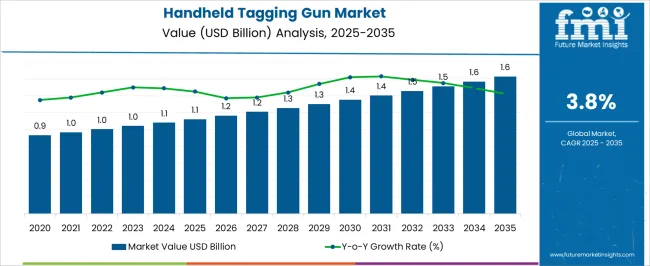

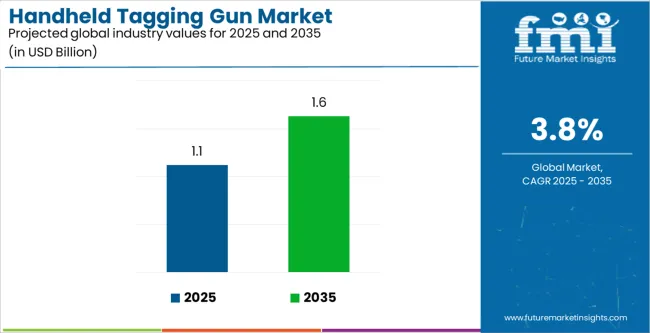

The Handheld Tagging Gun Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

The handheld tagging gun market is experiencing consistent growth driven by increasing retail automation, product identification needs, and the expanding demand for efficient labeling solutions. The current scenario reflects strong adoption across apparel, logistics, and warehouse management sectors due to the operational ease and cost efficiency of tagging devices. Advancements in design ergonomics, material durability, and tagging precision are enhancing product usability and lifespan.

The future outlook remains positive as retail digitization and e-commerce expansion continue to increase the need for accurate product tagging and inventory tracking. Growing integration of tagging systems with barcode and RFID technologies is streamlining workflows, reducing manual errors, and improving operational throughput.

Growth rationale is supported by ongoing technological innovation, scalable product designs suited for high-volume tagging operations, and the steady replacement of manual tagging practices with semi-automated systems These factors collectively are expected to ensure steady revenue expansion and sustained market penetration across end-use industries.

| Metric | Value |

|---|---|

| Handheld Tagging Gun Market Estimated Value in (2025 E) | USD 1.1 billion |

| Handheld Tagging Gun Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

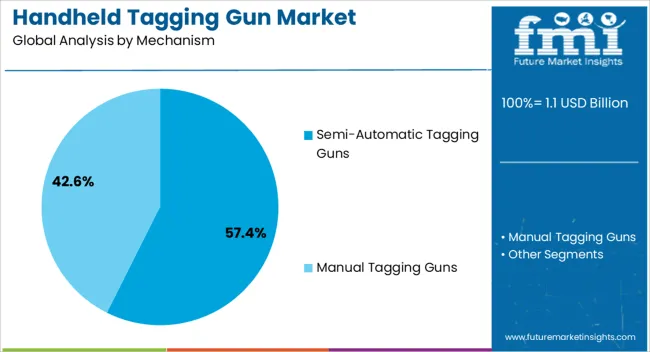

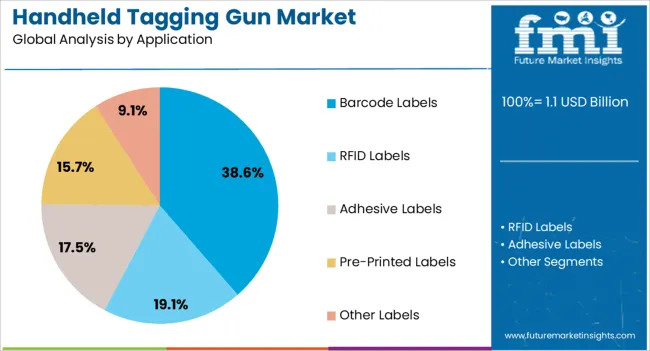

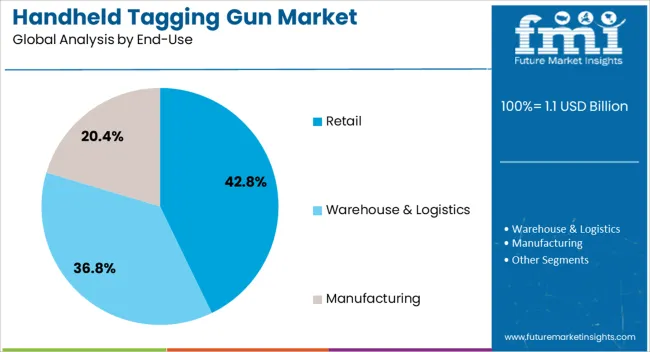

The market is segmented by Mechanism, Application, and End-Use and region. By Mechanism, the market is divided into Semi-Automatic Tagging Guns and Manual Tagging Guns. In terms of Application, the market is classified into Barcode Labels, RFID Labels, Adhesive Labels, Pre-Printed Labels, and Other Labels. Based on End-Use, the market is segmented into Retail, Warehouse & Logistics, and Manufacturing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The semi-automatic tagging guns segment, holding 57.40% of the mechanism category, has been leading the market due to its efficiency, consistency, and reduced operator fatigue. This segment’s dominance is supported by high usability in environments requiring rapid and repetitive tagging such as garment and logistics facilities.

Improved mechanical precision and lightweight design have enhanced user comfort and tagging accuracy, while compatibility with various tag types has increased operational flexibility. Demand has been driven by manufacturers seeking scalable tagging solutions without full automation costs.

Reliability and ease of maintenance have further strengthened adoption rates Continued innovations in trigger mechanisms and tag insertion systems are expected to sustain the segment’s leadership, ensuring its critical role in productivity-driven tagging applications.

The barcode labels segment, representing 38.60% of the application category, has maintained its leading position owing to the increasing reliance on barcoding for product traceability, pricing accuracy, and inventory control. Integration of handheld tagging guns with barcode labeling systems has enabled faster tagging operations and seamless product tracking.

Demand has been further reinforced by the widespread implementation of digital inventory management systems across retail and logistics sectors. High precision in label placement and durability of tags have contributed to improved operational efficiency and compliance with supply chain standards.

As barcode technology continues to evolve toward more compact and data-rich formats, the demand for compatible tagging tools is expected to rise, ensuring sustained growth for this application segment.

The retail segment, accounting for 42.80% of the end-use category, has emerged as the dominant user segment due to high product turnover rates and the necessity for consistent labeling in stores and warehouses. Expansion of organized retail and omnichannel distribution networks has significantly increased tagging volume requirements.

Handheld tagging guns are being preferred for their speed, portability, and ease of use in labeling garments, accessories, and packaged goods. Retailers are adopting ergonomic and semi-automatic models to reduce labor costs and tagging time.

Continuous upgrades in tagging gun durability and compatibility with various tag materials are supporting longer equipment lifecycles With increasing emphasis on accurate pricing and stock management, the retail sector is expected to continue driving the largest share of demand in the handheld tagging gun market.

Global handheld tagging gun sales increased at a CAGR of 1.4% during the historical period. It attained a valuation of USD 1,048.8 million in 2025. Over the forecast period, the global market for handheld tagging guns is projected to expand at 3.8% CAGR.

Expansion of Retail Sector Driving Demand for Handheld Tagging Guns

The global retail industry has emerged as the most dynamic and fast-paced industry, and many players are entering the market. The way of shopping has undergone many changes in consumer behavior and shopping, thereby creating prospects for handheld tagging guns.

Labeling accuracy and efficiency are critical factors in the retail industry. The tagging guns allow retailers to attach the price tags to the products they sell quickly and efficiently and ensure they are correctly priced for display and sales.

Retailers have to deal with a lot of inventory, and handheld tagging guns can facilitate efficient inventory management as they allow labeling with barcodes, SKUs, etc. Proper labeling helps streamline the tracking, restocking, and order fulfillment process. These handheld tagging guns are an ideal solution for managing these things.

Growth of the retail industry will likely drive the demand for handheld tagging guns by addressing the unique challenges and requirements of retail operations. These tools contribute to operational efficiency, accurate pricing, and improved customer experiences, making them integral to the success of retail businesses.

Rapidly Growing Food and Beverage Industry Contributing to Market Growth

The ever-expanding food and beverage industry is also contributing to fueling the growth of the handheld tagging gun market. Growing consumption and changing consumer habits are impacting the food and beverage industry's growth.

The need for efficient labeling, enhanced productivity, and compliance with regulations drives the demand for handheld tagging guns in the food and beverage industry. These guns help streamline operations across various supply chain segments, from production to retail.

Handheld labeling guns are used in the food industry to attach labels and tags for various applications. They can be accommodated anywhere, such as the home pantry and commercial kitchen.

Handheld tagging guns can be used for labeling foods with expiration dates, allergy warnings, and other health-related details, especially in the consumer food service business. Since the food and beverage industry is subjected to strict labeling regulations that ensure customer safety, usage of tags and labels is increasing, creating opportunities for handheld tagging guns.

Handheld tagging guns provide product traceability by labeling them with batch information, which is important for maintaining quality, product recalls, and regulatory information. These guns offer convenience in labeling delicate and perishable products without damaging sensitive products and are efficient in labeling varying weights and sizes.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

| H1 | 3.2% (2025 to 2035) |

| H2 | 4.4% (2025 to 2035) |

The table below shows the anticipated growth rates of the top countries. India and China are set to record high CAGRs of 6.8% and 6.1%, respectively, through 2035.

| Countries | Expected Handheld Tagging Gun Market Value (CAGR) |

|---|---|

| United States | 2.4% |

| Canada | 4.1% |

| Brazil | 2.9% |

| Mexico | 4.3% |

| Germany | 2.9% |

| France | 3.1% |

| United Kingdom | 1.0% |

| China | 6.1% |

| India | 6.8% |

| Japan | 4.6% |

| GCC Countries | 5.3% |

| South Africa | 3.5% |

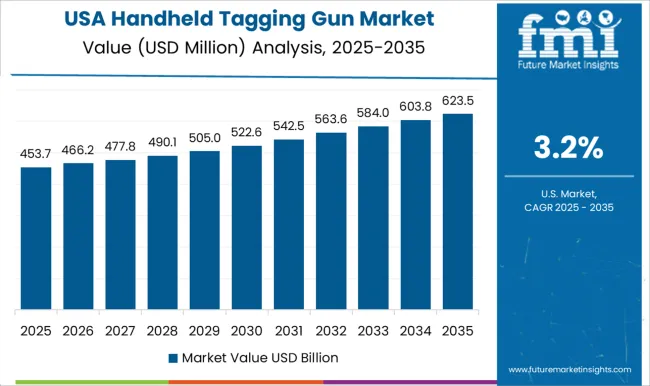

The United States handheld tagging gun market is poised to grow at a steady compound annual growth rate (CAGR) of 2.4% during the forecast period. This is attributable to increasing usage of handheld tagging guns in the thriving retail sector.

The retail sector has undergone enormous changes and accelerated its digital offerings by adapting to consumer demands. This has led to an increase in the demand for efficient inventory management, which is driving the adoption of handheld tagging guns.

The number of retail stores continues to rise across the United States, and the trend will likely continue through 2035. This, in turn, is expected to fuel sales of handheld tagging guns as they are increasingly used in retail stores for tagging labels.

Retail sales in the United States rose by 3.1% from USD 5,402.3 billion in 2020 to USD 5,570.4 billion in 2024, as per the USA Census Bureau’s 2024 Annual Retail Trade Survey (ARTS). These stats indicate growth opportunities that the nation can provide to handheld tagging gun manufacturers.

As per the latest analysis, India will likely emerge as the most lucrative market for handheld tagging gun manufacturing companies. This is due to expanding apparel & fashion industry in the nation.

Sales of handheld tagging guns in India are projected to rise at 6.8% CAGR throughout the assessment period. By 2035, India's handheld tagging gun market value is predicted to reach USD 107.5 million.

The table section offers vital insights into leading segments in the handheld tagging gun industry. This can help companies maximize profits and stay ahead of the curve.

Based on application, the RFID labels segment is expected to dominate the global market, exhibiting a CAGR of 3.6% through 2035. By end-use, the retail segment will likely progress at a CAGR of 4.2%.

| Application | Value CAGR (2025 to 2035) |

|---|---|

| RFID Labels | 3.6% |

| Barcode Labels | 5.1% |

Handheld tagging guns are mostly used in attaching RFID labels across different sectors. As per the latest analysis, the RFID labels segment is expected to grow at 3.6% CAGR during the forecast period, reaching a valuation of USD 1.6 million in 2035.

On the other hand, the barcode labels segment is poised to grow at a higher CAGR of 5.1% during the assessment period. This can be attributed to increasing adoption of barcode labels in manufacturing and retail sectors due to increased focus on digitalization.

| End-use | Value CAGR (2025 to 2035) |

|---|---|

| Retail | 4.2% |

| Warehouse & Logistics | 3.4% |

Based on end-use, the retail segment will continue to dominate the handheld tagging gun industry during the forecast period. The target segment is expected to grow at a steady CAGR of 4.2% from 2025 to 2035, driven by rising usage of handheld tagging guns in the retail sector.

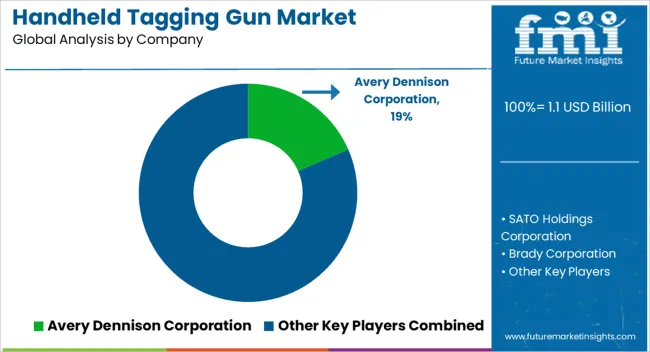

Leading manufacturers of handheld tagging guns are focusing on developing ergonomic and user-friendly designs to differentiate their products. They are incorporating an intuitive interface, comfortable grips, lightweight construction, and add-on features to provide a positive user experience with improved efficiency and less operation fatigue.

New semi-automatic tagging guns with safety features like retractable needles, guards, and trigger locks are being continuously introduced into the market to meet evolving needs of customers.

Several handheld tagging gun companies are also employing strategies like distribution agreements, partnerships, mergers, and acquisitions to stay ahead of the competition.

Recent Developments in the Global Handheld Tagging Gun Market

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 1,080.8 million |

| Projected Market Size (2035) | USD 1,565.1 million |

| Anticipated Growth Rate (2025 to 2035) | 3.8% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Mechanism, Application, End Use, Region |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Companies Profiled | Avery Dennison Corporation; SATO Holdings Corporation; Brady Corporation; Healthmark Industries Company, Inc.; Meto International GmbH; Garvey Applications; START International; Motex Applications Co. Ltd.; Towa Seiko Co. Ltd.; DayMark Safety Systems; Lotus Labels; HALCO Europe; JAY GROUP OF COMPANIES; Hardy Diagnostics; Weber Packaging Solutions |

The global handheld tagging gun market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the handheld tagging gun market is projected to reach USD 1.6 billion by 2035.

The handheld tagging gun market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in handheld tagging gun market are semi-automatic tagging guns and manual tagging guns.

In terms of application, barcode labels segment to command 38.6% share in the handheld tagging gun market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Point of Sale Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Ultrasound Scanner Market Analysis – Trends & Forecast 2024-2034

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Handheld DC Torque Tools Market

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Wireless Handheld Spectrometer Market

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA