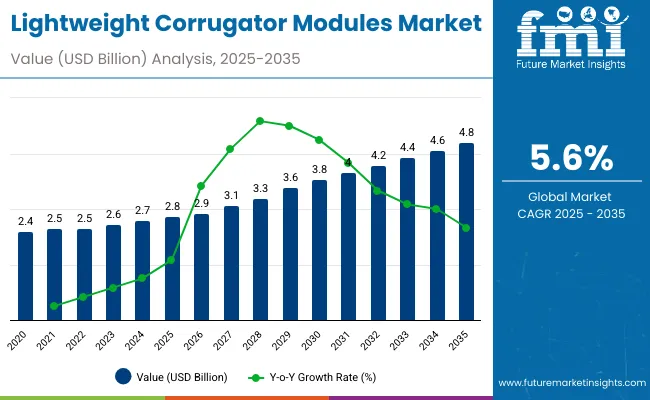

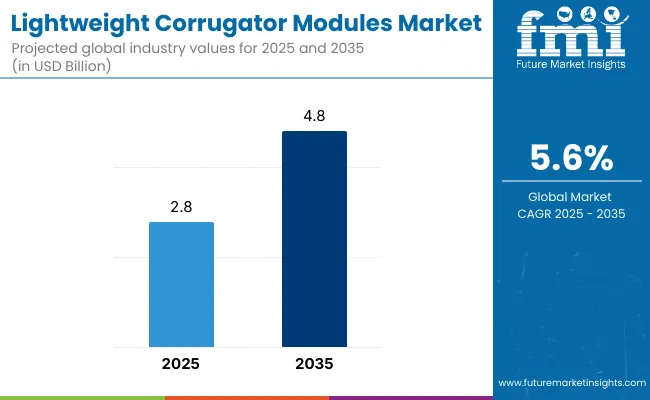

The global lightweight corrugator modules market will expand from USD 2.8 billion in 2025 to USD 4.8 billion by 2035, growing at a CAGR of 5.6%. Increasing preference for energy-efficient corrugation and lightweight board production is driving investments in advanced module systems. Single facer modules dominate installations due to their operational flexibility and reduced power consumption. Between 2025 and 2030, digital automation and predictive maintenance integration will enhance performance efficiency. By 2035, Asia-Pacific’s strong manufacturing infrastructure will make it the largest regional producer of lightweight corrugated solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.8 billion |

| Forecast Value in (2035F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

Between 2020 and 2024, the corrugation industry experienced a transition toward automation, modular production lines, and energy recovery systems. Sustainable board design and reduced paperweight standards defined investment priorities. By 2035, the market will reach USD 4.8 billion as servo-driven and heat-efficient modules become standard across manufacturing facilities. Asia-Pacific’s manufacturing hubs, led by South Korea, Japan, and China, will account for over 45% of global installations.

Growth is supported by surging demand for lightweight, high-strength corrugated packaging used in e-commerce and FMCG sectors. Efficiency-driven module designs, coupled with sustainability mandates, are pushing upgrades in production lines. Manufacturers are transitioning to servo-driven systems for reduced energy usage and improved accuracy.

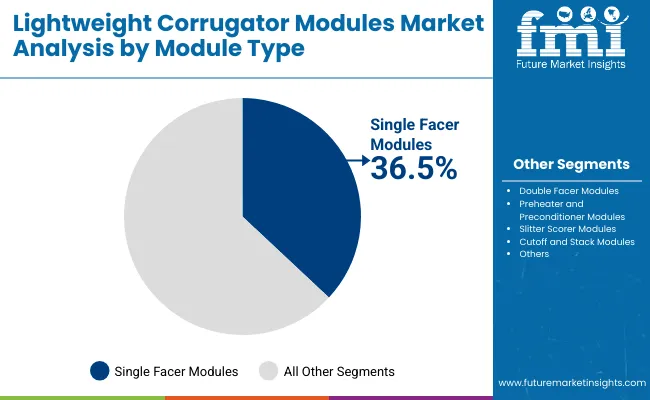

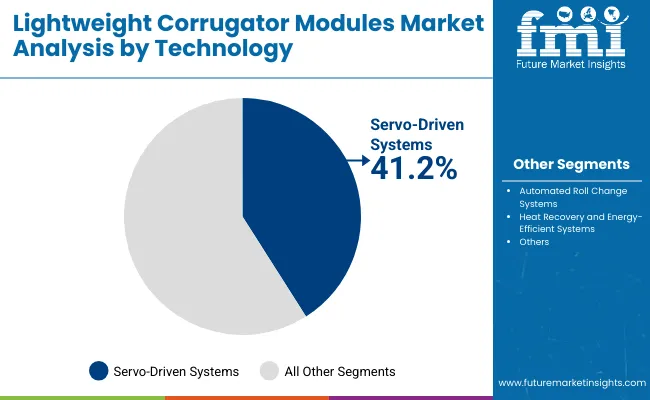

The market is segmented by module type, technology, board type, application, and region. Module type includes single facer modules, double facer modules, preheater and preconditioner modules, slitter scorer modules, and cutoff and stack modules, enabling efficient corrugated board production. Technology segmentation covers servo-driven systems, automated roll change systems, and heat recovery and energy-efficient systems, optimizing productivity and sustainability. Board type includes single wall board, double wall board, and triple wall board, serving diverse packaging strength requirements. Applications comprise e-commerce packaging, retail corrugated boxes, industrial packaging, and food and beverage cartons, highlighting expanding demand for lightweight, recyclable packaging. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

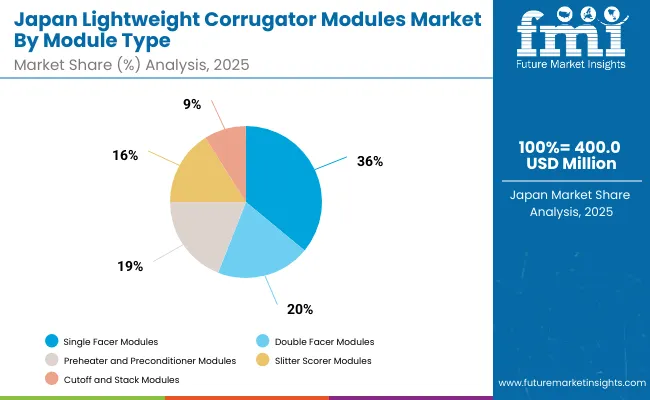

Single facer modules are projected to hold 36.5% of the market in 2025, supported by their ability to produce high-quality lightweight corrugated boards efficiently. These modules offer compact configurations and rapid flute change systems, reducing setup time and improving line flexibility for both large and mid-scale converters.

Their growing use reflects the demand for space-saving, energy-efficient corrugation systems that support smaller production runs. Integration with digital monitoring tools enhances process stability and board quality. As manufacturers shift toward lightweight packaging, single facer modules remain essential for optimizing productivity and material utilization.

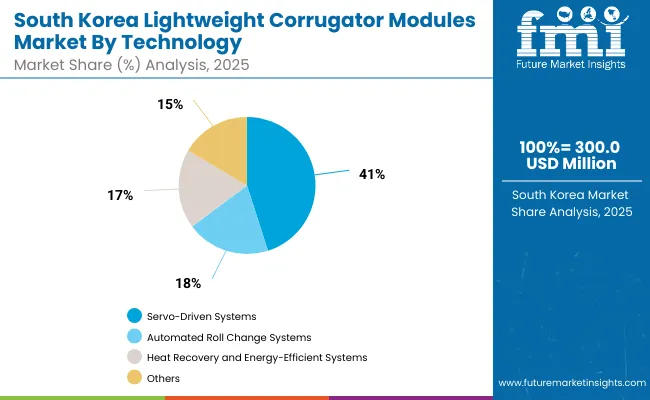

Servo-driven systems are forecast to capture 41.2% of the market in 2025, as they deliver precise control, faster response, and reduced energy consumption. Their ability to maintain consistent tension and alignment ensures superior board formation and minimal waste.

Manufacturers prefer servo technology for its role in automated maintenance and data-driven production. Integration with smart control systems improves accuracy while lowering downtime. As sustainability becomes central to corrugated operations, servo-driven systems provide both operational and environmental benefits.

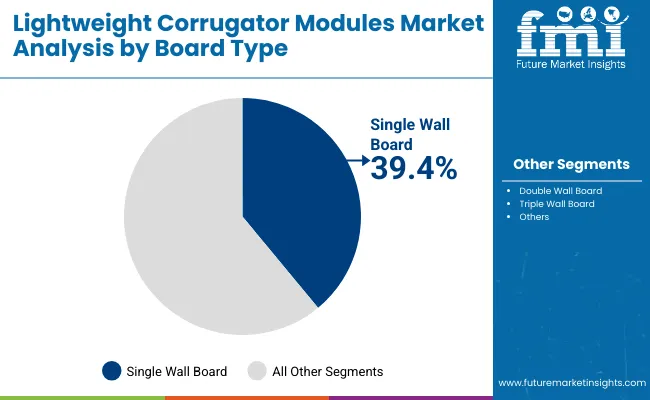

Single wall boards are expected to account for 39.4% of the market in 2025, offering an ideal balance between durability and material savings. They are widely used in consumer goods and e-commerce packaging where protection and weight reduction are equally important.

Their lighter structure supports high-speed converting while maintaining stacking strength and printability. Growing adoption of recyclable substrates further strengthens their demand. As online retail packaging evolves, single wall boards continue to dominate corrugated board preferences.

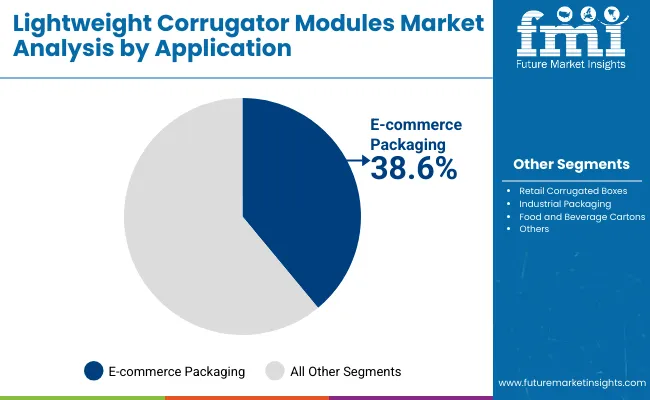

E-commerce packaging is projected to represent 38.6% of the market in 2025, fueled by rapid online retail expansion and higher parcel shipping volumes. Lightweight corrugator modules enhance production efficiency to meet the growing demand for sustainable and protective shipping solutions.

Automation in e-commerce fulfillmentcenters supports continuous demand for consistent, low-weight packaging. Manufacturers adopt modular corrugation systems to reduce waste and improve responsiveness to variable order sizes. As e-commerce continues to reshape supply chains, this application remains the largest market driver.

E-commerce growth, sustainability regulations, and automation in corrugation drive steady demand for lightweight modules. High machinery costs and technical complexity limit adoption among small converters. Adoption of IoT-enabled modules and energy-efficient preheating technologies opens new growth potential. Smart manufacturing, digital performance monitoring, and modular retrofits for sustainability compliance are defining next-generation corrugator systems.

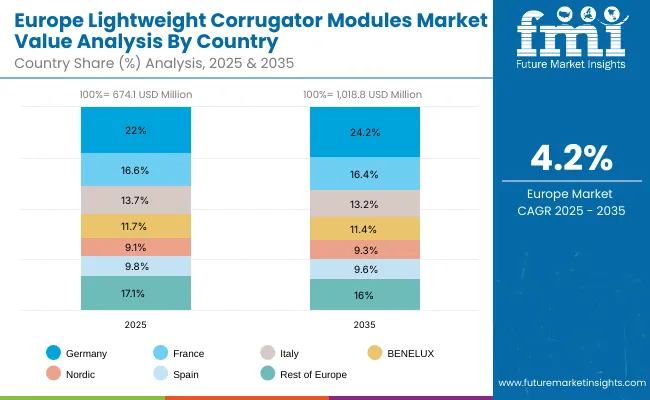

The global lightweight corrugator modules market is expanding rapidly as automation, sustainability, and digitalization reshape the packaging landscape. Asia-Pacific leads with large-scale production and export-oriented manufacturing, while North America focuses on advanced automation and smart control integration. Europe continues to modernize under strict environmental regulations and energy-efficiency standards. Increasing demand for e-commerce and lightweight board packaging is fueling investments in servo-driven systems, AI-based maintenance, and modular corrugation technology across regions.

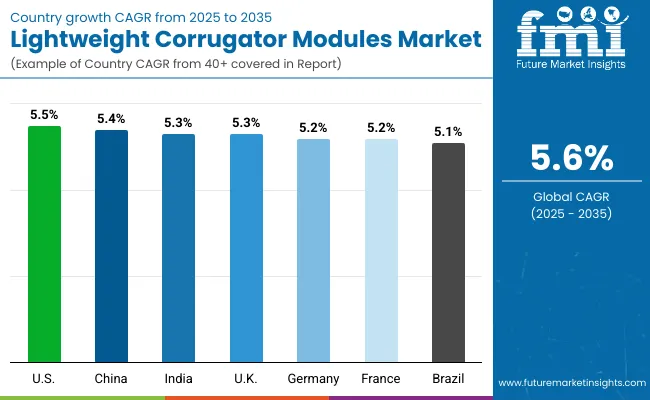

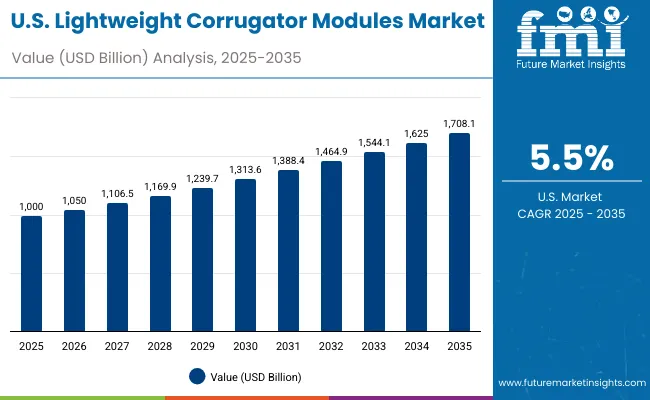

The USA will grow at 5.5% CAGR, supported by automation and the rise of smart corrugation lines in packaging manufacturing. Continuous upgrades in energy-efficient corrugator modules are driving operational cost reductions. E-commerce packaging remains a dominant segment, creating sustained demand for lightweight and durable board production. Growing R&D investments in digital control systems and data-driven monitoring solutions are advancing U.S. competitiveness in precision corrugation machinery.

Germany will expand at 5.2% CAGR, driven by its engineering expertise and focus on sustainability-driven modernization. Adoption of servo-based automation is improving efficiency and reducing waste in corrugator operations. Strengthening paper recycling and sustainability standards are influencing equipment redesigns and upgrades. Local equipment manufacturers are enhancing export competitiveness through advanced, high-speed corrugation systems and eco-certified production processes.

The U.K. will grow at 5.3% CAGR, emphasizing sustainable and efficient corrugation practices across its packaging sector. Lightweight board production is rising as logistics and e-commerce demand intensifies. Corrugator modernization initiatives are being driven by both government policies and private-sector sustainability commitments. Local manufacturers are investing in automation to increase throughput while aligning with circular packaging and carbon reduction objectives.

China will grow at 5.4% CAGR, maintaining its position as the global hub for corrugator manufacturing. Expansion of domestic module suppliers is supporting export growth and regional self-sufficiency. Corrugated packaging exports continue to increase, serving global demand for lightweight transport packaging. Industrial automation and digital control integration are lowering operational costs and improving productivity across China’s large-scale corrugator facilities.

India will grow at 5.3% CAGR, driven by retail and FMCG packaging growth across urban and rural markets. Investments in local module manufacturing are increasing to reduce dependency on imports. Lightweight material substitution and design innovation are strengthening sustainability credentials. SMEs are embracing affordable servo-controlled systems to improve production efficiency and meet domestic demand for eco-friendly corrugated packaging.

Japan will grow at 6.0% CAGR, leading advancements in automation, precision engineering, and AI-based monitoring for corrugation systems. Compact modular designs are enhancing productivity and reducing downtime in limited production spaces. Energy recovery systems are widely adopted to minimize waste and improve sustainability metrics. AI-driven predictive maintenance is further elevating system reliability and performance consistency across the packaging industry.

South Korea will lead with 6.1% CAGR, emphasizing smart corrugation technology and digital integration. Export-oriented production growth continues, fueled by high-tech manufacturing and automation. Robotics are enhancing precision and assembly accuracy in lightweight corrugator modules. The country’s focus on circular packaging initiatives and sustainability innovation is scaling up across both domestic and international markets.

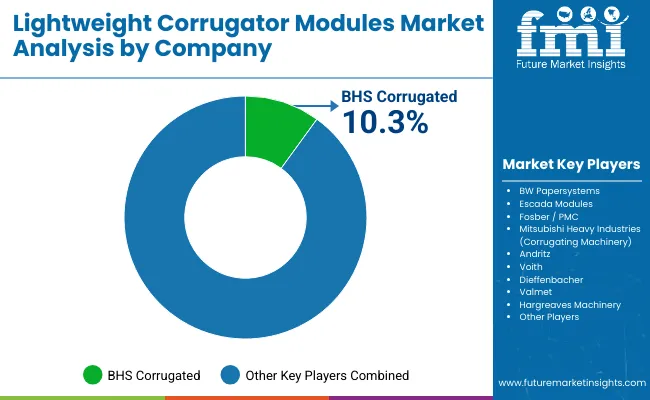

The market is moderately consolidated with BHS Corrugated, BW Papersystems, Escada Machinery, Fosber/ProJet, Mitsubishi Heavy Industries, Andritz, Voith, Durr Systems, Diefenbach, and Valmet as major participants. Players are expanding smart manufacturing lines, optimizing maintenance automation, and introducing predictive software for performance tracking.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| By Module Type | Single Facer, Double Facer, Preheater, Slitter Scorer, Cutoff Stack |

| By Technology | Servo-Driven, Automated Roll Change, Energy-Efficient Systems |

| By Board Type | Single Wall, Double Wall, Triple Wall |

| By Application | E-commerce, Retail, Industrial, Food & Beverage |

| Key Companies Profiled | BHS Corrugated, BW Papersystems , Escada Machinery, Fosber / ProJet , Mitsubishi Heavy Industries, Andritz , Voith , Durr Systems, Diefenbach , Valmet |

| Additional Attributes | Growth driven by automation, energy efficiency, and modular smart corrugation systems. |

The Lightweight Corrugator Modules Market is valued at USD 2.8 billion in 2025.

The Lightweight Corrugator Modules Market will reach USD 4.8 billion by 2035.

The market will grow at a CAGR of 5.6%.

Servo-Driven Systems dominate with a 41.2% share in 2025.

Key companies include BHS Corrugated, BW Papersystems, Escada Machinery, Fosber/ProJet, Mitsubishi Heavy Industries, Andritz, Voith, Durr Systems, Diefenbach, and Valmet.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

Train Ceiling Modules Market

Thermoelectric Modules Market Size and Share Forecast Outlook 2025 to 2035

Power Amplifier Modules Market

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaic Modules Market

Automated Radiosynthesis Modules Market

Automotive Power Distribution Modules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA