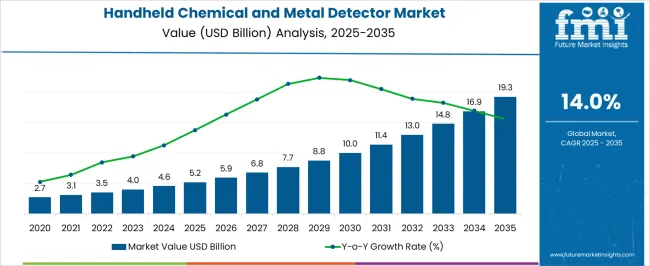

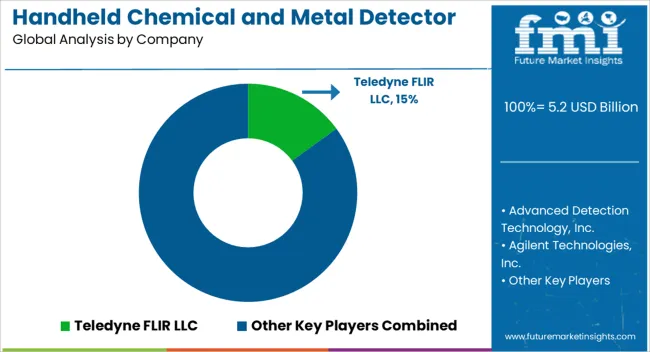

The handheld chemical and metal detector market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 19.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.0% over the forecast period.

From 2025 to 2035, values rise consistently from USD 4.1 billion to USD 6.4 billion, reflecting growing demand driven by factors such as rising birth rates, increased awareness about infant hygiene, and improved product innovations. Analyzing the year-over-year (YoY) growth, the market experiences a steady expansion with an average annual increment of approximately USD 0.15 billion in the early years (2023-2027), gradually increasing to around USD 0.20 billion annually between 2030 and 2035.

The market is growing due to rising global security concerns, stricter regulatory requirements, and expanding applications across multiple sectors. Increasing threats from terrorism, drug trafficking, and cross-border smuggling are driving adoption by defense, law enforcement, and customs agencies. Industrial sectors such as mining, oil and gas, and chemical processing are using handheld detectors to ensure workplace safety and compliance with hazardous material regulations. Technological advancements including AI-enabled analytics, multi-sensor fusion, and miniaturization have improved detection accuracy, portability, and ease of use, boosting adoption. Additionally, growing demand for narcotics detection, environmental monitoring, and emergency response solutions further supports strong market growth worldwide.

| Metric | Value |

|---|---|

| Handheld Chemical and Metal Detector Market Estimated Value in (2025 E) | USD 5.2 billion |

| Handheld Chemical and Metal Detector Market Forecast Value in (2035 F) | USD 19.3 billion |

| Forecast CAGR (2025 to 2035) | 14.0% |

The handheld chemical and metal detector market is showing robust growth, fueled by the rising need for portable, accurate, and rapid detection tools across critical field operations. Increasing concerns over national security, cross-border threats, and industrial safety are driving the adoption of real-time detection devices capable of identifying a wide range of hazardous substances.

The transition from bulky, fixed systems to compact handheld solutions is being supported by technological advancements in miniaturization, sensor sensitivity, and user-friendly interfaces. Moreover, the integration of intelligent analytics and digital reporting has enhanced decision-making in the field, enabling more responsive and proactive threat mitigation.

Future market expansion is expected to be supported by growing investments in homeland security, military modernization, and disaster response infrastructure across both developed and developing regions With a continued emphasis on threat detection accuracy and operational efficiency, handheld detection technologies are anticipated to remain central to field-based chemical and metal identification strategies.

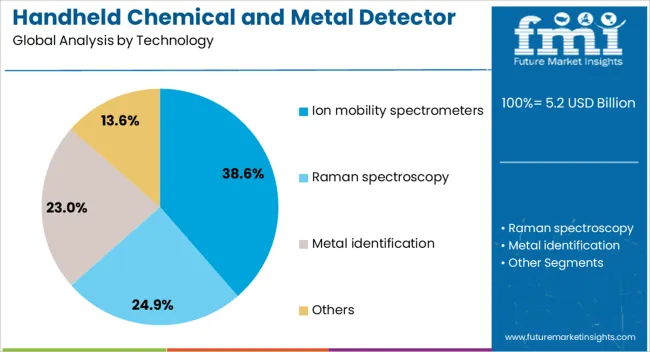

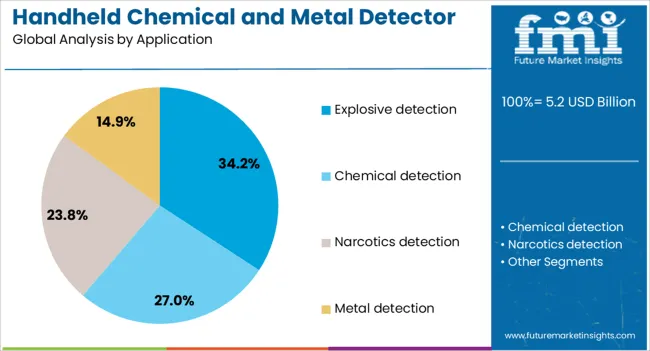

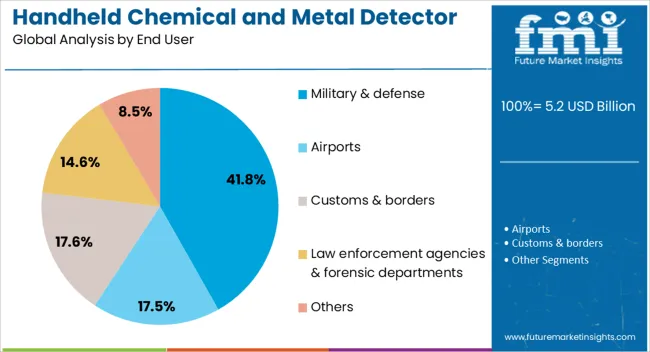

The handheld chemical and metal detector market is segmented by technology, application, end user, and geographic regions. By technology, the market is divided into Ion mobility spectrometers, Raman spectroscopy, metal identification, and others. In terms of application, the market is classified into explosive detection, chemical detection, narcotics detection, and metal detection. Based on end user, the market is segmented into military & defense, airports, customs & borders, law enforcement agencies & forensic departments, and others. Regionally, the handheld chemical and metal detector industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Ion mobility spectrometers segment is projected to hold 38.6% of the market revenue share in 2025, positioning it as the leading technology segment. This dominance is being attributed to the high sensitivity, rapid response time, and portability of ion mobility-based systems, which make them well-suited for detecting trace levels of hazardous chemicals and explosives in field environments.

These detectors are preferred for their ability to operate in rugged and unpredictable conditions without compromising performance. Their lightweight design and ability to deliver real-time results have made them integral to security screening, border control, and emergency response applications.

In addition, advancements in battery life, miniaturized drift tube technology, and integrated data analysis capabilities have enhanced the operational reliability of these instruments As field operatives and defense personnel prioritize accuracy and mobility, ion mobility spectrometers are expected to remain a critical component of handheld detection systems.

The explosive detection segment is expected to account for 34.2% of the market revenue share in 2025, making it the largest application segment. This leading position is being driven by the growing threat of improvised explosive devices and the increased emphasis on counter-terrorism strategies globally.

Handheld detectors used for explosive identification have gained prominence due to their ability to provide fast, reliable results in high-pressure security environments such as airports, event venues, and conflict zones. The portability and ease of deployment of these devices have made them essential tools for law enforcement and first responders.

Demand has also risen due to ongoing geopolitical tensions and the growing need for on-site threat verification without delay Continued innovation in detection range, selectivity, and false-positive reduction is expected to support further growth in this segment, as rapid and accurate identification of explosive materials remains a high priority for national and civilian safety programs.

The ilitary and defense segment is projected to contribute 41.8% of the total revenue in the market in 2025, emerging as the largest end-user category. This leadership is being supported by growing investments in tactical detection technologies used in combat, surveillance, and field reconnaissance operations.

Handheld devices provide the necessary mobility and speed required by military personnel to detect and analyze chemical agents or metallic threats in mission-critical scenarios. As modern warfare increasingly involves chemical and biological risks, there is a strong demand for compact tools that offer rapid, accurate identification capabilities under extreme conditions.

These devices are also favored due to their rugged design, ease of use with minimal training, and compatibility with military-grade communication systems Additionally, ongoing modernization programs and defense procurement strategies are focusing on enhancing soldier survivability and threat awareness, which in turn is reinforcing the dominance of this segment across global military applications.

Rising Security Threats to Bolster Demand

The handheld chemical and metal detector market is growing rapidly due to rising global security threats, stricter safety regulations, and expanding applications across industries. Heightened concerns over terrorism, drug trafficking, and public safety have driven adoption by law enforcement, airports, and border security agencies. At the same time, industries such as oil and gas, mining, and manufacturing rely on portable detectors to ensure workplace safety and regulatory compliance. Technological advancements including artificial intelligence integration, miniaturization, and multi modal detection have improved sensitivity, portability, and accuracy, boosting uptake. Expanding use in environmental monitoring, food safety, and quality control further supports strong market growth worldwide.

A key trend in the handheld chemical and metal detector market is the integration of artificial intelligence and advanced sensor fusion to enable multi modal detection in a single portable device. This allows users to identify a wider range of threats such as explosives, narcotics, hazardous chemicals, and concealed metals with higher accuracy and faster response times. AI driven analytics also reduce false alarms and improve decision making in the field, making detectors more reliable for law enforcement, defense, and industrial safety applications. This trend is accelerating adoption across security and non security sectors and positioning smart AI enabled handheld detectors as the next growth driver in the market.

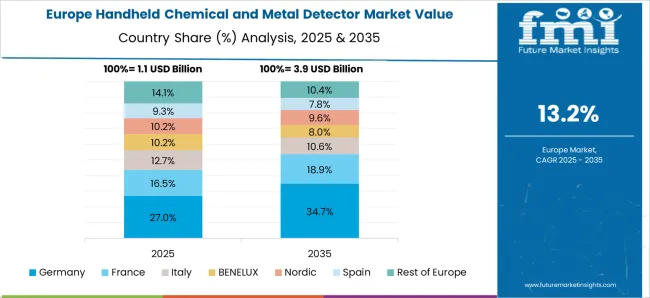

The global handheld chemical and metal detector market is projected to grow at a CAGR of 10.4% through 2032, supported by increasing adoption across security agencies, industrial safety environments, and defense applications. Among BRICS nations, China leads with 12.1% growth, driven by large-scale domestic production and rising homeland security budgets. India follows at 11.4%, where demand from law enforcement and border control is expanding rapidly. In the OECD region, Germany reports 9.6% growth, underpinned by strict regulatory standards and advanced technology adoption. France, growing at 8.9%, benefits from integration of handheld devices in both airport security and emergency response services. The United Kingdom, at 8.3%, reflects steady procurement by defense agencies and consistent usage in public safety infrastructure. Market dynamics have been shaped by security regulations, industrial compliance standards, and technological benchmarks for detection accuracy. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in China’s handheld chemical and metal detector market has been recorded at a CAGR of 12.1%, driven by expanding border control operations and rapid urban security upgrades. Domestic manufacturers have invested in developing AI-enabled multi-sensor detectors with higher sensitivity and portability. Distribution channels have expanded to include provincial law enforcement agencies and customs departments. Demand for narcotics and explosive detection has surged, especially in major airports and freight terminals. Industrial users in mining and chemical processing plants have adopted portable detectors for compliance monitoring. Export-oriented producers have also scaled up capacity to meet demand in Asia-Pacific markets.

India has witnessed steady growth in the handheld chemical and metal detector market at a CAGR of 11.4%, supported by heightened security concerns and investments in smart city projects. Local manufacturers have introduced cost-efficient portable detectors to cater to police forces and transportation hubs. Rural and semi-urban regions are increasingly adopting mobile security checkpoints, driving demand for lightweight and rugged devices. Online procurement platforms and government tenders have improved accessibility across states. Product innovation has centered on handheld Raman spectroscopy devices for drug detection and miniaturized detectors for frontline police use. Training programs for security personnel have accelerated device adoption nationwide.

A CAGR of 9.6% has been observed in Germany’s handheld chemical and metal detector market, driven by advanced regulatory standards and a strong focus on precision technologies. Manufacturers have developed biometric-enabled handheld detectors to ensure secure operator use. Devices featuring AI-based false alarm reduction have gained traction across airports and seaports. Industrial adoption is strong in the chemical and pharmaceutical sectors, where strict safety mandates require accurate portable solutions. Premium handhelds with real-time wireless data transmission are increasingly supplied to defense agencies. Eco-conscious product design, including recyclable detector casings, has also emerged as a trend.

Growth of 8.9% CAGR has been recorded in France’s handheld chemical and metal detector market as demand increases for compact and reliable detection solutions. Production facilities have integrated multi-layer sensing technologies that improve accuracy across explosives, narcotics, and chemical agents. Law enforcement has emphasized procurement of hypoallergenic grip materials for operator comfort during extended use. Emergency response teams rely on handheld detectors for hazardous incident management. Retailers and specialized suppliers have promoted lightweight, battery-efficient devices for municipal use. Packaging innovations include compact carrying cases for rapid deployment in urban environments.

The United Kingdom has registered a CAGR of 8.3% in the handheld chemical and metal detector market, driven by sustained investment in public safety and defense. Manufacturers have introduced elasticized side grips and ergonomic back panels to improve portability. Law enforcement and border agencies are deploying hypoallergenic, dermatologically safe grip coatings for extended duty cycles. Retailers and defense contractors have expanded product lines to include AI-enabled narcotics and explosive detectors. E-commerce platforms have enhanced procurement speed for local police authorities. Packaging innovations now support rugged resealable cases for field storage and rapid mobility. Security training programs have reinforced adoption.

The competitive landscape of the handheld chemical and metal detector market is defined by a mix of global technology leaders, regional manufacturers, and specialized startups. Established players such as Smiths Detection, Thermo Fisher Scientific, Bruker, and FLIR Systems dominate with broad product portfolios, strong R&D investments, and government contracts. These companies leverage advanced technologies like AI-driven analytics, Raman spectroscopy, and multi-sensor integration to maintain market leadership.

Regional players in China and India are increasingly competitive, offering cost-efficient detectors tailored for law enforcement and industrial use. Startups and niche innovators are focusing on miniaturization, eco-friendly casings, and wireless data connectivity, catering to emerging smart city and mobile security needs. Strategic collaborations with defense agencies, airports, and customs authorities have become a key growth strategy. Price competitiveness, regulatory compliance, and product reliability remain decisive factors shaping vendor positioning in this rapidly expanding security and safety market.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Technology | Ion mobility spectrometers, Raman spectroscopy, Metal identification, and Others |

| Application | Explosive detection, Chemical detection, Narcotics detection, and Metal detection |

| End User | Military & defense, Airports, Customs & borders, Law enforcement agencies & forensic departments, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Teledyne FLIR LLC, Advanced Detection Technology, Inc., Agilent Technologies, Inc., Amphenol Corporation, Bruker Corporation, Chemring Group PLC, Garrett Metal Detectors, Hitachi High-Technologies Corporation, L-3 Security & Detection Systems, Leidos, Nuctech Company Limited, OSI Systems, Inc. (US), Safariland, Smith Detection, and Teledyne Technologies Incorporated |

| Additional Attributes | Dollar sales by type including metal detectors, chemical detectors, and hybrid detectors, application across security, military, industrial safety, and customs inspection, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing security concerns, rising industrial safety regulations, and technological advancements in portable detection systems. |

The global handheld chemical and metal detector market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the handheld chemical and metal detector market is projected to reach USD 19.3 billion by 2035.

The handheld chemical and metal detector market is expected to grow at a 14.0% CAGR between 2025 and 2035.

The key product types in handheld chemical and metal detector market are ion mobility spectrometers, raman spectroscopy, metal identification and others.

In terms of application, explosive detection segment to command 34.2% share in the handheld chemical and metal detector market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Tagging Gun Market Size and Share Forecast Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Point of Sale Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Ultrasound Scanner Market Analysis – Trends & Forecast 2024-2034

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Handheld DC Torque Tools Market

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Wireless Handheld Spectrometer Market

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA