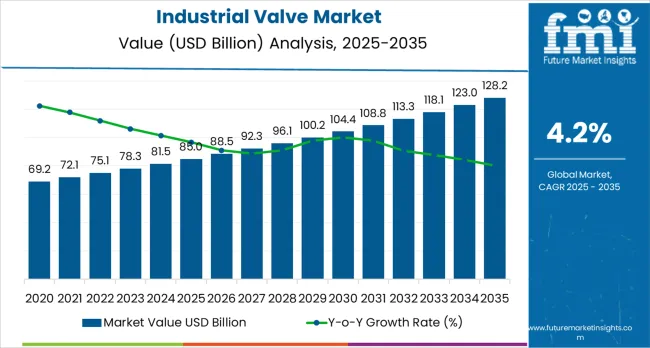

The global industrial valve market is projected to reach USD 128.2 billion by 2035, recording an absolute increase of USD 43.25 billion over the forecast period. The market is valued at USD 85 billion in 2025 and is projected to grow at a CAGR of 4.2% during the forecast period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for reliable flow control solutions across critical industries, rising investments in midstream oil and gas pipeline infrastructure, and expanding water treatment projects worldwide. However, geopolitical developments and supply chain complexities may pose challenges to market expansion.

Between 2025 and 2030, the industrial valve market is projected to expand from USD 85 billion to USD 105.2 billion, resulting in a value increase of USD 20.23 billion, which represents 46.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for advanced valve solutions in oil and gas exploration, product innovation in smart and automated valve systems, and expanding integration with Industrial Internet of Things technologies and artificial intelligence capabilities. Companies are establishing competitive positions through investment in sensor-enabled valve platforms, corrosion-resistant materials development, and strategic market expansion across energy, water treatment, and chemical processing applications.

From 2030 to 2035, the market is forecast to grow from USD 105.2 billion to USD 128.22 billion, adding another USD 23.02 billion, which constitutes 53.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized valve systems, including advanced automatic formulations and integrated application solutions tailored for specific industry requirements, strategic collaborations between valve manufacturers and end-user industries, and an enhanced focus on operational efficiency and environmental compliance. The growing emphasis on automation mandates in industrial zones and EPA regulations will drive demand for advanced, high-performance valve solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 85 billion |

| Market Forecast Value (2035) | USD 128.22 billion |

| Forecast CAGR (2025-2035) | 4.2% |

The industrial valve market grows by enabling manufacturers to achieve superior process control and operational efficiency in critical industrial applications, ranging from small-scale processing plants to mega industrial complexes. Industrial manufacturers face mounting pressure to improve operational safety and environmental compliance, with advanced valve solutions typically providing real-time condition monitoring and predictive maintenance capabilities compared to conventional systems, making smart valve technologies essential for competitive manufacturing operations. The energy industry's need for maximum flow control reliability creates demand for advanced valve solutions that can minimize downtime, enhance durability, and ensure consistent performance across diverse operational conditions. Government initiatives promoting infrastructure modernization and automation drive adoption in oil and gas, water treatment, and chemical processing applications, where operational performance has a direct impact on production efficiency and regulatory compliance. However, high production costs of specialty alloys and the complexity of achieving consistent performance across different operational environments may limit adoption rates among cost-sensitive manufacturers and developing regions with limited technical expertise.

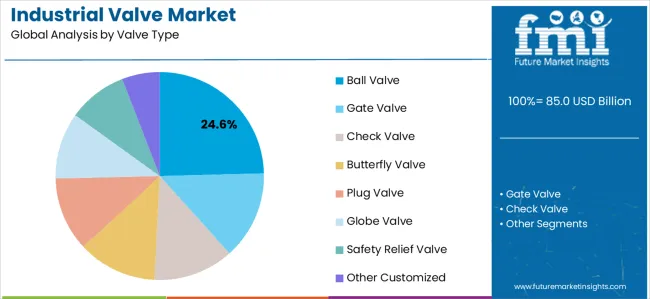

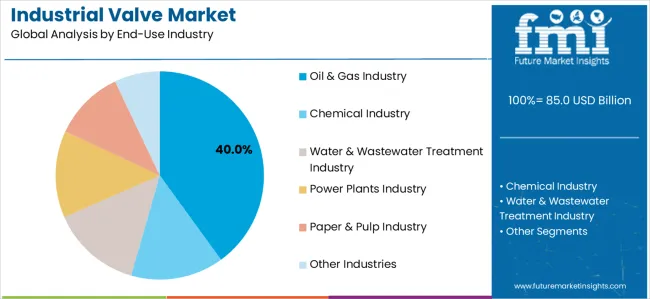

The market is segmented by valve type, material, end-use industry, function, and region. By valve type, the market is divided into gate valves, check valves, ball valves, butterfly valves, plug valves, globe valves, safety relief valves, and other customized valves. Based on material, the market is categorized into cast steel, carbon steel, stainless steel, bronze, and other alloys. By end-use industry, the market covers oil and gas industry, chemical industry, water and wastewater treatment industry, power plants industry, paper and pulp industry, and other industries. By function, the market is divided into manual and automatic valves. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East &Africa.

The ball valve segment represents the dominant force in the industrial valve market, capturing approximately 24.6% of total market share in 2025. This advanced valve category encompasses formulations featuring superior sealing performance characteristics, including enhanced pressure drop minimization and optimized tight shutoff capabilities that enable superior operational reliability and enhanced flow control characteristics. The ball valve segment's market leadership stems from its exceptional versatility in high-pressure, extreme temperature environments, with valves capable of withstanding demanding conditions while maintaining consistent performance and leak-proof operation across diverse operating conditions.

The gate valve segment maintains a substantial market share, serving manufacturers who require reliable shutoff solutions for high-pressure pipeline applications. These valves offer dependable performance for general-purpose industrial applications while providing sufficient durability to meet basic performance requirements in power generation and chemical processing applications.

Key technological advantages driving the ball valve segment include:

Stainless steel material applications demonstrate the strongest growth potential in the industrial valve market with a CAGR of 4.8% through 2035, reflecting the critical role of corrosion-resistant materials in serving demanding industrial applications and supporting advanced manufacturing initiatives. The stainless steel segment's market leadership is reinforced by increasing adoption in pharmaceuticals and food processing, standardized material specifications, and rising demand for hygiene-critical applications that directly correlates with chemical stability and purity requirements.

The cast steel segment represents the dominant market category, capturing significant market share through specialized requirements for high-pressure applications, heavy industrial machinery, and robust operational facilities. This segment benefits from growing demand for cost-effective systems that meet stringent strength and durability requirements in demanding industrial applications.

The carbon steel segment accounts for substantial market share, serving general-purpose manufacturers requiring balanced mechanical performance solutions. The bronze segment captures market share through marine and low-pressure applications, while other alloys represent specialized market segments.

Key market dynamics supporting material growth include:

Water and wastewater treatment industry applications demonstrate the strongest growth potential in the industrial valve market with a CAGR of 4.9% through 2035, reflecting the critical role of advanced treatment facilities in serving municipal infrastructure demand and supporting environmental compliance initiatives. The water treatment segment's market leadership is reinforced by increasing investment in desalination projects, municipal water infrastructure development, and rising demand for environmental performance optimization that directly correlates with regulatory compliance and operational efficiency requirements.

The oil and gas industry segment represents the largest end-use category, capturing significant market share through specialized requirements for exploration activities, pipeline expansions, and refinery operations. This segment benefits from growing demand for robust flow control systems that meet stringent safety, reliability, and performance requirements in demanding upstream and midstream applications.

The chemical industry segment accounts for substantial market share, serving manufacturers requiring corrosion-resistant solutions for aggressive fluid handling. The power plants segment captures market share through high-integrity applications, while other industries represent diverse market segments.

Key market dynamics supporting industry growth include:

Automatic valve applications demonstrate the strongest growth potential in the industrial valve market with a CAGR of 4.7% through 2035, reflecting the critical role of automation technologies in serving Industry 4.0 initiatives and supporting smart manufacturing development. The automatic valve segment's market leadership is reinforced by increasing adoption of IoT-enabled systems, predictive maintenance capabilities, and rising demand for operational optimization that directly correlates with efficiency improvement and remote operation requirements.

The manual valve segment maintains substantial market share, serving cost-sensitive applications requiring operational simplicity. These valves offer reliable performance for basic industrial processes while providing sufficient functionality to meet standard performance requirements in water distribution and low-pressure applications.

Key market dynamics supporting function growth include:

The market is driven by three concrete demand factors tied to industrial automation and infrastructure optimization outcomes. First, global infrastructure development and industrial modernization create increasing demand for high-performance valve solutions, with aging infrastructure in developed countries requiring replacement and modernization programs, requiring specialized valve solutions for maximum operational efficiency. Second, automation mandates and environmental regulations drive the adoption of smart valve technologies, with manufacturers seeking real-time monitoring and predictive maintenance capabilities for regulatory compliance enhancement. Third, technological advancements in artificial intelligence and Industrial Internet of Things enable more effective and intelligent valve solutions that reduce operational risks while improving long-term performance and cost-effectiveness.

Market restraints include high production costs of specialty materials that can impact manufacturing expenses and profitability margins, particularly during periods of commodity price volatility affecting key steel and specialty alloy components. Technical complexity in smart valve integration poses another significant challenge, as achieving consistent performance standards across different operational conditions and connectivity requirements requires specialized expertise and quality control systems, potentially causing project delays and increased development costs. Supply chain disruption and geopolitical developments create additional challenges for manufacturers, demanding ongoing investment in production capabilities and compliance with varying regional regulatory standards.

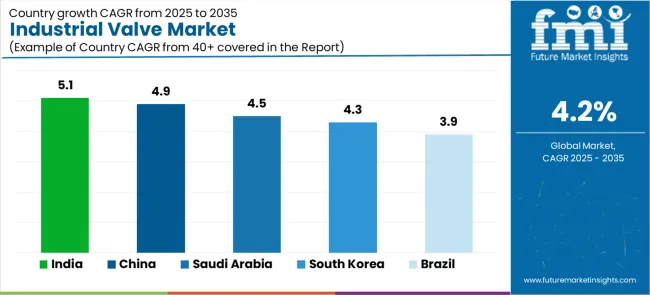

Key trends indicate accelerated adoption in emerging markets, particularly India, China, and Southeast Asia, where rapid industrialization and infrastructure capacity expansion drive comprehensive valve system development. Technology advancement trends toward artificial intelligence integration with enhanced predictive maintenance, real-time monitoring, and multi-functional valve capabilities enable next-generation product development that addresses multiple performance requirements simultaneously. However, the market thesis could face disruption if alternative flow control technologies or significant changes in industrial automation practices minimize reliance on traditional valve solutions.

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.1% |

| China | 4.9% |

| Saudi Arabia | 4.5% |

| South Korea | 4.3% |

| Brazil | 3.9% |

The industrial valve market is gaining momentum worldwide, with India taking the lead thanks to massive infrastructure expansion and government-backed industrial development programs. Close behind, China benefits from growing manufacturing modernization and power generation initiatives, positioning itself as a strategic growth hub in the East Asian region. Saudi Arabia shows strong advancement, where integration of advanced industrial technologies strengthens its role in the Middle Eastern energy and petrochemical supply chains. South Korea is focusing on nuclear power development and industrial modernization, signaling an ambition to capitalize on growing opportunities in advanced manufacturing markets. Meanwhile, Brazil stands out for its oil and gas infrastructure development in offshore applications, recording consistent progress in industrial facility advancement. Together, India and China anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries;5 top-performing countries are highlighted below.

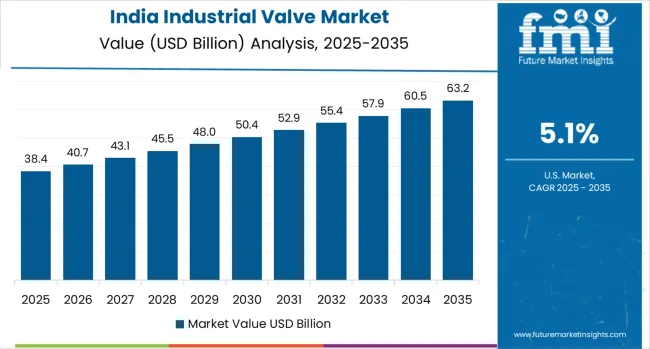

India demonstrates the strongest growth potential in the Industrial Valve Market with a CAGR of 5.1% through 2035. The country's leadership position stems from massive infrastructure expansion projects, government-backed industrial development programs, and aggressive manufacturing competitiveness targets, driving the adoption of high-performance valve systems. Growth is concentrated in major industrial regions, including Maharashtra, Gujarat, Tamil Nadu, and Karnataka, where manufacturers and industrial companies are implementing advanced valve solutions for enhanced production performance and international competitiveness. Distribution channels through established equipment suppliers and direct manufacturer relationships expand deployment across power plants, chemical facilities, and water treatment centers. The country's Make in India strategy provides policy support for advanced manufacturing development, including high-performance valve system adoption.

Key market factors:

In Beijing, Shanghai, Guangzhou, and Shenzhen, the adoption of industrial valve systems is accelerating across manufacturing facilities and power generation centers, driven by decarbonization targets and government industrial modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 4.9% through 2035, linked to comprehensive industrial capacity expansion and increasing focus on manufacturing excellence solutions. Chinese manufacturers are implementing advanced valve systems and automation platforms to enhance operational performance while meeting growing demand for flow control solutions in domestic and export markets. The country's industrial development programs create continued demand for high-performance production solutions, while increasing emphasis on quality upgrade drives adoption of advanced materials and automation technologies.

Saudi Arabia's advanced energy industry demonstrates sophisticated implementation of industrial valve systems, with documented case studies showing efficiency improvements in petrochemical applications through optimized flow control solutions. The country's industrial infrastructure in major energy centers, including Riyadh, Jeddah, Dammam, and Jubail, showcases integration of advanced valve technologies with existing production systems, leveraging expertise in oil and gas processing and precision engineering. Saudi manufacturers emphasize safety standards and environmental compliance, creating demand for high-performance valve solutions that support Vision 2030 initiatives and regulatory requirements. The market maintains strong growth through focus on energy diversification and production modernization, with a CAGR of 4.5% through 2035.

Key development areas:

South Korea's market expansion is driven by diverse industrial demand, including power generation in Seoul and Busan regions, semiconductor manufacturing development in Gyeonggi and Chungcheong, and comprehensive industrial modernization across multiple technology areas. The country demonstrates promising growth potential with a CAGR of 4.3% through 2035, supported by national technology programs and regional industrial development initiatives. Korean manufacturers face implementation challenges related to high-precision requirements and technical specification availability, requiring equipment upgrade approaches and international partnership support. However, growing clean energy targets and manufacturing competitiveness requirements create compelling business cases for valve system adoption, particularly in nuclear and electronics manufacturing regions where performance optimization has a direct impact on operational competitiveness.

Market characteristics:

Brazil's market leads in advanced oil and gas applications based on integration with next-generation offshore technologies and sophisticated processing applications for enhanced performance characteristics. The country shows solid potential with a CAGR of 3.9% through 2035, driven by energy sector modernization programs and advanced industrial initiatives across major production regions, including Rio de Janeiro, São Paulo, Espírito Santo, and Rio Grande do Norte. Brazilian manufacturers are adopting advanced valve systems for production optimization and environmental compliance, particularly in regions with offshore mandates and advanced processing facilities requiring superior product differentiation. Technology deployment channels through established equipment distributors and direct manufacturer relationships expand coverage across oil and gas facilities and industrial processing centers.

Leading market segments:

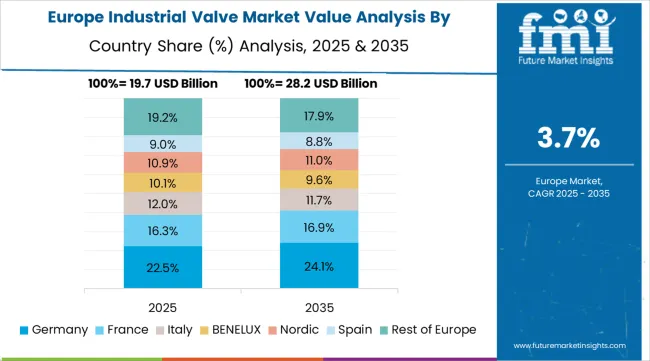

The industrial valve market in Europe is projected to grow from USD 18.4 billion in 2025 to USD 25.7 billion by 2035, registering a CAGR of 3.4% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 28.1% by 2035, supported by its extensive industrial manufacturing infrastructure and major chemical processing centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg production facilities.

United Kingdom follows with a 13.2% share in 2025, projected to reach 13% by 2035, driven by comprehensive water utility modernization programs and advanced pharmaceutical manufacturing initiatives implementing valve technologies. France holds a 12.8% share in 2025, expected to maintain 12.5% by 2035 through ongoing industrial facility upgrades and chemical technology development. Italy commands an 11.4% share, while Spain accounts for 9.7% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 24.4% to 25.3% by 2035, attributed to increasing valve adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing advanced equipment programs.

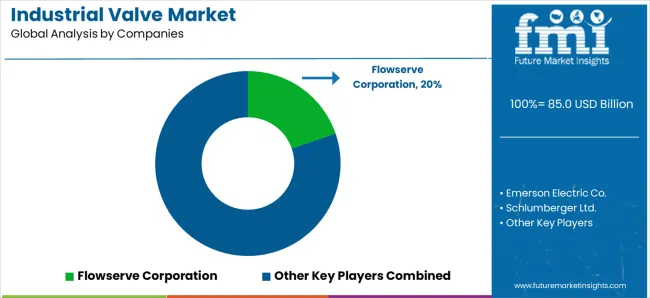

The industrial valve market features approximately 15-18 meaningful players with moderate to high concentration, where the top three companies control roughly 18-22% of global market share through established technology platforms and extensive industrial equipment relationships. Competition centers on technological innovation, material durability, and comprehensive service capabilities rather than price competition alone.

Market leaders include Flowserve Corporation, Emerson Electric Co., and Schlumberger Limited, which maintain competitive advantages through comprehensive valve solution portfolios, global manufacturing networks, and deep expertise in the energy, water treatment, and chemical processing sectors, creating high switching costs for customers. These companies leverage research and development capabilities and ongoing technical support relationships to defend market positions while expanding into adjacent industrial automation and flow control applications.

Challengers encompass KSB SE, KITZ Corporation, and Alfa Laval, which compete through specialized engineering solutions and strong regional presence in key manufacturing markets. Technology specialists, including CIRCOR International, Neway Valves, and AVK Group, focus on specific valve configurations or vertical applications, offering differentiated capabilities in materials technology, customization services, and specialized performance characteristics.

Regional players and emerging equipment providers create competitive pressure through cost-effective solutions and rapid customization capabilities, particularly in high-growth markets including India, China, and Southeast Asia, where local presence provides advantages in customer service and regulatory compliance. Market dynamics favor companies that combine advanced valve technologies with comprehensive technical support offerings that address the complete equipment lifecycle from design development through ongoing operational optimization.

Industrial valves represent specialized flow control equipment that enable manufacturers to achieve superior operational efficiency and reliability compared to conventional systems, delivering enhanced process control and safety performance with advanced automation capabilities in demanding industrial applications. With the market projected to grow from USD 85 billion in 2025 to USD 128.22 billion by 2035 at a 4.2% CAGR, these valve systems offer compelling advantages - enhanced flow control precision, customizable material configurations, and operational durability - making them essential for energy applications, water treatment operations, and industrial facilities seeking alternatives to inefficient control systems that compromise performance through inadequate flow regulation. Scaling market adoption and technological advancement requires coordinated action across industrial policy, manufacturing standards development, valve manufacturers, processing industries, and materials science investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 85 Billion |

| Valve Type | Gate Valve, Check Valve, Ball Valve, Butterfly Valve, Plug Valve, Globe Valve, Safety Relief Valve, Other Customized |

| Material | Cast Steel, Carbon Steel, Stainless Steel, Bronze, Other Alloys |

| End-Use Industry | Oil &Gas Industry, Chemical Industry, Water &Wastewater Treatment Industry, Power Plants Industry, Paper &Pulp Industry, Other Industries |

| Function | Manual, Automatic |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East &Africa |

| Country Covered | India, China, Saudi Arabia, South Korea, Brazil, and 40+ countries |

| Key Companies Profiled | Flowserve Corporation, Emerson Electric Co., Schlumberger Ltd., KSB SE, KITZ Corporation, Alfa Laval, CIRCOR International, Neway Valves |

| Additional Attributes | Dollar sales by valve type and material categories, regional adoption trends across South Asia Pacific, East Asia, and Middle East &Africa, competitive landscape with equipment providers and technology integrators, manufacturing facility requirements and specifications, integration with industrial automation and flow control systems, innovations in valve technology and manufacturing systems, and development of specialized configurations with performance and reliability capabilities. |

The global industrial valve market is estimated to be valued at USD 85.0 billion in 2025.

The market size for the industrial valve market is projected to reach USD 128.2 billion by 2035.

The industrial valve market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in industrial valve market are ball valve, gate valve, check valve, butterfly valve, plug valve, globe valve, safety relief valve and other customized.

In terms of end-use industry, oil & gas industry segment to command 40.0% share in the industrial valve market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Valve Actuators Market

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA