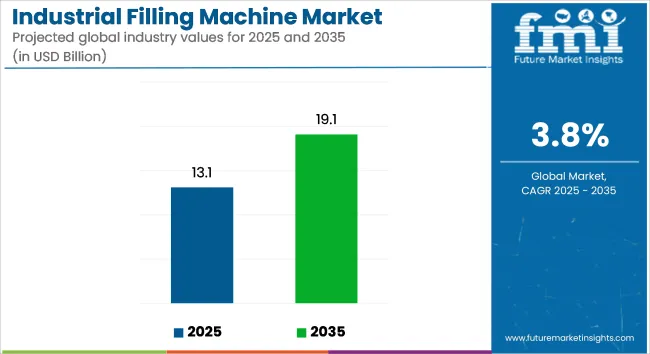

The industrial filling machine market is projected to grow from USD 13.1 billion in 2025 to USD 19.1 billion by 2035, registering a CAGR of 3.8% during the forecast period. Sales in 2024 reached USD 12.6 billion. Growth has been driven by the increasing demand for automation in manufacturing processes, advancements in filling technology, and the rising need for efficient and precise filling solutions across various industries such as food and beverage, pharmaceuticals, and cosmetics.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 13.1 billion |

| Projected Market Size in 2035 | USD 19.1 billion |

| CAGR (2025 to 2035) | 3.8% |

The surge in packaged goods consumption, coupled with stringent regulatory requirements for product safety and consistency, has further propelled the demand for advanced filling machines. In November 2024, Mengniu has been awarded ‘lighthouse factory’ certification by the World Economic Forum for its world-first fully intelligent dairy factory in Ningxia, China. The site was recognized for its innovation, utilizing Tetra Pak’s end-to-end solutions, together with a network of specialists and partners.

Its technology onsite includes 24 filling lines among them the Tetra Pak® E3/Speed Hyper, the world’s fastest carton packaging machine. Li Pengcheng, Executive President at Mengniu commented “After over 25 years in the dairy business, Mengniu wanted to bring together its accumulated wealth of manufacturing experience to optimize operations establishing 100% consistent production and management processes with the help of digitalization. Together with Tetra Pak and our other partners, we are setting new standards for the future of dairy production.”

The industrial filling machine market is expected to witness significant growth over the next decade, driven by increasing automation in manufacturing processes, advancements in filling technology, and the rising need for efficient and precise filling solutions across various industries.

The surge in packaged goods consumption, coupled with stringent regulatory requirements for product safety and consistency, will further propel the demand for advanced filling machines. Manufacturers are continuously innovating to enhance the speed, accuracy, and versatility of filling machines, catering to diverse product types and packaging formats.

Technological advancements in filling machines have focused on enhancing automation, precision, and sustainability. Manufacturers are adopting servo-driven and robotic filling systems to improve accuracy and flexibility in filling operations. The integration of IoT and AI technologies enables real-time monitoring, predictive maintenance, and customization to meet diverse industry requirements efficiently.

Sustainability concerns are driving innovations in eco-friendly packaging and reduced material wastage. Filling machines are being designed with features that support sustainable packaging, such as the ability to handle recyclable materials and minimize material wastage.

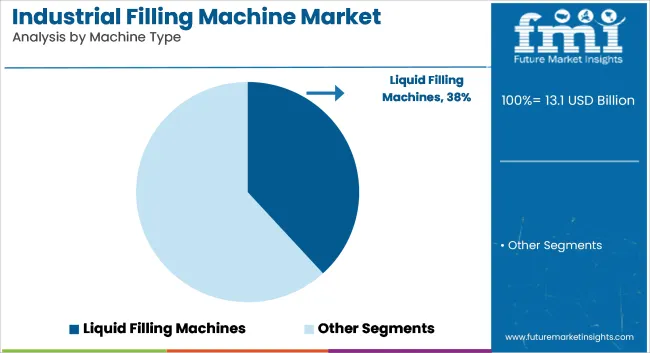

The market is segmented based on machine type, automation, end use industry, and region. By machine type, the market includes liquid filling machines, powder filling machines, granule filling machines, paste filling machines, and aerosol filling machines.

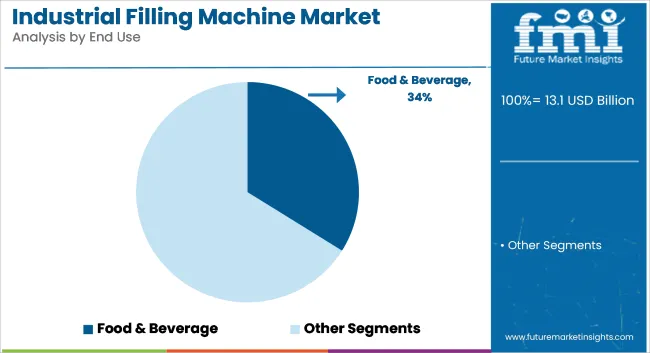

In terms of automation, the market is categorized into manual, semi-automatic, and automatic systems. By end use industry, the market comprises agriculture, food & beverages, building & construction, chemicals, paints & coatings, oil & lubricants, personal care & cosmetic, and pharmaceutical sectors. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Liquid filling machines have been projected to hold a 38.2% market share in 2025 due to their adaptability in bottling operations across diverse viscosities. Used in high-speed lines, these machines have been integrated into beverage, pharmaceutical, and chemical packaging. Multiple formats such as volumetric, gravity, and piston fillers have been deployed to ensure accuracy and reduce product wastage.

Compatibility with hot, cold, and sterile fills has driven their adoption across regulated industries. Automation capabilities have been enhanced through servo controls, vision systems, and touchless interfaces. Quick-change features and clean-in-place (CIP) systems have supported hygienic production in food and healthcare sectors. Inline and rotary configurations have been selected based on throughput and floor space constraints. Liquid fillers have also been adapted for foaming and corrosive liquids using specialty nozzles and corrosion-resistant materials.

Growth in demand for ready-to-drink (RTD) beverages, edible oils, personal care liquids, and industrial chemicals has supported the segment’s expansion. Packaging formats ranging from pouches and bottles to jars and drums have been accommodated efficiently. Energy-efficient drives and low-waste configurations have further enhanced operational performance.

The versatility of these machines has positioned them as the cornerstone of automated filling lines. Manufacturers have focused on digital integration, offering IoT-enabled machines for real-time diagnostics and predictive maintenance. Custom-built fillers for multi-product lines have addressed the need for operational agility. Regulatory compliance across pharma and F&B has reinforced the relevance of precision liquid fillers. This segment is expected to remain dominant with continuous investment in hygiene, automation, and sustainability.

The food & beverages industry has been estimated to command 33.9% of the industrial filling machine market in 2025, attributed to its large-scale and diversified packaging needs. Liquid, powder, paste, and granule fillers have all been employed across processed foods, sauces, snacks, dairy, and beverages. Shelf-life sensitivity and consumer safety have demanded high precision and hygiene.

Regulatory mandates have necessitated machines that comply with FDA, HACCP, and EU directives. Speed, fill accuracy, and contamination control have been critical in operations involving dairy, baby food, and beverages. Modified atmosphere packaging (MAP) and aseptic systems have been integrated with filling lines. Portion packs, sachets, pouches, and bottles have required customized dosing systems. Foodservice and retail packaging growth has driven demand for both single-serve and bulk-fill applications.

Digital controls and recipe management software have enabled flexible production for SKUs across multiple food categories. Integration with labeling, capping, and cartooning systems has improved throughput and traceability. Cleaning cycles and downtime have been minimized through design innovations tailored to sticky and particulate-rich products. Ease of operation and maintenance has become a priority for food processors seeking to minimize training and labor costs.

Food companies have continued to invest in fillers that offer traceability, reduced waste, and compliance with food safety protocols. Growing demand for plant-based beverages, fortified foods, and functional ingredients has expanded machine specifications. Custom nozzles, heat-sealed delivery systems, and nitrogen flushing capabilities have all been implemented. As food and beverage packaging evolves, the need for advanced filling systems is expected to rise proportionally.

High Initial Investment and Maintenance Costs

The market for Industrial filling machine is hindered by the high initial business costs involved in the purchase, installation, and maintenance of advanced filling machines. Moreover, automated and high-speed filling systems need precision engineering, quality components, and integration with digital control systems which drives up capital expenditure.

Moreover, regular maintenance, frequent calibration, and adherence to industry orthodoxy further drive meeting operational costs. This will require companies to shift towards modular, cost-effective designs and predictive maintenance solutions that reduces downtime and total cost of ownership.

Stringent Regulatory Compliance and Hygiene Standards

Industries such as food & beverage, pharmaceuticals, and chemicals all of which must comply with regulatory guidelines regarding product safety, sanitation, and accuracy experience major repercussions when product errors occur, so this is definitely the area in which it’s easiest to see the impact that QMS software can have on product quality.

To comply with FDA, GMP and ISO standards high-precision filling systems, contamination-free designs and advanced quality control measures are needed. Compliance with such strict requirements adds operational complexity and requires constantly improving equipment design and materials usage. In pursuit of compliance, enterprises will need to leverage AI-based quality control solutions, innovate into hygienic design principles, and establish real-time compliance tracking mechanisms.

Rising Demand for Automation and Smart Manufacturing

As a result, the demand for automated, AI-based, and IoT-integrated filling machines is increasing, thereby catalyzing the growth of the filling machines market due to the adoption of Industry 4.0 technologies. Manufacturers can use smart manufacturing solutions to improve their precision, efficiency, and monitoring in real time, which together can help optimize production lines and minimize waste.

Predictive maintenance powered by AI, robotic filling systems, and cloud-based analytics of performance are reshaping the market. Organizations leveraging intelligent automation, machine-learning-driven process optimization, and digital twin simulations will enjoy a competitive advantage in the industrial filling space.

Growth in Sustainable and Eco-Friendly Packaging Solutions

With industries moving toward sustainable products, filling machine demand that promotes biodegradable, recyclable and lighter packaging is also on the rise. In the challenge of filling systems becoming increasingly versatile to maintain output for diverse material properties, with products ranging from paper-based, to bio-plastic to compostable packaging material.

Furthermore, energy-efficient filling technologies are becoming increasingly implemented to lessen the carbon footprints of production. Businesses whose services emphasize sustainable material compatibility, low-energy operation, and environmentally conscious automation will succeed as the trend evolves.

Future industrial filling machine market scenarios between 2020 and 2021, the industrial filling machine market experienced growth due to increasing automation in food, beverage, and pharmaceutical sectors among others. Companies adopted innovations in hygienic design, high-speed fill accuracy and digital entry to comply with regulatory and operational needs.

Nonetheless, supply chain disruptions, volatile cost of raw materials, and significant machine maintenance requirements were factored as hindrances to the market growth. And businesses turned to modular machinery, improved remote monitoring and smart sensors for real-time data analytics.

In the 2025 to 2035 perspective, the market favors groundbreaking innovations in AI driven process control, 3D-printed precision nozzles, and sustainable filling technologies. Implementing blockchain for supply chain traceability, autonomous robotic filling arms, as well as zero-waste production lines will set new industry standards.

Advanced human-machine collaboration, self-sterilizing mechanisms, and novel intelligent adaptive controls such as next-generation filling machines will propel further efficiency and innovation. Digital transformation, sustainability, and flexible production capabilities are key pillars of the next evolution of the Industrial filling machine market, which will be led by the companies that understand them and are ready to invest in future growth.

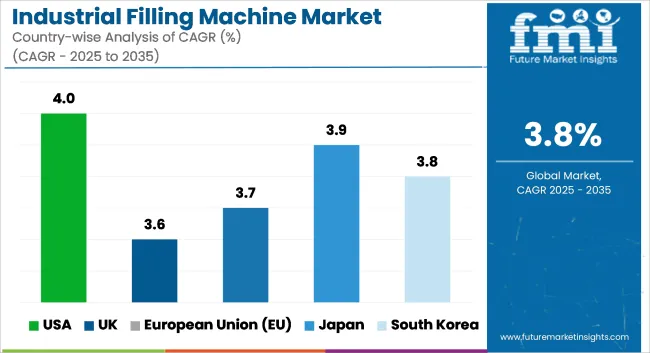

The USA dominates the industrial filling machine market with automation gradually being used in the food, beverage, pharmaceutical, and chemical sectors. High-speed advanced filling technologies, precision filling, increase in production volumes, and demand for an increased rate of accuracy, speed, hijacking the market. Market development is also supported by increasing investments in smart manufacturing and innovation in servo-driven, volumetric and gravimetric filling machines. The increased use of IoT-enabled monitoring, real-time data analytics, and automated quality control systems is also improving production efficiency.

Manufacturers are also working towards developing energy-efficient and multi-purpose machines to cater to changing regulatory as well as sustainability standards. Moreover, bottling machines are increasingly being deployed in packaging operations of dairy, personal care, and home cleaning consumables, which is also significantly supporting the market growth in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

Industrial filling machines sector is one of the most important in the UK market driven by demand for precise packaging, investments in digitalized manufacturing and attention of strict regulatory agencies on hygienic and contamination free process. Additionally, the demand for sustainable and environmentally friendly packaging solutions for waste reduction is propelling the market forward. Aimed at bolstering market growth, government intervention advocating for automation of manufacturing processes along with technological development of rotary high-speed and aseptic filling machinery are forecasted to contribute to the growth of the market.

In addition, lightweight packaging, personalized filling systems, and low-energy technologies are also emerging trends. They are also spending on modular, AI-embedded filling equipment to add flexibility to the production lines. Moreover, the growing need for precision filling solutions in the pharmaceuticals, cosmetics, and specialty food products is augmenting the market adoption in the UK. Also, the transition toward biodegradable and recyclable packaging is driving demand for novel filling technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Germany, France, and Italy are the leading countries in the European industrial filling machine market due to their robust industrial automation integration and significant investments in high-precision packaging equipment, alongside growing demand for eco-friendly and efficient production solutions. Favorable European Union's emphasis on food safety improvement, pharmaceutical compliance, and clean-label packaging, along with investments in smart filling machine technology, is propelling steady growth of the market.

Moreover, fully automated, AI-based, and Robotic-assisted Filling machines are being used to provide high efficiency and accuracy. Market growth is also being driven by the increasing need for flexible-filling solutions for dairy, beverage, and personal-care-products. The adoption is being further influenced by tighter EU regulations on food-grade packaging materials and traceability, along with growing collaborations between machine manufacturers and packaging companies fueling the uptake in the EU. This, along with rising awareness around Industry 4.0 & predictive maintenance solutions, is providing a major stimulus to innovation in the filling machines space.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

The Japan industrial filling machine market is witnessing growth on account of the country being a leader in robotics, increasing demand for precise-engineered packaging solutions, and expanding applications in food, beverage, and pharmaceutical industries. The demand for high-precisions and contamination-free filling systems in sterile production environments is propelling the market growth. Innovation is also in full swing thanks to the country’s focus on high-speed, digitally controlled filling machines and the rapid advancement of micro-dosing, vacuum sealing and nitrogen-flushing technologies.

In addition, strict government regulations around packaging hygiene along with increasing investment for smart factory integration, is driving companies to develop high-efficiency filling solutions. Market Expansion is further accelerated by growing demand for flexibility, for small batches and for high-speed filling machines in the domestic premium food, cosmetics and electronic chemical industries in Japan. The future of industrial filling machine technology is also being driven by the advancements Japan is making with AI-powered machine learning for uses such as quality control and predictive maintenance.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The industrial filling machine market in South Korea is also on the rise, due to growing investments in automatic manufacturing, demand for sustainable packaging, and strong government initiative promoting high-efficiency production lines. Market growth is driven by stringent environmental regulations regarding packaging waste reduction and increased investment in precision filling and automated handling systems. The country is also boosting competitiveness by adopting servo-driven controls, AI integration, and real-time monitoring to enhance machine speed, efficiency, and versatility.

Market adoption is also spurred by increasing demand for advanced filling solutions in ready-to-eat food packaging, beverage processing, and manufacturing of household cleaning products. To meet the evolving industry requirements, companies are investing in intelligent control systems, robotic-assisted filling stations, and aseptic packaging technologies. Increasing deployment of digitalized production facilities and smart packaging solutions in South Korea is positively influencing the demand for advanced industrial filling machines.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The industrial filling machine market is driven by the need for higher efficiency and precision in today’s packaging lines where companies are striving to meet the increasing demand for products that come in all shapes and sizes especially food and beverage products. To boost productivity, manufacturers are targeting fast, multi-component, and low-energy filling systems. Real-time monitoring through IoT integration, hygienic design for food safety compliance, and robotic filling solutions for enhanced accuracy are some key trends.

The overall market size for industrial filling machine market was USD 13.1 billion in 2025.

The industrial filling machine market expected to reach USD 19.1 billion in 2035.

The demand for the industrial filling machine market will be driven by increasing automation in manufacturing, rising demand in the food and beverage and pharmaceutical industries, growing need for high-speed and precision filling solutions, advancements in smart packaging technology, and expanding e-commerce and FMCG sectors.

The top 5 countries which drives the development of industrial filling machine market are USA, UK, Europe Union, Japan and South Korea.

Automatic and semi-automatic filling machines propel market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Relay Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Industrial Noise Control Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA