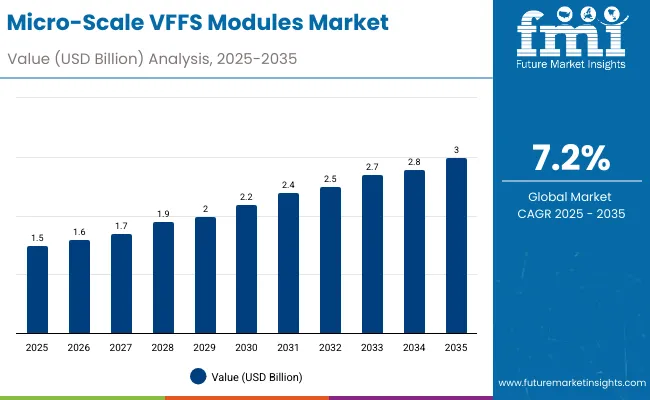

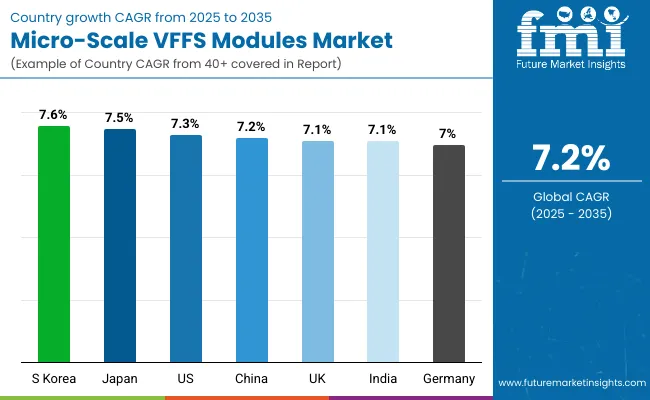

The micro-scale VFFS modules market will expand from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, advancing at a CAGR of 7.2%. Demand is driven by miniaturized packaging lines, flexible pouch formats, and increased automation in small-scale production facilities. Continuous motion systems dominate due to higher speed and precision packaging capabilities.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.8 billion |

| CAGR (2025 to 2035) | 7.2% |

Between 2025 and 2030, the market will add USD 0.6 billion, primarily from FMCG and healthcare packaging. From 2030 to 2035, an additional USD 0.7 billion will be generated by cosmetics and nutraceutical packaging. Asia-Pacific will lead expansion as local manufacturers adopt compact and energy-efficient packaging lines.

From 2020 to 2024, micro-scale VFFS modules gained strong adoption in compact production environments, driven by demand for precision packaging of powders, liquids, and granules. Food, cosmetics, and healthcare industries adopted modular systems for flexibility and speed. Continuous motion designs became popular due to high throughput and minimal downtime.

By 2035, the market will reach USD 2.8 billion at 7.2% CAGR. Compact and smart modules will dominate across FMCG and pharmaceutical packaging. Asia-Pacific will remain the fastest-growing region, supported by small-to-medium enterprises upgrading automation. Sustainability trends will favor biodegradable film usage, enhancing equipment compatibility and efficiency.

Growth is fueled by global demand for flexible and small-batch packaging, especially across FMCG and healthcare. Miniaturized production facilities prefer micro-VFFS modules for efficiency and reduced material wastage.

Automation and digital control systems improve precision, enabling seamless integration with Industry 4.0 lines. Flexible pouch packaging’s expanding role in e-commerce, retail, and healthcare sectors reinforces adoption. Technological innovation, modular design, and film versatility will continue driving the market’s upward trajectory.

The market is segmented by machine type, packaging material, pouch type, end-use industry, and region. Machine types include continuous motion, intermittent motion, and multi-lane micro-VFFS modules. Packaging materials include laminated films, PE, PP, PET, and biodegradable films. Pouch types include stick packs, pillow, sachets, gusseted, and 3-/4-side seal pouches. End-use industries include food, pharmaceuticals, cosmetics, chemicals, and pet food.

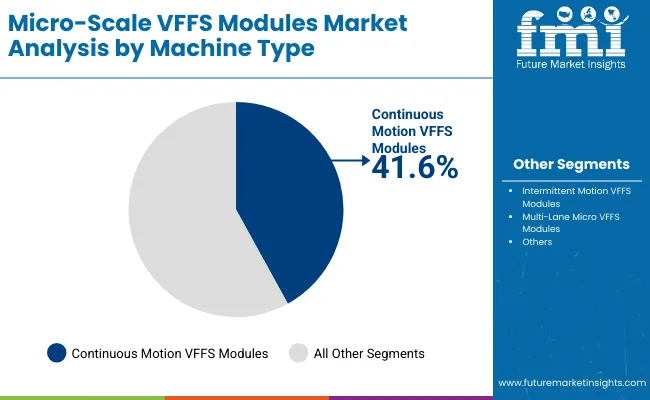

Continuous motion modules will hold 41.6% share in 2025 due to their speed, accuracy, and consistent sealing efficiency. They are favored in food and pharmaceuticals for compact operation and minimal wastage.

Future growth will stem from integration with robotic feeding and advanced motion controls. Their high throughput makes them vital in small, automated packaging plants worldwide.

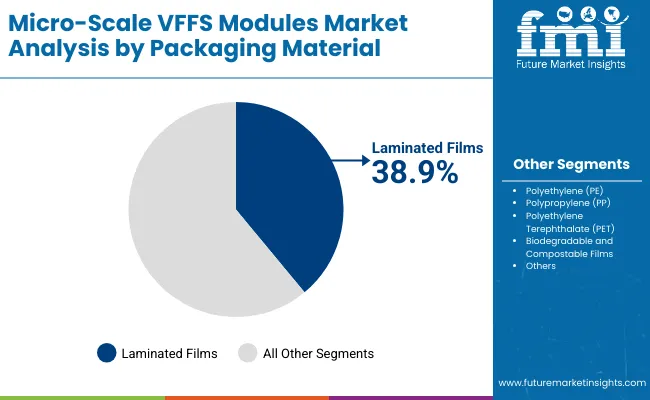

Laminated films will capture 38.9% share in 2025, valued for flexibility, durability, and extended shelf life. Their multilayer structure enhances product protection.

Future demand will rise in FMCG, where laminated films balance sustainability with performance. Compatibility with heat and ultrasonic sealing will ensure steady dominance.

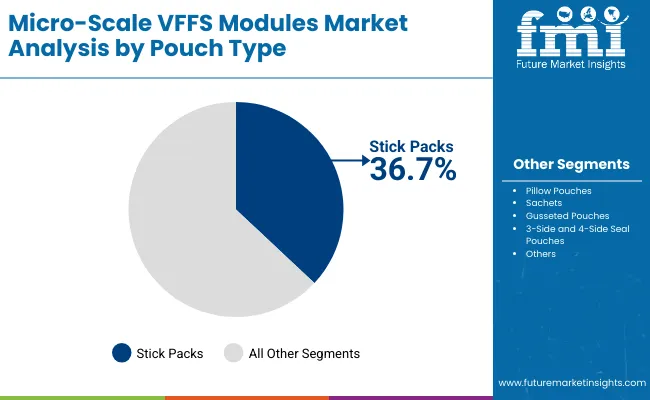

Stick packs will account for 36.7% share in 2025, driven by portion-controlled food, nutraceuticals, and instant beverages. Compact design and convenience support growth.

Future adoption will rise in pharmaceuticals and cosmetics, enhancing on-the-go packaging applications. Energy-efficient sealing further supports scalability.

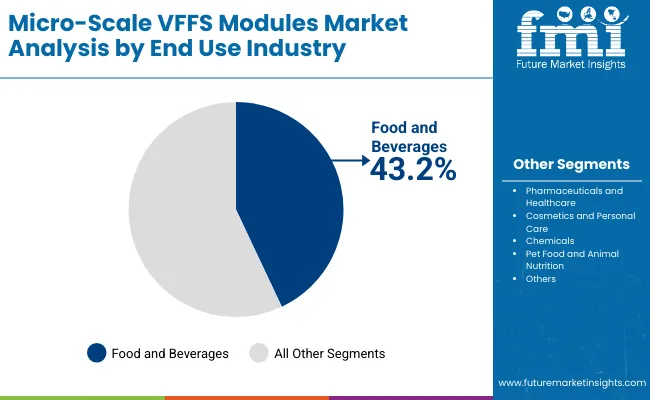

Food and beverages will represent 43.2% share in 2025, anchored by snack, powder, and liquid packaging. Compact VFFS modules enable small-batch, multi-format production.

By 2035, this segment will remain dominant due to rapid FMCG growth and sustainability alignment. Automation and portioning efficiency will reinforce usage.

Rising demand for compact packaging automation, flexibility, and sustainability drives market expansion. Micro-VFFS systems enhance precision and reduce waste, meeting demand across small producers.

High initial costs, film compatibility challenges, and limited scalability in large operations restrain growth. Maintenance complexity deters low-capacity plants.

Opportunities lie in pharmaceuticals, nutraceuticals, and personalized packaging. Eco-friendly film integration and servo-driven sealing create new potential.

Smart automation, predictive maintenance, and IoT-enabled control dominate trends. Growing use of biodegradable films and low-energy sealing technologies enhances adoption.

The global automated packaging equipment market is accelerating as industries pursue greater efficiency, precision, and sustainability. Asia-Pacific remains the fastest-growing region, with South Korea and Japan advancing automation in manufacturing and healthcare sectors. China and India continue to scale adoption through expanding FMCG and e-commerce ecosystems. Meanwhile, developed markets such as the USA, Germany, and the UK are optimizing production through digital control systems, energy-efficient machinery, and eco-friendly materials aligned with circular economy goals.

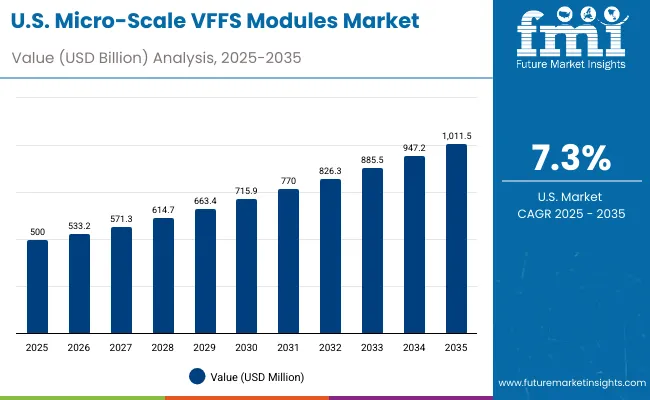

The USA market will grow at a CAGR of 7.3% from 2025 to 2035, driven by automation upgrades in FMCG and healthcare packaging. Investments in robotic handling, predictive maintenance, and digital monitoring systems are improving efficiency and reducing operational costs. The healthcare sector is expanding the use of automated lines to enhance sterile packaging and regulatory compliance, while sustainability-focused initiatives are pushing for recyclable and lightweight materials.

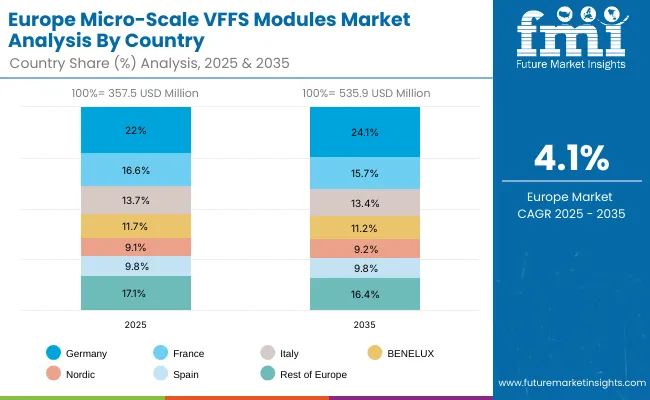

Germany is projected to expand at a CAGR of 7.0%, guided by EU-wide sustainability mandates and advancements in food packaging automation. German OEMs are integrating smart robotics and IoT-enabled controls to optimize performance. Automation in food and beverage lines is leading market expansion, while energy-efficient sealing and labeling systems are helping reduce production footprints across industrial packaging applications.

The UK market will grow at a CAGR of 7.1%, driven by rapid modernization among small and medium packaging startups. SMEs are upgrading to digitalized, modular systems that support smaller, customizable batch sizes. The shift toward flexible pouch formats and reduction of single-use plastics are key accelerators, with new automation platforms enhancing speed, sustainability, and precision for e-commerce and FMCG packaging lines.

China will expand at a CAGR of 7.2%, fueled by booming nutraceutical exports, food manufacturing, and e-commerce. Automation adoption is growing rapidly among SMEs seeking compact, efficient systems to enhance productivity. Domestic OEMs are focusing on cost-effective packaging automation compatible with biodegradable films, while multinational producers continue to expand smart factory networks aligned with China’s "Made in Green" and digitalization goals.

India is projected to grow at a CAGR of 7.1%, supported by FMCG expansion, sachet-based packaging, and increased automation in mid-scale facilities. Manufacturers are prioritizing compact, high-speed systems for flexible packaging formats. The country’s export competitiveness is being strengthened by cost-efficient automated machinery, helping reduce manual intervention and improve output consistency across both rural and urban packaging sectors.

Japan will grow at a CAGR of 7.5%, driven by compact industrial setups and precision engineering in packaging automation. The country’s strong focus on healthcare, nutraceuticals, and premium consumer goods is fostering demand for high-precision machinery with motion control innovations. Local manufacturers are emphasizing miniaturized, high-speed systems for space efficiency, supporting both domestic and export-oriented packaging industries.

South Korea is expected to lead growth with a CAGR of 7.6%, driven by rapid automation adoption and digital control integration. The country’s smart factory initiatives are enhancing efficiency in cosmetics, pharmaceuticals, and electronics packaging. Growing exports and demand for sustainable materials are reinforcing the shift toward high-speed, sensor-driven autoboxing and sealing systems that reduce waste and energy consumption.

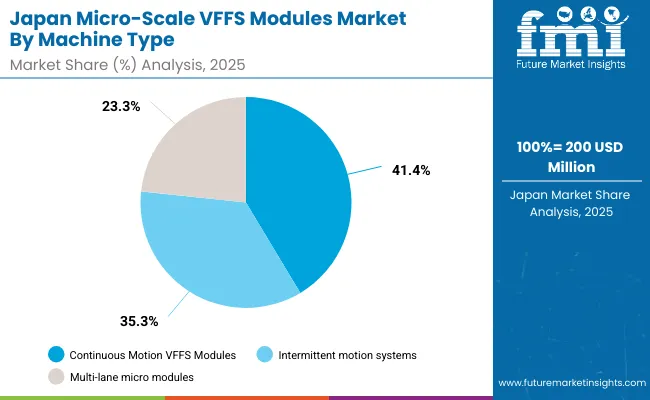

Japan’s micro-scale VFFS modules market, valued at USD 200 million in 2025, is dominated by continuous motion modules with a 41.4% share due to superior speed and precision in snack and pharma packaging. Intermittent motion systems account for 35.3%, catering to flexible batch production. Multi-lane micro modules hold 23.3%, supporting compact, high-output operations. These machines benefit from Japan’s automation investments and IoT-integrated controls enhancing micro-pouch accuracy. Growth is driven by demand for mini-dose formats, cleanroom-compatible designs, and compact multi-feed sealing innovations tailored for high-precision product handling and efficiency across food and nutraceutical applications.

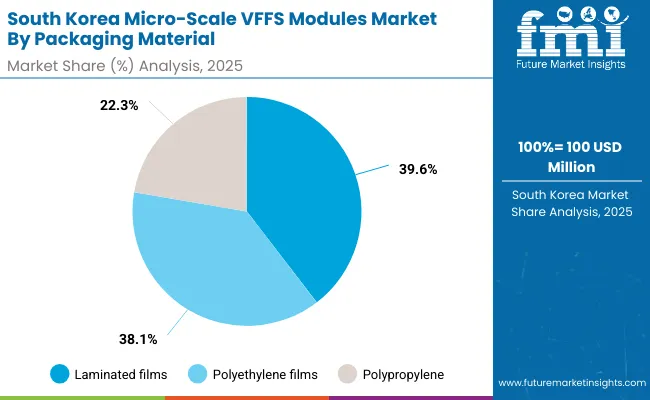

South Korea’s market, estimated at USD 100 million in 2025, is led by laminated films with a 39.6% share for their high barrier protection and multi-layer sealing reliability. Polyethylene films follow closely at 38.1%, offering cost-efficient and recyclable solutions. Polypropylene holds 22.3%, preferred for thermal resistance and product clarity. The market benefits from sustainability-driven material innovation and automated packaging modernization. South Korea’s smart manufacturing push and precision packaging expansion continue to favor lightweight, durable, and recyclable film use in micro VFFS applications, particularly across food, healthcare, and single-serve product industries adopting automated dispensing technologies.

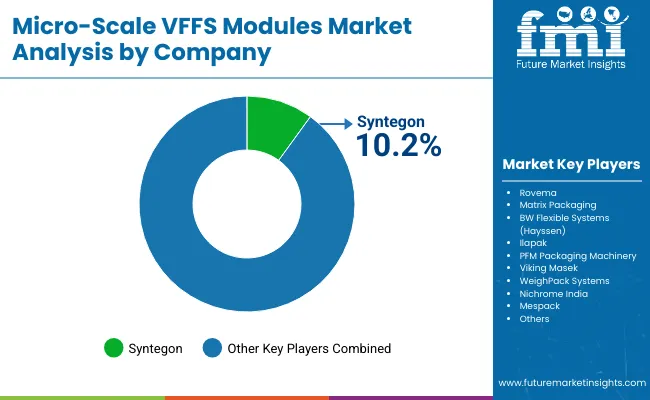

The market is moderately consolidated, with leading players including Syntegon, Rovema, Matrix Packaging, BW Flexible Systems (Hayssen), Ilapak, PFM Packaging Machinery, Viking Masek, WeighPack Systems, Nichrome India, and Mespack. These companies focus on automation, modularity, and sustainability.

Syntegon and Rovema lead innovation in servo-based micro modules. Matrix Packaging and BW Flexible Systems enhance compact sealing systems. Nichrome and Mespack dominate emerging Asia with affordable automation. Competition centers on speed, precision, and eco-film compatibility.

Key Developments of Micro-Scale VFFS Modules Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Machine Type | Continuous Motion, Intermittent Motion, Multi-Lane Micro Modules |

| By Packaging Material | Laminated Films, PE, PP, PET, Biodegradable & Compostable Films |

| By Pouch Type | Stick Packs, Pillow, Sachets, Gusseted, 3-/4-Side Seal Pouches |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics, Chemicals, Pet Food |

| Key Companies Profiled | Syntegon, Rovema, Matrix Packaging, BW Flexible Systems (Hayssen), Ilapak, PFM Packaging Machinery, Viking Masek, WeighPack Systems, Nichrome India, Mespack |

| Additional Attributes | Growth driven by miniaturized automation, sustainable films, and high-speed compact packaging demand. |

The market will be valued at USD 1.5 billion in 2025.

The market will reach USD 2.8 billion by 2035.

The market will grow at a CAGR of 7.2% during 2025-2035.

Continuous motion VFFS modules will lead with a 41.6% share in 2025.

Laminated films will dominate with a 38.9% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

Train Ceiling Modules Market

Thermoelectric Modules Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Power Amplifier Modules Market

Power Integrated Modules Market Trends – Growth & Forecast through 2034

Power Discrete and Modules Market Size and Share Forecast Outlook 2025 to 2035

Signal Conditioning Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaic Modules Market

Vertical Form Fill Seal VFFS Machine Market Size and Share Forecast Outlook 2025 to 2035

Automated Radiosynthesis Modules Market

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Distribution Modules Market Size and Share Forecast Outlook 2025 to 2035

Underground Rainwater Collection Modules Market Size and Share Forecast Outlook 2025 to 2035

Special Sealant for Photovoltaic Modules Market Forecast and Outlook 2025 to 2035

Automotive Electrochromic Rearview Modules Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Package Shell for Optical Communication Modules Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA