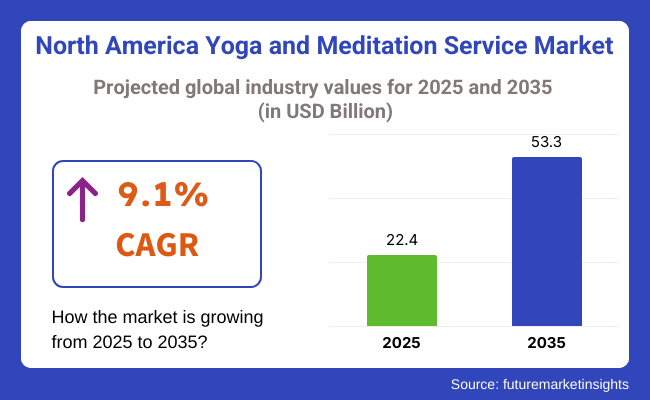

The North America yoga and meditation service market size is valued at USD 22.4 billion in 2025 and is expected to grow at a 9.1% CAGR from 2025 to 2035. The industry is projected to reach USD 53.3 billion by 2035. A key factor propelling this growth is the widespread integration of digital wellness platforms, which has revolutionized the delivery and accessibility of yoga and meditation services across the region.

As mental health awareness gains mainstream traction, consumers are increasingly prioritizing preventative care and mindfulness as essential aspects of their daily routines. This shift has led to surging demand for both in-person studio classes and virtual platforms offering live-streamed or on-demand sessions. The adaptability of service formats has broadened the consumer base beyond urban centers, enabling access to mindfulness programs in suburban and rural communities as well.

The corporate sector has emerged as a significant demand driver, with a growing number of companies embedding yoga and meditation into employee wellness programs. Organizations view these services as cost-effective tools to improve productivity, reduce burnout, and foster a healthier work environment. This has resulted in consistent demand for certified instructors, workplace-specific wellness plans, and enterprise-level digital subscriptions.

In addition, the demographic profile of service users has evolved, with Gen Z and Millennials representing a major consumer cohort. These segments favor hybrid wellness models combining traditional mindfulness practices with personalized digital experiences. The proliferation of apps, AI-driven meditation coaches, and immersive VR yoga is meeting their preference for convenience, interactivity, and tech-enabled personalization.

Despite increasing competition, the North American industry benefits from supportive regulatory environments, strong private investment, and a cultural shift that elevates self-care as a lifestyle standard. Over the forecast period, sustained innovation in service delivery, along with broadening acceptance of mental wellness as a healthcare priority, will continue to reinforce industry growth.

The North America yoga and meditation service industry will be dominated by sleep tracking and monitoring applications with a 35% industry share in 2025. The meditation and mindfulness apps segment will hold 27.5% of the total market share.

Sleep monitoring and tracking apps are extensively booming among consumers, who are becoming more aware of the importance of sound quality sleep and the improvement of sleep disorders via technological means. Popular among them are the Calm, Sleep Cycle, and Headspace apps, which combine aspects of sleep-tracking, relaxation methods, and guided techniques in meditation to promote better lighting patterns.

The increasing awareness of the need for restoration of sleep as part of overall health, along with the overseas use of biotechnologies and smart wearables such as Oura Ring and Fitbit, are fueling the power of that segment in the industry. Therefore, these sleep applications provide data-based insights concerning an individual's sleep cycles. Thus, it becomes much easier for individuals to take care of their sleep, reduce anxiety, and promote well-being.

Meditation and mindfulness apps also have a notable penetration at 27.5% in the industry. For example, a few of these apps are Calm, Headspace, Insight Timer, and Simple Habit. They provide guided meditation sessions, mindfulness exercises, and stress-reduction techniques for anxiety management, focus enhancement, and emotional well-being.

Of course, these apps cater to all levels of users and are thus accessible to millions of people, contributing to the success of these applications on the industry. As there is still a high increase in demand for mental health, it is bound to become part of most people's lives, with these apps becoming a major source of mindfulness.

In 2025, residential end users will significantly drive the industry with 50% of the total industry share. followed by 2 the schools and corporate industry segment with 25% of industry share.

The segment of residential users is the largest of the four, representing an ever-increasing interest in individual at-home yoga and meditation practices. Online platforms, mobile apps, and streaming services are fueling this rise in wellness at home, adding ease and convenience to access to yoga, meditation, and mindfulness content, as exemplified by names like Calm, Headspace, and Peloton, which are quickly taking their place as household standards, offering guided meditation, relaxation techniques, and virtual yoga classes.

The rise of wearable devices, such as the Apple Watch and Fitbit, also supports residential users by enabling them to track their physical and mental wellness progress in real time. This upward trend of home-based wellness practice shows the preference for flexibility and convenience in psychological and physical well-being management.

The schools and corporate industry segment is also major, accounting for 25% of the overall industry share. In the educational domain, schools and colleges are increasingly recognizing the significance of yoga and meditation as essential components of their wellness program. This is to help students deal with stress and enhance their powers of concentration and emotional well-being.

In the corporate world, companies are implementing wellness programs to promote employee mental well-being, which improves productivity and creates a positive work environment. On-site yoga, meditation workshops, and wellness challenges as part of a program to help employees cope with stress while achieving a balance promoting work-life integration constitute a package for successful organizations.

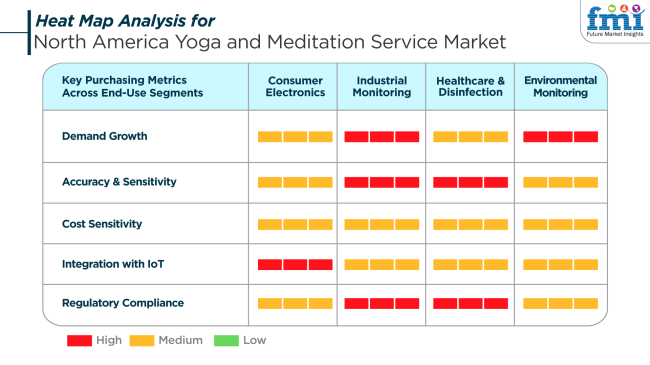

In North America, demand for yoga and meditation services linked to consumer electronics is increasing due to rising interest in wellness wearables and smart platforms that offer personalized coaching. Users seek high accuracy and seamless integration with mobile ecosystems, although pricing plays a moderate role in the decision-making process.

Industrial applications, particularly within high-stress job environments, are experiencing very high growth in service demand. Employers prioritize solutions that offer verifiable outcomes, placing emphasis on effectiveness and regulatory alignment. Healthcare and institutional disinfection sectors are incorporating yoga and meditation to complement behavioral therapy and patient recovery, where sensitivity and compliance are crucial.

Environmental monitoring initiatives, including public wellness programs and outdoor mindfulness projects, are promoting community-wide service access. These services are increasingly supported by local government health agendas and benefit from strong demand, although cost constraints and policy adherence remain critical factors for deployment.

One of the primary risks in the industry is market saturation, particularly in metropolitan regions where numerous studios, apps, and digital providers vie for consumer attention. This intense competition may lead to price undercutting and challenges in retaining customer loyalty without strong service differentiation or value-added features.

Economic volatility is another area of concern. Although mental wellness is often viewed as essential, discretionary service spending can decline during periods of inflation or recession. This could particularly impact mid-tier service providers that lack the pricing flexibility or subscription base of large platforms.

Regulatory ambiguity around therapeutic claims and instructor certifications presents a reputational and legal risk. Providers must navigate evolving standards related to mental health services and ensure that offerings remain within permitted guidelines. Failure to do so could result in compliance issues or consumer mistrust, particularly as the integration of digital health tools becomes more prominent.

In 2020 to 2024, the industry increased significantly driven by growing awareness of mental health, stress management, and the need for physical wellness during the pandemic. With lockdowns and social distancing, consumers turned to virtual yoga and meditation services, and most yoga studios and gyms soon added online classes and apps.

This allowed consumers to enjoy yoga, meditation, and mindfulness exercises from home. Virtual classes apart, corporate wellness programs also gained traction, as businesses discovered the importance of mental well-being among employees. Yoga and meditation entered the mainstream as part of employee wellness programs aimed at overcoming stress, enhancing productivity, and fostering overall wellness.

The future up to 2025 to 2035 looks towards a greater convergence of technology and personalization. Yoga and meditation will also be supplemented by AI-driven personalized routines, where information and user feedback will help guide specific meditation and yoga exercises. The use of AR/VR technologies will create more immersive, interactive experiences that bring consumers into serene, calming environments.

In addition, the marriage of wearables and biofeedback systems will offer immediate feedback on physical and emotional status, allowing for a more optimized and effective experience. The focus on comprehensive well-being and mental health will increasingly expand, and services will embed more tightly into healthcare systems, workplace well-being initiatives, and in education. Demand will similarly expand throughout the industry for mindfulness-based services, trauma recovery, and interfacing with communities.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Pandemic-induced change in digital wellness, increasing emphasis on mental well-being, corporate wellness program expansion. | Personalized wellness experiences, AI-based services, healthcare alignment, workplace wellness revolution. |

| Remote workers, stressed professionals, health-aware consumers, yoga and meditation novices. | Health-conscious consumers, health-oriented communities, corporate teams, and aging populations who need holistic care. |

| Virtual instruction, on-demand programming, corporate wellness initiatives, hybrid studio concepts. | AI-driven routines, AR/VR immersive experiences, wellness subscriptions, biofeedback-enabled services. |

| Growth of wellness apps, livestream classes, mobile platforms, virtual fitness communities. | AR/VR-envirhonmental spaces, wearables, AI-driven customization, biometric feedback and real-time analytics. |

| Inclusivity focus, accessible cost, diverse instructor populations. | Ethical models of service, wellness programs with community focus, carbon-free products, and data protection. |

| Mobile apps, livestream sites, membership in studios, and social media platforms. | Virtual reality environments, digital wellness ecosystems, health partnership, and wellness retreats. |

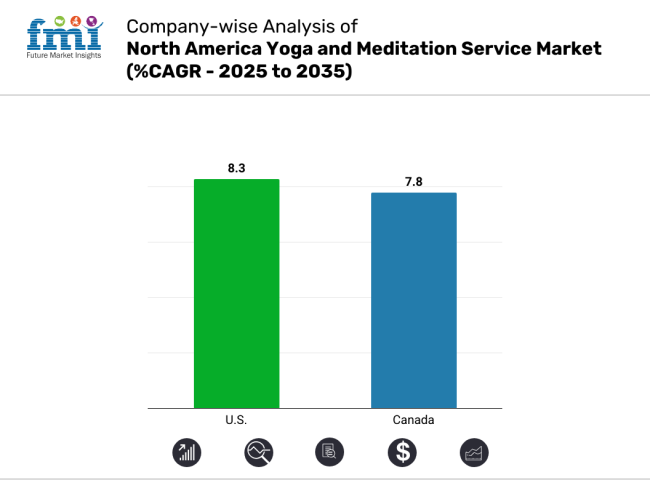

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| Canada | 7.8% |

The USA industry will have a growth rate of 8.3% CAGR during the study period. The yoga and meditation services industry in the USA is experiencing good growth due to rising awareness among consumers regarding holistic health practices, mental well-being, and managing stress. Greater lifestyle disorders and anxiety disorders have triggered demand for alternative wellness solutions.

Urban residents are taking up yoga and meditation not only as forms of exercise but as integral components of preventive care. This trend is enabled through the inclusion of services in corporate health programs, health centers, and schools. Also, has industry evolution been spurred on by digital technology as mobile app utilization, virtual studio utilization, and AI-enabled wellness platforms have brought it to reach? The USA industry has a stable base of qualified practitioners, a well-developed wellness infrastructure, and strong levels of consumer spending on health-oriented services.

Insurance providers and employers increasingly add wellness incentives and reimbursement for participation in yoga and meditation sessions. This intersection of trends, added to the growing demand for personalized and technology-facilitated experiences, is set to sustain strong growth momentum and solidify the USA position as a top contributor to North America's wellness ecosystem through the next decade.

The Canadian industry is expected to grow at 7.8% CAGR during the period of study. In Canada, the yoga and meditation service industry are picking up pace as there is increasing awareness of mental health and well-being. National awareness regarding mindfulness and stress management has created a good environment for traditional and online wellness services. Young consumers are adopting yoga and meditation as a lifestyle option, backed by easy access to streaming media and fitness apps capable of meeting local requirements.

The wellness trend is also extending beyond large cities as trainers and neighborhood centers become more widely available with hybrid models. Mental illness support systems and government-subsidized mental health programs are another industry development driver. Wellness services are increasingly being integrated into benefits plans by employers and insurers, a signal of institutional support.

Canada's culturally diverse population is also generating diversity in service delivery, with various styles, languages, and spiritual approaches being accommodated in yoga and meditation practice. As preventive care interest continues to build and online websites improve with more tailored advice, Canada's industry should likewise continue to deliver solid growth. The convergence of rising engagement, motivating policy direction, and accelerating service innovation positions Canada as a strong and potential niche in the North America yoga and meditation service industry.

The North America yoga and meditation service industry is characterized by intense competition as both traditional fitness brands and digital-first companies aggressively expand their offerings. Lululemon Athletica remains the industry leader, leveraging its premium yoga apparel, community engagement strategies, and digital initiatives such as Mirror to strengthen its presence.

Nike and Adidas continue to capitalize on the growing demand for athleisure apparel, integrating yoga-specific product lines to enhance their industry relevance. Alo Moves, part of Alo Yoga, has also gained prominence by offering a hybrid of premium yoga wear and digital wellness content, appealing to consumers seeking a holistic lifestyle brand.

Fitness chains such as CorePower Yoga, Equinox, Gold's Gym, and Lifetime Fitness are expanding their in-store product ranges while integrating retail opportunities with yoga and meditation services. Meanwhile, digital fitness players, including Peloton Digital, Obé Fitness, and POPSUGAR Fitness, are influencing consumer purchasing decisions by promoting associated yoga and meditation gear through their platforms.

Other notable players, such as Columbia Sportswear, Under Arm our, and New Balance, contribute significantly by offering performance apparel suited for yoga and meditation activities. Boutique platforms like Yoga Anytime, Yoga Glo, Gaia, and Down Dog also drive product interest through their specialized yoga and mindfulness content. As the industry continues to grow, success hinges on brand differentiation, lifestyle alignment, and omnichannel strategies.

Market Share Analysis by Company

Key Company Insights

Lululemon Athletica continues to hold the lion's share of the North America yoga meditation service industry simply because it effectively combines high-end clothing, digital fitness content, and community-based brand strategies. As far as innovation is concerned, designing Mirror to conduct mindfulness events has thus gained top-of-mind awareness among its customers concerning both the old-school retail and emerging digital platforms.

Nike and Adidas retaliated by mounting tough competition, at the same time using their worldwide brand strength to increase their yoga-specific offerings targeted mostly at athleisure consumers looking for comfort and style for practical and everyday use. At the same time, digital platforms, like Peloton Digital or Alo Moves, transform the purchase experience as they apply yoga product offerings to their subscription models.

These brands then develop more and more service subscription offerings that drive the sales of standalone products. Fitness brands like CorePower Yoga, Equinox, or Lifetime Fitness are working on branded product lines so that, together with the investments in physical locations, sites expand into retailing similar brands on their own. Under such dynamic and multi-channel circumstances, product innovation, brand loyalty, and digital engagement will always be important matters of success.

By service type the industry is segmented into meditation and mindfulness apps, sleep tracking and monitoring apps, mindful yoga and stretching apps, and other services.

By end user, the industry is categorized into residential, schools & corporate industry, infotainment, and other end users.

By country, the industry spans the United States, Canada, and Mexico.

The industry is expected to reach USD 22.4 billion in 2025.

The industry is projected to grow to USD 53.3 billion by 2035.

The industry is expected to grow at a CAGR of approximately 9.1% during the forecast period.

Sleep tracking and monitoring applications are a key segment in the industry.

Key players include CorePower Yoga, Equinox, Gold's Gym, Lifetime Fitness, SoulCycle, YMCA, Obé Fitness, Peloton Digital, POPSUGAR Fitness, Yoga Anytime, YogaGlo, Alo Moves, Gaia, Down Dog, Virgin Pulse, Grokker, Lululemon Athletica, Nike, Adidas, Under Armour, New Balance, Columbia Sportswear.

Table 1 : Business Value (US$ million) Forecast, by Service Type, 2019 to 2034

Table 2 : Business Value (US$ million) Forecast, by End User, 2019 to 2034

Table 3 : Business Value (US$ million) Forecast, by Country, 2019 to 2034

Table 4 : United States Business Value (US$ million) Forecast, by Service Type, 2019 to 2034

Table 5 : United States Business Value (US$ million) Forecast, by End User, 2019 to 2034

Table 6 : Canada Business Value (US$ million) Forecast, by Service Type, 2019 to 2034

Table 7 : Canada Business Value (US$ million) Forecast, by End User, 2019 to 2034

Table 8 : Mexico Business Value (US$ million) Forecast, by Service Type, 2019 to 2034

Table 9 : Mexico Business Value (US$ million) Forecast, by End User, 2019 to 2034

Figure 01: Business Value (US$ million) Analysis, 2019 to 2023

Figure 02: Business Value (US$ million) Forecast, 2024 to 2034

Figure 03: Business Share by Service Type, 2024 to 2034

Figure 04: Business Attractiveness by Service Type, 2024 to 2034

Figure 05: Business Share by End User, 2024 to 2034

Figure 06: Business Attractiveness by End User, 2024 to 2034

Figure 07: Business Share by Country, 2024 to 2034

Figure 08: Business Attractiveness by Country, 2024 to 2034

Figure 09: United States Business Share by Service Type, 2024 to 2034

Figure 10: United States Business Attractiveness by Service Type, 2024 to 2034

Figure 11: United States Business Share by End User, 2024 to 2034

Figure 12: United States Business Attractiveness by End User, 2024 to 2034

Figure 13: Canada Business Share by Service Type, 2024 to 2034

Figure 14: Canada Business Attractiveness by Service Type, 2024 to 2034

Figure 15: Canada Business Share by End User, 2024 to 2034

Figure 16: Canada Business Attractiveness by End User, 2024 to 2034

Figure 17: Mexico Business Share by Service Type, 2024 to 2034

Figure 18: Mexico Business Attractiveness by Service Type, 2024 to 2034

Figure 19: Mexico Business Share by End User, 2024 to 2034

Figure 20: Mexico Business Attractiveness by End User, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yoga Market Analysis – Trends & Forecast 2024-2034

Yoga & Meditation Product Industry in Europe - Analysis by Growth, Trends and Forecast from 2025 to 2035

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Yoga and Pilates Mats Market Trends - Growth & Demand 2025 to 2035

Yoga and Meditation Market Growth - Forecast 2025 to 2035

Yoga and Meditation Service Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

UK Yoga and Meditation Service Market Trends – Growth, Demand & Outlook 2025-2035

USA Yoga and Meditation Service Market Insights – Growth & Demand 2025-2035

Japan Yoga and Meditation Service Market Trends – Growth, Demand & Forecast 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Pilates & Yoga Studios Market Trends - Growth & Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA