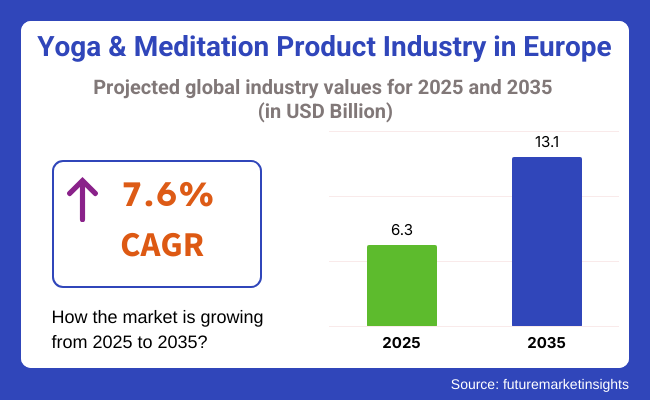

The valuation of yoga & meditation product market in Europe was USD 6.3 billion in 2025 and is expected to grow at a 7.6% CAGR between 2025 and 2035. Industry valuation is projected to be worth USD 13.1 billion in 2035. The increasing public and institutional focus on mental wellness, coupled with shifting consumer lifestyles and greater adoption of preventive health practices, are among the key drivers fueling this growth.

Across Europe, consumer behavior is changing sharply, with a trend towards the management of mental health through non-invasive, lifestyle-centered solutions. With increasingly urban stress and digital exhaustion, more consumers are turning to yoga and meditation to establish psychological equilibrium. Green mat products, up to high-end meditation cushions and sensory devices, are experiencing consistent demand, particularly in Germany, France, and the Nordic countries.

Technological convergence is also changing the industrial scenario. The embedding of digital functionalities in traditional yoga accessories, such as posture-tracking sensors and app-integrated meditation devices, is driving interest among young people and working professionals. Increasing accessibility of such technology through web-based wellness platforms is also driving industrial access at an accelerated pace.

Institutional adoption is also growing, with companies, schools, and public health systems embracing yoga and meditation as part of workplace and school wellness programs. In addition, the trend of green consumerism in Europe has led to demand for sustainably produced products skyrocketing, forcing brands to be environmentally conscious and ethical.

Though differences in regional capacity for expenditure and product selection persist, the broader trend in the industry is promising, underpinned by firm socio-political support for mental health and self-care. As consumer sophistication increases, brands' high-quality, innovative, and culturally appealing products are most likely to take over share growth in the next decade.

In 2025, the wearables will lead the entire European Yoga & Meditation Product Market with 48% of the total revenue share. Closely resembling traditional devices like yoga cushions, mats, blocks, and bolsters, with a share of 44%. Sustaining the top position of wearables is now the continuation of digital mindfulness tools and biofeedback into personal routines within wellness. The products will provide real-time insight into stress levels, guided breathing, and heart rate variability (HRV). HRV is a vital biomarker in emotional regulation and an accompaniment of products such as the Apple Watch, Fitbit Sense, and Whoop Strap.

These are devices now part of the practice of yoga and meditation in wellness-conscious countries like Germany, Sweden, and the Netherlands. The neurofeedback headbands of Muse and Flowtime have found application in transforming mindfulness experiences through real-time cognitive feedback.

Simultaneously, traditional yoga and meditation tools are still strongly held across the continent. For instance, high-end yoga mats from brands like Manduka, Liforme, and Gaiam are still regarded by consumers who prefer mats with grip-enhancing textures, alignment guides, and eco-friendly materials, such as cork and natural rubber.

In countries where in-person yoga culture is the likes of France, Italy, and Spain, products are the same accessories to have for practicing at home or joining a studio class. Yogamatters in the UK and Bodynova in Germany present a diverse catalog of yoga blocks, bolsters, and meditation cushions, indicating the continuing relevance of such traditional accessories that appeal to physical posture and comfort.

Online retailing will take the lead in sales channels in Europe for the Yoga & Meditation Product Market, with 32.5% of the total expected share for the year 2025. On the contrary, direct sales channels like yoga studios, wellness retreats, and pop-up events contribute a 14% revenue share.

eCommerce and lightweight online platforms speak to a newly assembled customer voice, which is increasingly demanding availability, wider assortment ranges, and price transparency. No wonder yoga practitioners flock to typical online platforms like Amazon EU and wellness outlets like Decathlon and Yogamatters-where exercise enthusiasts find their adaptive gadgetry as well as traditional yoga gear.

These platforms have vast catalogs of products, user reviews, and possible avenues for international delivery, making them especially vibrant for digitally born consumers in Germany, the Netherlands, and the UK. Also, DTCs from brands like Muse and Flowtime are reaping the benefits of the e-commerce boom in niche product visibility and brand loyalty across Europe.

Boutique yoga studios and full-service holistic retreats might work jointly to come up with co-branded or co-developed exclusive products at the artisanal level, such as handwoven meditation cushions or yoga mats, which are "limited edition." Manduka does work with high-end studios to offer curated kits directly to clients. In countries such as Spain and Italy, where a wellness culture is largely community and trust-based, local artisans and practitioners adopt face-to-face interaction to market sustainable and handmade goods.

In Europe, consumer electronics with yoga and meditation features are experiencing strong demand due to the prevalent digital wellness culture. Wearables and smart mats designed for personalized experiences are received positively, particularly in city areas, evidencing increasing demands for connected solutions with high sensitivity and consistent performance.

Healthcare and industrial industries are increasingly adopting yoga and mindfulness for mental wellness programs. Hospitals and rehabilitation facilities use these instruments in therapy regimens, ensuring accuracy and compliance with regulations. Employees working high-stress jobs appreciate scalable and cost-effective solutions.

Environmental and public health initiatives are increasingly contributing, particularly as municipalities promote outdoor mindfulness practice and nature-based healing. Products that comply with environmental sustainability and digital surveillance standards are preferred, where alignment with community health initiatives and compliance structures is an important driver of buying behavior.

The industry is prone to a number of region-specific risks. Inconsistency in regulation among EU member states is a challenge for brands, particularly those dealing with differing certification requirements for wellness claims or safety standards. This absence of uniform regulation can lead to postponed product launches or extra compliance costs.

Economic differences within Western, Central, and Eastern Europe can influence the homogeneity of growth. Though high-income nations have high demands for high-quality wellness products, reduced purchasing ability in developing economies can restrict potential markets unless there is effective affordability and accessibility to be addressed by sellers.

The rising competition and brand overload, especially in the premium and digital wellness segments, might depress margins. New entrants would have to make large R&D or brand investments to differentiate themselves. Changes in public funding of wellness programs may also affect institutional demand, which would necessitate diversified channel strategies and flexible product portfolios.

During 2020 to 2024, Europe witnessed an unexpected rise in demand, largely owing to increased awareness regarding mental health and post-pandemic lifestyle change. Garrison's stay-at-home culture and work-from-home life dominated. Consequently, consumers opted for wellness routines such as yoga and meditation in an effort to offset idleness, tension, and stress. There was a spike in demand for meditation cushions, yoga blocks, yoga mats, essential oils, and clothing.

Between 2025 to 2035, the trend will likely change with more shots of technology and personalization. Products will become more smart home-enabled, like posture and movement-tracking floors or pillows with guided breathing through onboard speakers. AI-powered wellness apps will further individualize yoga and meditation classes using the user data, engaging the users even further.

Europe emphasizes sustainability, and theindustry will move towards circular design, biodegradable materials, and carbon-neutral production. Increasing efficacy of holistic health will also lead to demand for products that integrate aromatherapy, light therapy, and sound healing into a single multisensory experience for practitioners.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Mental health awareness, work-from-home lifestyles, popularity of wellness influencers and virtual classes. | Personalization via AI, integration of tech in products, and expansion of holistic wellness practices. |

| Wellness-conscious individuals, remote workers, young adults, and middle-aged health seekers. | Tech-conscious well-being consumers, green consumers, and those looking for interactive well-being solutions. |

| Green yoga mats, meditation cushions, clothing, essential oils, and basic props. | Smart mats and cushions, multisensory wellness products (aromatherapy, light, sound), and AI-driven routines. |

| Growth of online classes and wellness apps, digital influencers, and social media-enabled discovery. | Smart sensors in products, AI-based customization, and integration with wearables and digital health tools. |

| Organic and recycled materials, non-toxic manufacturing, and minimalistic, eco-friendly packaging. | Products made from biodegradable, carbon-neutral materials that are circular-designed with a complete life cycle accountability. |

| E-commerce platforms, boutique wellness stores, and brand-owned websites. | Omnichannel wellness destinations with AR/VR experience centers, subscription models, and AI-curated wellness kits. |

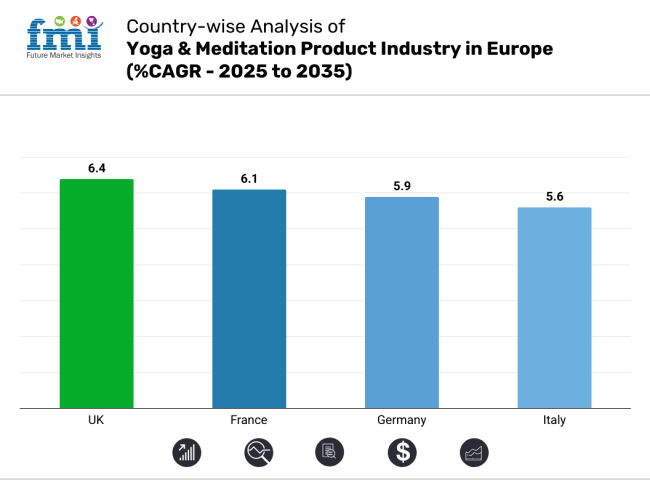

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.4% |

| France | 6.1% |

| Germany | 5.9% |

| Italy | 5.6% |

The UK is forecasted to advance at a rate of 6.4% CAGR throughout this study. This improvement has been steadily the increase of concern for the body and the mind. Requirements for yoga mats, meditation pillows, wellness journals, and incense sticks have greatly increased, especially within the metropolitan locations where people who lead high-strained lifestyles propelled individuals toward contemplative practices.

All demographics are embracing wellness culture as a result of corporate wellness programs, social media, and increased access to online mindfulness content. Retail sales, both online and in-store, have continued to show traction, supported by the increased numbers of wellness studios, workshops, and retreats across England, Scotland and Wales.

The UK is also experiencing an aging population, leading to higher demand, with yoga and meditation increasingly being prescribed for elderly stress relief and mobility improvement.

In the meantime, collaborations between global wellness brands and local UK retailers are solidifying supply chains and country-wide visibility. As mobile apps and online platforms providing guided meditation and virtual yoga sessions become more prevalent, product sales linked to the activity are also likely to experience robust growth. Strategic brand positioning and environmental product innovation will remain key drivers throughout the forecast period.

France is expected to achieve a 6.1% CAGR during the study period. The growing interest in mental health and well-being has driven the demand. France's strong emphasis on wellness and lifestyle, especially in urban areas such as Paris, Lyon, and Marseille, has made yoga part of mainstream everyday living.

Increased customers are making investments in quality accessories, including non-toxic yoga mats, organic pillows, and fragrant therapy products aligning with personal well-being goals. Cultural adoption of Eastern wellness philosophy has been key to the expansion of yoga studios, internet classes, and mindfulness practices recommended by health experts.

Additionally, the rise in environmentally conscious customers has also created favorable ground for brands offering eco-friendly and recyclable yoga gear. Local manufacturing units and boutique well-being product companies are leading the way in meeting complex consumer tastes.

E-commerce has boosted distribution incapabilities, especially among high-end product segments. Additionally, school and corporate mindfulness programs are making yoga and meditation more mainstream, creating long-term demand for products that accompany those practices. A robust growth curve awaits as consumer behavior continues to favor holistic health and slow-living philosophies.

Germany will grow at 5.9% CAGR during the study period. Germany boasts one of the best-organized wellness markets in Europe, underpinned by high health awareness, disposable income, and a high inclination towards quality wellness products. German consumers prefer scientifically proven methods of stress relief and fitness, and therefore, yoga and meditation are extremely appealing.

The increased popularity of a combination of physical activity and mindfulness exercise programs has further stimulated growth. Preventive care programs like mindfulness and yoga therapies have been added by German health insurers, thereby promoting visibility and acceptance of related products.

Consumersprefer a broad range of yoga equipment, apparel, and meditation products. Materials innovations such as natural cork mats and biodegradable props have gained momentum among eco-conscious German consumers. The corporate wellness marketplace continues to expand, especially within the high-tech and service industries of urban cities such as Munich and Berlin, facilitating the integration of wellness equipment.

Local and foreign digital platforms are thriving with editorial collections and web-based shopping, offering Germany an ideal outlet for growth within the wellness products category.

Italy will grow at 5.6% CAGR over the study period. Italian consumer preferences have increasingly turned toward holistic wellness regimens, with yoga and meditation practices becoming core elements. The cultural focus on balance, way of living, and beauty resonates perfectly with mindfulness's underlying principles, making Italy the perfect choice for wellness-conducive consumption.

Metropolitan cities such as Milan, Rome, and Florence are witnessing growth in boutique yoga centers and wellness centers that often sell luxury products in the process. Wellness tourism is driving sales growth to a great extent.

Wellness resorts and retreats across Tuscany, Sicily, and the Amalfi Coast have incorporated yoga-based activities that enhance accessories and kit demand specific to tourists. Italian consumers are opting for handcrafted, aesthetically pleasing, and eco-friendly products, compelling niche players to step up production and rationalize distribution channels.

Additionally, increasing awareness of stress-induced health issues and increasing mental well-being programs by schools and organizations are creating encouraging conditions for ongoing product demand. Internet influentials, bloggers, and mass media helped popularize meditation as a daily practice, also adding to growth through the integration of tradition, innovation, and online popularity.

The European Yoga & Meditation Product Market is expanding rapidly due to greatly increased attention on health, wellness, and the mind's well-being. Lululemon Athletica Inc. is one of the major fitness and wellness brands making an indelible mark in the niche, having put a premium on its products and yoga-focused innovations to reach a bigger audience of yoga enthusiasts.

Lululemon is Europe's best vendor for yoga apparel, accessories, and home fitness equipment. Other significant players like Gaiam, Manduka LLC, and Alo Yoga have been able to make significant strides in the area through eco-conscious yoga products and a wide range of high-quality yoga mats, apparel, and other accessories. For these reasons, they are sought after by European consumers.

Wave-digital fitness has surged, with companies such as Peloton Digital, Obé Fitness, and POPSUGAR Fitness offering online pay-per-view sponsorships for services related to yoga, meditation, and the broader wellness experience. Most nontraditional fitness brands, like Equinox, Gold's Gym, and Lifetime Fitness, have also been catching up with the trend of including yoga and meditation in their list of services on offer.

Sportswear giants Nike, Adidas, Under Armour, New Balance, and Columbia Sportswear are yet to deny their dominance in the athleisure space, offering a well-defined apparel and accessory line for yoga practitioners as well as the comfort and functionality of fitness wear. Smaller players, such as Yoga Anytime, YogaGlo, Gaia, and Down Dog, are also offering specialized yoga content, making loyal audiences and enriching the competitive space toward conquering Europe.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Lululemon Athletica Inc. | 19-22% |

| Gaiam (Sequential Brands) | 14-17% |

| Manduka LLC | 11-14% |

| Alo Yoga | 8-11% |

| Headspace Inc. | 5-8% |

| Other Players | 28-33% |

Key Success Factors Driving the Yoga & Meditation Product Industry in Europe

Lululemon Athletica Inc. has a strong hold over the entire European Yoga & Meditation Product Market, with a 19-22% share. The company has magically brought premium yoga products together with new-age, high-tech, at-home fitness products, like the Mirror device, which has become the leading choice in yoga in Europe.

Besides having the best performance apparel, Lululemon increased its reach through wellness workshops and mindfulness offerings to make the brand about comprehensive wellness. This application of fashion, functionality, and technology has made Lululemon a tough competitor.

Other important competitors include Gaiam (Sequential Brands) and Manduka LLC, which have already established a strong place in the industry by creating high-quality yoga products that serve performance and sustainability. They resonate well with European consumers who appreciate making eco-conscious products while doing everything to be fit and healthy.

Gaiam's wide selection of fitness items, Manduka's emphasis on high-end yoga mats and props, and Alo Yoga's chic yet functional clothes keep these brands going strong. Alongside a few very small foreign or niche companies such as Yoga Anytime, YogaGlo, Gaia, and Down Dog, the industry remains healthy under specialized offerings, with a loyal customer base.

The industry is segmented into Wearables, Smart Sleep Masks, Meditation Headbands and Earplugs, Fitness Trackers, Clothing and Accessories, Devices, Meditation Cushions and Benches, Weighted Blankets, Yoga Mats and Other Props, and Other Devices, catering to various aspects of physical and mental well-being.

The segmentation is into residential, school, and corporate industries, infotainment, and other end users addressing the diverse needs for relaxation, sleep, and wellness in different environments.

The segmentation is into Direct Sales, Modern Trade, Departmental Stores, Specialty Stores, Independent Small Stores, Online Retailers, and Other Sales Channels, reflecting the evolving retail landscape and the growth of digital commerce.

The regions covered include Germany, Italy, France, Spain, the United Kingdom, BENELUX, and the Rest of Western Europe, influenced by regional wellness trends, consumer behavior, and purchasing power.

The sales of yoga & meditation products in Europe are expected to reach USD 6.3 billion in 2025.

The industry is projected to grow to USD 13.1 billion by 2035.

The revenue is expected to grow at a CAGR of approximately 6.4% during the forecast period.

Wearables are a key segment in the European yoga & meditation product market.

Key players include CorePower Yoga, Equinox, Gold's Gym, Lifetime Fitness, SoulCycle, YMCA, Obé Fitness, Peloton Digital, POPSUGAR Fitness, Yoga Anytime, YogaGlo, Alo Moves, Gaia, Down Dog, Virgin Pulse, Grokker, Lululemon Athletica, Nike, Adidas, Under Armour, New Balance, and Columbia Sportswear.

Table 1: Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 2: Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 3: Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 4: Market Volume (Units) Analysis By End User, 2019 to 2034

Table 5: Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 6: Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 7: Market Value (US$ Million) Analysis By Country, 2019 to 2034

Table 8: Market Volume (Units) Analysis By Country, 2019 to 2034

Table 9: Germany Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 10: Germany Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 11: Germany Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 12: Germany Market Volume (Units) Analysis By End User, 2019 to 2034

Table 13: Germany Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 14: Germany Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 15: Italy Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 16: Italy Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 17: Italy Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 18: Italy Market Volume (Units) Analysis By End User, 2019 to 2034

Table 19: Italy Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 20: Italy Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 21: France Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 22: France Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 23: France Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 24: France Market Volume (Units) Analysis By End User, 2019 to 2034

Table 25: France Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 26: France Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 27: UK Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 28: UK Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 29: UK Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 30: UK Market Volume (Units) Analysis By End User, 2019 to 2034

Table 31: UK Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 32: UK Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 33: Spain Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 34: Spain Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 35: Spain Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 36: Spain Market Volume (Units) Analysis By End User, 2019 to 2034

Table 37: Spain Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 38: Spain Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 39: Benelux Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 40: Benelux Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 41: Benelux Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 42: Benelux Market Volume (Units) Analysis By End User, 2019 to 2034

Table 43: Benelux Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 44: Benelux Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 45: Nordic Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 46: Nordic Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 47: Nordic Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 48: Nordic Market Volume (Units) Analysis By End User, 2019 to 2034

Table 49: Nordic Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 50: Nordic Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 51: Russia Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 52: Russia Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 53: Russia Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 54: Russia Market Volume (Units) Analysis By End User, 2019 to 2034

Table 55: Russia Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 56: Russia Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 57: Hungary Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 58: Hungary Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 59: Hungary Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 60: Hungary Market Volume (Units) Analysis By End User, 2019 to 2034

Table 61: Hungary Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 62: Hungary Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 63: Poland Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 64: Poland Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 65: Poland Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 66: Poland Market Volume (Units) Analysis By End User, 2019 to 2034

Table 67: Poland Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 68: Poland Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Table 69: Balkan & Baltics Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 70: Balkan & Baltics Market Volume (Units) Analysis By Product Type, 2019 to 2034

Table 71: Balkan & Baltics Market Value (US$ Million) Analysis By End User, 2019 to 2034

Table 72: Balkan & Baltics Market Volume (Units) Analysis By End User, 2019 to 2034

Table 73: Balkan & Baltics Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 74: Balkan & Baltics Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 01: Market Value (US$ Million) and Volume (Units) Analysis, 2019 to 2024

Figure 02: Market Value (US$ Million) and Volume (Units) Forecast, 2024 to 2034

Figure 03: Market Value (US$ Million) Analysis, 2019 to 2024

Figure 04: Market Value (US$ Million) Forecast, 2024 to 2034

Figure 05: Market Absolute $ Opportunity Value (US$ Million), 2024 to 2034

Figure 06: Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 07: Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 08: Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 09: Market Attractiveness By Product Type, 2024 to 2034

Figure 10: Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 11: Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 12: Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 13: Market Attractiveness By End-users, 2024 to 2034

Figure 14: Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 15: Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 16: Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 17: Market Attractiveness By Sales Channel, 2024 to 2034

Figure 18: Market Value (US$ Million) Analysis By Country, 2019 to 2034

Figure 19: Market Volume (Units) Analysis By Country, 2019 to 2034

Figure 20: Market Y-o-Y Growth (%) Projections, By Country, 2024 to 2034

Figure 21: Market Attractiveness By Country, 2024 to 2034

Figure 22: Germany Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 23: Germany Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 24: Germany Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 25: Germany Market Attractiveness By Product Type, 2024 to 2034

Figure 26: Germany Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 27: Germany Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 28: Germany Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 29: Germany Market Attractiveness By End-users, 2024 to 2034

Figure 30: Germany Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 31: Germany Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 32: Germany Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 33: Germany Market Attractiveness By Sales Channel, 2024 to 2034

Figure 34: Italy Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 35: Italy Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 36: Italy Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 37: Italy Market Attractiveness By Product Type, 2024 to 2034

Figure 38: Italy Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 39: Italy Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 40: Italy Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 41: Italy Market Attractiveness By End-users, 2024 to 2034

Figure 42: Italy Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 43: Italy Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 44: Italy Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 45: Italy Market Attractiveness By Sales Channel, 2024 to 2034

Figure 46: France Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 47: France Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 48: France Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 49: France Market Attractiveness By Product Type, 2024 to 2034

Figure 50: France Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 51: France Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 52: France Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 53: France Market Attractiveness By End-users, 2024 to 2034

Figure 54: France Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 55: France Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 56: France Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 57: France Market Attractiveness By Sales Channel, 2024 to 2034

Figure 58: Spain Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 59: Spain Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 60: Spain Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 61: Spain Market Attractiveness By Product Type, 2024 to 2034

Figure 62: Spain Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 63: Spain Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 64: Spain Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 65: Spain Market Attractiveness By End-users, 2024 to 2034

Figure 66: Spain Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 67: Spain Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 68: Spain Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 69: Spain Market Attractiveness By Sales Channel, 2024 to 2034

Figure 70: UK Market Value (US$ Million) Analysis By Country, 2019 to 2034

Figure 71: UK Market Volume (Units) Analysis By Country, 2019 to 2034

Figure 72: UK Market Y-o-Y Growth (%) Projections, By Country, 2024 to 2034

Figure 73: UK Market Attractiveness By Country, 2024 to 2034

Figure 74: UK Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 75: UK Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 76: UK Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 77: UK Market Attractiveness By Product Type, 2024 to 2034

Figure 78: UK Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 79: UK Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 80: UK Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 81: UK Market Attractiveness By End-users, 2024 to 2034

Figure 82: UK Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 83: UK Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 84: UK Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 85: UK Market Attractiveness By Sales Channel, 2024 to 2034

Figure 86: Benelux Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 87: Benelux Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 88: Benelux Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 89: Benelux Market Attractiveness By Product Type, 2024 to 2034

Figure 90: Benelux Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 91: Benelux Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 92: Benelux Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 93: Benelux Market Attractiveness By End-users, 2024 to 2034

Figure 94: Benelux Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 95: Benelux Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 96: Benelux Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 97: Benelux Market Attractiveness By Sales Channel, 2024 to 2034

Figure 98: Nordic Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 99: Nordic Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 100: Nordic Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 101: Nordic Market Attractiveness By Product Type, 2024 to 2034

Figure 102: Nordic Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 103: Nordic Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 104: Nordic Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 105: Nordic Market Attractiveness By End-users, 2024 to 2034

Figure 106: Nordic Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 107: Nordic Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 108: Nordic Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 109: Nordic Market Attractiveness By Sales Channel, 2024 to 2034

Figure 110: Russia Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 111: Russia Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 112: Russia Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 113: Russia Market Attractiveness By Product Type, 2024 to 2034

Figure 114: Russia Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 115: Russia Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 116: Russia Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 117: Russia Market Attractiveness By End-users, 2024 to 2034

Figure 118: Russia Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 119: Russia Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 120: Russia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 121: Russia Market Attractiveness By Sales Channel, 2024 to 2034

Figure 122: Hungary Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 123: Hungary Market Volume (Units) Analysis By Product Type, 2019 to 2034

Figure 124: Hungary Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 125: Hungary Market Attractiveness By Product Type, 2024 to 2034

Figure 126: Hungary Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 127: Hungary Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 128: Hungary Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 129: Hungary Market Attractiveness By End-users, 2024 to 2034

Figure 130: Hungary Market Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Figure 131: Hungary Market Volume (Units) Analysis By Sales Channel, 2019 to 2034

Figure 132: Hungary Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 133: Hungary Market Attractiveness By Sales Channel, 2024 to 2034

Figure 134: Poland Market Value (US$ Million) Analysis By Product Type, 2019 to 2034

Figure 135: Poland Market Volume (Units) Analysis By Product Type, 2024 to 2034

Figure 136: Poland Market Y-o-Y Growth (%) Projections, By Product Type, 2024 to 2034

Figure 137: Poland Market Attractiveness By Product Type, 2019 to 2034

Figure 138: Poland Market Value (US$ Million) Analysis By End-users, 2019 to 2034

Figure 139: Poland Market Volume (Units) Analysis By End-users, 2024 to 2034

Figure 140: Poland Market Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 141: Poland Market Attractiveness By End-users, 2019-2035

Figure 142: Poland Market Value (US$ Million) Analysis By Sales Channel, 2024 to 2034

Figure 143: Poland Market Volume (Units) Analysis By Sales Channel, 2024 to 2034

Figure 144: Poland Market Y-o-Y Growth (%) Projections, By Sales Channel, 2019 to 2034

Figure 145: Poland Market Attractiveness By Sales Channel, 2019 to 2034

Figure 146: Balkan & Baltics Market Value (US$ Million) Analysis By Product Type, 2024 to 2034

Figure 147: Balkan & Baltics Market Volume (Units) Analysis By Product Type, 2024 to 2034

Figure 148: Balkan & Baltics Market Y-o-Y Growth (%) Projections, By Product Type, 2019 to 2036

Figure 149: Balkan & Baltics Market Attractiveness By Product Type, 2024 to 2034

Figure 150: Balkan & Baltics Market Value (US$ Million) Analysis By End-users, 2024 to 2034

Figure 151: Balkan & Baltics Market Volume (Units) Analysis By End-users, 2019 to 2034

Figure 152: Balkan & Baltics Market Y-o-Y Growth (%) Projections, By End-users, 2019 to 2034

Figure 153: Balkan & Baltics Market Attractiveness By End-users, 2024 to 2034

Figure 154: Balkan & Baltics Market Value (US$ Million) Analysis By Sales Channel, 2024 to 2034

Figure 155: Balkan & Baltics Market Volume (Units) Analysis By Sales Channel, 2019 to 2037

Figure 156: Balkan & Baltics Market Y-o-Y Growth (%) Projections, By Sales Channel, 2024 to 2034

Figure 157: Balkan & Baltics Market Attractiveness By Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yoga and Pilates Mats Market Trends - Growth & Demand 2025 to 2035

Yoga Market Analysis – Trends & Forecast 2024-2034

Yoga and Meditation Market Growth - Forecast 2025 to 2035

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

Yoga and Meditation Service Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

UK Yoga and Meditation Service Market Trends – Growth, Demand & Outlook 2025-2035

USA Yoga and Meditation Service Market Insights – Growth & Demand 2025-2035

Japan Yoga and Meditation Service Market Trends – Growth, Demand & Forecast 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Pilates & Yoga Studios Market Trends - Growth & Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA