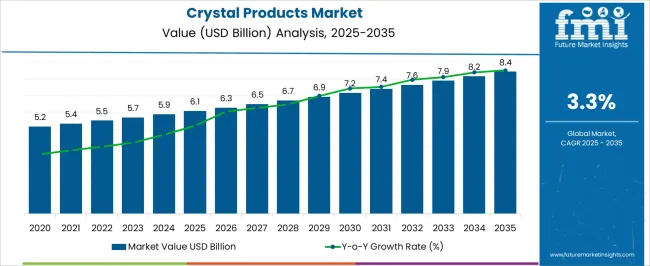

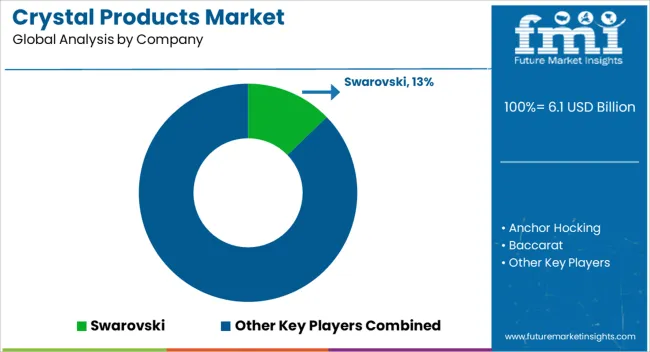

The crystal products market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

The market’s growth trajectory indicates steady adoption across decorative, industrial, and specialty applications, with notable demand in luxury consumer goods, interior design, and jewelry segments. Decorative crystals and home décor products are benefiting from increasing consumer interest in premium lifestyle items, while industrial and optical crystal applications continue to gain traction due to precision requirements and technological integration. Mid-market and artisanal crystal producers are capitalizing on personalized designs, limited editions, and co-branding with luxury brands to differentiate products. The market exhibits breakpoint behavior around the mid-2020s, where rising consumer awareness and disposable income in emerging economies start influencing global demand patterns.

Seasonal peaks, festival-driven sales, and gifting trends create predictable high-demand periods, while B2B demand from fashion, electronics, and industrial sectors ensures sustained baseline growth. Companies are increasingly investing in innovative cutting, polishing, and coating techniques to enhance brilliance, durability, and application versatility. Strategic partnerships, online retail expansion, and experiential marketing are further supporting market penetration, reflecting a dynamic yet moderately paced growth outlook over the next few years.

The crystal products market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The luxury and decorative goods market holds the largest share at 35%, driven by demand for home décor, jewelry, lighting, and fashion accessories featuring high-quality crystal components that enhance aesthetics and perceived value. The industrial and optical applications market contributes 25%, as precision crystals are used in electronics, optics, instrumentation, and scientific equipment requiring exacting clarity, purity, and durability. The giftware and seasonal products market accounts for 15%, where crystal figurines, awards, and collectible items see spikes in demand during festivals, holidays, and corporate gifting cycles.

The interior design and architectural applications market holds a 15% share, incorporating crystals in chandeliers, decorative panels, and bespoke furnishings for luxury residences and commercial spaces. Finally, the arts, crafts, and hobbyist market represents 10%, supporting DIY enthusiasts, craft studios, and small-scale manufacturers who integrate crystal elements into custom designs. Collectively, luxury, industrial, and giftware segments account for 75% of total demand, highlighting that aesthetics, precision, and seasonal gifting are the primary growth drivers, while interior design and hobbyist applications provide complementary opportunities for global market expansion.

| Metric | Value |

|---|---|

| Crystal Products Market Estimated Value in (2025 E) | USD 6.1 billion |

| Crystal Products Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The crystal products market is experiencing consistent growth, driven by rising consumer demand for premium home décor, dining accessories, and collectible items that blend functionality with aesthetic appeal. Lifestyle trends emphasizing luxury living and personalized interior design have amplified interest in high-quality crystal products. Industry updates and brand press releases have highlighted increasing product diversification, with manufacturers introducing contemporary designs alongside traditional styles to appeal to a broader demographic.

Growth in gifting culture, particularly for weddings, anniversaries, and corporate occasions, has further boosted sales volumes. Additionally, the global expansion of luxury retail channels, both offline and online, has enhanced product accessibility for affluent and aspirational buyers.

Artisanal craftsmanship, brand heritage, and premium material quality remain strong differentiators in the market. Looking forward, demand is expected to be sustained by growing appreciation for handmade, high-clarity crystal products and by strategic marketing campaigns that position crystal items as timeless investments in both functionality and design.

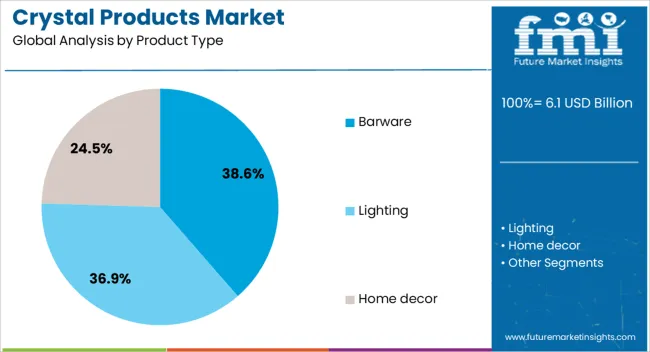

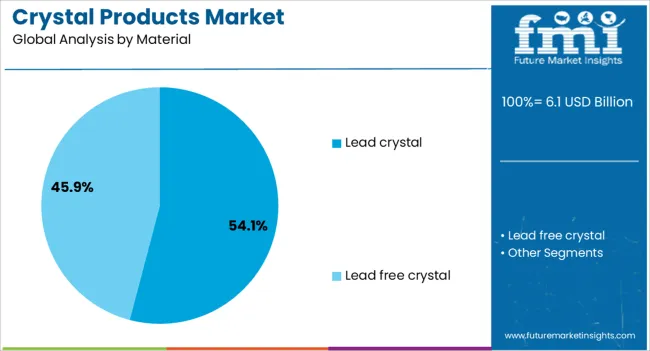

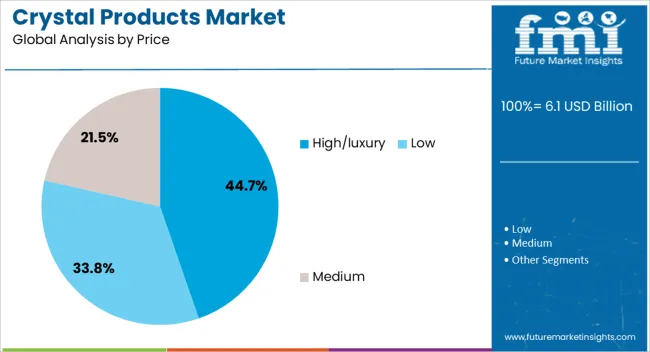

The crystal products market is segmented by product type, material, price, end users, distribution channel, and geographic regions. By product type, crystal products market is divided into barware, lighting, home decor, and others (jewelry and watches etc.). In terms of material, crystal products market is classified into Lead crystal and Lead free crystal. Based on price, crystal products market is segmented into high/luxury, low, and medium. By end users, crystal products market is segmented into residential and commercial. By distribution channel, crystal products market is segmented into offline and online. Regionally, the crystal products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The barware segment is projected to contribute 38.6% of the crystal products market revenue in 2025, retaining its position as the leading product type. This dominance has been supported by the rising popularity of at-home entertaining, mixology culture, and the preference for premium glassware in both residential and hospitality settings.

Barware items such as decanters, wine glasses, and cocktail sets have been favored for their ability to enhance the drinking experience while serving as statement pieces. Brand collaborations with designers and luxury hotels have further elevated the profile of crystal barware.

Additionally, premium barware has become a sought-after gifting category, particularly in high-value consumer markets. As lifestyle trends continue to favor sophisticated and curated dining experiences, the barware segment is expected to maintain steady growth, supported by product innovation and design refinement.

The lead crystal segment is projected to account for 54.1% of the crystal products market revenue in 2025, making it the leading material category. This segment’s prominence has been driven by the exceptional brilliance, weight, and sound quality associated with lead crystal, attributes highly valued in luxury homeware and decorative items.

Manufacturing expertise in shaping and engraving lead crystal has allowed for intricate designs that enhance its premium positioning. Consumer preference for high-clarity, refractive products in collectible and display categories has also sustained demand.

Despite rising awareness of lead-free alternatives, lead crystal continues to dominate the luxury segment due to its unmatched optical properties and heritage association with fine craftsmanship. With established prestige among collectors and premium buyers, the lead crystal segment is expected to remain central to the market’s luxury positioning.

The high/luxury price segment is projected to contribute 44.7% of the crystal products market revenue in 2025, holding its status as the primary revenue generator. Growth in this segment has been shaped by consumer willingness to invest in artisanal, limited-edition, and heritage-branded crystal items.

Luxury positioning has been reinforced through exclusive distribution in premium retail outlets, bespoke product lines, and collaborations with renowned designers. Consumer behavior studies indicate that high-net-worth individuals and aspirational buyers view crystal products in this price range as both functional and collectible assets.

Additionally, the association of luxury crystal with life events and gifting traditions has sustained steady demand. As the market continues to target affluent customers through curated collections and storytelling-driven marketing, the high/luxury price segment is expected to remain a cornerstone of revenue generation in the crystal products market.

Crystal products market growth is driven by luxury décor, industrial precision applications, gifting, and hobbyist demand. Collectively, these segments create diverse revenue streams and ensure global market expansion.

The crystal products market is witnessing strong growth in the luxury and decorative segments, driven by consumer preferences for premium home décor, jewelry, and fashion accessories. Rising disposable incomes in developed and emerging economies are encouraging purchases of high-end crystal items such as chandeliers, vases, figurines, and ornamental pieces. Designers and retailers are leveraging crystal’s aesthetic appeal to attract affluent consumers, while branded collections and limited editions boost exclusivity. Seasonal demand during festivals, weddings, and gifting occasions further fuels growth. Customization and personalization options, including engraved and colored crystals, are gaining traction. Retailers are expanding e-commerce platforms, enabling convenient access to a wider audience. Overall, luxury and decorative applications remain a critical growth driver for the crystal products market globally.

Industrial and optical applications form a significant share of the crystal products market, particularly in electronics, precision instruments, and optical devices. Crystals are valued for their purity, clarity, and durability, which are essential for devices such as oscillators, sensors, lenses, and laboratory equipment. The electronics and semiconductor sectors drive demand for quartz and synthetic crystals, while scientific research and medical instrumentation require high-precision components. Manufacturers are focusing on meeting strict dimensional tolerances, surface finishes, and optical performance standards to cater to industrial users. Supply chain partnerships, quality certifications, and consistent production capabilities are critical factors influencing adoption. Industrial and optical applications ensure steady, year-round demand, complementing the more seasonal luxury and decorative segments.

Crystal products are increasingly popular in the gifting, collectibles, and seasonal product market, which accounts for a substantial portion of total demand. Figurines, awards, commemorative items, and decorative collectibles see heightened sales during holidays, corporate gifting events, and special occasions. Limited-edition releases, branded collaborations, and custom designs create additional value and appeal. Retailers and e-commerce platforms leverage seasonal promotions, festive packaging, and marketing campaigns to enhance visibility and drive purchases. Collectors and enthusiasts contribute to repeat purchases and brand loyalty, particularly for premium crystal lines. The gifting and collectibles segment complements industrial and decorative demand, providing cyclical revenue streams and supporting consistent market expansion globally.

The interior design and hobbyist segment is a growing contributor to the crystal products market, with applications in luxury furnishings, chandeliers, decorative panels, and DIY craft projects. Interior designers and architects are increasingly incorporating crystals in upscale residential and commercial projects for aesthetic enhancement and visual impact. Small-scale artisans and hobbyists also drive demand for craft crystals, beads, and embellishments used in personalized creations. Online marketplaces and specialty retailers are expanding product availability for these niche consumers. Customized and modular crystal designs, combined with educational workshops and craft kits, encourage adoption among enthusiasts. This segment provides complementary growth opportunities alongside luxury, industrial, and gifting applications.

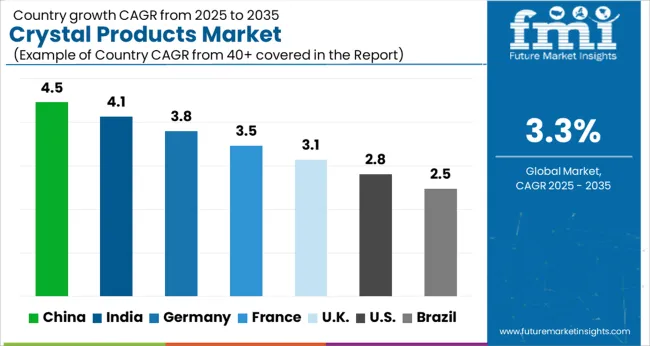

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The global crystal products market is projected to grow at a CAGR of 3.3% from 2025 to 2035. China leads with 4.5%, followed by India (4.1%), Germany (3.8%), the UK (3.1%), and the USA (2.8%). Market growth is driven by rising consumer demand for luxury décor, gifting, collectibles, and precision industrial applications. BRICS nations, particularly China and India, are witnessing high adoption due to increasing disposable incomes, expanding retail and e-commerce channels, and cultural affinity for ornamental and decorative products. OECD countries such as Germany, the UK, and the USA focus on premium quality, design innovation, and industrial-grade crystals for electronics, optical devices, and laboratory applications. Seasonal campaigns, personalized offerings, and collaborations with designers and artisans further enhance global growth. The analysis spans over 40+ countries, with the leading markets highlighted below.

The crystal products market in China is projected to grow at a CAGR of 4.5% from 2025 to 2035, driven by rising demand for decorative, luxury, and industrial applications. Consumer preference for premium home décor items, collectibles, and gifting products is increasing, supported by expanding retail chains, e-commerce platforms, and specialty stores. Industrial and electronic applications, including optical instruments, laboratory equipment, and electronics components, further boost demand. Domestic manufacturers are investing in high-precision crystal cutting, polishing, and design technologies to meet both aesthetic and technical standards. Collaborations with international designers and suppliers enhance product differentiation. Seasonal gifting, festive promotions, and customizable crystal items are creating additional market opportunities.

The crystal products market in India is expected to grow at a CAGR of 4.1% from 2025 to 2035, fueled by increasing disposable income, rising lifestyle awareness, and the popularity of luxury home décor and gifting. Urban households and premium commercial spaces are increasingly adopting decorative crystal items, including vases, chandeliers, and tableware. Domestic manufacturers focus on cost-effective yet high-quality production, while international collaborations enhance design and finish. E-commerce platforms and retail distribution channels are expanding product reach. Industrial applications in optics, laboratories, and electronics complement consumer demand. Seasonal gifting, weddings, and corporate gifting trends contribute to market growth, alongside campaigns emphasizing craftsmanship, design uniqueness, and product durability.

The crystal products market in Germany is projected to grow at a CAGR of 3.8% from 2025 to 2035, supported by demand for premium home décor, collectibles, and industrial-grade crystal applications. High standards for craftsmanship, design, and product quality characterize consumer expectations. Industrial sectors such as optics, electronics, and laboratory equipment drive the adoption of precision crystals. Manufacturers focus on specialized cutting, polishing, and finishing processes to maintain quality and compliance with EU standards. Retailers and e-commerce platforms facilitate availability, while collaborations with designers and international brands enhance product innovation. Sustainability in sourcing and adherence to safety regulations also influence market preferences. Seasonal, gifting, and commercial interior design trends further boost market opportunities.

The crystal products market in the UK is anticipated to grow at a CAGR of 3.1% from 2025 to 2035, driven by demand for luxury decorative items, awards, and gifting solutions. Consumers and businesses increasingly value designer crystal pieces, tableware, and custom collectibles. Domestic and international manufacturers focus on premium finishing, intricate designs, and bespoke offerings. Retail expansion through high-end stores, e-commerce, and department chains improves product accessibility. Industrial and technical applications in laboratories and optical instruments supplement consumer demand. Seasonal promotions, corporate gifting, and collaborations with interior designers enhance market appeal. The emphasis on quality, durability, and design innovation sustains long-term growth.

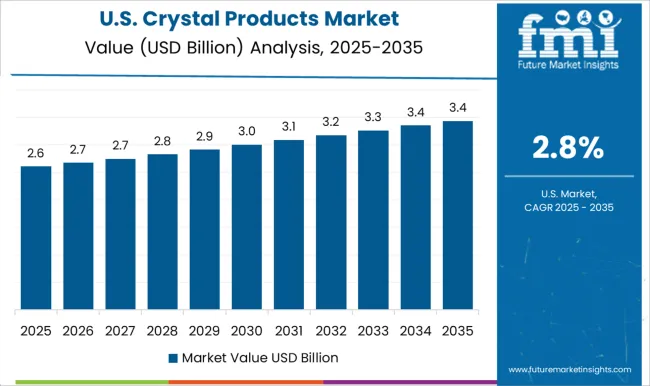

The crystal products market in the USA is expected to expand at a CAGR of 2.8% from 2025 to 2035, influenced by the demand for home décor, collectibles, and corporate gifting items. Consumers increasingly adopt chandeliers, vases, trophies, and tableware made from premium crystal. Domestic production focuses on precision cutting, polishing, and high-quality finishing, while international brands bring design innovation and variety. E-commerce and specialty retail stores enhance market reach, and collaborations with designers drive product differentiation. Industrial applications, including optical components and laboratory instruments, add incremental demand. Seasonal gifting, weddings, and corporate recognition events provide periodic growth spikes, reinforcing overall market stability and expansion.

Competition in the crystal products market is defined by design excellence, quality, brand recognition, and product differentiation. Swarovski leads with precision-cut crystals, luxury jewelry, home décor, and lighting solutions, emphasizing innovation, craftsmanship, and global brand prestige. Anchor Hocking competes through affordable glassware and functional crystal items, targeting mass-market consumers while maintaining clarity, durability, and aesthetic appeal. Baccarat differentiates with handcrafted luxury crystal for decorative items, tableware, and lighting, combining artisanal expertise with heritage branding. Bormioli Rocco focuses on premium glassware and functional crystal products for households and hospitality, emphasizing design, clarity, and usability.

Crystal Bohemia leverages traditional Czech crystal craftsmanship, producing intricate decorative and collectible items for global markets. Dartington Crystal emphasizes artisanal production and bespoke designs, targeting interior décor and gift segments. La Opala and Lalique focus on premium and luxury crystal tableware, decorative pieces, and collectibles, combining design innovation with material quality. Lladro and Lucaris offer collectible and functional crystal products with modern aesthetics. Ravenscroft Crystal and Riedel differentiate through specialized crystal glassware, including wine and barware, highlighting clarity, resonance, and elegance. Saint-Louis and Waterford lead in heritage luxury crystal products, combining traditional craftsmanship with contemporary design. Williams-Sonoma integrates branded crystal offerings in retail, combining accessibility with curated design and gifting appeal.

Strategies across the market emphasize innovation, heritage craftsmanship, seasonal launches, and collaborations with designers and interior brands to expand reach, maintain exclusivity, and reinforce brand value. Product portfolios are detailed with clarity, cut quality, lead content, dimensions, weight, and intended use. Applications include decorative items, luxury tableware, collectibles, lighting fixtures, and corporate gifting. Brochures highlight design uniqueness, customization options, and care instructions. Seasonal promotions, collaborations with interior designers, and limited editions support premium positioning and consumer engagement. Market competition revolves around combining aesthetic appeal, material excellence, and brand recognition to capture both consumer and commercial segments globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 billion |

| Product Type | Barware, Lighting, Home decor, and Others (jewelry and watches etc.) |

| Material | Lead crystal and Lead free crystal |

| Price | High/luxury, Low, and Medium |

| End Users | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Swarovski, Anchor Hocking, Baccarat, Bormioli Rocco, Crystal Bohemia, Dartington Crystal, La Opala, Lalique, Lladro, Lucaris, Ravenscroft Crystal, Riedel, Saint-Louis, Waterford, and Williams-Sonoma |

| Additional Attributes | Dollar sales, market share, premium vs. mass-market segment growth, key distribution channels, luxury vs. functional product demand, top-performing brands, consumer preferences, and emerging decorative/trend-driven applications, seasonal trends, and collectible vs. everyday usage, import-export dynamics, pricing benchmarks, and market penetration in hospitality, home décor, and gifting sectors. |

The global crystal products market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the crystal products market is projected to reach USD 8.4 billion by 2035.

The crystal products market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in crystal products market are barware, glasses, decanters, and others.

In terms of material, lead crystal segment to command 54.1% share in the crystal products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Crystal Malt Market Size and Share Forecast Outlook 2025 to 2035

Crystallization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Crystal Oscillator Market Analysis - Size, Share, and Forecast 2025 to 2035

Crystal Barware Market Size and Share Forecast Outlook 2025 to 2035

Crystalline Fructose Market Growth - Trends & Forecast through 2034

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Monocrystalline Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Nanocrystal Packaging Coating Market Analysis - Size, Share, and Forecast 2025 to 2035

Polycrystalline Silicon Market Growth 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Anti Crystallizing Agents Market

Microcrystalline Wax Market

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Protein Crystallization and Crystallography Market Analysis - Growth & Forecast 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA