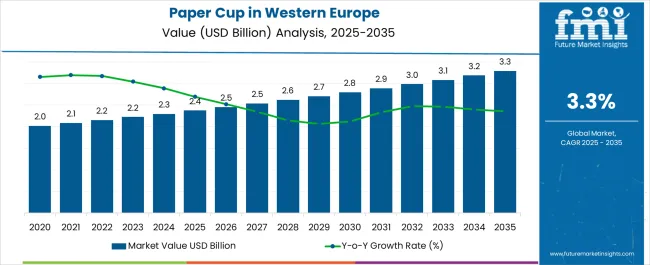

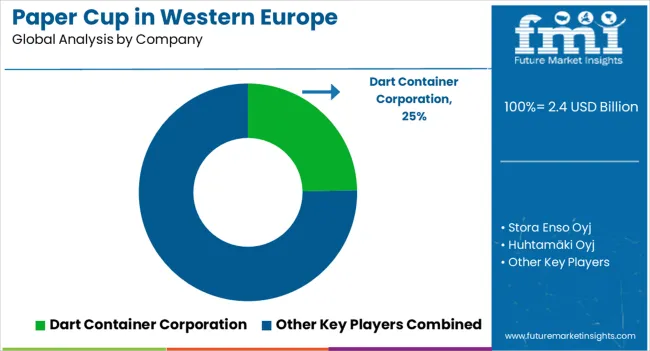

The Demand and Sales Analysis of Paper Cup in Western Europe is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Sales Analysis of Paper Cup in Western Europe Estimated Value in (2025 E) | USD 2.4 billion |

| Demand and Sales Analysis of Paper Cup in Western Europe Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The paper cup market in Western Europe is experiencing notable demand growth, supported by regulatory pressure against single-use plastics, increasing consumer preference for sustainable packaging, and strong uptake within the foodservice industry. Demand dynamics are shaped by quick-service restaurants, coffee chains, and institutional buyers that require scalable and eco-friendly solutions.

Current market conditions reflect a balance between price competitiveness and compliance with circular economy directives that mandate recyclable and biodegradable alternatives. Sales expansion is being driven by the penetration of branded and customized paper cups that offer marketing visibility and functional convenience.

The future outlook is defined by continued regulatory alignment with EU green policies, ongoing investment in recycling infrastructure, and growing adoption of bio-based coatings that enhance sustainability Growth rationale is centered on the rising acceptance of paper-based disposables as a mainstream packaging solution, the ability of manufacturers to scale production through automated lines, and the sustained integration of paper cups into foodservice supply chains, ensuring consistent revenue generation across both institutional and retail channels.

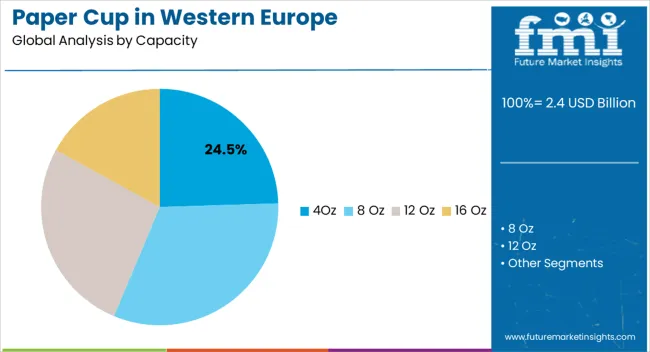

The 4Oz capacity segment, holding 24.5% of the capacity category, has gained prominence due to its wide use in sampling, espresso servings, and controlled portion beverages. Its share has been supported by strong demand from coffee shops and institutional buyers seeking smaller-size convenience solutions.

Production scalability and cost efficiency have enabled this capacity to remain competitive in price-sensitive markets. Demand is further sustained by the increasing use of portion-controlled packaging formats that minimize waste and align with consumer preferences for on-the-go lifestyles.

Distribution networks have adapted to supply 4Oz cups across retail and commercial channels, and customization opportunities through branding have reinforced visibility in high-frequency usage environments Future sales are expected to remain stable as both small-capacity utility and convenience-driven adoption continue to reinforce its market leadership within the capacity category.

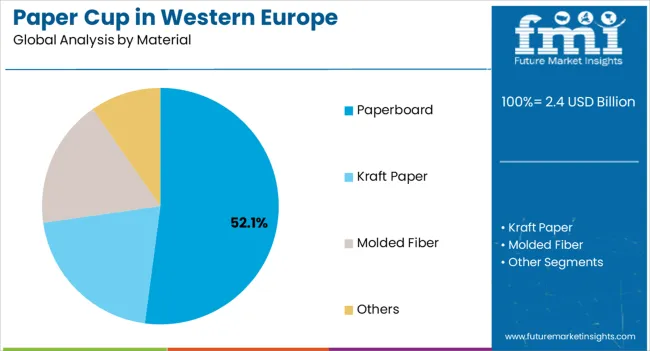

The paperboard segment, accounting for 52.1% of the material category, has been leading due to its strength, versatility, and regulatory approval for food contact applications. Its widespread use has been driven by compatibility with various coatings, recyclability potential, and consumer perception of paperboard as an eco-friendly alternative.

Consistent sourcing from sustainably managed forestry operations has strengthened supply security, while innovations in lightweight yet durable grades have improved cost efficiency. Sales have been supported by bulk procurement from large foodservice providers and quick-service chains across Western Europe.

Future growth is expected to benefit from technological advancements in fiber treatment and improved recycling infrastructure, reinforcing paperboard’s position as the dominant material choice in paper cup manufacturing.

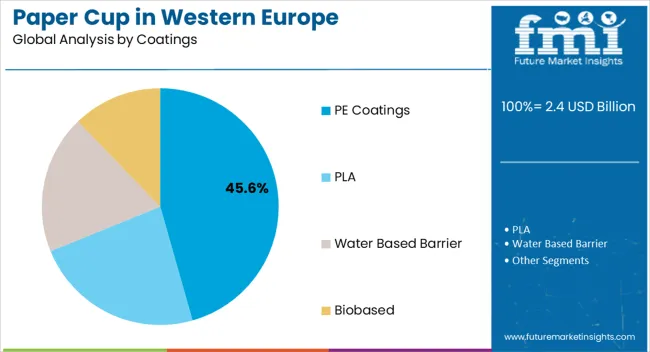

The PE coatings segment, representing 45.6% of the coatings category, has remained dominant due to its proven ability to provide moisture resistance, durability, and cost-effectiveness in mass-scale production. Its adoption has been reinforced by reliable performance in hot and cold beverages, ensuring product integrity during use.

Although regulatory scrutiny on plastic linings has encouraged exploration of bio-based alternatives, PE coatings have sustained demand due to their well-established manufacturing compatibility and lower production costs. Sales resilience has been further supported by high-volume orders from quick-service restaurants and institutional buyers requiring consistency and reliability.

The segment’s future growth trajectory is expected to depend on regulatory adaptation and the pace of alternative coating adoption, but near-term dominance remains secure due to established production infrastructure and widespread end-user trust in performance reliability.

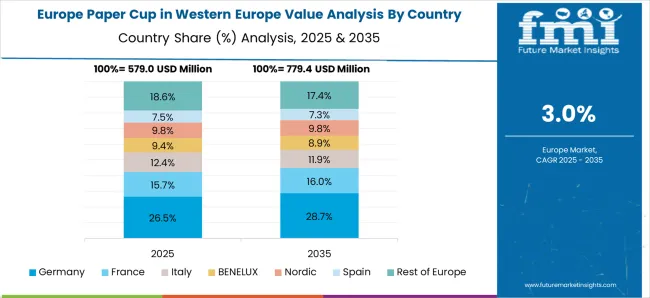

The United Kingdom has a significant paper cup ecosystem, primarily driven by the popularity of takeaway coffee and tea. The latte levy and other environmental initiatives have encouraged using recyclable and biodegradable paper cups. Large coffee shop chains, including Starbucks and Costa Coffee, are crucial in driving industry trends in the United Kingdom paper cups industry.

On-the-go-coffee culture on account of busy lifestyles and hectic schedules. Coupled with the established food service sector, there has been an increased demand for paper cups in the United Kingdom.

Germany has a strong recycling culture that influences the choice of paper cups. Sustainable and eco-friendly packaging options are highly sought after, leading to the use of recyclable paper cups. Numerous bakeries, cafes, and restaurants contribute to robust paper cups. The country's tourism industry drives paper cup consumption in cafes and tourist areas.

The growing consumer awareness and use of sustainable practices and regulations promote the use of paper cups that are biodegradable and compostable, increasing the growth outlook for the paper cup industry in Germany.

Sustainability and aesthetics play a role in choosing paper cup designs in Italy. The demand for biodegradable and eco-friendly paper cups has increased due to increased consumer awareness. The players lean toward smaller-sized cups due to the traditional coffee servings.

Italy's coffee culture has grown rapidly in recent years, leading to increased use of disposable cups. Italy, known for its espresso culture, uses paper cups predominantly for takeaway espresso and cappuccino.

Owing to the busy lifestyle in Western Europe, people often prefer to enjoy their hot beverages while on the move. Paper cups offer a convenient and portable option for this purpose. The beverage segment accounts for a share of 71.1% in 2025.

Western Europe has a strong coffee culture with a long history of coffee consumption. Countries like Italy, France, and Spain are known for their café culture as people often prefer to enjoy their coffee on the go or in coffee shops.

Manufacturers are actively diversifying their paper cup offerings to meet the rising demand from consumers on the move. The escalating consumption of beverages is notably propelling the sales of paper cups in the region.

| Paper Cups in Western Europe Based on End Use | Beverage |

|---|---|

| Share in % 2025 | 71.1% |

Western Europe has a strong environmental consciousness, and consumers are increasingly concerned about the environmental impact of single-use plastics. Paperboard paper cups align with these preferences and are seen as a responsible choice for hot and cold beverages. Paperboard paper cups are perceived as a more eco-friendly alternative to plastic cups, which drives their demand in Western European countries.

| Paper Cups in Western Europe Based on Cup Material | Paperboard |

|---|---|

| Total Share (2025) | 56.4% |

With their extensive expertise, resources, and focus on sustainability, paper cup companies are actively contributing to expansion. They invest in research and development to innovate and introduce eco-friendly materials, designs, and manufacturing processes that align with environmental concerns and regulations.

Companies are focused on introducing paper cups made from sustainable materials, such as FSC-certified paper and biodegradable coatings. These cups were designed to reduce the environmental impact of single-use cups and align with increasing consumer demand for eco-friendly options.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 2.4 billion |

| Projected Industry Size in 2035 | USD 3.3 billion |

| Anticipated CAGR between 2025 to 2035 | 3.3% CAGR |

| Historical Analysis of Demand for Paper Cups in Western European | 2020 to 2025 |

| Demand Forecast for Paper Cups in Western European Countries | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing mile delivery adoption in Western Europe, Insights on Industry Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Providers |

| Key Countries Analyzed while Studying Opportunities in Paper Cups in Western Europe Countries | United Kingdom, Germany, Italy, France, Spain |

| Key Companies Profiled | Dart Container Corporation; Stora Enso Oyj; Huhtamäki Oyj; International Paper Company; Nestlé S.A. |

The global demand and sales analysis of paper cup in Western Europe is estimated to be valued at USD 2.4 billion in 2025.

The market size for the demand and sales analysis of paper cup in Western Europe is projected to reach USD 3.3 billion by 2035.

The demand and sales analysis of paper cup in Western Europe is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in demand and sales analysis of paper cup in Western Europe are 4oz, _single wall, _double wall, _ripple wall, 8 oz, _single wall, _double wall, _ripple wall, 12 oz, _single wall, _double wall, _ripple wall, 16 oz, _single wall, _double wall, _ripple wall, 20 oz, _single wall, _double wall, _ripple wall, other capacity, _single wall, _double wall and _ripple wall.

In terms of material, paperboard segment to command 52.1% share in the demand and sales analysis of paper cup in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA