The signal conditioning modules market is forecasted to grow significantly, with an estimated value of USD 1.7 billion in 2025 projected to reach USD 3.9 billion by 2035, advancing at a CAGR of 9.0% during the forecast period.

Growth in this market is driven by the increasing need for accurate and reliable data acquisition in industries such as automation, energy, oil & gas, healthcare, aerospace, and automotive. Signal conditioning modules are essential for filtering, amplifying, and converting signals into standardized formats that can be processed by control and monitoring systems. With the rising adoption of Industry 4.0, smart manufacturing, and IIoT applications, the role of these modules has become more critical in ensuring precise measurement and control.

Technological advancements, including modular designs, improved compatibility with PLC/DCS systems, and integration of isolation features, are enhancing performance and usability. The shift toward renewable energy monitoring, process automation, and advanced medical devices further supports demand. However, cost sensitivity in emerging markets and the complexity of integrating advanced systems may pose challenges.

Quick Stats for Signal Conditioning Modules Market

| Metric | Value |

|---|---|

| Signal Conditioning Modules Market Estimated Value in (2025 E) | USD 1.7 billion |

| Signal Conditioning Modules Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The signal conditioning modules market is experiencing notable momentum due to the rapid digitalization of industrial infrastructure and increasing demand for precise data interpretation in mission-critical applications. The need to convert, isolate, amplify, and filter analog signals into standardized digital formats has become essential for ensuring compatibility and accuracy across complex control systems.

Growing investments in smart manufacturing, process automation, and industrial IoT solutions are further propelling adoption across sectors such as energy, transportation, and utilities. The focus on real time monitoring, predictive maintenance, and system reliability has reinforced the deployment of signal conditioning modules across legacy and modernized plants alike.

The outlook remains robust as industries continue to prioritize data fidelity, operational efficiency, and seamless integration with programmable logic controllers and distributed control systems.

The signal conditioning modules market is segmented by form, type, applicationend-use industry, and geographic regions. By form of the signal conditioning modules market is divided into DIN Rail-/Rack-mounted Module and Standalone/Modular Module. In terms of type of the signal conditioning modules market is classified into Temperature Signal Conditioner, Pressure Sensor Signal Conditioner, AC & DC Signal Conditioner, and Frequency Signal Conditioner. Based on application of the signal conditioning modules market is segmented into Data acquisition, Process control, Measurement & Evaluation, and Others. By end-use industry of the signal conditioning modules market is segmented into Aerospace & Defense, Consumer Electronics, Energy & Power, Food & Beverage, Industrial Equipment, Manufacturing, Water & Wastewater, and Others. Regionally, the signal conditioning modules industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DIN rail or rack mounted module segment is expected to capture 58.60% of total revenue by 2025 within the form category, making it the leading configuration. This dominance is driven by its ease of installation, high modularity, and space saving benefits in industrial control panels.

These modules offer strong mechanical support and streamlined cable management, contributing to reliable performance in high vibration and confined environments. Additionally, compatibility with standardized enclosures and wide availability of accessories support their scalability and customization in complex automation systems.

As industries seek robust and maintainable signal transmission infrastructure, DIN rail and rack mounted modules continue to lead due to their proven adaptability and deployment efficiency.

The temperature signal conditioner segment is projected to represent 26.90% of the market by 2025 under the type category. This segment’s prominence is attributed to the critical need for accurate temperature measurement in sectors such as manufacturing, power generation, food processing, and HVAC.

These conditioners convert thermocouple or RTD inputs into standard signals, ensuring compatibility with control and monitoring equipment. Their role in safeguarding process consistency, maintaining quality standards, and improving energy efficiency has been widely acknowledged.

As temperature remains one of the most monitored parameters in industrial applications, the demand for reliable and calibrated signal conditioners continues to grow, reinforcing this segment’s leadership.

The data acquisition segment is anticipated to hold 39.40% of total market revenue by 2025 within the application category. This growth is being driven by increased requirements for continuous monitoring, performance analysis, and real time system diagnostics across industrial and research environments.

Signal conditioning modules play a crucial role in capturing clean and accurate data from various sensors and transducers, supporting critical decisions and system automation. Their use in applications ranging from quality control to structural health monitoring has become increasingly common.

The integration of these modules with edge computing and cloud platforms further enhances data visibility and scalability. As organizations continue to prioritize actionable data and process transparency, the data acquisition segment remains central to the signal conditioning modules market.

The market has expanded due to increasing demand for reliable power transmission solutions in locomotives, metro systems, and freight rail operations. Gearboxes are critical in ensuring torque conversion, speed regulation, and operational efficiency across rail propulsion systems. Growth has been driven by the modernization of rail fleets, adoption of electric and hybrid propulsion, and expansion of urban and freight rail networks. Technological advancements in materials, precision manufacturing, and lubrication systems have enhanced performance and durability, reinforcing adoption across passenger and freight rail applications globally.

Advancements in gear design and materials have strengthened the rail gearbox market by improving performance, durability, and maintenance intervals. High-strength alloys, case-hardened steel, and precision-machined components have been employed to reduce wear and extend service life under heavy load conditions. Gear geometries have been optimized for torque efficiency, noise reduction, and vibration control, while surface treatments have enhanced resistance to corrosion and fatigue. Modular designs have allowed customization for diverse locomotive and freight applications, enabling easier installation and maintenance. Lubrication technologies have been enhanced with high-performance oils and self-lubricating coatings to ensure stable operation across varying temperatures and speeds. Collectively, these advancements have positioned modern rail gearboxes as highly reliable, long-lasting, and essential components for safe and efficient rail operations globally.

The growth of electric and hybrid rail systems has driven demand for advanced gearboxes capable of handling variable torque and high-speed performance. Gearboxes in electric locomotives, metro trains, and freight units have been engineered to integrate seamlessly with electric traction motors, regenerative braking systems, and energy storage solutions. Efficiency optimization has been achieved through precision gearing, optimized gear ratios, and lightweight materials, which reduce energy consumption and operational costs. Hybrid propulsion systems have further increased adoption by requiring gearboxes capable of accommodating fluctuating power inputs and high torque variability. The rise of electrified rail networks in Europe, Asia, and North America has reinforced investment in advanced gearboxes, making them indispensable for modern, energy-efficient rail propulsion systems.

Operational reliability and maintenance considerations have significantly influenced the rail gearbox market. Long service life, low downtime, and reduced maintenance requirements have been prioritized by operators seeking consistent fleet availability. Condition monitoring systems, vibration analysis, and predictive maintenance technologies have been employed to detect gear wear and prevent unplanned failures. Modular and standardized gearbox components have facilitated quicker replacement and minimized service disruptions. Lubrication and cooling enhancements have further contributed to reduced maintenance frequency. Rail operators handling high-speed passenger and heavy freight operations have increasingly adopted gearboxes designed for robust performance, ensuring safe and uninterrupted service. Consequently, operational reliability and maintenance efficiency have become critical drivers of market adoption globally.

Rail network modernization initiatives have been central to the expansion of the rail gearbox market. Investments in high-speed rail corridors, metro systems, and freight logistics have necessitated upgrades of older rolling stock and propulsion systems. Modern gearboxes with enhanced torque handling, vibration reduction, and efficiency capabilities have been installed to support new locomotives and retrofitted fleets. Urban and regional transit expansion projects have created demand for compact, high-performance gearboxes capable of accommodating tight installation spaces. The fleet standardization programs have encouraged procurement of modular and scalable gearboxes to simplify maintenance and spare part management. Modernization of rail infrastructure, combined with the growth of passenger and freight rail services, has driven consistent global demand for advanced rail gearboxes.

The market is projected to grow at a CAGR of 5.0% between 2025 and 2035, supported by modernization of rail systems, adoption of high-efficiency gear solutions, and investment in urban and freight rail networks. China leads with a 6.8% CAGR, driven by large-scale railway infrastructure expansion and advanced gearbox manufacturing capabilities. India follows at 6.3%, with growth fueled by railway electrification and modernization programs. Germany, at 5.8%, benefits from established precision engineering and advanced rail technologies. The UK, growing at 4.8%, focuses on upgrading regional and national rail networks. The USA, at 4.3%, experiences steady demand from freight rail modernization and high-performance gearbox adoption. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to expand at a CAGR of 6.8% in the market from 2025 to 2035, driven by modernization of high-speed rail networks and increasing freight traffic. Domestic manufacturers are investing in advanced gearbox designs and precision manufacturing techniques to enhance efficiency and reliability. Upgrades of existing rolling stock and expansion of urban rail systems are generating strong demand for high-performance gearboxes. Strategic collaborations between railway operators and component suppliers are facilitating adoption of advanced solutions and increasing service lifespan of equipment.

India is projected to grow at a CAGR of 6.3% in the industry from 2025 to 2035, supported by increasing urban and intercity rail connectivity projects. Upgrades in locomotive efficiency and adoption of lightweight and high-torque gearbox solutions are driving growth. Domestic and international suppliers are collaborating to enhance technology transfer and reliability standards. Government programs targeting regional rail networks and freight corridors are creating sustained demand for high-quality gearboxes.

Germany is forecast to grow at a CAGR of 5.8% in the market from 2025 to 2035, driven by modernization of freight and passenger train fleets. High-speed trains and regional commuter services are demanding advanced gearbox technologies to ensure reliability and reduce maintenance intervals. Manufacturers are focusing on precision engineering, enhanced torque capacities, and vibration reduction. Research collaborations between industry and technical institutes are enhancing performance and service life.

The United Kingdom is anticipated to grow at a CAGR of 4.8% in the market from 2025 to 2035, supported by modernization of commuter and freight rail systems. Upgrades in efficiency and reliability of gearboxes for high-speed and metro services are driving demand. Strategic alliances between manufacturers and rail operators are fostering development of customized solutions for specific service requirements. Regulatory compliance and maintenance efficiency are influencing technology adoption.

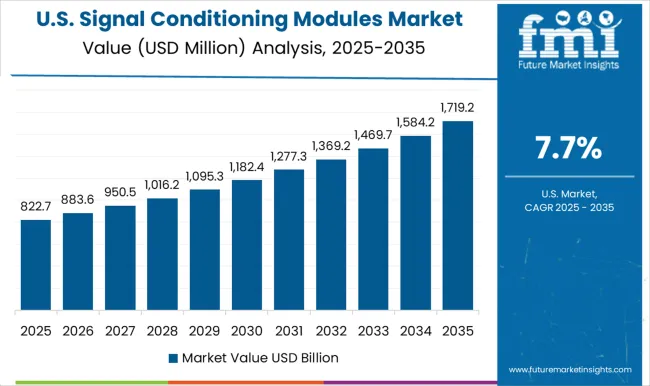

The United States is expected to expand at a CAGR of 7.7%% in the market from 2025 to 2035, driven by growth in freight and passenger rail modernization initiatives. Manufacturers are emphasizing durability, high torque capacity, and reduced maintenance requirements. Public and private investments in rail infrastructure are supporting adoption of advanced gearboxes. Collaborative programs with component suppliers are ensuring consistent quality and innovation in rolling stock drivetrain systems.

The signal conditioning modules market is defined by a mix of global automation leaders, specialized instrumentation providers, and regional suppliers. Key players such as Siemens, Rockwell Automation, Yokogawa Electric, National Instruments, and Pepperl+Fuchs dominate through comprehensive product portfolios integrated with PLC and DCS platforms.

These companies compete on reliability, modularity, and compatibility with diverse industrial systems. HBM, Dataforth, and Dewetron strengthen the field by offering specialized modules for high-precision testing and measurement, particularly in aerospace, automotive, and energy sectors. Regional manufacturers emphasize cost-effective, application-specific solutions to capture demand in emerging markets. Innovation in isolation techniques, digital communication support, and IIoT-ready modules has become a primary differentiator, with firms focusing on seamless integration, system safety, and improved accuracy to secure market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Form | DIN Rail-/Rack-mounted Module and Standalone/Modular Module |

| Type | Temperature Signal Conditioner, Pressure Sensor Signal Conditioner, AC & DC Signal Conditioner, and Frequency Signal Conditioner |

| Application | Data acquisition, Process control, Measurement & Evaluation, and Others |

| End-use Industry | Aerospace & Defense, Consumer Electronics, Energy & Power, Food & Beverage, Industrial Equipment, Manufacturing, Water & Wastewater, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB Ltd., Acromag, Inc., Advantech Co. Ltd., AMETEK, Inc., Analog Devices, Inc., Curtiss-Wright Corporation, Dwyer Instruments, Inc., Moore Industries, MTL Group – EATON, National Instruments, Omega Engineering Inc., Pepperl+Fuchs, Phoenix Contact GmbH & Co., Rockwell Automation, Inc, Schneider Electric, Siemens AG, TE Connectivity Ltd., Weidmüller Interface GmbH & Co. Kg, and Yokogawa Electric Corporation |

| Additional Attributes | Dollar sales by module type and end-use industry, demand dynamics across automation, energy, and transportation sectors, regional trends in industrial electronics adoption, innovation in accuracy, reliability, and integration, environmental impact of manufacturing and disposal, and emerging use cases in smart grid and industrial IoT applications. |

The global signal conditioning modules market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the signal conditioning modules market is projected to reach USD 3.9 billion by 2035.

The signal conditioning modules market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in signal conditioning modules market are din rail-/rack-mounted module and standalone/modular module.

In terms of type, temperature signal conditioner segment to command 26.9% share in the signal conditioning modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Signal Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Signals Intelligence (SIGINT) Market Size and Share Forecast Outlook 2025 to 2035

Signal Generator Market Analysis by Product, Technology, Application, End-use, and Region through 2035

Signaling Device Market – Industrial Safety & Automation

Signal Calibrators Market

Signal Transformer Market

Mixed Signal IC Market Size and Share Forecast Outlook 2025 to 2035

Small Signal Transistor Market Size and Share Forecast Outlook 2025 to 2035

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Traffic Signal Controller Market

Digital Signal Controller & Processor Market

Digital Signal Processors Market

Diameter Signaling Market Size and Share Forecast Outlook 2025 to 2035

Power And Signal Cables Market

Lane Control Signals Market Size and Share Forecast Outlook 2025 to 2035

Audible and Visual Signaling Devices Market Analysis by Product Type, End-Use Industry, and Region through 2035

Industrial Wireless Broken Signal Solutions Market Growth – Trends & Forecast 2025 to 2035

Conditioning Hair Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Conditioning Agents Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA