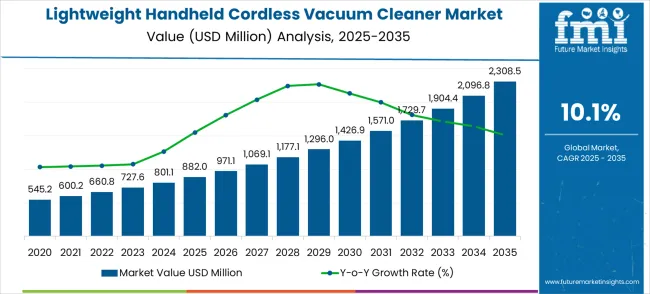

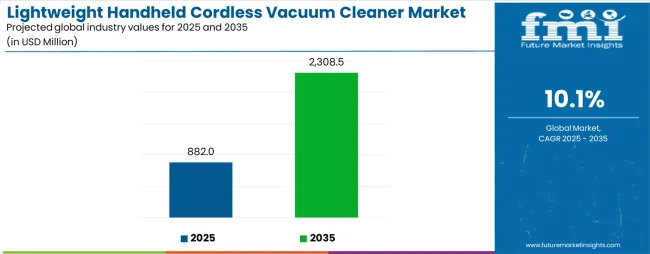

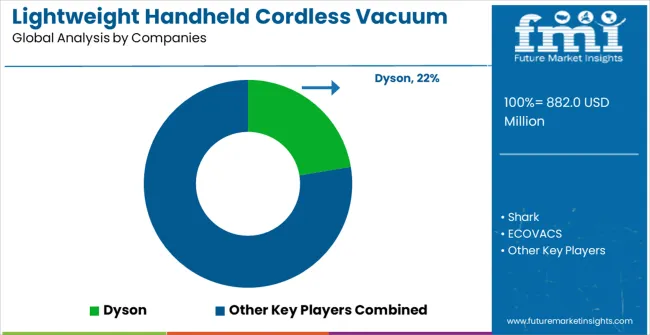

The global lightweight handheld cordless vacuum cleaner market is projected to grow from USD 882.0 million in 2025 to approximately USD 2,308.5 million by 2035, recording an absolute increase of USD 1,426.5 million over the forecast period. This translates into a total growth of 161.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.1% between 2025 and 2035. The overall market size is expected to grow by nearly 2.62X during the same period, supported by the rising adoption of cordless cleaning technology and increasing demand for lightweight, portable cleaning solutions.

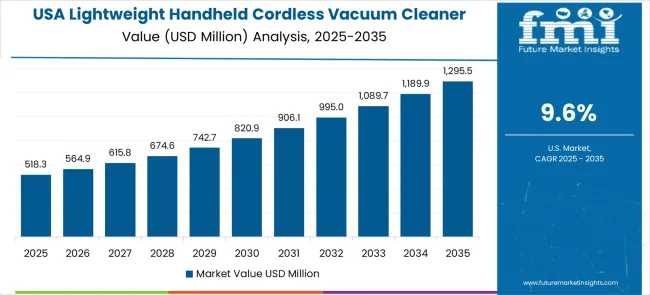

Between 2025 and 2030, the lightweight handheld cordless vacuum cleaner market is projected to expand from USD 882.0 million to USD 1,426.9 million, resulting in a value increase of USD 544.9 million, which represents 38.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of cordless cleaning technology in residential applications, increasing demand for lightweight portable cleaning solutions, and growing adoption of battery-powered cleaning equipment. Equipment manufacturers are expanding their cordless vacuum capabilities to address the growing complexity of modern household cleaning requirements.

The lightweight handheld cordless vacuum cleaner market has been positioned as a significant segment within broader household and consumer appliance industries, capturing around 7.1% of the home cleaning appliances market, 8.3% of the cordless vacuum cleaner market, 6.5% of the handheld cleaning devices market, 5.2% of the small domestic appliances market, and 4.8% of the consumer electronics market. Combined, this represents a total market share of approximately 31.9% across these parent domains. This demonstrates how these devices are increasingly preferred for their portability, ease of use, and convenience in maintaining residential and small commercial spaces. Consumer demand has been strongly influenced by preferences for lightweight, efficient, and reliable cleaning solutions, establishing the market as an important contributor to household maintenance technology.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 882 million |

| Market Forecast Value (2035) | USD 2,308.5 million |

| Market Forecast CAGR | 10.1% |

Market expansion is being supported by the rapid increase in consumer preference for convenient cleaning solutions worldwide and the corresponding need for lightweight portable equipment that provides superior cleaning performance and operational mobility. Modern households rely on efficient cleaning capabilities and equipment convenience to maintain optimal living standards including residential cleaning, automotive maintenance, and specialized cleaning applications. Even minor cleaning inefficiencies can require comprehensive cleaning protocol adjustments to maintain optimal cleanliness standards and operational performance.

The growing complexity of household cleaning requirements and increasing demand for high-efficiency portable solutions are driving demand for lightweight cordless vacuum equipment from certified manufacturers with appropriate performance capabilities and technical expertise. Consumer electronics companies are increasingly requiring documented cleaning efficiency and equipment reliability to maintain product quality and consumer satisfaction. Industry specifications and performance standards are establishing standardized cleaning procedures that require specialized cordless technologies and user-friendly operation.

The lightweight handheld cordless vacuum cleaner market is entering a transformative growth phase driven by increasing consumer preference for convenient cleaning solutions, advancing battery technologies, and rising demand for portable, efficient cleaning equipment. As consumers across both developed and emerging markets seek cleaning tools that are lightweight, cordless, powerful, and user-friendly, handheld cordless vacuum cleaners are evolving from basic cleaning tools to sophisticated cleaning systems integrated with smart features, advanced filtration, and multi-surface capabilities.

Rising household incomes and urbanization in Asia-Pacific, Latin America, and Middle East & Africa amplify demand, while manufacturers are advancing innovations in battery technology, motor efficiency, and ergonomic design improvements. Pathways like smart connectivity, premium battery technology, and sustainability-focused features promise strong margin uplift, especially in mature markets. Geographic expansion and localization will capture volume growth, particularly where cleaning convenience is prioritized and cord-free operation is valued. Consumer preferences around cleaning efficiency, convenience features, and technological integration provide structural market support.

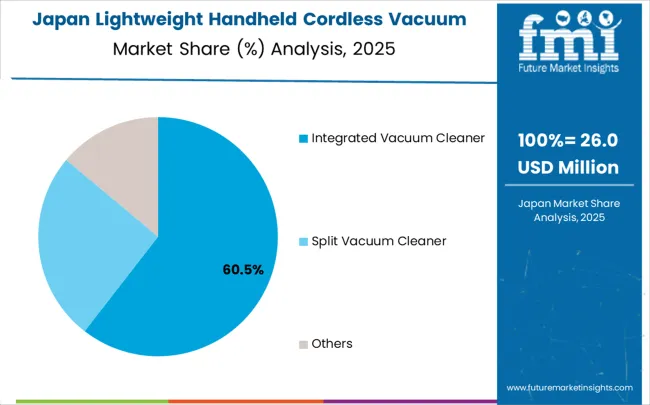

The market is segmented by product type, application, and region. By product type, the market is divided into integrated vacuum cleaner, split vacuum cleaner, and others. Based on application, the market is categorized into home use, automotive industry, hotel, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the integrated vacuum cleaner segment is projected to capture around 62% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of all-in-one design solutions that combine multiple cleaning components into a single, streamlined device, catering to consumer preferences for simplified operation and storage convenience. The integrated vacuum cleaner is particularly favored for its ability to deliver comprehensive cleaning performance without requiring separate attachments or complex assembly procedures, ensuring operational efficiency for diverse household applications. Residential consumers, apartment dwellers, busy professionals, and cleaning service providers increasingly prefer this design, as it meets daily cleaning needs without imposing excessive storage requirements or operational complexity. The availability of well-established product lines, along with comprehensive accessory options and customer support from leading manufacturers, further reinforces the segment's market position. Additionally, this product category benefits from consistent demand across regions, as it is considered a practical solution for households with varying cleaning requirements and space constraints. The combination of user-friendly operation, compact design, and versatile cleaning capabilities makes integrated cordless vacuum cleaners a preferred choice, ensuring their continued popularity in the portable cleaning equipment market. Advanced filtration systems and enhanced battery performance continue to drive adoption among quality-conscious consumers seeking reliable cleaning solutions.

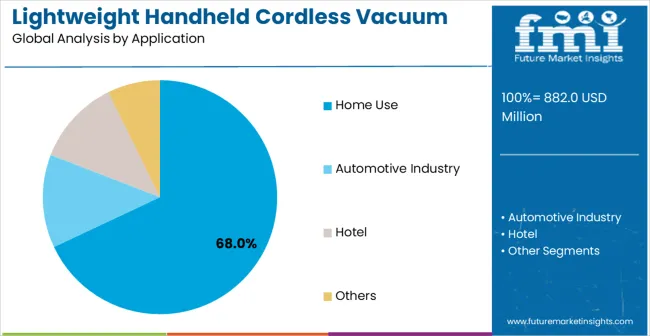

The home use segment is expected to represent 68% of lightweight handheld cordless vacuum cleaner demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of residential cleaning environments, where convenience, portability, and versatile cleaning capabilities are critical to maintaining household cleanliness standards. Home applications often feature diverse cleaning requirements across multiple surface types that demand flexible, lightweight equipment throughout daily cleaning routines, requiring efficient and maneuverable cleaning solutions. Lightweight cordless vacuum cleaners are particularly well-suited to residential environments due to their ability to deliver effective cleaning performance quickly and conveniently, even during busy household schedules and frequent cleaning tasks. As household sizes and living spaces continue to evolve globally and emphasis on cleaning convenience increases, the demand for lightweight cordless vacuum cleaners continues to rise. The segment also benefits from heightened focus on home hygiene and cleanliness standards, where consumers are increasingly prioritizing efficient cleaning tools and convenient maintenance solutions as essential components of modern household management. With homeowners investing in cleaning efficiency and household convenience enhancement, lightweight cordless vacuum cleaners provide an essential solution to maintain high-performance cleaning capabilities. The growth of dual-income households, coupled with increased focus on time-saving cleaning solutions, ensures that home use applications will remain the largest and most stable demand driver for lightweight handheld cordless vacuum cleaners in the forecast period. Enhanced battery life and improved suction power continue to strengthen the segment's market position.

The lightweight handheld cordless vacuum cleaner market is advancing rapidly due to increasing consumer preference for convenient cleaning solutions and growing recognition of cordless technology advantages over traditional corded alternatives. However, the market faces challenges including higher initial equipment costs compared to corded models, battery life limitations affecting extended cleaning sessions, and varying performance capabilities across different price segments. Technology advancement efforts and battery optimization programs continue to influence product development and market adoption patterns.

The growing development of advanced lithium-ion battery systems is enabling longer runtime performance with improved suction power and reduced charging time characteristics. Enhanced battery technologies and optimized power management systems provide superior cleaning performance while maintaining lightweight design requirements. These technologies are particularly valuable for residential consumers who require reliable cleaning equipment that can support comprehensive household cleaning operations with consistent suction power and extended operational duration.

Modern lightweight cordless vacuum manufacturers are incorporating advanced smart connectivity features and mobile app integration that enhance user convenience and equipment management capabilities. Integration of advanced monitoring systems and automated maintenance alerts enables superior user experience and comprehensive cleaning performance tracking. Advanced connectivity features support operation monitoring and maintenance scheduling while meeting various user preferences and operational requirements, including usage analytics, cleaning pattern optimization, and predictive maintenance notifications.

The continuous advancement of specialized brush designs and adjustable suction settings is expanding cleaning versatility across diverse surface types while maintaining optimal cleaning efficiency. Advanced multi-surface technologies and intelligent cleaning modes provide comprehensive cleaning solutions that adapt automatically to different flooring materials, upholstery, and specialized cleaning requirements. These technological innovations are particularly valuable for households with diverse cleaning needs where equipment versatility and consistent performance are essential for effective cleaning across carpets, hardwood floors, upholstery, and automotive interiors.

| Country | CAGR (2025-2035) |

|---|---|

| China | 13.6% |

| India | 12.6% |

| Germany | 11.6% |

| Brazil | 10.6% |

| United States | 9.6% |

| United Kingdom | 8.6% |

| Japan | 7.6% |

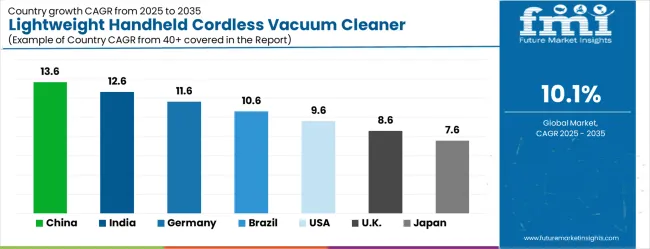

The lightweight handheld cordless vacuum cleaner market is growing rapidly, with China leading at a 13.6% CAGR through 2035, driven by strong consumer electronics adoption and increasing demand for convenient cleaning solutions. India follows at 12.6%, supported by rising household income levels and growing awareness of advanced cleaning technology benefits. Germany grows steadily at 11.6%, integrating cordless technology into its established home appliance market infrastructure. Brazil records 10.6%, emphasizing household modernization and cleaning convenience enhancement initiatives. The United States shows solid growth at 9.6%, focusing on technology innovation and premium product segments. The United Kingdom demonstrates steady progress at 8.6%, maintaining established consumer electronics applications. Japan records 7.6% growth, concentrating on technology refinement and quality optimization.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from lightweight handheld cordless vacuum cleaners in China is projected to exhibit the highest growth rate with a CAGR of 13.6% through 2035, driven by rapid expansion of consumer electronics adoption and increasing demand for advanced cleaning technology solutions. The country's growing middle-class population and rising household income levels are creating significant demand for convenient, high-performance cleaning equipment. Major appliance manufacturers are establishing comprehensive distribution networks to support the increasing requirements of residential consumers and commercial cleaning service providers across urban and suburban markets. Government initiatives supporting domestic manufacturing and consumer goods development are facilitating establishment of modern production capabilities and advanced technology integration, driving demand for sophisticated cordless vacuum technology throughout major metropolitan areas and emerging urban centers. Consumer electronics modernization programs are facilitating adoption of smart home technologies that enhance household convenience and cleaning efficiency standards across residential applications. China's rapid urbanization and apartment-style living arrangements are driving demand for space-efficient, portable cleaning solutions that can effectively maintain compact living spaces. The growing emphasis on household hygiene and cleanliness standards, particularly following health awareness campaigns, is accelerating adoption of advanced cleaning equipment. E-commerce platforms and digital retail channels are expanding access to premium cordless vacuum products, enabling consumer education and product comparison capabilities that drive market growth.

Revenue from lightweight handheld cordless vacuum cleaners in India is expanding at a CAGR of 12.6%, supported by increasing household income levels and growing awareness of advanced cleaning technology benefits. The country's expanding urban middle class and rising living standards are driving demand for convenient, efficient cleaning solutions that support modern lifestyle requirements. Consumer appliance retailers and electronics distributors are gradually introducing advanced cordless vacuum technology to meet evolving household cleaning preferences and operational convenience expectations. Household technology sector growth and consumer electronics infrastructure development are creating opportunities for equipment suppliers that can support diverse residential requirements and price sensitivity considerations. Consumer education and product demonstration programs are building awareness among households, enabling effective understanding of cordless vacuum technology benefits that meet modern cleaning standards and convenience requirements across residential applications. India's growing apartment culture and space-conscious living arrangements are creating demand for compact, versatile cleaning solutions. The expansion of organized retail channels and consumer electronics stores is improving product accessibility and consumer education. Rising awareness of hygiene and cleanliness standards, coupled with busy urban lifestyles, is driving preference for time-saving cleaning solutions that can efficiently maintain household cleanliness standards.

Demand for lightweight handheld cordless vacuum cleaners in Germany is projected to grow at a CAGR of 11.6%, supported by the country's emphasis on home appliance innovation and advanced technology adoption. German consumers are implementing sophisticated cordless vacuum systems that meet stringent quality requirements and operational specifications. The market is characterized by focus on equipment reliability, energy efficiency, and compliance with comprehensive environmental standards. Home appliance industry investments are prioritizing advanced cordless technology that demonstrates superior cleaning performance and durability while meeting German quality and sustainability standards. Consumer preference programs are ensuring comprehensive evaluation of technical features among households, enabling specialized cleaning capabilities that support diverse residential applications and operational requirements across regional markets. Germany's emphasis on sustainability and energy efficiency is driving demand for eco-friendly cleaning solutions with advanced battery technologies and reduced environmental impact. The country's established home appliance retail infrastructure supports comprehensive product education and technical support services. Consumer preference for premium, long-lasting appliances creates demand for high-quality cordless vacuum systems with advanced features and reliable performance characteristics that justify higher investment costs.

Revenue from lightweight handheld cordless vacuum cleaners in Brazil is growing at a CAGR of 10.6%, driven by increasing household modernization and growing recognition of cleaning convenience advantages. The country's expanding consumer electronics market is gradually integrating advanced cordless vacuum technology to enhance household cleaning capabilities and operational efficiency. Consumer appliance retailers and home improvement stores are investing in cordless cleaning technology to address evolving household requirements and convenience preferences. Household modernization is facilitating adoption of advanced cleaning technologies that support comprehensive home maintenance capabilities across urban and suburban residential regions. Consumer development programs are enhancing awareness among households, enabling effective cordless vacuum utilization that meets evolving cleaning standards and convenience requirements across residential applications. Brazil's growing urban population and changing lifestyle patterns are creating demand for efficient, convenient cleaning solutions. The expansion of consumer credit and financing options is making premium cleaning equipment more accessible to middle-income households. Rising awareness of household hygiene standards and cleaning efficiency is supporting adoption of advanced cleaning technology that can maintain residential cleanliness standards while reducing cleaning time and effort requirements.

Demand for lightweight handheld cordless vacuum cleaners in the U.S. is expanding at a CAGR of 9.6%, driven by established consumer electronics markets and growing emphasis on technology innovation and premium product segments. Large retail chains and appliance manufacturers are implementing comprehensive cordless vacuum capabilities to serve diverse residential requirements. The market benefits from established distribution networks and consumer education programs that support various household applications and cleaning preferences. Consumer electronics industry leadership is enabling advanced product development across multiple technology categories, providing consistent innovation and comprehensive feature integration throughout regional markets. Professional product evaluation and consumer testing programs are building specialized technical knowledge among households, enabling effective cordless vacuum utilization that supports evolving residential cleaning requirements across metropolitan areas. The U.S. market is characterized by strong consumer preference for innovative features and premium performance capabilities. Established home improvement retail channels and online marketplaces provide comprehensive product selection and consumer education resources. The emphasis on time-saving household solutions and cleaning convenience is driving demand for advanced cordless vacuum technology that enhances cleaning efficiency while maintaining performance standards across diverse household applications and cleaning requirements.

Demand for lightweight handheld cordless vacuum cleaners in the U.K. is projected to grow at a CAGR of 8.6%, supported by established consumer electronics sectors and growing emphasis on household convenience capabilities. British retailers and appliance manufacturers are implementing cordless vacuum equipment that meets industry quality standards and consumer expectations. The market benefits from established home appliance infrastructure and comprehensive consumer education programs for household applications. Consumer electronics investments are prioritizing advanced cleaning equipment that supports diverse household applications while maintaining established quality and performance standards. Consumer preference programs are building technical awareness among households, enabling specialized cordless vacuum operation capabilities that meet evolving cleaning requirements and convenience standards throughout residential markets. The United Kingdom's established retail infrastructure and consumer electronics market maturity support comprehensive product availability and technical support services. Consumer preference for reliable, efficient household appliances drives demand for quality cordless vacuum systems with proven performance capabilities. The emphasis on household convenience and cleaning efficiency is supporting adoption of advanced cordless technology that can effectively maintain residential cleanliness standards while providing operational flexibility and convenience features.

Revenue from lightweight handheld cordless vacuum cleaners in Japan is growing at a CAGR of 7.6%, driven by the country's focus on cleaning technology refinement and quality optimization applications. Japanese appliance manufacturers are implementing advanced cordless vacuum systems that demonstrate superior reliability and operational efficiency. The market is characterized by emphasis on technological precision, quality assurance, and integration with established household technology workflows. Technology industry investments are prioritizing innovative cleaning solutions that combine advanced cordless technology with precision engineering while maintaining Japanese quality and reliability standards. Consumer development programs are ensuring comprehensive technical knowledge among households, enabling specialized cleaning capabilities that support diverse residential applications and operational requirements throughout metropolitan household networks. Japan's commitment to technological excellence and precision engineering drives continuous innovation in cordless vacuum technology. The integration of smart features and IoT connectivity with household management systems requires sophisticated equipment capabilities and seamless operation. Consumer preference for high-quality, long-lasting appliances supports demand for premium cordless vacuum systems with advanced features and reliable performance characteristics that meet strict quality standards and operational requirements.

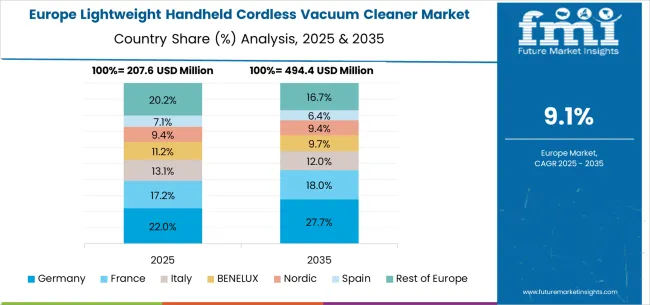

The lightweight handheld cordless vacuum cleaner market in Europe is projected to grow significantly from USD 430.0 million in 2025 to USD 1,124.0 million by 2035, registering a CAGR of 10.1% over the forecast period. Germany is expected to maintain leadership with a 30.0% share in 2025, driven by its strong consumer electronics market and focus on innovation and energy-efficient home appliances. The United Kingdom follows with an 18.4% market share, supported by increasing consumer preference for convenient cleaning solutions and a mature retail infrastructure for home appliances. France holds 15.2% of the European market, benefiting from rising urbanization and growing demand for cordless cleaning technology in residential settings. Italy and Spain collectively represent 23.3% of regional demand, fueled by increasing household incomes and modernization of living standards. The Rest of Europe, including Nordic countries, BENELUX, and Eastern Europe, accounts for 13.1% of the market, supported by expanding consumer awareness, improving distribution channels, and rising preference for portable and efficient cleaning equipment. This regional distribution highlights Europe's diverse consumer base driven by technology adoption and evolving household convenience needs.

The lightweight handheld cordless vacuum cleaner market is defined by competition among specialized appliance manufacturers, consumer electronics companies, and home cleaning solution providers. Companies are investing in advanced battery technology development, suction power optimization, ergonomic design improvements, and comprehensive user experience capabilities to deliver reliable, efficient, and convenient cleaning solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Dyson offers comprehensive cordless vacuum solutions with established engineering expertise and premium cleaning performance capabilities. Shark provides specialized cleaning equipment with focus on user-friendly operation and operational efficiency. ECOVACS delivers advanced robotic and handheld cleaning solutions with emphasis on smart technology integration. LG specializes in consumer electronics with advanced battery and motor technologies.

Panasonic offers professional-grade cleaning equipment with comprehensive reliability and performance capabilities. Philips delivers established home appliance solutions with advanced cordless technologies. Bissell provides specialized cleaning equipment with focus on residential applications. Roborock, Dreame Innovation Technology, Xiaomi, Kingclean, and Puppy Electronic Appliances offer specialized manufacturing expertise, innovative features, and comprehensive product development across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 882 million |

| Product Type | Integrated Vacuum Cleaner, Split Vacuum Cleaner, Others |

| Application | Home Use, Automotive Industry, Hotel, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Dyson, Shark, ECOVACS, LG, Panasonic, Philips, Bissell, Roborock, Dreame Innovation Technology, Xiaomi, Kingclean, Puppy Electronic Appliances |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major markets, competitive landscape with established appliance manufacturers and emerging technology providers, consumer preferences for different cordless technologies and cleaning options, integration with smart home systems and automation protocols, innovations in battery technology and suction power optimization, and adoption of ergonomic design features with enhanced user experience capabilities for improved cleaning workflows. |

The global lightweight handheld cordless vacuum cleaner market is estimated to be valued at USD 882.0 million in 2025.

The market size for the lightweight handheld cordless vacuum cleaner market is projected to reach USD 2,308.5 million by 2035.

The lightweight handheld cordless vacuum cleaner market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in lightweight handheld cordless vacuum cleaner market are integrated vacuum cleaner, split vacuum cleaner and others.

In terms of application, home use segment to command 68.0% share in the lightweight handheld cordless vacuum cleaner market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA