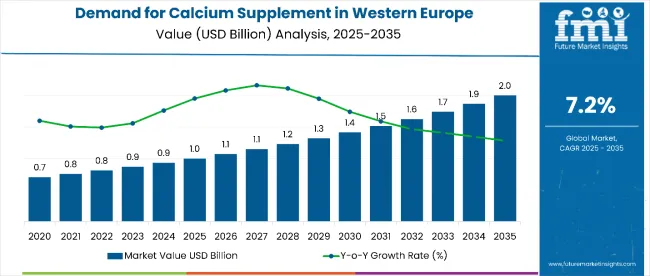

Sales of calcium supplements in Western Europe are estimated at USD 1.0 billion in 2025, with projections indicating a rise to USD 2.0 billion by 2035, reflecting a CAGR of approximately 7.2% over the forecast period. This growth reflects both a broadening consumer base and increased per capita consumption across key European nations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.0 billion |

| Forecast Value in (2035F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The rise in demand is linked to aging populations, growing awareness of bone health, and evolving preventive healthcare trends. By 2025, per capita consumption in leading Western European countries such as the United Kingdom, Germany, and France averages between 2.1 to 2.5 kilograms, with projections reaching 3.2 kilograms by 2035.

The United Kingdom leads among European nations, expected to generate USD 458 million in calcium supplement sales by 2033, followed by Germany (USD 412 million), France (USD 365 million), Italy (USD 298 million), and Spain (USD 293 million).

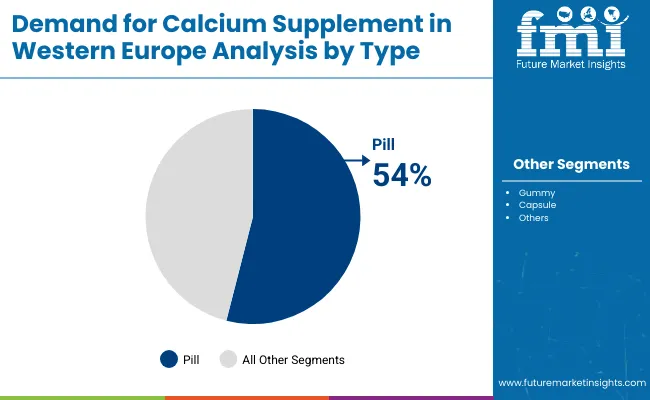

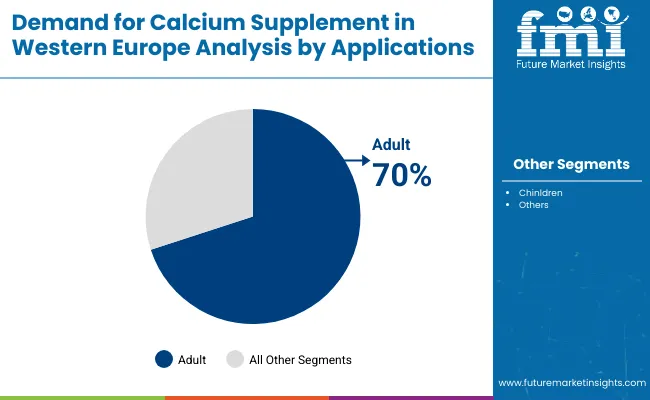

The largest contribution to demand continues to come from pill formulations, which are expected to account for 54% of total sales in 2023, owing to consumer familiarity, ease of consumption, and retail availability. By application segment, men represent the dominant consumer group, responsible for 47.6% of all sales, while women and children segments are expanding steadily.

Consumer adoption is particularly concentrated among health-conscious adults and aging populations concerned about osteoporosis prevention, with age and health awareness emerging as significant drivers of demand. While price remains a consideration, the growing emphasis on preventive healthcare and bone health education continues to support sustained consumption growth.

Regional disparities persist, but per capita demand in traditionally lower-consumption countries is narrowing the gap with established calcium supplement consumers in Northern and Central Europe.

The calcium supplements in Western Europe segments include type, product, applications, and country. The type segment covers gummy, pill, capsule, liquid, and others such as (powder, chewable tablets, effervescent tablets, and soft gels). The product segment comprises calcium carbonate, calcium gluconate, calcium citrate, calcium lactate, calcium phosphate, and calcium orotate. The applications segment includes adult and children. The country segment includes UK, Germany, Italy, France, Spain, and rest of Europe.

Calcium supplements in Western Europe serve diverse demographic groups with varying health objectives. Adults are expected to remain the primary consumer segment in 2023, followed by children and specialized populations. Consumption patterns are evolving to match specific health awareness trends across different age groups.

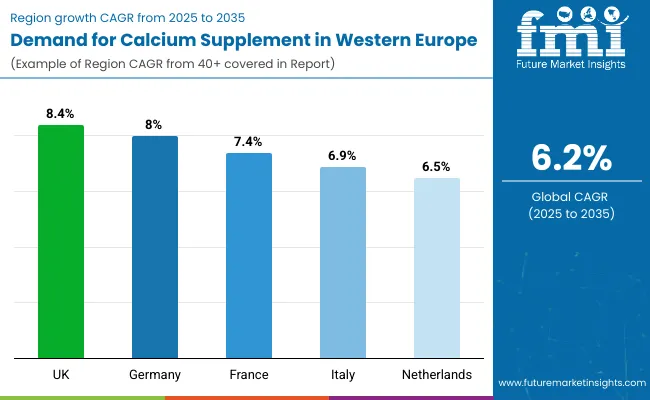

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.4% |

| Germany | 8.0% |

| France | 7.4% |

| Italy | 6.9% |

| Netherlands | 6.5% |

In Western Europe, the calcium supplements shows diverse growth dynamics across the top five countries. The UK leads with the highest projected CAGR of 8.4% from 2025 to 2035, supported by robust preventive health awareness and product innovation in fortified foods and supplements. Germany follows closely at 8%, driven by a health-conscious population, premium product demand, and strong regulatory frameworks.

France records a CAGR of 7.4%, reflecting its shift toward plant-based, organic formulations and strong pharmacy-led distribution. Italy’s growth rate of 6.9% is propelled by urban wellness trends and increasing e-commerce penetration, despite a traditionally calcium-rich diet. The Netherlands, while recording the lowest CAGR at 6.5%, maintains stable demand through sustainability-focused packaging, vegan-friendly innovations, and strong preventive healthcare initiatives.

Calcium supplement sales will not grow uniformly across every European nation. Rising health awareness and aging populations in the United Kingdom and Germany provide these countries with a measurable advantage, while other established European nations expand more steadily from varying baseline consumption levels. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2023 and 2033.

Revenue from calcium supplements in the UK is projected to grow at a CAGR of around 8.4% from 2025 to 2035, driven by a surge in preventive health practices and heightened consumer awareness of bone health. Demand is being fueled by the aging population, lifestyle-related calcium deficiencies, and growing participation in fitness activities.

Retail pharmacies and online platforms are significantly expanding reach. Functional food products fortified with calcium are capturing new demographics, especially younger consumers seeking wellness-focused nutrition. Multinational brands are competing with local supplement companies by launching innovative delivery formats such as gummies, chewables, and fortified drinks.

Public health campaigns on osteoporosis prevention are positively impacting sales. Consumers show a preference for products that combine calcium with Vitamin D and magnesium for better absorption and results. The UK benefits from both strong domestic demand and stable regulatory oversight that fosters consumer confidence.

Revenue from calcium supplements in Germany is set to expand at a CAGR of about 8% between 2025 and 2035, propelled by its large health-conscious population and well-developed healthcare infrastructure. The increasing focus on preventive nutrition aligns with rising osteoporosis screening programs and awareness initiatives.

German consumers value clinically validated, premium-grade products with transparent sourcing. Pharmacy-led distribution dominates, but e-commerce is seeing rapid growth, particularly for subscription-based supplement deliveries. The regulatory rigor ensures high product quality, attracting discerning buyers.

There is a marked rise in fortified plant-based foods offering calcium, meeting the needs of vegan and lactose-intolerant populations. Regional players are innovating with advanced formulations to improve bioavailability and convenience. Germany is also emerging as a leader in EU nutrition policy, influencing standards across Europe.

Revenue from calcium supplements in France is forecast to grow at a CAGR of 7.4% from 2025 to 2035, benefiting from consumer demand for natural and plant-based calcium sources. Public health initiatives targeting bone density maintenance, particularly in women, are strengthening penetration. Pharmacies remain the dominant retail channel, with strong trust from consumers.

A cultural inclination toward wellness and preventive care supports regular supplement use. The growing popularity of chewable and flavored formats is attracting younger demographics. France’s commitment to food fortification policies is also driving demand for functional products containing calcium.

Local and multinational players are competing by highlighting traceability, clean labeling, and sustainable packaging. Increasing research on calcium’s cardiovascular and metabolic benefits is further expanding its consumer appeal.

Demand for calcium supplements in Italy is expected to rise at a CAGR of nearly 6.9% during 2025 to 2035, driven by a cultural emphasis on wellness and proactive self-care. While traditional diets provide baseline calcium intake, modern lifestyles are increasing the adoption of supplement products. Urban consumers, in particular, are receptive to premium formulations addressing bone health, post-menopausal wellness, and sports nutrition.

Pharmacies and supermarkets are expanding their range of calcium-based products, while e-commerce is growing rapidly among tech-savvy consumers. Italian supplement brands are focusing on liquid and gummy forms, appealing to those seeking easy-to-consume formats. The also benefits from a rise in educational campaigns about the importance of calcium in preventing osteoporosis. Increasing medical recommendations from healthcare professionals are further supporting expansion.

Revenue from calcium supplements in Netherlands is anticipated to register a CAGR of approximately 6.5% between 2025 and 2035, supported by a strong preventive healthcare culture. Public awareness of bone health and osteoporosis prevention is high, contributing to stable consumption patterns. It is characterized by innovation in both formulation and eco-friendly packaging, resonating with sustainability-focused consumers.

Online sales are expanding rapidly, with subscription services offering convenience and affordability. Combination products containing calcium, Vitamin D, and magnesium are gaining traction due to their comprehensive health benefits. Local manufacturers are increasingly targeting vegan-friendly and allergen-free formulations.

Government health programs reinforce calcium’s importance, creating a favorable environment for steady demand growth. The country’s progressive regulatory stance supports nutraceutical innovation, keeping product quality high and consumer trust strong.

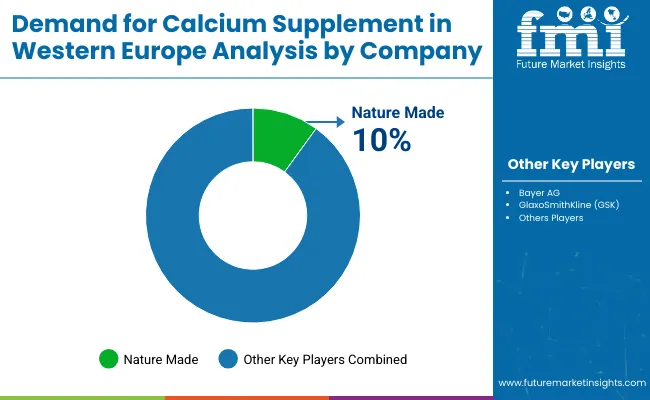

The competitive environment is characterized by a mix of established pharmaceutical companies and specialized nutrition manufacturers. Distribution breadth and healthcare professional relationships rather than product innovation alone remain decisive success factors: the leading suppliers collectively reach more than 25,000 retail outlets across Western Europe and maintain strong pharmacy channel presence.

Nature Made maintains strong positioning as a trusted healthcare brand. The company offers comprehensive calcium formulations across multiple delivery formats, with particular strength in evidence-based products supported by clinical research. Its core range of calcium carbonate and citrate formulations provides deep penetration in pharmacy channels while maintaining broad retail coverage through major European health store chains.

Bayer AG, leveraging its pharmaceutical heritage and European distribution network, positions calcium supplements within its broader health and wellness portfolio. The company's focus on scientifically-backed formulations and healthcare professional recommendations reinforces its role as a trusted source for bone health solutions across aging European populations.

GlaxoSmithKline (GSK) benefits from extensive pharmaceutical expertise and established relationships with healthcare providers throughout Western Europe. Recent launches focus on combination formulations that address multiple aspects of bone health, targeting both prevention and therapeutic applications across diverse consumer segments.

Pfizer, through its Caltrate brand, maintains significant presence in the calcium supplement category with formulations specifically designed for different life stages and health objectives. The brand's clinical heritage and doctor recommendations support premium positioning in key European nations.

Nature's Bounty focuses on natural health solutions and maintains strong presence in health food stores and online channels. The company's emphasis on quality sourcing and third-party testing appeals to health-conscious European consumers seeking transparency and efficacy in their nutritional supplements.

Private-label programs at major pharmacy chains and health retailers are expanding assortment at price points 10-15% below branded equivalents, putting margin pressure on smaller suppliers while supporting broader consumer access. Consolidation is likely to continue as regulatory compliance and healthcare professional engagement become critical for maintaining shelf visibility and prescription recommendations in this evolving category.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1.0 billion |

| Type | Gummy, Pill, Capsule, Liquid, Others (powder, chewable tablets, effervescent tablets, soft gels) |

| By Product Type | Calcium Carbonate, Calcium Gluconate, Calcium Citrate, Calcium Lactate, Calcium Phosphate, Calcium Orotate |

| By End-Use Application | Adult, Children |

| Regions Covered | Western Europe (including EU5 and other European countries) |

| Countries Covered | United Kingdom, Germany, France, Italy, Netherlands, Rest of Europe |

| Top Companies Profiled | Tetra Chemicals Europe, Pharma Manufacture, Bayer AG, AandZ Pharmaceutical, GSK, Bio Island, Nature Made, By-health Co., Ltd., Harbin Pharmaceutical Group, Bayer AG |

| Additional Attributes | Rising consumer focus on preventive healthcare, increasing awareness of osteoporosis prevention, growing adoption of fortified foods and beverages, product innovation in delivery formats such as gummies and chewables, expansion of e-commerce supplement sales, supportive regulatory frameworks, and targeted marketing toward aging populations |

The global demand and trend analysis of calcium supplement in Western Europe is estimated to be valued at USD 1.0 billion in 2025.

The market size for the demand and trend analysis of calcium supplement in Western Europe is projected to reach USD 1.9 billion by 2035.

The demand and trend analysis of calcium supplement in Western Europe is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of calcium supplement in Western Europe are capsule, gummy, pill, liquid and others.

In terms of product, calcium carbonate segment to command 42.1% share in the demand and trend analysis of calcium supplement in Western Europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Dietary Supplements Market Analysis by Ingredients, Form, Application, and Country Through 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Europe Calcium Propionate Market Outlook – Share, Growth & Forecast 2025-2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA