The rail tourism market in Europe is experiencing accelerated growth driven by increasing traveler preference for sustainable and experiential journeys. Expanding high-speed rail networks, seamless cross-border connectivity, and government investments in green transport infrastructure are contributing to the sector’s expansion. Current dynamics are characterized by the integration of comfort, convenience, and scenic value within train-based travel experiences.

Technological advancements in ticketing systems, digital route mapping, and onboard services have enhanced passenger satisfaction and operational efficiency. The future outlook remains optimistic as European nations prioritize eco-friendly tourism options and strengthen intermodal transport networks to support regional accessibility.

Growth rationale is based on rising environmental consciousness, the convenience of rail over air for short and mid-distance routes, and the cultural diversity of destinations accessible through rail itineraries The combination of policy support, digital transformation, and evolving traveler preferences is expected to sustain robust demand and create long-term opportunities for operators in the European rail tourism landscape.

| Metric | Value |

|---|---|

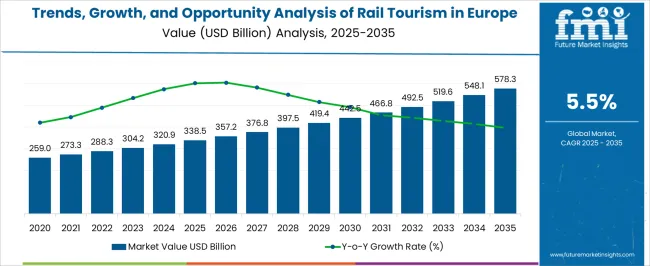

| Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Estimated Value in (2025E) | USD 338.5 billion |

| Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Forecast Value in (2035F) | USD 578.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

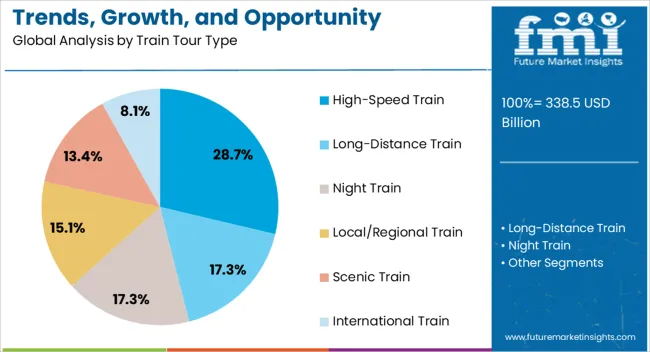

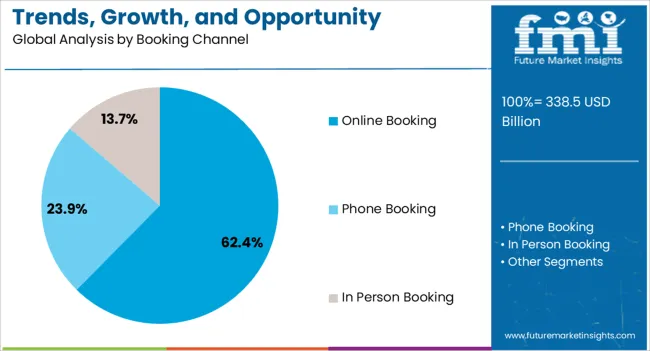

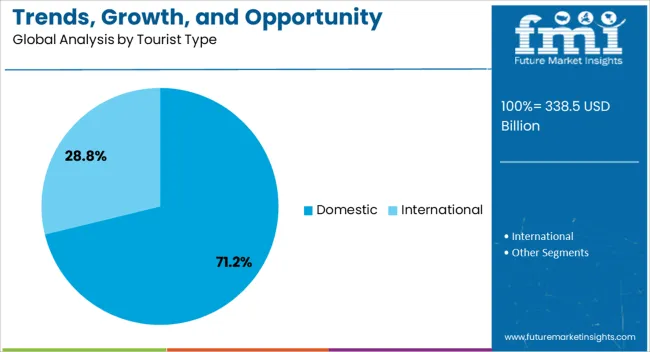

The market is segmented by Train Tour Type, Booking Channel, Tourist Type, and Age Group and region. By Train Tour Type, the market is divided into High-Speed Train, Long-Distance Train, Night Train, Local/Regional Train, Scenic Train, and International Train. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourist Type, the market is segmented into Domestic and International. By Age Group, the market is divided into 26 to 35 Years, 15 to 25 Years, 36 to 45 Years, 46 to 55 Years, and 66 to 75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high-speed train segment, holding 32.7% of the train tour type category, has been leading the market due to its efficiency, comfort, and time-saving advantages across major European routes. Its dominance is being reinforced by expanding high-speed corridors linking key tourist destinations and metropolitan hubs.

Demand has been further supported by the rising appeal of premium rail experiences that combine speed with scenic exploration. Investments in modern rolling stock, digital reservation systems, and passenger amenities have enhanced travel comfort and operational reliability.

Partnerships between railway operators and tourism boards have promoted curated packages that integrate high-speed journeys with cultural and leisure experiences Continued expansion of high-speed infrastructure and growing preference for sustainable, fast travel alternatives are expected to sustain this segment’s growth trajectory and strengthen its position in the European tourism ecosystem.

The online booking segment, representing 58.4% of the booking channel category, has emerged as the leading distribution mode due to widespread digital adoption and consumer preference for convenience and transparency. Growth has been accelerated by the proliferation of online travel agencies, mobile applications, and integrated booking platforms offering real-time pricing and itinerary management.

Enhanced user experience through personalized recommendations and secure payment systems has encouraged greater online engagement. Tour operators and railway companies are leveraging data analytics to optimize dynamic pricing and targeted marketing, further expanding the digital customer base.

Increasing smartphone penetration and the adoption of contactless travel solutions are expected to reinforce this segment’s dominance, ensuring consistent growth across both domestic and international traveler segments.

The domestic tourist segment, accounting for 61.2% of the tourist type category, has maintained its leading share due to strong intra-regional travel patterns and affordability compared to air or car travel. Growth has been driven by government initiatives promoting domestic tourism and regional travel incentives encouraging citizens to explore local destinations by train.

Familiarity with routes, ease of accessibility, and flexible ticketing options have supported repeat travel behavior among residents. Post-pandemic recovery has further strengthened domestic tourism as travelers increasingly prefer shorter, sustainable trips within their own countries.

The segment’s expansion is expected to continue with increasing investment in local rail infrastructure, improved onboard services, and the growing cultural appeal of scenic and heritage train journeys across Europe.

Development of Smart Trains is Opportunistic for the Industry

The smart train technology is taking the European rail tourism industry to the next level by making the traveling experience better for the passengers and improving operational efficiency.

Trains are being fitted with high-speed Wi-Fi, IoT devices, and digital entertainment systems to appeal to tech-savvy passengers. Services like customer-preferred seats, smart boarding passes, and in-flight ordering make it easier for travelers.

Integration of digital booking platforms and mobile apps for Europe rail tourism reservations makes it easier for travelers. This trend puts rail operators at the edge of technological developments. It draws a younger and tech-savvy audience and creates the opportunity for new revenue-generating ventures through premium services.

Launch of Themed and Entertainment Trains Means More Revenues

Themed entertainment trains are fun train travel packages where various themes form part of the package. Regional variations in rail tourism demand and preferences across European countries make trains more captivating.

These trains are decorated and equipped with activities or entertainment facilities according to the themes of the movies, books, or historical events.

For instance, the Harry Potter train, launched in Scotland in January 2025, includes stories and train dining options that evoke the feeling of magic. Such themed journeys not only draw the attention of specialized audiences as well as provide them with the right experiences that generate brand loyalty.

The rail tourism industry can create unique offerings based on entertainment brands and immerse the public to increase engagement and repeat business.

Multi-destination Train Launches is Beneficial for the Industry

Multi-destination train services increase the perceived value of travel because they allow travelers to visit several destinations with a single ticket. The impact of high-speed rail infrastructure development on Europe rail tourism growth highlights the significance of developing multi-destination train services.

This service is attractive to tourists who have only a short period of travel and who want the most efficient means of getting to different cities and regions. Multi-destination itineraries can attract more families, individual travelers, and group tourists visiting different regions on the same ticket. This can lead to more revenues, thereby benefiting the rail tourism industry.

In January 2025, Leo Express, a public transport operator in the Czech Republic, announced a new route that would link Belgium and Slovakia in the form of a very long train ride. It would pass through nearly 50 destinations in 19 hours such as Brussels, Dresden, Prague, and many others.

The industry expanded at a 5.1% CAGR between 2020 and 2025. European countries have been pumping billions of dollars into building tracks and connecting cities and tourist spots by rail.

Some examples include the expansion of high-speed railways as well as the implementation of rail facilities across international borders to enable the mobility of rail trips at a greater speed and convenience.

The upgraded rail system also shortens journey times and thus increases the attractiveness of railways as a means of transportation. The creation of new routes and the improvement of old ones have also boosted the industry by providing access to previously less-touristed parts of the country.

European governments have been particularly keen to incentivize and aid the rail industry through several policies and subsidies. Steps like subsidizing rail projects, slashing VAT on train tickets, and undertaking promotions have made journeys on trains easier and cheaper.

Furthermore, the implementation of policies such as flight taxes and restrictions on short routes has motivated many people to travel by train. This governmental support has been critical to the development of the rail tourism industry.

The future of the industry looks bright at a 5.5% CAGR predicted for 2025 to 2035. The growing interest in sustainability is likely to continue providing opportunities for the rail tourism industry in Europe.

With climate change and the conservation of the environment being key concerns across the globe today, rail transport will continue to attract consumers because of its emission advantage over air and road transport.

The Green Deal initiated by the European Union and other sustainability policies will also help continue this trend. It can further investments in green technologies and ecological approaches within the European rail industry.

This section takes a closer look at the industry segmentation of rail tourism in Europe. The research highlights that scenic train is the leading train tour type, with 28% of shares captured in 2025. Under the age group, the 26 to 35 years segment leads with 36% of shares garnered in 2025.

| Segment | Scenic Trains |

|---|---|

| Value Share (2025) | 28% |

The trends in experiential and slow travel are ideal for scenic train journeys, as they focus on leisure travel and authentic experiences. This is in stark contrast to air travel and is a selling point for those who hate rushing. Scenic train travel also has avenues for nostalgia and romanticism.

This can include the golden age of rail travel or luxurious options such as the Venice Simplon-Orient-Express to attract tourists. Companies in the rail tourism industry engage in strategic marketing and use images and social media to tell their story smartly and attractively.

Scenic trains have amenities such as larger windows and spacious seating that appeal to a wide audience. In Europe, there are various scenic routes such as the Glacier Express and the Flam Railway. They are attractive and present magnificent scenes that are appealing to domestic and international tourists alike.

| Segment | 26 to 35 Years |

|---|---|

| Value Share (2025) | 36% |

The rise of digital nomadism among 26 to 35-year-olds has reshaped travel preferences, with scenic train journeys becoming popular due to their conducive environment for remote work and exploration.

Targeted marketing efforts by rail companies emphasize adventure, sustainability, and cultural experiences, appealing to this demographic through engaging content and influencer partnerships. Additionally, scenic trains cater to group travel, offering space for social interaction and shared experiences, further enhancing their appeal to young travelers.

This section analyzes the demand for rail tourism in key European countries as given in the table below. The industry is LED by Spain, expanding at a 7.2% CAGR until 2035. Italy follows next, expanding at a 6.7% CAGR till 2035. Lastly, France is also on the list, expanding at a 6.2% CAGR until 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Spain | 7.2% |

| Italy | 6.7% |

| France | 6.2% |

The demand for rail tourism in Spain is set to amplify at a 7.2% CAGR until 2035. Following a rising need for luxury travel services, the Spanish rail industry has embarked on an expansion of luxury and premium trains to meet the expectations of wealthy people who prefer exotic amenities in their trains.

These luxury features include private suites, gourmet eateries, personal concierge, and special lounges bringing the luxury train travel to an entirely new level. By pursuing the luxury segment of rail travelers, rail companies can capture high-spending tourists and present themselves as suppliers of premium experiences in Spain’s rail tourism industry.

The revenues of Italy’s rail tourism industry are poised to increase at a 6.7% CAGR until 2035. Italian rail infrastructure investments, strategic partnerships, and customer experience enhancements are driving rail tourism growth. Targeted marketing, seasonal promotions, and digital transformation initiatives optimize operations and attract diverse travelers.

Sustainability initiatives align with eco-conscious trends, while international collaborations expand Italy's tourism reach. Accessibility improvements ensure inclusivity, while data analytics inform strategic decision-making for competitive advantage.

Together, these efforts elevate the Italian rail tourism industry’s appeal by offering convenient, sustainable, and enriching travel experiences for domestic and international tourists alike.

The demand for rail tourism in France is predicted to rise at a 6.2% CAGR by 2035. French rail operators are embracing digital transformation to enhance customer experience and operational efficiency. Sustainability initiatives position rail travel as eco-friendly, attracting environmentally conscious travelers.

Cultural and culinary tourism offerings capitalize on France's rich heritage, appealing to cultural enthusiasts and food lovers. Customer experience enhancements, including onboard amenities and station facilities, prioritize passenger satisfaction, fostering loyalty and positive word-of-mouth.

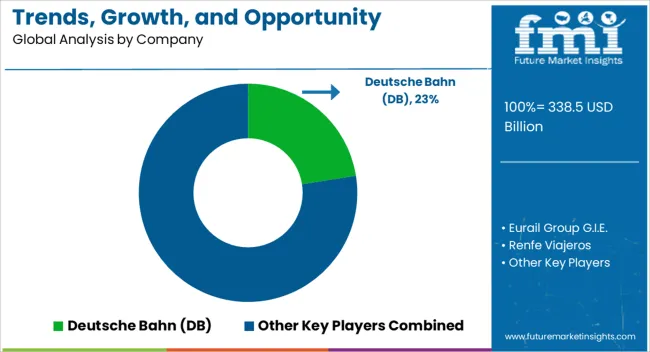

The competitive landscape of the Europe rail tourism industry is characterized by established players like Deutsche Bahn and SNCF, which leverage extensive infrastructure and brand recognition.

Emerging niche players such as Eurail Group focus on providing flexible travel options, while luxury operators target affluent travelers with premium experiences. Competition extends to other transportation modes, with rail operators investing in high-speed infrastructure and digitalization to enhance the passenger experience and remain competitive.

Recent Developments

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 320.9 billion |

| Projected Industry Size in 2035 | USD 548.1 billion |

| Anticipated CAGR between 2025 to 2035 | 5.5% CAGR |

| Historical Analysis of Demand for Rail Tourism in Europe | 2020 to 2025 |

| Demand Forecast for Rail Tourism in Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of Key Factors influencing Rail Tourism in Europe, Insights on Global Players and their Industry Strategy in Europe, Ecosystem Analysis of Local and Regional European Manufacturers |

| Key Companies Profiled | Eurail Group G.I.E.; Renfe Viajeros; Deutsche Bahn (DB); SNCF (Société Nationale des Chemins de fer Français); Trenitalia; Siemens Mobility; Swiss Travel System; ÖBB (Austrian Federal Railways); NS International (Nederlandse Spoorwegen); SBB (Swiss Federal Railways); Eurostar International Limited |

The sector fragments into High-Speed Train, Long-Distance Train, Night Train, Local/Regional Train, Scenic Train, and International Train.

The industry trifurcates into Phone Booking, Online Booking, and In Person Booking.

The sector bifurcates into Domestic and International.

The industry is classified into 15 to 25 Years, 26 to 35 Years, 36 to 45 Years, 46 to 55 Years, and 66 to 75 Years.

Analysis of the industry has been conducted in the United Kingdom, Scotland, Switzerland, Austria, Russia, Spain, Venice, Sweden, and Others.

The global trends, growth, and opportunity analysis of rail tourism in europe is estimated to be valued at USD 338.5 billion in 2025.

The market size for the trends, growth, and opportunity analysis of rail tourism in europe is projected to reach USD 578.2 billion by 2035.

The trends, growth, and opportunity analysis of rail tourism in europe is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of rail tourism in europe are high-speed train, long-distance train, night train, local/regional train, scenic train and international train.

In terms of booking channel, online booking segment to command 58.4% share in the trends, growth, and opportunity analysis of rail tourism in europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Tourism in Burma Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Europe Connected Car Market Growth - Trends & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Outbound Tourism in GCC Countries Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Europe Golf Tourism Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA