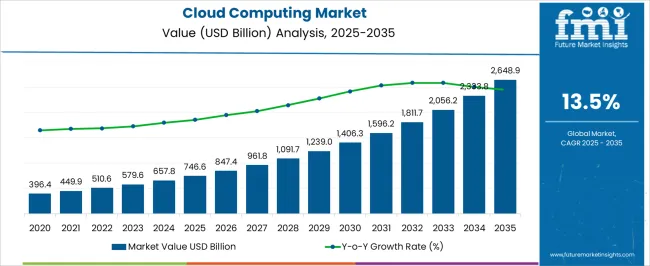

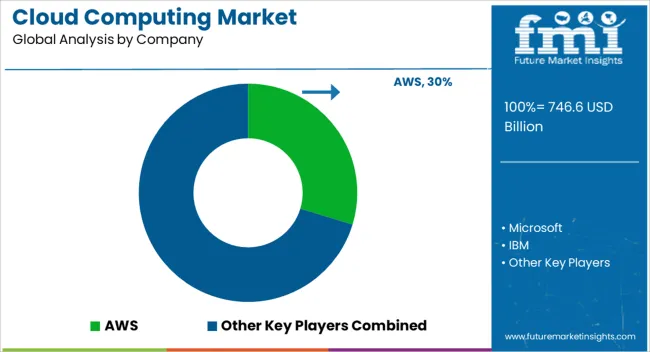

The Cloud Computing Market is estimated to be valued at USD 746.6 billion in 2025 and is projected to reach USD 2648.9 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period.

| Metric | Value |

|---|---|

| Cloud Computing Market Estimated Value in (2025 E) | USD 746.6 billion |

| Cloud Computing Market Forecast Value in (2035 F) | USD 2648.9 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The cloud computing market is expanding rapidly, supported by increasing digital transformation initiatives, demand for scalable IT infrastructure, and widespread adoption of advanced technologies such as artificial intelligence, data analytics, and machine learning. Enterprises are prioritizing cost efficiency, operational agility, and rapid deployment of services, all of which are enabled by cloud platforms.

The shift from traditional on premise systems to flexible cloud environments has been reinforced by global trends toward remote working, e commerce expansion, and real time data management. Advances in security frameworks, hybrid cloud integration, and compliance capabilities are further strengthening enterprise trust in cloud adoption.

The future outlook remains positive as organizations continue to migrate mission critical workloads to the cloud, fostering opportunities for both established providers and emerging innovators in the sector.

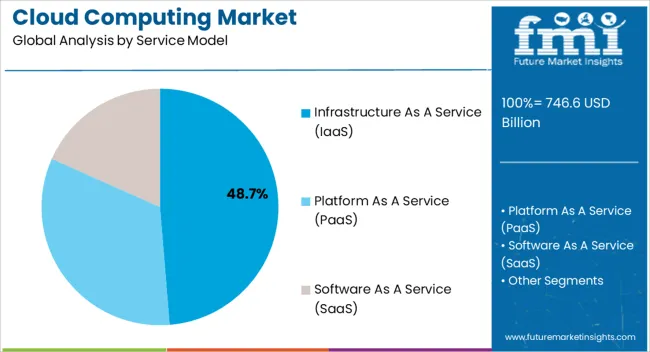

The infrastructure as a service segment is projected to hold 48.70% of total revenue by 2025 within the service model category, making it the leading segment. This dominance is being driven by the flexibility to scale infrastructure resources on demand, reduced capital expenditure on physical hardware, and support for complex workloads.

Enterprises are increasingly relying on IaaS to manage data intensive applications, testing environments, and enterprise grade IT infrastructure. The ability to enable business continuity and disaster recovery has further accelerated its adoption.

With growing demand for high performance computing and secure cloud environments, IaaS continues to lead as the most utilized service model.

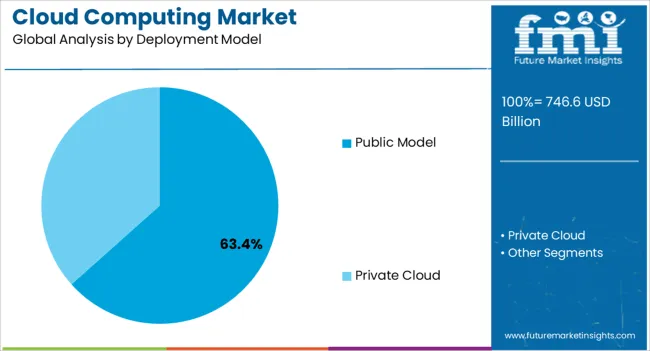

The public deployment model is expected to account for 63.40% of total market revenue by 2025, positioning it as the most prominent deployment approach. This growth is attributed to cost efficiency, scalability, and the ability to rapidly deploy services across global markets.

Small businesses, startups, and enterprises with limited IT resources have favored public cloud offerings due to their affordability and accessibility. The expansion of data centers by leading cloud providers has improved performance, reliability, and compliance with regional regulations, further supporting adoption.

As organizations prioritize agility and lower upfront costs, the public deployment model continues to dominate cloud infrastructure strategies.

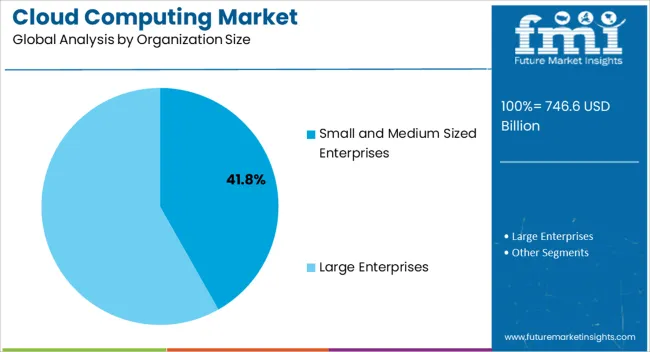

The small and medium sized enterprises segment is projected to contribute 41.80% of total market revenue by 2025 under the organization size category. This prominence is being driven by the need for cost effective IT solutions that can scale with business growth, enhance competitiveness, and provide secure access to digital resources.

SMEs are adopting cloud solutions to reduce dependency on in house IT teams and infrastructure, while leveraging advanced tools such as CRM, ERP, and data analytics through subscription based services. Government initiatives promoting digital adoption among smaller businesses are also accelerating uptake.

With their focus on agility and innovation, SMEs are emerging as a key growth engine in the cloud computing market.

Improving digital literacy around the world and the rapid adoption of digital applications for enhancing the user experience has compelled many service-based companies to blend in several features in their production systems.

This need for combining many different digital features is promoting the use of cloud computing platforms as a perfect model creating great opportunities for cloud computing providers.

The market is also getting high traction in the form of long-term subscriptions to personal cloud computing services these days. The establishment of many cloud computing industries in the global market has brought down computing costs considerably in the past years. The decreasing prices of cloud computing services are expected to surge the market for cloud computing from 2025 to 2035.

The use of the Google cloud platform or any other cloud computing platform has decreased the cost of production by reducing the requirement of hiring on-site employees. This stands as a prominent point for the high popularity of cloud computing services in the global market.

As per FMI study, the Software as a Service (SaaS) sub-segment led the market, holding a value share of 52.7% globally in 2025.

The rising enterprise demand is expected to accelerate the growth of the Software as a Service (SaaS) sector, driven by its simple deployment and low maintenance requirements. Its subscription-based model provides cost efficiencies by eliminating upfront infrastructure investments. SaaS sub segment also simplifies deployment and updates, relieving organizations of maintenance tasks.

By leveraging SaaS, organizations can focus on their core competencies and strategic goals. Outsourcing software functionality to SaaS providers allows businesses to allocate their resources and efforts toward their primary areas of expertise. This results in improved productivity and efficiency.

The applicability of cloud computing networks has covered a lot of areas in any economy. Most end users prefer the public cloud segment owing to its great affordability and easy availability of users. In the coming years, this segment is expected to continue its dominance over the cloud computing market share, where it accounted for 67.8% in 2025.

The private cloud deployment segment has also been analyzed to be gaining momentum with the introduction of some popular personal cloud computing products in the market. Individual customers mostly go for the best cloud backup for PC, which is anticipated to create some attractive opportunities for the market players.

| Regions | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom (UK) | 12.5% |

| China | 13.7% |

| India | 13.1% |

By the broad geographical division of the global market for cloud computing, North America holds the significant share by contributing about 34.6% of the revenue as per the 2025 records.

Due to the presence of most of the leading companies such as Google computing, Amazon cloud services, Microsoft edge computing, and others, the market in the United States of America was accounted for 21.2% value share in 2025.

North America boasts a thriving business ecosystem, with several enterprises embracing cloud computing solutions. The region's mature market, entrepreneurial culture, and technological adoption contribute to its supremacy.

The regulatory environment in North America, characterized by clear data protection and privacy laws, fosters trust and confidence among businesses and consumers, facilitating the widespread adoption of cloud computing services.

During the forecast time period, the growth of Asia Pacific cloud computing market share is predicted to be high than in any other geographic region. The evolution of a robust IT sector and the emergence of new cloud market shareholders have provided the necessary impetus for a significantly growing market in the region.

In accordance with the FMI research, the market for cloud computing in China is estimated to account for a significant portion of market share, advancing at a CAGR of 13.7% and India at a rate of 13.1% from 2025 to 2035.

Asia Pacific region is witnessing a significant digital transformation across various industries. Organizations are adopting cloud computing to modernize their operations, enhance agility, and drive innovation.

The growth of cloud computing providers in Europe and Latin America has also surged considerably in the past decade. With the growing demand for cloud computing services, the market is estimated to experience positive growth in these regions as well.

Europe cloud computing industry was forecasted to retain a value share of 22.4% on a global level. Europe has emerged as a significant player in the global cloud computing arena, witnessing substantial growth and adoption across various industries and sectors.

Moreover, key market players, both regional and global, have established a strong presence in Europe, offering a wide range of cloud services and solutions to cater to diverse customer needs. This competitive market environment fosters innovation, drives technological advancements, and fuels the continuous evolution of cloud computing in the region.

The demand for scalable and cost-effective IT infrastructure solutions is fostering the cloud computing market size in the United Kingdom, providing impetus to its growth rate of 12.5% from 2025 to 2035.

features in their cloud computing services as per the changing working models and demands from users.

The giant cloud companies are also spending on establishing data storage centers at different world locations to diversify their security storage networks and speed up data transfer.

This constant evaluation process adopted by cloud computing agencies has improved the performance of public cloud computing platforms over the years. It is further anticipated to increase the number of cloud computing subscribers in the coming days.

What are the Recent Developments in the Field of Cloud Computing Industry?

The global cloud computing market is estimated to be valued at USD 746.6 billion in 2025.

The market size for the cloud computing market is projected to reach USD 2,648.9 billion by 2035.

The cloud computing market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in cloud computing market are infrastructure as a service (iaas), _primary storage, _disaster recovery and backup, _archiving, _compute, platform as a service (paas), _application development and platforms, _application testing and quality, _analytics and reporting, _integration and orchestration, _data management, software as a service (saas), _customer relationship management (crm), _enterprise resource management (erm), _human capital management (hcm), _content management, _collaboration and productive suits, _supply chain management (scm), _business intelligence and analytics, _ppm and operations and _manufacturing applications.

In terms of deployment model, public model segment to command 63.4% share in the cloud computing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Telephony Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Field Service Management (FSM) Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Professional Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Printing Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Migration Service Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA