamlining product accessibility.

Growing concerns about pollution, heat damage, and hair styling practices continue to boost demand for protective and nourishing hair serums.

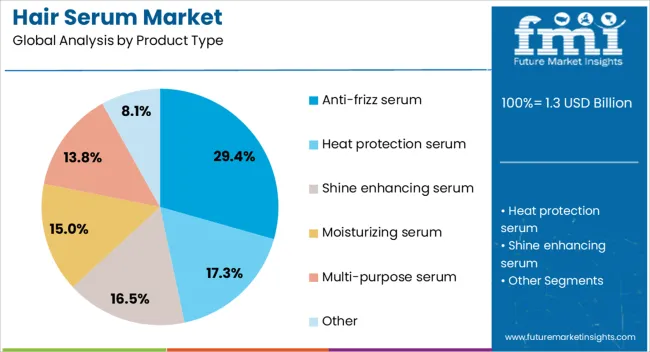

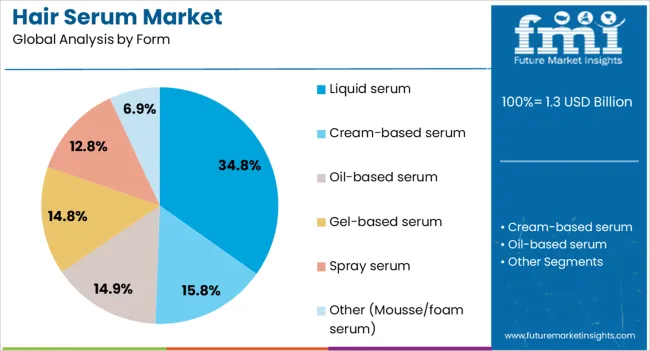

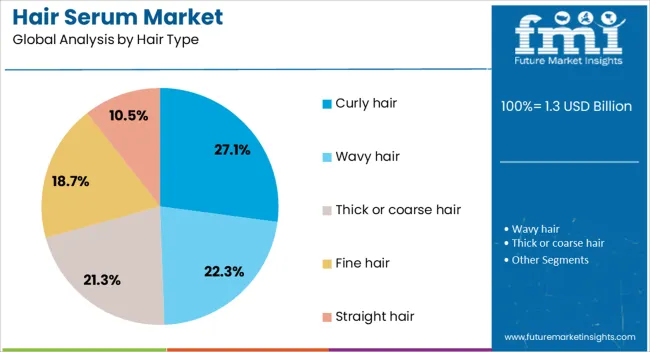

The hair serum market is segmented by product type, form, hair type, end use, gender, price, ingredients, and geographic regions. By product type, hair serum market is divided into anti-frizz serum, heat protection serum, shine enhancing serum, moisturizing serum, multi-purpose serum, and other. In terms of form, hair serum market is classified into liquid serum, cream-based serum, oil-based serum, gel-based serum, spray serum, and other (Mousse/foam serum). Based on hair type, hair serum market is segmented into curly hair, wavy hair, thick or coarse hair, fine hair, and straight hair. By end use, hair serum market is segmented into residential and commercial. By gender, hair serum market is segmented into women, men, and unisex. By price, hair serum market is segmented into medium, low, and high. By ingredients, hair serum market is segmented into organic/natural serum and chemical based serum. Regionally, the hair serum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Anti-frizz serum leads the product type category with a projected market share of 29.4% in 2025. This dominance is driven by growing consumer focus on smoothness and frizz control, especially in humid climates. Anti-frizz serums offer immediate visual improvement and long-term manageability, making them a daily-use essential for individuals with unmanageable or textured hair. Their ease of use, lightweight feel, and compatibility with styling routines make them a preferred choice for professionals and general consumers alike. Additionally, advancements in silicone-free and sulfate-free formulations have enhanced their appeal among health-conscious users.

Liquid serums are expected to command 34.8% of the market in 2025, ranking as the leading product form. This preference is shaped by their lightweight texture, fast absorption, and even application across hair lengths. Liquid serums are easy to dispense and blend well with other hair care or styling products, boosting their utility across routines. Their packaging flexibility often in droppers or pump bottles also supports precise usage and minimizes wastage. With increasing demand for scalp-friendly, non-greasy products, liquid serums remain the go-to format for innovation and consumer satisfaction.

Curly hair is forecast to represent 27.1% of the total demand in 2025, making it the dominant hair type driving serum adoption. Consumers with curly hair are more prone to dryness, breakage, and frizz, fueling a strong need for moisture-locking and definition-enhancing products. Hair serums offer essential nourishment without weighing down curls, promoting bounce and styling ease. The segment also benefits from increased representation of textured hair in media and advertising, normalizing product development tailored for curl patterns. As the natural hair movement continues to grow globally, the curly hair segment is likely to remain a major growth engine for serum products.

Hair serums are establishing a strong presence due to multifunctional benefits, salon integration, and e-commerce adoption. Targeted formulations and influencer marketing are accelerating consumer preference and market growth globally.

Consumer inclination toward hair serums has strengthened due to their multifunctional benefits, such as frizz control, shine enhancement, and nourishment. Individuals with damaged or chemically treated hair increasingly prefer lightweight formulations that deliver quick results without leaving residue. Growth is also influenced by the availability of specialized serums targeting hair fall, split ends, and scalp health. Marketing campaigns emphasizing natural extracts, vitamins, and proteins further encourage adoption. Retailers are expanding shelf space for hair serums in personal care aisles, while e-commerce platforms provide detailed product descriptions and user reviews, facilitating informed purchase decisions. Rising awareness of routine hair care and convenience-driven products contributes to steady market expansion across demographics globally.

Hair serums are increasingly integrated into professional salon treatments, creating consistent demand among stylists and salon clients. Premium salons promote serums as part of keratin, smoothing, and deep-conditioning treatments, highlighting product efficacy and post-treatment hair maintenance. Partnerships between manufacturers and salons ensure continuous product visibility and education on correct application techniques. The professional channel also drives adoption of high-margin, enriched serums with specialty ingredients that are less common in mass-market products. Training sessions for stylists enhance credibility and encourage product recommendations to clients. Expansion of spa and beauty service networks in urban and semi-urban regions further fuels market penetration, providing opportunities for both global and regional serum brands.

Online retail and social media platforms are driving growth in the hair serum market by increasing awareness and accessibility. Influencer-led campaigns, tutorials, and reviews highlight product benefits, demonstrating effective usage for hair care routines. Subscription-based models and online-exclusive launches attract consumers seeking convenience and novelty. Brands leverage targeted advertising, content marketing, and video demonstrations to engage audiences, particularly younger demographics. E-commerce platforms allow consumers to compare formulations, check ingredients, and assess value-for-money, increasing trust and repeat purchases. Faster delivery, easy returns, and promotions further incentivize adoption. This digital momentum complements physical retail channels and is becoming a key driver in market expansion.

Manufacturers are introducing serums enriched with natural oils, proteins, plant extracts, and vitamins to differentiate products and appeal to niche consumer preferences. Formulation improvements focus on reducing greasiness, enhancing absorption, and delivering measurable results in hair texture and shine. Targeted serums for hair growth, anti-hair fall, and scalp nourishment cater to growing concerns of different age groups and hair types. Limited-edition, seasonal, or fragrance-infused variants create brand excitement and customer loyalty. Product labeling, clinical claims, and certifications further build consumer confidence. These strategies encourage both trial and repeat purchases, positioning hair serums as essential daily grooming items and boosting overall market growth.

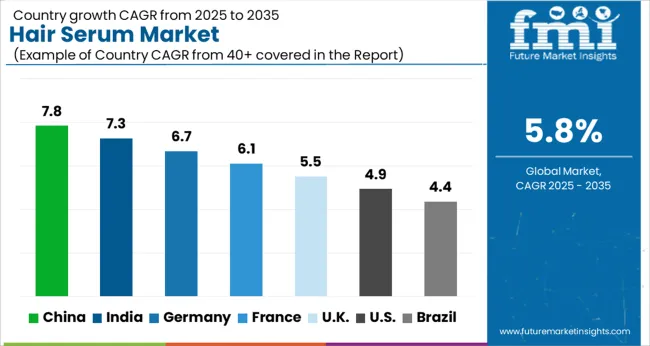

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The hair serum market is projected to grow globally at a CAGR of 5.8% from 2025 to 2035, fueled by rising consumer focus on hair care, premiumization, and multi-functional formulations. China leads with a CAGR of 7.8%, driven by increasing salon penetration, e-commerce adoption, and growing awareness of hair health among urban populations. India follows at 7.3%, supported by expanding professional beauty services, rising disposable incomes, and stronger online retail presence. France posts 6.1%, with growth guided by demand for premium personal care products and salon-driven recommendations. The United Kingdom achieves 5.5%, as demand is influenced by professional treatments and retail promotions. The United States records 4.9%, with moderate growth shaped by mature markets and consumer preference for established brands. This outlook highlights Asia as the fastest-growing hub, Europe maintaining consistent premium and professional-driven growth, and North America showing measured but steady expansion across established consumer bases.

China is projected to expand at a CAGR of 7.8% during 2025–2035, outpacing the global average of 5.8%. During 2020–2024, the CAGR was measured at 6.5%, supported by rising awareness of hair health, increasing salon penetration, and rapid e-commerce adoption. The higher growth in the coming decade is driven by multi-functional hair serums, rising premium personal care consumption, and expansion of beauty retail chains. Urban consumers and younger demographics are showing strong preference for professional-grade products, while domestic brands scale production to meet rising demand. This positions China as a leading market in both value and volume terms.

India’s hair serum market is expected to grow at a CAGR of 7.3% during 2025–2035, compared to 6.0% during 2020–2024. Early growth was supported by rising beauty awareness, expansion of professional hair salons, and increasing online retail penetration. The next decade sees accelerated adoption fueled by higher disposable incomes, strong growth in men’s grooming products, and increased regional distribution networks. Domestic manufacturers are launching affordable yet high-quality serums, while international brands expand localized offerings. Growing interest in natural and herbal-based hair care also supports volume expansion, positioning India as a high-growth hub in Asia-Pacific.

France is projected to register a CAGR of 6.1% for 2025–2035, up from 5.2% during 2020–2024. Initial growth was constrained by market maturity and strong brand loyalty toward established personal care lines. The subsequent period shows improved growth due to increasing demand for premium and multifunctional serums, influencer-driven product awareness, and expansion of specialty salons. Retail chains and online beauty platforms contribute to wider product distribution. Additionally, consumer willingness to experiment with international and luxury brands has stimulated higher sales. France remains a steady, premium-oriented market with continued moderate growth potential.

The United Kingdom hair serum market is projected to expand at a CAGR of 5.5% during 2025–2035, improving from 4.8% in 2020–2024. Earlier growth was tempered by mature retail channels and consumer preference for existing brands. Growth accelerates as professional salons adopt newer formulations, and online sales channels expand across regions. Multi-benefit serums and styling-enhancing products drive repeat purchase patterns, while seasonal campaigns by premium brands contribute to incremental dollar sales. Overall, the UK remains a mature yet steadily advancing market, balancing demand between professional salon adoption and growing retail consumption.

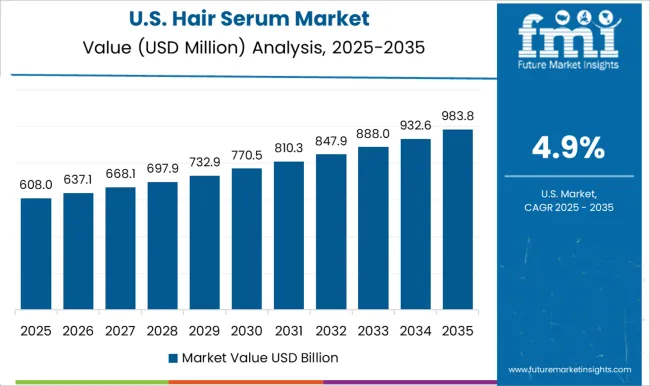

The United States is projected to grow at a CAGR of 4.9% during 2025–2035, compared to 4.2% during 2020–2024. Early growth was limited by saturated markets, strong brand presence, and conservative consumer adoption. Future expansion is supported by increased focus on men’s grooming, rise in specialty hair care products, and multi-functional serums that combine styling and protective properties. Online retail and subscription models further enhance reach, while niche natural and professional-grade brands encourage incremental dollar sales. Although growth remains moderate, the US market maintains a significant share in global revenue due to high per-unit pricing and large consumer base.

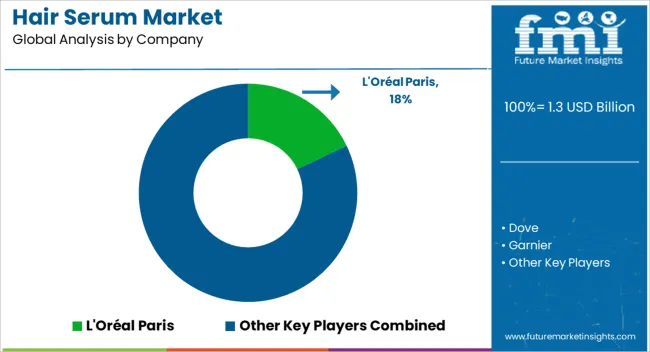

The hair serum market is shaped by global personal care giants and niche professional brands that cater to diverse hair types, styling needs, and consumer preferences. L’Oréal Paris maintains a leadership position worldwide, leveraging brand equity, multi-channel retail presence, and innovation in hair care formulations to drive broad adoption. Dove strengthens its reach through mass-market positioning, dermatologist-backed products, and consistent consumer engagement campaigns. Garnier and Himalaya Herbals emphasize natural and herbal ingredients, appealing to health-conscious consumers across emerging and mature markets. John Frieda, Kerastase, and Redken target premium salon channels with professional-grade formulations, while Living Proof, Matrix, Moroccanoil, and OGX (Organix) focus on specialized hair solutions such as repair, frizz control, and styling enhancement.

Pantene, TRESemmé, Schwarzkopf Professional, and Wella Professionals combine widespread retail availability with salon endorsements, driving brand trust and repeat purchases. Competitive differentiation in this sector is determined by product efficacy, ingredient quality, brand reputation, and pricing strategy. Leading players invest in R&D for innovative formulas, multi-benefit serums, and packaging that enhances usability. Market strategies include collaborations with salons and beauty influencers, expansion into e-commerce and subscription services, and targeted marketing campaigns to strengthen consumer loyalty. Brands continue to focus on region-specific preferences, premium versus mass-market segmentation, and product diversification to address styling, protective, and restorative hair needs. Intense competition encourages continuous innovation, brand reinforcement, and channel optimization to maintain and grow share in the dynamic global hair serum industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 billion |

| Product Type | Anti-frizz serum, Heat protection serum, Shine enhancing serum, Moisturizing serum, Multi-purpose serum, and Other |

| Form | Liquid serum, Cream-based serum, Oil-based serum, Gel-based serum, Spray serum, and Other (Mousse/foam serum) |

| Hair Type | Curly hair, Wavy hair, Thick or coarse hair, Fine hair, and Straight hair |

| End Use | Residential and Commercial |

| Gender | Women, Men, and Unisex |

| Price | Medium, Low, and High |

| Ingredients | Organic/natural serum and Chemical based serum |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal Paris, Dove, Garnier, Himalaya Herbals, John Frieda, Kerastase, Living Proof, Matrix, Moroccanoil, OGX (Organix), Pantene, Redken, Schwarzkopf Professional, TRESemmé, and Wella Professionals |

| Additional Attributes | Dollar sales, share, top-selling brands, segment-wise demand (premium vs mass), growth by region, ingredient trends (herbal, keratin, oils), consumer preferences, retail vs e-commerce performance, pricing trends, and competitive intensity. |

The global hair serum market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the hair serum market is projected to reach USD 2.4 billion by 2035.

The hair serum market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in hair serum market are anti-frizz serum, heat protection serum, shine enhancing serum, moisturizing serum, multi-purpose serum and other.

In terms of form, liquid serum segment to command 34.8% share in the hair serum market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Hair Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Extension Market Size and Share Forecast Outlook 2025 to 2035

Hair Bond Multiplier Market Size and Share Forecast Outlook 2025 to 2035

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Hair Thinning Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hair Finishing Stick Market Size and Share Forecast Outlook 2025 to 2035

Hair Mask Market Size and Share Forecast Outlook 2025 to 2035

Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Hair Removal Wax Pen Market Size and Share Forecast Outlook 2025 to 2035

Hair Perfume Market Size and Share Forecast Outlook 2025 to 2035

Hair Dryer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Hair Care Market Size and Share Forecast Outlook 2025 to 2035

Hair Wig and Extension Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA