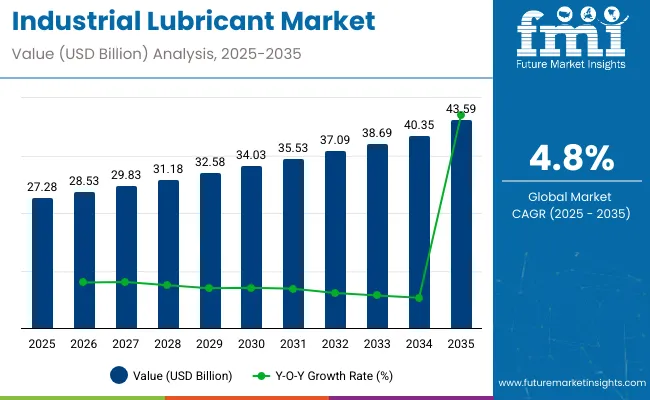

The industrial lubricant market is projected to reach a market size of USD 27.28 billion by 2025. It is expected to grow to USD 43.59 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8% during the forecast period.

Industrial lubricants, which play a crucial role in reducing friction, minimizing wear and tear, and enhancing the efficiency of machinery, are widely used across various sectors, including manufacturing, automotive, and energy. The market’s growth is primarily driven by the increasing demand for high-performance lubricants that improve machine reliability and extend equipment life in industrial applications.

A major driver of the market’s expansion is the growing emphasis on sustainability and energy efficiency in manufacturing and production processes. Industrial lubricants play a crucial role in optimizing machinery performance and reducing energy consumption, which is essential for meeting regulatory standards and lowering operational costs. As industries focus more on reducing environmental impacts, there is also an increasing demand for bio-based and environmentally friendly lubricants that offer superior performance without compromising ecological safety.

| Attributes | Description |

|---|---|

| Estimated Global Market Size (2025E) | USD 27.28 billion |

| Projected Global Market Value (2035F) | USD 43.59 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

Recent developments in the industrial lubricant market include innovations in synthetic and bio-based lubricants, which are gaining popularity due to their enhanced properties and eco-friendly benefits. Advances in formulation technologies have led to the development of lubricants that offer greater resistance to heat, oxidation, and wear, making them suitable for high-demand applications in industries such as automotive, mining, and power generation. These innovations are enabling businesses to achieve higher operational efficiency and reduce downtime, further driving market growth.

On February 26, 2025, BP announced the launch of a strategic review of its Castrol lubricants business. This move is part of BP's broader plan to divest up to USD 20 billion in assets by 2027, aiming to reduce debt and enhance shareholder value. The review could lead to the sale of Castrol, a leading global lubricants brand.

As the industrial lubricant market continues to grow, the increasing demand for high-quality, sustainable, and energy-efficient lubricants will remain a key driver of growth. Ongoing advancements in lubricant formulations, as well as the integration of digital monitoring tools for better performance analysis, will continue to support the market’s expansion and contribute to the broader trend of more sustainable industrial practices

The global trade of industrial lubricants is closely linked to the growth and development of the manufacturing, automotive, and heavy machinery sectors. Countries with advanced petrochemical and refining industries dominate exports, supplying a diverse range of lubricants worldwide. Meanwhile, emerging economies with expanding industrial bases but limited local production capacity rely heavily on imports to meet their lubricant needs. This dynamic trade relationship is fueled by increasing infrastructure projects, vehicle production, and industrial activities across the globe.

Industrial lubricants must meet various certification and quality standards to ensure performance, safety, and environmental compliance. These certifications help manufacturers and users confirm that lubricants are suitable for specific applications and comply with regulatory and industry norms.

The table below represents the annual growth rates of the global industrial lubricant industry from 2025 to 2035. In this study, we considered the industry's growth trend from January to December, differentiating the first half of the year (H1) from the second half (H2) for a given year, 2024, against the base year 2024. Stakeholders gain a comprehensive view of the sector's performance over time, which can also be used to identify potential future trends.

Graphs contain sectoral growth in the first and second halves of 2024 to 2025. Originally forecasted to have an annual growth rate of 4.5% in H1 2024, it seems the proposed switch-over into H2 will deliver a much higher increase in that forecast trend.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.5% |

| H2 (2024 to 2034) | 4.9% |

| H1 (2025 to 2035) | 4.4% |

| H2 (2025 to 2035) | 5.1% |

For the subsequent period, H1 2024 to H2 2024, CAGR is supposed to dip a little down to 4.4% in the first half and pick up some pace at around 5.1% in the second half. The sector has seen a 10 BPS dip in the first half (H1), but there was a marginal gain of 20 BPS recorded for this sector in the second half (H2).

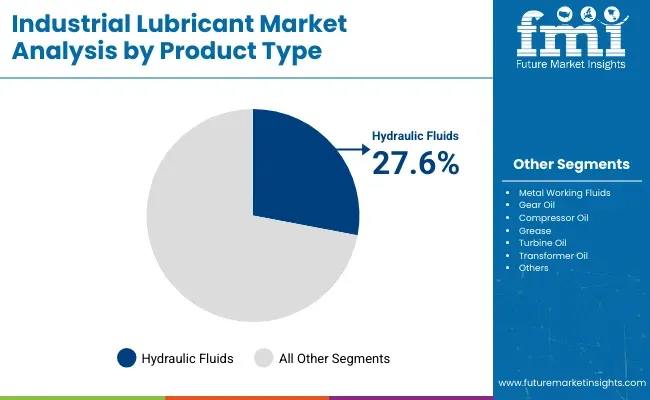

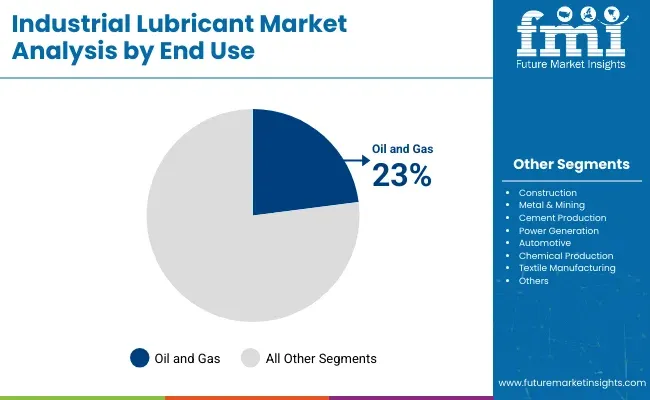

The global industrial lubricant market is projected to expand steadily from 2025 to 2035, driven by the increasing demand for equipment durability, energy efficiency, and operational uptime. In 2025, hydraulic fluids are projected to hold 27.6% of the product type segment, while the oil and gas sector is expected to capture 23.0% of the end-use segment. Key players include ExxonMobil, Shell, and Chevron.

The hydraulic fluids segment is projected to account for 27.6% of the product type segment market share in 2025. These fluids are essential for transferring power in hydraulic machinery used in manufacturing, construction, and heavy-duty industrial operations. The growing need for high-pressure, high-temperature stability and contamination resistance is accelerating demand for advanced hydraulic lubricants across sectors.

Leading manufacturers such as ExxonMobil and Shell are investing in the development of biodegradable, fire-resistant, and energy-efficient hydraulic fluid formulations to support their sustainability goals and enhance system responsiveness. With the increasing deployment of automation and precision machinery, the need for lubricants that reduce wear, prevent corrosion, and extend component life is more critical than ever.

Furthermore, government regulations around environmental impact and workplace safety are encouraging the shift toward non-toxic, high-performance formulations. As industries expand globally and capital-intensive machinery becomes more prevalent, hydraulic fluids are expected to remain a central focus of innovation and investment in the industrial lubricant market.

The oil and gas segment is expected to capture 23.0% of the end-use segment market share in 2025. This sector demands high-performance lubricants that can withstand extreme pressures, high temperatures, and exposure to corrosive substances in both upstream and downstream operations. Lubricants play a crucial role in maintaining equipment, such as compressors, pumps, valves, and turbines, that operate continuously under demanding conditions.

Chevron and TotalEnergies are among the key players offering specialized lubricants tailored for drilling rigs, refineries, and pipeline systems. These include synthetic and semi-synthetic oils that ensure long drain intervals, minimal equipment downtime, and reduced maintenance costs. As global exploration activities increase and offshore production expands, particularly in regions such as the Middle East, Africa, and Latin America, the reliance on high-end lubricants is expected to grow.

In addition, digital monitoring of lubricant condition is being adopted to optimize oil usage and predict mechanical failures. Given its critical role in operational continuity and risk mitigation, the oil and gas segment will continue to be a strategic driver of industrial lubricant demand.

Predictive maintenance is gaining traction across industries as technology continues to monitor machinery and identify potential problems before they occur. Smart sensors, for instance, that monitor temperature and friction in machines provide real-time data, potentially averting what could be expensive breakdowns.

Lubricants are also a huge part of this: machines run smoothly with them, and there is performance data. For instance, Shell and SKF have developed smart fluids that integrate with an IoT network system to optimize machine lubrication. As a result, this reduces wear and extends the equipment's lifespan.

In industries such as manufacturing, which are more technical and involve machine inputs, downtime is crucial. Predictive maintenance using such lubricants enables machinery to operate at its full capacity by generating data for servicing equipment at the optimal time.

The demand for green practices is driving the industrial lubricant market towards green lubricants, compelling companies to opt for bio-based lubricants produced from renewable resources over their petroleum-based alternatives.

Greenhouse gases emitted by companies are reduced, and very strict regulations regarding emissions are maintained while still performing as their petroleum equivalents. For example, Panolin offers lubricants for the wind energy industry made from biodegradable lubricants.

These value chains compel their industries to meet the needs arisen from environmental regulations and achieve the level set for sustainability. The use of eco-friendly lubricants allows companies the ability to meet criteria as prevalent as that of the EU's REACH, Registration, Evaluation, Authorisation, and Restriction of Chemicals. Today, selecting high performing lubricants with environmental sensitivity opens up the possibilities in regard to reduction of carbon footprint and sundry issues related to regulatory misuse.

The growth of the industrial lubricant market is being driven by construction activities in developing countries, including India, China, and Brazil. These nations are undertaking several large-scale projects, such as the building of roads, bridges, and other energy installations, which make use of heavy equipment.

The growth in the consumption of long-lasting and ultra-efficient lubricants would be a key factor in enhancing the functionality of the equipment while lessening the servicing cost of industry-grade lubricants.

Raw material price volatility in the industrial lubricant market. The two key inputs for this lubricant are base oils and additives, extracted from crude oil. Crude oil price is a volatile input sensitive to political instability and market sentiments.

For example, if crude oil prices are high, mineral oil for lubrication will also become costly. As a result, this increases production costs for lubricant manufacturers, ultimately leading to a higher selling price for consumers. This might delay the purchase for any business or shift it to cheaper alternatives, therefore affecting the demand.

The fluctuations in raw material prices present a challenge for manufacturers in stabilizing their lubricant price levels. This makes it likely that companies will have different prices, causing budgeting issues for maintenance.

For instance, instability in crude oil in recent times causes problems in the lubricants supply chain and has resulted in difficulties for ExxonMobil and Shell, among others. Such instability will also slow the market because these companies face pressures related to cost issues while managing uncertain pricing.

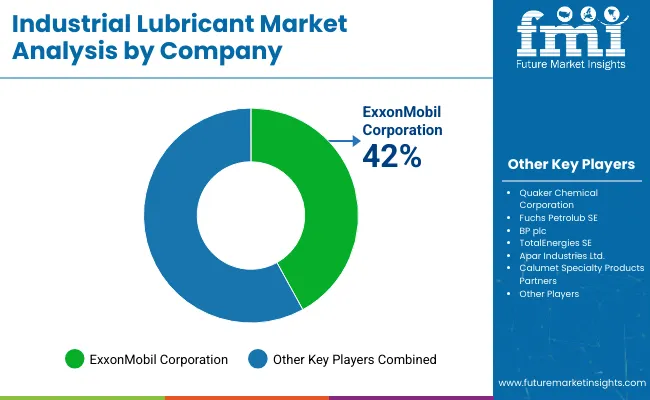

Tier 1 companies comprise industry leaders with annual revenues exceeding $500 million. These companies are currently capturing a significant share of 35% to 40% globally. High production capacity and a wide product portfolio characterize these frontrunners.

Extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base, distinguish them. The firms offer a diverse range of products and utilize the latest technology to meet regulatory requirements. Prominent companies within Tier 1 include Exxon Mobil Corporation, Shell Plc, PHILLIPS 66 Company, TotalEnergies, Chevron Corporation, British petroleum, Gazprom, Rosneft, & Quacker Houghton Chemical Corp. and few others.

Tier 2 companies include mid-size players with revenue of USD 100 to 500 million, having a presence in specific regions and highly influencing the local industry. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Lukoil, Petronas, Bharat Petroleum, FUCHS PETROLUB SE, Sinopec, Idemitsu Kosan Co., Ltd, Tide Water Oil Co (I) Ltd, and various others.

Tier 3 includes the majority of small-scale companies operating at the local level and serving niche areas, having revenue below USD 100 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized sector, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

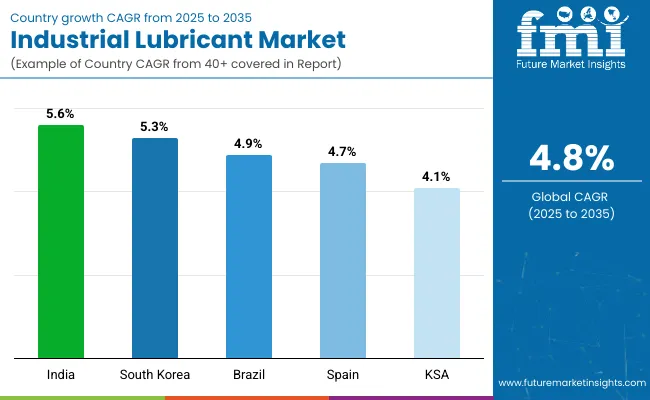

The industrial lubricant market is experiencing sustained momentum driven by advancements in manufacturing, infrastructure upgrades, and growing sustainability trends. Leading countries driving innovation, production, and supply integration include India, South Korea, Brazil, Spain, and Saudi Arabia.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 5.6% |

| South Korea | 5.3% |

| KSA | 4.1% |

| Brazil | 4.9% |

| Spain | 4.7% |

The industrial lubricant market in India is projected to expand at a CAGR of 5.6% from 2025 to 2035.

A projected CAGR of 5.3% is being estimated for South Korea’s industrial lubricant market from 2025 to 2035.

Brazil’s industrial lubricant market is expected to grow at a CAGR of 4.9% from 2025 to 2035.

Spain is forecasted to see a CAGR of 4.7% in its industrial lubricant market between 2025 and 2035.

Saudi Arabia’s industrial lubricant market is set to grow at a CAGR of 4.1% between 2025 and 2035.

Mine lubricant suppliers are seeing a rise in demand as domestic sector players reposition themselves as reliable suppliers for compound requirements.

Key companies are strengthening their resources and developing new goods through joint ventures and partnerships. Because innovative products across numerous end-use sectors have a significant market potential, key companies are launching new product lines.

Reputable businesses are also growing internationally. It is yet unclear how the sector's startup activity and interest will evolve, and industrial competitiveness is predicted to last until 2034.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 27.28 billion |

| Projected Market Size (2035) | USD 43.59 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Hydraulic Fluids, Metal Working Fluids, Gear Oil, Compressor Oil, Grease, Turbine Oil, Transformer Oil, Refrigeration Oil, Textile Machinery Lubricants, Others |

| Base Oils Analyzed (Segment 2) | Mineral Oil, Synthetic Oil, Bio-based Oil |

| End-uses Analyzed (Segment 3) | Construction, Metal & Mining, Cement Production, Power Generation, Automotive, Chemical Production, Oil & Gas, Textile Manufacturing, Food Processing, Agriculture, Pulp & Paper, Marine Applications, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Industrial Lubricant Market | ExxonMobil Corporation, Quaker Chemical Corporation, Fuchs Petrolub SE, BP plc, TotalEnergies SE, Apar Industries Ltd., Calumet Specialty Products Partners, L.P., Chevron Corporation, China Petroleum & Chemical Corp (Sinopec Corporation), Repsol SA, Phillips 66, Raj Petro Specialities Pvt. Ltd, Nynas AB, Valvoline, Inc., Shell plc, Savita Oil Technologies Ltd. |

| Additional Attributes | dollar sales, CAGR trends, product type segmentation, base oil distribution, end-use industry share, competitor dollar sales & market share, regional growth patterns |

Product type included in the study are hydraulic fluids, metal working fluids, gear oil, compressor oil, grease, turbine oil, transformer oil, refrigeration oil, textile machinery lubricants, and others.

Base oil included in the study are mineral oil, synthetic oil, and bio-based oil.

End use included in the study are construction, metal & mining, cement production, power generation, automotive, chemical production, oil & gas, textile manufacturing, food processing, agriculture, pulp & paper, marine applications, and others.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global market was valued at USD 26.0 billion in 2024.

The global market is set to reach USD 27.28 billion in 2025.

Global demand is anticipated to rise at 4.8% CAGR.

The industry is projected to reach USD 43.59 billion by 2035.

Hydraulic fluids segment dominates in terms of share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Lubricants Industry Analysis in India - Growth Trends, Regional Insights 2025 to 2035

Europe Industrial Lubricants Market: Growth, Trends, and Forecast 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA