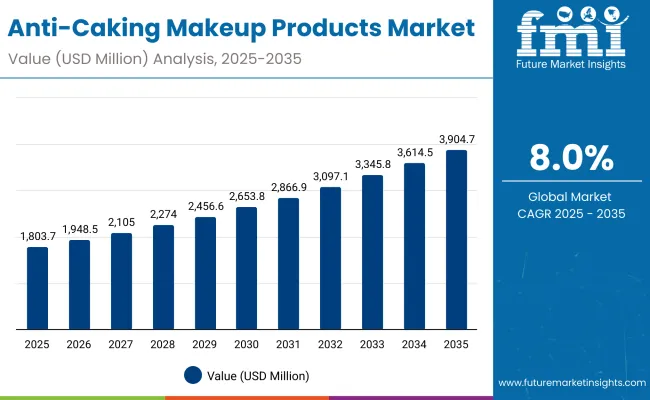

The Anti-Caking Makeup Products Market is expected to record a valuation of USD 1,803.7 million in 2025 and USD 3,904.7 million in 2035, with an increase of USD 2,101.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.0% and a 2X increase in market size.

Anti-Caking Makeup Products Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Caking Makeup Products Market Estimated Value in (2025E) | USD 1,803.7 million |

| Anti-Caking Makeup Products Market Forecast Value in (2035F) | USD 3,904.7 million |

| Forecast CAGR (2025 to 2035) | 8.00% |

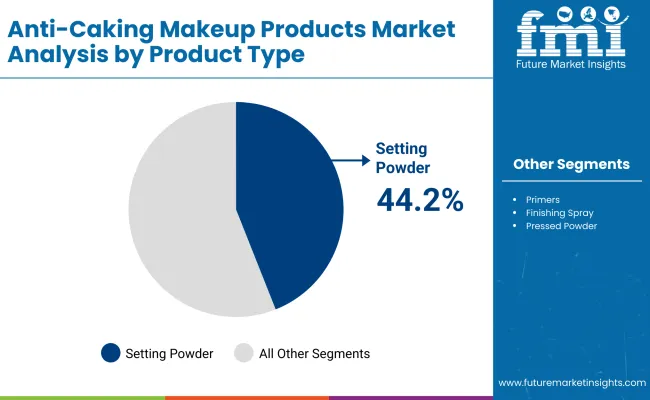

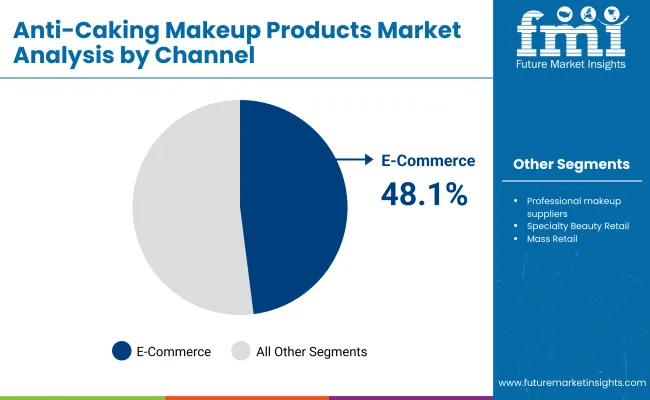

During the first five-year period from 2025 to 2030, the market increases from USD 1,803.7 million to USD 2,653.8 million, adding USD 850.1 million, which accounts for around 40% of the total decade growth. This phase records steady adoption in everyday consumer makeup, event and bridal applications, and professional makeup artistry, driven by the need for oil-control and mattifying finishes. Setting powders dominate this period as they cater to over 44% of total usage, particularly favored for base stability and long-lasting wear across multiple consumer groups. E-commerce platforms emerge as a strong driver of growth, capturing nearly 867.6 million in value during 2025, as online beauty trends and influencer-driven tutorials expand consumer reach.

The second half from 2030 to 2035 contributes USD 1,251.0 million, equal to around 60% of total growth, as the market jumps from USD 2,653.8 million to USD 3,904.7 million. This acceleration is powered by the widespread popularity of multifunctional primers, long-wear finishing sprays, and portable pressed powders. Technological innovation in formulations, such as micro-fine mattifying particles and moisture-balancing actives, enhances adoption among professional artists and high-performance consumers.

By the end of the decade, long-wear finishing categories and multi-use primers together capture a rising share above 50%, while the professional makeup supplier channel gains traction with expanding salon and studio networks. At the same time, software-like subscription models and brand-exclusive online bundles add recurring revenue, increasing the e-commerce share beyond 50% in total value.

From 2020 to 2024, the Anti-Caking Makeup Products Market grew steadily from around USD 1,200 million to USD 1,750 million, driven largely by the surge in hardware-style categories such as setting powders and pressed powders. During this period, the competitive landscape was dominated by international cosmetics leaders controlling nearly 70% of revenue, with brands such as Laura Mercier, MAC Cosmetics, and Maybelline focusing on powder-based anti-caking solutions designed for both professional and everyday use.

Competitive differentiation relied heavily on product finish, staying power, and oil-control properties, while sprays and primers remained niche but steadily growing segments. Service-based brand experiences, such as personalized shade matching and virtual try-ons, had minimal traction, contributing less than 10% of the total market value.

Demand for anti-caking products expanded to USD 1,803.7 million in 2025, and the revenue mix began to shift as finishing sprays and primers grew to over 30% share. Traditional powder-focused leaders faced rising competition from digital-first beauty brands offering long-wear, multifunctional, and skincare-infused solutions. Major beauty companies began pivoting to hybrid portfolios, integrating anti-caking benefits into broader foundation and primer lines to retain relevance. Emerging entrants specializing in clean-label, vegan, and AI-driven personalized recommendations gained share.

Advances in formulation science have improved the performance of anti-caking products, allowing for better oil absorption, smoother texture, and longer wear across diverse skin types. Setting powders and pressed powders have gained popularity due to their suitability for mattifying effects and their ability to lock in foundation. The rise of oil-control and moisture-balancing ingredients has contributed to enhanced skin comfort and real-time finish correction. Industries such as professional makeup artistry, event makeup, and everyday consumer cosmetics are driving demand for anti-caking products that can integrate seamlessly into multi-step routines.

Expansion of automated digital retail, AR-based beauty try-ons, and e-commerce subscription boxes has fueled market growth. Innovations in portable pressed powders, high-definition finishing sprays, and lightweight primers are expected to open new application areas. Segment growth is expected to be led by setting powders in product types, oil-absorbing formulations in functional benefits, and e-commerce channels in distribution, due to their accessibility, adaptability, and wide consumer acceptance.

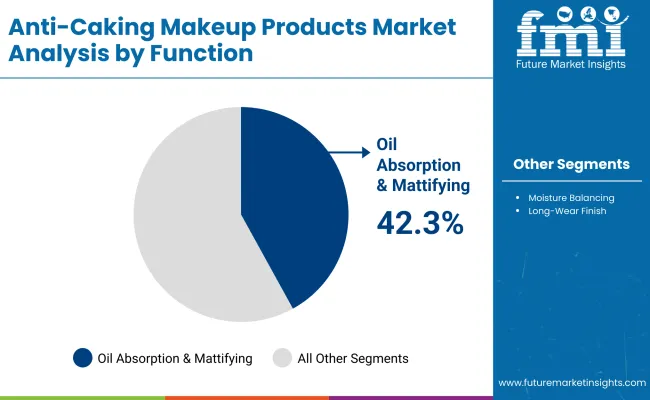

The market is segmented by product type, function, channel, end user, and region. Product types include setting powders, primers, finishing sprays, and pressed powders, highlighting the core formulations driving adoption across consumer and professional applications. Functions cover oil absorption & mattifying, moisture balancing, and long-wear finish, each addressing distinct skin concerns and performance expectations. Channel classification spans e-commerce, specialty beauty retail, mass retail, and professional makeup suppliers to cater to the different modes of consumer purchasing.

Based on end user, the segmentation includes professional makeup artists, everyday consumers, and event/bridal users, reflecting the broad base of both professional and lifestyle-driven demand. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, ensuring coverage of both mature beauty markets and fast-emerging growth regions.

Within these regions, countries such as the United States, United Kingdom, Germany, France, China, Japan, and India represent key contributors, while emerging economies in Latin America and Africa are beginning to capture share through expanding online beauty platforms and localized product launches.

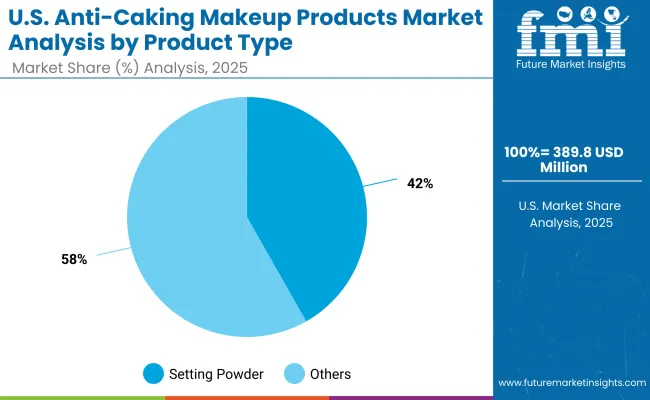

| Product Type | Value Share% 2025 |

|---|---|

| Setting powders | 44.2% |

| Others | 55.8% |

The setting powders segment is projected to contribute 44.2% of the Anti-Caking Makeup Products Market revenue in 2025, maintaining its lead as the dominant product type category. This is driven by ongoing consumer demand for advanced powder formulations with micro-fine textures that provide improved oil absorption, mattifying effects, and long-lasting coverage. Setting powders are prioritized by both everyday consumers and professional makeup artists for their reliability in locking in foundation and ensuring consistent results across skin types and climates.

The segment’s growth is also supported by the development of lightweight and portable pressed setting powders that enhance usability for on-the-go touch-ups. As digital retail and influencer-driven tutorials become more prevalent, brands are innovating with tinted, translucent, and clean-label formulations to meet diverse consumer preferences. The setting powders segment is expected to retain its position as the backbone of anti-caking makeup products, reflecting its indispensable role in achieving smooth, long-wear finishes.

| Function | Value Share% 2025 |

|---|---|

| Oil absorption & mattifying | 42.3% |

| Others | 57.7% |

The oil absorption & mattifying segment is forecasted to hold 42.3% of the market share in 2025, led by its application in controlling excess sebum and creating a shine-free finish. These formulations are favored for their high efficiency in managing oily skin conditions and ensuring long-lasting wear, making them ideal for both everyday use and professional applications in event and bridal makeup.

Their lightweight texture and ease of layering with other cosmetic products have facilitated widespread adoption among everyday consumers as well as makeup artists. The segment’s growth is bolstered by advancements in powder technology, such as silica-coated microspheres and botanical-infused mattifiers, which improve absorption efficiency while reducing skin dryness. As consumers increasingly require products that deliver flawless finishes for both casual and high-performance use, oil absorption & mattifying products are expected to continue their dominance in the market.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 48.1% |

| Others | 51.9% |

The e-commerce segment is projected to account for 48.1% of the Anti-Caking Makeup Products Market revenue in 2025, establishing it as the leading distribution channel. This channel is preferred due to the rapid rise of online beauty platforms, influencer-driven purchasing behavior, and the availability of virtual try-on tools that enhance consumer engagement.

Its suitability for offering bundled deals, subscription boxes, and personalized product recommendations has made e-commerce increasingly attractive across different consumer demographics. Developments in digital platforms and seamless delivery services have further accelerated adoption, improving accessibility and convenience. Given its balance of wide reach and high growth potential, e-commerce is expected to maintain its leading role in the Anti-Caking Makeup Products Market.

Rising Demand for Long-Wear, Oil-Control Formulations

One of the strongest growth drivers in the Anti-Caking Makeup Products Market is the rising consumer demand for long-wear makeup that can withstand oil, humidity, and extended usage hours. Urban lifestyles, climate variability, and high social media visibility have pushed consumers toward products that promise a shine-free, photo-ready finish throughout the day. The oil absorption & mattifying segment already commands 42.3% share in 2025, highlighting how sebum-control benefits resonate with diverse consumer bases.

This demand is particularly strong in emerging Asian markets like India and China, where humid climates and rising middle-class purchasing power are combining to accelerate uptake of anti-caking powders and sprays. The driver is not only functional but also aspirational, as consumers associate flawless, matte skin with modern beauty standards amplified by global influencer culture.

Expansion of E-commerce and Direct-to-Consumer Platforms

With 48.1% of global sales in 2025 already coming from e-commerce, online distribution is not just a channel it’s becoming a growth engine. E-commerce allows brands to launch micro-collections, leverage AR/VR try-on tools, and run influencer-led campaigns at low cost and high reach. Global consumers, particularly Gen Z and millennials, rely on reviews, tutorials, and social media-driven shopping journeys, which favor online-first anti-caking product launches. Subscription models and refill packs are increasingly bundled into e-commerce offerings, generating recurring sales. This driver is especially relevant in markets like the USA and UK, where Sephora Collection, Fenty Beauty, and NYX Professional dominate online engagement, and in Asia-Pacific, where platforms like Tmall and Shopee give premium and mass brands simultaneous reach.

Skin Health Concerns and Regulatory Scrutiny

Despite strong growth, the market faces a restraint due to increasing concerns around skin dryness, clogged pores, and irritation caused by heavy powder formulations. Dermatologists often caution against overuse of powders that may strip moisture or exacerbate acne-prone skin. In parallel, regulators in Europe and North America are tightening ingredient compliance for talc-based products, microplastics, and chemical mattifiers.

This scrutiny forces brands to reformulate, adding R&D costs while slowing time-to-market. Consumers shifting toward "clean beauty" and dermatologist-tested claims may limit adoption of traditional anti-caking formulas, especially among health-conscious demographics.

Pricing Pressure from Mass Retail Segments

Another restraint is the price competition between premium and mass-market anti-caking products. While luxury players like Laura Mercier and Charlotte Tilbury dominate the aspirational space, drugstore brands like Maybelline and NYX Professional aggressively compete on affordability and accessibility through supermarkets and pharmacies. This dual market dynamic compresses margins for mid-tier brands, especially in emerging economies where cost-sensitive consumers often trade down. The increasing availability of private label anti-caking powders and sprays in retail chains further pressures established players, restraining overall premiumization.

Hybrid Skincare-Infused Anti-Caking Products

A major trend reshaping the Anti-Caking Makeup Products Market is the rise of skincare-infused powders, primers, and sprays. Products now include actives like niacinamide, hyaluronic acid, and botanical extracts that balance mattifying with hydration and barrier support. This hybridization directly addresses consumer concerns over dryness or irritation, while positioning anti-caking products within the "skinification of makeup" trend. Brands like Fenty Beauty and Clinique are already advancing this shift, launching powders and setting sprays that double as skincare-enhancers. This aligns with consumer interest in multi-benefit products, cutting down steps in their routine.

Regional Surge in Asia-Pacific with Localized Formulations

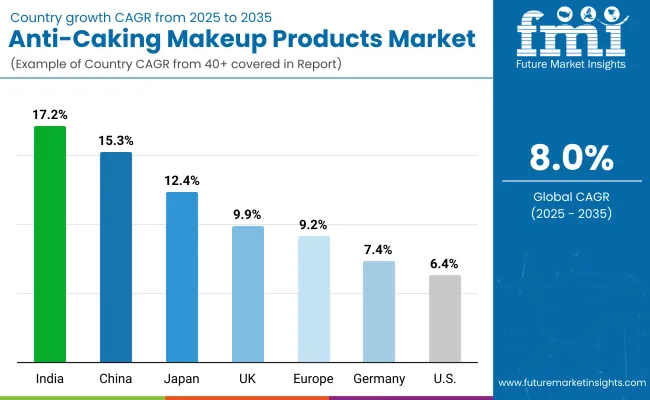

Asia-Pacific is emerging as the fastest-growing region, with India (17.2% CAGR) and China (15.3% CAGR) outpacing global growth rates. The trend here is not just volume growth but localization of textures, shades, and finishes to match diverse skin tones and climatic conditions. Lightweight powders suited for humid environments, dewy-yet-mattifying finishes, and finely milled textures are particularly sought after. Local players and global brands alike are innovating region-specific variants to capture this demand. For instance, translucent powders and mist-based finishing sprays are favored in Japan and Korea, while India’s market shows strong adoption of high-pigment pressed powders suited for event and bridal users. This regional customization trend is key to global growth momentum.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.3% |

| USA | 6.4% |

| India | 17.2% |

| UK | 9.9% |

| Germany | 7.4% |

| Japan | 12.4% |

| Europe | 9.2% |

The Anti-Caking Makeup Products Market shows highly uneven growth across key countries, reflecting differences in consumer behavior, beauty routines, and distribution maturity. India leads with a CAGR of 17.2%, driven by rising disposable incomes, a booming bridal and event makeup culture, and increased acceptance of premium powders and sprays among younger consumers. China follows with 15.3% CAGR, supported by the rapid expansion of e-commerce platforms like Tmall and JD.com, combined with strong consumer appetite for oil-control and long-wear products in humid climates.

Japan, at 12.4% CAGR, is fueled by innovation in hybrid skincare-infused powders and sprays, with local brands setting new standards in texture refinement and clean-label claims. These high-growth Asian markets are shaping the innovation agenda, pushing both global and regional players to localize formulations to suit skin tones, weather conditions, and cultural beauty expectations.

In contrast, growth in the Western markets is more moderate, highlighting saturation and brand maturity. The USA (6.4% CAGR) continues to expand steadily due to sustained e-commerce dominance and influencer-driven demand, but competition between luxury and mass-market brands keeps the market balanced. The UK (9.9%) and Germany (7.4%), along with broader Europe at 9.2% CAGR, benefit from strong professional makeup usage and evolving consumer preferences for clean, vegan, and dermatologist-tested powders and sprays.

However, regulatory pressures on certain ingredients and slower replacement cycles limit acceleration compared to Asia-Pacific. Overall, the global landscape demonstrates that while mature regions ensure stability, the true engine of growth lies in Asia, where demand expansion is redefining the competitive and product innovation outlook for anti-caking makeup products.

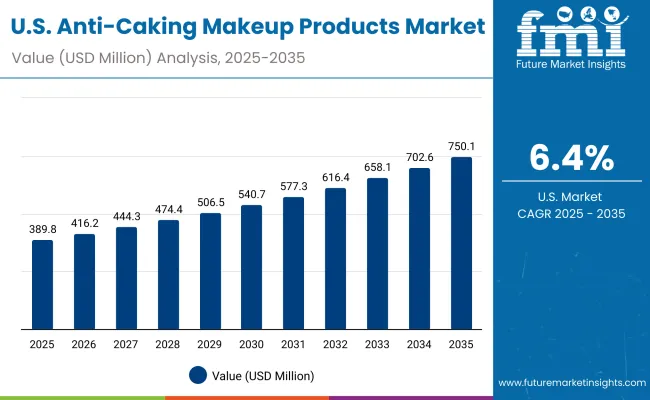

| Year | USA Anti-Caking Makeup Products Market (USD Million) |

|---|---|

| 2025 | 389.84 |

| 2026 | 416.21 |

| 2027 | 444.37 |

| 2028 | 474.43 |

| 2029 | 506.52 |

| 2030 | 540.78 |

| 2031 | 577.36 |

| 2032 | 616.42 |

| 2033 | 658.12 |

| 2034 | 702.64 |

| 2035 | 750.17 |

The Anti-Caking Makeup Products Market in the United States is projected to grow at a CAGR of 6.4%, led by increased demand for long-wear, oil-control formulations. Everyday consumers continue to drive volume, with setting powders accounting for 41.8% of the USA product type share in 2025. Bridal and event users are also a key growth audience, favoring finishing sprays that provide high performance under lighting and extended wear conditions.

The professional makeup artist community, particularly in urban centers like New York and Los Angeles, has been instrumental in popularizing premium powders and primers through social media and training academies. Growth is also supported by a strong e-commerce ecosystem, where brands like Fenty Beauty, Laura Mercier, and NYX Professional capitalize on influencer partnerships and personalized virtual try-on tools.

The Anti-Caking Makeup Products Market in the United Kingdom is expected to grow at a CAGR of 9.9%, supported by professional makeup adoption, retail innovation, and cultural event demand. London-based makeup schools and fashion shows are accelerating the use of anti-caking products for long-lasting finishes in high-performance settings. The wedding and events sector is a major growth driver, with pressed powders and primers gaining favor for extended wear during ceremonies. Additionally, UK retailers are introducing clean-label and vegan anti-caking products to align with the country’s fast-evolving sustainability and ethical consumption values.

India is witnessing rapid growth in the Anti-Caking Makeup Products Market, which is forecast to expand at a CAGR of 17.2% through 2035, the highest among all leading markets. Rising disposable incomes and aspirational lifestyles are fueling strong adoption of setting powders and pressed powders, especially among young women in Tier-2 and Tier-3 cities. Bridal makeup remains a cornerstone of demand, with primers and finishing sprays used extensively in multi-day wedding events. Increasing influence of Bollywood and regional cinema, along with widespread access to tutorials on platforms like Instagram and YouTube, is shaping consumer preferences. E-commerce platforms such as Nykaa and Myntra have accelerated affordability and accessibility by promoting both premium international and local brands.

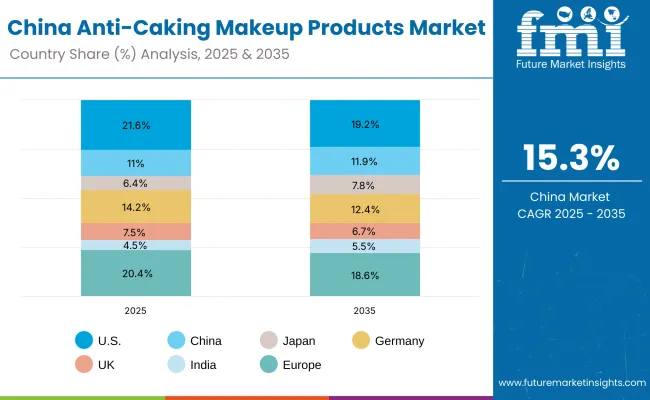

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.6% |

| China | 11.0% |

| Japan | 6.4% |

| Germany | 14.2% |

| UK | 7.5% |

| India | 4.5% |

| Europe | 20.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.2% |

| China | 11.9% |

| Japan | 7.8% |

| Germany | 12.4% |

| UK | 6.7% |

| India | 5.5% |

| Europe | 18.6% |

The Anti-Caking Makeup Products Market in China is expected to grow at a CAGR of 15.3%, making it one of the fastest-expanding economies in this segment. Strong momentum is driven by e-commerce dominance on Tmall and JD.com, skincare-makeup hybrid innovation, and youth-driven fashion trends. Finishing sprays and primers are gaining traction in humid regions, while setting powders remain a staple in northern provinces. Municipal interest in promoting beauty and fashion clusters has supported local innovation, while affordable but high-performing products from domestic brands are driving mass adoption. International brands like NARS and Charlotte Tilbury continue to compete by offering Asia-specific shades, translucent formulations, and lightweight textures tailored to Chinese consumers.

| USA By Product Type | Value Share% 2025 |

|---|---|

| Setting powders | 41.8% |

| Others | 58.2% |

The Anti-Caking Makeup Products Market in the United States is projected at USD 389.8 million in 2025. Setting powders contribute 41.8%, while other categories such as primers, finishing sprays, and pressed powders together hold 58.2%, which shows a balanced product mix where consumers are diversifying beyond powders. This distribution reflects the maturity of the USA beauty industry, where long-wear sprays and primers are gaining traction due to the popularity of hybrid skincare-makeup routines.

The USA market is shaped by e-commerce leadership, with nearly half of all anti-caking sales generated through online channels in 2025. The growing appeal of finishing sprays, promoted heavily on TikTok and Instagram, underlines the trend toward multi-function, all-day wear solutions. Professional makeup artists, influencers, and bridal users amplify the demand for products that perform well under strong lighting, photography, and extended use. As clean-label and dermatologist-tested claims become more important, brands are reformulating powders with talc alternatives and lightweight finishes to address consumer concerns.

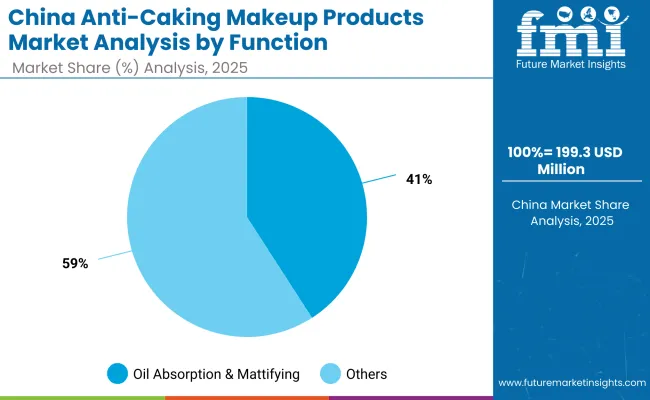

| China By Function | Value Share% 2025 |

|---|---|

| Oil absorption & mattifying | 40.9% |

| Others | 59.1% |

The Anti-Caking Makeup Products Market in China is valued at around USD 199.3 million in 2025, with oil absorption & mattifying products leading at 40.9%, followed by moisture-balancing and long-wear categories at 59.1%. The dominance of oil-control formulas directly reflects China’s humid climate conditions and the strong consumer preference for matte, poreless skin finishes. These products are also popular among younger consumers who seek camera-ready looks for social media engagement and livestream shopping.

China’s market momentum is tied closely to digital-first platforms like Tmall, JD.com, and Douyin, which drive direct-to-consumer sales and allow brands to localize formulations with great speed. Domestic brands are competing aggressively with international players by offering affordable, clean-label powders and sprays, often infused with skincare actives like niacinamide and green tea extracts. This positions China not only as a high-growth volume market but also as an innovation hub, where hybrid beauty trends are setting benchmarks for global product launches.

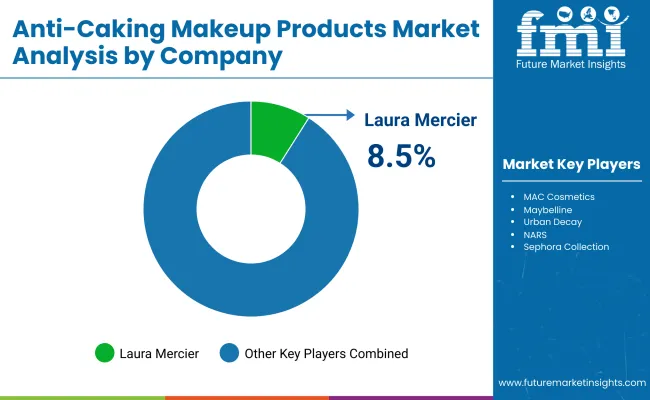

The Anti-Caking Makeup Products Market is moderately consolidated, with global leaders, prestige brands, and mass-market innovators competing across categories. Laura Mercier leads with 8.5% share, driven by its reputation as a pioneer in setting powders that deliver flawless finishes and long-lasting performance. Its flagship translucent powder has set industry benchmarks and remains a staple in professional kits worldwide.

Prestige brands such as Charlotte Tilbury, NARS, and Fenty Beauty are expanding their presence with multifunctional sprays, primers, and pressed powders that combine mattifying benefits with skincare actives. Mass brands like Maybelline and NYX Professional play a critical role in democratizing access, offering affordable yet effective powders and sprays that appeal to younger consumers and dominate drugstore channels. Retail-owned labels such as Sephora Collection enhance competitiveness through exclusive online launches and influencer collaborations

Competitive differentiation is shifting away from traditional powder quality alone toward ecosystem strategies that blend product innovation with omnichannel engagement. This includes AR-based virtual try-ons, subscription-based product bundles, and clean beauty credentials (vegan, dermatologist-tested, talc-free). As Asian markets surge, global and local brands alike are increasingly investing in region-specific textures and shades, making localization and digital-first strategies essential for competitive advantage.

Key Developments in Anti-Caking Makeup Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Product Type | Setting powders, Primers, Finishing sprays, Pressed powders |

| Function | Oil absorption & mattifying, Moisture balancing, Long-wear finish |

| Channel | E-commerce, Specialty beauty retail, Mass retail, Professional makeup suppliers |

| End User | Professional makeup artists, Everyday consumers, Event/bridal users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Laura Mercier, MAC Cosmetics, Maybelline, Urban Decay, NARS, Fenty Beauty, Charlotte Tilbury, Sephora Collection, NYX Professional, Clinique |

| Additional Attributes | Dollar sales by product type and channel, adoption trends in professional makeup and everyday consumer routines, rising demand for e-commerce and online-exclusive beauty launches, sector-specific growth in bridal, event, and professional makeup artistry, revenue segmentation by skincare-infused vs. traditional formulations, integration with AR/VR try-on technologies and digital-first retail strategies, regional trends influenced by beauty culture and sustainability claims, and innovations in setting powders, finishing sprays, and hybrid primer formulations. |

The Anti-Caking Makeup Products Market is estimated to be valued at USD 1,803.7 million in 2025.

The market size for the Anti-Caking Makeup Products Market is projected to reach USD 3,904.7 million by 2035.

The Anti-Caking Makeup Products Market is expected to grow at a CAGR of 8.0% between 2025 and 2035.

The key product types in the Anti-Caking Makeup Products Market are setting powders, primers, finishing sprays, and pressed powders.

In terms of function, the oil absorption & mattifying segment is expected to command 42.3% share in the Anti-Caking Makeup Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Makeup Setting Spray Market Forecast and Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Makeup Remover Pen Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

AI Makeup Market Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Eyebrow Makeup Market Size and Share Forecast Outlook 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA