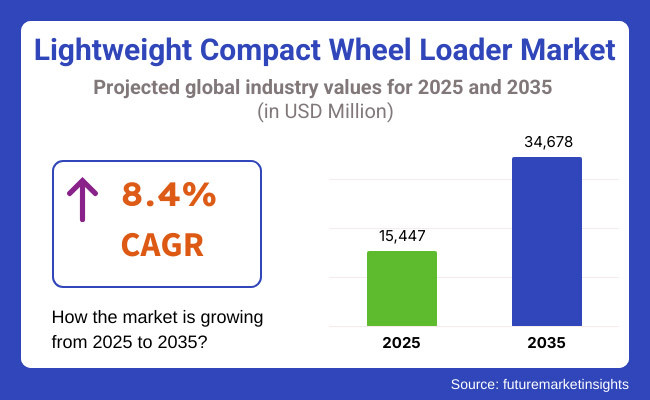

lightweight compact wheel loader market is forecasted to have high growth between 2025 and 2035 owing to expanding demand within the construction, agriculture, landscaping, and municipal markets. The compact lightweight wheel loader market worth will be around USD 15,447 million in 2025 and should reach around USD 34,678 million in 2035 with a growth rate of CAGR at 8.4% in the forecast period.

Some forces are remodelling the market. Leading them are the increasing need for heavy, versatile, and economical equipment that is utilized in urban building projects. Compact wheel loaders give economy and versatility, best suited to occupy tight spaces involved in building city infrastructure. Urban cities in the European and North American regions, for example, extensively employ such loaders in clearing city roads of snow, maintaining roads, and dealing with trash.

Moreover, the agriculture sector is embracing compact wheel loaders for tasks like material handling, feed mixing, and farm upkeep. Nevertheless, challenges like high upfront cost and pressure of electrification are compelling manufacturers to design, provide battery-based, and price products affordably.

There are different forms of light compact wheel loaders based on power source and application. The most popular with their rugged reliability and high torque are still the diesel-powered ones. Electric light compact wheel loaders are increasingly so in Europe and North America in response to rigorous emission control norms. In application, the biggest market for their consumption is construction, followed by agriculture and local government works. Increasing urban construction projects using efficient, compact gear are driving global demand.

The North American market is a major market for light compact wheel loaders, supported by growing urban construction demand and municipal fleet replacement. The United States and Canada are some of the quickest adopters, notably in construction, landscaping, and agricultural applications.

Municipal governments are trying to minimize their carbon footprint using electrically powered loaders. For instance, cities like New York and Toronto are procuring fleets of electric wheel loaders for works and public maintenance. The Environmental Protection Agency (EPA) that has tight regulations on emissions is also contributing towards a shift into cleaner solutions that are motivating firms to develop hybrid and electric alternatives.

Europe dominates the majority of the compact lightweight wheel loader market, and the top countries are the UK, France, and Germany. European Union efforts for sustainable and energy-efficient equipment are driving the speedy growth of electric and hybrid loaders.

Productive agriculture in the region, especially the Netherlands and Spain, is increasing demand for compact farm loaders for agricultural purposes. State subsidies promoting the use of electrically powered construction equipment and electric buses for public transport are also spurring firms to replace old diesel-fuelled loaders with green equipment.

The Asia-Pacific is going to be the fastest-growing market with increasing infrastructure plans and mechanization of agriculture. The key countries like China, India, Japan, and Australia are significant customers of compact lightweight wheel loaders. The world's largest construction equipment-manufacturing nation, China, is followed by production and consumption.

Urbanization and government policy-driven smart city growth are driving demand in India and Southeast Asia for energy-efficient and compact loaders. However, price-sensitive markets such as India prefer diesel variants because they are economical and have an extremely long lifespan, although electric variants are gaining popularity with declining battery prices.

Challenge

High Initial Investment and Switch to Electrification

One of the greatest issues in the market is that electric compact wheel loaders are much too expensive up front to replace diesel-powered compact wheel loaders. Small towns and low-budget contractors would not be able to afford newer, greener models. Also, it involves huge investment in infrastructure in terms of charging stations and battery switch centers.

Opportunity

Advancement in Battery Technology and Automation

The rising emphasis on battery technology is a gigantic challenge for manufacturers. Developments in lithium-ion batteries, longer running times, and quicker charging are making electric compact wheel loaders more practical. In addition, automated and semi-automated features are being added by manufacturers to loaders, improving productivity for recurring tasks such as material handling and grading. Telematics-based smart fleet management and AI-driven predictive maintenance are also revolutionizing the industry, helping operators achieve the highest possible efficiency and lowest possible downtime.

In 2020 to 2024, the urban building, farming, and landscaping sectors for small lightweight wheel loaders experienced growth in uptake because of the demand for fuel-efficient and multi-functional equipment. Demand for more comfortable operators, digital control, and hybrid powertrains for the loader experienced higher growth. Supply chain disturbances and volatile raw material prices affected the production.

Forward to 2025 to 2035, the industry will be defined by sustainability, technology, and tighter emissions regulations. Hybrid and electric loader demand will increase, with market leaders investing in high-performance batteries with cutting-edge technology. Automation and intelligent machine functionality will further increase operating productivity, with compact wheel loaders at the center of efficient modern construction and farm operations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emission norms drove producers towards lower particulate and NOx emissions Tier 4 Final and Stage V engines. Electrification was in early stages of adoption due to cost considerations. |

| Technological Advancements | Hydraulic and powertrain developments enhanced fuel economy and efficiency. Telematics integration gained traction for fleet management. |

| Construction Sector Dynamics | Urbanization and infrastructure development drove demand, especially in Europe and North America. Compact loaders emerged as the go-to option in space-restricted job sites. |

| Agriculture & Landscaping Trends | Expansion of precision agriculture and small-scale horticulture encouraged the use of compact loaders. Attachments made loaders more versatile. |

| Mining & Material Handling | Adoption of compact loaders expanded in aggregate handling and mining due to greater efficiency and reduced operating expenses. |

| Environmental Sustainability | Biofuels and alternate fuels were introduced as a short-term solution to meet emissions regulations. |

| Production & Supply Chain Dynamics | Worldwide supply chain interruptions affected the availability of key parts, including engines and hydraulics. Companies looked for local suppliers to mitigate risks. |

| Market Growth Drivers | Infrastructure expansion, residential development, and the increase in mechanization of agriculture. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global regulations require more stringent carbon neutrality levels, hastening electrification. Governments offer incentives for battery-electric and hybrid wheel loaders to decrease dependence on diesel-based equipment. |

| Technological Advancements | Autonomous and semi-autonomous operation become the norm, with AI-driven sensors maximizing load cycles. Solid-state batteries and hydrogen fuel cells enhance energy efficiency and range. |

| Construction Sector Dynamics | Green construction practices, such as modular building technology, drive demand for lightweight, energy-efficient loaders. Urban renewal projects require compact, agile equipment. |

| Agriculture & Landscaping Trends | All-electric loaders become increasingly prevalent in greenhouses and precision agriculture uses. AI-driven automation improves material handling efficiency. |

| Mining & Material Handling | Expansion in underground and small-scale mining activities requires lightweight, battery-operated loaders to meet emission standards and restricted space operations. |

| Environmental Sustainability | Electrification is prioritized, with circular economy efforts propelling recycling of batteries and building materials. Loaders incorporate energy recovery systems to maximize efficiency. |

| Production & Supply Chain Dynamics | Supply chain localization heightens, aided by additive manufacturing (3D printing) and rapid part-making. Investment in alternatives to rare-earth metals reduces reliance on select regions. |

| Market Growth Drivers | Integration of Industry 4.0 boosts operational effectiveness. Sustainability requirement and automation drives loader uptake for various applications. |

The lightweight compact wheel loader market in America is growing with increasing urban regeneration activities, tighter emissions standards, and automated technology advancements. Demand from the agriculture sector also is growing with compact agriculture farms with small and medium sizes using compact loaders heavily for precision farming.

Urban Development Growth: Mini wheel loaders find application in the construction industry depending on how convenient they are to maneuver and how effective they are in congested construction sites. Electric and hybrid loaders become the most desired due to the federal incentives to mitigate greenhouse gases that make them even more appealing. Technology Application in Agriculture: America's farm sector is adopting automation. Accuracy attachments and AI-enabled telematics in small loaders enhance farm productivity and agricultural efficiency.

Regulatory Push towards Electrification: The EPA's strict emission regulations are opening the door for all-electric and hybrid loaders, and market leaders are placing bets on newer battery technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

The UK market for lightweight compact wheel loaders is seeing consistent growth due to increasing investment in green infrastructure projects and green building. There is increasing demand for compact electric wheel loaders as policy turns to reducing carbon emissions and improving energy efficiency.

Sustainability in Construction: The UK construction industry for building is embracing battery-powered compact machines to facilitate the ambitious Net Zero goals. Urban and infrastructure construction focuses on infrastructure investment in low-noise, low-energy machinery.

Green Farming upgrades: The UK agricultural sector is also embracing electric loaders, especially for organic produce and glasshouse agriculture, where low-emission machinery is greatly sought after.

Electrification & Robotics Integration: Autonomous loader and loader robot adoption will rise in agriculture and the construction industries, with productivity and labor efficiency boosts.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The European Union's lightweight compact wheel loaders market is dominated by digitalization and sustainable policy in construction and agriculture. Zero-emission machines are boosting demand for battery-powered loaders.

Tougher Emission Laws: EU regulation in the Green Deal and Fit for 55 program encourages electrification, with mini loaders that are increasingly lithium-ion and hydrogen fuel-cell based.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.0% |

The light weight Japanese market for small wheel loaders is growing with increasing demands from smart building projects, robotics technology development, and precision farming. Smart Construction and Robotics: Japan's construction sector is quickly embracing autonomous compact loaders equipped with AI-enabled sensors and telematics for remote operation.

Sustainable Agricultural Innovations: Japan's agricultural sector, with its rapidly increasing emphasis on sustainable farming, is embracing electric loaders with robot-based automated soil tilling and greenhouse applications. Energy-Efficient Equipment: Government incentives for zero-emissions building equipment drive innovation in hydrogen fuel-powered compact loaders as a robust substitute for lithium-ion technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.2% |

South Korean light-weight compact wheel loader market is expanding with the investment in smart infrastructure, automation, and green manufacturing.

Urban Development and Infrastructure: Local infrastructure development is following the route of smart city construction, thus creating demand for energy-efficient compact loaders.

Incorporation of IoT & AI in Equipment: Real-time diagnostics, predictive maintenance, and autonomous machines are being deployed more and more in industrial usage.

Government Assistance to Electrification: South Korean government subsidy and regulation favour the shift toward electric building equipment for the adoption of battery-electric and hybrid loaders.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

Compact track loaders rule the light compact wheel loaders market with the largest market share, owing to improved traction, stability, and performance on unfavourable ground conditions. The rubber tracks installed in the loaders reduce the ground pressure and therefore capable of operating under soft, muddy, or uneven ground conditions. Compact track loaders dominate the marketplace in construction and farm uses where year-around operation under adverse ground conditions is inevitable.

In farming, compact track loaders are the go-to machine to deal with feed, to move large bales of hay, and to clear land in wet or hard ground. For construction in urban environments, their ability to maneuver cramped spaces with minimal surface disturbance has made them a number one best seller for both material handling and excavation. The demand for compact track loaders is also growing for forestry operations where the machines are used for clearing land, stump grinding, and heavy lift under backcountry conditions.

Skid steer loaders are still an important part of the market, especially for city building construction, industrial material handling, and building repair. With their miniaturization and high manoeuvrability, they function extremely well in confined spaces and are therefore very suitable for the task of road maintenance, demolitions, and snow ploughing. Their ability to mount attachments like augers, trenchers, and grapples, amongst others, is a key reason why so flexible and popular such machines have grown to be throughout industries.

In spite of the risk posed by compact track loaders, skid steer loaders continue to be employed in industrial settings where smooth surfaces and flat ground enable wheels to be utilized instead of tracks. Skid steer loaders, for example, are widely used by warehouses and distribution centers for loading and offloading materials, and municipalities use them for trash collection and maintenance.

Backhoe loaders form an integral component of road building on road sides, utility works in municipal areas, and infrastructure work because they possess a twin aspect-loading and digging. The machines are in high demand in developing economies where budget-friendly, multi-purpose machines are highly sought after. Their capability to alternate between loading and digging operations using one machine without auxiliary equipment renders them necessary in government projects such as small road repairs, installation of drainage, and utility trenches.

Furthermore, backhoe loaders are also gaining popularity in agriculture where they are used for irrigation infrastructure construction, land breaking, and fence building. Despite competing aggressively with specialized compact loaders, their multi-functionality ensures steady demand, particularly in nations with developing infrastructure and frugal construction firms.

Wheeled loaders, as strong and speedy on solid ground, are increasingly being utilized in industrial and large building facility operations. Their primary strength is high cycle times, and they are best utilized in material handling in logistics terminals, rubbish processing plants, and large commercial buildings.

Wheeled loaders are used by property management companies for landscaping, snow, and trash removal at malls, airports, and large housing developments. Their application in the mining and quarrying industries, too, has been driven by their efficiency in the bulk material transportation. Increasing urbanization and development of commercial infrastructure will drive demand for wheeled loaders in large facility and property management.

The construction sector is the biggest application of compact lightweight wheel loaders, driven by urbanization, infrastructure development, and smart city investment expansion. They are required for excavation, grading, and site preparation activities in residential and commercial construction. Compact loaders are especially preferred due to their flexibility to work in heavily populated urban areas and because they can accommodate a range of attachments depending on the task at hand.

With governments all over the world funding infrastructure growth, including road networks, public transport, and upgrading utilities, demand for compact wheel loaders just continues to increase. China, India, and the United States of America are leading the way, with the main focus on green and energy-saving building strategies.

Wheel loaders are an essential part of very mechanized farming and forestry operations with increasing mechanization driving their need. They are utilized in farms for the handling of material, feeding livestock, clearing land, and the loading and unloading of agricultural products. They are utilized for versatility and small-size benefits in small- and medium-scale operations where heavy equipment accessibility is out of the question owing to limited space.

Compact loaders are applied in forestry use to transport logs, clear land, and transport heavy material over rugged terrain. Forestry equipment markets are most robust in Scandinavia and North America, where forest management under low-impact conditions requires effective but low-impact machinery. With increasing global interest in sustainable agriculture and forestry, compact loaders can expect broader application.

As industrial operations are being influenced by automation trends, manufacturers are introducing compact wheel loaders with advanced telematics and remote monitoring capability to improve productivity and minimize downtime. The trend is very conspicuous in Europe and North America, and intelligent industrial solutions are gaining tremendous momentum.

The manufacturing sector is witnessing increased application of small wheel loaders in material handling, logistics, and production processes. They are being used in factories, warehouses, and recycling centers, where unobstructed movement of raw materials and finished goods is crucial. Cement plants, metal processing industries, and waste management sectors have also incorporated compact loaders for bulk material handling.

Property and facility maintenance is becoming a new application for small wheel loaders, especially on large commercial and municipal properties. The units are utilized extensively for snow ploughing, grounds maintenance, lot maintenance, and general facility maintenance of public and private facilities. Compact loaders are utilized by municipal governments for street sweeping, sidewalk maintenance, and small repair work.

Further development of smart cities and green city growth is also creating further demand for compact loaders in utility and facilities management. Compact loaders have had decent demand in Russia and Canada, which are both countries that have long, cold winters. With increasing urbanization and the pace quickening on developing smart infrastructure, further use of compact loaders in these markets is expected to increase.

The lightweight compact wheel loader market is very competitive with top international firms and a combination of local players leading the growth of the market. The leaders set the trend with innovation through technology, product, and solutions that are driven by efficiency in construction, agricultural, and landscaping use cases. The market has a combination of legacy brands and new entrants, with all contributing significantly to industry dynamics with differentiated solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Caterpillar Inc. | 14-18% |

| Volvo Construction Equipment | 11-15% |

| Deere & Company | 9-13% |

| Komatsu Ltd. | 7-11% |

| Wacker Neuson SE | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Caterpillar Inc. | Develops fuel-efficient compact wheel loaders with advanced telematics and operator assistance systems. Focuses on sustainable machine solutions with hybrid technology. |

| Volvo Construction Equipment | Specializes in electric compact wheel loaders, emphasizing zero-emission solutions and high energy efficiency for urban applications. |

| Deere & Company | Offers compact loaders with industry-leading attachment versatility, targeting agriculture and small construction firms. Invests in automation and smart controls. |

| Komatsu Ltd. | Produces compact wheel loaders with intelligent hydraulic systems and fuel-saving technologies. Focuses on durability for extreme conditions. |

| Wacker Neuson SE | Develops ultra-compact loaders with all-wheel steering and lightweight designs. Targets rental fleets and small contractors with easy-to-maintain models. |

Key Company Insights

Caterpillar Inc. (14-18%)

Caterpillar Inc. dominates the light compact wheel loader market with fuel-efficient and technology-driven products. The company is also dedicated to sustainability with hybrid-powered products and low-emission engines. Its vast global footprint and aftermarket network are its strengths in the construction and agricultural machinery industries.

Volvo Construction Equipment (11-15%)

Volvo Construction Equipment leads the way in electric compact wheel loader manufacturing, providing zero-emission equipment well suited for urban construction and municipal use. Volvo emphasizes longer runtime intervals and battery lifespan, making it a premier brand to environmentally focused customers. Volvo is reaching more customers with new rental and service packages aimed at customers.

Deere & Company (9-13%)

Deere & Company is a leader in agriculture, forestry, and small-construction compact loaders. Its focus on attachment compatibility and auto-control allows users to perform different activities with one machine. The company invests heavily in precision farming and smart machine guidance systems that help end users be productive.

Komatsu Ltd. (7-11%)

Komatsu Ltd. is renowned for its innovative hydraulic technology and strong construction to endure severe conditions. Its smaller wheel loaders incorporate load-sensing hydraulics, which optimize fuel economy and operating performance. Komatsu is also expanding in mining and heavy-duty segments where reliability is the key buying driver.

Wacker Neuson SE (4-8%)

Wacker Neuson SE excels with lightweight, extremely mobile compact loaders that are perfectly adapted to the needs of rental company and small builders. Its all-wheel steering of compact loaders offers improved manoeuvrability in narrow spaces. Wacker Neuson is located on the cost-effective solution platform to build in urban environments and landscape business use.

Other Key Players (45-55% Combined)

In addition to the market-leading producers, some of the manufacturers have a considerable market share that they focus on targeting regional markets, value-for-money, and specialty applications for loaders. Some of the industry majors are:

The overall market size for the lightweight compact wheel loader market was USD 15,447 million in 2025.

The lightweight compact wheel loader market is expected to reach USD 34,678 million in 2035.

The increasing adoption of lightweight machinery for construction, agriculture, and landscaping applications, coupled with advancements in fuel-efficient and electric-powered loaders, fuels the lightweight compact wheel loader market during the forecast period.

The top 5 countries driving the development of the lightweight compact wheel loader market are the USA, Germany, China, Japan, and France.

On the basis of application, the construction sector is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Compact Resin Type Silencer Market Size and Share Forecast Outlook 2025 to 2035

Compact Construction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Recloser Replacement Market Size and Share Forecast Outlook 2025 to 2035

Compact Pick-up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Compacted Graphite Iron Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Compact Construction Equipment

Compact E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Compact Road Sweepers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA