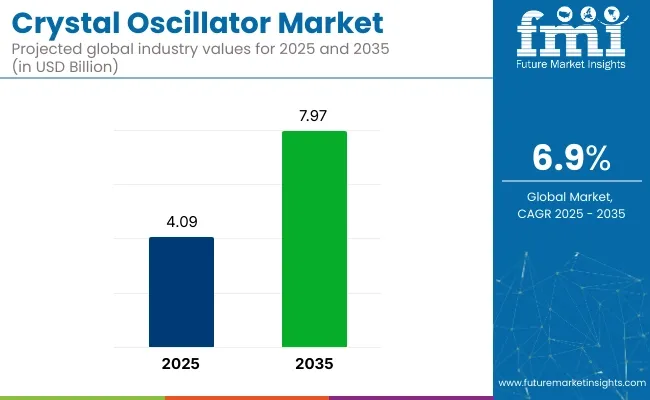

The crystal oscillator market is estimated to generate a market size of USD 4.09 billion in 2025 and is expected to reach USD 7.97 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.9% during the forecast period. Crystal oscillators, which are essential components in timing devices, provide accurate frequency signals for various applications such as telecommunications, automotive, consumer electronics, and aerospace. The market's growth is driven by the increasing demand for high-precision frequency control systems across these industries, as well as the growing reliance on electronic devices that require reliable timing mechanisms.

A key driver for the growth of the crystal oscillator market is the rising demand for consumer electronics and mobile devices. With the increasing use of smartphones, wearables, and IoT devices, there is a greater need for precise timing solutions that ensure optimal performance and energy efficiency.

Additionally, the automotive industry’s adoption of advanced technologies such as autonomous driving and electric vehicles is boosting the demand for crystal oscillators in systems like navigation, communication, and safety features, where accuracy is critical.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 4.09 billion |

| Market Size in 2035 | USD 7.97 billion |

| CAGR (2025 to 2035) | 6.9% |

Recent developments in the crystal oscillator market have seen the integration of advanced technologies such as MEMS (Micro-Electro-Mechanical Systems) oscillators, which offer smaller sizes, lower power consumption, and improved stability compared to traditional quartz-based oscillators.

These advancements are making crystal oscillators more versatile, efficient, and suitable for a broader range of applications, further driving market growth. Additionally, the increasing trend toward 5G networks is creating a significant demand for high-frequency crystal oscillators to support the required data transfer speeds and network reliability.

On October 28, 2024, Seiko Epson Corporation introduced the OG7050CAN, an oven-controlled crystal oscillator (OCXO) that consumes 56% less power than its predecessor, the OG1409 series. With dimensions of 7.0 × 5.0 mm and a height of 3.3 mm, the new OCXO is 85% smaller by cubic volume, offering improved energy efficiency and compactness for various applications. This was officially announced in the company's press release.

As the crystal oscillator market continues to expand, ongoing advancements in miniaturization, power efficiency, and frequency control technologies will contribute to its continued growth. The rising adoption of 5G, IoT, and automotive electronics, combined with the increasing demand for high-precision and energy-efficient timing solutions, will drive the market’s evolution in the coming years.

Crystal oscillators, essential components in electronic devices for frequency control and timing, are subject to regulatory oversight to ensure safety, electromagnetic compatibility, environmental compliance, and product reliability. These regulations affect their manufacturing, export, and integration into consumer, industrial, and military electronics.

Electromagnetic Compatibility (EMC) Regulations:

Crystal oscillators must comply with EMC standards to prevent interference with other electronic devices. Regulatory bodies such as the Federal Communications Commission (FCC) in the U.S. and the EU’s EMC Directive (2014/30/EU) set limits on electromagnetic emissions and require testing to ensure devices operate reliably in electromagnetic environments. Compliance is essential for market access in regulated regions.

Environmental Compliance and Hazardous Substance Restrictions:

Manufacturers must adhere to environmental regulations such as the EU’s RoHS Directive (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals). These rules restrict or ban substances like lead, mercury, cadmium, and certain flame retardants in crystal oscillator components to minimize environmental and health risks.

The global trade of crystal oscillators is driven by their widespread use in telecommunications, automotive electronics, consumer devices, aerospace, and industrial automation. As demand for precision timing and frequency control rises with advancing technologies like 5G, IoT, and electric vehicles, international trade in crystal oscillators continues to expand. Trade flows reflect the concentration of manufacturing hubs and high-tech assembly operations.

Major Exporting Countries:

Leading exporters include Japan, China, Germany, the United States, and South Korea.

Japan and the U.S. are known for high-precision, high-reliability oscillators used in aerospace, defense, and medical applications. China exports large volumes of general-purpose oscillators, benefiting from high-volume electronics production. Germany and South Korea focus on automotive and industrial-grade timing components.

Major Importing Countries:

Top importers include India, Mexico, Vietnam, Brazil, and the United States. Countries with strong electronics manufacturing, like India and Vietnam, import oscillators for integration into telecom, mobile devices, and consumer electronics. The U.S., while also a major producer, imports specific categories for use in specialized applications or to meet cost-efficiency demands. Mexico and Brazil import oscillators as part of their growing automotive and industrial electronics sectors.

The below table presents the expected CAGR for the global Crystal Oscillator market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, (2024 to 2034) | 5.3% |

| H2, (2024 to 2034) | 5.9% |

| H1, (2025 to 2035) | 6.9% |

| H2, (2025 to 2035) | 7.2% |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 6.9% in the first half and remain relatively moderate at 7.2% in the second half. In the first half H1 the market witnessed a decrease of 60 BPS while in the second half H2, the market witnessed an increase of 30 BPS.

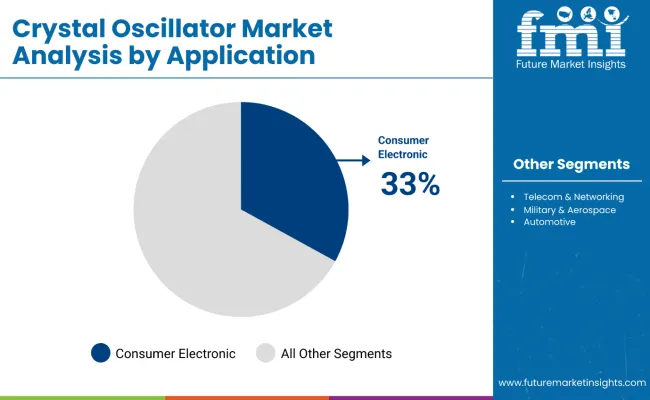

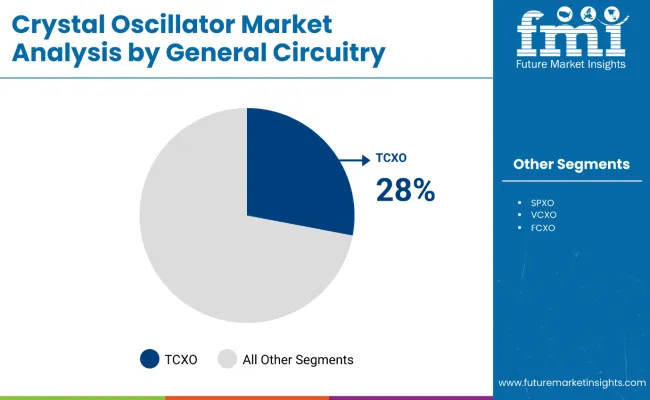

The global crystal oscillator market is set to experience stable growth from 2025 to 2035. In 2025, the consumer electronics segment is projected to hold 33.0% of the application segment, while temperature-compensated crystal oscillators (TCXO) are expected to capture 28.0% of the general circuitry segment. Key players include Seiko Epson, TXC Corporation, and Murata Manufacturing.

The consumer electronics segment is projected to account for 33.0% of the application segment market share in 2025. Crystal oscillators are essential in maintaining clock stability in electronic devices such as smartphones, laptops, tablets, smartwatches, and gaming consoles. The segment’s growth is driven by the rising global adoption of portable, connected consumer devices that rely on consistent timing for wireless communication, navigation, and synchronization functions.

Companies like Murata and Seiko Epson are developing miniature, low-power oscillators optimized for compact devices that require high stability and energy efficiency. The growth of 5G-enabled smartphones, wearable tech, and smart home devices is further boosting demand for reliable oscillators that can operate under varying temperature and voltage conditions.

In addition, as device manufacturers seek to offer improved connectivity and faster data processing, the need for high-precision timing components becomes critical. With consumer electronics continuing to evolve in functionality and complexity, this segment is expected to remain a core driver in the crystal oscillator market.

The temperature-compensated crystal oscillator (TCXO) segment is projected to hold 28.0% of the general circuitry market share in 2025. TCXOs are specifically designed to maintain frequency stability across a wide temperature range, making them ideal for applications where environmental variability can impact timing accuracy. Their integration is critical in GPS modules, mobile communication devices, IoT sensors, and RF systems.

TXC Corporation and Abracon are among the key manufacturers delivering high-performance TCXOs with ultra-low phase noise, compact size, and extended temperature tolerance. These oscillators are seeing growing demand in mission-critical communication systems and navigation technologies, particularly in automotive telematics, industrial automation, and defense electronics.

Additionally, the proliferation of location-based services and machine-to-machine communication is further accelerating the need for precise and thermally stable timing components. As electronics continue to move into harsher environments-from outdoor smart infrastructure to autonomous vehicles-TCXOs are expected to maintain strong relevance as a preferred frequency control solution in advanced general circuitry systems.

Increasing Deployment of 5G Infrastructure and IoT Devices Boosting Demand for High-Precision Crystal Oscillators.

High-precision crystal oscillators are being greatly spurred by the fast roll-out of 5G networks and the expansion of IoT connectivity. They are used to get base stations, network equipment, and IoT sensors accurate frequency control and synchronization. 5G requires oscillators with low phase noise and high frequency stability for ultra-reliable, low-latency communication.

Furthermore, the booming Internet of Things (IoT) applications, such as smart home devices, industrial automation, and connected vehicles, rely on crystal oscillators to offer seamless connectivity. As 5G works its way around the globe and smart technologies gain greater traction, the demand for little, high-performance oscillators will keep growing, further solidifying their future presence across a variety of industries.

Rising Demand for High-Precision Timing Solutions in Aerospace, Defense, and Automotive Sectors.

High-precision crystal oscillators have become integral to mission-critical applications across the aerospace, defense and automotive domains - from GPS navigation, radar systems and avionics to autonomous vehicles - as systems depend on high-precision timing for proper operation," Eric Hsieh, a manager in the product marketing group at the LSI division of the company, said in a press release. TCXO (temperature-compensated) and OCXO (oven-controlled) oscillators demand high levels for stable operation in harsh environments.

In automotive, technologies like ADAS (Advanced Driver Assistance Systems) and V2X (Vehicle-to-Everything) communication has unique requirements of ultra-stable oscillators for reliability and performance. The dmestic market demands an impulse of secure comminucation systems and military-grade electronics, where crystal oscillators play an important role.

The demand for high durable and reliable robust, high-frequency oscillators in these industries and implementing the next generation technologies is expected to create new opportunities for the growth of the market.

Miniaturization and Energy Efficiency Trends in Consumer Electronics Driving Crystal Oscillator Adoption

Due to the increasing focus on miniaturization of electronic devices and enhancement in energy efficiency, miniaturized crystal oscillators are witnessing a surge in adoption. The portable devices including smartphones, wearables, tablets, and other embedded mechanisms need low-power and high-stability oscillators to prolong battery longevity but still maintain time and signal accuracy.

The shift toward MEMS-based oscillators has also spurred market growth by offering better features compared to conventional quartz-based oscillators by providing reduced power consumption, increased shock resistance, and improved reliability. Oscillators small enough to meet increasing consumer demands for both weight and power are being developed by manufacturers.

This trend will continue to reign as a main driver as consumer electronics continue to evolve into smaller, smarter and more efficient form factors - think more powerful mobile devices, larger ultra HD displays, better audio quality, and high-performance gaming.

Supply Chain Disruptions and Raw Material Shortages Impacting Crystal Oscillator Production

One of the major restraints of the crystal oscillator market is the supply chain disruptions and raw material shortages that are impacting oscillator production and prices. Quartz, the primary utilized material in oscillators is impacted by geopolitical risks, mining constraints, and supply level de-stabilization which cause erratic production throughput and increasing manufacturing expenses.

Moreover, this has been compounded by global semiconductor shortages impacting the availability of components, leading to further production delays for oscillators used in vital applications, including telecommunications, automotive and industrial electronics. Logistics constraints, from rising transportation costs to geopolitical frictions affecting international sea lanes, compound the problem.

Moreover, manufacturers are developing alternative materials and MEMS-based solutions in an attempt to de-risk components, but the persistent volatility in the supply chain is a major constraint to the growth trajectory of the market.

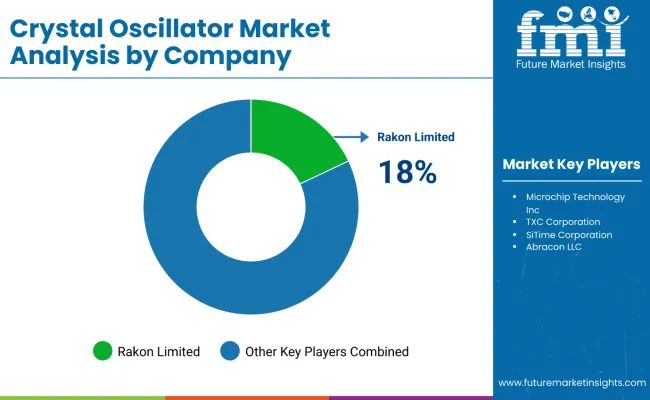

Tier 1: Kyocera Corporation, Microchip Technology Inc., Seiko Epson Corporation, TXC Corporation These companies have a dominant position in the crystal oscillator market, due to their extensive R&D, large-scale, and diversified product breadth. They work with high end industries like telecommunications, aerospace, automotive and industrial automation.

So, they can easily manage a bulk order with a single source of truth while excelling in quality with a stronghold in the Asia-pacific, North America, and Europe. Through its significant investment in MEMS-based oscillators, high-precision TCXO, and OCXO solutions, these companies continue to lead the charge for technology innovation as well as product development.

Tier 2: SiTime Corporation, Rakon Limited, NDK America, Inc. (Nihon Dempa Kogyo Co., Ltd.) These mid-sized players excel in high-performance crystal oscillators, including military, defense, satellite communications, and precision timing applications.

They target niche markets demanding ultra stability and precision, for example high frequency RF applications, GPS systems and quantum computing. Although they do not enjoy the mass-market reach of Tier 1 players, they maintain strong regional market shares and actively partner with OEMs and defense contractors. TCXO, OCXO expertise ensures high accuracy timing solution.

Tier 3: Murata Manufacturing Co., Ltd., Abracon LLC, Vectron International (A Knowles Company). Registration is also you know what- plenty of crystal oscillator specialist and customized suppliers for consumer electronics, IoT, and IOT industrial automation. Though they don't have the worldwide presence of a Tier 1 (or Tier 2) company, they specialize in low-power, miniaturized, and cost effective oscillators for wearables, smart home devices, and medical electronics.

Target companies like Murata utilize their proficiency in small and power-efficient parts, while their counterparts such as Abracon and Vectron specialize in frequency control technologies for wireless end products. They are dedicated to continuously improving their standalone test suites and explore identifying and aligning more partners in the industry as they further establish a foothold in the evolving high-frequency, low-power oscillator market.

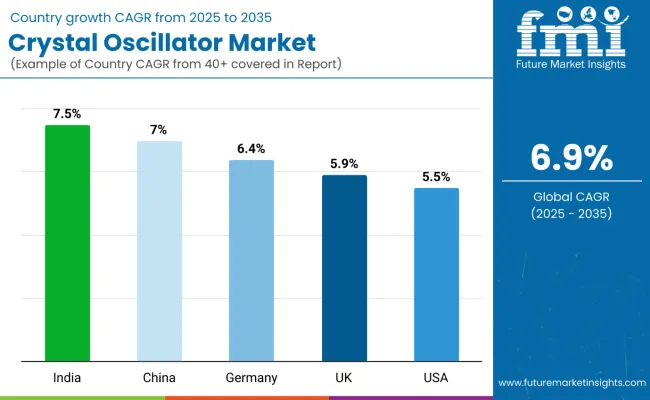

The section below covers the industry analysis for the Crystal Oscillator market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 60.2% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 7.5% during the forecasted period.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| Germany | 6.4% |

| UK | 5.9% |

| China | 7.0% |

| India | 7.5% |

The United States is an important market for crystal oscillators due to significant demand from the aerospace, defense, and semiconductor sectors. The major military ordinance defense contractors as well as space exploration agencies such as Lockheed Martin, Northrop Grumman, and NASA drive the demand for high-integration TCXO and OCXO oscillators for satellite communication, radar, and secure military networks.

Moreover, the USA semiconductor sector, with the help of domestic companies like Microchip Technology and Intel, is integrating advanced crystal oscillators into high-performance computing, AI applications and 5G base stations.

Ultra-Stable Oscillators are witnessing increased demand owing to robust investments from the government in national security & next-generation technology infrastructure. With the rise of the cloud computing and edge devices landscape, USA crystal oscillator market is further bolstered as it emerges as the global leader of precision timing solutions.

The dynamics of crystal oscillator market includes automotive, aerospace and industrial automation industry in France and its role in driving growth. Major consumers, which include automotive leaders like Renault and Peugeot, drive the demand for temperature-stable oscillators used in ADAS, infotainment systems, and V2X communication. Meanwhile, in the aerospace industry, companies including Airbus and Thales Group need for high-reliability oscillators for avionics, GPS navigation, and military defense systems.

Moreover, with France’s robust objective for Industry 4.0, demand for IoT-enabled industrial automation systems that require accurate timing components has also witnessed a sharp upsurge. France, which is already a stronghold in Europe in high-performance oscillators, will be strengthened with greater adoption of crystal oscillators in wireless communication and robotic automation backed by government investment in 5G infrastructure and smart manufacturing.

Due to expanding consumer electronics sectors, developing 5G network, and emerging IoT ecosystem, the crystal oscillators market within India is expected to flourish. The influx of leading smartphone brands and the government-driven Make in India campaign are fueling local PCB and semiconductor production, which, in turn, is driving an upsurge in low-power and miniaturized crystal oscillators consumption.

The rollout of 5G networks by Reliance Jio, Bharti Airtel, and Vodafone Idea is also propelling the demand for high-frequency oscillators used in base stations and networking gear. Moreover, growing industrial IoT (IIoT) and smart city projects in India is driving the demand for real-time synchronization components. Due to rapid digitalization, increasing middle class, and more spending on R&D for semiconductor technology, a large portion of upcoming crystal oscillator production as well as demand will take place in India.

The market is highly competitive crystal oscillator industry with larger companies focusing on technological advancement, down scoping and improving frequency stability. Some of the dominant market players include Seiko Epson Corporation, TXC Corporation, Microchip Technology Inc., Kyocera Corporation, among other domestic and global players. MEMS-based oscillator manufacturers drive innovation for low-power, shock-resistant oscillators - and it is SiTime Corporation that usually leads the competition in this area.

The market participants are expanding in new applications including 5G, IoT, AI-enhanced automation and autonomous vehicles, wherein high-precision timing solutions are required. Also, strategic partnerships, acquisition and new product launch continue to be key growth strategies.

Moreover, we are focusing on supply chain resilience and raw material procurement strategies that mitigate the risks originating from geopolitical tensions and semiconductor shortages - protecting our ability to compete in the market in the long term.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2024) | USD 3.82 billion |

| Current Total Market Size (2025) | USD 4.09 billion |

| Projected Market Size (2035) | USD 7.97 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Mounting Schemes Analyzed (Segment 1) | Surface Mount, Through-Hole |

| Crystal Cuts Assessed (Segment 2) | AT Cut, BT Cut, SC Cut, Others |

| General Circuitry Analyzed (Segment 3) | SPXO, TCXO, VCXO, FCXO, OCXO, Others |

| Applications Analyzed (Segment 4) | Telecom & Networking, Consumer Electronics, Military & Aerospace, Research & Measurement, Industrial, Automotive, Medical |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, South Korea, GCC Countries |

| Key Players Influencing the Market | Seiko Epson, TXC Corporation, Microchip Technology, Kyocera, SiTime, Rakon, NDK America, Murata, Abracon, Vectron (Knowles) |

| Additional Attributes | Dollar sales by application and circuitry type, TCXO innovations for 5G and IoT, Consumer electronics demand for miniaturized oscillators, Military-grade oscillator stability |

In terms of Mounting Scheme, the segment is segregated into Surface Mount and Through-Hole.

In terms of Crystal Cut, the segment is distributed into AT Cut, BT Cut, SC Cut, and Others.

In terms of General Circuitry, the segment is categorized into Simple Packaged Crystal Oscillator (SPXO), Temperature-Compensated Crystal Oscillator (TCXO), Voltage-Controlled Crystal Oscillator (VCXO), Frequency-Controlled Crystal Oscillator (FCXO), Oven-Controlled Crystal Oscillator (OCXO), and Others.

In terms of Application, the segment is classified into Telecom & Networking, Consumer Electronics, Military & Aerospace, Research & Measurement, Industrial, Automotive, and Medical.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Crystal Oscillator industry is projected to witness CAGR of 6.9% between 2025 and 2035.

The global Crystal Oscillator industry stood at USD 4.09 billion in 2025.

The global Crystal Oscillator industry is anticipated to reach USD 7.97 billion by 2035 end.

East Asia is set to record the highest CAGR of 7.7% in the assessment period.

The key players operating in the global Crystal Oscillator industry include Seiko Epson Corporation, TXC Corporation, Microchip Technology Inc., Kyocera Corporation, SiTime Corporation, Rakon Limited and others.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 9: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 10: Global Market Volume (Units) Forecast by Application, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 17: North America Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 18: North America Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 19: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 20: North America Market Volume (Units) Forecast by Application, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 25: Latin America Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 26: Latin America Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 27: Latin America Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 28: Latin America Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 29: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 30: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

Table 31: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 33: Western Europe Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 34: Western Europe Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 35: Western Europe Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 36: Western Europe Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 37: Western Europe Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 38: Western Europe Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 39: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

Table 41: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: Eastern Europe Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 44: Eastern Europe Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 45: Eastern Europe Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 46: Eastern Europe Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 47: Eastern Europe Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 48: Eastern Europe Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 49: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

Table 51: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 53: South Asia and Pacific Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 55: South Asia and Pacific Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 57: South Asia and Pacific Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 58: South Asia and Pacific Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 59: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

Table 61: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 62: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

Table 63: East Asia Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 64: East Asia Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 65: East Asia Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 66: East Asia Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 67: East Asia Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 68: East Asia Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 69: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 70: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

Table 71: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2020 to 2035

Table 73: Middle East and Africa Market Value (USD Million) Forecast by Mounting Scheme, 2020 to 2035

Table 74: Middle East and Africa Market Volume (Units) Forecast by Mounting Scheme, 2020 to 2035

Table 75: Middle East and Africa Market Value (USD Million) Forecast by Crystal Cut, 2020 to 2035

Table 76: Middle East and Africa Market Volume (Units) Forecast by Crystal Cut, 2020 to 2035

Table 77: Middle East and Africa Market Value (USD Million) Forecast by General Circuitry, 2020 to 2035

Table 78: Middle East and Africa Market Volume (Units) Forecast by General Circuitry, 2020 to 2035

Table 79: Middle East and Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 3: Global Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Application, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 6: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 7: Global Market Volume (Units) Analysis by Region, 2020 to 2035

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 10: Global Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 11: Global Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 12: Global Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 13: Global Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 14: Global Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 15: Global Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 16: Global Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 17: Global Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 18: Global Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 19: Global Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 20: Global Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 21: Global Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 22: Global Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 23: Global Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 26: Global Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 27: Global Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 28: Global Market Attractiveness by General Circuitry, 2025 to 2035

Figure 29: Global Market Attractiveness by Application, 2025 to 2035

Figure 30: Global Market Attractiveness by Region, 2025 to 2035

Figure 31: North America Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 32: North America Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 33: North America Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 34: North America Market Value (USD Million) by Application, 2025 to 2035

Figure 35: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 36: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 37: North America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 40: North America Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 41: North America Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 42: North America Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 43: North America Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 44: North America Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 45: North America Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 46: North America Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 47: North America Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 48: North America Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 49: North America Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 50: North America Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 51: North America Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 52: North America Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 53: North America Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 56: North America Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 57: North America Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 58: North America Market Attractiveness by General Circuitry, 2025 to 2035

Figure 59: North America Market Attractiveness by Application, 2025 to 2035

Figure 60: North America Market Attractiveness by Country, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 62: Latin America Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 63: Latin America Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 64: Latin America Market Value (USD Million) by Application, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 66: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 70: Latin America Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 71: Latin America Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 74: Latin America Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 75: Latin America Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 78: Latin America Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 79: Latin America Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 80: Latin America Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 82: Latin America Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 86: Latin America Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 87: Latin America Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 88: Latin America Market Attractiveness by General Circuitry, 2025 to 2035

Figure 89: Latin America Market Attractiveness by Application, 2025 to 2035

Figure 90: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 91: Western Europe Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 92: Western Europe Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 93: Western Europe Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 94: Western Europe Market Value (USD Million) by Application, 2025 to 2035

Figure 95: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 96: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 100: Western Europe Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 101: Western Europe Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 104: Western Europe Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 105: Western Europe Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 108: Western Europe Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 109: Western Europe Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 112: Western Europe Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 116: Western Europe Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 117: Western Europe Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 118: Western Europe Market Attractiveness by General Circuitry, 2025 to 2035

Figure 119: Western Europe Market Attractiveness by Application, 2025 to 2035

Figure 120: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 121: Eastern Europe Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 122: Eastern Europe Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 123: Eastern Europe Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 124: Eastern Europe Market Value (USD Million) by Application, 2025 to 2035

Figure 125: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 126: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 130: Eastern Europe Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 131: Eastern Europe Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 134: Eastern Europe Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 135: Eastern Europe Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 138: Eastern Europe Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 139: Eastern Europe Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 142: Eastern Europe Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 146: Eastern Europe Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 147: Eastern Europe Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 148: Eastern Europe Market Attractiveness by General Circuitry, 2025 to 2035

Figure 149: Eastern Europe Market Attractiveness by Application, 2025 to 2035

Figure 150: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 151: South Asia and Pacific Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 152: South Asia and Pacific Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 153: South Asia and Pacific Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 154: South Asia and Pacific Market Value (USD Million) by Application, 2025 to 2035

Figure 155: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 156: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 160: South Asia and Pacific Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 164: South Asia and Pacific Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 168: South Asia and Pacific Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 172: South Asia and Pacific Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 176: South Asia and Pacific Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 177: South Asia and Pacific Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 178: South Asia and Pacific Market Attractiveness by General Circuitry, 2025 to 2035

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2025 to 2035

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 181: East Asia Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 182: East Asia Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 183: East Asia Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 184: East Asia Market Value (USD Million) by Application, 2025 to 2035

Figure 185: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 186: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 190: East Asia Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 191: East Asia Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 194: East Asia Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 195: East Asia Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 198: East Asia Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 199: East Asia Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 200: East Asia Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 202: East Asia Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 206: East Asia Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 207: East Asia Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 208: East Asia Market Attractiveness by General Circuitry, 2025 to 2035

Figure 209: East Asia Market Attractiveness by Application, 2025 to 2035

Figure 210: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 211: Middle East and Africa Market Value (USD Million) by Mounting Scheme, 2025 to 2035

Figure 212: Middle East and Africa Market Value (USD Million) by Crystal Cut, 2025 to 2035

Figure 213: Middle East and Africa Market Value (USD Million) by General Circuitry, 2025 to 2035

Figure 214: Middle East and Africa Market Value (USD Million) by Application, 2025 to 2035

Figure 215: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 216: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 220: Middle East and Africa Market Value (USD Million) Analysis by Mounting Scheme, 2020 to 2035

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Mounting Scheme, 2020 to 2035

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Mounting Scheme, 2025 to 2035

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Mounting Scheme, 2025 to 2035

Figure 224: Middle East and Africa Market Value (USD Million) Analysis by Crystal Cut, 2020 to 2035

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Crystal Cut, 2020 to 2035

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Crystal Cut, 2025 to 2035

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Crystal Cut, 2025 to 2035

Figure 228: Middle East and Africa Market Value (USD Million) Analysis by General Circuitry, 2020 to 2035

Figure 229: Middle East and Africa Market Volume (Units) Analysis by General Circuitry, 2020 to 2035

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by General Circuitry, 2025 to 2035

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by General Circuitry, 2025 to 2035

Figure 232: Middle East and Africa Market Value (USD Million) Analysis by Application, 2020 to 2035

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2020 to 2035

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2025 to 2035

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2025 to 2035

Figure 236: Middle East and Africa Market Attractiveness by Mounting Scheme, 2025 to 2035

Figure 237: Middle East and Africa Market Attractiveness by Crystal Cut, 2025 to 2035

Figure 238: Middle East and Africa Market Attractiveness by General Circuitry, 2025 to 2035

Figure 239: Middle East and Africa Market Attractiveness by Application, 2025 to 2035

Figure 240: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

kHz Crystal Oscillator Market Size and Share Forecast Outlook 2025 to 2035

MHz Crystal Oscillator Market Size and Share Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Crystal Malt Market Size and Share Forecast Outlook 2025 to 2035

Crystallization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Barware Market Size and Share Forecast Outlook 2025 to 2035

Crystalline Fructose Market Growth - Trends & Forecast through 2034

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Monocrystalline Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Nanocrystal Packaging Coating Market Analysis - Size, Share, and Forecast 2025 to 2035

Polycrystalline Silicon Market Growth 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Anti Crystallizing Agents Market

Microcrystalline Wax Market

Liquid Crystal Polymers Market Size and Share Forecast Outlook 2025 to 2035

Liquid Crystal Polymer (LCP) Market Size and Share Forecast Outlook 2025 to 2035

Protein Crystallization and Crystallography Market Analysis - Growth & Forecast 2025 to 2035

Photonic Crystal Displays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA