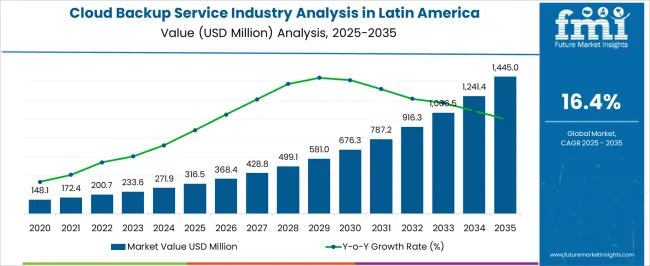

The Cloud Backup Service Industry Analysis in Latin America is estimated to be valued at USD 316.5 million in 2025 and is projected to reach USD 1445.0 million by 2035, registering a compound annual growth rate (CAGR) of 16.4% over the forecast period.

The cloud backup service industry in Latin America is expanding rapidly, driven by accelerating digital transformation, increased cloud adoption, and growing concerns over data protection and regulatory compliance. Enterprises across sectors are migrating from traditional storage infrastructure to scalable cloud-based backup solutions to ensure data continuity and resilience.

Regional growth is being supported by enhanced internet connectivity, government initiatives promoting digitalization, and the entry of global cloud providers establishing local data centers. The demand for cost-efficient and secure backup services is further amplified by the proliferation of remote work and the rising threat of cyberattacks.

As businesses prioritize hybrid data management and disaster recovery, the market is expected to maintain double-digit growth over the coming years, with increasing adoption among SMEs and large enterprises seeking greater operational agility.

| Metric | Value |

|---|---|

| Cloud Backup Service Industry Analysis in Latin America Estimated Value in (2025 E) | USD 316.5 million |

| Cloud Backup Service Industry Analysis in Latin America Forecast Value in (2035 F) | USD 1445.0 million |

| Forecast CAGR (2025 to 2035) | 16.4% |

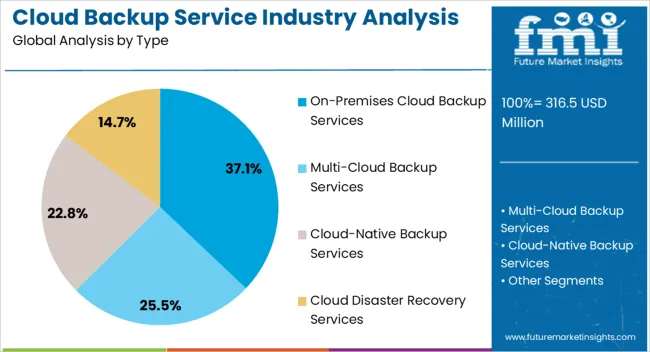

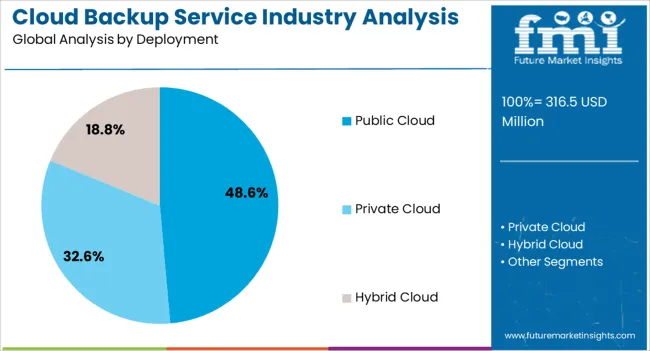

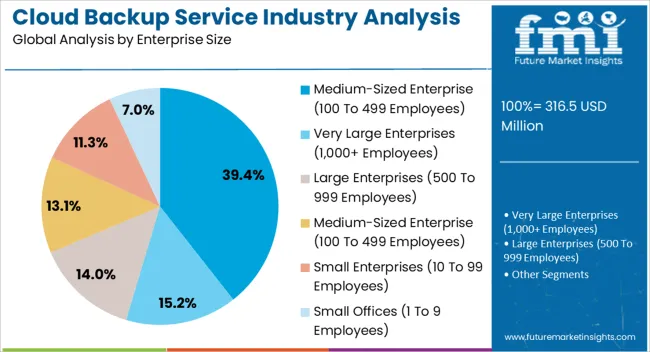

The market is segmented by Type, Deployment, and Enterprise Size and region. By Type, the market is divided into On-Premises Cloud Backup Services, Multi-Cloud Backup Services, Cloud-Native Backup Services, and Cloud Disaster Recovery Services. In terms of Deployment, the market is classified into Public Cloud, Private Cloud, and Hybrid Cloud. Based on Enterprise Size, the market is segmented into Medium-Sized Enterprise (100 To 499 Employees), Very Large Enterprises (1,000+ Employees), Large Enterprises (500 To 999 Employees), Medium-Sized Enterprise (100 To 499 Employees), Small Enterprises (10 To 99 Employees), and Small Offices (1 To 9 Employees). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-premises cloud backup services segment holds approximately 37.10% share within the type category, reflecting continued reliance on hybrid data storage models across Latin American enterprises. Organizations prefer on-premises backup for sensitive workloads requiring full data control and compliance with local data residency regulations.

This approach allows businesses to combine the security of local storage with the flexibility of cloud replication. Demand remains particularly strong in industries such as finance, government, and healthcare, where regulatory frameworks necessitate higher data sovereignty.

With increasing awareness of hybrid deployment benefits and advancements in backup automation, the segment is anticipated to retain a steady share, supported by its ability to balance security, control, and operational scalability.

The public cloud segment dominates the deployment category with approximately 48.60% share, driven by cost efficiency, scalability, and minimal infrastructure management requirements. Businesses across Latin America are adopting public cloud platforms to streamline backup operations, enhance accessibility, and reduce capital expenditure.

Global and regional cloud providers are expanding infrastructure across key markets such as Brazil, Mexico, and Chile to meet growing enterprise demand. The segment benefits from continuous improvements in data encryption, multi-region replication, and automated disaster recovery solutions.

Increased acceptance of cloud-native technologies and integration with SaaS platforms are further accelerating growth. As enterprises continue to migrate workloads to the cloud, the public cloud segment is expected to maintain its leadership position in the region.

The medium-sized enterprise segment accounts for approximately 39.40% share of the enterprise size category, representing one of the fastest-growing user bases for cloud backup services. These organizations are increasingly adopting cloud solutions to mitigate data loss risks, improve operational resilience, and meet regulatory standards without the cost burden of large IT departments.

Service providers are targeting this segment with tailored backup-as-a-service offerings that ensure affordability and scalability. The segment’s expansion is supported by growing digitalization among regional SMEs and increased reliance on remote collaboration tools.

With continued emphasis on cybersecurity and data governance, medium-sized enterprises are expected to drive consistent demand across the Latin American cloud backup service landscape.

The cloud backup service industry in Latin America experienced a CAGR of 13.1% from 2020 to 2025. It attained a valuation of USD 316.5 million at the end of 2025. This growth was propelled by increased digitization and high awareness of the importance of data protection.

During the historical period, small and medium-sized enterprises (SMEs) played a significant role in driving demand for cloud backup services in Latin America. This was due to these companies’ increased need for cost-effective and scalable solutions.

In the assessment period, demand for cloud backup services in Latin America is expected to rise at a CAGR of 16.4%. By 2035, the Latin America cloud backup service industry size is expected to reach USD 1,233.43 million.

As companies continue to digitize their operations, demand for cloud backup services will likely expand rapidly, driven by the need for secure and accessible data storage. The integration of advanced technologies such as AI, machine learning, and edge computing into cloud backup services may become more prevalent, enhancing efficiency and data management.

Growing adoption of cloud backup and recovery strategies across diverse industries is expected to foster the Latin America cloud backup service industry growth through 2025. Similarly, usage of cloud backup software across industries like finance and services will likely boost revenue in Latin America.

Semi-annual Update

| Particular | Value CAGR |

|---|---|

| H1 | 12.8% (2025 to 2035) |

| H2 | 13.2% (2025 to 2035) |

| H1 | 16.2% (2025 to 2035) |

| H2 | 16.5% (2025 to 2035) |

The below section shows the on-premises segment dominating the Latin America cloud backup industry. It is projected to hold a value share of 37.1% in 2035. By enterprise size, the medium-sized enterprise segment is poised to expand at a higher CAGR of 19.1% through 2035. Based on industry, the services segment will likely register a robust CAGR of 19.1% from 2025 to 2035.

| Growth Outlook by Type | Value CAGR |

|---|---|

| Multi-cloud Backup Services | 18.3% |

| Cloud-native Backup Services | 16.9% |

| On-premises Cloud Backup Services | 15.8% |

| Cloud Disaster Recovery Services | 14.1% |

As per the latest analysis, demand for on-premises cloud backup services across Latin America remains high. This is due to the growing preference for localized control and compliance. The target segment is poised to grow at 15.8% CAGR during the forecast period, accounting for a dominant value share of 37.1% in 2035.

Many organizations prioritize direct tracking and monitoring of their data, especially considering regulations in Latin America. On-premise cloud backup services enable companies to maintain control over their data in their physical infrastructure, thereby minimizing downtime.

Reduced risk of cyberattacks is another factor encouraging the adoption of on-premise cloud backup services across Latin America. This is because data stored on-site is less vulnerable to online breaches.

| Growth Outlook by Enterprise Size | Value CAGR |

|---|---|

| Small Offices (1 to 9 employees) | 13.8% |

| Small Enterprises (10 to 99 employees) | 17.5% |

| Medium-sized Enterprise (100 to 499 employees) | 19.1% |

| Large Enterprises (500 to 999 employees) | 15.8% |

| Very Large Enterprises (1,000+ employees) | 15.0% |

Based on enterprise size, the medium-sized enterprise (100 to 499 employees) segment is projected to rise at a CAGR of 19.1% over the forecast period. It will likely total a valuation of USD 1445 million at the end of 2035.

There is a growing awareness of the need for scalable, cost-effective data security solutions in mid-sized companies. As these companies expand their digital businesses, they prioritize adopting cloud backup services to manage and protect their data efficiently.

Midstream companies need the flexibility offered by cloud solutions to meet their dynamic needs. Cloud backup services allow these companies to scale their cloud storage up or down easily as their data needs fluctuate.

A greater focus on data security and compliance in the region fuels the adoption of cloud backup services among medium-sized enterprises. Thus, the target segment is poised to witness higher growth than others during the assessment period.

| Growth Outlook by Industry | Value CAGR |

|---|---|

| Finance | 17.3% |

| Manufacturing & Resources | 14.2% |

| Distribution Services | 16.1% |

| Services | 19.1% |

| Public Sector | 13.7% |

| Infrastructure | 13.1% |

As per the latest report, the adoption of cloud backup services is expected to remain high in the services segment. It is projected to register a CAGR of 19.1% during the assessment period, totaling USD 362.29 million by 2035.

Service-focused companies in Latin America are using these cloud services to increase their operational speed and ensure robust data protection. The scalability of cloud backup solutions enables service providers to change their storage needs dynamically, adapting to the fluctuating demands of their business.

The efficient cloud-based storage simplifies data management processes. This enables service-oriented enterprises to focus more on their core activities. Accessible data from multiple sources further facilitates lean operations, supporting increasingly mobile and interconnected service industries in Latin America.

Cloud backup services also empower the service sector to manage the digital landscape better, ensuring data accuracy and flexibility in an ever-evolving business environment. As a result, demand for cloud backup services is expected to remain high in the services sector through 2035.

Key players are focusing on providing tailored cloud backup solutions to meet the specific needs of their clients. They are launching new cloud backup services across countries like Mexico and Chile to boost their revenue.

Vendors differentiate themselves through superior connectivity and network capabilities. They also employ strategies like mergers, acquisitions, partnerships, collaborations, and agreements to stay ahead of the competition.

Key Developments in the Latin America Cloud Backup Service Industry-

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 271.89 million |

| Projected Value (2035) | USD 1,233.43 million |

| Anticipated Growth Rate (2025 to 2035) | 16.4% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Deployment, Enterprise Size, Industry, Region |

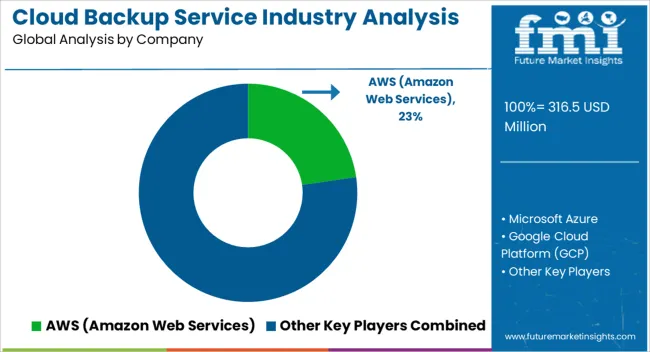

| Key Companies Profiled | AWS (Amazon Web Services); Microsoft Azure; Google Cloud Platform (GCP); IBM Cloud; Veeam; Acronis; Oracle Cloud; Commvault; Dell; Veritas Technologies; Backblaze; Rackspace Technology |

The global cloud backup service industry analysis in latin america is estimated to be valued at USD 316.5 million in 2025.

The market size for the cloud backup service industry analysis in latin america is projected to reach USD 1,445.0 million by 2035.

The cloud backup service industry analysis in latin america is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in cloud backup service industry analysis in latin america are on-premises cloud backup services, multi-cloud backup services, cloud-native backup services and cloud disaster recovery services.

In terms of deployment, public cloud segment to command 48.6% share in the cloud backup service industry analysis in latin america in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Hyperscale Cloud Industry Market Trends – Growth & Forecast 2024-2034

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Latin America OTT Services Market Trends and Forecast 2025 to 2035

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Cloud-based Backup Services Market by Enterprise, End-User, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Latin America Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Banking as a Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Weatherization Services Market in North and Latin America - Trends & Forecast 2025 to 2035

EduTech Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

Walk-in Cooler & Freezer Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA