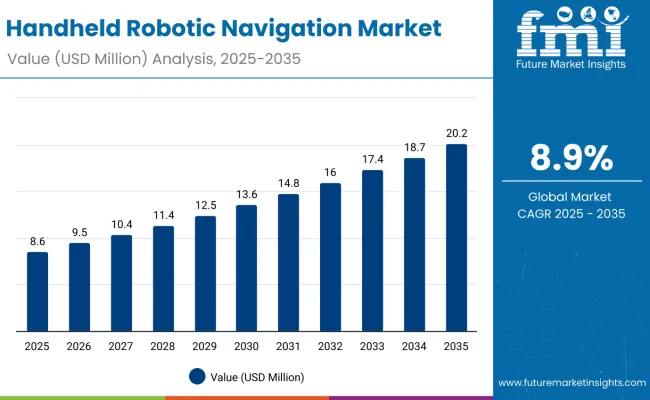

The handheld robotic navigation market is projected to grow from USD 8.6 million in 2025 to approximately USD 20.2 million by 2035, recording an absolute increase of USD 11.6 million over the forecast period. This translates into a total growth of 134.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.9% between 2025 and 2035.

The overall market size is expected to grow by approximately 2.3X during the same period, supported by increasing demand for precision surgical procedures, growing adoption of robotic-assisted surgery, and rising integration of advanced navigation technologies across global hospital and surgical center sectors.

Handheld Robotic Navigation Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 8.6 million |

| Forecast Value in (2035F) | USD 20.2 million |

| Forecast CAGR (2025 to 2035) | 8.90% |

Between 2025 and 2030, the handheld robotic navigation market is projected to expand from USD 8.6 million to USD 13.6 million, resulting in a value increase of USD 5.0 million, which represents 43.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of robotic stabilization technologies, rising demand for precision surgical navigation, and growing utilization in specialized surgical departments. Medical device manufacturers and surgical robotics specialists are expanding their product portfolios to address the growing preference for handheld navigation systems in robotic surgical procedures.

From 2030 to 2035, the market is forecast to grow from USD 13.6 million to USD 20.2 million, adding another USD 6.6 million, which constitutes 56.9% of the overall ten-year expansion. This period is expected to be characterized by the advancement of semi-autonomous execution technologies, the integration of AI-powered navigation platforms for premium surgical procedures, and the development of specialized systems for complex robotic surgical applications. The growing emphasis on surgical precision optimization and patient outcomes will drive demand for advanced handheld robotic navigation systems with enhanced imaging capabilities and improved surgical effectiveness.

Between 2020 and 2024, the handheld robotic navigation market experienced rapid growth, driven by increasing adoption of robotic surgical systems and growing recognition of navigation technologies' effectiveness in enhancing surgical precision across hospital and surgical center applications. The market developed as healthcare providers recognized the potential for handheld robotic navigation to improve surgical outcomes while meeting modern healthcare requirements for minimally invasive treatment options. Technological advancement in surgical robotics and navigation systems began emphasizing the critical importance of maintaining surgical precision while extending patient outcomes and improving surgical success rates.

The handheld robotic navigation market represents a high-growth frontier within surgical robotics and advanced navigation systems, projected to expand from an estimated USD 65-80 million in 2025 to USD 180-250 million by 2035, achieving a 12-15% CAGR (2.5-3X growth). Expansion is driven by accelerating adoption of minimally invasive procedures, surgeon demand for flexible low-cost navigation adjuncts, and integration of AI-enabled guidance into portable surgical tools.

This convergence opportunity leverages the need for cost-effective alternatives to full robotic systems, surgeon mobility and control during procedures, and miniaturization of real-time navigation technologies to create handheld devices that deliver precision, portability, and interoperability in the operating room. Orthopedic, spinal, neurosurgical, and ENT procedures dominate demand, with early uptake in developed markets where surgical robotics penetration and capital investment are highest.

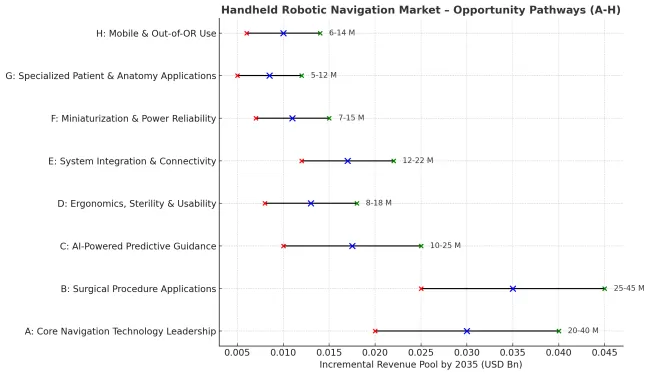

Pathway A - Core Navigation Technology Leadership

The leading value segment, focused on precision mapping and real-time localization through sensor fusion (optical, IMU, ultrasound, LiDAR). Companies that achieve sub-millimeter accuracy with robust, drift-resistant handheld navigation systems will secure early leadership. Expected revenue pool: USD 20-40 million

Pathway B - Surgical Procedure Applications (Spine, Ortho, Neuro, ENT)

The dominant application driver, reflecting demand for procedure-specific handheld tools tailored to spine implants, neurosurgical targeting, orthopedic alignment, and ENT micro-navigation. Providers developing specialty variants validated in clinical workflows will capture this core growth. Opportunity: USD 25-45 million

Pathway C - AI-Powered Predictive Guidance

Next-generation solutions require intelligent assistance with predictive path planning, automated safety boundaries, and recognition of anatomical structures. Companies investing in AI algorithms with strong clinical validation will gain premium positioning. Revenue uplift: USD 10-25 million

Pathway D - Ergonomics, Sterility & Usability

Surgeon acceptance depends on lightweight, ergonomically optimized designs with haptic feedback, sterilizable housings, and disposable covers. Products delivering superior ease-of-use in the operating room will reduce adoption friction and boost compliance. Expected upside: USD 8-18 million

Pathway E - System Integration & Connectivity

Solutions that integrate seamlessly with imaging modalities (CT, MRI, fluoroscopy), hospital PACS, and robotic surgical suites provide higher value for providers. Companies delivering plug-and-play interoperability will build defensible ecosystems. USD 12-22 million

Pathway F - Miniaturization & Power Reliability

Handheld systems require compact sensors, long battery life, and consistent reliability under sterilization cycles. Firms advancing in power management, embedded compute, and ruggedized designs will differentiate strongly. Pool: USD 7-15 million

Pathway G - Specialized Patient & Anatomy Applications

Developing devices tailored for pediatrics, small-anatomy navigation (inner ear, deep brain), and soft tissue deformation cases offers niche but high-value opportunities beyond standard adult use cases. Expected revenue: USD 5-12 million

Pathway H - Mobile & Out-of-OR Use

Emerging adoption in ambulatory surgical centers, remote hospitals, and outpatient clinics creates demand for rugged, portable, cost-efficient handheld navigators. Companies addressing this segment will unlock incremental growth. Pool: USD 6-14 million

Market expansion is being supported by the increasing global demand for precision surgical procedures and the corresponding shift toward robotic-assisted surgical technologies that can provide superior patient outcomes while meeting healthcare requirements for precise and effective surgical intervention. Modern healthcare providers are increasingly focused on incorporating advanced handheld robotic navigation techniques to enhance surgical success rates while satisfying demands for comprehensive robotic surgery services and specialized surgical navigation capabilities. Handheld robotic navigation systems' proven ability to deliver effective surgical guidance, precision enhancement, and surgeon satisfaction makes them essential technologies for robotic surgery programs and specialized surgical departments.

The growing emphasis on personalized surgical care and precision medicine is driving demand for high-quality handheld robotic navigation systems that can support distinctive surgical outcomes and comprehensive robotic surgery positioning across hospital, surgical center, and specialized robotics categories. Healthcare provider preference for technologies that combine surgical excellence with advanced navigation capabilities is creating opportunities for innovative handheld robotic navigation implementations in both traditional and emerging surgical applications. The rising influence of minimally invasive surgery programs and precision surgical initiatives is also contributing to increased adoption of specialized handheld robotic navigation systems that can provide authentic surgical enhancement characteristics.

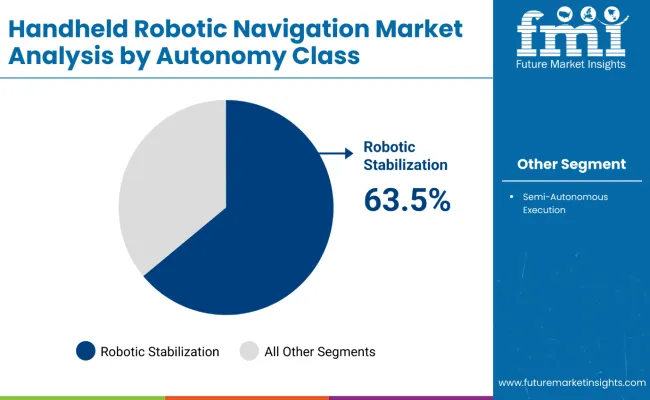

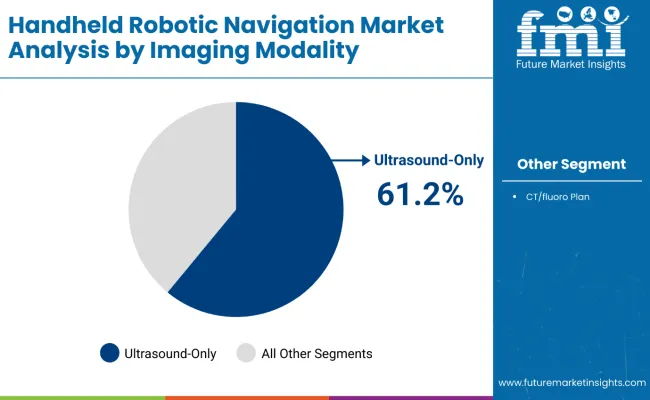

The market is segmented by autonomy class, imaging modality, end user, and region. By autonomy class, the market is divided into robotic stabilization and semi-autonomous execution. Based on imaging modality, the market is categorized into ultrasound-only and CT/fluoro plan. By end user, the market covers hospitals, large tertiary & academic hospitals, and ambulatory surgical centers. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The robotic stabilization segment is projected to account for 63.5% of the handheld robotic navigation market in 2025, reaffirming its position as the leading autonomy class category. Medical device manufacturers and surgical robotics producers increasingly utilize robotic stabilization for its superior precision capabilities, surgical compatibility, and essential functionality in robotic navigation procedures across diverse surgical applications. Robotic stabilization's standardized design elements and proven effectiveness directly address the clinical requirements for precise surgical guidance and optimal procedural outcomes in robotic surgical operations.

This autonomy class forms the foundation of modern handheld robotic navigation applications, as it represents the technology with the greatest surgical precision potential and established compatibility across multiple robotic surgical systems. Manufacturer investments in robotic stabilization optimization and specialized design continue to strengthen adoption among medical equipment producers. With healthcare providers prioritizing surgical precision and patient outcomes, robotic stabilization aligns with both clinical effectiveness objectives and safety assurance requirements, making it the central component of comprehensive handheld robotic navigation surgical strategies.

Ultrasound-only imaging modalities are projected to represent 61.2% of the handheld robotic navigation market in 2025, underscoring their critical role as the primary imaging technology for real-time surgical navigation and precision guidance applications. Healthcare providers and surgeons prefer ultrasound-only approaches for their exceptional real-time visualization capabilities, non-invasive imaging features, and ability to provide continuous surgical guidance while supporting advanced robotic surgical requirements during complex navigation procedures. Positioned as essential technologies for high-performance robotic surgery, ultrasound-only imaging offers both technological advancement and clinical effectiveness advantages.

The segment is supported by continuous advancement in ultrasound imaging technology and the growing availability of specialized integration programs that enable enhanced surgical visualization and procedural outcome optimization at the imaging level. Additionally, surgical teams are investing in advanced ultrasound-only techniques to support clinical excellence and improved surgical outcomes. As ultrasound imaging technology continues to advance and healthcare providers seek superior visualization solutions, ultrasound-only imaging will continue to dominate the imaging landscape while supporting technology advancement and surgical outcome optimization strategies.

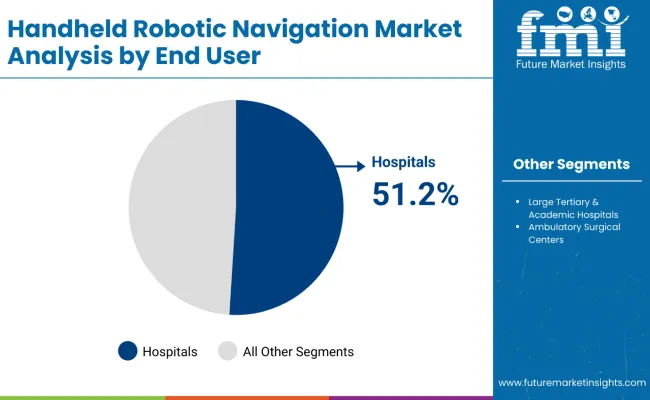

Hospitals are projected to represent 51.2% of the handheld robotic navigation market in 2025, underscoring their critical role as the primary end user for specialized robotic surgical services and comprehensive surgical navigation applications. Healthcare administrators and surgical departments prefer hospital-based handheld robotic navigation services for their comprehensive surgical capabilities, specialized equipment availability, and ability to provide integrated robotic surgery while supporting complex surgical requirements during advanced navigation procedures. Positioned as essential facilities for high-performance robotic surgery, hospitals offer both technological resources and clinical expertise advantages.

The segment is supported by continuous investment in robotic surgical capabilities and the growing establishment of specialized robotic surgery programs that enable comprehensive patient care and advanced surgical outcomes at the institutional level. Additionally, hospitals are expanding their robotic surgery services to support market differentiation and comprehensive surgical positioning. As robotic surgery continues to advance and institutions seek specialized service offerings, hospitals will continue to dominate the end user landscape while supporting clinical excellence and comprehensive robotic surgery strategies.

The handheld robotic navigation market is advancing rapidly due to increasing surgical robotics adoption and growing demand for precision navigation solutions that emphasize superior surgical outcomes across hospital and surgical center applications. However, the market faces challenges, including high system costs compared to traditional surgical navigation, limited availability of specialized robotic surgery expertise, and competition from established surgical navigation technologies. Innovation in robotic stabilization techniques and surgical robotics training continues to influence market development and expansion patterns.

Expansion of Advanced Robotic Stabilization Applications

The growing adoption of handheld robotic navigation in comprehensive robotic surgery programs and specialized precision surgical applications is enabling medical device manufacturers to develop products that provide distinctive navigation capabilities while commanding premium positioning and enhanced clinical outcome characteristics. Advanced applications provide superior precision while allowing more sophisticated robotic surgical development across various surgical categories and specialty segments. Manufacturers are increasingly recognizing the competitive advantages of robotic stabilization technology positioning for premium product development and surgical robotics market penetration.

Integration of Surgical Outcome Optimization Programs

Modern handheld robotic navigation providers are incorporating advanced surgical planning systems, outcome tracking technologies, and procedural management protocols to enhance surgical success rates, improve precision surgical outcomes, and meet healthcare demands for evidence-based robotic surgical solutions. These programs improve navigation effectiveness while enabling new applications, including personalized surgical planning and integrated robotic surgical systems. Advanced outcome integration also allows providers to support premium market positioning and clinical excellence leadership beyond traditional surgical navigation products.

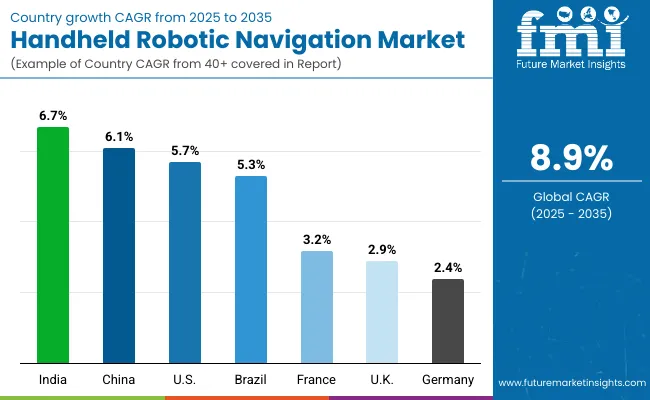

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.70% |

| China | 6.10% |

| USA | 5.70% |

| Brazil | 5.30% |

| France | 3.20% |

| UK | 2.90% |

| Germany | 2.40% |

The handheld robotic navigation market is experiencing robust growth globally, with India leading at a 6.7% CAGR through 2035, driven by the expanding healthcare infrastructure, growing surgical robotics adoption, and increasing investment in precision surgery services. Europe follows at 6.5%, supported by advanced medical technology infrastructure, comprehensive surgical robotics programs, and strong healthcare system integration.

China shows growth at 6.1%, emphasizing healthcare modernization and surgical technology advancement. The USA records 5.7%, focusing on advanced robotic surgery capabilities and specialized surgical expertise while maintaining market leadership in surgical innovation. Brazil demonstrates 5.3% growth, prioritizing healthcare technology access and surgical modernization initiatives. France exhibits 3.2% growth, supported by advanced medical technology and specialized surgical centers. The UK demonstrates 2.9% growth, focusing on NHS surgical technology integration and private surgical services expansion.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from handheld robotic navigation systems in the United States is projected to grow at a CAGR of 5.7% through 2035, supported by strong demand for precision surgical solutions and advanced adoption of robotic-assisted surgical technologies across established healthcare systems. The country's mature surgical robotics ecosystem, coupled with rising awareness of navigation system benefits, is driving consistent expansion. Leading medical device manufacturers and surgical specialists continue to invest in innovation, offering high-quality handheld robotic navigation solutions within a well-regulated clinical environment.

Revenue from handheld robotic navigation systems in Germany is projected to grow at a CAGR of 2.4% through 2035, reflecting steady but moderate expansion as hospitals and surgical centers selectively integrate robotic-assisted navigation technologies. Germany’s strong medical device manufacturing base and well-established healthcare reimbursement structures provide a solid foundation, though adoption rates remain measured compared to higher-growth markets. Investment in advanced surgical navigation tools is gradually increasing, driven by the country’s emphasis on precision, patient safety, and high clinical outcomes.

Revenue from handheld robotic navigation systems in India is projected to exhibit strong growth with a CAGR of 6.7% through 2035, driven by the rapidly expanding healthcare infrastructure and government initiatives supporting surgical technology advancement across major urban centers. The country's growing surgical robotics awareness and increasing acceptance of precision surgical treatments are creating substantial demand for handheld robotic navigation systems in both public and private healthcare settings. Major medical device manufacturers and surgical specialists are establishing comprehensive service capabilities to serve both domestic consumption and regional markets.

Revenue from handheld robotic navigation systems in China is projected to grow at a CAGR of 6.1% through 2035, supported by the country's comprehensive healthcare modernization initiatives, expanding surgical technology infrastructure, and established commitment to precision surgery requiring specialized navigation solutions. Chinese healthcare providers and patients consistently seek innovative surgical treatments that enhance procedural accuracy for both public and private healthcare applications. The country's position as a healthcare technology leader continues to drive innovation in surgical robotics applications and treatment standards.

Revenue from handheld robotic navigation systems in Brazil is projected to grow at a CAGR of 5.3% through 2035, supported by the country's expanding healthcare technology infrastructure, growing surgical modernization initiatives, and increasing adoption of specialized precision surgery requiring navigation solutions. Brazilian healthcare providers and patients prioritize comprehensive surgical care and advanced procedural techniques, making handheld robotic navigation systems essential tools for both public and private healthcare applications. The country's comprehensive healthcare development and clinical care patterns support continued market expansion.

Revenue from handheld robotic navigation systems in France is projected to grow at a CAGR of 3.2% through 2035, supported by the country's advanced medical technology sector, specialized surgical centers, and established expertise in precision surgical procedures. French healthcare providers' focus on innovation, clinical excellence, and comprehensive patient care creates steady demand for handheld robotic navigation systems. The country's attention to technology integration and surgical outcomes drives consistent adoption across both university medical centers and specialized surgical clinic applications.

Revenue from handheld robotic navigation systems in the United Kingdom is projected to grow at a CAGR of 2.9% through 2035, driven by the country's comprehensive National Health Service surgical programs, expanding private surgical technology sector, and established expertise in precision surgery requiring specialized navigation solutions. British healthcare providers and patients consistently seek innovative surgical treatments that enhance procedural precision for both NHS and private healthcare applications. The country's position as a European healthcare leader continues to drive innovation in surgical technology applications and treatment standards.

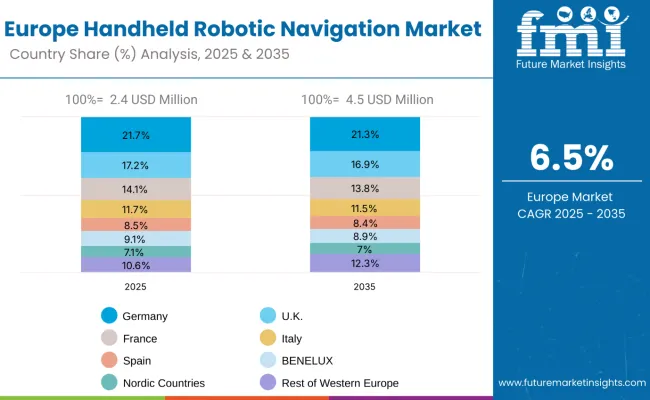

The Europe handheld robotic navigation market is projected to grow from USD 2.4 million in 2025 to USD 4.5 million by 2035, recording a CAGR of 6.5% over the forecast period. Germany leads with a 21.7% share in 2025, maintaining 21.3% by 2035, supported by advanced healthcare infrastructure and strong surgical technology adoption. The United Kingdom follows with 17.2% in 2025, declining slightly to 16.9% by 2035, driven by steady clinical demand but moderated by healthcare cost controls. France accounts for 14.1% in 2025, declining to 13.8% by 2035, reflecting moderate growth from surgical technology centers.

Italy holds 11.7% in 2025, declining to 11.5% by 2035, facing slower adoption rates. Spain contributes 8.5% in 2025, declining to 8.4% in 2035, reflecting stable demand patterns. BENELUX maintains 9.1% in 2025, declining slightly to 8.9% in 2035. The Nordic countries hold 7.1% in 2025, maintaining 7.0% in 2035, supported by high per-capita healthcare spending. The Rest of Western Europe moderates from 10.6% in 2025 to 12.3% in 2035, reflecting varied growth patterns across smaller healthcare markets.

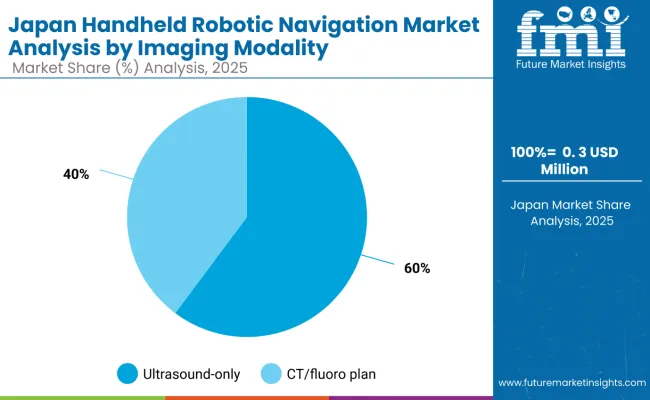

The Japan handheld robotic navigation market is valued at USD 0.3 million in 2025, with ultrasound-only systems holding the lead at 60% share, supported by demand for real-time imaging in advanced surgical procedures. CT/fluoro plan follows with 40%, driven by specialized surgical applications and established imaging protocols. The market distribution highlights Japan's focus on advanced imaging integration and precision surgical capabilities across specialized medical centers.

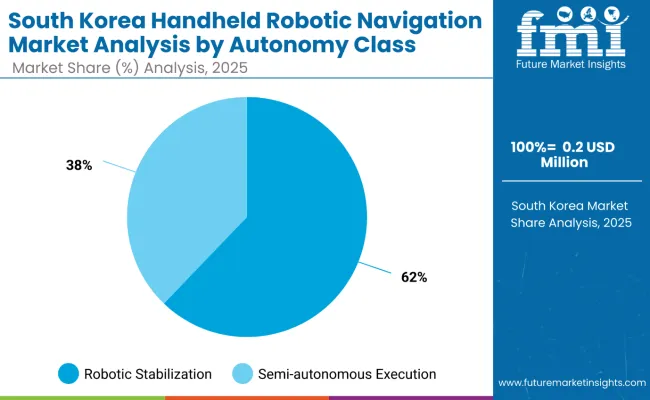

The South Korea handheld robotic navigation market is valued at USD 0.2 million in 2025, led by robotic stabilization at 62% share, supported by growing clinical demand and advanced surgical technology adoption. Semi-autonomous execution holds 38%, driven by emerging surgical robotics applications and technology advancement initiatives. The distribution reflects South Korea's commitment to surgical technology innovation and precision surgery development across specialized healthcare institutions.

The handheld robotic navigation market is characterized by competition among established medical device companies, specialized surgical robotics manufacturers, and integrated navigation solution providers. Companies are investing in advanced robotic stabilization technologies, specialized navigation development systems, application-specific product innovation, and comprehensive clinical training capabilities to deliver consistent, high-performance, and effective handheld robotic navigation solutions. Innovation in surgical precision enhancement, procedural outcome optimization, and customized robotic surgery compatibility is central to strengthening market position and clinical satisfaction.

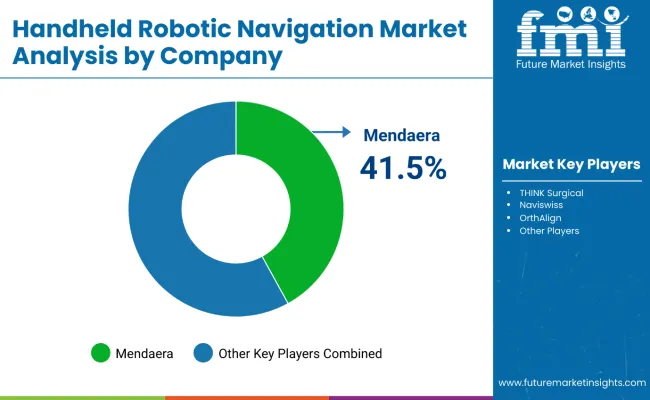

Mendaera leads the market with a 41.5% share, focusing on specialized surgical robotics innovation and comprehensive navigation solutions, offering advanced handheld robotic navigation systems with emphasis on clinical effectiveness and surgical precision excellence. THINK Surgical provides specialized robotic surgery capabilities with a focus on premium surgical technology and integrated navigation systems. Nuviswiss delivers advanced surgical navigation solutions with a focus on precision guidance and operational efficiency. OrthAlign specializes in orthopedic surgical navigation with an emphasis on specialized surgical applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 8.6 Million |

| Autonomy Class | Robotic Stabilization, Semi-Autonomous Execution |

| Imaging Modality | Ultrasound-Only, CT/ Fluoro Plan |

| End User | Hospitals, Large Tertiary & Academic Hospitals, Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Mendaera, THINK Surgical, Nuviswiss, OrthAlign |

| Additional Attributes | Dollar sales by autonomy class, imaging modality, and end user; regional demand trends, competitive landscape, technological advancements in robotic navigation systems, surgical robotics integration initiatives, clinical outcome optimization programs, and precision surgical enhancement strategies |

By North America

By Europe

By Asia Pacific

By Latin America

By Middle East & Africa

The global handheld robotic navigation market is estimated to be valued at USD 8.6 million in 2025.

The handheld robotic navigation market is projected to reach USD 20.2 million by 2035.

The handheld robotic navigation market is expected to grow at an 8.9% CAGR between 2025 and 2035.

The key autonomy classes in the handheld robotic navigation market are robotic stabilization and semi-autonomous execution.

In terms of end users, hospitals are anticipated to command 51.2% share of the handheld robotic navigation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Point of Sale Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Handheld DC Torque Tools Market

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Wireless Handheld Spectrometer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA