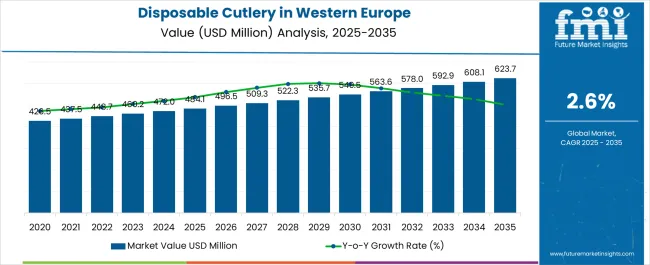

The Demand and Trend Analysis of Disposable Cutlery in Western Europe is estimated to be valued at USD 484.1 million in 2025 and is projected to reach USD 623.7 million by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trend Analysis of Disposable Cutlery in Western Europe Estimated Value in (2025 E) | USD 484.1 million |

| Demand and Trend Analysis of Disposable Cutlery in Western Europe Forecast Value in (2035 F) | USD 623.7 million |

| Forecast CAGR (2025 to 2035) | 2.6% |

The disposable cutlery market in Western Europe is experiencing a notable transformation. Shifts in consumer behavior, sustainability regulations, and foodservice expansion are influencing demand. Current trends reflect growing adoption of eco-friendly alternatives, yet plastic-based options remain in circulation due to cost advantages and functional durability.

Food delivery platforms, quick service restaurants, and institutional catering continue to drive baseline consumption. Regulatory frameworks aimed at reducing single-use plastics are reshaping product portfolios, compelling manufacturers to explore biodegradable materials and innovative fabrication technologies. The future outlook suggests a gradual transition toward sustainable cutlery options, supported by consumer awareness campaigns and investments in green manufacturing.

Market growth rationale is tied to the balance between regulatory compliance, evolving customer preferences, and operational efficiency of production As brands focus on recyclable and compostable offerings while maintaining affordability, the Western European disposable cutlery market is projected to demonstrate moderate but steady growth with strong emphasis on product innovation and supply chain resilience.

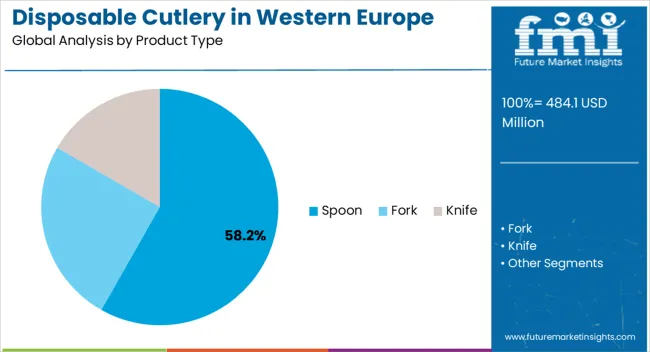

The spoon segment, holding 58.20% of the product type category, has been leading due to its dominant role in takeaway meals, institutional dining, and food delivery services. Its significant share is being reinforced by high usage frequency across both hot and cold food applications.

Manufacturers have optimized production volumes and distribution channels to meet consistent demand, ensuring stable availability across retail and commercial outlets. While sustainability regulations are beginning to impact traditional plastic spoons, transition strategies involving compostable and biodegradable materials are being implemented.

Product innovations in lightweighting and durability have further sustained market adoption The segment is expected to maintain its leadership through adaptability in material sourcing and alignment with consumer expectations for convenience, hygiene, and cost-effectiveness in everyday use.

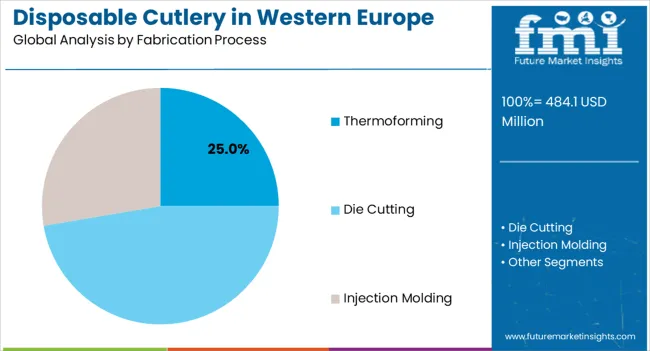

The thermoforming segment, accounting for 25.0% of the fabrication process category, is maintaining leadership owing to its efficiency in high-volume production and ability to deliver consistent product quality. The process is widely favored for its cost-effectiveness, design flexibility, and scalability, which are crucial for meeting demand from foodservice operators and retail chains.

Regulatory-driven material innovations are being integrated into thermoforming, enabling the production of biodegradable and recyclable cutlery without compromising structural performance. The process also supports thinner wall designs and reduced material usage, aligning with sustainability and cost-reduction objectives.

As manufacturers continue to refine thermoforming techniques and integrate automation, the segment is expected to sustain its share and remain a cornerstone of disposable cutlery fabrication in Western Europe.

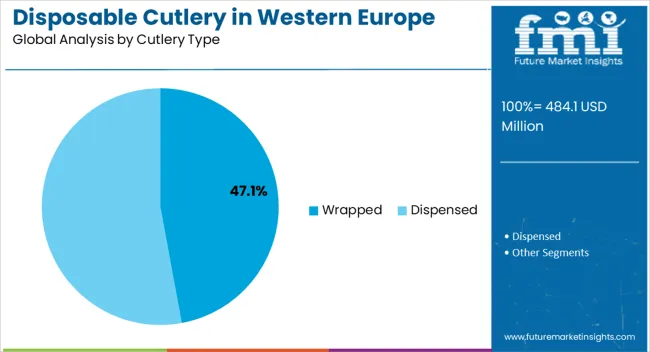

The wrapped cutlery segment, representing 47.10% of the cutlery type category, is leading due to heightened hygiene awareness and demand from takeaway, catering, and institutional dining services. Individually wrapped sets have been favored for their ability to ensure safety, reduce contamination risks, and improve convenience for end users.

The segment has gained further momentum following public health concerns, as foodservice providers increasingly prioritize packaged solutions. Manufacturers are focusing on recyclable wrapping materials and compact packaging formats to align with environmental standards while retaining convenience.

Strategic adoption by airlines, hospitals, and quick-service restaurants has reinforced the segment’s strong position With ongoing emphasis on hygiene, safety, and eco-friendly packaging integration, the wrapped cutlery segment is expected to retain its dominance and support stable market growth in Western Europe.

In 2025, the spoon segment is likely to gain a share of 58.20% in Western Europe.

| Product Type | Spoons |

|---|---|

| Expected share in 2025 | 58.20% |

Spoons are popular in the Western Europe disposable cutlery industry due to their versatility in a variety of food consumption settings. They serve a broad variety of foods, such as takeaway, desserts, and soups, which makes them a go to option for eating at home or on the go. Disposable spoons are convenient and fit in well with the fast paced lives that are common in the region.

Spoons are becoming more and more popular in the disposable cutlery industry as a result of the demand for environmentally acceptable materials in their manufacture, which addresses sustainability issues.

The food and beverage segment in Western Europe disposable cutlery industry is estimated to garner a 26.50% share in 2025.

| End Use Segment | Food Service |

|---|---|

| Expected share in 2025 | 61.80% |

The rise in takeaway and delivery services in the food service business in Western Europe is contributing considerably to an increase in disposable flatware sales.

Single use utensils are becoming more and more common due to shifting customer tastes brought on by hectic lives and the growth of food delivery services on the internet. Cafés, restaurants, as well as food delivery services to improve ease and hygiene during these interactions frequently use disposable cutlery.

Sales have also been boosted by the response of this industry to environmental concerns, which has raised consumer demand for eco friendly and sustainable disposable products. The food service industry in Western Europe is seeing a surge in the use of disposable cutlery due to the combination of convenience, cleanliness, and sustainability.

Manufacturers dealing with disposable cutlery have made significant strides in two Western European regions, the United Kingdom and Germany.

| Regions Profiled | CAGR from 2025 to 2035 |

|---|---|

| Germany | 2.70% |

| The United Kingdom | 2.90% |

During the forecast period, Germany disposable cutlery industry is likely to garner a 2.70% CAGR. A number of reasons, including shifting lifestyles and an increase in food consumption while on the go, in addition to environmental concerns, impacts the disposable cutlery market in Germany. The need for convenience and busy urban lifestyles have increased demand for single use cutlery for fast food and takeout.

The foodservice industry, which includes coffee shops and meal delivery services, is a major factor in the spread of disposable cutlery. As customers seek more convenient meal options, manufacturers are responding by producing lightweight, portable, as well as disposable utensils.

During the forecast period, the United Kingdom industry is likely to develop with a 2.90% CAGR. The increasing demand for environmentally friendly and sustainable solutions is the main driver of the disposable cutlery sector in the United Kingdom. Consumer demands for less plastic have led to a move towards compostable and biodegradable materials as environmental awareness has grown.

Laws and government programs encouraging the decrease of single use plastics further fuel this tendency. Using resources like sugarcane, bamboo, and cornstarch, manufacturers are coming up with innovative methods to provide environmentally friendly alternatives.

Sustainability is a major factor driving development in the disposable cutlery industry in the United Kingdom. This is because consumers have become more conscious of the adverse environmental impacts of using traditional plastic silverware and prefer it since it is more convenient.

In order to increase revenues, existing companies and startups in the Western Europe disposable cutlery industry are concentrating on innovation and environmental sustainability. Many are making investments in environmentally friendly materials, like compostable substitutes or biodegradable plastics, in response to the increased demand from consumers for goods that are ecologically friendly.

Premium and aesthetic designs, partnerships with retail chains, and product diversity are popular approaches to stand out and gain market dominance. A dynamic market where firms strive to match changing customer tastes and contribute to lowering the ecological footprint for long-term profitability is reflected in the emphasis on aesthetics, convenience, and sustainability.

Recent Developments Observed in Western Europe Disposable Cutlery Ecosystem

| Company | Product Portfolio |

|---|---|

| DOpla S.p.A. |

|

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 484.1 million |

| Projected Industry Size in 2035 | USD 623.7 million |

| Attributed CAGR between 2025 and 2035 | 2.6% |

| Historical Analysis of Demand for disposable cutlery in Western Europe Countries | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Report Coverage | Industry size, industry trends, analysis of key factors influencing disposable cutlery in Western Europe, insights on global players and their industry strategy in Western Europe, ecosystem analysis of local and regional Western Europe providers |

| Key Countries within Western Europe Analyzed while Studying Opportunities for disposable cutlery in Western Europe | The United Kingdom, Germany, Italy, France, Spain, Rest of Western Europe |

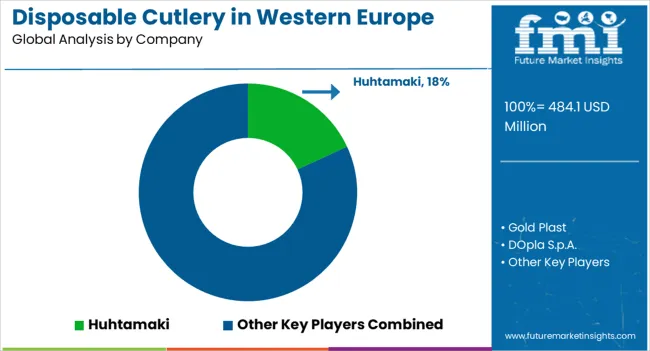

| Key Companies Profiled | Huhtamaki; Gold Plast; DOpla S.p.A.; Anchor Packaging; Apollo Funds; Biopak; D&W Fine Pack; Dart Container Corporation; Hotpack Global; Pactiv Evergreen |

The global demand and trend analysis of disposable cutlery in Western Europe is estimated to be valued at USD 484.1 million in 2025.

The market size for the demand and trend analysis of disposable cutlery in Western Europe is projected to reach USD 624.6 million by 2035.

The demand and trend analysis of disposable cutlery in Western Europe is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of disposable cutlery in Western Europe are spoon, fork and knife.

In terms of fabrication process, thermoforming segment to command 25.0% share in the demand and trend analysis of disposable cutlery in Western Europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Pepper in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Evaporative Condensers in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial & Institutional Cleaning Products in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Zinc-Tin Alloy Sputtering Target in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Miniature Duplex Connectors in USA Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in UK Size and Share Forecast Outlook 2025 to 2035

Demand for 4-Inch SiC Laser Annealing Equipment in the USA Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in USA Size and Share Forecast Outlook 2025 to 2035

Demand for AGV Intelligent Management Systems in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA