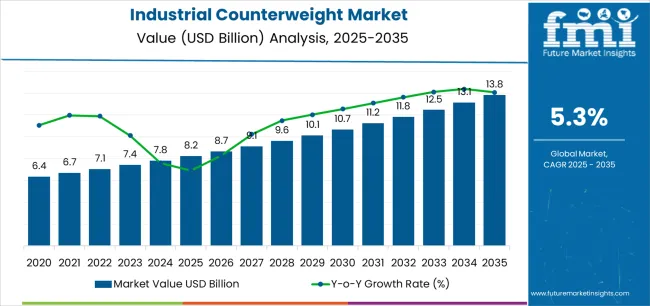

The Industrial Counterweight Market is estimated to be valued at USD 8.2 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The industrial counterweight market is experiencing steady expansion due to rising demand across construction, material handling, and manufacturing sectors. Growth is being driven by the widespread adoption of heavy machinery, cranes, and lifting equipment that rely on counterbalance systems for operational stability and safety. Current market dynamics reflect a focus on performance efficiency, load optimization, and cost-effective materials.

Manufacturers are emphasizing precision-engineered designs that improve equipment balance and extend service life. Increasing infrastructure investments and industrial automation trends are further supporting market expansion. The future outlook remains positive as industries continue to modernize equipment fleets and integrate safety-enhancing technologies.

Continuous innovation in material composition and fabrication processes is expected to reduce overall weight while maintaining strength and durability These advancements, coupled with the proliferation of heavy-duty applications in logistics and energy sectors, are projected to reinforce steady growth momentum and broaden adoption across global industrial markets.

| Metric | Value |

|---|---|

| Industrial Counterweight Market Estimated Value in (2025 E) | USD 8.2 billion |

| Industrial Counterweight Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

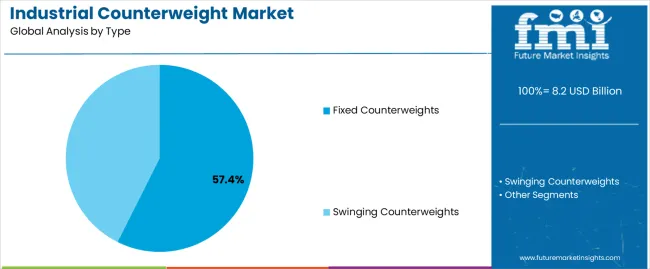

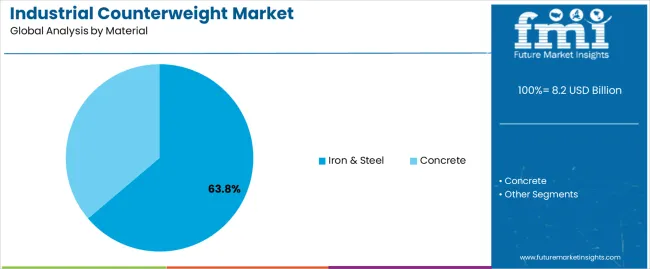

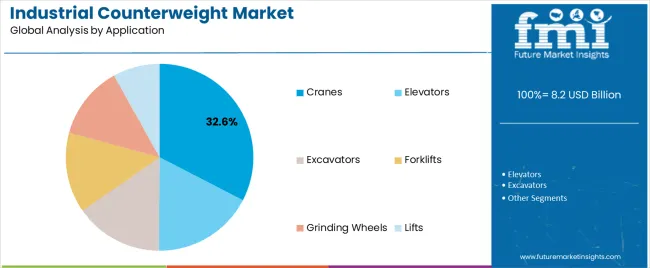

The market is segmented by Type, Material, Application, and End User and region. By Type, the market is divided into Fixed Counterweights and Swinging Counterweights. In terms of Material, the market is classified into Iron & Steel and Concrete. Based on Application, the market is segmented into Cranes, Elevators, Excavators, Forklifts, Grinding Wheels, and Lifts. By End User, the market is divided into Construction, Agriculture, Industrial Manufacturing, Logistics, Marine, Mining, and Renewables. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed counterweights segment, holding 57.40% of the type category, has maintained its dominant position due to its structural simplicity, stability, and widespread use in stationary equipment. Its adoption has been supported by low maintenance requirements and proven reliability in maintaining machine equilibrium during high-load operations.

Fixed counterweights are extensively utilized in cranes, elevators, and construction machinery, where consistent balancing is essential for safety and performance. The segment’s growth is reinforced by its cost-effectiveness and ease of integration into various industrial applications.

Manufacturers are optimizing production through modular designs and advanced casting techniques, improving both strength and operational efficiency The reliability of fixed counterweights in heavy-duty applications continues to ensure their leading market share and strong preference across industries that prioritize stability and safety in mechanical operations.

The iron and steel segment, accounting for 63.80% of the material category, leads the market owing to its superior strength, durability, and affordability. Its dominance is driven by consistent mechanical performance and adaptability to different manufacturing processes, including casting and forging. Iron and steel counterweights offer high density and corrosion resistance, making them suitable for demanding environments such as construction and mining.

The material’s availability and recyclability further enhance its cost efficiency and sustainability profile. Continuous improvements in metallurgical techniques are contributing to better weight-to-strength ratios and extended service life.

Manufacturers are also leveraging alloy advancements to reduce brittleness and enhance performance under stress conditions These factors collectively support the continued prominence of iron and steel materials in counterweight production and ensure their ongoing relevance in high-performance industrial applications.

The cranes segment, representing 32.60% of the application category, remains the leading application area due to the critical role of counterweights in ensuring load stability and operational safety. Increasing deployment of mobile, tower, and overhead cranes in infrastructure and industrial projects has been a major growth driver.

Demand is further supported by expanding construction activity and the modernization of lifting equipment across global markets. Technological innovations such as smart load monitoring systems and adjustable counterweight mechanisms are improving performance efficiency and safety compliance.

Manufacturers are focusing on design standardization and modular installation to meet diverse lifting capacities and project requirements With continuous investments in heavy equipment and large-scale construction initiatives, the cranes segment is expected to retain its leadership, driving sustained demand for reliable and efficient industrial counterweight solutions.

The industrial counterweights market was worth 6.8% CAGR from 2020 to 2025. Industrial equipment can now be monitored in real-time and data-driven decisions can be made based on Internet of Things (IoT) technologies.

With the help of smart sensors, weight counters can provide valuable information regarding usage, maintenance requirements, and performance enhancement. Investing in upgraded equipment and retrofitting older machines with modern counterweights can be profitable.

Industry after industry is looking for ways to make their existing assets perform and stay safe. Counterweight manufacturers can seamlessly integrate their solutions into new machinery by collaborating with original equipment manufacturers (OEMs). Increased market penetration can be achieved by establishing partnerships with OEMs. A 5.6% CAGR is forecast between 2025 and 2035.

| Historical CAGR from 2020 to 2025 | 7.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.6% |

In accordance with the table provided, South Korea generates the largest amount of revenue. Among the sectors that are expected to contribute to growth are the automotive, aerospace, and defense industries.

Counterweights help balance rotating components and improve efficiency in these sectors. Due to the expansion of these industries, industrial counterweights will also become more in demand

In the future, development projects in the field of infrastructure, including those related to transportation, energy, and renewable energy, will increase the demand for industrial counterweights. Developing countries will increase their investment in infrastructure, increasing the demand for counterweights in machinery and equipment for construction.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 5.8% |

| China | 6.5% |

| Japan | 7.1% |

| South Korea | 7.2% |

| The United Kingdom | 6.7% |

Increasing oil and gas production in the United States drives the need for industrial counterweights. Industrial counterweights are needed in the United States to install and maintain renewable energy infrastructure with the expansion of renewable energy. Between 2025 and 2035, the United States is expected to expand at a CAGR of 5.8%.

Increasing construction industries and rising projects in the United States are expected to drive demand in the market. The United States government sets engineering standards and regulations to ensure the safe use of industrial equipment, including counterweights, including OSHA (Occupational Safety and Health Administration).

The industrial counterweight market in China is growing due to ongoing industrialization and infrastructure development. Growing water and wastewater treatment facilities also drive the demand for the industrial counterweights market. The growth rate between 2025 and 2035 is expected to be 6.5%.

As China's infrastructure projects progress, including the construction of buildings, bridges, and transit networks, industrial counterweights become essential to maintain stability and safety. With China's fast urbanization and skyscraper construction in major cities, industrial counterweights are needed in tall cranes and equipment for stabilizing and protecting vertical construction projects.

A 7.1% CAGR is forecast for Japan from 2025 to 2035. Due to Japan's advanced manufacturing sector's reliance on large machinery and equipment, industrial counterweights are required for stability and precision. This includes the electronics, robotics, and automotive industries.

As a result of Japan's aging infrastructure, where significant renovations and maintenance are needed, industrial counterweights have increased in infrastructure projects. Several factors contribute to Japan's growth in the industrial counterweight market, including its focus on industrial manufacturing. Human labor is reduced, and efficiency is improved with counterweights in automotive applications

Due to technological advancements, industrial machinery using counterweights might become more efficient, effective, and safe due to performance, efficiency, and safety improvements. A market of USD 13.8 million is expected in 2035. According to the forecast, the market is expected to expand by 7.9% between 2025 and 2035.

During manufacturing operations, the shipbuilding and aerospace industries in South Korea use heavy machinery and equipment that rely on industrial counterweights for stability and balance. Heavy equipment and industrial counterweights are required to construct South Korea's nuclear power plants so that reactors and other vital parts can be installed safely.

The United Kingdom projects involving infrastructure upgrades, including transit improvements and renewable energy programs, require heavy machinery equipped with industrial counterweights. A CAGR of 6.7% is projected for the United Kingdom between 2025 and 2035.

Due to its involvement in international trade, the United Kingdom may encounter a demand for industrial machinery and equipment counterweights. Ports and harbors in the United Kingdom are expanding and developing, causing this demand.

Regulations regarding health and safety are crucial to the industrial sector. A counterweight contributes to the safety of industrial operations, especially in applications requiring balance and stability.

This section illustrates the market's leading segment. the fixed counterweight segment is projected to register a CAGR of 5.4% by 2035. The concrete segment is expected to expand at a CAGR of 5.1% by 2035. Construction equipment, cranes, elevators, and other industrial equipment requiring balance and stability usually feature fixed counterweights.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Fixed Counterweight | 5.4% |

| Concrete | 5.1% |

Fixed counterweights are essential features of many industries because they allow machinery and equipment to function safely and efficiently by counterbalancing the weight of moving parts and loads. Fixed counterweights are expected to increase at a CAGR of 5.4% by 2035.

For permanent counterweights to be safe and effective, they must be installed and maintained correctly. A fixed counterweight's design and implementation must consider weight distribution, fastening, and space availability. Providing stability and balancing loads are the primary purposes of fixed counterweights. The safety and efficiency of equipment is vital to various industrial processes.

Construction projects involving buildings, roads, bridges, dams, and infrastructure rely extensively on concrete's strength, adaptability, and durability. The concrete market is expected to expand at a CAGR of 5.1% by 2035. Combined with its affordability and availability of raw materials, its versatility makes it an attractive option for structural and aesthetic applications.

Concrete technology is advancing in response to environmental concerns and contemporary construction methods. Concrete is becoming stronger, easier to work with, and more durable due to adding admixtures and additives. Resilient and sustainable, concrete is a great building material. All these factors are expected to drive demand for the industrial counterweight market.

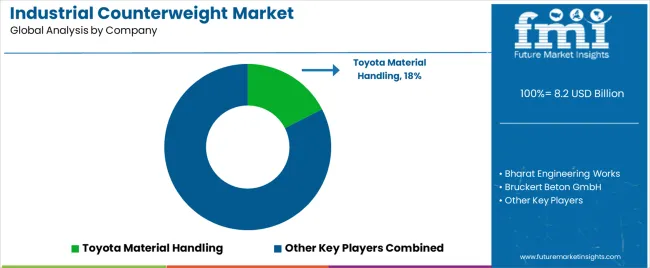

Industry, mining, and construction sectors need reliable counterweight machines, helping leaders in the global industrial counterweight market capitalize on this demand.

Other key players are conducting research and development activities to launch innovative products. Their global presence is also strengthened through mergers and acquisitions.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 7.8 billion |

| Projected Market Valuation in 2035 | USD 13.5 billion |

| Value-based CAGR 2025 to 2035 | 5.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Type, Material, Application, End User, Region |

| Key Countries Profiled | The United States; Canada; Brazil; Mexico; Germany; The United Kingdom; France; Spain; Italy; Poland; Russia; Czech Republic; Romania; India; Bangladesh; Australia; New Zealand; China; Japan; South Korea; GCC countries; South Africa; Israel |

| Key Companies Profiled | Bharat Engineering Works; Bruckert Beton GmbH; Crescent Foundry Pvt Ltd.; EdgeTech Industries LLC; FARINIA S.A.; Frans Pateer B.V.; GALLIZO S.L.; LKAB Minerals Limited; Mars Metal Company; Shanxi Huaxiang Group Co.; Ultraray; So.me.fer. S.r.l.; Tenwinkel GmbH & Co.KG; Toyota Material Handling |

The global industrial counterweight market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the industrial counterweight market is projected to reach USD 13.8 billion by 2035.

The industrial counterweight market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in industrial counterweight market are fixed counterweights and swinging counterweights.

In terms of material, iron & steel segment to command 63.8% share in the industrial counterweight market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA