The outbound tourism market in China is witnessing robust growth, driven by rising disposable incomes, increasing international travel awareness, and the desire for diversified leisure experiences. Leisure travel is emerging as the primary motivator for outbound trips, supported by a growing middle class seeking cultural, recreational, and lifestyle experiences abroad. Technological advancements and improved connectivity, including digital travel platforms and seamless online booking systems, are facilitating smoother trip planning and management.

The expansion of flight networks, visa facilitation, and attractive tourism packages from global destinations are further enhancing accessibility. Governments and travel agencies are increasingly promoting international travel through targeted marketing campaigns and strategic partnerships, which is supporting overall market expansion.

Changing consumer preferences, such as a shift towards personalized itineraries and experiential travel, are encouraging the adoption of independent and customized travel solutions As international travel confidence increases and infrastructure improves, the outbound tourism market in China is expected to continue growing steadily, offering opportunities for tour operators, technology platforms, and destination marketers to capture rising demand.

| Metric | Value |

|---|---|

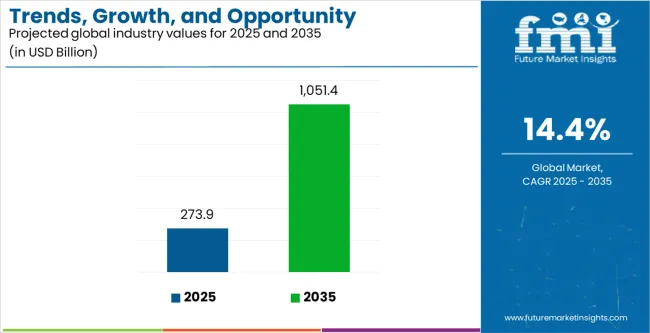

| Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Estimated Value in (2025 E) | USD 273.9 billion |

| Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Forecast Value in (2035 F) | USD 1051.4 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

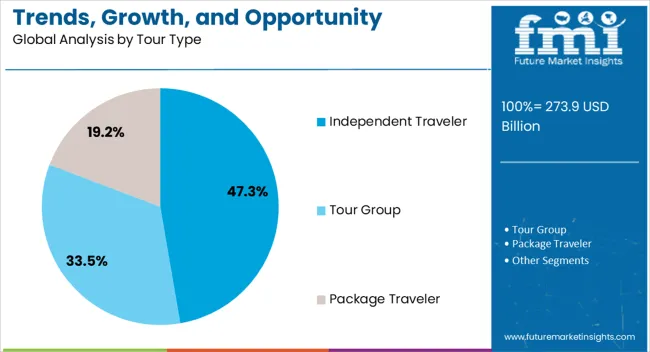

The market is segmented by Purpose, Booking Channel, Tour Type, and Age Group and region. By Purpose, the market is divided into Leisure, Business, VFR, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tour Type, the market is segmented into Independent Traveler, Tour Group, and Package Traveler. By Age Group, the market is divided into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

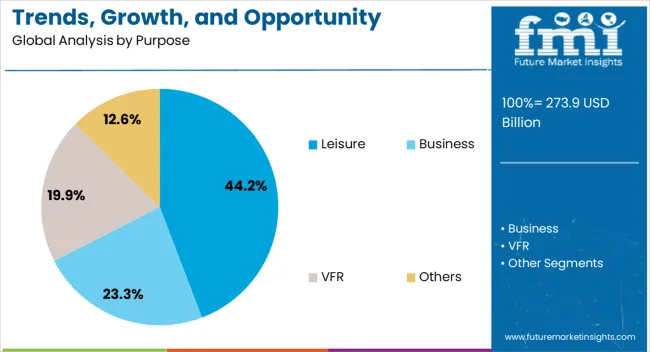

The leisure segment is projected to account for 44.2% of the outbound tourism market revenue in 2025, making it the leading purpose for travel. Growth in this segment is being driven by the increasing preference for travel as a means of relaxation, cultural exploration, and social experience. Rising disposable incomes and expanding vacation allowances are enabling more Chinese travelers to spend on international trips.

Leisure travelers increasingly seek personalized and flexible itineraries that allow for unique cultural experiences, recreation, and exploration. Travel agencies and tour operators are offering packages and experiences tailored to leisure needs, while digital platforms facilitate easy planning and booking.

The availability of information through social media, travel blogs, and review platforms has also influenced the growth of leisure travel by enhancing awareness and destination selection As leisure remains the most sought-after purpose for outbound travel, this segment is expected to sustain its leading market position, supported by evolving consumer lifestyles and continued improvements in travel infrastructure.

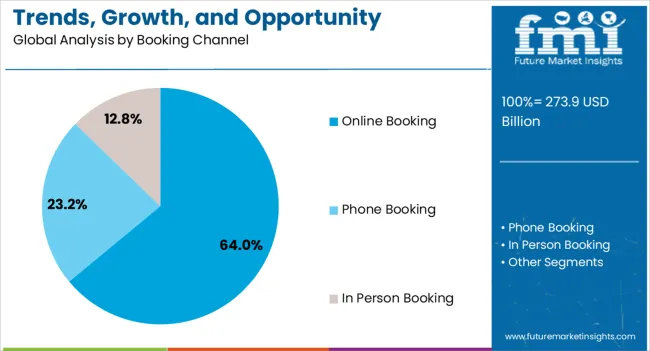

The online booking channel segment is anticipated to hold 64.0% of the outbound tourism market revenue in 2025, establishing it as the leading channel. This dominance is driven by the convenience, speed, and accessibility offered by digital booking platforms, which allow travelers to compare flights, accommodations, and tour packages efficiently. Increasing smartphone penetration, reliable internet connectivity, and integration with payment platforms have facilitated seamless booking experiences.

Online channels also provide access to reviews, ratings, and recommendations, enhancing traveler confidence in decision-making. The ability to customize itineraries and access promotions through online platforms further strengthens adoption.

Travel agencies and tour operators are increasingly investing in digital platforms to reach broader audiences and provide real-time support As Chinese travelers continue to prioritize convenience, transparency, and flexibility in planning outbound trips, online booking is expected to remain the dominant channel, supported by advancements in technology, personalized service offerings, and integration with global travel networks.

The independent traveler segment is projected to hold 47.3% of the outbound tourism market revenue in 2025, making it the leading tour type. Growth in this segment is being driven by a preference for flexible itineraries, personalized experiences, and the ability to explore destinations at one’s own pace. Independent travelers are increasingly seeking unique cultural, recreational, and lifestyle experiences, which are often not fully accommodated by traditional packaged tours.

The availability of online booking platforms, navigation tools, and local guides has facilitated independent travel planning and execution. Social media and travel communities provide inspiration, peer recommendations, and reviews, reinforcing confidence in self-planned trips.

Increasing disposable income and changing lifestyles, particularly among younger generations, are further supporting the adoption of independent travel As flexibility, personalization, and immersive experiences continue to shape traveler preferences, independent tourism is expected to remain a leading segment, driving demand for technology-enabled planning tools and experiential travel offerings.

Direct Flights and Easy Visas Drive Chinese Travel Abroad! Tourism has always played a crucial role in boosting demand in China outbound tourism because of urbanization. With rising disposable income in China, millions of people can now afford to travel abroad. Given new direct-flight services and easier visa procedures, Chinese travelers now have more mobility and can travel abroad more easily. This trend is expected to continue, leading to increased travel volume and global impact.

China's Government Boosts Outbound Tourism! The government is now more enthusiastic about the outbound tourism sector. In August 2025, the Ministry of Culture and Tourism in China announced that travel agencies could start organizing trips to 138 countries for Chinese group tours again.

This decision is expected to significantly boost outbound travel from China. Among destination regions, the Middle East is expected to experience the fastest recovery in arrivals from China.

Southeast Asian Countries Woo Chinese Tourists! Travelers today are looking for genuine, local experiences, especially in countries like Australia, New Zealand, Africa, India, the United States, and Japan. Thailand, Malaysia, Sri Lanka, and Singapore have all made efforts in 2025 to draw in Chinese tourists.

They have removed visa requirements to make visiting easier and more appealing. With the urge to have rich travel experiences, the outbound travel Industry from China is expected to grow significantly in the next decade. As a result, our experts predict a 3.82X increase in outbound tourism sales in China by 2035.

Digital Revolution Fuels China's Travel Interest! Around half of the population in China uses social media, email, and instant messaging, and 85% have a personal account. Travel influencers are posting pictures and videos on Facebook, Twitter, and Instagram. Outbound tourism companies are using digital technology more extensively and are advertising on these platforms, too. All of these are likely to lead to China outbound tourism demand.

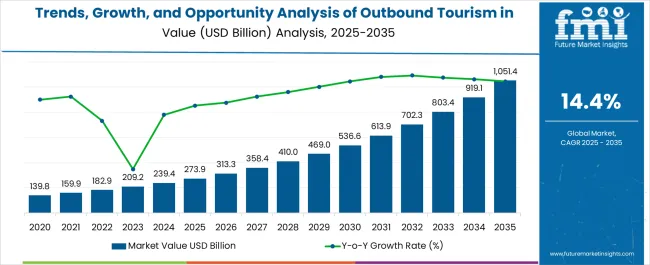

From 2020 to 2025, the outbound tourism industry in China showed impressive growth, boasting a 13.70% CAGR. Before the COVID-19 pandemic, China led the world as the biggest outbound tourism market. This makes up over 9% of total outbound tourism expenditure in China. Domestic travel in China has bounced back strongly. This happened after the government relaxed three years of zero-COVID rules.

Recent information from the United Nations World Tourism Organization showed that outbound tourism in China reached around 55% of its pre-pandemic levels in the third quarter of 2025. During Golden Week in early October, millions more individuals are likely to travel within China. This includes visits to Hong Kong, Macau, and Thailand.

| Attributes | Quantitative Outlook |

|---|---|

| China Outbound Tourism Industry Size (2020) | USD 125.31 billion |

| China Outbound Tourism Industry Size (2025) | USD 209.80 billion |

| Historical CAGR (2020 to 2025) | 13.70% |

While domestic trips rebounded in 2025, domestic spending is expected to fully recover by 2025. Data from the Civil Aviation Administration of China shows a notable increase in international passenger flights, jumping from less than 500 flights per week in early 2025 to over 4,600 flights in early 2025.

With the rapid resumption of international flights and more favorable visa policies in major destinations, there has been a notable rise in residents' interest in exploring foreign countries.

Many travelers in China prefer going abroad in family or group settings. Chinese tourists prefer Southeast Asian countries because of easy transportation, friendly language settings, many tourist attractions, and affordable travel expenses. This means travel companies in this region must create a positive environment and reputation to earn the trust and loyalty of their customers.

The growing interest of tourists from China in gastronomy tourism presents significant opportunities for travel companies in the China overseas travel market. Food is important in Chinese culture.

Tourists from China enjoy gastronomy tourism because it lets them try different foods, taste local flavors, and learn about culinary customs. Consequently, travel companies can create specialized gastronomy tour packages that showcase local cuisines, flavors, and culinary traditions of various destinations.

Sharing food experiences on social media is also trendy among Chinese tourists, adding to the appeal of gastronomy tourism. Travel companies can use the fact that many Chinese tourists love social media to their advantage. They can ask tourists to share their food adventures online. This helps promote gastronomy tourism and makes the travel company more known and respected among possible customers.

There is another opportunity available for businesses to attract tourists from China by leveraging personalized experiences and excellent customer service. Many tourists from China, particularly millennials, have a strong desire for customized travel experiences.

Therefore, strategies such as having multilingual staff, offering translation services, and providing personalized itineraries and special services/amenities could be proven beneficial. Therefore, the future of China’s outbound tourism and hotel market looks bright.

As far as the booking channel is concerned, the online booking segment is likely to perform better in 2025, holding 64.00% of China’s outbound tourism industry share. Similarly, the leisure segment is expected to generate significant turnover in terms of purpose, possessing a 44.20% revenue share of the outbound tourism industry in China in 2025.

| Segment | Estimated Industry Share in 2025 |

|---|---|

| Online Booking Channel | 64.00% |

| Leisure Purpose | 44.20% |

The online booking channel segment is likely to become the prime revenue generator within the industry. The majority of bookings are done online, matching how people search for travel information. The significant impact of digital technology on tourists in China is expected to reshape the online booking channel for China’s travelers abroad market. China has a large number of smartphone users, with over 600 million people using them.

With the rise of online travel platforms and enticing deals, the online booking sector is expected to grow the most in the coming years. With a large number of Chinese travelers using smartphones, there is likely to be a surge in online bookings through mobile apps and websites.

Over 80% of Chinese independent travelers (FITs) book their flight tickets online because of the advanced global distribution system (GDS). This is likely to make online booking a big part of how people plan their trips in the China outbound tourism industry.

The leisure purpose is the top segment in the China outbound vacation market. Leisure is the top reason for travel, followed by visiting friends and relatives (VFR) and business trips.

The rise in disposable income among Chinese households has made leisure travel more accessible and affordable. Moreover, the growing influence of social media and digital platforms has contributed to the popularity of leisure travel. Travelers are inspired by online content showcasing exciting activities and unique experiences. This has prompted them to plan leisure-oriented trips.

Travelers have become more refined in their tastes as they explore new leisure experiences like beach resorts, skiing trips, and "staycations." Many senior travelers from China, aged 55-65, plan to spend their next leisure trip during the Chinese New Year holiday instead of celebrating at home with family.

For example, tourists from China see South Korea as a perfect destination. They visit for different reasons such as leisure, kimchi, Khan Steam, skiing, cosmetics, corporate trips, or attending concerts over the weekend.

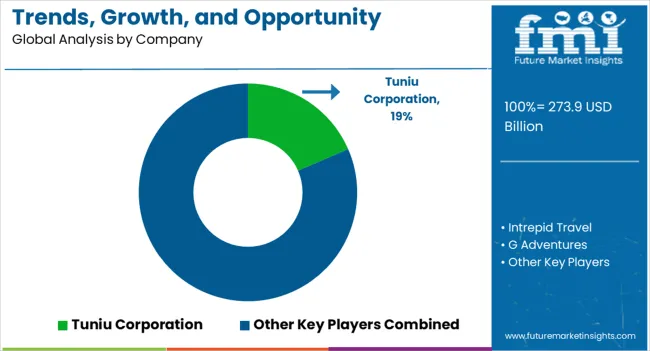

Outbound tourism industry players employ miscellaneous strategies to attract Chinese travelers and get a competitive edge. They highly focus on offering personalized travel experiences, such as customized itineraries and exclusive packages. They also capitalize on digital platforms for marketing and booking convenience. Some adopt competitive pricing strategies, while others prioritize customer service excellence and partnerships with local businesses for unique offerings.

Recent Developments:

The global trends, growth, and opportunity analysis of outbound tourism in china is estimated to be valued at USD 273.9 billion in 2025.

The market size for the trends, growth, and opportunity analysis of outbound tourism in china is projected to reach USD 1,051.4 billion by 2035.

The trends, growth, and opportunity analysis of outbound tourism in china is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in trends, growth, and opportunity analysis of outbound tourism in china are leisure, business, vfr and others.

In terms of booking channel, online booking segment to command 64.0% share in the trends, growth, and opportunity analysis of outbound tourism in china in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Micro-investing Platform in Australia Size and Share Forecast Outlook 2025 to 2035

US Luxury Fine Jewelry Market Insights 2024 to 2034

Trends, Growth, and Opportunity Analysis of Pea Protein in South Korea Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Europe Connected Car Market Growth - Trends & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Tourism in Burma Market Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Market Forecast and Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

UK Medical Tourism Market Analysis – Growth & Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

United States Outbound Tourism Market Analysis - Size, Share, and Forecast 2024 to 2034

Outbound Tourism in GCC Countries - Trends, Growth, and Opportunity Analysis (2024 to 2034)

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA