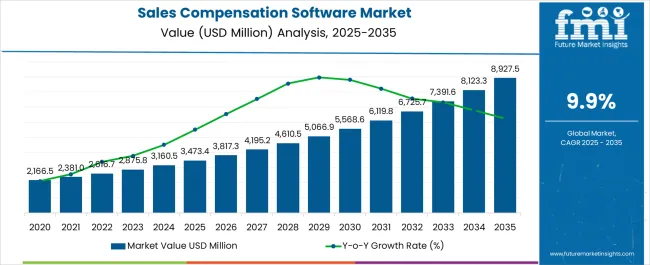

The Sales Compensation Software Market is estimated to be valued at USD 3473.4 million in 2025 and is projected to reach USD 8927.5 million by 2035, registering a compound annual growth rate (CAGR) of 9.9% over the forecast period.

| Metric | Value |

|---|---|

| Sales Compensation Software Market Estimated Value in (2025 E) | USD 3473.4 million |

| Sales Compensation Software Market Forecast Value in (2035 F) | USD 8927.5 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

The sales compensation software market is expanding steadily as enterprises seek efficient ways to align incentives with performance, reduce manual errors, and improve transparency in compensation management. Increasing demand for automation in sales operations, combined with the need for data driven decision making, is fostering strong adoption across industries.

Cloud based solutions are further enabling scalability, remote accessibility, and seamless integration with existing CRM and ERP systems, supporting hybrid and distributed workforce models. Regulatory requirements around compensation compliance and growing pressure for auditability are also driving investments in advanced platforms.

As businesses prioritize workforce motivation and productivity, the market outlook remains positive with significant opportunities emerging from the integration of AI, predictive analytics, and advanced reporting features.

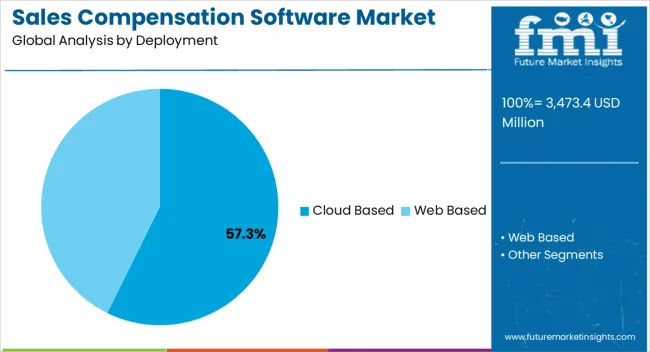

The cloud based deployment segment is anticipated to represent 57.30% of market revenue by 2025 within the deployment category, making it the dominant segment. Growth has been fueled by the increasing need for cost effective, scalable, and easily deployable solutions that support dynamic sales teams.

Cloud platforms enable real time updates, remote accessibility, and integration with enterprise applications, enhancing efficiency and user adoption. Security advancements and improved data privacy protocols have also encouraged organizations to transition from on premise models to cloud environments.

As enterprises expand globally and adopt flexible working structures, cloud based solutions are expected to maintain their leadership position within the deployment landscape.

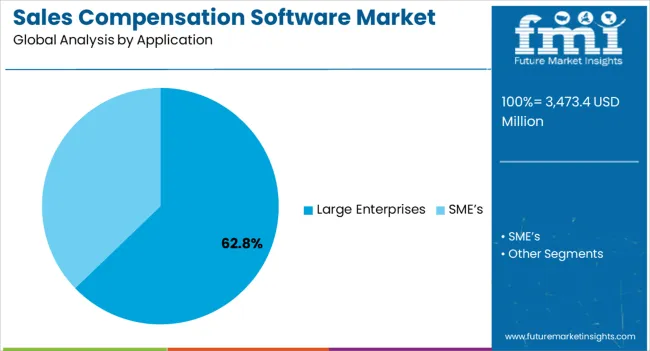

The large enterprises segment is projected to hold 62.80% of overall market revenue by 2025 under the application category, positioning it as the leading segment. This dominance is attributed to the complexity of managing extensive sales networks, diverse compensation structures, and multi level performance tracking within larger organizations.

Significant investment capacity has enabled large enterprises to deploy advanced platforms that integrate predictive analytics, AI based insights, and seamless reporting functionalities. Additionally, the drive to enhance workforce satisfaction, reduce compensation disputes, and comply with evolving regulatory standards has reinforced adoption.

As large enterprises continue to focus on operational efficiency and strategic workforce management, this segment remains central to the overall growth of the sales compensation software market.

The global market for sales compensation software marked a CAGR of 7.8% over the last historical period. In 2025, the global market size of sales compensation services was valued at USD 2,655.4 million, estimated to reach a valuation of USD 2,875.8 million in 2025. Organizations can automate and streamline the creation of sales incentive schemes and commission calculations with the use of sales compensation software. Additionally, the program provides a mechanism for sales teams to keep track of their short-term incentives, earned commissions, and quota attainment.

Reps are motivated by knowing their future earnings because they may see their potential commissions based on existing deals. Many companies are using spreadsheets to keep track of their commission records. The limited efficiency of Excel is leading to problems like data repeating, unclear commission agreements, and overpayments, which demotivate sales reps and affect the sales of the enterprises. As a result, many enterprises are considering implementing sale compensation software as they can solve all the limitations of spreadsheets, eliminate errors leading to price erosion, and make enterprises deliver efficient sales compensation, which is expected to drive the market in the coming years.

The global sales compensation software industry is predicted to mark a CAGR of 9.9% and sales worth USD 7,413.9 million by the end of 2035. North America is projected to continue to be the significant procurer of sales compensation software throughout the analysis period accounting for over USD 2.6 billion absolute dollar opportunity in the coming 10-year epoch.

The enhancement in technology and increasing automation in industries have increased the adoption of sales compensation software in the industries. Large and small business enterprises are using sale compensation software for managing and keeping records of the accomplishments of the sales rep and formulating and computing compensation plans accordingly to it.

Start-ups are rising as many governments around the world are framing policies and providing incentives to the emergence of start-ups, which has increased the adoption of sales compensation software in the start-ups that are driving the market.

The lack of privacy and data security in cloud-based software and regulations related to data and hosting are expected to restrain the market growth. Numerous cloud-based services include a third–party, and they may give the user's information to others, which is a security threat to is an issue associated with cloud-based software, which is also hindering the growth of the sales compensation software industry.

| Country/ Region | Value Share % (2025) |

|---|---|

| North America | 28.8% |

| The United States | 17.1% |

The early adoption of advanced technologies among enterprises is driving the sales compensation software market in North America. The sales compensation market in North America has been estimated to be valued at USD 3473.4 billion in 2025. Higher technology knowledge and awareness among business enterprises are boosting the adoption of sales compensation software in enterprises as they improve operations and performance. The sales compensation software market in North America is forecast to reach a valuation of USD 8927.5 billion by the end of 2035.

| Countries | Forecast CAGR % (2025 to 2035) |

|---|---|

| India | 10.4% |

| China | 8.1% |

The sales compensation software market in the Asia Pacific is expected to grow at a substantial pace over the forecast period. The market in the Asia Pacific was valued at more than USD 3473.4 million in 2025. The advancing technologies and the emergence of SMEs are the key factors driving the market in the region. The sales compensation software market in the Asia Pacific is likely to reach a valuation of USD 1.4 billion by the end of 2035.

The sales compensation software industry in China was valued at more than USD 177 million in 2025, making it the second-leading market in the world. The market in China has expected to reach a valuation of USD 454.1 million by the end of the forecast period. The sales compensation software industry in Japan is forecast to reach a valuation of USD 368.8 million by the end of 2035.

| Country/ Region | Value |

|---|---|

| Europe Market Share % (2025) | 21.4% |

| Germany Market Share % (2025) | 9.2% |

| The United Kingdom Forecast CAGR % | 9.1% |

The sales compensation software industry in Europe is anticipated to grow at a modest rate over the forecast period. The sales compensation software industry in Europe was valued at more than USD 582 million in 2025 and is estimated to reach a valuation of above USD 642 million in 2025. The surging automation in every industry vertical is driving the European market. The sales compensation software market in Europe is forecast to reach a valuation of above USD 1.6 billion by the end of 2035.

The sales compensation software industry in the United Kingdom was valued above USD 110 million in 2025. The market in the United Kingdom is forecast to reach a valuation of USD 266.6 million by the end of 2035. The sales compensation software industry in the United Kingdom is expected to expand with a USD 149.7 million absolute dollar growth opportunity in the coming 10-year epoch.

The sales compensation software market in the United States was valued at around USD 3473.4 million in 2025 and is estimated to reach a valuation of USD 3473.4 million in 2025. The increasing adoption of sales compensation software among small-sized and medium enterprises is fuelling the expansion of the market in the United States. The United States is also home to several key players in the market, which is boosting the adoption of new versions of software among enterprises at a faster pace. The sales compensation software industry in the United States is forecast to reach a valuation of USD 8927.5 billion by the end of 2035.

| Segment | Large Enterprises |

|---|---|

| Market Share % (2025 to 2035) | 65.2% |

The surging digitalization and technological advancement have boosted the adoption of sales compensation software in large enterprises. Large enterprises with a high amount of sales data are adopting cloud-based sales compensation software as they reduce the adoption cost that is driving the market in the segment. Revenue generated from large enterprises grew at a CAGR of 10.2% from 2020 to 2025.

The SMEs segment is anticipated to grow at a significant rate over the forecast period. Sales compensation software helps SMEs to formulate commercial strategies according to their incentive scheme, which is effective for the business. As several SMEs is rising, sales compensation software providers are developing software specifically for SMEs which is expected to drive market expansion.

The cloud-based sales compensation software has high demand because they offer multiple plans that are suitable for enterprises according to their size. Using cloud-based software is uncomplicated for the sales management department, which is driving the segment. The cloud-based sales compensation software accounted for a CAGR of 10.6% from 2020 to 2025.

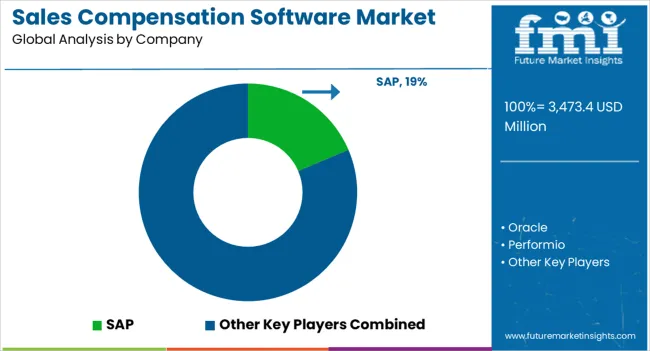

Sales compensation software providers are mostly active in client win and product launches. The key companies operating in the sales compensation software industry include SAP, Oracle, Performio, IconiSales Compensation Software, Optymyze, Xactly Corp., NICE Systems Ltd., Apttus, NetSuite, Commissionly.io, ZS Associates, IBM, CellarStone, Inc., Anaplan, QuotaPath Inc., CaptivateIQ, Inc., and Atmax Technologies.

Some recent developments by key providers of sales compensation software are as follows:

Similarly, recent developments related to companies developing sales compensation software have been tracked by the team at Future Market Insights, which is available in the full report.

Key Companies Covered

The global sales compensation software market is estimated to be valued at USD 3,473.4 million in 2025.

The market size for the sales compensation software market is projected to reach USD 8,927.5 million by 2035.

The sales compensation software market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in sales compensation software market are cloud based and web based.

In terms of application, large enterprises segment to command 62.8% share in the sales compensation software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salesforce Services Market Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Sales of Sports Nutrition Products in Latin America Analysis Size and Share Forecast Outlook 2025 to 2035

Sales of Plant‑based Ready Meals in US Analysis - Size, Share & Forecast 2025 to 2035

Sales Enablement Platform Market Analysis - Size, Share, and Forecast 2025 to 2035

Sales Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Sales Coaching Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Sales Performance Management (SPM) Software Market Size and Share Forecast Outlook 2025 to 2035

Salesforce CRM Document Generation Software Market Size and Share Forecast Outlook 2025 to 2035

Retail Sales of Legume Snacks in the UK Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Kvass in Russia and CIS countries Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA