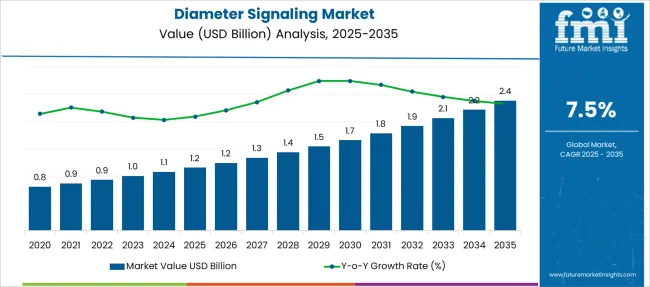

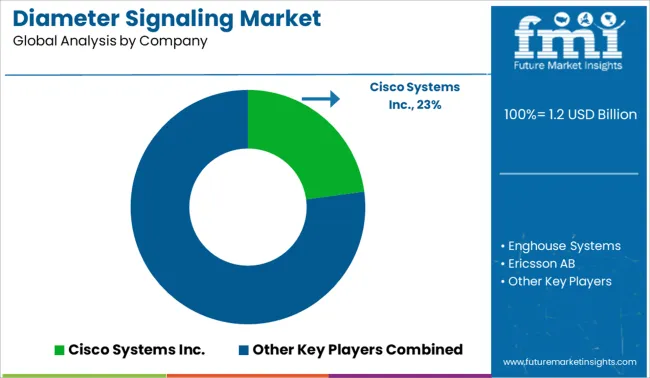

The Diameter Signaling Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Diameter Signaling Market Estimated Value in (2025 E) | USD 1.2 billion |

| Diameter Signaling Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The expansion of 5G networks has significantly driven the need for advanced signaling protocols that ensure efficient authentication, authorization, and accounting processes.

Industry trends indicate a shift toward scalable and reliable signaling infrastructures that can handle complex network architectures and diverse service requirements. Continuous investments in network modernization and the integration of cloud-native technologies have enhanced diameter signaling capabilities.

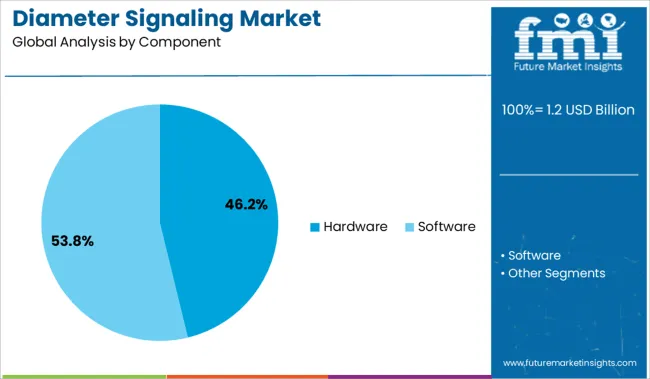

Growing digital transformation initiatives in sectors such as banking, financial services, and insurance have increased the demand for secure and efficient network communications. The market is expected to benefit from ongoing advancements in hardware components and increasing adoption of 5G connectivity solutions. Segmental growth is anticipated to be led by hardware components, 5G connectivity, and BFSI as the leading end-user sector.

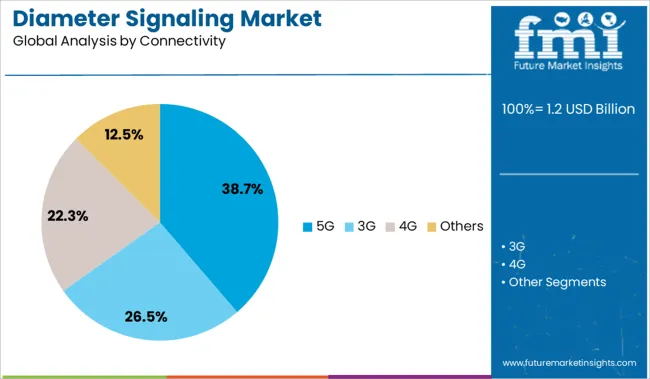

The market is segmented by Component, Connectivity, End-User and region. By Component, the market is divided into Hardware, Process systems, Analysis systems, and Software. In terms of Connectivity, the market is classified into 5G, 3G, 4G, and Others.

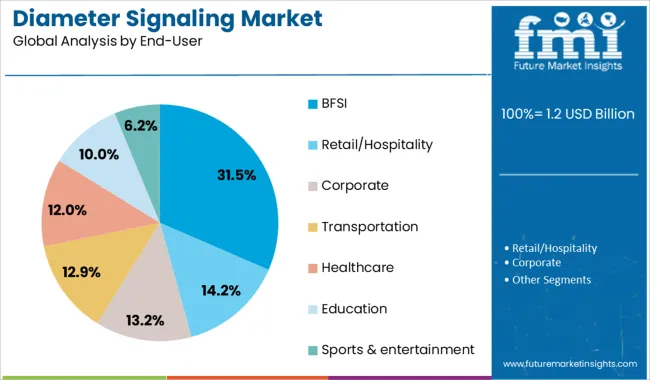

Based on End-User, the market is segmented into BFSI, Retail/Hospitality, Corporate, Transportation, Healthcare, Education, and Sports & Entertainment. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to account for 46.2% of the diameter signaling market revenue in 2025, maintaining its dominance among component categories. This growth is attributed to the essential role of physical network devices such as routers, switches, and gateways in supporting diameter signaling functions.

Robust hardware infrastructure is critical to managing large volumes of signaling traffic and ensuring low latency in telecommunications networks. Advances in hardware design have improved processing speeds and reliability while reducing power consumption.

The need for scalable and flexible hardware solutions to support 5G deployments has further strengthened this segment’s position. As networks continue to upgrade to meet growing connectivity demands, the hardware segment is expected to retain its market leadership.

The 5G connectivity segment is expected to contribute 38.7% of the diameter signaling market revenue in 2025, establishing it as the leading connectivity type. The rapid rollout of 5G networks has increased the complexity and volume of signaling traffic requiring advanced diameter protocol support.

Diameter signaling plays a critical role in 5G by handling subscriber authentication session management and quality of service controls. Network operators have prioritized upgrading their signaling infrastructure to accommodate the dynamic requirements of 5G services such as enhanced mobile broadband and massive IoT.

The increasing adoption of 5G-enabled devices and applications has further driven demand for efficient signaling solutions. This segment is expected to remain pivotal in the evolution of next-generation telecommunications networks.

The BFSI (banking, financial services, and insurance) segment is projected to hold 31.5% of the diameter signaling market revenue in 2025, maintaining its position as the largest end-user segment. Growth in this sector has been driven by the increasing digitization of financial services, which requires secure and reliable network communications.

BFSI institutions demand robust authentication and authorization processes to protect sensitive transactions and customer data. Diameter signaling facilitates real-time policy enforcement and session management in digital financial platforms.

Regulatory compliance and the need for uninterrupted service availability have further emphasized the importance of advanced signaling infrastructure in BFSI. As digital financial services continue to expand, the BFSI segment is expected to sustain strong demand for diameter signaling solutions.

Diameter signaling has gained strategic relevance amid growing LTE and VoLTE deployments, along with the expanding M2M and IoT ecosystem. Operators have prioritized its implementation to manage control plane congestion and ensure session-level granularity across dynamic policy environments. However, adoption has been constrained by legacy system dependence, protocol fragmentation, and persistent security gaps in signaling interconnects. Despite these restraints, the ongoing shift to standalone 5G cores, growing emphasis on real-time subscriber management, and increasing roaming traffic offer compelling avenues for long-term market expansion across developed and emerging mobile networks.

The widespread adoption of VoLTE, IMS-based services, and machine-to-machine communications has forced telecom operators to address escalating signaling traffic within the control plane. As more bandwidth-intensive applications and devices flood networks with session-based triggers, the demand for centralized signaling management has intensified. Diameter has been deployed to handle authentication, policy control, and charging coordination in real time. Network congestion resulting from session storms, especially in high-density geographies, has highlighted the necessity of robust signaling infrastructure. Vendors offering scalable routing agents with intelligent rule engines have experienced stronger uptake, particularly in regions where subscriber data consumption is growing exponentially. Carriers now prioritize signaling efficiency as a core capability, with diameter serving as the primary enabler for policy-aware service delivery across complex, distributed core architectures.

The global migration toward 5G standalone architecture presents a promising opportunity for diameter signaling expansion. As operators decouple from 4G EPC and shift to cloud-native 5G cores, the need for flexible, interoperable, and secure signaling solutions becomes critical. Diameter is expected to coexist alongside HTTP/2 and service-based interfaces during transitional deployments, especially in hybrid networks that maintain legacy functions. Real-time session control and subscriber authentication are projected to remain key use cases, where diameter provides backward compatibility and orchestration consistency. Furthermore, surging international roaming demand, MVNO integration, and multi-cloud core slicing will require enhanced signaling visibility and policy mediation. Vendors positioned to offer next-gen signaling firewalls, interworking functions, and control layer abstraction will benefit from this foundational shift in mobile core infrastructure design.

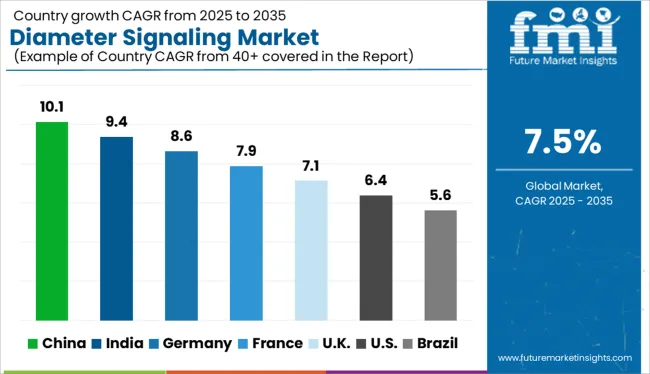

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

Global demand for diameter signaling is projected to increase at a 7.5% CAGR between 2025 and 2035. Among the 40+ nations analyzed, China leads with a 10.1% CAGR, followed by India at 9.4%, and Germany at 8.6%. France and the United Kingdom trail at 7.9% and 7.1% respectively. China and India exceed the global benchmark significantly due to higher growth in mobile broadband, VoLTE, and 5G subscriber volume. Germany benefits from strong telco-cloud interoperability. France displays modest momentum through regulatory alignment and investment in IMS infrastructure. The United Kingdom’s growth rate reflects maturity in signaling capacity with incremental upgrades rather than structural network overhaul.

China is projected to register a 10.1% CAGR in the diameter signaling industry, led by an aggressive 5G rollout and continuous expansion of IMS (IP Multimedia Subsystem) networks. Large-scale deployments by operators such as China Mobile and China Unicom have significantly accelerated signaling volume, requiring scalable routing and control solutions. National investments in 5G SA (Standalone Architecture) and network slicing drive demand for dynamic signaling orchestration. Local suppliers and global OEMs have partnered for interoperable signaling exchanges tailored to regional architectures.

India’s diameter signaling market is expected to grow at 9.4% CAGR, driven by rising VoLTE adoption, 4G subscriber base saturation, and emerging 5G pilots. Diameter signaling is increasingly critical for handling high-volume authentication, policy, and charging functions across networks. Telcos like Reliance Jio and Airtel are adopting virtualized signaling cores to meet cost-efficiency and scalability needs. The transition to VoNR services and standalone 5G networks is shaping signaling policy architecture.

Germany is forecast to post an 8.6% CAGR in diameter signaling through 2035, supported by the convergence of mobile and fixed network signaling demands. Major telecoms like Deutsche Telekom and Vodafone Germany have led multi-vendor deployments of signaling firewalls, policy servers, and DRA (Diameter Routing Agents). Adoption of NFV/SDN technologies and evolving B2B IoT services contribute to signaling intensity. Enterprises leveraging private 5G require custom signaling protocols, which bolsters modular signaling solutions.

France’s diameter signaling market is growing at a 7.9% CAGR, influenced by national broadband and 5G infrastructure goals. Operators such as Orange and Bouygues Telecom have expanded signaling core infrastructure to accommodate multi-access edge computing (MEC) and converged networks. IMS modernization for HD voice and video services boosts the signaling load, while signaling firewall deployments mitigate DDoS risks. Demand is increasing for vendor-agnostic signaling routers to bridge legacy systems and new cloud-native cores.

The UK’s diameter signaling industry, expanding at a 7.1% CAGR, reflects moderate yet stable growth, sustained by enhancements in signaling performance rather than infrastructure overhaul. Operators such as BT and O2 have maintained consistent investment in network security and interconnectivity. Growing usage of cloud-native telco stacks and expansion of edge services are prompting signaling architecture refinement. Diameter edge agents and firewalls are being integrated with analytics and QoS management tools to streamline policy enforcement.

The Diameter signaling market is moderately consolidated, driven by telecom infrastructure upgrades and signaling management in LTE and 5G environments. Cisco Systems Inc. leads with a significant share, offering scalable Diameter Signaling Controllers (DSCs) and robust protocol handling capabilities. Oracle Corporation follows as a Tier 1 provider, focusing on secure signaling and cloud-native deployments for telecom operators. Huawei, Ericsson AB, and Nokia Corporation constitute the Tier 2 segment, providing integrated signaling solutions within broader telecom network architectures. F5 Networks and Enghouse Systems form the Tier 3 cohort, serving specialized signaling needs and regional telecom deployments. The market's growth is supported by traffic optimization, IP-based signaling evolution, and growing operator reliance on signaling orchestration tools.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Component | Hardware, Process systems, Analysis systems, and Software |

| Connectivity | 5G, 3G, 4G, and Others |

| End-User | BFSI, Retail/Hospitality, Corporate, Transportation, Healthcare, Education, and Sports & entertainment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems Inc., Enghouse Systems, Ericsson AB, F5 Networks, Huawei Technologies Co., Ltd., Nokia Corporation, and Oracle Corporation |

| Additional Attributes | Dollar sales by product type (DRA, DEA, IWF, Diameter firewall, load balancer), Dollar sales by deployment model (cloud-native, hybrid, on-premise), Trends in signaling security and SS7-to-Diameter transition, Use of Diameter protocol in policy, roaming, and mobility management, Growth of signaling infrastructure for VoLTE and 5G standalone networks, Regional patterns of Diameter controller implementation across telecom operators. |

The global diameter signaling market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the diameter signaling market is projected to reach USD 2.4 billion by 2035.

The diameter signaling market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in diameter signaling market are hardware, process systems, analysis systems and software.

In terms of connectivity, 5G segment to command 38.7% share in the diameter signaling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large Diameter Steel Pipes Market Growth - Trends & Forecast 2025 to 2035

Signaling Device Market – Industrial Safety & Automation

Audible and Visual Signaling Devices Market Analysis by Product Type, End-Use Industry, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA