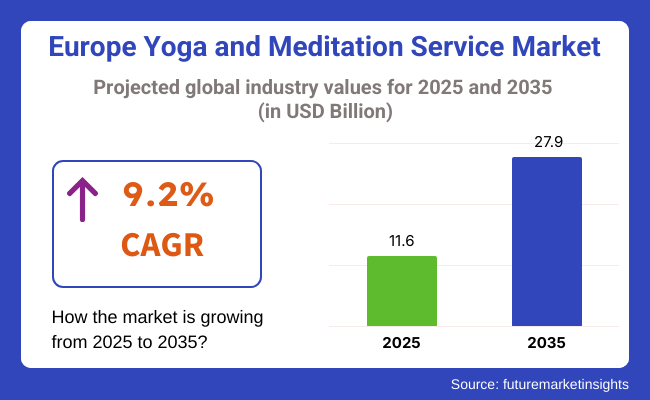

The Europe yoga and meditation service market size was valued at USD 11.6 billion in 2025 and is expected to grow at a 9.2% CAGR from 2025 to 2035. The regional industry for yoga and meditation services is projected to reach USD 27.9 billion by 2035. A key driver of this growth is the increasing adoption of integrative mental health therapies, coupled with expanding demand for digital wellness platforms.

Across Europe, the integration of mindfulness practices into daily routines is becoming a normalized aspect of personal and professional life. From stress management to chronic illness prevention, consumers are seeking holistic services that deliver both physiological and psychological benefits.

This trend is supported by rising awareness of non-pharmaceutical health alternatives, as well as growing workplace wellness initiatives across countries like Germany, France, and the UK The surge of mobile health apps and on-demand meditation streaming services has transformed access to guided practices, allowing consumers to participate in sessions from home or on the move.

Subscription-based models, personalized AI coaches, and multilingual support have broadened reach across age groups and demographics. This digitization not only fuels user engagement but also offers service providers scalable monetization opportunities.

Boutique studios and wellness retreats continue to thrive, particularly in urban centers and tourism hotspots. These facilities offer immersive in-person experiences, often complemented by therapeutic services such as sound healing, breathwork, and Ayurvedic consultations.

Consumers show a strong preference for programs that blend traditional philosophies with evidence-based approaches, creating demand for certified instructors and curated class formats. Over the forecasting period, the Europe yoga and meditation service industry is poised to benefit from cross-sector collaborations in healthcare, education, and technology.

Public sector endorsements of mindfulness in schools and clinical settings, coupled with private investment in digital wellness startups, are expected to drive innovation and inclusivity in service delivery throughout the next decade.

Travel retreats will take the lead in the Europe yoga and meditation service industry, providing 30% of the industry share, along with yoga and meditation classes at 25%.

Travel retreats are expected to take the largest share, given the increasing demand for wellness tourism in Europe. Among the most effective of such retreats are designed for yoga, meditation, and wellness privately within spaces of natural tranquillity. Spain, Portugal and Switzerland have already become primary centers for these retreats as they are able to attract tourists interested in the possibility of breaking their daily habits and using intensive mindfulness activities to reset.

Luxury wellness retreats generally combine yoga with a wider variety of spa treatments, mindfulness coaching, and detox programs, providing holistic health solutions. Striking while the iron is hot, brands like The BodyHoliday and Yoga Retreats Europe offer specialized programs targeting stress relief, rejuvenation, and personal development.

Yoga and meditation classes have sustained well in this segment as well, actually having 25% of the service share. There are emerging local studios and wellness center types of practitioners combined with online courses, all boosting this segment. There are quite a number of studio-based classes in these countries, of which Germany, France, and the Netherlands are significant.

However, it would be said that yoga culture in these countries is maintained dominantly in a live event or the physical assembly setup. Virtual classes grew popular during the pandemic but have since turned into a booming industry catering to those who prefer flexible and convenient practices from their homes.

Not that many brands are responding to this trend, such as Yogamatters and Liforme, but they do carry a multitude of studio-based membership and online classes in favor of face-to-face and this kind of wellness offering.

The residential sector in the Europe yoga and meditation service industry will hold higher shares in 2025, with a 45% demand for this industry segment. Schools and corporate industry segments hold the other 25%.

Thus, the segment has been dominated by residential clients, who are stressing more and more mental health and physical well-being at home. The ease of doing yoga and meditation in one's own space has surged with COVID-related online platforms, and they have made the most notable impact in this area.

Countries such as Germany, France, and the United Kingdom have noted a heavy use of online yoga subscriptions, virtual meditations, and guided online self-care programs. Moreover, the proliferation of wearable devices has made taking note of wellness activities while doing yoga and meditation at home more interesting than ever. So, the demand for self-care rituals and stress relief practices keeps home-based yoga services in demand.

The schools and corporate industry segment is expected to hold around 25% of the industry share, showing a progressive increase in the recent past. Yoga and meditation have become an integral part of the curriculum in schools. Mindfulness is now seen in academic institutions as vital hackery to sustain the concentration, emotional well-being, and academic performance of students.

Companies similarly welcome corporate wellness programs to assist their employees with stress management and productivity. Various corporations throughout Europe offer yoga classes, meditation workshops, and wellness seminars as employee benefits. Such demand is being answered by companies such as Liforme and Manduka through partnerships with institutions to provide corporate wellness packages and on-site yoga sessions.

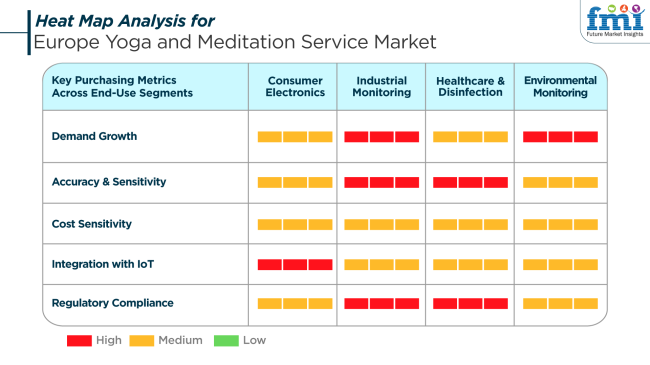

In the yoga and meditation service landscape across Europe, consumer electronics enable enhanced personalization and real-time tracking, making them integral to user adoption. These technologies are increasingly bundled with service subscriptions, allowing users to track mood, stress levels, and sleep quality alongside guided sessions.

In the healthcare segment, the rise of therapeutic yoga and trauma-informed meditation practices is creating strong institutional demand. Hospitals and wellness clinics are incorporating these services into rehabilitation programs and mental health treatments. This adoption is contingent upon adherence to strict regulatory frameworks, making quality assurance and certified practitioner networks critical.

The environmental and sensory components of meditation services are also gaining importance, with consumers seeking nature-based and ambient settings. Environmental monitoring tools that enhance air quality, light, and sound within meditation spaces contribute to a more immersive experience. These trends reflect a deeper desire for sensory alignment and eco-conscious well-being.

One of the primary risks in the European yoga and meditation service industry stems from fragmented regulatory standards. While the demand for therapeutic services is growing, inconsistent certification and licensing requirements across countries can create barriers for providers aiming to expand regionally. This regulatory disparity may hinder uniform service delivery and reduce consumer trust.

Economic disparities across Europe present another risk. While Northern and Western European countries exhibit high disposable income and service penetration, Southern and Eastern regions may experience slower adoption due to affordability and infrastructure gaps.

This imbalance could lead to uneven industry development and limit growth in underserved areas. Oversaturation of digital service providers with similar offerings may dilute value perception among consumers. As competition intensifies, platforms must differentiate through innovation, content quality, and user engagement to maintain customer retention. Providers failing to adapt to shifting user expectations and digital behavior may face churn and stagnation in growth.

During 2020 to 2024, the yoga and meditation services sector in Europe saw tremendous expansion primarily driven by the pandemic-fueled increased awareness of mental health, stress management requirements, and the trend towards home-based wellness practices. As increasing gym and studio use constraints plagued customers, they turned towards virtual yoga and meditation classes, mobile apps, and on-demand platforms.

This birthed a digital service boom in Europe, and well-being was democratized to cater to users of all forms. Traditional studio yoga studios adapted by combining their offerings-blending studio classes with livestreams and recorded classes.

At the same time, corporate business organizations started offering wellness services as a personnel benefit since the corporations realized that mindfulness and physical activity contribute to workplace efficiency and emotional resilience. Consumers continued to be drawn toward inclusive, secular, and science-based mindfulness practices, expanding the industry's penetration across age and cultural divides.

Europe's yoga and meditation service sector will be more personalized, technology-oriented, and mainstreamed into public health policy. Services will be more evolved to include AI-designed routines, biofeedback-based meditation, and immersive virtual environments (utilizing AR/VR) that simulate nature and improve mindfulness.

Wellness will be mainstreamed into education systems, healthcare streams, and workplace programs, and yoga and meditation will become the norm in preventive health and mental resilience training. Incentives for insurance and government-sponsored mindfulness training programs could also become an option, especially in countries with developed public health policy. Ethics and sustainability will also influence delivery of service, with studios placing emphasis on sustainable design and community well-being outreach.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Mental wellbeing awareness, pandemic stress reduction, virtual class uptake, and lifestyle wellbeing changes. | AI-driven personalization, VR/AR-based mindfulness, integration with public healthcare and education. |

| Urban professionals, students, wellness seekers, and stressed populations using online services. | Improved corporate team participation, older adult membership, school wellness programs, and mental health participation. |

| Virtual workshops, on-demand video, blended studio options, corporate wellness packages. | Immersive digital escapes, AI-planned routines, wearable-integrated feedback services. |

| Expansion of mobile wellness apps, Zoom/YouTube-based live lessons, and membership services. | AR/VR mindful spaces, AI-optimized schedules, biofeedback integration, voice-enabled AI coaching. |

| Focus on teacher-led validity and universal accessibility. | Community-model approaches, climate-responsible practice studios, and ethical wellness sites. |

| Studio sites, mobile applications (e.g., Headspace, Insight Timer), corporate packages, and online stores. | Experiential wellness facilities, tailored app ecosystems, and public-private mental health collaborations. |

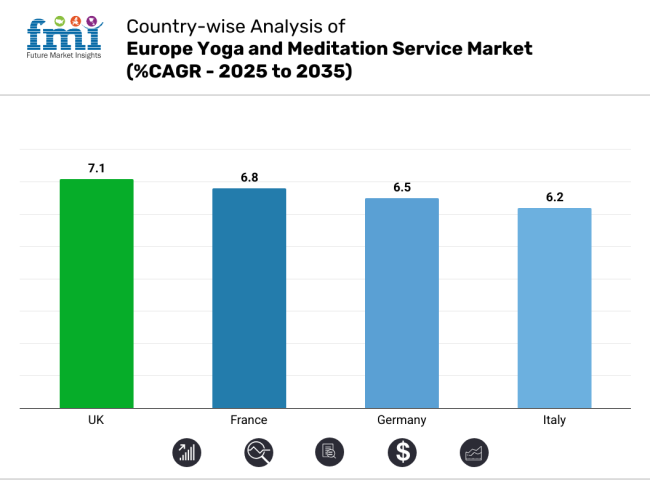

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

| France | 6.8% |

| Germany | 6.5% |

| Italy | 6.2% |

The UKindustry is projected to register a 7.1% CAGR during the study period. The industry of yoga and meditation services has been completely transformed by the incorporation of wellness into lifestyles and workplaces. London and other metropolitan areas have witnessed a trend of boutique yoga studios, virtual studios, and hybrid wellness facilities.

These providers offer a range of formats-from prenatal and power yoga to guided mindfulness workshops-that cater to a range of age groups and wellness needs. Corporate wellness initiatives are a major driver of growth, with companies increasing spending on mental health services for employees.

To that end, government and NHS-led efforts to tackle burnout and mental health stress are leading to yoga and meditation as part of public health interventions. Virtual platforms have unlocked accessibility, with live streaming and on-demand sessions gaining popularity in urban as well as rural settings.

Also, integration with fitness apps, wellness resorts, and healthcare experts has bolstered the presence of yoga and meditation services. Investment in mobile-centric infrastructure, trained teachers, and inclusivity-oriented offerings is further expected to support growth in the UK wellness ecosystem over the forecast period.

The French industry will grow at a 6.8% CAGR during the period under review. Growing social acceptance of complementary wellness solutions and cultural receptiveness towards holistic lifestyles are driving the growth of the yoga and meditation services industry. Large urban centers such as Paris and Lyon now have vibrant communities of well-being, and the majority of studios have specialty programs to alleviate stress and offer emotional stability and rehabilitation in body and mind.

Virtual service platforms have been on the upswing with a response to pandemic post-shift behavior, offering bilingual or native-language-led yoga and meditation sessions, thus extending demographic penetration. Wellness tourism, in terms of weekend retreats and workshops, has been one of the strongest sub-sectors, with both local and international participants seeking integrated wellness experiences.

The German industry is expected to progress at 6.5% CAGR during the study period. As a country with robust preventive healthcare and mental well-being values, Germany is fertile ground for yoga and meditation services. Metropolitan towns like Berlin, Hamburg, and Frankfurt have emerged as hubs of excellence for novel models of service that blend traditional methods with technology-driven delivery systems.

Services have come to range from therapeutic yoga and trauma-sensitive meditation to tailored corporate wellness sessions tailored for stress management and building resilience. Health insurance policies now cover mindfulness-based treatments when prescribed, with an official imprimatur and financial support system for stimulating growth in the industry.

In addition, university research based in Germany and clinical trials lend scientific credibility to such practices, enhancing public acceptance and adoption. Tech-enabled services like AI-driven meditation guides, personalized yoga routines, and interactive VR wellness programs are redefining customer expectations.

High-income professionals and millennials, particularly, are fueling demand for niche experiences like forest bathing yoga, sound healing meditation, and seasonal retreat programs. Penetration to rural regions is made possible through mobile network operators and local wellness cooperatives to ensure countrywide coverage as awareness evolves.

The Italian industry will increase at 6.2% CAGR over the period spanned. Italy's passion for lifestyle wellness has witnessed an increase in demand for experiential yoga and mindfulness services. Milan, Rome, and Bologna have emerged as the centers where boutique studios, wellness clubs, and co-living spaces encompassing yoga and meditation classes have become the focal points. It is not only the cities where the need lies, as smallest towns and rural communities are incorporating wellness into local tourism and community medicine programs as well.

Yoga retreats conducted at culturally enhanced locations such as vineyards, historic villas, and seaside resorts offer intensive well-being experiences that attract cross-border and domestic participants. The services sector also benefits from the increased availability of experienced Italian instructors and well-being coaches catering to local tastes and linguistic requirements.

Schools and educational institutions have started including straightforward meditation and movement exercises in students' schedules, indicating early-stage normalization of well-being habits among young cultures. Meanwhile, mobile applications offering voice-guided audio meditations and live classes are becoming widely popular, especially among younger generations that require flexibility and convenience.

The convergence of traditional aesthetics with contemporary wellness fashion renders the Italian marketplace extremely attractive for innovative service providers of mindfulness and movement.

The Europe yoga and meditation service industryis experiencing strong momentum, underpinned by the widespread integration of wellness practices into mainstream lifestyles. CorePower Yoga has maintained a notable presence, combining physical studio offerings with flexible digital programs to meet the diverse needs of European consumers.

Equinox has expanded its luxury wellness proposition across major cities, providing premium yoga and meditation experiences that appeal to high-income demographics. Peloton Digital and Obé Fitness are capitalizing on the growing preference for at-home wellness, offering curated yoga and meditation content through subscription-based models.

Lifetime Fitness continues to strengthen its position by integrating yoga and mindfulness into broader wellness and fitness offerings across large-scale facilities. Additionally, boutique providers like SoulCycle and YMCA are increasingly focusing on yoga-centered services, aiming to capture a broader share of wellness-conscious customers.

Digital disruptors such as Yoga Anytime, YogaGlo, and Alo Moves further intensify competition by delivering specialized, high-quality yoga and meditation content across multiple platforms. Apparel and fitness brands like Lululemon Athletica, Nike, Adidas, Under Armour, and New Balance also contribute to the ecosystem by aligning their offerings with holistic fitness and mindfulness trends.

With competition spanning studio chains, digital platforms, and lifestyle brands, industry dynamics are expected to remain highly competitive and innovation-driven.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| CorePower Yoga | 14-17% |

| Equinox | 12-15% |

| Peloton Digital | 10-13% |

| Obé Fitness | 7-10% |

| Lifetime Fitness | 6-9% |

| Other Players | 36-41% |

Key Success Factors Driving the Yoga and Meditation Service Market in Europe

CorePower Yoga and Equinox are becoming the top-end players in the growing European yoga and meditation service industry by delivering elite experiences through both physical and digital means. CorePower Yoga has gotten off to a decent start with its flexible membership model, and Equinox continues to develop its brand through the delivery of a luxury wellness experience across yoga, meditation, and holistic fitness. Both have kept a loyal, expanding customer base from among Europe's urban seekers of wellness.

Digital-first offerings like Peloton Digital and Obé Fitness are quickly catching on by providing easily accessible, quality content across Europe. Their model is agile enough to support changing customer demand for on-demand personal yoga and meditation experiences.

Lifetime Fitness effectively captured the demand of customers seeking an integrated model with hybrid physical and digital offerings. Industry leadership of this institute will be well ensured beyond the given competition with boutique providers, digital innovators, and lifestyle brands. Therefore, the European industry for the forecast period will remain dynamic and highly innovative.

By service type, the industry is segmented into classes, teacher training programs, travel retreats, online subscription services, and others.

By end user, the industry is categorized into residential, schools and corporate industry, infotainment, and other end users.

The industry spans Germany, Italy, France, the United Kingdom, Spain, Benelux, Nordic, Russia, Hungary, Poland, Balkan and Baltics, and the Rest of Western Europe.

The industry is expected to reach USD 11.6 billion in 2025.

The industry is projected to grow to USD 27.9 billion by 2035.

The industry is expected to grow at a CAGR of approximately 9.2% during the forecast period.

Travel retreats are a key segment in the Europe yoga and meditation service industry.

Key players include CorePower Yoga, Equinox, Gold's Gym, Lifetime Fitness, SoulCycle, YMCA, Obé Fitness, Peloton Digital, POPSUGAR Fitness, Yoga Anytime, YogaGlo, Alo Moves, Gaia, Down Dog, Virgin Pulse, Grokker, Lululemon Athletica, Nike, Adidas, Under Armour, New Balance, Columbia Sportswear.

Table 1: Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 2: Value (US$ million) Analysis By End User, 2019 to 2034

Table 3: Value (US$ million) Analysis , 2019 to 2034

Table 4: Value (US$ million) Analysis By Country, 2019 to 2034

Table 5: Germany Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 6: Germany Value (US$ million) Analysis By End User, 2019 to 2034

Table 7: Germany Value (US$ million) Analysis , 2019 to 2034

Table 8: Italy Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 9: Italy Value (US$ million) Analysis By End User, 2019 to 2034

Table 10: Italy Value (US$ million) Analysis , 2019 to 2034

Table 11: France Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 12: France Value (US$ million) Analysis By End User, 2019 to 2034

Table 13: France Value (US$ million) Analysis , 2019 to 2034

Table 14: United Kingdom Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 15: United Kingdom Value (US$ million) Analysis By End User, 2019 to 2034

Table 16: United Kingdom Value (US$ million) Analysis , 2019 to 2034

Table 17: Spain Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 18: Spain Value (US$ million) Analysis By End User, 2019 to 2034

Table 19: Spain Value (US$ million) Analysis , 2019 to 2034

Table 20: Benelux Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 21: Benelux Value (US$ million) Analysis By End User, 2019 to 2034

Table 22: Benelux Value (US$ million) Analysis , 2019 to 2034

Table 23: Nordic Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 24: Nordic Value (US$ million) Analysis By End User, 2019 to 2034

Table 25: Nordic Value (US$ million) Analysis , 2019 to 2034

Table 26: Russia Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 27: Russia Value (US$ million) Analysis By End User, 2019 to 2034

Table 28: Russia Value (US$ million) Analysis , 2019 to 2034

Table 29: Hungary Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 30: Hungary Value (US$ million) Analysis By End User, 2019 to 2034

Table 31: Hungary Value (US$ million) Analysis , 2019 to 2034

Table 32: Poland Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 33: Poland Value (US$ million) Analysis By End User, 2019 to 2034

Table 34: Poland Value (US$ million) Analysis , 2019 to 2034

Table 35: Balkan and Baltics Value (US$ million) Analysis By Service Type, 2019 to 2034

Table 36: Balkan and Baltics Value (US$ million) Analysis By End User, 2019 to 2034

Table 37: Balkan and Baltics Value (US$ million) Analysis , 2019 to 2034

Figure 01: Value (US$ million) Analysis, 2019 to 2024

Figure 02: Value (US$ million) Forecast, 2024 to 2034

Figure 03: Value (US$ million) Analysis, 2019 to 2024

Figure 04: Value (US$ million) Forecast, 2024 to 2034

Figure 05: Absolute $ Opportunity Value (US$ million), 2024 to 2034

Figure 06: Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 07: Attractiveness By Service Type, 2024 to 2034

Figure 08: Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 09: Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 10: Attractiveness By End-users, 2024 to 2034

Figure 11: Value (US$ million) Analysis , 2019 to 2034

Figure 12: Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 13: Attractiveness , 2024 to 2034

Figure 14: Value (US$ million) Analysis By Country, 2019 to 2034

Figure 15: Y-o-Y Growth (%) Projections, By Country, 2024 to 2034

Figure 16: Attractiveness By Country, 2024 to 2034

Figure 17: Germany Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 18: Germany Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 19: Germany Attractiveness By Service Type, 2024 to 2034

Figure 20: Germany Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 21: Germany Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 22: Germany Attractiveness By End-users, 2024 to 2034

Figure 23: Germany Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 24: Germany Attractiveness , 2024 to 2034

Figure 25: Italy Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 26: Italy Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 27: Italy Attractiveness By Service Type, 2024 to 2034

Figure 28: Italy Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 29: Italy Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 30: Italy Attractiveness By End-users, 2024 to 2034

Figure 31: Italy Value (US$ million) Analysis , 2019 to 2034

Figure 32: Italy Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 33: Italy Attractiveness , 2024 to 2034

Figure 34: France Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 35: France Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 36: France Attractiveness By Service Type, 2024 to 2034

Figure 37: France Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 38: France Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 39: France Attractiveness By End-users, 2024 to 2034

Figure 40: France Value (US$ million) Analysis , 2019 to 2034

Figure 41: France Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 42: France Attractiveness , 2024 to 2034

Figure 43: Spain Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 44: Spain Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 45: Spain Attractiveness By Service Type, 2024 to 2034

Figure 46: Spain Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 47: Spain Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 48: Spain Attractiveness By End-users, 2024 to 2034

Figure 49: Spain Value (US$ million) Analysis , 2019 to 2034

Figure 50: Spain Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 51: Spain Attractiveness , 2024 to 2034

Figure 52: United Kingdom Value (US$ million) Analysis By Country, 2019 to 2034

Figure 53: United Kingdom Y-o-Y Growth (%) Projections, By Country, 2024 to 2034

Figure 54: United Kingdom Attractiveness By Country, 2024 to 2034

Figure 55: United Kingdom Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 56: United Kingdom Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 57: United Kingdom Attractiveness By Service Type, 2024 to 2034

Figure 58: United Kingdom Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 59: United Kingdom Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 60: United Kingdom Attractiveness By End-users, 2024 to 2034

Figure 61: United Kingdom Value (US$ million) Analysis , 2019 to 2034

Figure 62: United Kingdom Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 63: United Kingdom Attractiveness , 2024 to 2034

Figure 64: Benelux Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 65: Benelux Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 66: Benelux Attractiveness By Service Type, 2024 to 2034

Figure 67: Benelux Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 68: Benelux Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 69: Benelux Attractiveness By End-users, 2024 to 2034

Figure 70: Benelux Value (US$ million) Analysis , 2019 to 2034

Figure 71: Benelux Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 72: Benelux Attractiveness , 2024 to 2034

Figure 73: Nordic Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 74: Nordic Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 75: Nordic Attractiveness By Service Type, 2024 to 2034

Figure 76: Nordic Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 77: Nordic Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 78: Nordic Attractiveness By End-users, 2024 to 2034

Figure 79: Nordic Value (US$ million) Analysis , 2019 to 2034

Figure 80: Nordic Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 81: Nordic Attractiveness , 2024 to 2034

Figure 82: Russia Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 83: Russia Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 84: Russia Attractiveness By Service Type, 2024 to 2034

Figure 85: Russia Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 86: Russia Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 87: Russia Attractiveness By End-users, 2024 to 2034

Figure 88: Russia Value (US$ million) Analysis , 2019 to 2034

Figure 89: Russia Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 90: Russia Attractiveness , 2024 to 2034

Figure 91: Hungary Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 92: Hungary Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 93: Hungary Attractiveness By Service Type, 2024 to 2034

Figure 94: Hungary Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 95: Hungary Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 96: Hungary Attractiveness By End-users, 2024 to 2034

Figure 97: Hungary Value (US$ million) Analysis , 2019 to 2034

Figure 98: Hungary Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 99: Hungary Attractiveness , 2024 to 2034

Figure 100: Poland Value (US$ million) Analysis By Service Type, 2019 to 2034

Figure 101: Poland Y-o-Y Growth (%) Projections, By Service Type, 2024 to 2034

Figure 102: Poland Attractiveness By Service Type, 2019 to 2034

Figure 103: Poland Value (US$ million) Analysis By End-users, 2019 to 2034

Figure 104: Poland Y-o-Y Growth (%) Projections, By End-users, 2024 to 2034

Figure 105: Poland Attractiveness By End-users, 2019 to 2034

Figure 106: Poland Value (US$ million) Analysis , 2024 to 2034

Figure 107: Poland Y-o-Y Growth (%) Projections, , 2019 to 2034

Figure 108: Poland Attractiveness , 2019 to 2034

Figure 109: Balkan and Baltics Value (US$ million) Analysis By Service Type, 2024 to 2034

Figure 110: Balkan and Baltics Y-o-Y Growth (%) Projections, By Service Type, 2019 to 2034

Figure 111: Balkan and Baltics Attractiveness By Service Type, 2024 to 2034

Figure 112: Balkan and Baltics Value (US$ million) Analysis By End-users, 2024 to 2034

Figure 113: Balkan and Baltics Y-o-Y Growth (%) Projections, By End-users, 2019 to 2034

Figure 114: Balkan and Baltics Attractiveness By End-users, 2024 to 2034

Figure 115: Balkan and Baltics Value (US$ million) Analysis , 2024 to 2034

Figure 116: Balkan and Baltics Y-o-Y Growth (%) Projections, , 2024 to 2034

Figure 117: Balkan and Baltics Attractiveness , 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yoga Market Analysis – Trends & Forecast 2024-2034

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Yoga & Meditation Product Industry in Europe - Analysis by Growth, Trends and Forecast from 2025 to 2035

Yoga and Pilates Mats Market Trends - Growth & Demand 2025 to 2035

Yoga and Meditation Market Growth - Forecast 2025 to 2035

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

UK Yoga and Meditation Service Market Trends – Growth, Demand & Outlook 2025-2035

USA Yoga and Meditation Service Market Insights – Growth & Demand 2025-2035

Japan Yoga and Meditation Service Market Trends – Growth, Demand & Forecast 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Pilates & Yoga Studios Market Trends - Growth & Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA