About The Report

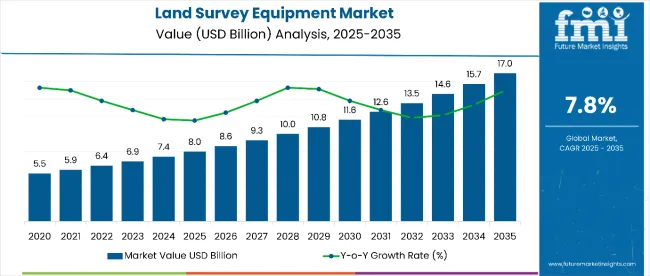

The global land survey equipment market is forecasted to reach USD 8.7 billion in 2026 and expand to USD 13.2 billion by 2036, advancing at a CAGR of 4.2%. Demand for land survey equipment is being boosted by growth in infrastructure development, urbanization, and large construction projects that require precise land measurement and mapping. Expansion of transportation networks such as roads, railways, and bridges drives the need for advanced surveying tools to ensure accurate planning and design. Rising investment in utility and energy projects, including pipelines, power transmission lines, and renewable energy installations, increases usage of GNSS receivers and total stations.

Technological progress in survey instruments, including drone‑based LiDAR, 3D laser scanners, and real‑time kinematic systems, improves efficiency and accuracy, encouraging adoption. Government initiatives to modernize cadastral records and land management systems further support market growth. Increased emphasis on smart city projects and digital mapping for environmental monitoring and urban planning enhances equipment demand. Growth in mining and agricultural land assessment also contributes to broader usage of advanced survey technologies.

| Metric | Value |

|---|---|

| Market Value (2026) | USD 8.7 billion |

| Market Forecast Value (2036) | USD 13.2 billion |

| Forecast CAGR (2026-2036) | 4.2% |

Source: FMI analysis based on primary research and proprietary forecasting model

Major exporting countries for land survey equipment include manufacturing centers in Europe, North America, and Asia where production of precision instruments and optical devices is established. Germany is a leading exporter of survey instruments because of its advanced manufacturing infrastructure and precision engineering capabilities. The United States and Japan are also significant exporters of land survey equipment to global markets. China contributes to exports through cost-effective manufacturing technologies and production scale systems.

Other exporting countries that participate in the global supply chain include various European and Asian manufacturing hubs. On the importing side, several countries with expanding infrastructure development and growing construction markets are primary destinations for land survey equipment. India is among the top importers of such equipment to support domestic construction and infrastructure development growth. The United States and China also import specialized survey instruments to complement domestic production and meet specific application requirements. Germany and Brazil represent notable import markets focused on advanced surveying solutions and specialized measurement applications.

Land survey equipment plays a critical role in delivering measurement accuracy, data precision, and operational efficiency for testing and inspection across construction projects, infrastructure development, and mapping applications. Adoption is influenced by accuracy requirements, environmental conditions, technology integration, and application-specific criteria. Segmentation by equipment type, technology, and end-use application highlights how professionals select specific surveying solutions to meet precision standards, productivity targets, and project requirements across diverse surveying categories.

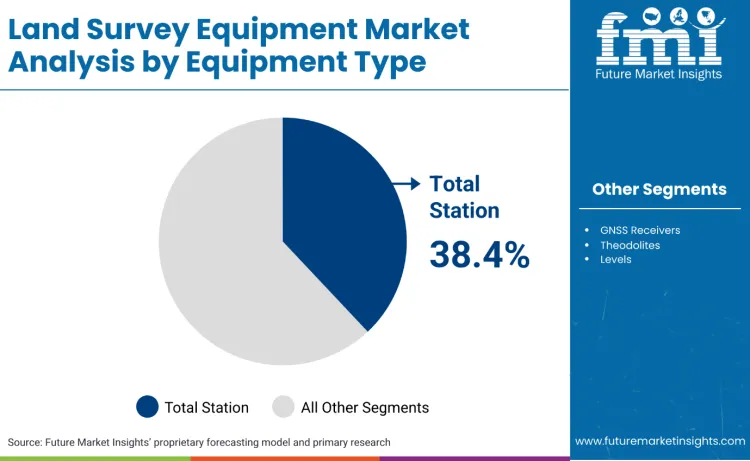

Total stations account for 38.4%, driven by extensive use in construction layout, boundary surveys, and topographic mapping applications. GNSS receivers hold 28.7%, supporting positioning applications, geodetic surveys, and mobile mapping requirements. Theodolites represent 15.2%, favored for angle measurement, alignment projects, and basic surveying applications. Levels contribute 12.1%, used in elevation measurement and construction grading applications. Other equipment accounts for 5.6%, used in specialized applications and niche surveying segments.

Key Points

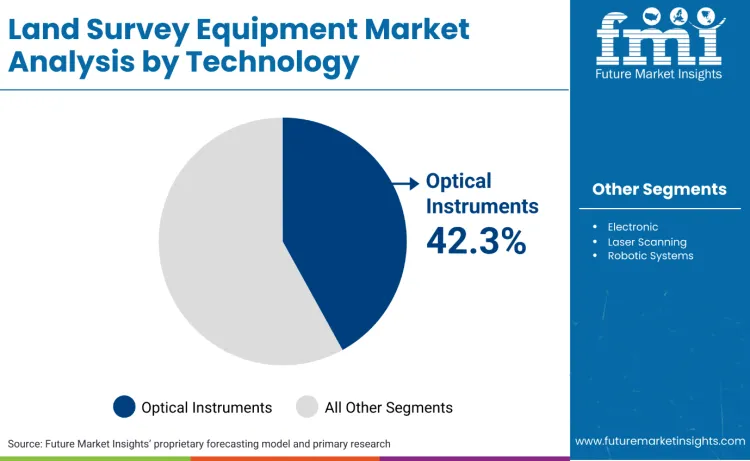

Optical instruments represent 42.3%, reflecting priority on applications requiring direct measurement and field reliability features. Electronic instruments account for 35.8%, suitable for automated data collection requiring digital integration and processing capabilities. Laser scanning systems hold 14.7%, used for detailed mapping and building information modeling requiring high-density data capture. Robotic systems contribute 7.2%, favored for automated measurement and remote operation requirements.

Key Points

Demand in the land survey equipment market arises from professionals seeking to improve measurement accuracy, reduce surveying costs, focus on digital transformation, and meet precision targets in applications where manual methods prove insufficient. Activity is notable in construction sites, engineering firms, and mapping organizations where survey instruments address accuracy requirements, productivity needs, and data quality standards. Equipment selection centers on measurement precision, durability characteristics, and technology features that support project completion without compromising operational efficiency.

Market uptake grows where measurement precision characteristics of land survey equipment are critical to project success. In construction and infrastructure development, instruments must maintain accuracy standards and measurement reliability to achieve engineering specifications and quality compliance requirements. Large-scale construction operations use total station and GNSS platforms to ensure measurement precision during layout processes, preventing errors while maintaining cost-effective surveying characteristics. Engineering firms depend on consistent instrument performance to deliver measurement accuracy, data reliability, and precision capabilities comparable to established surveying protocols. Operators evaluate performance under field conditions and environmental scenarios to ensure measurement quality through various project phases.

Broader adoption is shaped by the complexity of technology pricing and specialized training requirements. Some applications experience cost constraints due to equipment price considerations or technology availability limitations, requiring careful instrument selection and supplier management strategies. Regional differences in training infrastructure and technical support systems affect where professionals can access cost-effective equipment without triggering complex logistics challenges. Price considerations arise when accuracy requirements and technology capabilities are needed to balance instrument performance, equipment costs, and total ownership expenses in operations requiring consistent precision specifications. Technology evaluation processes that assess measurement capabilities and operational efficiency extend equipment selection timelines, influencing decisions about which platforms to deploy across diverse surveying regions where cost requirements drive equipment approach decisions.

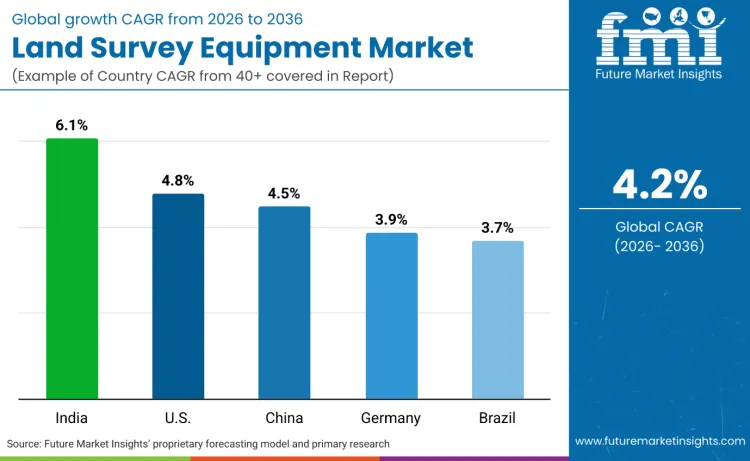

Global demand for land survey equipment is increasing as construction and engineering companies expand project capacity while addressing measurement accuracy, operational efficiency, and data integration application requirements. Growth reflects rising use of automated measurement systems, digital data collection platforms, and precision-optimized instrument specifications across construction sites, engineering facilities, and mapping organizations. Equipment selection focuses on measurement accuracy, operational reliability, and cost performance under various project scenarios. India records 6.1% CAGR, USA records 4.8% CAGR, China records 4.5% CAGR, Germany records 3.9% CAGR, and Brazil records 3.7% CAGR. Adoption remains driven by accuracy requirements and operational efficiency rather than volume expansion alone.

| Country | CAGR (2026-2036) |

|---|---|

| India | 6.1% |

| USA | 4.8% |

| China | 4.5% |

| Germany | 3.9% |

| Brazil | 3.7% |

Source: FMI analysis based on primary research and proprietary forecasting model

Demand for land survey equipment in India is expanding as construction facilities develop infrastructure capabilities and quality improvement programs. Growth at 6.1% CAGR reflects rising use of total stations, GNSS receivers, and digital measurement systems addressing domestic construction and export infrastructure requirements. Equipment accuracy improvement under project conditions remains critical for measurement reliability and client acceptance. Cost considerations encourage surveying solutions delivering measurement precision and operational efficiency at competitive price points. Construction companies prioritize instruments compatible with existing project workflows and operational capabilities. Demand concentrates within infrastructure development zones, urban construction areas, and engineering facilities serving residential and commercial markets.

Land survey equipment demand in USA is rising as construction systems expand project programs and accuracy enhancement initiatives. Growth at 4.8% CAGR reflects strong activity in infrastructure development, commercial construction, and municipal surveying applications. Large-scale construction projects are driving demand for instruments delivering measurement precision, cost efficiency, and regulatory compliance. Construction facilities increase utilization of total stations and electronic instruments due to accuracy requirements and productivity specifications. Domestic manufacturing policies support advanced surveying technologies and measurement accuracy standards. Demand remains centered on major construction regions and integrated engineering complexes serving national and local markets.

Sales of land survey equipment in China are increasing as operators expand manufacturing facilities and accuracy improvement capabilities aligned with construction growth and infrastructure processing needs. Growth at 4.5% CAGR reflects rising use in infrastructure surveying, construction layout, and mapping applications. Instrument performance under project conditions and measurement reliability drives technology selection. Manufacturing financing mechanisms increase access to advanced surveying equipment for qualifying construction facilities. Infrastructure programs focus on measurement accuracy and operational efficiency to demonstrate equipment value. Demand remains strongest within construction centers and surveying facilities serving domestic markets.

Land survey equipment market demand in Germany is advancing as engineering systems expand project capabilities across construction surveying, infrastructure measurement, and precision mapping applications. Growth at 3.9% CAGR reflects strong use in construction projects, engineering surveys, and municipal mapping applications. Advanced engineering operations introduce complex measurement scenarios requiring consistent instrument performance and accuracy reliability. Project strategies prioritize equipment with proven precision characteristics and operational stability. Major construction facilities emphasize instrument specifications and quality control protocols to optimize surveying efficiency. Demand is driven by performance evidence and cost effectiveness rather than raw technology availability trends.

Demand for land survey equipment in Brazil is rising as construction programs expand accuracy capabilities across infrastructure development, commercial projects, and mapping applications. Growth at 3.7% CAGR reflects utilization driven by quality standards and performance-based surveying protocols. Instrument consistency under long-term project scenarios influences technology selection and project management approaches. Construction operators prioritize systems supporting measurement accuracy, cost efficiency, and operational performance. Quality acceptance standards elevate focus on equipment reliability, instrument performance, and supply consistency. Demand remains tied to construction program development and infrastructure capacity rather than general equipment expansion.

Performance requirements in construction surveying, infrastructure development, and mapping applications are shaping demand for land survey instruments. Construction professionals assess measurement accuracy, cost efficiency, operational capabilities, and supply reliability during equipment selection processes. Quality assessment includes precision tolerance, environmental resistance, data integration compatibility, and integration with existing project protocols. Procurement behavior reflects extensive performance validation, supply reliability requirements, and reliance on suppliers offering technical support and consistent instrument specifications. Trends in the land survey equipment market reflect emphasis on measurement quality and operational efficiency in construction projects, infrastructure development, and mapping applications.

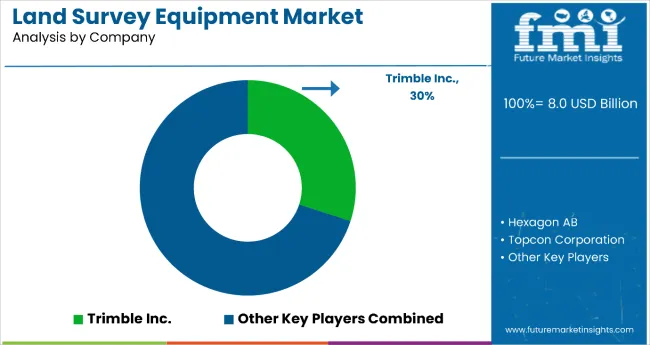

Trimble Inc. accounts for a leading position through integrated survey instrument operations designed to deliver measurement accuracy, operational reliability, and supply consistency capabilities. Hexagon AB competes by combining precision measurement technology with comprehensive software systems supporting data integration across diverse surveying applications. Topcon Corporation supports demand through specialized construction surveying platforms aligned with accuracy and productivity requirements. Leica Geosystems AG maintains relevance by supplying precision instruments enhancing measurement accuracy and operational performance potential. SOUTH Group participates with surveying solutions emphasizing cost efficiency and project integration. Competitive differentiation centers on instrument accuracy, supply reliability, technical specifications, and depth of project collaboration.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Equipment Type | Total Stations; GNSS Receivers; Theodolites; Levels; Others |

| Technology | Optical; Electronic; Laser Scanning; Robotic Systems |

| Application | Construction; Infrastructure; Mining; Agriculture; Others |

| End-Use Industry | Construction & Engineering; Government; Mining; Utilities; Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, USA, China, Germany, Brazil, and 40+ countries |

| Key Companies Profiled | Trimble Inc.; Hexagon AB; Topcon Corporation; Leica Geosystems AG; SOUTH Group; Others |

| Additional Attributes | Dollar sales by equipment type, technology, and application; performance in measurement accuracy and cost efficiency across construction projects, infrastructure development, and mapping matrices; accuracy improvement, operational efficiency enhancement, and precision benefit under project operations; impact on measurement quality, supply reliability, and cost management during surveying processes; compatibility with data systems and quality control targets; procurement dynamics driven by construction expansion, accuracy improvement programs, and long-term equipment supply partnerships. |

The global land survey equipment market is estimated to be valued at USD 8.7 billion in 2026.

The market size for the land survey equipment market is projected to reach USD 13.2 billion by 2036.

The land survey equipment market is expected to grow at a 4.2% CAGR between 2026 and 2036.

The key equipment types in the land survey equipment market include total stations, GNSS receivers, theodolites, levels, and other specialized surveying instruments.

In terms of equipment type, the total stations segment is set to command a 38.4% share in the land survey equipment market in 2026.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seismic Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

The Equipment, Inspection & End-of-Line Market is segmented by Equipment Type (Palletizers, Case Packers, Stretch Wrappers, Labeling/Inspection, Others), Application (Primary Packaging Completion, Secondary Packaging, Tertiary Packaging, Others), End Use (Food & Beverage, Pharmaceuticals, Consumer Goods, E-commerce & Logistics), Automation (Fully Automatic, Semi-Automatic, Manual), and Region. Forecast for 2026 to 2036.

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Landing Page Builders Market Analysis - Size, Share, and Forecast 2025 to 2035

Land Mobile Radio (LMR) Market Analysis by Type, Technology, Frequency, Application, and Region Through 2025 to 2035

Landscaping Services Market Analysis by Type, Application, and Region Through 2025 to 2035

Survey and Feedback Management Software Market

Glandular Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Homeland Security Market Size and Share Forecast Outlook 2025 to 2035

Thailand Destination Wedding market Analysis from 2025 to 2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Thailand Surfing Tourism Market Report – Demand, Innovations & Forecast 2025-2035

USA Landing Page Builders Market Analysis – Size, Trends & Forecast 2025-2035

Thailand Culinary Tourism Market Trends – Growth & Forecast 2024-2034

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.