The demand for industrial and institutional cleaning products in the European Union is projected to grow from USD 15.3 billion in 2025 to approximately USD 30.7 billion by 2035, recording an absolute increase of USD 15.4 billion over the forecast period. This translates into total growth of 100.5%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.2% between 2025 and 2035.

The overall industry size is expected to expand by nearly 2.0X during the same period, supported by rising demand for professional-grade hygiene solutions, tightening regulatory requirements for sanitation standards, and expanding applications across commercial facilities, manufacturing operations, and institutional environments throughout the EU cleaning and facility management sectors. Between 2025 and 2030, demand is projected to grow from USD 15.3 billion to USD 21.5 billion, resulting in an increase of USD 6.2 billion, which represents 40.4% of the total forecast growth. This phase will be shaped by stricter hygiene regulations, growing outsourcing in facility management requiring specialized cleaning products, and mainstream adoption of professional-grade solutions across commercial and institutional channels. Manufacturers are enhancing their product portfolios to meet evolving preferences for disinfection efficacy, eco-friendly formulations, and multi-surface cleaning capabilities comparable to specialized alternatives.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 15.3 billion |

| Forecast Value in (2035F) | USD 30.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

From 2030 to 2035, sales are forecast to grow from USD 21.5 billion to USD 30.7 billion, adding another USD 9.2 billion, which accounts for 59.6% of the total decade-long expansion. This phase is expected to be characterized by expanded adoption of biodegradable and environmentally responsible cleaning formulations, integration of antimicrobial technologies for superior hygiene protection, and the introduction of innovative product formats addressing diverse facility management and industrial sanitation requirements. The emphasis on green credentials and greater institutional willingness to invest in premium-grade cleaning products will drive demand for advanced industrial and institutional cleaning solutions offering both performance and environmental advantages.

Between 2020 and 2025, EU industrial and institutional cleaning product demand expanded at a CAGR of 4.5%, increasing from USD 12.3 billion to USD 15.3 billion. Growth in this phase was supported by rising commercial facility requirements, heightened hygiene awareness due to pandemic influences, and stronger recognition of the advantages of professional cleaning products over consumer-grade alternatives. The period also marked increased participation of chemical manufacturers and specialist cleaning firms recognizing the commercial potential of institutional-grade cleaning solutions. Advances in formulation technologies and performance improvements helped build customer confidence and encouraged mainstream adoption across professional cleaning and facility management applications.

Industry expansion is being supported by the rapid increase in commercial facility operations and institutional hygiene requirements across European countries and the corresponding demand for professional-grade, performance-validated, and regulation-compliant cleaning solutions with proven effectiveness in sanitation, disinfection, and facility maintenance applications. Modern facility managers and professional cleaning operations rely on industrial and institutional cleaning products as essential supplies for consistent hygiene outcomes, regulatory compliance, and operational efficiency, driving demand for products that deliver reliable cleaning power, broad-spectrum efficacy, and specialized formulations compared to traditional consumer cleaning products offering limited professional-grade performance.

The growing awareness of hygiene standards and increasing recognition of professional cleaning capabilities are driving demand for industrial and institutional cleaning products from certified manufacturers with appropriate quality credentials and performance validation documentation. Regulatory authorities are increasingly establishing clear guidelines for cleaning product efficacy standards, disinfection capabilities, and safety requirements to maintain workplace hygiene and ensure sanitation consistency. Scientific research studies and antimicrobial testing are providing evidence supporting professional cleaning products' efficacy reliability and application advantages, requiring standardized testing methods and quality control protocols for optimal microbial reduction, appropriate surface compatibility, and consistent cleaning performance across diverse facility management applications.

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into general purpose cleaners, disinfectants and sanitizers, laundry care products, vehicle wash products, and others including specialty and warewashing formats. Based on application, sales are categorized into commercial and manufacturing operations. In terms of distribution channel, demand is segmented into direct B2B sales, distributors, and online marketplace platforms. By nature, sales are classified into eco-friendly/biodegradable and conventional formulations. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The general purpose cleaners segment is projected to account for 31% of EU industrial and institutional cleaning products sales in 2025, declining slightly to 29% by 2035, establishing itself as the dominant format across European facility management and professional cleaning applications. This commanding position is fundamentally supported by general purpose cleaners' versatile functionality, broad-surface compatibility, and comprehensive cleaning capabilities enabling consistent facility maintenance. The general purpose cleaners format delivers exceptional operational appeal, providing facility managers and professional cleaners with a product category that facilitates multi-surface cleaning, cost-effective operations, and simplified inventory management essential for efficiency-focused facility operations.

This segment benefits from mature formulation technologies, well-established distribution networks, and extensive adoption by major facility management companies and institutional customers who maintain confidence in product quality and cleaning consistency. The general purpose cleaners segment's slight declining share reflects growing adoption of specialized disinfectants and sanitizers, which expand from 25% in 2025 to 27% in 2035, capturing market share through enhanced antimicrobial performance and regulatory compliance requirements throughout the forecast period.

Key advantages:

Disinfectants and sanitizers are positioned to represent 25% of total industrial and institutional cleaning products demand across European operations in 2025, expanding to 27% by 2035, reflecting the segment's importance as a critical hygiene category within the overall market. This substantial share directly demonstrates that antimicrobial protection represents a priority application, with disinfectants and sanitizers utilized extensively in healthcare facilities, food service operations, and institutional environments for pathogen elimination and contamination prevention.

Modern facility managers increasingly view disinfectants and sanitizers as essential hygiene tools, driving demand for products optimized for broad-spectrum efficacy, fast-acting performance, and residual antimicrobial protection that resonates with safety-conscious institutions. The segment benefits from continuous innovation focused on advanced antimicrobial agents, contact time reduction formulations, and efficacy optimization enhancing hygiene assurance and operational efficiency. The segment's growing share reflects accelerating regulatory requirements, heightened hygiene awareness, and expanding applications in healthcare, food processing, and public facilities demanding superior antimicrobial performance throughout the forecast period.

Key drivers:

Commercial applications are strategically positioned to represent 69% of total European industrial and institutional cleaning products sales in 2025, expanding slightly to 70% by 2035, reflecting the segment's dominance as the primary consumption category within the overall market. This substantial share directly demonstrates that commercial facilities represent the dominant application, with cleaning products utilized extensively in office buildings, retail spaces, hospitality facilities, and healthcare institutions for routine cleaning and hygiene maintenance.

Modern commercial facility managers increasingly view professional cleaning products as essential operational requirements, driving demand for products optimized for efficiency, safety, and consistent performance that supports facility appearance and occupant health. The segment benefits from continuous facility expansion, outsourced cleaning service growth, and performance standardization enhancing operational consistency and service quality. The segment's expanding share reflects faster commercial infrastructure development compared to manufacturing facilities throughout the forecast period.

Success factors:

Direct B2B sales channels are strategically estimated to control 45% of total European industrial and institutional cleaning products sales in 2025, declining to 40% by 2035, reflecting the critical importance of manufacturer-to-customer direct supply relationships for large facility operators and cleaning service providers. European direct sales operations consistently demonstrate strong customer retention delivering customized formulations, technical support, and competitive pricing to institutional customers. The segment provides essential customer service through dedicated account management, on-site training, and application optimization supporting professional cleaning operations.

Major cleaning product manufacturers systematically supply products directly to facility management companies, healthcare networks, and hospitality chains, often providing volume discounts, inventory management services, and technical consultation that facilitate category adoption and usage optimization. The segment's declining share reflects faster growth in distributor channels, which expand from 45% in 2025 to 43% in 2035, and online marketplace platforms growing from 10% to 17%, capturing market share through convenience and competitive pricing throughout the forecast period.

Development factors:

Conventional industrial and institutional cleaning products are strategically positioned to contribute 72% of total European sales in 2025, declining to 55% by 2035, representing products formulated with traditional chemical ingredients without biodegradable or eco-friendly certification requirements. These conventional products successfully deliver proven cleaning effectiveness and cost competitiveness while ensuring broad commercial availability across all distribution channels that prioritize performance reliability and pricing accessibility over environmental certification. Conventional formulations serve cost-conscious facility operators, mainstream cleaning service providers, and budget-oriented institutions that require effective cleaning at competitive price points.

The segment derives significant competitive advantages from established formulation platforms, economies of scale in chemical manufacturing, and the ability to meet substantial volume requirements from major facility management companies without environmental certification constraints limiting ingredient options and formulation flexibility. The segment's declining share through 2035 reflects the category's evolution toward eco-friendly products, which grow from 28% in 2025 to 45% in 2035, as sustainability-focused facilities and environmentally conscious institutions increasingly prioritize biodegradable formulations and green certification requirements.

Competitive advantages:

EU industrial and institutional cleaning products sales are advancing rapidly due to increasing hygiene standards in commercial facilities, growing regulatory requirements for sanitation compliance, and rising outsourcing of professional cleaning services across European institutions. However, the industry faces challenges, including environmental regulations affecting chemical formulations, supply chain pressures for specialized ingredients, and price sensitivity among cost-conscious facility operators. Continued innovation in sustainable formulations and performance optimization remains central to industry development.

The rapidly accelerating development of sustainable and biodegradable formulations is fundamentally transforming industrial and institutional cleaning products from traditional chemical-intensive solutions to environmentally responsible formulations enabling effective cleaning with reduced environmental impact, delivering sustainability credentials and performance reliability previously unattainable through conventional cleaning product formulations. Advanced formulation platforms featuring plant-based surfactants, biodegradable solvents, and renewable ingredient technologies allow producers to create eco-friendly cleaning products with effective soil removal, antimicrobial performance, and environmental safety comparable to conventional chemical formulations. These sustainability innovations prove particularly transformative for environmentally conscious facilities, green-certified buildings, and institutions where environmental responsibility proves essential for corporate sustainability commitments and regulatory compliance. Major cleaning product manufacturers invest heavily in green chemistry research, biodegradable ingredient development, and environmental certification programs, recognizing that sustainable formulations represent breakthrough solutions for environmental demands driving category transformation. Producers collaborate with environmental organizations, certification bodies, and sustainability consultants to develop scalable formulations that achieve eco-label certification while maintaining cleaning performance and cost competitiveness supporting commercial adoption.

Modern industrial and institutional cleaning product manufacturers systematically incorporate advanced antimicrobial agents, long-lasting disinfection technologies, and residual protection formulations that deliver superior pathogen elimination, extended hygiene assurance, and infection prevention capabilities comparable to specialized healthcare disinfectants. Strategic integration of quaternary ammonium compounds, hydrogen peroxide technologies, and novel antimicrobial actives optimized for institutional applications enables producers to position advanced disinfection products as legitimate infection control solutions where antimicrobial efficacy directly determines purchasing behavior among healthcare facilities and hygiene-critical institutions. These antimicrobial improvements prove essential for premium market positioning, as healthcare and food service applications demand efficacy validation, regulatory approval documentation, and pathogen elimination superiority supporting infection prevention protocols. Companies implement extensive antimicrobial testing programs, efficacy validation studies, and regulatory compliance documentation targeting broad-spectrum pathogen elimination, including bacterial reduction, viral inactivation, and fungal control throughout product application and residual protection periods. Producers leverage antimicrobial performance in marketing campaigns, on-label efficacy claims featuring pathogen elimination data, and technical documentation, positioning advanced disinfection products as professional-grade solutions delivering hygiene assurance with scientifically validated antimicrobial protection.

European facility operators and professional cleaning services increasingly prioritize concentrated cleaning product formulations featuring dilution-control systems, automated dispensing technologies, and precise dosing mechanisms that differentiate professional solutions through cost efficiency and usage optimization. This concentration trend enables producers to drive operational efficiency through reduced packaging waste, transportation cost savings through volume reduction, and usage precision resonating with cost-conscious facility managers seeking operational excellence without compromising cleaning effectiveness. Concentrated formulations prove particularly important for large facility operations where product economics drive purchasing decisions and operational efficiency. The development of sophisticated dilution systems, including automated dispensers, color-coded dilution equipment, and integrated dosing technologies expands producers' abilities to create concentrated products delivering consistent cleaning performance with reduced environmental impact through packaging reduction and transportation efficiency. Producers collaborate with dispensing equipment manufacturers, facility management companies, and sustainability consultants to develop formulations optimized for dilution control while maintaining cleaning efficacy, supporting cost reduction and environmental sustainability while ensuring performance consistency across diverse professional applications.

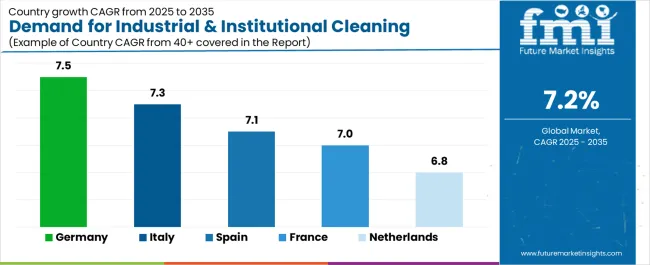

| Country | CAGR 2025-2035 |

|---|---|

| Germany | 7.5% |

| France | 7% |

| Italy | 7.3% |

| Spain | 7.1% |

| Netherlands | 6.8% |

EU industrial and institutional cleaning products sales demonstrate robust growth across major European economies, with Germany leading expansion at 7.5% CAGR through 2035, driven by manufacturing sector strength and institutional infrastructure development. Italy and Spain show strong growth at 7.3% and 7.1% CAGR through healthcare facility expansion and commercial building development.

France records 7% CAGR reflecting established market maturity and steady institutional demand growth. Netherlands demonstrates 6.8% CAGR with consistent commercial facility management sophistication. Rest of Europe demonstrates 7.1% CAGR with steady institutional cleaning product adoption across emerging European Union member states. Overall, sales show consistent regional development reflecting EU-wide trends toward professional facility maintenance and institutional hygiene compliance.

Revenue from industrial and institutional cleaning products in Germany is projected to exhibit steady growth with a CAGR of 7.5% through 2035, driven by exceptionally well-developed manufacturing sector, comprehensive healthcare system infrastructure, and strong institutional commitment to hygiene standards throughout the country. Germany's sophisticated industrial economy and internationally recognized quality standards are creating substantial demand for high-performance cleaning products across all institutional segments.

Major facility management companies, including WISAG and Gegenbauer, combined with extensive healthcare networks throughout German cities and industrial regions, systematically utilize industrial and institutional cleaning products for facility maintenance, often prioritizing premium formulations to maintain stringent cleanliness standards and regulatory compliance.

German demand benefits from high hygiene consciousness, substantial commercial and institutional facility base supporting large-volume consumption, and technical sophistication that naturally supports advanced cleaning product adoption across mainstream facility management beyond basic cleaning applications. The country's chemical industry expertise and manufacturing precision culture drive expectations for superior product performance, consistency, and safety validation supporting premium institutional cleaning product positioning.

Growth drivers:

Revenue from industrial and institutional cleaning products in France is expanding at a CAGR of 7%, supported by France's extensive commercial real estate portfolio, developed healthcare system, and established facility management industry serving diverse institutional sectors. France's strong service economy and sophisticated hospitality sector are driving demand for premium cleaning products across commercial facility applications. Major facility service providers, including Elior Services and Sodexo, maintain comprehensive cleaning product utilization to serve continuously growing institutional demand across healthcare, education, hospitality, and corporate facility segments.

French sales particularly benefit from sophisticated hygiene standards demanding superior cleaning performance and aesthetic maintenance, driving product specialization and premium positioning within the institutional cleaning product category. The combination of tourism industry requirements and expanding healthcare infrastructure significantly enhances consumption rates driven by French quality expectations and service excellence standards.

Success factors:

Revenue from industrial and institutional cleaning products in Italy is growing at a robust CAGR of 7.3%, fundamentally driven by expanding healthcare facility infrastructure, significant tourism and hospitality sector, and gradual modernization of Italian commercial facility management practices. Italy's traditionally quality-focused service culture naturally accommodates professional-grade cleaning products as facility managers recognize performance benefits and compliance advantages. Major facility management companies, including ISS Italia and Dussmann Service, strategically invest in institutional cleaning product adoption for operational efficiency and hygiene standard achievement across healthcare, hospitality, and commercial building portfolios.

Italian sales particularly benefit from healthcare system requirements creating consistent institutional demand, combined with extensive hospitality infrastructure in Rome, Milan, Venice, and tourist regions contributing to commercial cleaning product consumption through facility maintenance and guest satisfaction priorities. The country's strong regional economies and diverse industrial base support steady institutional cleaning product demand across manufacturing facilities, commercial buildings, and public institutions.

Development factors:

Demand for industrial and institutional cleaning products in Spain is projected to grow at a CAGR of 7.1%, substantially supported by expanding commercial real estate sector, growing healthcare system capacity, and increasing institutional facility development across major Spanish cities. Spanish commercial sector modernization and infrastructure investment positions institutional cleaning products as essential for facility management excellence and hygiene compliance. Major facility service companies, including Ferrovial Services and Clece, systematically expand institutional cleaning product utilization, with healthcare facility growth and commercial building development proving particularly successful in driving mainstream adoption through consistent professional product consumption.

Spain's growing tourism sector supports institutional cleaning product demand among hotel operators and hospitality facility managers providing guest accommodation and public facility services requiring high hygiene standards. The country's economic recovery and commercial investment expansion create favorable conditions for institutional cleaning product market development across healthcare, hospitality, commercial office, and retail facility segments.

Growth enablers:

Demand for industrial and institutional cleaning products in the Netherlands is expanding at a CAGR of 6.8%, fundamentally driven by sophisticated facility management industry, leadership in sustainability innovation, and quality-focused institutional procurement standards. Dutch facility managers demonstrate particularly high receptivity to sustainable cleaning formulations and performance-optimized institutional products aligned with environmental responsibility objectives. Netherlands sales significantly benefit from well-developed commercial infrastructure, innovative facility management companies testing sustainable cleaning technologies, and environmental consciousness driving eco-friendly institutional cleaning product adoption across healthcare, education, and commercial facility segments.

The country's sustainability leadership and green building certification prevalence support demand for biodegradable cleaning formulations, with successful Dutch facility management practices often influencing broader European institutional cleaning approaches. Strong economic fundamentals and sophisticated service sector create consistent institutional cleaning product demand across diverse commercial and institutional applications throughout major Dutch cities and business districts.

Innovation drivers:

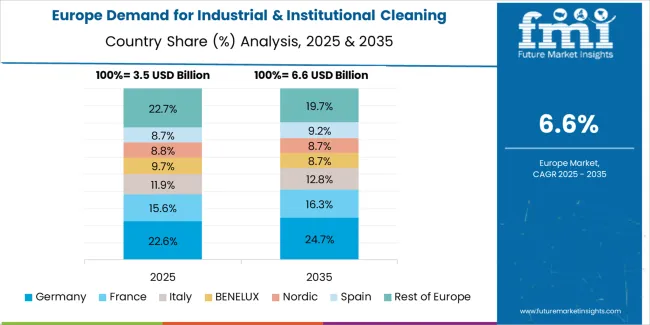

EU industrial and institutional cleaning products sales are projected to grow from USD 15.3 billion in 2025 to USD 30.7 billion by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 7.5% CAGR, supported by advanced manufacturing infrastructure, stringent hygiene standards, and extensive institutional facility base requiring professional cleaning solutions.

France and Italy follow with 7% and 7.3% CAGR respectively, attributed to expanding commercial real estate development and growing healthcare facility requirements. Germany maintains the largest share at 24% in 2025, driven by an established industrial economy and quality-focused facility management culture, while growing at a 7.5% CAGR. The rest of Europe shows a 7.1% CAGR, reflecting diverse regional development stages and consistent category expansion across emerging European markets.

EU industrial and institutional cleaning products sales are defined by competition among multinational chemical manufacturers, specialized cleaning companies, and regional formulation suppliers. Companies are investing in sustainable formulation technologies, antimicrobial development programs, quality assurance systems, and technical application support to deliver high-quality, performance-validated, and environmentally responsible industrial and institutional cleaning solutions. Strategic partnerships with facility management companies and distribution network expansion initiatives, along with technical support programs emphasizing application expertise and efficacy validation are central to strengthening competitive position.

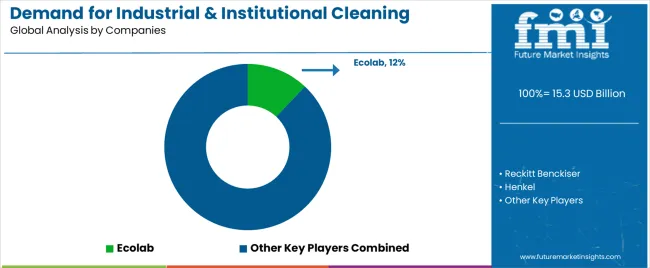

Major participants include Ecolab with an estimated 12% share, leveraging its global institutional hygiene leadership, comprehensive product portfolio, and established European presence through extensive distribution networks across multiple countries. Ecolab benefits from sophisticated dispensing systems, deep application expertise, and ability to serve diverse sectors from healthcare to food service, supporting customer requirements and operational optimization through technical service excellence and comprehensive hygiene programs.

Reckitt Benckiser holds approximately 10% share, emphasizing diverse institutional and industrial cleaning portfolio, brand strength across professional cleaning categories, and formulation innovation supporting product differentiation. Reckitt's success in developing effective disinfection solutions with regulatory compliance credentials creates strong positioning and customer loyalty, supported by technical service capabilities and scientific research backing antimicrobial performance claims.

Henkel accounts for roughly 8% share through its position as comprehensive cleaning solutions provider with integrated European manufacturing, providing diverse industrial and institutional products through technical expertise and application support. The company benefits from facility management relationships, regional production facilities, and technical service helping customers optimize cleaning performance, supporting premium positioning and long-term partnerships.

BASF represents approximately 7% share, supporting growth through strong position in cleaning chemical ingredients, surfactant technology leadership, and formulation expertise across diverse applications. BASF leverages chemical manufacturing capabilities, technical knowledge, and application development support, attracting quality-conscious manufacturers seeking reliable ingredient suppliers with performance validation.

Procter & Gamble accounts for approximately 6% share through institutional cleaning distribution strength, brand recognition in commercial cleaning segments, and comprehensive product portfolio serving facility management requirements.

Other companies collectively hold 57% share, reflecting competitive dynamics within European industrial and institutional cleaning products sales, where numerous regional manufacturers, specialized formulation companies, private-label suppliers for distributors, and emerging sustainable cleaning firms serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through sustainable formulations, antimicrobial innovation, concentrated products, and application-specific solutions resonating with facility managers and institutions seeking high-performance cleaning products.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.7 billion |

| Product Type | General Purpose Cleaners, Disinfectants & Sanitizers, Laundry Care Products, Vehicle Wash Products, Others (Specialty, Warewashing) |

| Application | Commercial, Manufacturing |

| Distribution Channel | Direct (B2B), Distributors, Online/Marketplace |

| Nature | Eco-friendly/Biodegradable, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Ecolab, Reckitt Benckiser, Henkel, BASF, Procter & Gamble, Specialized producers |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established chemical manufacturers and specialized cleaning companies; customer preferences for various cleaning product formats and efficacy characteristics; integration with sustainable formulation technologies and antimicrobial development programs; innovations in concentrated formulations and dispensing systems; adoption across commercial facilities, manufacturing operations, and institutional channels; regulatory framework analysis for cleaning product efficacy standards and safety requirements; supply chain strategies including ingredient sourcing and distribution optimization; and penetration analysis for institutional and commercial European markets. |

The global demand for industrial & institutional cleaning products in EU is estimated to be valued at USD 15.3 billion in 2025.

The market size for the demand for industrial & institutional cleaning products in EU is projected to reach USD 30.7 billion by 2035.

The demand for industrial & institutional cleaning products in EU is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in demand for industrial & institutional cleaning products in EU are general purpose cleaners, disinfectants & sanitizers, laundry care products, vehicle wash products and others (specialty, warewashing).

In terms of application, commercial segment to command 69.0% share in the demand for industrial & institutional cleaning products in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial and Institutional Cleaning Chemical Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Industrial Lubricants Market: Growth, Trends, and Forecast 2025 to 2035

Industrial Cleaning Solvent Market Growth – Trends & Forecast 2024-2034

Industrial and Institutional Hand Hygiene Chemicals Market - Trends & Forecast 2025 to 2035

Leukapheresis Products Market - Growth & Forecast 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Industrial Rubber Products Market Growth - Trends & Forecast 2025 to 2035

Pharmaceutical Cleaning Validation Market Size and Share Forecast Outlook 2025 to 2035

Reusable Incontinence Products Market Analysis - Size, Share & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Incontinence Products Market

Industrial Plant Derived Cleaning Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Interdental Cleaning Products Market Trends - Growth & Forecast 2025 to 2035

Anti-Caking Makeup Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Professional Cleaning Products Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Anti-wrinkle Products Market Analysis – Size, Share & Trends 2025 to 2035

Europe & Asia Pacific Herbal Beauty Products Market Trends – Growth & Forecast 2016-2026

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Western Europe Industrial Drum Market Growth – Trends & Forecast 2023-2033

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA