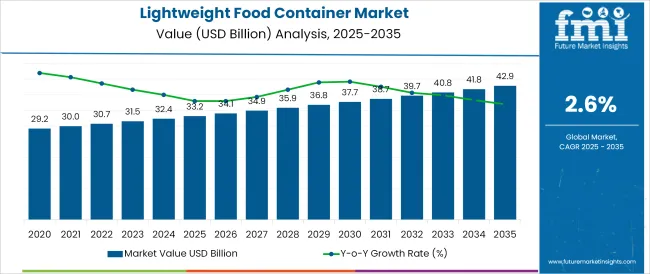

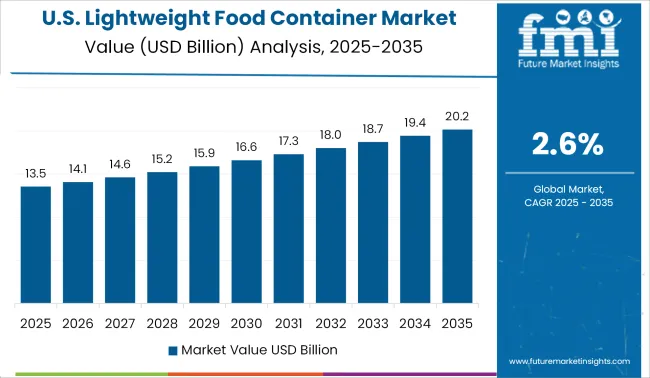

The Lightweight Food Container Market is estimated to be valued at USD 33.2 billion in 2025 and is projected to reach USD 42.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

The lightweight food container market is gaining momentum as sustainability imperatives, cost optimization, and evolving consumer expectations reshape the packaging industry. The transition toward reduced material usage without compromising functionality has become central to both manufacturers and brands.

Lightweight containers are enabling lower transportation costs, improved carbon footprint, and enhanced regulatory compliance while maintaining product integrity. Future growth is expected to be fueled by rising demand in convenience food and ready to eat segments, stricter waste reduction policies, and the adoption of innovative materials and designs.

Increased focus on circular economy principles and the growing influence of environmentally conscious consumers are anticipated to create further opportunities, supported by ongoing investments in manufacturing efficiencies and advanced molding technologies. The combination of cost savings, regulatory alignment, and brand differentiation continues to position lightweight food containers as a preferred choice across industries.

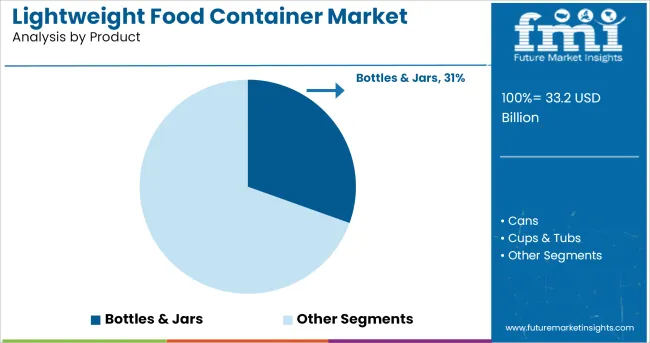

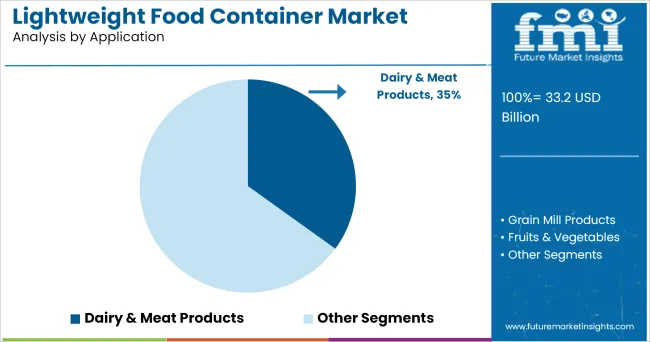

The market is segmented by Product and Application and region. By Product, the market is divided into Bottles & Jars, Cans, Cups & Tubs, Boxes, Pouches, and Others. In terms of Application, the market is classified into Dairy & Meat Products, Grain Mill Products, Fruits & Vegetables, Bakery Products, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, bottles and jars are expected to hold 30.5% of the total market revenue in 2025, making them the leading product segment. This dominance has been attributed to their versatility, ability to preserve product quality, and compatibility with automated filling and sealing processes.

The lightweight design of bottles and jars has facilitated cost efficient transportation and storage, making them particularly favorable in high-volume production environments. Durability and reusability have also contributed to their preference in both retail and food service applications.

Enhanced consumer appeal through ergonomic designs, coupled with the capability to incorporate branding elements effectively, has strengthened their adoption. Furthermore, the segment’s leadership has been reinforced by ongoing innovations in material technology, enabling reduced weight without sacrificing strength or barrier properties, thereby maintaining product protection while supporting sustainability goals.

Segmented by application, dairy and meat products are projected to account for 35.0% of the market revenue in 2025, positioning this as the foremost application segment. This prominence has been driven by the critical need for hygienic, tamper evident, and moisture-resistant packaging solutions to preserve freshness and extend shelf life.

Lightweight containers have been widely implemented in this segment due to their ability to withstand cold chain conditions and maintain structural integrity under refrigeration and freezing. The adoption of advanced sealing technologies and high-barrier materials in lightweight formats has further supported their growth.

Consumer demand for portion-controlled and convenient packaging has also fueled this segment’s expansion. Regulatory emphasis on food safety and waste reduction has reinforced the transition to innovative lightweight solutions, ensuring both compliance and operational efficiency, which has solidified dairy and meat products as the leading application within the market.

Global demand for frozen and packaged food has increased in recent decades due to busy lifestyle of consumers. The frozen or packaged food producer are adapting to ecological demands and so the demand for lightweight food container is increasing as the lightweight food container helps to reduce the cost of packaging by lower material consumption and greater shipping efficiency.

Adopting lightweight food container not only reduces overall costs but also saves energy in the production process and transportation. Lightweight food containers survive extreme environments and are not easily degraded in cold or hot temperature, thus preserving the integrity of food or beverages inside it and also protects the products from odours, and moisture.

Durability of lightweight food container allow manufacturers to print eye-catching, high quality custom designs of container.

Rigid food containers that are mostly preferred in food industry are quickly being replaced by flexible food containers that are made up of plastics. Plastics, due to their lightweight, durability, and flexibility are rapidly replacing rigid containers which are made up of rigid plastics and different non-plastic materials that includes metal and glass.

Glass and metal, which are prominently used in rigid containers, offer high barrier packaging irrespective of shelf-life requirements. Further, rigid containers formats are vulnerable to breakage and corrosion. Brands are able to offer longer shelf life and convenient user experience to consumers with the help of flexible containers.

Plastic flexible container products can be made in dense as well as transparent forms according to the merchandising requirements of the product.

Due to the properties of flexible plastic containers, the flexible containers provides brands and manufacturers the ability to increase product appeal by various innovative designs.

Nearly 2 percent of the cost of the purchase of the product is accounted by packaging. In European countries the numbers are high and Germany accounts for nearly 48kg per person per annum of packaging.

However, over the last 5 years, there is increasing awareness among the consumers about environmental issues and so consumers prefer lightweight container in order to reduce waste and to prioritize portable packaging.

Consumers across the developed market are increasing focusing on buying smaller pack containers that are resealable and easy to carry.

Companies in the region are focusing on manufacturing light weight containers for maintaining both quality and quantity of products and demand is increasing by food companies and outlets for functional food containers with proper locking system, handling system, protection and prevention from external factors resulting in contamination.

Companies in the region are developing lightweight, spill proof, and portable food containers for on-the-go food and beverages. Manufacturers are developing highly functional containers for delivering better consumer experience. A unique design of container leads to minimum wastage, no-mess and reduced food contamination.

Technological advancements are also leading to the development of pouches, boxes, and bags that can keep the food hot for a long time. Companies are introducing new containers for on-the-go food that features easy-to-hold, lightweight, and consumer-friendly containers for snacks, lunch and other grab and go food products.

Some of the leading manufacturers and suppliers include

Lightweight Food Container vendors adopt various expansion strategies for enhancing their presence and increasing the market share in the global market. The strategies that vendors follow include partnership and collaborations, with other players, merger & acquisitions, Strategic alliances, new product launches, and strengthening of regional and global distribution networks.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

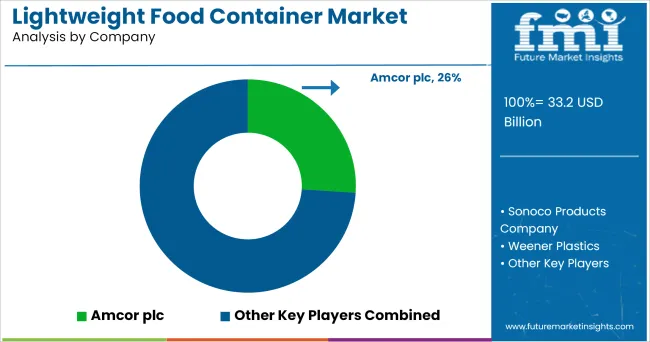

The global lightweight food container market is estimated to be valued at USD 33.2 billion in 2025.

The market size for the lightweight food container market is projected to reach USD 42.9 billion by 2035.

The lightweight food container market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in lightweight food container market are bottles & jars, cans, cups & tubs, boxes, pouches and others.

In terms of application, dairy & meat products segment to command 35.0% share in the lightweight food container market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA