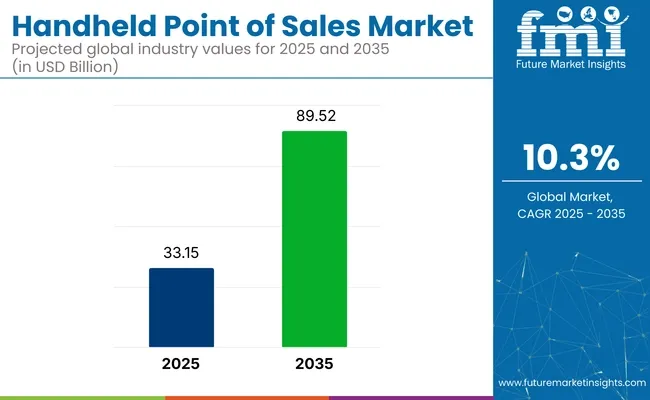

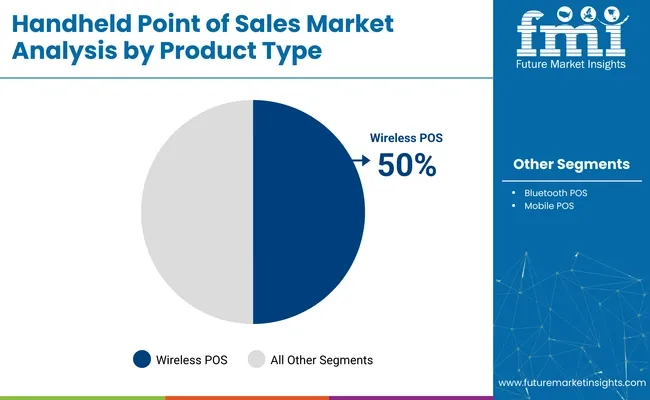

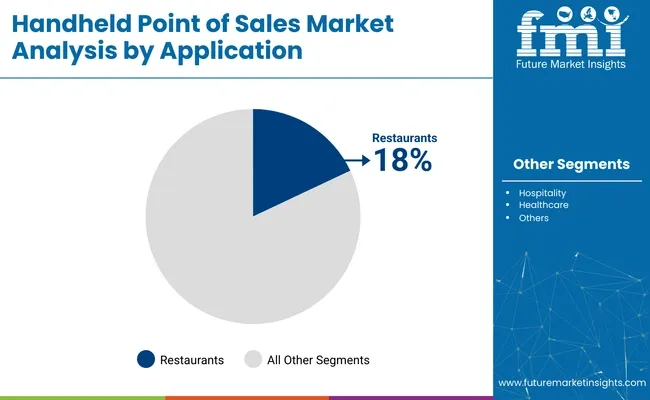

The handheld POS market is projected to grow from USD 33.15 billion in 2025 to USD 89.52 billion by 2035, reflecting a CAGR of 10.3%. Wireless POS devices lead with a 50% share in product types, while the restaurant sector accounts for 18% of applications in 2025. Growth is being driven by demand for mobility, contactless transactions, and seamless customer engagement.

Handheld POS devices allow payments to be processed anywhere tableside, curbside, or on the go enhancing speed and convenience. In April 2025, Toast Inc. introduced its Toast Go 2, a rugged handheld terminal featuring contactless payment, real-time menu sync, and integrated loyalty functions.

This device was built to modernize service in busy restaurants.Verifone updated its Engage™ series with enhanced battery life, NFC support, and multi-layered EMV security in late 2024. These improvements are designed to secure mobile payments and simplify deployment in retail and hospitality environments. Such advancements reflect the broader industry focus on compact hardware, reliable connectivity, and regulatory compliance.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 33.15 Billion |

| Market Size in 2035 | USD 89.52 Billion |

| CAGR (2025 to 2035) | 10.3% |

Mobile POS adoption is being boosted by integrations with cloud-based loyalty, inventory, and analytics platforms. Square, PAX, and Ingenico are offering Android-based terminals that support both offline and online use cases.

AI-driven features such as dynamic upselling, real-time inventory alerts, and sales analytics are being embedded to deliver operational insights at the point of service.Regional trends show North America dominating due to early digital payment adoption and strong POS infrastructure. However, Asia-Pacific is expected to grow faster, propelled by rising card use and smartphone penetration in markets like India and Southeast Asia.

As businesses continue to prioritize mobility, personalization, and data-driven operations, handheld POS systems are being relied upon to deliver faster checkout, better customer engagement, and richer business intelligence. This transformation positions handheld POS at the center of digital commerce strategies through 2035.

Demand for mobile-first retail operations is fueling the handheld POS market. Wireless POS systems and restaurant applications are emerging as leading growth avenues driven by speed, flexibility, and customer experience optimization.

Wireless POS terminals are projected to capture 50% of the handheld POS market in 2025. These devices empower frontline staff to accept payments anywhere within the premises. Square, Ingenico, and PAX Technology produce terminals that support WiFi, Bluetooth, and 4G connections.

Android-based platforms are being used to integrate POS with CRM systems, enabling tasks like customer profiling and loyalty program management on the go. Mobile payment demand, especially in hospitality and curbside retail, is driving adoption of compact and robust wireless readers.

The restaurant sector is estimated to represent 18% of handheld POS applications in 2025. Mobile ordering, contactless payments, and real-time order management are key demand drivers in both quick-service and full-service establishments. The Toast Go 2 was launched to streamline table-side ordering and payments.

Other solutions from Lightspeed and Revel Systems include features like digital tipping, guest feedback, and real-time menu updates. These tools reduce wait times and boost customer satisfaction. Mobile POS systems are becoming essential for delivering efficient and personalized dining experiences.

Android-based Handheld POS leads the market, capturing approximately 60% of the market share due to its open-source nature, flexibility, and compatibility with a wide range of devices and applications. It is favored for its seamless integration with cloud-based solutions, real-time analytics, and mobile payment support, making it the preferred choice for retailers and service industries.iOS-based Handheld POS follows closely with around 20% market share.

It is preferred in environments demanding high security, reliability, and seamless integration with Apple devices, such as high-end retail, hospitality, and financial services.Windows-based Handheld POS caters to enterprises with legacy systems and accounts for approximately 10% of the market share.

It is primarily used by large businesses that need specific software solutions and integration capabilities.Other operating systems, including proprietary systems, are emerging and are projected to hold around 10% of the market share. These systems cater to specialized markets, offering unique features for specific use cases.

Hardware is the dominant component, holding approximately 50% of the market share. This segment includes devices like card readers, POS terminals, and scanners, which are essential for mobile payment processing and are driving the adoption of handheld POS systems.Software follows closely with around 30% market share.

Software is critical for enabling payment processing, inventory management, and customer relationship management (CRM) features. With cloud-based solutions, it is rapidly evolving to offer more features such as real-time data analysis, sales insights, and inventory tracking, contributing to its growth.

Services, which include installation, maintenance, and cloud-based support, represent approximately 20% of the market share. These services ensure continuous performance, security, and compliance, helping businesses optimize their handheld POS systems and supporting the overall growth of the market.

Handheld POS adoption is fueled by the global pivot to cashless, mobile-first payments and strong regional growth-especially in Asia-Pacific. However, high compliance costs, integration hurdles with legacy systems, and significant hardware/software investments still pose obstacles, particularly for smaller businesses and markets with limited digital infrastructure.

Mobile-First Transactions and Digital Payments Fuel Handheld POS Market Expansion

The handheld POS market is increasingly driven by the global shift toward cashless payments. Consumers want seamless, onthego transactions whether in retail, hospitality, or transit-boosting demand for wireless, mobile-ready devices. The AsiaPacific region led the market in 2024, capturing 34.4% of global revenue due to rapid urbanization and SME digitalization.

Meanwhile, North America follows closely, supported by advanced infrastructure and early adoption of digital payment systems. As mobile POS systems now offer real-time analytics, inventory tracking, and remote customer engagement, businesses are rapidly deploying them to stay competitive and customer-focused in a digital-first economy.

Data Security, Integration Barriers, and High Costs Limit Handheld POS Adoption

Despite rising adoption, handheld POS solutions face significant barriers. Data security and privacy obligations such as PCI-DSS compliance and encryption add layers of complexity and cost that can deter small and mid-sized companies.

Integration issues also persist: legacy systems and fragmented databases prevalent in hospitality and retail make deploying new POS platforms resource-intensive and slow. In addition, hardware costs (smart devices, card readers) and ongoing expenses for software updates and cloud services remain challenging for operators with constrained budgets, particularly in emerging markets, impeding widespread upgrades.

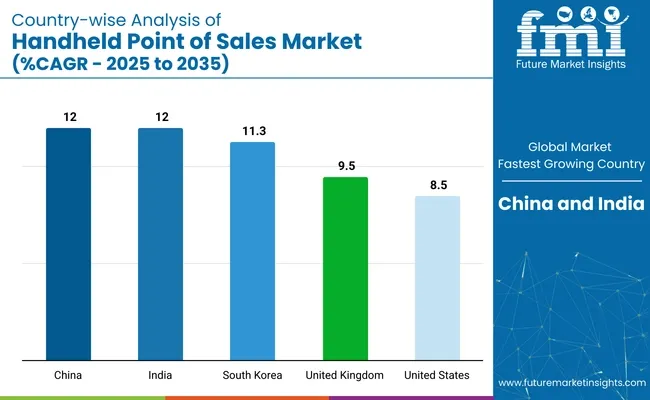

The handheld point of sale (POS) market is accelerating as mobile-first commerce and digital transactions expand across retail, hospitality, and logistics sectors. Countries including the United States, China, India, South Korea, and the United Kingdom are advancing software innovation, contactless payment infrastructure, and hardware manufacturing to support secure and efficient payment experiences.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 12% |

| India | 12% |

| South Korea | 11.3% |

| United Kingdom | 9.5% |

| United States | 8.5% |

The United States handheld POS market is projected to grow at a CAGR of 8.5% through 2035. Rising demand for mobile checkout solutions in quick-service restaurants, retail chains, and delivery platforms is driving adoption. Companies such as Square, Toast, and Clover are providing cloud-integrated, NFC-enabled POS systems.

Data encryption, EMV compliance, and PCI standards are supporting secure transactions. Retailers are integrating handheld devices with CRM and inventory systems for real-time tracking. Demand from food trucks, curbside pick-ups, and event merchants continues to grow. The USA remains the largest market by value, supported by mature payment infrastructure and tech-forward merchants.

The handheld POS market in the United Kingdom is expected to grow at a CAGR of 9.5% through 2035. Contactless transactions, mobile wallets, and fintech penetration are accelerating handheld POS deployments. Firms such as SumUp, Zettle by PayPal, and Revolut are streamlining mobile payments for SMEs and micro-merchants.

Retailers are adopting handheld terminals to reduce queue times and enhance in-store experience. Government-backed cashless initiatives and open banking APIs are enabling real-time settlement. Handheld POS integration with e-commerce platforms is supporting omnichannel operations. With strong digital banking infrastructure, the UK remains a leader in portable payment system innovation in Europe.

China’s handheld POS market is projected to grow at a CAGR of 12.0% through 2035, driven by its cashless economy and robust mobile payment ecosystems. Companies such as Sunmi, Newland, and PAX Technology dominate device manufacturing. Integration with Alipay and WeChat Pay enables instant transactions across retail, transit, and food delivery.

Government efforts to promote digital RMB and 5G-enabled devices are boosting smart terminal deployment. Retail digitization in Tier 2 and Tier 3 cities continues to grow. Hardware-software ecosystems are localized for regional merchant needs. China remains a global hub for handheld POS production, distribution, and payment innovation.

India’s handheld POS market is forecasted to grow at a CAGR of 12.0% through 2035. Government-led digitization programs such as Digital India and UPI are increasing mobile payment acceptance. Fintech players like Pine Labs, Paytm, and Mswipe are supplying affordable, wireless POS devices to small merchants.

Retailers, delivery agents, and healthcare providers are adopting handheld terminals for faster transactions. Growth in Tier 2 and Tier 3 cities is supported by mobile network expansion and digital literacy initiatives. Integration with QR-based payments and Aadhaar-linked services is enabling frictionless checkout. India is emerging as both a high-growth market and exporter of low-cost POS solutions.

South Korea’s handheld POS market is expected to grow at a CAGR of 11.3% through 2035. A strong technology ecosystem and rapid consumer adoption of contactless payments are key enablers. Companies like KSNET, KICC, and LG CNS are providing AI-enabled, 5G-connected POS terminals.

Retailers and cafes use handheld POS to streamline ordering and integrate with loyalty apps. Public transportation, convenience stores, and pop-up stores are deploying POS systems with facial recognition and biometric security. Government initiatives supporting cashless transactions and fintech partnerships further accelerate growth. South Korea remains a front-runner in Asia for deploying next-gen, portable payment infrastructure.

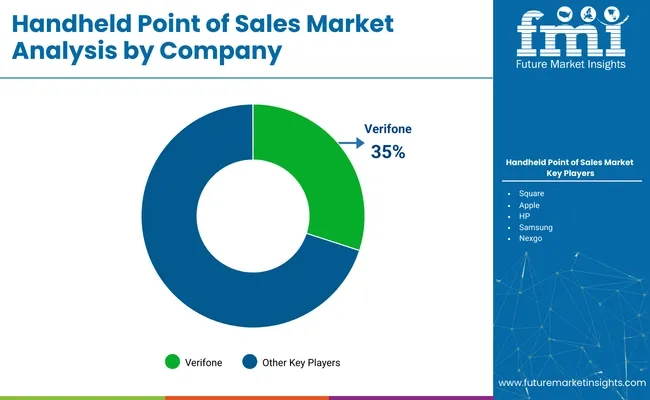

The handheld POS market is moderately consolidated, dominated by Tier 1 players like Square, Verifone, Ingenico (Worldline), PAX Tech, and Zebra Technologies-renowned for their integrated hardware-software ecosystems, global reach, and enterprise-grade solutions. Tier 2 firms such as HP, Samsung, and Apple focus on rugged mobile devices that blend consumer-grade ease with business-grade durability.

Tier 3 vendors cater to niche sectors like healthcare, hospitality, and transportation, providing specialized devices. Barriers include regulatory compliance, integration with merchant systems, and high R&D costs. Key trends driving growth include digital and contactless payments, AI-powered inventory tools, and cloud-based POS adoption especially in emerging markets where handheld flexibility is critical.

Recent Handheld POS Industry News

In May 2025, Square unveiled its new Square Handheld, a lightweight, phone-like terminal priced at USD 399. It supports taptopay, barcode scanning, inventory management, and seven sector-specific modes, weighing just 11 ounces and under an inch thick. The device aligns hardware with Square’s unified POS app and offers AI-ready accessory support, like Belkin cases. This launch reinforces Square’s dominance in user-friendly, mobile-first POS tools and reflects a broader industry move toward portable, cloud-based systems integrating software, payments, and analytics.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 33.15 billion |

| Projected Market Size (2035) | USD 89.52 billion |

| CAGR (2025 to 2035) | 10.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Component Outlook (Segment 1) | Hardware, Software, Services |

| Product Type Outlook (Segment 2) | Wireless Handheld POS, Bluetooth Handheld POS, Mobile Handheld POS |

| Operating System Outlook (Segment 3) | Android-based Handheld POS, iOS-based Handheld POS, Windows-based Handheld POS, Others |

| Application Outlook (Segment 4) | Restaurant, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, United Kingdom, Germany, France, China, India, Japan, South Korea, Australia, Brazil, United Arab Emirates, Saudi Arabia, South Africa |

| Key Players influencing the Handheld POS Market | Square, Verifone , Ingenico ( Worldline ), PAX Technology, Zebra Technologies, HP, Samsung, Apple, Nexgo , Newland Digital Technology |

| Additional Attributes | Dollar sales by component, product type, and OS platform; Retail and hospitality dominance in application volume; Integration with digital wallets and cloud services; Regional hardware-software bundling trends; Growth of Android-based terminals in emerging markets; Impact of mobility and wireless connectivity in POS transactions |

The handheld point of sale market is segmented by component into hardware, software, and services.

Based on product type, the market includes wireless handheld POS, Bluetooth handheld POS, and mobile handheld POS.

In terms of operating system, the market is categorized into Android-based handheld POS, iOS-based handheld POS, Windows-based handheld POS, and others.

By application, the market is segmented into restaurant, hospitality, healthcare, retail, warehouse, entertainment, and others.

Geographically, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is projected to reach USD 89.52 billion by 2035 from USD 33.15 billion in 2025.

Wireless POS systems will lead with a 50% market share in 2025.

The restaurant segment dominates with an 18% market share in 2025.

Demand for mobility, contactless payments, cloud integration, and real-time analytics are key growth drivers.

Leading companies include Square, Verifone, Ingenico (Worldline), PAX Technology, and Zebra Technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Handheld DC Torque Tools Market

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Wireless Handheld Spectrometer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA