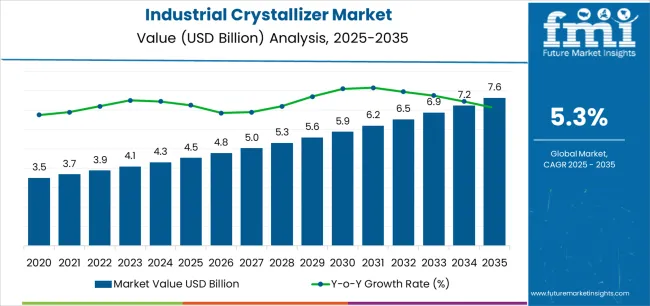

The Industrial Crystallizer Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The industrial crystallizer market is experiencing steady growth driven by increasing demand for high-purity chemical production, expansion of the pharmaceutical and food processing industries, and advancements in crystallization process control technologies. The market is witnessing continuous improvements in design efficiency, scalability, and energy optimization, which are enhancing productivity and reducing operational costs.

Industrial operators are increasingly adopting crystallizers for precise particle size control and improved yield consistency, supporting broader industrial applications. The future outlook remains positive, as automation, digital monitoring, and advanced material construction are being integrated to enhance process reliability and equipment lifespan.

Environmental regulations promoting sustainable waste management and solvent recovery are further supporting market expansion The overall growth rationale is anchored on the growing need for process efficiency, rising adoption of continuous crystallization technologies, and strategic investments in process optimization that ensure consistent performance across a diverse range of chemical and industrial manufacturing applications.

| Metric | Value |

|---|---|

| Industrial Crystallizer Market Estimated Value in (2025 E) | USD 4.5 billion |

| Industrial Crystallizer Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

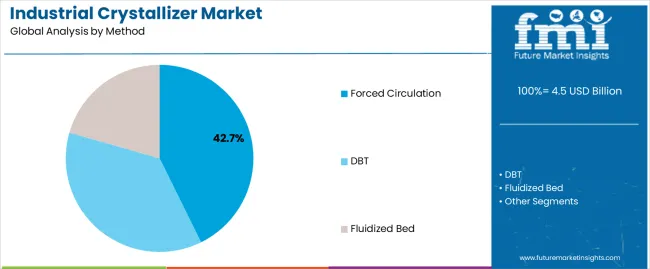

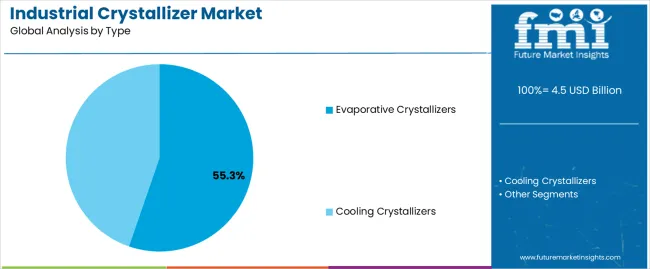

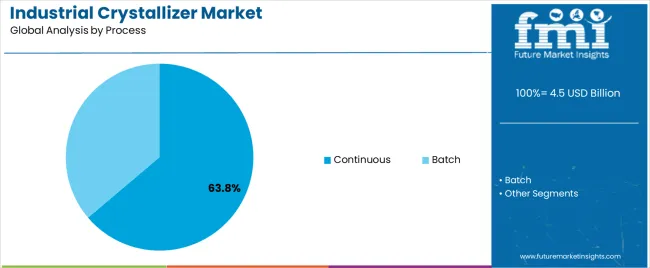

The market is segmented by Method, Type, Process, and End Use Industry and region. By Method, the market is divided into Forced Circulation, DBT, and Fluidized Bed. In terms of Type, the market is classified into Evaporative Crystallizers and Cooling Crystallizers. Based on Process, the market is segmented into Continuous and Batch. By Process, the market is divided into Continuous and Batch. By End Use Industry, the market is segmented into Chemicals, Food And Beverages, Pharmaceuticals, Agrochemical, and Wastewater Treatment. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

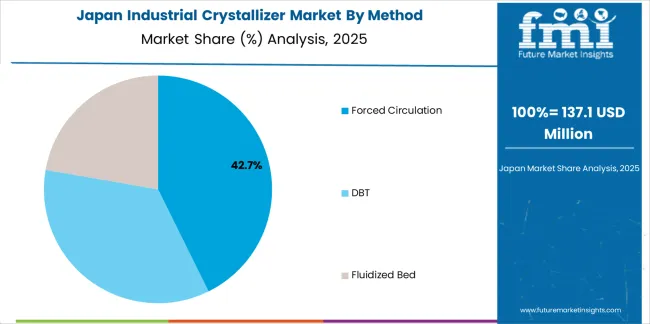

The forced circulation segment, accounting for 42.70% of the method category, has emerged as the leading technology due to its strong adaptability to a wide range of solutes and operational robustness under variable industrial conditions. Its high circulation rate enables effective heat transfer and reduced fouling, resulting in improved process efficiency and stable product quality.

This method has gained preference across industries such as chemicals, fertilizers, and food processing where continuous operation and scale-up flexibility are critical. Technological enhancements in pump design and control systems have further improved energy efficiency and operational safety.

The segment’s dominance is supported by low maintenance requirements and compatibility with automated systems, making it suitable for large-scale crystallization units Growing demand for consistent purity levels and enhanced productivity continues to reinforce the position of forced circulation crystallizers as a preferred method in industrial applications.

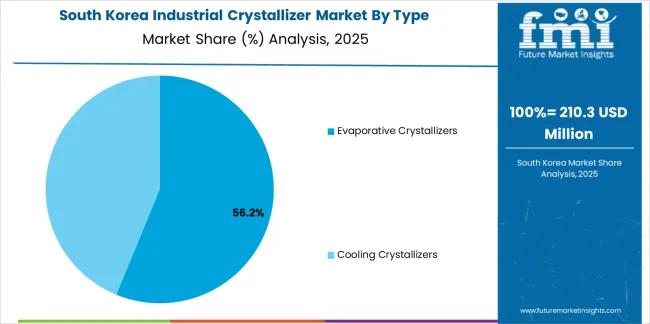

The evaporative crystallizers segment, representing 55.30% of the type category, has maintained its leading position owing to its ability to handle high-solubility compounds and deliver superior product recovery rates. The segment’s performance is supported by advancements in vapor recompression and heat recovery systems that optimize energy use and minimize operating costs.

Its wide applicability across industries including pharmaceuticals, chemicals, and wastewater treatment has further strengthened its dominance. Continuous improvements in process control, automation, and anti-scaling measures have enhanced operational reliability.

The rising focus on minimizing water and energy consumption aligns with the efficiency characteristics of evaporative crystallizers, ensuring long-term adoption As industries continue to emphasize process sustainability and cost optimization, the demand for evaporative crystallizers is projected to remain strong across global industrial manufacturing sectors.

The continuous process segment, holding 63.80% of the process category, has become the dominant configuration due to its superior operational efficiency and capability for uninterrupted production. Continuous crystallization enables precise control of supersaturation and particle size distribution, ensuring uniform product quality while reducing batch-to-batch variability.

The growing focus on process automation, scalability, and energy optimization has accelerated the adoption of continuous systems in chemical, food, and pharmaceutical industries. Reduced downtime, consistent output, and better integration with digital monitoring platforms have made continuous crystallization a preferred choice among modern manufacturing facilities.

Its compatibility with smart manufacturing practices and ability to achieve high throughput under controlled conditions are key drivers of its market leadership Continued innovation in process design and control systems is expected to further strengthen this segment’s role in shaping the next generation of industrial crystallization technology.

DTB (Draft Tube Baffle) is expected to upsurge the global market with a 5.4% CAGR through 2035.

| Attributes | Details |

|---|---|

| Method | DTB (Draft Tube Baffle) |

| CAGR ( 2025 to 2035) | 5.4% |

This rising popularity is attributed to:

The global market is poised for an upsurge, with evaporative crystallizers projected to exhibit a robust 5.2% CAGR through 2035.

| Attributes | Details |

|---|---|

| Type | Evaporative Crystallizers |

| CAGR ( 2025 to 2035) | 5.2% |

This rising popularity is attributed to:

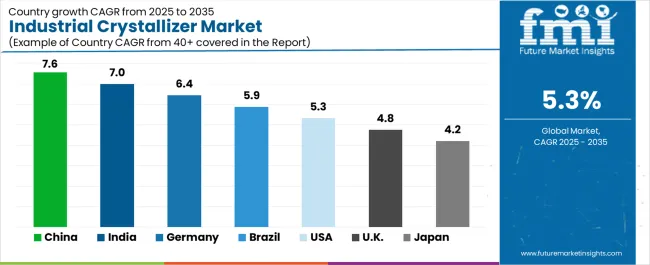

The section analyzes the global industrial crystallizer market by country, including the United Kingdom, the United States, China, South Korea, and Japan. The table presents the CAGR for each country, indicating the expected market growth through 2035.

South Korea is emerging as a global player in the industrial crystallizer market with a CAGR of 7.6% from 2025 to 2035.

South Korea's growth in the industrial crystallizer market is closely linked to its thriving semiconductor and electronics industries. The country demands advanced crystallizer technologies to purify and produce semiconductor materials and electronic components.

South Korea's strong emphasis on high-tech manufacturing and precision engineering has made it a preferred destination for businesses looking for high-quality and reliable crystallizer equipment. The country's commitment to innovation and quality manufacturing drives the adoption of cutting-edge crystallizer solutions.

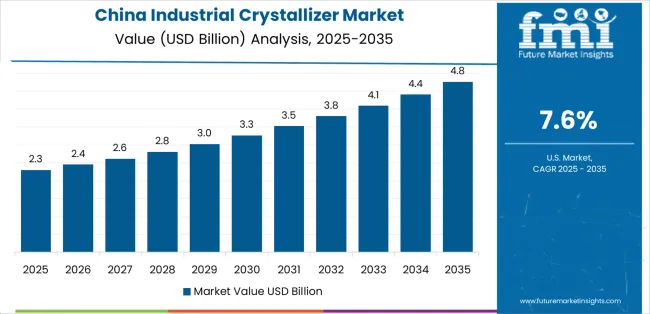

China is emerging as a global player in the industrial crystallizer market, with a CAGR of 7.0% from 2025 to 2035.

China's dominance in the industrial crystallizer market can be attributed to its booming chemical and petrochemical industries. The country is the world's largest producer and consumer of chemicals and relies heavily on crystallizer processes for purification, separation, and production of various chemical products.

China's focus on modernization and technological advancements further fuels the adoption of industrial crystallizers across different sectors. The country's commitment to innovation and quality manufacturing drives the adoption of cutting-edge crystallizer solutions.

Japan is becoming a global industrial crystallizer market player, projecting a steady growth rate with a CAGR of 6.9%, which is expected to continue through 2035.

Advanced materials and chemicals industries are Japan's leader in the industrial crystallizer market. The country has a reputation for precision engineering and high-quality manufacturing.

It relies on crystallizer processes to produce specialty chemicals, pharmaceuticals, and advanced materials used in electronics and automotive sectors. Japan's relentless pursuit of technological excellence fosters continuous innovation and drives demand for crystallizer equipment and solutions.

The United Kingdom is a contributor to the industrial crystallizer market player. With a CAGR of 6.7% projected through 2035, it is maintaining a steady pace of growth.

The United Kingdom has always been a hub for innovation and advanced manufacturing technologies, which has LED to its significant growth in the industrial crystallizer market.

The country's focus on research and development has helped foster the adoption of advanced crystallizer processes across various industries, including pharmaceuticals, chemicals, and food processing. The United Kingdom's strength in developing innovative crystallizer solutions has made it a preferred destination for businesses looking for high-quality and reliable equipment.

The United States is steadily emerging as a significant contender in the worldwide industrial crystallizer market, with a projected CAGR of 5.9% expected to persist until 2035.

The United States remains superior in the industrial crystallizer market due to its thriving pharmaceutical and biotechnology sectors. The presence of numerous pharmaceutical companies investing in advanced crystallizer technologies for drug development and manufacturing has been instrumental in driving the demand for crystallizer equipment and solutions.

The United States' commitment to developing cutting-edge solutions has helped it maintain its position as a key driver of innovation in the crystallizer market.

Major companies and manufacturers invest heavily in research and development to improve crystallizer processes' efficiency, scalability, and sustainability. They are developing advanced technologies, such as novel crystallizers and process optimization solutions, to meet the changing demands of various industries.

Key players are expanding their geographical presence and market reach through strategic partnerships, collaborations, and acquisitions. By establishing strong networks and distribution channels, they are tapping into emerging markets and capitalizing on the growing global demand for industrial crystallizer solutions.

Major players are also customizing their offerings to meet specific customer requirements across diverse sectors such as pharmaceuticals, chemicals, food and beverages, and wastewater treatment. By understanding different industries' unique needs and challenges, these companies are positioning themselves as trusted partners and solution providers.

Recent Developments

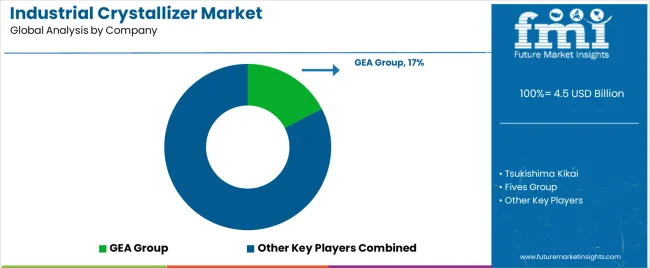

The global industrial crystallizer market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the industrial crystallizer market is projected to reach USD 7.6 billion by 2035.

The industrial crystallizer market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in industrial crystallizer market are forced circulation, dbt and fluidized bed.

In terms of type, evaporative crystallizers segment to command 55.3% share in the industrial crystallizer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA