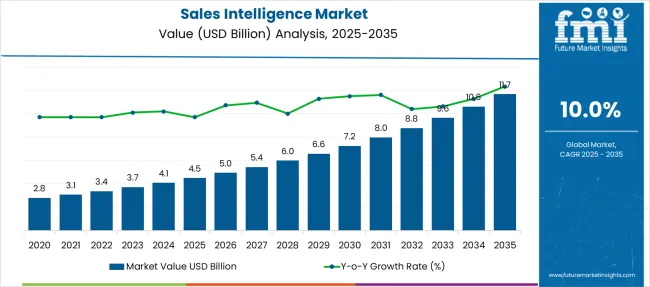

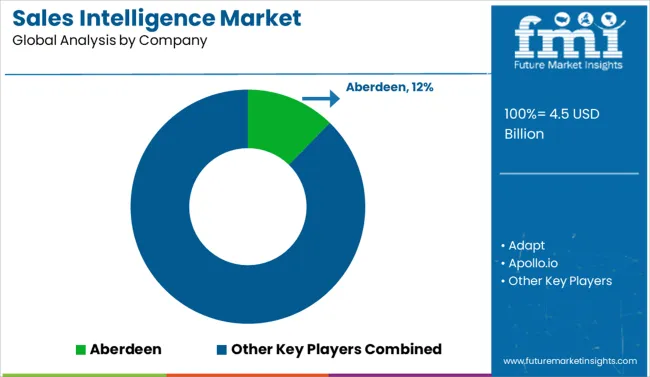

The Sales Intelligence Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

As per our white space mapping, many untapped verticals are contributing to the market growth. From 2025-2028, the market adds USD 1.5 billion, driven by B2B SaaS adoption in mid-tier enterprises. However, penetration in emerging markets lags, creating a white space worth USD 700 million by 2028. Between 2028 and 2031, growth accelerates to USD 3.6 billion, reflecting advanced CRM analytics integration, leaving a USD 1.2 billion gap in financial services and healthcare sectors due to delayed digitization.

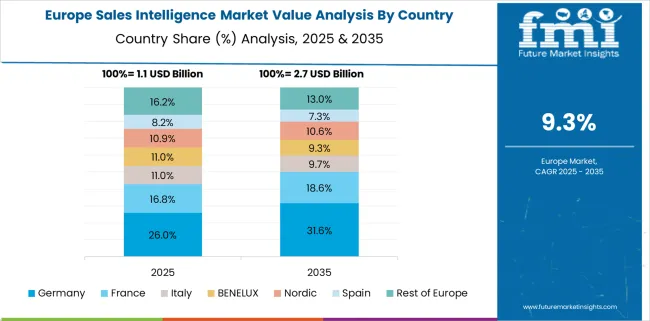

By 2035, potential white space narrows to USD 900 million, concentrated in SMB automation and AI-driven account intelligence. Incremental contribution peaks during 2029-2032, adding USD 3.4 billion, while YoY growth touches 11%, suggesting the highest opportunity for diversification into predictive analytics. Strategic focus on regionalizing solutions for Asia-Pacific and Europe can capture over 18% incremental revenue, converting existing gaps into monetization streams.

| Metric | Value |

|---|---|

| Sales Intelligence Market Estimated Value in (2025 E) | USD 4.5 billion |

| Sales Intelligence Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

Organizations are increasingly investing in tools that deliver actionable insights, identify high potential prospects, and optimize sales cycles through predictive analytics. The market is being shaped by the need to improve lead conversion rates and personalize engagement across multi channel environments. As competition intensifies across sectors, businesses are prioritizing platforms that integrate CRM systems with real time data, intent signals, and behavioral analytics.

Adoption of advanced technologies such as artificial intelligence and machine learning within sales intelligence platforms is expanding the range of use cases across industries. The market outlook remains strong as sales teams seek scalable and intelligent tools to drive productivity, shorten deal cycles, and enhance revenue generation.

The sales intelligence market is segmented by component type, deployment model, enterprise size, application type, industry vertical, and region. By component type, it includes software, services, consulting, implementation, and support and maintenance, meeting diverse business requirements. In terms of deployment model, the segmentation comprises cloud and on-premises solutions, reflecting varying infrastructure preferences. Based on enterprise size, the market is classified into large enterprises and SMEs, highlighting adoption across organizational scales.

By application type, it covers inventory management, order management, asset tracking, shipment tracking, supply chain planning, and others. Industry vertical segmentation includes transportation and logistics, retail and consumer goods, healthcare and pharmaceuticals, manufacturing, automotive, aerospace and defense, food and beverage, and additional sectors. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

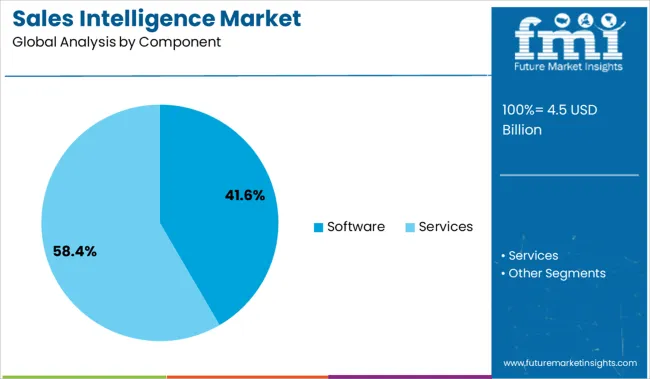

The software segment is projected to account for 41.60 percent of total market revenue by 2025 under the component category, emerging as the leading segment. This is due to the increasing reliance on automation, real time data analysis, and predictive sales modeling.

Software solutions offer integration with existing CRM systems and provide dynamic insights that support sales strategy refinement and customer engagement. The flexibility, scalability, and customizability of sales intelligence software allow businesses to deploy tailored analytics that align with specific operational needs.

With organizations seeking tools that offer faster deployment, continuous updates, and AI-powered features, the software segment continues to dominate the component category by providing measurable improvements in sales effectiveness and team performance.

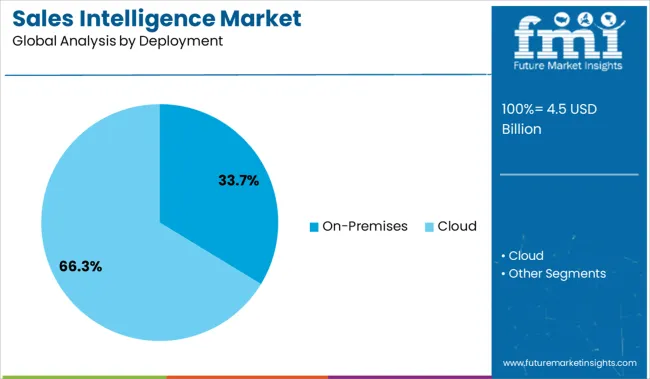

The on-premises deployment model is expected to hold 33.70 percent of the total market share by 2025, leading within the deployment category. This dominance is driven by large enterprises and data-sensitive industries requiring complete control over data privacy, infrastructure, and compliance.

On-premises solutions offer enhanced security and better integration with legacy systems, making them a preferred choice for organizations with strict regulatory obligations and complex IT environments. Businesses in sectors such as banking, government, and healthcare are favoring on-premises deployments to ensure data integrity and mitigate cybersecurity risks.

As a result, this deployment model remains significant for enterprises prioritizing data ownership and internal control over cloud flexibility.

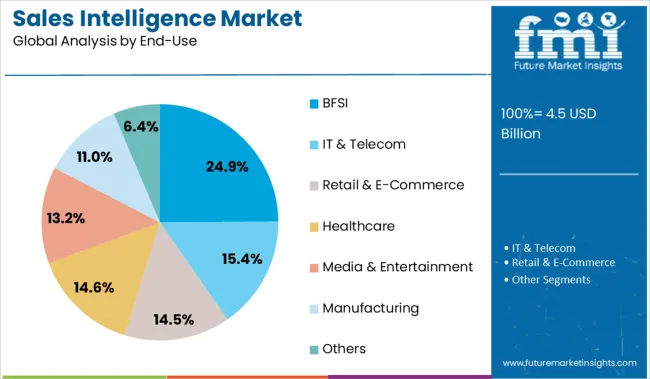

The banking, financial services, and insurance sector is projected to capture 24.90 percent of market revenue by 2025, making it the most prominent end use segment. The growth is driven by the need for real-time client intelligence, risk profiling, and personalized financial product recommendations.

BFSI institutions are using sales intelligence to gain deeper insights into customer behavior, identify cross-selling opportunities, and improve customer lifetime value. The complexity of financial products and the highly regulated nature of the sector necessitate advanced tools that deliver accurate, compliant, and strategic data.

As the sector continues its digital transformation journey, investment in sales intelligence solutions is accelerating to enable smarter sales processes, reduce churn, and meet evolving client expectations.

North America holds roughly 40-43% of today's revenue, while Asia-Pacific is showing the fastest growth trajectory. Most revenues stem from software platforms (about 70-80% share), supported by growing uptake across lead management, sales analytics, and data enrichment services. Cloud deployment dominates with over 80% of installations in 2024, while hybrid models and SME use are expanding rapidly. Key verticals include IT/telecom, retail, healthcare, and BFSI.

Adoption is rising as companies seek to accelerate lead scoring, target engagement, and sales pipeline conversion. Deployments of predictive AI tools accelerated research throughput tenfold, reducing prospecting cycles from hours to minutes. Revenue operations teams are formalizing unified intelligence stacks to standardize dashboards and insights across sales, marketing, and customer success.

Cloud-native platforms now support intent-data scoring, enrichment, and account clustering, aiding outreach personalization. The SME segment is rapidly adopting pay-as-you-go pricing bundles. Enterprises have also turned to data co-ops and intent signals to pre-identify in-market accounts, with estimated uplifts in conversion performance between 15-20 %.

Challenges persist due to integration complexity, privacy concerns, and platform fragmentation. Sales intelligence installation often requires harmonizing CRM, ERP, and analytics layers, lengthening deployment by 4-6 weeks. Data privacy legislation, especially in EU and California jurisdictions, mandates explicit consent practices leading to reduced batch ingestion rates and opt-out percentages rising toward 25-30 % in some trials.

Fragmented platform ecosystems across operating systems and endpoint form factors increase development and maintenance costs by up to 15%. SME buyers face pricing barriers as value propositions require more modular and educative service models. These factors constrain wider platform penetration, especially in regulated industries and smaller geographies.

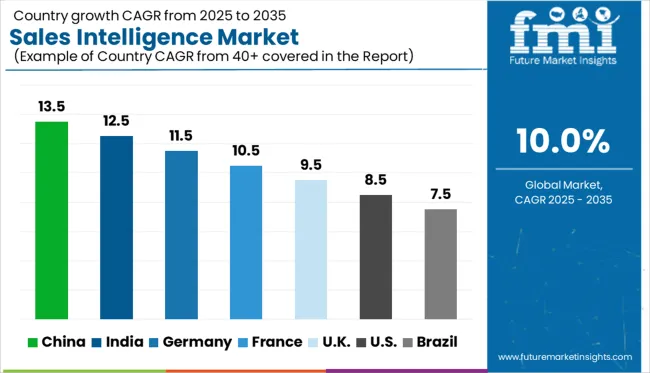

| Countries | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global sales intelligence market is projected to grow at a CAGR of 10.0% between 2025 and 2035. China (BRICS) leads with a growth rate of 13.5%, driven by strong enterprise adoption and integration with AI-based CRM systems. India (BRICS) follows at 12.5%, supported by expanding SaaS ecosystems and increased demand among mid-sized firms. Germany (OECD) posts 11.5%, reflecting use among B2B tech and manufacturing exporters. France records 10.5%, closely aligned with the global rate, as adoption spreads across traditional industries transitioning to digital pipelines. The UK comes in at 9.5%, slightly below the global average, shaped by mature enterprise platforms and regional investment patterns. The report includes data from over 40 countries, with the top five outlined below.

China holds a 13.5% growth rate in the sales intelligence market, outperforming the global average of 10%. SaaS vendors are embedding local CRM modules with industry-specific targeting algorithms. Telecom and electronics lead AI-enabled lead scoring system adoption. Regional resellers are expanding channel-based data feeds integrated with behavior analytics.

Pilot programs in tier-2 cities are testing LLM-assisted outreach workflows within business services. API integrations with Chinese language models are bundled into mid-tier subscription layers. Data localization mandates have led vendors to build containerized infrastructure in seven urban nodes. Distributors prioritize in-house training on data tagging for multilingual sales reps. Preference continues for lightweight UIs with mobile optimization.

India reports a 12.5% growth rate in the sales intelligence market, ahead of the 10% global rate. Startups favor tools combining lead qualification, WhatsApp CRM integrations, and predictive scoring via local plugins. Tier-1 cities host the highest deployment of AI outbound call analytics. Usage is rising in insurance, logistics, and SME-focused software resellers.

Decision-makers rely on cross-channel tracking tools that unify B2B email signals and local trade event footfall. Cloud-native dashboards are optimized for regional language filters. Behavioral datasets are being refined using synthetic training models tailored for micro-segments. Demand is anchored in agile sales playbooks, reused across telesales and enterprise outreach funnels.

Germany shows an 11.5% sales intelligence growth rate, ahead of the global 10%. B2B manufacturing and industrial resellers are the main adopters. Use cases include auto-tagging of procurement leads and multi-tier contact ranking. Regional sales units’ demand audit logs and GDPR-tagged source lineage within integrated BI dashboards.

Voice and email sync tools are favored among enterprise SaaS vendors in Frankfurt and Munich. Corporate procurement platforms embed sales enrichment modules into client onboarding. System integrators deploy zero-trust environments to house API-based scoring engines. Real-time flagging tools have gained adoption for high-LTV deal tracking.

United Kingdom records a 9.5% growth rate in the sales intelligence market, trailing the global 10% average. Mid-market adoption is concentrated in legal tech, SaaS, and recruitment services. Intent-based alerts have become standard in email-driven deal flow. AI scoring add-ons are bundled with VoIP analytics packages sold via UK-based resellers.

SME teams focus on cost-per-contact optimization and browser plug-in tools for CRM overlays. B2B sales workflows are extending to social prospecting integration and channel lead tagging. Deployments prioritize easy API passthroughs into cloud-based invoicing tools. Remote-first teams in London and Manchester emphasize time-to-insight reporting as a core metric.

France posts a 10.5% sales intelligence market growth rate, just above the global average. Growth stems from pharma, B2B travel, and mid-cap consulting services. Usage spans prospect clustering, multi-stage lead enrichment, and scorecard modeling using voice tone detection. Email template tuning using GPT-backed plugins has seen adoption among cross-border deal teams.

B2B sellers prefer fixed-function dashboards over modular analytics builders. Native-language support for sales scoring tools is in demand among mid-size firms in Toulouse, Lyon, and Paris. Enterprises use rule-based segmentation overlays rather than black-box predictive systems. Use of contact graph engines is growing within professional services.

Aberdeen commands a significant market share, leveraging its proprietary research frameworks and analytics solutions tailored for enterprise sales enablement. These offerings emphasize strategic decision-making through granular performance benchmarking and persona-based engagement recommendations. Salesforce Einstein, LinkedIn Sales Navigator, and HubSpot continue as foundational platforms, offering robust pipeline visualization, behavior-driven lead scoring, and advanced account-mapping functionalities. These solutions play a pivotal role in improving forecast accuracy and accelerating deal velocity.

Emerging players like Apollo.io, Clearbit, and Lusha specialize in automated contact discovery and CRM enrichment, enabling outbound teams to execute highly personalized outreach at scale. Concurrently, revenue operations platforms such as Gong, Clari, and Highspot are transforming deal management by integrating conversation intelligence, dynamic forecasting, and sales content optimization. Sales enablement leaders Seismic and Outreach are expanding into engagement automation, empowering sales teams with guided workflows, interactive content, and personalized buyer journeys.

Despite rapid innovation, significant barriers to entry persist. These include escalating data licensing costs, stringent compliance requirements related to data privacy, and technical challenges associated with integrating advanced tools into complex CRM ecosystems. Moreover, the necessity for high-precision real-time behavioral analytics demands sophisticated AI architectures, creating a resource-intensive environment for new entrants. Vendors are increasingly forming strategic alliances to enhance interoperability and reduce onboarding friction for enterprise clients.

On May 27, 2025, Salesforce agreed to acquire data-management firm Informatica in a deal valued at approximately USD 8 billion. The acquisition is intended to strengthen Salesforce’s AI and data infrastructure stack, integrating Informatica’s tools to support enterprise data governance, integration, and analytics.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Component | Software, Lead Generation, Sales Analytics & Reporting, Contact & Account Management, Email Tracking & Engagement, Others, Services, Integration & Implementation, Consulting Services, and Support & Maintenance |

| Deployment | On-Premises and Cloud |

| End-Use | BFSI, IT & Telecom, Retail & E-Commerce, Healthcare, Media & Entertainment, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aberdeen, Adapt, Apollo.io, Clari, Clearbit, Conversica, Crunchbase, Crystal Knows, Dialpad, Drift, Gong, Highspot, HubSpot, InsightSquared, Instantly, Kaspr, Leadfeeder, LinkedIn Sales Navigator, Lusha, Outreach, Prospect IQ, Salesforce Einstein, Seismic, and Zoho |

| Additional Attributes | Dollar sales by deployment model and enterprise size, growing adoption in B2B technology and financial services sectors, stable usage across retail and professional services, advancements in AI-driven lead scoring and CRM integration enhance prospect targeting and pipeline visibility |

The global sales intelligence market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the sales intelligence market is projected to reach USD 11.7 billion by 2035.

The sales intelligence market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in sales intelligence market are software, lead generation, sales analytics & reporting, contact & account management, email tracking & engagement, others, services, integration & implementation, consulting services and support & maintenance.

In terms of deployment, on-premises segment to command 33.7% share in the sales intelligence market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sales Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Sales Compensation Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Performance Management (SPM) Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Coaching Software Market Size and Share Forecast Outlook 2025 to 2035

Salesforce CRM Document Generation Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Sales of Sports Nutrition Products in Latin America Analysis Size and Share Forecast Outlook 2025 to 2035

Sales of Plant‑based Ready Meals in US Analysis - Size, Share & Forecast 2025 to 2035

Sales Enablement Platform Market Analysis - Size, Share, and Forecast 2025 to 2035

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Sales Platforms Software Market - Growth & Forecast 2034

Salesforce Services Market Analysis – Growth & Forecast 2024-2034

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA