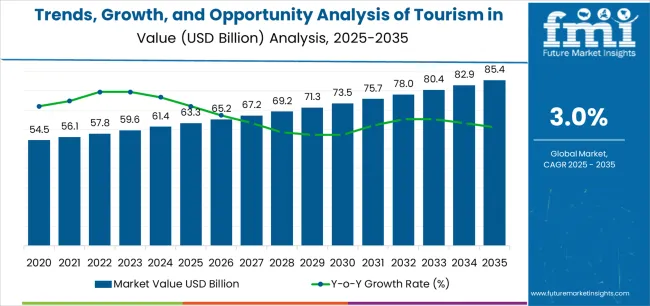

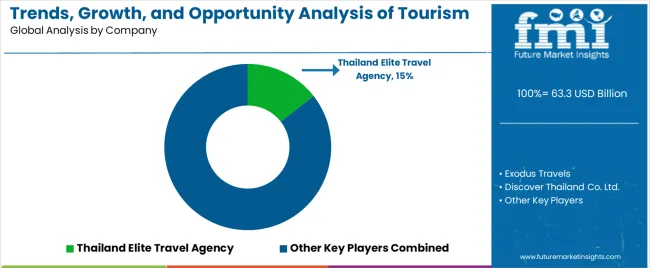

The Trends, Growth, and Opportunity Analysis of Tourism in Thailand is estimated to be valued at USD 63.3 billion in 2025 and is projected to reach USD 85.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period.

The Tourism in Thailand market is experiencing robust growth, driven by increasing domestic and international travel demand, expanding tourism infrastructure, and the growing popularity of Thailand as a leisure and cultural destination. Rising disposable incomes, improved connectivity, and the proliferation of digital platforms are enabling easier access to travel information and booking services. Domestic tourism is being particularly encouraged by government initiatives and campaigns that promote local attractions, festivals, and cultural experiences.

Advances in digital technologies, such as online booking platforms and mobile travel applications, are enhancing the traveler experience and simplifying trip planning. The market is also being shaped by changing consumer preferences toward personalized and flexible travel options, including self-guided itineraries and experiential tourism.

Investments in hospitality, transport, and tourism services are further supporting sector expansion As Thailand continues to prioritize tourism as a key economic driver, opportunities are emerging in sustainable tourism, digital engagement, and niche travel segments, positioning the market for sustained growth through 2034.

| Metric | Value |

|---|---|

| Trends, Growth, and Opportunity Analysis of Tourism in Thailand Estimated Value in (2025 E) | USD 63.3 billion |

| Trends, Growth, and Opportunity Analysis of Tourism in Thailand Forecast Value in (2035 F) | USD 85.4 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

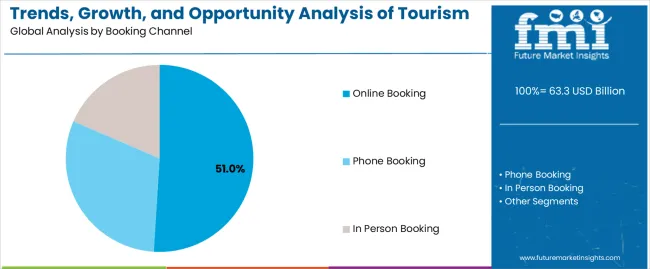

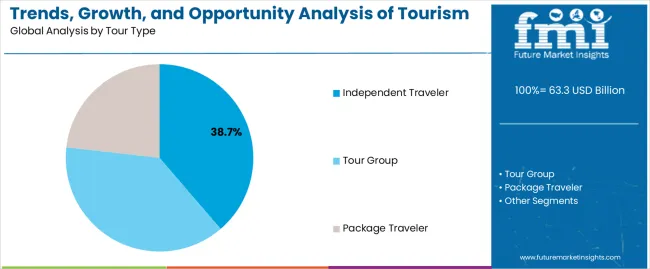

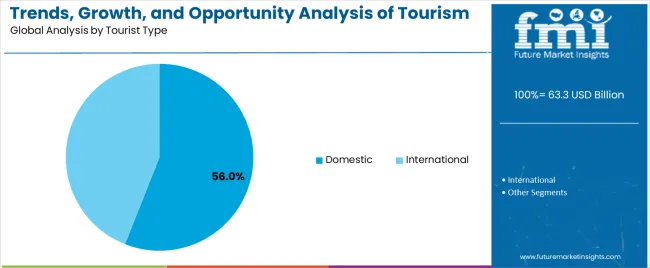

The market is segmented by Booking Channel, Tour Type, Tourist Type, Age Group, and Consumer Orientation and region. By Booking Channel, the market is divided into Online Booking, Phone Booking, and In Person Booking. In terms of Tour Type, the market is classified into Independent Traveler, Tour Group, and Package Traveler. Based on Tourist Type, the market is segmented into Domestic and International. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, and 66-75 Years. By Consumer Orientation, the market is segmented into Women, Men, and Children. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The online booking channel segment is projected to hold 51.0% of the market revenue in 2024, making it the leading booking channel. Its growth is being driven by increasing internet penetration, smartphone adoption, and the convenience of digital platforms that enable real-time reservations, price comparison, and itinerary customization. Online booking platforms also offer access to reviews, ratings, and curated recommendations, which enhance traveler confidence and decision-making.

Travel agencies and service providers are increasingly integrating AI-driven personalization, dynamic pricing, and loyalty programs to attract and retain users. The segment benefits from the growing preference for contactless and instant booking options, particularly among tech-savvy travelers.

As more domestic and international tourists adopt digital solutions for trip planning, the online booking channel is expected to maintain its market leadership Enhanced user experience, integration with multiple service providers, and real-time availability updates are reinforcing its prominence and ensuring long-term adoption in Thailand’s tourism ecosystem.

The independent traveler tour type segment is anticipated to account for 38.7% of the market revenue in 2024, establishing it as the leading tour type. Its growth is driven by changing traveler preferences toward flexibility, personalized experiences, and autonomy in planning itineraries. Independent travelers are increasingly seeking authentic local experiences, cultural immersion, and customized activities that allow exploration at their own pace.

The rise of digital tools, travel blogs, mobile apps, and online booking platforms has empowered travelers to plan trips independently without reliance on traditional tour operators. Economic considerations, convenience, and the desire for personalized itineraries further support adoption.

Service providers are responding by offering modular packages, self-guided tours, and curated local experiences that align with independent travel preferences As Thailand continues to develop its tourism infrastructure, including accommodations, transport, and digital information access, the independent traveler segment is expected to maintain its dominance, driven by the growing desire for experiential, flexible, and self-directed tourism.

The domestic tourist type segment is projected to hold 56.0% of the market revenue in 2024, positioning it as the leading tourist type. Its growth is being driven by increased disposable income, improved transportation networks, and domestic tourism campaigns promoting local destinations. Domestic tourists are contributing to higher occupancy in hotels, growth in attractions, and increased demand for food, transport, and cultural experiences.

Seasonal festivals, heritage sites, and natural attractions are encouraging repeat visits and multi-destination travel. Convenience, cost-effectiveness, and safety considerations are enhancing domestic travel preference compared with international tourism.

Additionally, digital platforms and mobile applications are facilitating trip planning and bookings, making domestic tourism more accessible and organized As government initiatives and private sector investments continue to enhance infrastructure and tourism services, domestic tourists are expected to remain the primary revenue contributor, reinforcing Thailand’s position as a leading destination for both leisure and cultural travel.

Thailand’s numerous religious destinations, not only of the dominant Buddhist kind but also Hindu and Muslim, are seeing a greater number of spiritual and family tourists abound in the country.

Efforts by tourism providers to provide a comprehensive temple or Wat experience, i.e., a guided tour of the major religious destinations in a location, are attracting tourists. For example, boat tours in Bangkok not only cover the important Wats in the city but also provide a scenic experience to tourists.

From the spiritual to the luxurious, Thailand has a plethora of experiences for tourists with loose purses. Tourism industry stakeholders in Thailand are concentrating on premium experiences to increase earnings.

Private rooms in clubs, fine dining experiences, and other assorted luxuries, such as access to the roof of the King Power Mahanakhon, are seeing a higher grade of tourists make the journey to Thailand’s hotspots.

The enormous volume of tourists visiting Thailand is necessitating tour companies in the country to provide consumers with better facilities and guidance. Bangkok is reputed as the most visited city in the world, while other popular areas like Pattaya and Phuket are also teeming with tourists.

To help tourists navigate the country better, tourist companies are providing facilities like online booking, AI tools for planning trips, virtual experiences, and more. The street food of Thailand is another selling point that is being utilized by stakeholders.

Street tours in Thailand incorporate indulging in various Thai delicacies, while the cheap nature of the street food also enamors tourists. These street food excursions are complemented by shopping stops, where again the relatively cheap nature of the goods comes into play.

Thailand’s happening nightlife draws a significant number of tourists to the country who want to take part in the club culture. Whether sports bars, pubs, or racier establishments, tourist companies have the opportunity to go beyond traditional tourist routes and offer a freer and more pleasurable experience to tourists.

Tour companies in Thailand are thus seeing bachelors and trendy couples emerge as a significant part of the consumer base. Chinatown in Bangkok and Walking Street in Pattaya are popular destinations for these kinds of experiences.

The vibrant nature of the nightlife in Thailand is aided by the wide availability of alcohol, in all price ranges, as well as fewer restrictions on cannabis use as compared to other Asian countries.

International tourists in Thailand are also finding navigating the country to be an easy experience due to the proliferation of convenience stores in the country. For example, Thailand boasts the second-highest number of 7-Eleven stores in the world.

The beaches in Thailand are one of the primary selling points for tourism in the country. Tour companies, to save time and give more bang for the buck to tourists, are selling island-hopping packages. These island-hopping packages incorporate a variety of beaches into the tour’s itinerary, with the islands in southern Thailand, near Phuket and Krabi, prominent hubs for these packages.

The availability of different boating experiences, such as kayaking, speed boats, cruises, and more is also making these packages attractive to consumers. Thus, vendors have the opportunity to enhance demand by offering convenient and varied island-hopping packages.

While hotspots like Bangkok, Chiang Mai, and Phuket see a high concentration of tourists, social media influencers are opening people’s eyes to other untapped corners of the country.

Spots like Wat Pa Maha Chedi Kaew, a Buddhist temple constructed by monks from leftover beer bottles, are receiving renewed attention due to social media. Thus, tour operators in Thailand have the opportunity to make use of social media to widen the scope of the tourist sector.

Thailand is associated with Muay Thai. As the number of Muay Thai fights increases, the sport is becoming more accessible to tourists. Muay Thai promoters are also offering schemes like free beers and snacks on the purchase of tickets to tempt more consumers. Thus, Muay Thai getting more recognition is a promising avenue of growth for players in the Thai tourist industry.

Negative connotations associated with trips to Thailand make consumers hesitant about undertaking trips to the country. These negative connotations arise as a result of the presence of hustlers, frauds, thieves, etc. littering the country.

The language barrier also acts as a restraining factor, with a considerable number of small-scale service providers struggling to communicate with outsiders. Tourist companies are concentrating on providing a safe experience to tourists as well as making available online and offline guides to counter these drawbacks.

Domestic tourists are anticipated to account for 56.0% of the industry share in 2025. With upgrades in lifestyles observed across the country, more percentage of the Thai population is putting aside time for leisure, which is positively impacting traveling activities in the country. The spiritual bent of a considerable portion of the Thai population also increases tourist activities related to temples.

Foreign tourists represent a significant avenue for growth for industry players. Thailand’s climbing reputation as a party hotspot ensures foreign tourists keep streaming into the country.

| Attributes | Details |

|---|---|

| Top Tourist Type | Domestic |

| Industry Share (2025) | 56.0% |

In 2025, online booking is expected to account for 51.0% of the industry share by booking channel. To get ahead of the pack and ensure a seamless tour, consumers are booking online tours.

The determination of tour operators to preview a captivating experience to travelers is also enticing tourists to come to Thailand in increasing measure. Online booking is also helping domestic tourists on brief trips to have a more convenient experience.

| Attributes | Details |

|---|---|

| Top Booking Channel | Online Booking |

| Industry Share (2025) | 51.0% |

Tourist companies in Thailand are undertaking regulatory formalities for foreign tourists to offer a more attractive package to consumers. With individuals from more than 60 nations allowed in Thailand without visas, tour operators are targeting tourists from these countries.

Bangkok Travel Agency is concentrating on providing attractive temple tours, with tours involving the Bangkok nightlife also sprinkled in. Another significant industry player, NS Travels & Tours, has honed in on specific cultural experiences like Thai cuisine cooking classes and history-focused tours.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | USD million for Value |

| Key Segments Covered | Booking Channel, Consumer Orientation, Tour Type, Tourist Type, and Age Group |

| Key Companies Profiled | Bangkok Travel Agency Thailand; NS Travels & Tours; Elite Holiday & Agency; Sun Leisure World; Holiday Tours and Travel; Bike Tours Thailand; Thailand Holiday Group; Thai Travel Plus Co. Ltd.; TIC Holidays Company Limited; Thrilling Thai Tours Ltd.; Discover Thailand Co. Ltd.; Exodus Travels; Thailand Elite Travel Agency |

| Report Coverage | Growth Forecast, Competition Intelligence, DROT Analysis, Industry Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global trends, growth, and opportunity analysis of tourism in thailand tourist type for 2024 to 2034 is estimated to be valued at USD 63.3 billion in 2025.

The market size for the trends, growth, and opportunity analysis of tourism in thailand tourist type for 2024 to 2034 is projected to reach USD 85.4 billion by 2035.

The trends, growth, and opportunity analysis of tourism in thailand tourist type for 2024 to 2034 is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of tourism in thailand tourist type for 2024 to 2034 are online booking, phone booking and in person booking.

In terms of tour type, independent traveler segment to command 38.7% share in the trends, growth, and opportunity analysis of tourism in thailand tourist type for 2024 to 2034 in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thailand Surfing Tourism Market Report – Demand, Innovations & Forecast 2025-2035

Thailand Culinary Tourism Market Trends – Growth & Forecast 2024-2034

Thailand Medical Tourism Market Growth – Trends & Forecast 2024-2034

Thailand Sustainable Tourism Market Trends – Growth & Forecast 2024-2034

Thailand Destination Wedding market Analysis from 2025 to 2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA