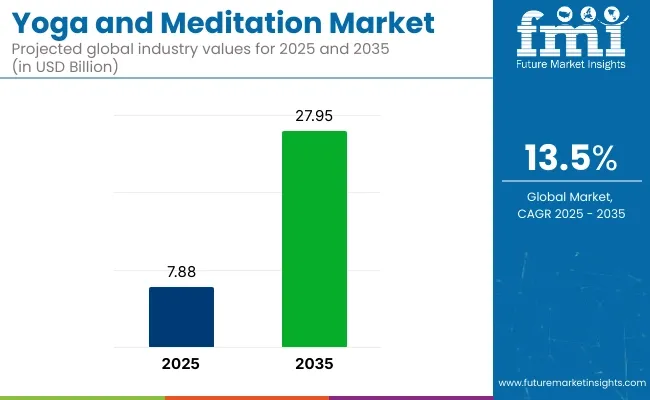

The yoga and meditation market is valued at USD 7.88 billion in 2025 and is expected to reach USD 27.95 billion by 2035, reflecting a CAGR of 13.5% over the forecast period. This growth is driven by the increasing adoption of yoga and meditation practices due to their well-documented physical, mental, and emotional benefits.

Rising awareness of the importance of mental health, coupled with a growing focus on holistic wellness, is propelling demand for yoga and meditation services, products, and digital platforms. Additionally, the expansion of yoga and meditation programs in schools, workplaces, and healthcare settings is contributing to market growth, as individuals seek stress reduction and improved well-being.

Looking ahead, the yoga and meditation market is likely to continue its upward trajectory, supported by advancements in digital platforms and mobile applications. The increasing popularity of online yoga classes, meditation apps, and virtual wellness programs is expected to drive further market expansion, especially as consumers seek convenience and personalized wellness experiences.

The growing number of fitness influencers and yoga professionals promoting the benefits of yoga and meditation through social media is likely to boost awareness and participation in these practices. As these digital solutions continue to evolve, they will play a significant role in attracting new consumers and fostering greater global adoption of yoga and meditation.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.88 billion |

| Industry Value (2035F) | USD 27.95 billion |

| CAGR (2025 to 2035) | 13.5% |

Government regulations, along with initiatives promoting mental health awareness and wellness programs, are also likely to contribute to the market's growth. Various organizations and governments around the world are increasingly recognizing the importance of mental and physical health, and many are integrating yoga and meditation into public health strategies.

These efforts are expected to create a supportive environment for the growth of the yoga and meditation market, further enhancing its expansion. As healthcare policies increasingly emphasize preventive health measures, including stress management and mindfulness, the inclusion of yoga and meditation in wellness programs is likely to be encouraged, boosting market demand.

The table compares how much the yoga and meditation market could grow every six months from 2025 to 2035. To make it clearer, it also demonstrates how these new forecasts differ from the older ones from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 12.3% |

| H2 (2024 to 2034) | 14.5% |

| H1 (2025 to 2035) | 12.4% |

| H2 (2025 to 2035) | 14.6% |

In the former analysis, the industry was anticipated to progress toward advancement at a CAGR of 12.3% each year in the first half of the preceding forecast period, from 2020 to 2024.

Then, this rate was projected to inflate marginally to 14.5% in the second half of that period. From 2025 to 2035, the progression of the yoga and meditation industry is estimated to take off again at 12.4% CAGR and then spike further to 14.6% in the second half of this period.

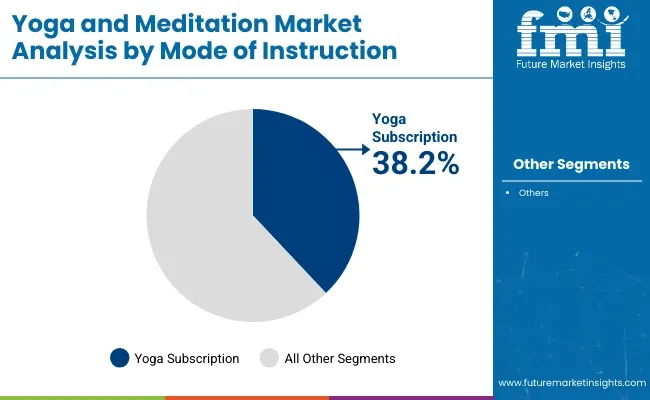

The market is segmented based on mode of instruction, indication, organizer, and region. By mode of instruction, the market is divided into yoga subscription, yoga centers, workshops, and other modes (corporate wellness programs, retreat programs, online live streaming classes, television-based programs). Yoga subscription is further categorized into app subscription and web subscription.

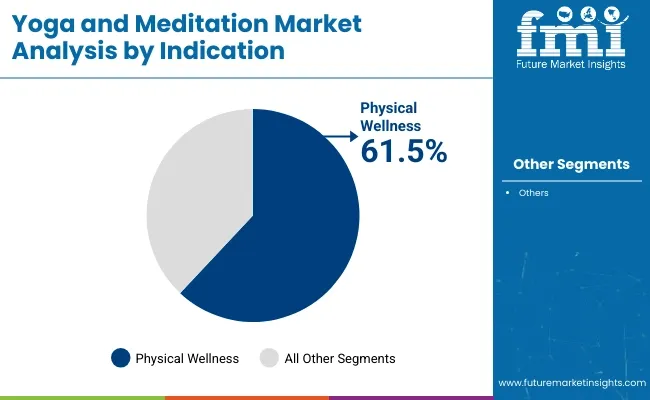

In terms of indication, the market is segmented into physical wellness and mental wellness. Based on organizer, the market is categorized into individuals, schools, corporates, and other institutional organizers (government organizations, non-profit organizations, fitness clubs, community centers). Regionally, the market is classified into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The yoga subscription segment is projected to dominate the yoga and meditation market by mode of instruction, accounting for a 38.2% market share in 2025. This segment benefits from the rapid digital transformation in the wellness industry, where consumers increasingly prefer app- and web-based subscription services offering flexibility and on-demand access.

App-based platforms such as Daily Yoga and Yoga Studio provide personalized sessions, progress tracking, and meditation guides, making them particularly attractive for busy urban consumers. Meanwhile, web subscriptions enable users to join live streaming classes or access vast content libraries, eliminating geographical barriers.

This shift is fueled by growing consumer demand for home-based fitness solutions post-pandemic, affordability compared to in-person classes, and the desire for privacy during wellness routines.

Developers are constantly updating their platforms with AI-driven personalizations, community forums, and integrative health features to sustain engagement and subscription renewals. Corporate wellness programs are also adopting subscription services as part of employee health initiatives. The expanding use of smart TVs and wearable devices further enhances the appeal of these digital services, solidifying yoga subscriptions’ leadership position in the market.

| Mode of Instruction Segment | Market Share (2025) |

|---|---|

| Yoga Subscription | 38.2% |

The physical wellness segment is expected to lead the yoga and meditation market by indication, capturing a 61.5% share in 2025. Rising awareness of the physical health benefits associated with yoga including improved flexibility, strength, cardiovascular health, and pain management has fueled demand for yoga programs targeting bodily fitness.

Medical professionals increasingly recommend yoga for rehabilitation and chronic condition management, such as lower back pain and arthritis. Meanwhile, aging populations and sedentary lifestyles globally are also driving demand, as consumers seek gentle yet effective fitness alternatives. Corporate wellness initiatives are prioritizing physical wellness offerings to reduce healthcare costs and enhance employee productivity.

This segment’s dominance is further supported by media endorsements, celebrity influence, and government-funded fitness campaigns promoting yoga as a preventive healthcare measure. Technological innovations, such as virtual reality-based yoga and interactive streaming platforms, are enhancing user engagement, expanding the market for physical wellness-focused yoga. This trend ensures that the physical wellness segment will maintain its leadership over the forecast period.

| Indication Segment | Market Share (2025) |

|---|---|

| Physical Wellness | 61.5% |

The corporate segment is anticipated to register the highest CAGR of 7.1% from 2025 to 2035 in the yoga and meditation market. Organizations worldwide are recognizing the importance of employee mental health and physical well-being, incorporating yoga and meditation programs into their workplace wellness strategies.

These initiatives aim to reduce stress, improve focus, and enhance productivity, responding to increased burnout and mental health challenges post-pandemic. Large corporations are investing in dedicated wellness spaces, on-site instructors, and digital platforms offering yoga classes as part of flexible benefit plans.

Tech companies, in particular, are leading this trend, integrating mindfulness applications and virtual yoga classes into daily routines. Meanwhile, smaller enterprises are adopting cost-effective, subscription-based services to promote staff well-being.

As companies compete to attract and retain talent, the inclusion of comprehensive wellness programs including yoga and meditation is becoming a differentiating factor. The growing body of evidence supporting the return on investment (ROI) of such programs ensures continued expansion of the corporate segment during the forecast period.

| Organizer Segment | CAGR (2025 to 2035) |

|---|---|

| Corporate | 7.1% |

Yoga Tourism is the Next Big Thing in Wellness Travel

Yoga tourism has caught attention recently and emerged as a top segment of the wellness tourism industry. Several tour companies are offering wellness visit programs that are typically personalized to each individual's needs and preferences. Individuals now prefer to visit yoga retreats either alone or with family for wellness purposes.

These kinds of customized wellness tours are more widespread now. For instance, Wellnesstour.com announced dedicated wellness tours for quite a few Indian towns. They collaborated with Britannia, Amul, Bajaj, Cipla, BHEL, Infosys, and Mahindra to make this work. These tours include stops in Goa, Pune, Sikkim, and other sites with wellness facilities.

The “Travel to Feel Better” movement has boosted yoga tourism. Outdoor yoga sessions offered over long weekend breaks and festival time holidays are becoming extremely popular. The yoga industry has really taken off and profited from multiple corresponding trends, including the surge of leisureliness and the growth of boutique wellness.

Modern spas, luxurious accommodations, and scenic natural surroundings attract luxury travelers. Nonetheless, the most crucial element is the celebrity life coaches and fitness instructors who have countless loyal followers. This popularity has led to more wellness resorts.

Deepak Chopra, a well-known frontrunner in the field of meditation and mindfulness, announced his integrative wellness company in October 2023. It also established a multiyear partnership with Swan Hellenic which is a high-end cruise company.

Technology is Changing the Entire Landscape of Yoga and Meditation

The wellness industry is bourgeoning with new startups and health programs through new technology trends. Contemporary individuals nowadays go through a very hectic work life. So, they search for technological-driven solutions that can help them to maintain their health and fitness.

With technological advancements, yoga and meditation have turned into digital. Several online platforms are available through which one can practice yoga in the comfort of their home. Mobile apps, wearables, social media platforms, and online classes are transforming practice accessibility.

Wysa, Asana Rebel, Glo, Calm, and Prayoga are some popular applications that are available on both Android and iOS. These applications have all-inclusive exercise plans, including meditation and yoga, for users.

Wearable technology is also uplifting the appeal of yoga and meditation. Demand for wearable devices is growing since these let users track and observe fitness intensities, sports activities, heart rate, blood pressure, and the calories burned during exercises.

Yoga and meditation market players are improving their existing wearable devices by incorporating the latest technologies to attract more customers. For instance, in January 2024, Apple introduced new content for its workout service Fitness+.

Some of the great features it contains are a fresh meditation theme, a yoga package for golfers, artists’ limelight with Super Bowl Halftime Show artists, and new superstar guests for its audio walking experience “Time to Walk.”

Social Media is Amplifying Awareness and Engagement in the Yoga Community

The role of social media platforms in promoting wellness trends, including yoga, cannot be overstated. Influencers, celebrities, and other wellness activists share their yoga routines and after experiences on social media platforms like Facebook and Instagram. This inspires others to walk around similar options.

YouTube and other online video streaming platforms captured attention as well. People are turning to yoga routines shared by celebrities, influencers, and trainers. This way of doing yoga became popular during the pandemic particularly and remained so even during the post-pandemic period.

Individuals also nowadays enjoy listening to soothing meditation music for their peace of mind. Some Yoga Nidra YouTube videos even have more than 10 million lifetime views as well. This has contributed to the industry’s prominence and growth.

The yoga and meditation market size was USD 4.1 billion in 2020 and USD 6.9 billion in 2024. Taking into account the CAGR of 8.7% from 2020 to 2024, it can be inferred that investment and development opportunities are set to remain promising to some extent.

During the historical period, COVID-19 impacted the industry positively. Customers became extremely conscious of their health and well-being. Hence, they were ready to spend both money and time in nature through self-recreational activities like yoga, meditation, art therapy, and many others. This consequently heightened the demand for yoga tourism.

During the forecast period from 2025 to 2035, the industry’s growth is likely to keep rising. Technology like virtual reality and artificial intelligence is going to make yoga and meditation more personalized and engaging. Awareness of mental health is also projected to drive this trend as individuals perceive these practices as effective for stress and anxiety.

Corporate companies still focus on the overall well-being of their employees, and this trend shows no sign of degeneration. Even micro, small, and medium enterprises are considering this trend and allocating budgets to this as well. Corporate wellness programs are likely to grow, offering more jobs for instructors and fueling market growth from 2025 to 2035 and beyond.

Tier 1 companies control the yoga and meditation market. Big names like Lululemon Athletica, Manduka, Alo Yoga, and YogaWorks dominate a large part of the industry. These companies are famous for their strong presence and offer premium products and services globally.

Tier 2 companies include prAna, Hugger Mugger, Jade Yoga, CorePower Yoga, and Yogi Tea. Even though these companies are not as large as Tier 1 companies, they are esteemed for their expertise. These mid-sized companies, often with a strong regional presence, provide quality products and services at a lower price point.

Tier 3 companies comprise Saje Natural Wellness, Liforme, Spiritual Gangster, Yoga Journal, and Gaia, Inc. While not as perceptible as Tier 1 and Tier 2 companies, they still harvest a decent revenue of USD 548.5 million. What sets them apart is their focus on niche markets and personalized services.

The main differences between these tiers are their industry reach, brand recognition, and pricing strategies. Tier 1 has the widest reach and highest prices, while Tier 3 tends to be more localized and often offers more affordable options.

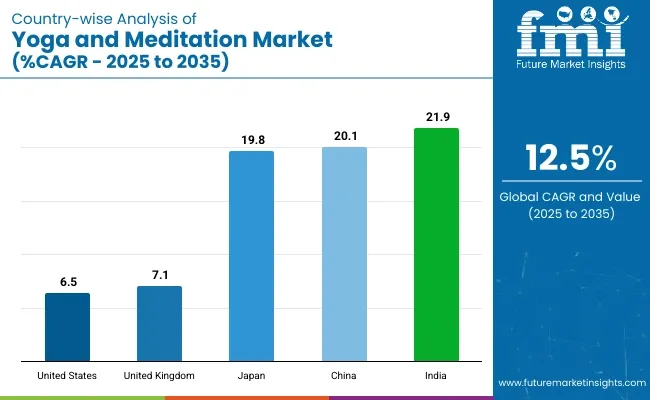

Recent trends in the yoga and meditation market across Europe, Asia Pacific, and North America are discussed below. In North America, the United States leads the industry and is expected to progress at a CAGR of 6.5% from 2025 to 2035. In Europe, the United Kingdom is at the forefront, with a projected CAGR of 7.1% from 2025 to 2035.

In Asia Pacific, India is evolving as a key player in the industry. It is estimated to grow faster than China and Japan, with a CAGR of 21.9% compared to China's 20.1% and Japan’s 19.8% from 2025 to 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 6.5% |

| United Kingdom | 7.1% |

| Japan | 19.8% |

| China | 20.1% |

| India | 21.9% |

The yoga and meditation market statistics report indicates that several brands have emerged as leaders by implementing various strategies. To stay ahead, key players focus on highlighting their unique strengths and offerings.

They now focus on offering online classes and medication apps to acquire more customers. They also collaborate with influencers and coaches to expand their reach.

Many players offer immersive retreats in serene locations. They provide holistic experiences including accommodations, meals, and workshops. Also, they join hands with wellness experts for specialized retreats. They also take the help of social media platforms for marketing purposes.

In the competitive landscape of the yoga and meditation market, top companies focus on tiered pricing models. They offer different pricing tiers for classes or subscriptions. They often add freemium models as well by offering basic features for free to attract users.

Industry Updates

In terms of mode of instruction, the industry is branched into yoga subscription, yoga centers, yoga and meditation workshops, and other modes. The yoga subscription segment is further bi-furcated into app subscription and web subscription.

Based on indication, the industry is bifurcated into physical wellness and mental wellness.

Depending on organizer, the industry is categorized into individuals, schools, corporates, and other institutional organizers.

A regional analysis of the yoga and meditation market is conducted across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, and the Middle East and Africa

The global yoga and meditation market is expected to grow from USD 7.88 billion in 2025 to USD 27.95 billion by 2035, reflecting a CAGR of 13.5% over the forecast period.

The yoga subscription segment is projected to dominate the market with a 38.2% share in 2025, driven by the rapid growth of app- and web-based subscription services offering flexible and on-demand access.

The physical wellness segment is expected to hold the largest market share of 61.5% in 2025, fueled by growing awareness of the physical health benefits of yoga and its increasing adoption for pain management and chronic condition rehabilitation.

The corporate segment is expected to register the fastest CAGR of 7.1% from 2025 to 2035, as organizations incorporate yoga and meditation programs into their wellness strategies to improve employee mental health and productivity.

Top companies include Smiling Mind, Inner Explorer Inc., Calm Headspace Inc., BetterMe, Aura Health, and Simple Habit Inc., offering digital solutions and mindfulness platforms to cater to the growing demand for yoga and meditation services.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Yoga & Meditation Product Industry in Europe - Analysis by Growth, Trends and Forecast from 2025 to 2035

Yoga and Meditation Service Industry Analysis in North Americat Growth – Demand & Forecast 2025 to 2035

Yoga and Meditation Service Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

UK Yoga and Meditation Service Market Trends – Growth, Demand & Outlook 2025-2035

USA Yoga and Meditation Service Market Insights – Growth & Demand 2025-2035

Japan Yoga and Meditation Service Market Trends – Growth, Demand & Forecast 2025-2035

India Yoga and Meditation Service Market Trends – Size, Share & Growth 2025-2035

Thailand Yoga and Meditation Service Market Insights – Size, Share & Industry Trends 2025-2035

Yoga and Pilates Mats Market Trends - Growth & Demand 2025 to 2035

Yoga Market Analysis – Trends & Forecast 2024-2034

Pilates & Yoga Studios Market Trends - Growth & Outlook 2025 to 2035

Mindfulness Meditation App Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA