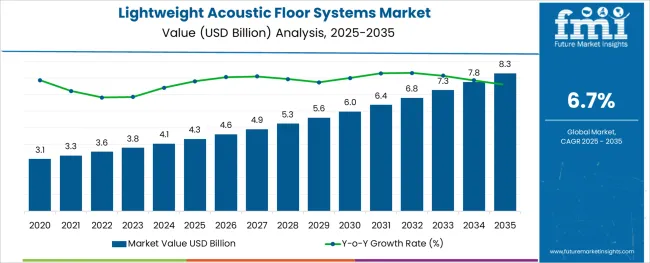

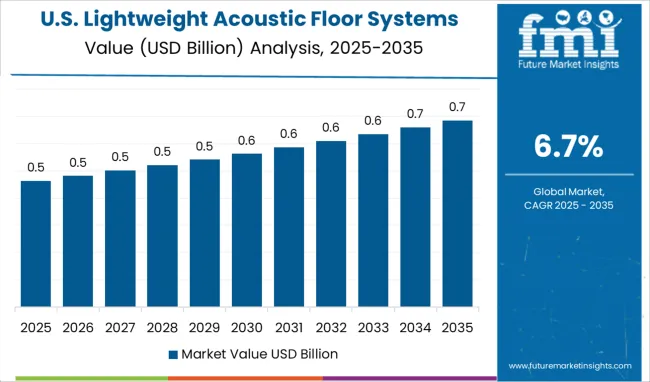

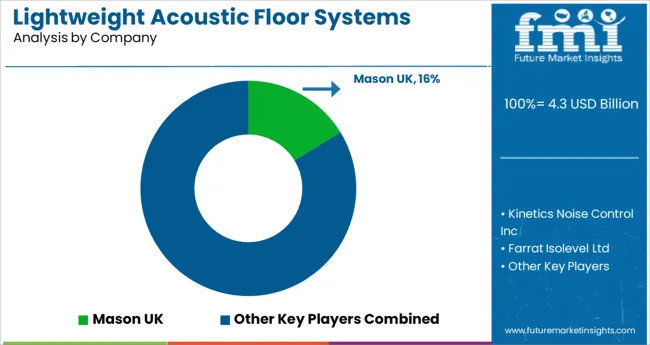

The Lightweight Acoustic Floor Systems Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The lightweight acoustic floor systems market is undergoing steady growth as construction practices increasingly prioritize noise insulation, structural efficiency, and compliance with evolving building acoustics standards. Rapid urbanization, combined with densification in commercial and mixed-use developments, has elevated the demand for soundproofing technologies that add minimal weight to floor structures.

Advances in floating floor technologies, dry installation methods, and composite materials have improved design flexibility and installation efficiency. Emphasis on sustainability is also encouraging the use of recyclable and low-emission materials that integrate seamlessly with modular flooring systems.

Regulatory enforcement related to occupational noise exposure and multi-tenant building codes is further stimulating adoption across industrial and commercial segments. As end users seek to minimize both airborne and impact sound transmission without compromising on structural performance, the market is expected to expand steadily with innovations in material science and construction integration.

The market is segmented by Type of Flooring, Material, and Application and region. By Type of Flooring, the market is divided into Fixed and Spring. In terms of Material, the market is classified into Concrete, Rubber, Wood, Fiberglass, and Foam. Based on Application, the market is segmented into Industry, Manufacturing, Construction, Mining, Energy, Automotive, Commercial, Hospitals, Hotels, and Education Institutes.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

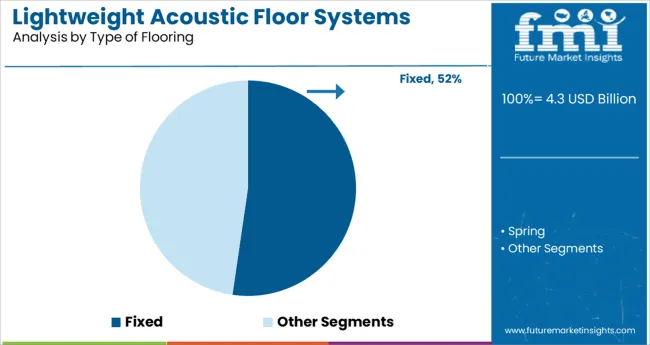

Fixed flooring solutions are expected to hold 52.3% of revenue share within the type of flooring category in 2025, making them the dominant installation type. Their consistent performance in providing long-term acoustic insulation and structural stability has positioned them as the preferred choice for permanent construction settings.

Fixed systems typically deliver superior load-bearing capacity and minimal maintenance requirements, supporting their use in high-traffic environments. Integration with underlayment and vibration-damping layers ensures durability while complying with acoustic standards.

Additionally, fixed installations facilitate precise levelling and minimize the risk of shifting or sound bridging, which can occur with modular or floating systems. The prevalence of fixed flooring in large-scale projects such as public infrastructure, healthcare facilities, and educational institutions has further solidified its leadership in the lightweight acoustic floor systems market.

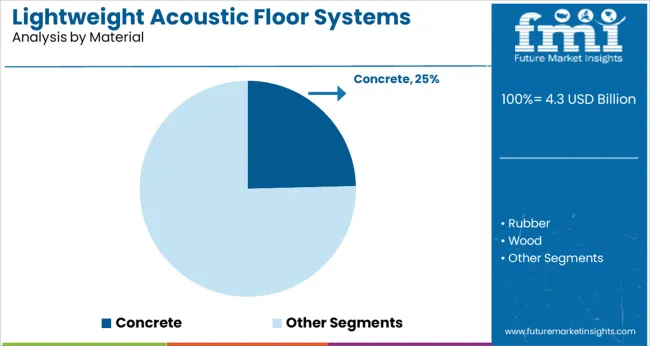

Concrete-based systems are projected to contribute 24.6% of market revenue under the material category in 2025, reflecting their strong market presence. Concrete offers inherent mass and rigidity, essential properties for mitigating impact noise and airborne sound transmission.

Its thermal and acoustic insulation characteristics are enhanced when used in combination with lightweight substructures and dampening layers. Advances in precast and lightweight concrete formulations have enabled better handling without compromising acoustic performance, making them viable in both retrofits and new construction.

The material’s durability and fire resistance also align with safety regulations in commercial and industrial environments. As architects and contractors increasingly specify concrete solutions for sound-sensitive areas, the segment’s share is expected to grow steadily with continued innovations in mix design and modular construction techniques.

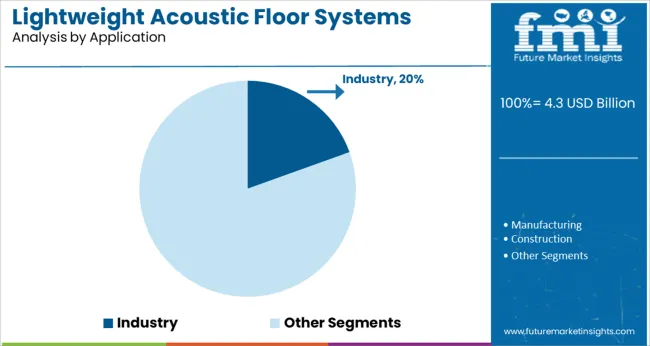

The industrial application segment is anticipated to account for 19.5% of market revenue by 2025, leading as a key application area. Rising awareness around occupational noise exposure and compliance with workplace acoustic regulations has accelerated the adoption of lightweight acoustic floor systems in manufacturing plants, logistics centers, and assembly facilities.

These systems help mitigate the transmission of machinery vibrations and operational noise to adjacent workspaces or structural zones. Industrial projects often demand durable solutions that can withstand high load cycles and abrasive activities, characteristics addressed by reinforced acoustic flooring systems.

Additionally, the need for quick installation and minimal operational disruption favors the adoption of prefabricated or dry-installed systems. As industries invest in employee well-being and compliance with environmental health and safety norms, the use of acoustic flooring is expected to rise further within industrial infrastructure development.

The presence of strict rules and regulations relating to noise limits in residential buildings, along with an increasing number of commercial buildings is anticipated to enhance demand for lightweight acoustic floor systems.

Further, there has been surged demand for lightweight acoustic floors in industrial projects to dampen the noise generated from structures. Movie theaters, concert halls, music studios, and auditoriums are some of the major consumers of lightweight acoustic floors.

Further, the introduction of environment-friendly acoustic panels is projected to widen the growth prospects of the market during the forecast period. For instance, Shumanet Eco is an eco-friendly fiberglass slab that features a high sound insulation performance. It is used as a middle layer while building frame sound-absorbing and ceiling structures. Such factors are expected to augment the market size in the forecast period.

High costs associated with acoustic floors are expected to hamper the market growth in the forecast period. Also, the availability of cheaper alternatives and the presence of software that aid in absorbing sounds are likely to further limit the market size.

Other factors affecting the market growth include heavy development costs and research expertise. However, rising demand from commercial sectors to regulate noise is expected to counter the hampering factor and benefit the industry growth in the assessment period.

As per the analysis, North America is anticipated to dominate the global lightweight acoustic floor systems market during the forecast period. In 2025, the regional market is anticipated to secure about 34.6% of the total global revenue.

The growth of the market can be attributed to the expansion of the construction sector of the USA As per Construction Outlook 2024 by Oxford Economics, the USA construction market is anticipated to grow faster than China in the coming 15 years. Also, players in the region are focusing to expand their reach in the market through acquisitions.

For instance, in December 2024, Armstrong World Industries announced that it has agreed to buy Arkutra, LLC, a Los Angeles-based fabricator and designer of wall partitions, facades, floors, and ceilings. Such factors are expected to benefit the regional market growth during the forecast period.

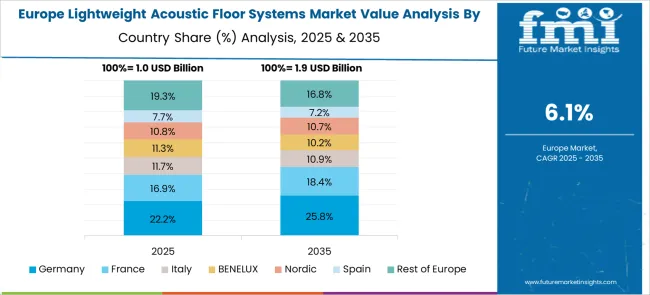

According to the study, Europe is anticipated to be the second-largest lightweight acoustic floor systems market. In 2025, the region is anticipated to accumulate 21.1% of the global market share.

Expansion of the regional market can be attributed to the increasing construction activities in Germany, France, the UK, Italy, and Russia. Further, an increasing number of players entering the market is likely to augment the market size during the forecast period. For instance, Mogu Bio, an Italy-based player officially revealed the first collection of products based on the most advanced Mycelium technology. Such factors are likely to benefit the regional market in the forecast period.

As per the analysis, APAC is anticipated to be the most lucrative market for lightweight acoustic floor systems market. This can be attributed to the rapid urbanization and expanding construction sector in emerging economies like India, China, and Japan.

Further, FDI is anticipated to play important role in accelerating the region’s economic development. Other factors contributing to the market growth include increasing disposable income, growing interest of new players in the region, and the presence of untapped opportunities. Such factors are likely to bolster market growth in the coming time.

Mogu, Baux, Aisti, Natural Acoustics, Siamo Suono e musica, Aural-Aid, and UNStudio, are some of the emerging entities in the global lightweight acoustic floor systems market. Startups are likely to make a significant contribution to developing the industry. For instance, Aisti, a Finnish construction tech startup announced that it received funding of 1.6 Million Euros. Such funding is likely to back the market growth in the forecast period.

Key players in the global lightweight acoustic floor systems market include Mason UK, Kinetics Noise Control Inc, Farrat Isolevel Ltd, Rockcote Resene Ltd., Monarfloor Acoustic Systems Ltd., Cellecta Ltd., Knauf Insulation, Saint-Gobain Isover, Ubiq, and YOSHINO GYPSUM CO., LTD.

| Report Attribute | Details |

|---|---|

| Growth Rate (2025 to 2035) | 6.7% |

| Market Value in 2025 | USD 4.3 billion |

| Market Value in 2035 | USD 8.3 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type of Flooring, Application, Material, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Argentina, Brazil, Germany, UK, France, Spain, Italy, Nordic Countries, Poland, Russia, Australia & New Zealand, China, India, ASEAN, GCC, North Africa, South Africa |

| Key Companies Profiled | Mason UK; Kinetics Noise Control Inc; Farrat Isolevel Ltd; Rockcote Resene Ltd.; Monarfloor Acoustic Systems Ltd.; Cellecta Ltd.; Knauf Insulation; Saint-Gobain Isover; Ubiq; YOSHINO GYPSUM CO., LTD |

| Customization Scope | Available upon Request |

The global lightweight acoustic floor systems market is estimated to be valued at USD 4.3 billion in 2025.

It is projected to reach USD 8.3 billion by 2035.

The market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types are fixed and spring.

concrete segment is expected to dominate with a 24.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Acoustic Vehicle Alerting System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acoustic Wave Sensors Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Wave Filters Market Size and Share Forecast Outlook 2025 to 2035

Acoustic Insulation Market Analysis & Forecast for 2025 to 2035

Acoustic Respiration Sensors Market Outlook 2025 to 2035

Acoustic Camera Market Growth - Size, Trends & Forecast 2025 to 2035

Acoustic Puncture Assist Devices Market

Acoustic Neurinoma Treatment Market

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Bioacoustics Sensing Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA