The Signals Intelligence (SIGINT) Market is estimated to be valued at USD 17.7 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

-market-market-value-analysis.webp)

| Metric | Value |

|---|---|

| Signals Intelligence (SIGINT) Market Estimated Value in (2025 E) | USD 17.7 billion |

| Signals Intelligence (SIGINT) Market Forecast Value in (2035 F) | USD 30.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Signals Intelligence market is expanding steadily as defense agencies and intelligence organizations increasingly prioritize advanced electronic surveillance capabilities. Growing geopolitical tensions and the need for real-time information gathering have heightened demand for sophisticated intelligence systems.

Technology developments in electronic signal detection and processing have enhanced the accuracy and speed of intelligence collection. Airborne platforms are widely used due to their mobility and broad coverage, making them integral to modern surveillance operations.

Additionally, portable SIGINT systems have gained popularity for their flexibility and rapid deployment in diverse environments. Increasing investment in intelligence modernization programs worldwide is driving market growth. Future expansion is expected as emerging technologies such as artificial intelligence and data analytics become more integrated into SIGINT operations. Segmental growth is forecasted to be led by ELINT as the dominant type, airborne applications as the key deployment platform, and portable systems due to their operational versatility.

The signals intelligence (SIGINT) market is segmented by type, application, mobility, end use and geographic regions. By type of signals intelligence (SIGINT), the market is divided into ELINT (Electronic Intelligence), COMINT (Communications Intelligence), and FISINT (Foreign Instrumentation Signals Intelligence). In terms of application of the signals intelligence (SIGINT) market, it is classified into Airborne, Cyber, Ground, Naval, and Space. Based on the mobility of the signals intelligence (SIGINT) market, it is segmented into Portable and Fixed. By end use, the signals intelligence (SIGINT) market is segmented into Military & defence, Government & law enforcement, and Commercial & private sectors. Regionally, the signals intelligence (SIGINT) industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

-market-analysis-by-type.webp)

The ELINT segment is projected to contribute 39.2% of the SIGINT market revenue in 2025, maintaining its position as the leading type. This segment’s growth has been driven by its critical role in intercepting and analyzing electronic signals for strategic military and intelligence purposes. ELINT systems provide valuable insights into adversary radar and communication systems, supporting situational awareness and threat assessment.

The increasing complexity of electronic warfare environments has necessitated advanced ELINT capabilities. Additionally, the rising demand for electronic reconnaissance in both peacetime and conflict scenarios has elevated the importance of ELINT technologies.

As defense strategies evolve to counter sophisticated threats, the ELINT segment is expected to sustain its market dominance.

-market-analysis-by-application.webp)

The Airborne segment is expected to hold 41.7% of the SIGINT market revenue in 2025, positioning it as the leading application. Airborne SIGINT platforms offer extensive geographic coverage and rapid data acquisition, making them essential for surveillance and reconnaissance missions. These systems can be deployed on manned aircraft, drones, and other aerial vehicles, providing flexible and mobile intelligence gathering.

The growing emphasis on border security and maritime surveillance has further increased the reliance on airborne SIGINT. Operational advantages such as line-of-sight communication and high-altitude positioning contribute to their effectiveness.

Continued advancements in aerial platform endurance and sensor integration are anticipated to fuel growth in this segment.

-market-analysis-by-mobility.webp)

The Portable segment is projected to account for 54.3% of the SIGINT market revenue in 2025, establishing it as the dominant mobility category. Portable SIGINT devices have gained prominence due to their ease of transport and deployment in diverse and challenging operational theaters. Their compact design allows for rapid setup and mobility by field operatives, enhancing tactical intelligence capabilities.

The need for flexible intelligence gathering in asymmetric warfare and counterterrorism operations has driven adoption. Additionally, technological miniaturization and improved power efficiency have expanded the operational capabilities of portable SIGINT equipment.

As defense forces focus on agile and adaptive intelligence solutions, the Portable segment is expected to remain the most widely used mobility option.

The Signals intelligence market has witnessed rising adoption due to the growing necessity for threat detection, border security, and defense modernization. Opportunities have been driven by rising investments in electronic warfare and intelligence infrastructure among NATO allies and Asia-Pacific nations.

Key trends include the adoption of AI-driven analytics, satellite-based interception systems, and cybersecurity-integrated SIGINT platforms. However, significant restraints involve regulatory challenges, encryption complexities, and the high cost of integration for advanced signal processing systems. The market outlook suggests strong vendor competition with governments prioritizing multi-domain surveillance and tactical communication interception.

Large-scale defense modernization programs and the need for real-time threat assessment have driven major growth in the SIGINT market. In 2024, the USA Department of Defense allocated substantial funding toward enhancing electronic warfare capabilities through advanced interception platforms. Similarly, NATO members invested in upgrading tactical communication intelligence solutions to counter hybrid warfare risks.

The deployment of signals intelligence in maritime surveillance and aerial reconnaissance has intensified across multiple geographies. Escalating cyber and electronic threats have influenced these initiatives, compelling defense agencies to prioritize sophisticated signal interception solutions.

Significant opportunities have been identified in the integration of space-based SIGINT platforms for strategic surveillance. In 2025, multiple contracts were awarded for satellite constellations dedicated to global signal interception and secure communication monitoring. Governments in Asia-Pacific and North America have focused on partnerships with private space-tech firms to establish resilient intelligence ecosystems.

This evolution is creating demand for advanced payload design and interoperability features in SIGINT platforms. The future trajectory strongly favors companies that can develop hybrid architectures linking ground stations, aerial platforms, and orbital assets for comprehensive data collection.

Emerging trends reveal the rapid inclusion of AI and machine learning algorithms in SIGINT data interpretation. In 2024, contracts for automated signal decryption and real-time pattern recognition systems were awarded to several USA defense contractors. AI-enabled analytics are being integrated into unmanned systems, enabling autonomous interception and filtering of electronic signals.

Cyber resilience measures have also been embedded in new platforms to prevent spoofing and signal manipulation. These advancements indicate that future SIGINT operations will prioritize predictive analytics and faster decision cycles, reshaping the operational doctrine for both military and homeland security agencies.

The market faces significant restraints due to escalating complexities in decrypting modern communication protocols and encrypted channels. Advanced encryption standards deployed in commercial and defense-grade systems have increased operational challenges for intelligence agencies.

Additionally, procurement delays have been reported in 2024 because of high costs associated with next-generation SIGINT hardware, ground infrastructure, and integration services. Several developing economies have deferred planned upgrades due to constrained defense budgets, further limiting adoption. These barriers underscore the need for cost-optimized solutions and collaborative development models to ensure continued SIGINT deployment at scale.

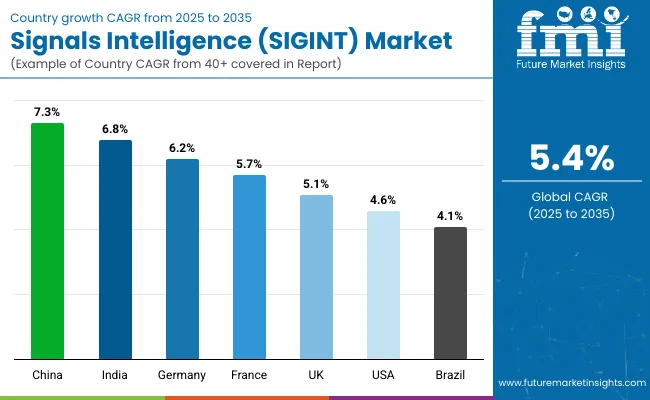

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global signals intelligence (SIGINT) market is projected to expand at a 5.4% CAGR during 2025–2035. China leads with 7.3% CAGR, driven by large-scale military modernization and electronic warfare programs. India follows at 6.8%, supported by border security requirements and satellite-based intelligence initiatives. Germany records 6.2% CAGR, leveraging NATO partnerships and cybersecurity investments. The United Kingdom posts 5.1%, while the United States grows at 4.6%, indicating saturation but continued upgrades to space-based SIGINT and cyber-intelligence platforms. Asia-Pacific nations are accelerating SIGINT adoption due to heightened geopolitical tensions, while Western markets focus on integrating AI and quantum encryption for advanced surveillance capabilities.

China dominates the SIGINT market with an expected 7.3% CAGR through 2035. This growth is underpinned by state-funded defense modernization, cyber-electronic warfare programs, and large-scale deployment of advanced radar and signal interception systems. The People’s Liberation Army (PLA) is investing in AI-enabled platforms for real-time threat detection, complemented by space-based SIGINT satellites for strategic intelligence gathering. Civil-military fusion policies encourage domestic tech companies to collaborate on next-generation SIGINT solutions. The country also focuses on integrating big data analytics and machine learning for predictive intelligence to strengthen national security and countermeasure capabilities.

The SIGINT market in India is projected to achieve 6.8% CAGR, supported by increasing investment in defense technology modernization and satellite-based surveillance. Geopolitical sensitivities along the northern and western borders fuel the demand for advanced interception systems and spectrum monitoring solutions. The Defence Research and Development Organisation (DRDO) and private defense tech firms are collaborating on indigenous SIGINT systems for ground, airborne, and maritime platforms. Focus on secure communication, cyber threat mitigation, and integration of AI-based analytics tools further strengthens market adoption. Government programs under “Make in India” aim to reduce import dependency and accelerate local production.

Analysis of Signals Intelligence (SIGINT) Market in Germany

-market-europe-country-market-share-analysis,-2025-&-2035.webp)

Germany records a 6.2% CAGR, fueled by NATO-led defense cooperation and stringent cybersecurity mandates. The country prioritizes SIGINT for counter-terrorism, electronic warfare, and critical infrastructure protection. Investments in airborne SIGINT platforms and advanced radio frequency (RF) monitoring systems enhance interoperability with allied forces. German defense contractors are focusing on AI-based data fusion and quantum-secure communication channels to counter emerging threats. Cyber defense programs, combined with expanded satellite-based SIGINT infrastructure, position Germany as a significant European hub for next-gen intelligence solutions.

The United Kingdom market is expected to grow at 5.1% CAGR, supported by modernization of military intelligence infrastructure and integration of space-based SIGINT capabilities. The government’s focus on cyber resilience and counterterrorism initiatives drives investments in interception systems and encrypted communication networks. Collaboration with allied nations under intelligence-sharing agreements (Five Eyes) strengthens the country’s operational readiness. Private contractors, in partnership with the Ministry of Defence, are deploying multi-domain SIGINT platforms for maritime, airborne, and land-based operations. Enhanced data processing and predictive analytics remain key priorities for threat detection.

-market-country-value-analysis.webp)

The United States, despite being a mature market, is projected to grow at 4.6% CAGR during 2025–2035. Modernization efforts emphasize AI-powered SIGINT platforms, quantum encryption, and satellite-based reconnaissance systems. The USA Department of Defense and intelligence agencies are upgrading electronic warfare capabilities to maintain strategic dominance. Significant investments are directed toward integrating cyber-SIGINT with conventional signal monitoring for hybrid threat environments. Advanced spectrum dominance programs and low-earth orbit (LEO) satellite constellations enhance tactical and strategic intelligence efficiency, while private sector partnerships accelerate the development of autonomous SIGINT systems.

-market-analysis-by-company.webp)

The signals intelligence (SIGINT) market is moderately consolidated, with Lockheed Martin recognized as a leading player due to its advanced electronic warfare systems, satellite-based SIGINT platforms, and integrated cyber-electronic solutions for military and defense applications. The company’s strong R&D capabilities and global defense partnerships reinforce its leadership in strategic intelligence programs.

Key players include Airbus, BAE Systems, Boeing, Elbit Systems, General Dynamics, L3Harris, Northrop Grumman, Raytheon, and Thales. These companies specialize in airborne, ground-based, and naval SIGINT systems that capture, process, and analyze communication and electronic signals for threat detection, situational awareness, and mission planning.

Their offerings leverage advanced technologies such as AI-driven signal analysis, high-capacity data links, and encryption-resistant interception systems. Market growth is driven by rising geopolitical tensions, modernization of military intelligence networks, and the need for real-time situational awareness in multi-domain warfare. Leading manufacturers are investing in miniaturized payloads for UAVs, space-based SIGINT constellations, and cyber-electromagnetic integration to counter evolving threats.

Emerging trends include AI-enabled signal classification, quantum-resistant communication interception, and cloud-based data analytics for faster decision-making. North America leads the market due to significant defense budgets, while Europe and Asia-Pacific are witnessing rapid adoption driven by border security and surveillance modernization initiatives.

On July 1, 2025, Saab launched Poland’s first SIGINT vessel, ORP Jerzy Różycki, in Gdańsk under the DELFIN program. The ship is equipped to collect maritime electronic intelligence and is the first of two ordered. Construction began in 2023 with sea trials forthcoming.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.7 Billion |

| Type | ELINT (Electronic Intelligence), COMINT (Communications Intelligence), and FISINT (Foreign Instrumentation Signals Intelligence) |

| Application | Airborne, Cyber, Ground, Naval, and Space |

| Mobility | Portable and Fixed |

| End Use | Military & defence, Government & law enforcement, and Commercial & private Sector |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, Airbus, BAE Systems, Boeing, Elbit Systems, General Dynamics, L3Harris, Northrop Grumman, Raytheon, and Thales |

| Additional Attributes | Dollar sales classified by system type (COMINT, ELINT, FISINT) and platform (airborne, ground, naval, space). North America dominates current share, while Asia‑Pacific records the highest growth trajectory. Buyer priorities include AI-driven analytics, open-architecture fusion, and software-defined radios. Key innovations feature space-based SIGINT, real-time anomaly detection, and multi-domain interoperability solutions. |

The global signals intelligence (SIGINT) market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the signals intelligence (SIGINT) market is projected to reach USD 30.0 billion by 2035.

The signals intelligence (SIGINT) market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in signals intelligence (SIGINT) market are elint (electronic intelligence), comint (communications intelligence) and fisint (foreign instrumentation signals intelligence).

In terms of application, airborne segment to command 41.7% share in the signals intelligence (SIGINT) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lane Control Signals Market Size and Share Forecast Outlook 2025 to 2035

Intelligence Surveillance Reconnaissance (ISR) Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Threat Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Content Intelligence – AI-Powered Insights for Marketers

Audience Intelligence Platform Market Size and Share Forecast Outlook 2025 to 2035

Decision Intelligence Market Forecast and Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Location Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Embedded Intelligence Market Growth – Trends & Industry Forecast 2023-2033

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA